Location Analytics Market by Solutions (Geocoding & Reverse Geocoding, Data Integration & ETL, Reporting & Visualization, Thematic Mapping & Spatial Analysis), Emergency & Response Management, Supply Chain Planning & Optimization - Global Forecast to 2028

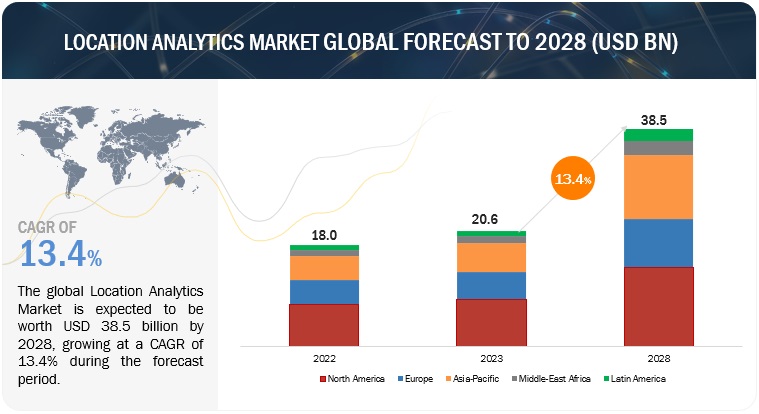

The global Location Analytics Market size was estimated at $20.6 billion in 2023 and is projected to reach $38.5 billion by 2028, at a CAGR of 13.4% during the forecast period. Location analytics integrates geographic data encompassing assets, infrastructure, transportation, and the environment with an organization's operational and customer data.

This convergence facilitates the discovery of potent solutions for a wide array of business challenges. The resulting insights are then seamlessly shared across the organization, empowering informed decision-making and operational enhancements. By combining spatial context with operational information, location analytics uncovers patterns, trends, and correlations that might otherwise remain hidden. This holistic approach not only aids in optimizing processes and resource allocation but also offers valuable insights into customer behavior, market trends, and efficiency improvements. Ultimately, location analytics serves as a strategic tool that empowers organizations to harness the power of geospatial data for informed, efficient, and impactful business strategies.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growth in adoption of spatial data and analytical tools across several verticals

The surge in digitalization has amplified the role of data in boosting customer service and revenue growth for businesses. To navigate this landscape, spatial data visualization has emerged as a powerful driver. It enables effective business planning by unveiling regional priorities, optimal pricing strategies, and peak purchase periods. However, the vast volume of fragmented location-based data has posed challenges for traditional BI tools, necessitating innovative solutions like location analytics. This is especially crucial across various industries, where spatial data aids in understanding evolving trends and regional dynamics. By effectively processing and analyzing vast spatial data sets, location analytics solutions empower businesses with real-time insights into shifting customer preferences, market trends, and regulatory landscapes. This transformative potential is particularly evident in sectors such as retail, where spatial insights optimize store-product correlations, enhance supply chain coordination, and ultimately enrich business strategies and customer experiences.

Restraint: Legal concerns associated with geoprivacy and confidential data

The potential misuse of location data, whether intentional or accidental, carries significant legal implications for both organizations and consumers. Combining location data with personal information raises privacy issues, leading to concerns over data disclosure. Addressing consumer privacy apprehensions is pivotal in handling location data due to stringent regulatory laws that require user consent for accessing such data. Users anxious about their location information's security may opt to withhold critical data collection, as mandated by certain location analytics apps. Government regulations curtail data processing, location sharing, usage, and storage. The European Union's General Data Protection Regulation (GDPR) stands as a unified effort to safeguard citizens' Personally Identifiable Information (PII). Companies collecting data must adhere to regional laws and secure explicit consent from each customer. Limitations on consumer location data accessibility curtail organizations' options, constraining the utilization of location data analytics solutions. This mounting individual concern regarding geo privacy and sensitive data dampens the projected growth of the global location analytics market in the upcoming years.

Opportunity: Growth in penetration of advanced technologies

The surging adoption of advanced technologies serves as a catalyst propelling the growth trajectory of the location analytics market. The prolific proliferation of the Internet of Things (IoT), coupled with the maturation of Artificial Intelligence (AI) and Machine Learning (ML) frameworks, propels fervent interest among enterprises. This confluence of technologies empowers organizations to harness complex data ecosystems and derive actionable insights. The ubiquitous presence of IoT devices engenders an unprecedented influx of real-time, geospatially-tagged data, facilitating a deeper understanding of consumer behavior, operational dynamics, and informed decision-making. Through intricate integration with location intelligence, AI and ML enable predictive analytics capabilities, facilitating strategic imperatives such as market expansion, risk mitigation, and precise asset management. As businesses progressively pivot toward these technologies for competitive advantage, the role of location analytics solutions becomes paramount in unraveling nuanced patterns and extracting actionable intelligence from voluminous datasets. This paradigm shift underscores the pivotal role of location analytics in orchestrating data-driven, precision-centric business paradigms across diverse industries.

Challenge: Lack of uniform regulatory norms

The rapid advancement of technology has undeniably ushered in a multitude of positive transformations, encompassing innovations such as cloud computing, the internet, software-as-a-service, big data, and analytics. This technological surge has wrought revolutionary changes across diverse sectors, spanning retail, healthcare, government, defense, and BFSI. Within this context, location analytics services are garnering significant traction as service providers recognize their potential for security and promotional endeavors. Despite this heightened adoption, there exists a lack of universal protocols for location analytics. Varied legal landscapes across countries impede the development of standardized solutions applicable worldwide, presenting vendors with challenges in offering their services and solutions across diverse regions.

Location Analytics Market Ecosystem

By location type, outdoor location to account for the largest market size during the forecast period.

The utilization of geospatial data in outdoor locations enables businesses to comprehend foot traffic patterns, optimize advertising strategies, and enhance customer experiences. Urban planners leverage outdoor location analytics to design smarter cities, while retailers harness it to identify optimal store placements. In the realm of tourism, outdoor location analytics aids in understanding visitor preferences and crafting tailored experiences. However, challenges encompass data accuracy and privacy concerns in outdoor settings. Despite these hurdles, outdoor location analytics remains integral, shaping smarter urban planning, personalized marketing, and informed decision-making across various sectors.

By deployment, cloud to account for the largest market size during the forecast period.

The adoption of cloud deployment in location analytics is reshaping the landscape by offering scalable and efficient solutions. Leveraging cloud infrastructure, organizations process vast geospatial data, gain actionable insights, and enable real-time decision-making. This approach ensures seamless integration, collaborative data sharing, and reduced infrastructure costs. Cloud providers manage security and updates, allowing businesses to focus on strategic goals. The growing demand for dynamic geospatial insights aligns with cloud deployment's capabilities, driving its adoption as a transformative force in the location analytics domain.

By application, risk management to account for the largest market size during the forecast period.

As businesses increasingly leverage location-based insights to refine their strategies, the imperative to proactively address potential pitfalls becomes evident. Effective risk management in this market involves meticulous assessment of data accuracy, privacy vulnerabilities, and technological limitations. By preemptively identifying and mitigating these risks, enterprises fortify the integrity of their analytical outputs and ensure compliance with data protection regulations. Such prudence not only bolsters decision-making confidence but also empowers the creation of resilient business models. In the ever-evolving landscape of location analytics, adept risk management emerges as an indispensable tool, enabling organizations to harness the full potential of geospatial data and chart a secure path to success across diverse industries.

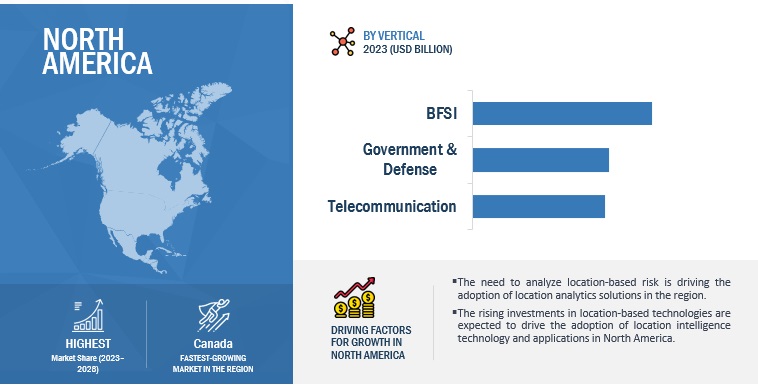

North America to account for the largest market size during the forecast period.

The location analytics market in North America has experienced remarkable growth, driven by technological advancements and a robust business landscape. With the proliferation of IoT, AI, and big data, businesses across industries such as retail, transportation, and urban planning have harnessed location-based insights to enhance decision-making and operational efficiency. The region's well-established infrastructure, high mobile penetration, and data-driven culture have facilitated the rapid adoption of location analytics solutions. Moreover, the increasing demand for personalized experiences and targeted marketing has fueled the market's expansion. As North American companies continue to recognize the value of spatial data in gaining a competitive edge, the location analytics market is projected to sustain its upward trajectory, contributing significantly to the region's digital transformation and economic growth.

Key Market Players

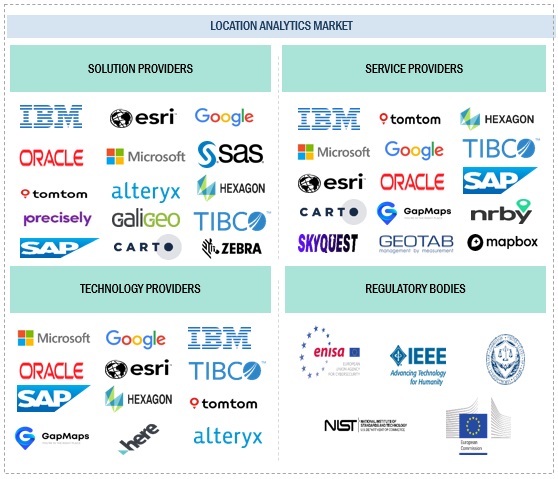

The location analytics vendors have implemented various types of inorganic and organic growth strategies, such as product upgradations, new product launches, partnerships and agreements, mergers and acquisitions and business expansions, to strengthen their offerings in the market. The major vendors in the global market for location analytics IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

Offering, Location Type, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US). |

This research report categorizes the location analytics market based on Offering, Location Type, Applications, Vertical, and Region.

By Offering:

-

Solutions

-

By Type

- Geocoding & Reverse Geocoding

- Data Integration & ETL

- Reporting & Visualization

- Thematic Mapping & Spatial Analysis

- Others

-

By Deployment

- Cloud

- On-premises

-

By Type

-

Services

-

Professional Service

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

- Managed Service

-

Professional Service

By Location Type:

- Indoor Location

- Outdoor Location

By Application:

- Risk Management

- Emergency & Response Management

- Customer Experience Management

- Remote Location Analytics

- Supply Chain Planning & Optimization

- Sales & Marketing Optimization

- Others

By Vertical:

- BFSI

- Retail & eCommerce

- Government & Defense

- Media & Entertainment

- Automotive, Transportation & Logistics

- Energy & Utilities

- Telecom

- Healthcare & Life Sciences

- IT/ITeS

- Tourism & Hospitality

- Manufacturing

- Agriculture

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ASEAN

- South Korea

- ANZ

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Israel

- Qatar

- Turkey

- South Africa

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In June 2023, IBM acquired Agyla SAS to bolster IBM Consulting's capabilities in providing localized cloud solutions to clients in France. By integrating Agyla's expertise, IBM will enhance its portfolio of hybrid multicloud services and strengthen its commitment to advancing hybrid cloud and AI strategies within the region.

- In May 2023, TomTom and Alteryx partnered to seamlessly incorporate TomTom’s Maps APIs into Alteryx products and location insights packages. This integration extends to Alteryx Designer and the recently introduced Location Intelligence offering on the Alteryx Analytics Cloud Platform.

- In May 2023, Hexagon AB and Hitachi Zosen Corporation signed a deal to bring the TerraStar-X Enterprise correction service to Japan. Under the agreement, Hexagon will receive GNSS data from Nippon GPS Data Service (NGDS), a subsidiary of Hitachi Zosen.

- In January 2023, Precisely acquired Transerve to enhances businesses’ ability to make faster and more confident decisions by providing them with SaaS visualization, data enrichment, and analysis capabilities that offer valuable spatial context.

- In October 2022, Zebra Technologies partnered with PartnerConnect Location and Tracking Specialisation for partners focused on selling RFID and real-time location systems (RTLS). Developed as a strategic component of Zebra’s award-winning PartnerConnect program, the new Location and Tracking Specialisation would provide resellers with the tools they need to drive RFID and RTLS sales and help businesses successfully deploy these solutions for transformational business benefits.

Frequently Asked Questions (FAQ):

What is Location Analytics?

Location analytics involves deriving insights from business data's geographic aspect, using thematic mapping and spatial analysis. These solutions seamlessly integrate with existing analytics tools and enterprise data systems, simplifying implementation. By leveraging geographic context, organizations make informed decisions, uncover patterns, and enhance operational strategies.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, Italy, and Rest of Europe in the European region.

Which are key verticals adopting Location Analytics solution and services?

Key verticals adopting Location Analytics include BFSI, Retail & eCommerce, Healthcare & Life Sciences, Government & Defense, Automotive, Transportation and Logistics, Manufacturing, IT/ITeS, Energy & Utilities, Media & Entertainment, Telecommunication, Agriculture, and others (real estate & construction, education, tourism & hospitality).

Which are the key drivers supporting the market growth for Location Analytics?

The key drivers supporting the market growth for location analytics include growth in adoption of spatial data and analytical tools across several verticals, rise in use of location-based applications among consumers, greater organizational need to gain competitive advantage across verticals.

Who are the key vendors in the market for Location Analytics?

The key vendors in the global Location Analytics market include IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Zebra Technologies (US), Alteryx (US), HERE (US), Purple (UK), Galigeo (France), GeoMoby (Australia), Quuppa (Finland), CleverMaps (Czech Republic), IndoorAtlas (Finland), Lepton Software (India), CARTO (US), TIBCO (US), Sparkgeo (Canada), Ascent Cloud (US), Foursquare (US), MapLarge (US), SedimentIQ (US), Ariadne Maps (Germany), Locale.ai (India), Geoblink (Spain), Nrby (US), Mapidea (Portugal), GapMaps (Australia), and LocationsCloud (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in adoption of spatial data and analytical tools- Rise in use of location-based applications among consumers- Greater organizational need to gain competitive advantage across verticalsRESTRAINTS- Legal concerns associated with geoprivacy and confidential data- High initial cost of deploymentOPPORTUNITIES- Increase in adoption by small- and medium-sized enterprises- Growth in penetration of advanced technologiesCHALLENGES- Lack of uniform regulatory norms- Lack of skilled workforce

-

5.3 CASE STUDY ANALYSISBANKING & FINANCIAL SERVICES- Use case 1: CARTO helped Mastercard with data monetization- Use case 2: Esri helped retail bank improve business performance- Use case 3: Quadrant.io helped optimize ATM locations for retail bank- Use case 4: Quadrant.io improved targeted advertisingINSURANCE- Use case 1: CARTO modeled platforms to detect fraud- Use case 2: GravyAnalytics worked with insurance companies to predict risks- Use case 3: Esri helped risk managers build profitable portfoliosRETAIL- Use case 1: CARTO used location analytics to select sites for brick-and-mortar workspaces- Use case 2: Xtract.io assisted companies in expanding new markets- Use case 3: Cisco DNA Spaces’ location-based services acquired new customers and increase loyaltyHEALTHCARE- Use case 1: Quuppa Intelligent Locating System solution reduced hospital infections- Use case 2: Spatial modeling and analysis identified root causes of health issuesREAL ESTATE- Use case 1: Jones Lang LaSalle used CARTO-designed platform for site planning- Use case 2: Tinsa Digital used CARTO’s platform for to manage real estate portfolio- Use case 3: CARTO-powered platform enabled OneMap’s customers to leverage location dataENERGY & UTILITY- Use case 1: MapLarge Platform assisted oil & gas companies in fulfilling growing resource demand- Use case 2: MapLarge Platform helped manage outagesHOSPITALITY- Use case 1: Skyhook LI implemented loyalty management- Use case 2: Skyhook’s solutions helped gain competitive insightsMEDIA & ENTERTAINMENT- Use case 1: CARTO Platform analyzed ad campaigns for geomarketingTRANSPORTATION & LOGISTICS- Use case 1: CARTO’s logistics analytics helped achieve supply chain optimizationGOVERNMENT- Use case 1: Quuppa Intelligent Locating System enhanced access control- Use case 2: Quuppa Intelligent Locating System helped in law enforcement and corrections

-

5.4 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING MODEL ANALYSIS

-

5.8 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.11 TECHNOLOGIES IN LOCATION ANALYTICSKEY TECHNOLOGIES- BLUETOOTH- GPS- RFID- WI-FI- NFC- BEACONADJACENT TECHNOLOGIES- Smart Sensors and IoT- Cloud Computing- Blockchain

- 5.12 KEY CONFERENCES & EVENTS, 2023–2024

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 BUSINESS MODELS OF LOCATION ANALYTICSDATA AS A SERVICE (DAAS)SOFTWARE AS A SERVICE (SAAS)PLATFORM AS A SERVICE (PAAS)

- 5.15 FUTURE DIRECTION OF LOCATION ANALYTICS MARKET

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOLUTIONSCOMPANIES INVESTING IN GEOSPATIAL ANALYTICS SOLUTIONS TO UNDERSTAND BUSINESS TRENDS AND INCREASE PRODUCTIVITYSOLUTIONS: LOCATION ANALYTICS MARKET, BY TYPE- Geocoding & reverse geocoding- Data integration & ETL- Reporting & visualization- Thematic mapping & spatial analysis- Other solutionsSOLUTIONS: LOCATION ANALYTICS MARKET, BY DEPLOYMENT- On-premises- Cloud

-

6.3 SERVICESPROFESSIONAL SERVICES- Need to develop location analytics strategies and roadmaps to drive market growth- Consulting Services- Deployment & Integration- Training, Support, and MaintenanceMANAGED SERVICES- Optimizing location analytics with managed services for improved business performance

-

7.1 INTRODUCTIONLOCATION TYPE: MARKET DRIVERS

-

7.2 INDOOR LOCATIONADVANCED TECHNOLOGIES TO BE USED FOR INDOOR LOCATION TRACKING

-

7.3 OUTDOOR LOCATIONOUTDOOR LOCATION ANALYTICS TO MONITOR IMMOVABLE ASSETS TO REDUCE COSTS

-

8.1 INTRODUCTIONAPPLICATION: MARKET DRIVERS

-

8.2 RISK MANAGEMENTLOCATION ANALYTICS TO IMPROVE DATA QUALITY AND STREAMLINE BUSINESS PROCESSES

-

8.3 EMERGENCY RESPONSE MANAGEMENTLOCATION ANALYTICS TO COORDINATE CRISIS RESPONSE BETWEEN SERVICES AND EMERGENCY DEPARTMENTS

-

8.4 CUSTOMER EXPERIENCE MANAGEMENTLOCATION ANALYTICS TO PROVIDE USER INFORMATION AND USER EXPERIENCE DATA

-

8.5 SUPPLY CHAIN PLANNING AND OPTIMIZATIONLOCATION ANALYTICS TO IMPROVE PERFORMANCE OF ORDER-PICKING AND STOCK-TAKING PROCESSES

-

8.6 SALES & MARKETING OPTIMIZATIONLOCATION ANALYTICS TO ENABLE OPTIMIZATION OF SUPPLY CHAIN NETWORKS FOR ENHANCED EFFICIENCY AND COST SAVINGS

-

8.7 LOCATION SELECTION & OPTIMIZATIONLOCATION ANALYTICS TO AID IN UNDERSTANDING BUSINESS GROWTH WITH LOCATION INTELLIGENCE AND OTHER FEATURES

- 8.8 OTHER APPLICATIONS

-

9.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

9.2 RETAIL & ECOMMERCELOCATION ANALYTICS SOLUTIONS TO PROMOTE CUSTOMER EXPERIENCE

-

9.3 MANUFACTURINGLOCATION ANALYTICS SOLUTIONS TO SUPPORT INCREASING PRODUCTIVITY

-

9.4 GOVERNMENT & DEFENSEDATA SECURITY AND SAFETY TO BE KEY FACTOR FOR MARKET GROWTH

-

9.5 MEDIA & ENTERTAINMENTADOPTION OF TECHNOLOGIES IN MEDIA & ENTERTAINMENT TO HELP VENDORS INCREASE PROFITABILITY

-

9.6 AUTOMOTIVE, TRANSPORTATION & LOGISTICSDEMAND FOR REAL-TIME LOCATION SYSTEMS TO DRIVE GROWTH

-

9.7 ENERGY & UTILITYGIS TO AID ELECTRIC UTILITY COMPANIES IN DATA MANAGEMENT, PLANNING AND ANALYSIS, AND SITUATIONAL AWARENESS

-

9.8 TELECOMMUNICATIONSTRATEGIC ALIGNMENT OF LOCATION-BASED INSIGHTS WITH CUSTOMER SEGMENTATION TO DRIVE GROWTH

-

9.9 BFSILOCATION ANALYTICS TO FACILITATE DIGITAL PORTFOLIO MANAGEMENT FROM DATA REPOSITORY

-

9.10 IT/ITESLOCATION ANALYTICS TO PROVIDE ACCURATE INSIGHTS TO MINIMIZE DOWNTIME

-

9.11 HEALTHCARE & LIFE SCIENCESLOCATION ANALYTICS TO AID HEALTHCARE PROFESSIONALS IN CLASSIFYING HEALTH TRENDS

-

9.12 AGRICULTUREABILITY TO PROVIDE UNPARALLELED INSIGHTS INTO CROP PHENOLOGY TO DRIVE DEMAND

- 9.13 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Increase in adoption of geospatial analytics technologies to drive growthCANADA- Rising adoption of cloud to drive adoption of location analytics

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Investments in innovation for smart infrastructure to boost tracking and navigation solutionsGERMANY- Adoption of location intelligence in smart grid development to contribute to market growthFRANCE- Investment in intelligent location technologies to augment market growthITALY- Location analytics for enhanced decision-making and operational efficiency to drive growthSPAIN- Technological advancements to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Government initiatives for R&D and investments by global players to drive marketJAPAN- Growth of geospatial analytics in construction to create opportunities for location intelligence technologiesINDIA- Adoption of location intelligence to increase profitability and improve customer engagementANZ- Data-driven technologies to lower costs, manage risk, and drive growthSOUTH KOREA- Real-time location data to enhance route optimization and transportation efficiencyASEAN- Increasing shift toward adoption of advanced technologies to fuel growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Adoption of location analytics and other data-driven technologies to drive growthUAE- Initiatives by government to promote adoption and development of AI and ML technologiesISRAEL- Support for technological innovation in Israel to accelerate adoption of location analytics across industries and public servicesTURKEY- Growing adoption of geospatial analytics through government initiatives and collaborations to drive growthQATAR- Location analytics to improve route planning and supply chain effectivenessSOUTH AFRICA- Increasing investments and initiatives from government and private sector companies to drive growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Investments to enable asset and people management to push demand for location intelligence solutionsMEXICO- Adoption of location analytics in construction and oil & gas to fuel growthARGENTINA- Skilled workforce and supportive government initiatives to fuel growthREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 STARTUP/SME COMPETITIVE BENCHMARKING

-

11.9 LOCATION ANALYTICS PRODUCT LANDSCAPECOMPARATIVE ANALYSIS OF LOCATION ANALYTICS PRODUCTS

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 11.11 VALUATION AND FINANCIAL METRICS OF KEY LOCATION ANALYTICS VENDORS

- 11.12 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY LOCATION ANALYTICS VENDORS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewESRI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAS INSTITUTE- Business overview- Products/Solutions/Services offered- Recent developmentsPRECISELY- Business overview- Products/Solutions/Services offered- Recent developmentsSAP- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsTOMTOM- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developmentsZEBRA TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsFOURSQUARE- Business overview- Products/Solutions/Services offered- Recent developmentsALTERYX- Business overview- Products/Solutions/Services offered- Recent developmentsHERE TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsPURPLE- Business overview- Products/Solutions/Services offered- Recent developmentsGALIGEO- Business overview- Products/Solutions/Services offered- Recent developmentsCARTOTIBCO SOFTWAREMAPLARGESPARKGEOASCENT CLOUDLEPTON SOFTWARE

-

12.3 STARTUPS/SMESGEOMOBYQUUPPACLEVERMAPSINDOORATLASSEDIMENTIQARIADNE MAPLOCALE.AIGEOBLINKNRBYMAPIDEAGAPMAPSLOCATIONSCLOUD

-

13.1 ADJACENT/RELATED MARKETSGEOSPATIAL IMAGERY ANALYTICS MARKET- Market definition- Market overview- Geospatial imagery analytics market, by type- Geospatial imagery analytics market, by collection medium- Geospatial imagery analytics market, by application- Geospatial imagery analytics market, by deployment mode- Geospatial imagery analytics market, by organization size- Geospatial imagery analytics market, by vertical- Geospatial imagery analytics market, by regionINDOOR LOCATION MARKET- Market definition- Market overview- Indoor Location Market, by offering- Indoor Location Market, by solution- Indoor Location Market, by Service- Indoor Location Market, by technology- Indoor Location Market, by application- Indoor Location Market, by vertical- Indoor Location Market, by region

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2020–2022

- TABLE 2 PRIMARY SOURCES

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 RECESSION IMPACT ON LOCATION ANALYTICS MARKET

- TABLE 5 MARKET AND GROWTH RATE, 2017–2022 (USD MILLION AND Y-O-Y GROWTH)

- TABLE 6 MARKET AND GROWTH RATE, 2023–2028 (USD MILLION AND Y-O-Y GROWTH)

- TABLE 7 PATENTS FILED, 2013–2023

- TABLE 8 TOP 20 PATENT OWNERS, 2013–2023

- TABLE 9 LIST OF PATENTS IN MARKET, 2021–2023

- TABLE 10 MARKET: SOLUTION PROVIDERS

- TABLE 11 MARKET: SERVICE PROVIDERS

- TABLE 12 MARKET: TECHNOLOGY PROVIDERS

- TABLE 13 LOCATION ANALYTICS MARKET: REGULATORY BODIES

- TABLE 14 AVERAGE SELLING PRICING ANALYSIS, 2022

- TABLE 15 PORTER’S FIVE FORCES ANALYSIS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 SHORT-TERM ROADMAP, 2023–2025

- TABLE 24 MID-TERM ROADMAP, 2026–2028

- TABLE 25 LONG-TERM ROADMAP, 2029–2030

- TABLE 26 LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 27 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 28 SOLUTIONS: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 29 SOLUTIONS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 TYPE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 TYPE: LOCATION ANALYTICS SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 GEOCODING & REVERSE GEOCODING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 GEOCODING & REVERSE GEOCODING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 DATA INTEGRATION & ETL: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 DATA INTEGRATION & ETL: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 REPORTING & VISUALIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 REPORTING & VISUALIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 THEMATIC MAPPING & SPATIAL ANALYSIS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 THEMATIC MAPPING & SPATIAL ANALYSIS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 OTHER SOLUTIONS: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 43 MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 44 ON-PREMISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 49 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 50 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 SERVICES: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 53 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 54 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 CONSULTING SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 CONSULTING SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 DEPLOYMENT & INTEGRATION: LOCATION ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 65 MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 66 INDOOR LOCATION: LOCATION ANALYTICS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 INDOOR LOCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 OUTDOOR LOCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 OUTDOOR LOCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 71 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 RISK MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 73 RISK MANAGEMENT: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 EMERGENCY RESPONSE MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 75 EMERGENCY RESPONSE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 77 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 SUPPLY CHAIN PLANNING AND OPTIMIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 79 SUPPLY CHAIN PLANNING AND OPTIMIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 SALES & MARKETING OPTIMIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 81 SALES & MARKETING OPTIMIZATION: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 LOCATION SELECTION & OPTIMIZATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 83 LOCATION SELECTION & OPTIMIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 87 LOCATION ANALYTICS MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 RETAIL & ECOMMERCE: USE CASES

- TABLE 89 RETAIL & ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 90 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 MANUFACTURING: USE CASES

- TABLE 92 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 93 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 GOVERNMENT & DEFENSE: USE CASES

- TABLE 95 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 96 GOVERNMENT & DEFENSE: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 MEDIA & ENTERTAINMENT: USE CASES

- TABLE 98 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 99 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: USE CASES

- TABLE 101 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 102 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 ENERGY & UTILITY: USE CASES

- TABLE 104 ENERGY & UTILITY: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 105 ENERGY & UTILITY: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 TELECOMMUNICATION: USE CASES

- TABLE 107 TELECOMMUNICATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 108 TELECOMMUNICATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 BFSI: USE CASES

- TABLE 110 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 111 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 IT/ITES: USE CASES

- TABLE 113 IT/ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 114 IT/ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 HEALTHCARE & LIFE SCIENCES: USE CASES

- TABLE 116 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 117 HEALTHCARE & LIFE SCIENCES: LOCATION ANALYTICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 118 AGRICULTURE: USE CASES

- TABLE 119 AGRICULTURE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 120 AGRICULTURE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 122 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 124 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 136 NORTH AMERICA: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 138 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 140 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 142 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 143 US: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 144 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 145 US: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 146 US: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 147 US: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 148 US: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 149 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 150 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 151 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 152 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 153 US: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 154 US: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 156 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 EUROPE: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 158 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 160 EUROPE: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 161 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 162 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 163 EUROPE: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 164 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 165 EUROPE: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 166 EUROPE: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 167 EUROPE: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 168 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 170 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 171 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 172 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 173 UK: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 174 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 UK: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 176 UK: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 177 UK: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 178 UK: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 179 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 180 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 181 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 182 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 183 UK: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 184 UK: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 190 ASIA PACIFIC: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 194 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 196 ASIA PACIFIC: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 198 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 200 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 CHINA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 204 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 205 CHINA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 206 CHINA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 207 CHINA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 208 CHINA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 209 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 210 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 211 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 212 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 213 CHINA: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 214 CHINA: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 233 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: LOCATION ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2017–2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: MARKET, BY LOCATION TYPE, 2023–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 251 OVERVIEW OF STRATEGIES ADOPTED BY KEY LOCATION ANALYTICS VENDORS

- TABLE 252 LOCATION ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 253 MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- TABLE 254 MARKET: DETAILED LIST OF KEY STARTUP/SME

- TABLE 255 MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME

- TABLE 256 COMPARATIVE ANALYSIS OF LOCATION ANALYTICS PRODUCTS

- TABLE 257 PRODUCT LAUNCHES, JUNE 2019–AUGUST 2023

- TABLE 258 DEALS, AUGUST 2019–AUGUST 2023

- TABLE 259 IBM: BUSINESS OVERVIEW

- TABLE 260 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 262 IBM: DEALS

- TABLE 263 GOOGLE: BUSINESS OVERVIEW

- TABLE 264 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 266 GOOGLE: DEALS

- TABLE 267 ORACLE: BUSINESS OVERVIEW

- TABLE 268 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 ORACLE: DEALS

- TABLE 271 MICROSOFT: BUSINESS OVERVIEW

- TABLE 272 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 274 MICROSOFT: DEALS

- TABLE 275 ESRI: BUSINESS OVERVIEW

- TABLE 276 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ESRI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 ESRI: DEALS

- TABLE 279 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 280 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 SAS INSTITUTE: DEALS

- TABLE 283 PRECISELY: BUSINESS OVERVIEW

- TABLE 284 PRECISELY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 PRECISELY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 PRECISELY: DEALS

- TABLE 287 SAP: BUSINESS OVERVIEW

- TABLE 288 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 SAP: DEALS

- TABLE 291 CISCO: BUSINESS OVERVIEW

- TABLE 292 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 294 CISCO: DEALS

- TABLE 295 TOMTOM: BUSINESS OVERVIEW

- TABLE 296 TOMTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 TOMTOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 298 TOMTOM: DEALS

- TABLE 299 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 300 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 HEXAGON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 302 HEXAGON: DEALS

- TABLE 303 ZEBRA TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 304 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 ZEBRA TECHNOLOGIES: DEALS

- TABLE 307 FOURSQUARE: BUSINESS OVERVIEW

- TABLE 308 FOURSQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 FOURSQUARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 310 FOURSQUARE: DEALS

- TABLE 311 ALTERYX: BUSINESS OVERVIEW

- TABLE 312 ALTERYX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 314 ALTERYX: DEALS

- TABLE 315 HERE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 316 HERE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 HERE TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 318 HERE TECHNOLOGIES: DEALS

- TABLE 319 PURPLE: BUSINESS OVERVIEW

- TABLE 320 PURPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 PURPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 322 PURPLE: DEALS

- TABLE 323 GALIGEO: BUSINESS OVERVIEW

- TABLE 324 GALIGEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 GALIGEO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 326 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 327 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 328 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2016–2020 (USD MILLION)

- TABLE 329 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY COLLECTION MEDIUM, 2021–2026 (USD MILLION)

- TABLE 330 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 331 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 332 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 333 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 334 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 335 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 336 HEALTHCARE AND LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 337 HEALTHCARE AND LIFE SCIENCES: GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 338 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 339 GEOSPATIAL IMAGERY ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 340 INDOOR LOCATION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 341 INDOOR LOCATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 342 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 343 SOLUTIONS: INDOOR LOCATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 344 INDOOR LOCATION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 345 INDOOR LOCATION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 346 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 347 INDOOR LOCATION MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 348 INDOOR LOCATION MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 349 INDOOR LOCATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 350 INDOOR LOCATION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 351 INDOOR LOCATION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 352 INDOOR LOCATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 353 INDOOR LOCATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 LOCATION ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: DATA TRIANGULATION

- FIGURE 3 TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF LOCATION ANALYTICS COMPANIES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE) - COLLECTIVE REVENUE OF LOCATION ANALYTICS SOLUTIONS/SERVICES PROVIDING COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM LOCATION ANALYTICS SOFTWARE/SERVICES

- FIGURE 7 LOCATION ANALYTICS MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4 - BOTTOM-UP (DEMAND SIDE): SHARE OF LOCATION ANALYTICS THROUGH OVERALL LOCATION ANALYTICS SPENDING

- FIGURE 8 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 9 GEOCODING & REVERSE GEOCODING SOLUTIONS TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 10 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 11 CONSULTING SERVICES TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 12 CLOUD TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 13 OUTDOOR LOCATION TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 14 RISK MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 15 HEALTHCARE & LIFE SCIENCES VERTICAL TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 17 ANALYZING OPTIMUM ROUTES WITH EFFICIENT ALTERNATE ROUTES TO DRIVE MARKET

- FIGURE 18 RISK MANAGEMENT TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST REGIONAL MARKET IN 2023

- FIGURE 20 SOLUTION AND TELECOMMUNICATION TO ACCOUNT FOR LARGEST SHARES IN 2023

- FIGURE 21 LOCATION ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 24 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 31 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 GEOCODING AND REVERSE GEOCODING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 CLOUD SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 34 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 36 OUTDOOR LOCATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 SUPPLY CHAIN PLANNING AND OPTIMIZATION APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 HEALTHCARE & LIFE SCIENCES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 44 REVENUE ANALYSIS FOR LEADING PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 45 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 46 GLOBAL MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 47 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 GOOGLE: COMPANY SNAPSHOT

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 53 SAP: COMPANY SNAPSHOT

- FIGURE 54 CISCO: COMPANY SNAPSHOT

- FIGURE 55 TOMTOM: COMPANY SNAPSHOT

- FIGURE 56 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 57 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 58 ALTERYX: COMPANY SNAPSHOT

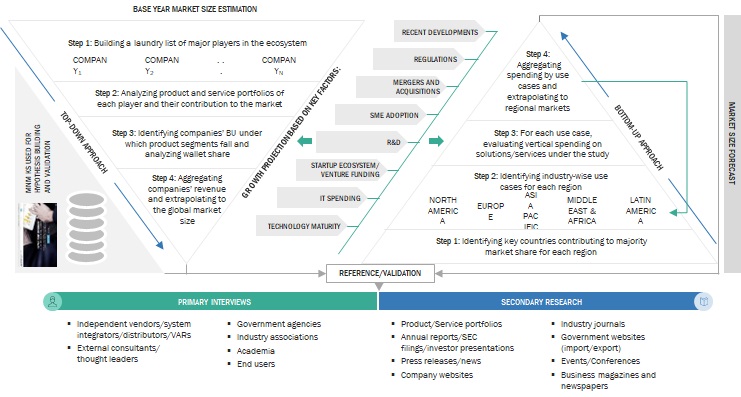

The research study involved the use of extensive secondary sources, directories, and databases, such as Factiva, D&B Hoovers, Bloomberg, Location World, CARTO, and ScienceDirect, to identify and collect information useful for the comprehensive market research study on the location analytics market. The primary sources were mainly industry experts from the core and related verticals, preferred location analytics solution and service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects. The following figure highlights the market research methodology applied to the report on the global location analytics market.

Secondary Research

Various secondary sources were referred to in the secondary research process for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was mainly used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the location analytics market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing location analytics software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecast for the overall market segments and subsegments listed in the report. To list the key information/insights, extensive qualitative and quantitative analysis was performed on the complete market engineering process.

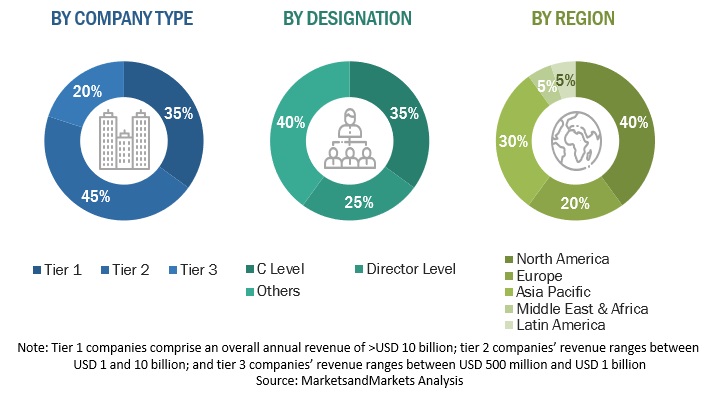

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the location analytics market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global location analytics market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the global location analytics market was prepared. The revenue contribution of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its products/solutions by technology, service, and application. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Information Officers (CIOs), CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, regions that contribute the most to the market share in adopting location analytics solutions among different end users in key countries were identified. For cross-validation, the adoption of location analytics solutions and services among different industries, along with different use cases with respect to their regions, was identified and extrapolated. In addition, weightage was given to the use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on location analytics solutions based on some of the key use cases. These factors for the Location analytics tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Top-Down and Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to Geoblink, location intelligence (LI)/location analytics collects and analyzes many location data sources. These location data are transformed into strategic insights to solve various business challenges. The technology can compile and enrich different types of large datasets, such as GPS data, transactional data, socio-demographic data, footfall traffic, and points of sale data, to be used for deep location analysis. The information is then displayed on a simple and map-centric interface, which allows users to visually conceptualize the factors that affect the performance of their businesses in various locations.

According to CARTO, location intelligence (LI)/location analytics is the methodology of deriving insights from location data to answer spatial questions. LI goes beyond simple data visualization on maps to analyze location data as an integral part of a business or societal problem.

Key Stakeholders

- Location analytics solution providers

- Location-based solution providers

- Consultants/consultancies/advisory firms

- Independent software vendors (ISVs)

- Investors and venture capitalists (VCs)

- Managed service providers

- Support and maintenance service providers

- System integrators/migration service providers

- Value-added resellers (VARs) and distributors

Report Objectives

- To define, describe, and forecast the location analytics market by offering (solutions and services), location type, application, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze subsegments with respect to the individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market

- To forecast the revenue of the market segments with respect to all the major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America (LA)

- To profile the key players and comprehensively analyze their recent developments and positioning related to the location analytics market

- To analyze competitive developments such as mergers and acquisitions, new product launches and developments, and research & development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American market for location analytics

- Further breakup of the European market for location analytics

- Further breakup of the Asia Pacific market for location analytics

- Further breakup of the Latin American market for location analytics

- Further breakup of the Middle East & Africa market for location analytics

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Location Analytics Market

looking for market outlook and forecast for global location analytics market