Medical Simulation Market Size, Growth, Share & Trends Analysis

Medical Simulation Market by Offering (Anatomical Models [Patient (High Fidelity), Surgical (Laparoscopic, Ortho, Gynae), Trainers, Ultrasound], Software), Technology (3D Printing, Virtual Patient, Procedural Rehearsal), End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Medical Simulation market, valued at USD 3.01 billion in 2024, stood at USD 3.50 billion in 2025 and is projected to advance at a resilient CAGR of 15.6% from 2025 to 2030, culminating in a forecasted valuation of USD 7.23 billion by the end of the period. This growth is expected to be fueled by the increasing demand for standardized clinical training, the rising prevalence of chronic diseases, greater investment in healthcare technology, and a higher number of medical and nursing schools incorporating simulation.

KEY TAKEAWAYS

-

By RegionNorth America to dominate the market with a share of 42.6% in 2024.

-

By OfferingBy offering, the web-based simulation segment is expected to register the highest CAGR of 17.3% during the forecast period.

-

By TechnologyBy technology, the virtual patient simulation segment is expected to register the highest CAGR of 16.6% during the forecast period.

-

By End UserBy end user, the academic institutes segment held the largest market share in 2024.

-

Competitive LandscapeSurgical Science Sweden AB, Laerdal Medical, and Kyoto Kagaku were identified as some of the star players in the medical simulation market, given their strong market share and product footprint.

-

Competitive LandscapeHaag-Streit AG and HRV Simulation, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The medical simulation market is projected to reach USD 7.23 billion by 2030 from USD 3.50 billion in 2025, at a CAGR of 15.6% from 2025 to 2030. The market is driven by rising demand for patient-safe training, increasing adoption of VR/AR and AI-enabled simulators, and shortages of real-world clinical training opportunities. Hospitals (Johns Hopkins Hospital, Massachusetts General Hospital, etc.), medical schools, and nursing programs are increasingly using simulation to improve clinical skills, surgical outcomes, and team-based care.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the medical simulation market, impact on consumers is driven by advanced training methods and high-fidelity technologies. Hospitals, academic institutions, medical device firms, and defense healthcare organizations are adopting simulation for surgical training, skills assessment, and patient safety, with rising use of VR/AR, cloud platforms, and digital twin models shaping investments and driving growth for vendors such as Laerdal Medical, Surgical Science Sweden AB, Gaumard Scientific, Kyoto Kagaku, and Limbs & Things.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for realistic and risk-free training environments in medical education

-

Rapid technological advancements in medical education

Level

-

Limited availability of funds to establish simulation training centers

-

Poorly designed medical simulators

Level

-

Widening workforce gaps creating demand for simulation-based training solutions

-

Growing awareness about simulation training in emerging economies

Level

-

High cost of simulators

-

Operational challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for realistic and risk-free training environments in medical education

The medical simulation market is experiencing strong growth due to the increasing demand for realistic and risk-free training environments in medical education. Simulation technologies allow healthcare professionals and students to practice clinical procedures, emergency responses, and decision-making skills in a safe, controlled setting without endangering patients. These tools support standardized training, repeated practice, and competency-based education, helping reduce medical errors and improve patient outcomes. For example, Cleveland Clinic uses advanced simulation centers to train physicians, nurses, and surgical teams, strengthening clinical skills while maintaining high standards of patient safety.

Restraint: Limited availability of funds to establish simulation training centers

The establishment of simulated learning environments and simulation programs requires significant capital investments, mainly due to the cost of high-fidelity simulators and virtual environments. Healthcare simulation training facilities usually rely heavily on government and private funding. In the US, Medicare supports teaching hospitals with USD 7.8 billion per year for their graduate medical education (GME), while Medicaid funds over USD 2 billion. Other bodies, including the Department of Defense and the Veterans Administration, and private payers also pay for portions of resident physician education. Despite the availability of substantial support, teaching hospitals are struggling financially to match challenging medical education standards.

Opportunity: Widening workforce gaps creating demand for simulation-based training solutions

The shortage of professionals in the healthcare sector is among the most challenging factors affecting healthcare quality and accessibility. The WHO projection (2023) reveals that this shortage will contribute to an estimated 11 million shortage in the universal health care workforce by the year 2030, mostly in low and middle-income economies. In the US, it is projected to face a shortage of 86,000 medical practitioners by the year 2036, based on demographics and growing health needs, as indicated by AAMC (2024).

Challenge: High cost of simulators

Patient simulators are highly expensive devices, priced between USD 50,000 and USD 400,000 in developed countries (depending on type, services, brand, and features). This is a key deterrent to their adoption in countries with limited government funding. In developing countries, ensuring the affordability of healthcare simulation is a major challenge for manufacturers. The cost involved in simulated training includes products, services, software, and maintenance. The requirements for simulation training vary depending on the solutions selected, ranging from manikins to web-based virtual environments or both. Thus, economic evaluations play a significant role in determining the return on investments. A lack of proper economic evaluation results in low returns on investment for end users, increasing the overall cost of their projects. Thus, the lack of economic evaluation, coupled with the high cost of simulators, often restricts the adoption of simulated training solutions among end users.

MEDICAL SIMULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers high-fidelity simulators like LapSim and TraumaVR for surgical training, including robotic surgery and endovascular procedures. Provides customizable training modules through MentorLearn and iCase | Improves surgical proficiency and reduces error rates through evidence-based, proficiency-based training |

|

Develops immersive simulation solutions, including SimMan and virtual reality training for emergency, obstetric, and neonatal care | Collaborates with Unity for scalable simulation platforms | Enhances team communication and coordination, leading to improved patient safety outcomes |

|

Provides advanced patient simulators like HAL S5301 and robotic obstetric simulators for training across specialties, including trauma, pediatrics, and obstetrics | Facilitates safe, repeatable training scenarios, enabling learners to practice rare or high-risk events without patient risk |

|

Manufactures anatomical models, imaging phantoms, and simulators for medical imaging and procedural training | Provides realistic, hands-on training tools that enhance understanding of anatomy and procedural techniques |

|

Offers simulation products like the Laparoscopic Skills Trainer and AR-based trainers for catheterization and wound care | Provides augmented reality training apps to visualize internal anatomy | Improves clinical skills and team coordination, leading to better patient outcomes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical simulation ecosystem includes various participants, including simulation hardware vendors (CAE Healthcare, Laerdal Medical), software/platform vendors, and curriculum developers. Technology vendors bring AI, VR/AR devices, and infrastructure to support training. The end users are medical and nursing education institutions, hospitals, government, and associations that demand simulation education. The regulators check for safety, quality, and compliance with data protection norms. Accrediting agencies develop the criteria for simulation programs. Governments and funding bodies develop policies, grant funds, and encourage innovation in healthcare simulation solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Simulation Market, by Offering

In 2024, the healthcare simulation anatomical models segment held the largest share of the medical simulation market, driven by its extensive applications in basic education and procedural training worldwide. Medical colleges and teaching hospitals globally utilize anatomy models for practical learning, helping students build core clinical competencies. Notable institutions such as Harvard Medical School, Karolinska Institute, and the National University of Singapore extensively use these models because of their cost-effectiveness, durability, and standardized training value for multiprofessional education in medicine and nursing worldwide.

Medical Simulation Market, by Technology

In 2024, the virtual patient simulation segment accounted for the largest share of the medical simulation market, driven by a global emphasis on digital-first and standardized medical education. Medical institutions worldwide are implementing virtual patient simulations to expose trainees to a variety of medical cases and scenarios relevant to specific populations. Notable institutions utilizing virtual patients include the Mayo Clinic Alix School of Medicine, the University of Melbourne Faculty of Medicine, and Keio University School of Medicine. These organizations collaborate to enhance diagnostic and decision-making skills through the use of virtual patients.

Medical Simulation Market, by End User

In 2024, academic institutions held the largest share of the medical simulation market. This growth was driven by a global emphasis on structured, competency-based medical training. Medical schools, nursing colleges, and university-affiliated teaching hospitals worldwide have increasingly adopted simulation-based education to enhance clinical skills and meet patient safety standards. For instance, prestigious institutions such as Stanford University School of Medicine, Monash University Faculty of Medicine, and Seoul National University College of Medicine have integrated simulation solutions into their curricula, positioning academic institutions as key global adopters of healthcare simulation technologies.

REGION

Asia Pacific region to register fastest growth in medical simulation market during forecast period

The medical simulation market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is growing at the fastest rate, driven by increasing investments in medical education and simulation centers, the adoption of Cloud-based simulation software & VR/AR technology, and the need for procedure-focused training in robotics, endovascular, and minimally invasive surgery. Almost all nations in the region, including China, India, Japan, and Australia, are increasing the use of simulation across hospitals (VASA, KD Hospital, etc.), medical colleges, and nursing colleges due to a shortage of medical practitioners.

MEDICAL SIMULATION MARKET: COMPANY EVALUATION MATRIX

In the medical simulation market matrix, CAE Inc. (Star) leads with a strong market share and an extensive product footprint, driven by its high-fidelity simulators, VR-based training platforms, and strong presence across academic, military, and hospital training programs worldwide. Mentice (Emerging Leader) is gaining momentum with its cutting-edge endovascular and interventional simulation solutions, offering high clinical realism, seamless integration with medical devices, and expanding partnerships with healthcare institutions and OEMs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Surgical Science Sweden AB (Sweden)

- CAE Inc. (Canada)

- Gaumard Scientific Co. (US)

- Kyoto Kagaku Co. (Japan)

- Laerdal Medical (Norway)

- Mentice AB (Sweden)

- Simulab Corporation (US)

- Simulaids (UK)

- Anatomage (US)

- Operative Experience, Inc. (US)

- Limbs & Things Ltd (UK)

- 3B Scientific (Germany)

- VirtaMed AG (Switzerland)

- Synbone AG (Switzerland)

- Erler-Zimmer Medical GmbH (Germany)

- Medical-X (Netherlands)

- KaVo Dental GmbH (Germany)

- Altay Scientific (Italy)

- TruCorp Ltd. (Ireland)

- Simendo B.V. (Netherlands)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.01 Billion |

| Market Forecast in 2030 (Value) | USD 7.23 Billion |

| Growth Rate | CAGR of 15.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

North America Healthcare Simulation Market Trauma Simulation Market Surgical Simulation Market Europe Healthcare Simulation Market US Healthcare Simulation Market Asia Pacific Healthcare Simulation Market |

WHAT IS IN IT FOR YOU: MEDICAL SIMULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client requested insights on the Healthcare Simulation Market in Middle East, focusing on growth drivers, regional trends, and market dynamics. | Provided a detailed analysis highlighting the expansion of simulation-based medical training, government-backed investments in healthcare education, and the integration of advanced VR/AR and haptic technologies enhancing clinical competency and patient safety across the Middle East (GCC countries). | Included custom growth drivers, regional adoption examples (e.g., UAE’s healthcare education reforms, Saudi Arabia’s Vision 2030 medical training initiatives), and strategic insights on the role of simulation in improving clinician preparedness, procedural accuracy, and overall healthcare quality. |

RECENT DEVELOPMENTS

- May 2025 : The Society for Imaging Informatics in Medicine (SIIM) unveiled the enhanced Virtual Hospital Platform (VHP) 2.0 at the SIIM25 Annual Meeting. Developed in partnership with MEDIC at Mohawk College (Canada), this platform delivers an immersive, scalable training environment for imaging informatics professionals.

- April 2025 : Munster Technological University (MTU), Kerry Campus, launched a state-of-the-art healthcare simulation center to address Ireland's nursing shortage. Funded by the Higher Education Authority, the facility features high-fidelity labs, AI-powered manikins, and interprofessional training spaces.

- March 2025 : The University of Texas at Arlington (UTA) has launched its Mobile Simulation Lab, a cutting-edge training facility from the College of Nursing and Health Innovation's Center for Rural Health and Nursing. This initiative aims to improve healthcare education in rural Texas communities, where nearly a quarter of Texans live and access to clinical training is often limited.

- January 2024 : GigXR and CAE Healthcare formed a strategic alliance to enhance clinical training through multimodal simulation, combining analog, digital, and immersive XR technologies. This collaboration aims to boost training efficiency for medical and nursing schools, hospitals, first responders, and government agencies.

Table of Contents

Methodology

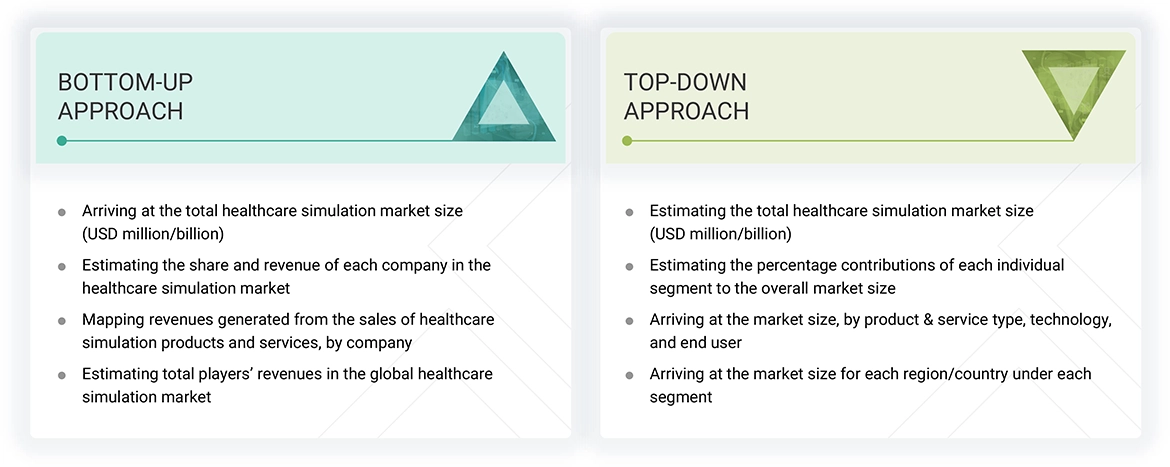

The study involved five major activities to estimate the current size of the global Medical Simulation market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the Securities and Exchange Commission (SEC) filings of companies. The market for companies providing global Medical Simulation solutions is assessed using secondary data from paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases. The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of healthcare simulation vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of global Medical Simulation solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

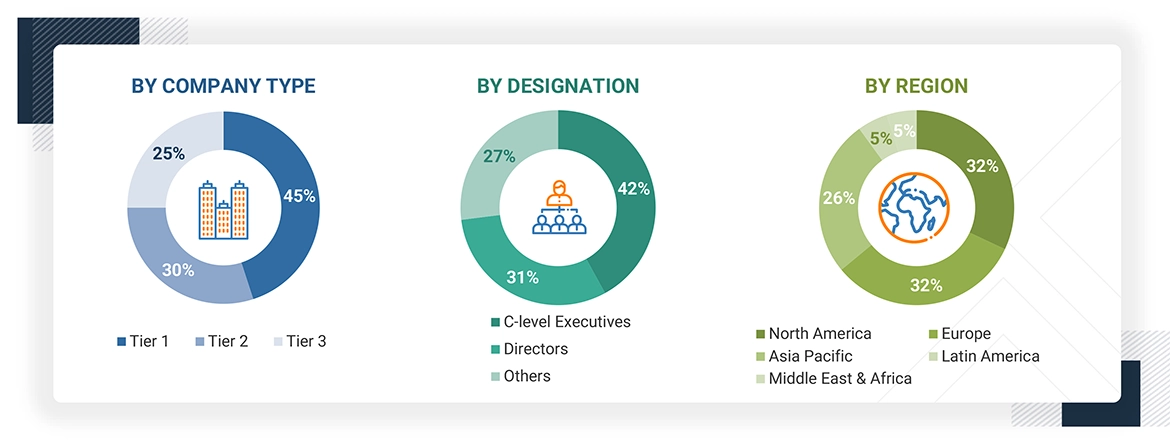

Breakdown of Primary Respondents:

Note: Other designations include sales, marketing, and product managers.

Tiers are defined based on a company’s total revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends by product and service, technology, end user, and region).

Data Triangulation

After arriving at the overall market size, the market size estimation processes split the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the global Medical Simulation market.

Market Definition

Medical Simulation uses virtual patients, mannequins, task trainers, or computer-based environments to replicate real-life clinical situations for training, education, evaluation, or system improvement without risking patient safety. It is a strategic tool that enables safe, repeatable, and immersive learning experiences, enhancing clinical performance, reducing medical errors, and improving healthcare delivery outcomes.

Stakeholders

- Healthcare simulation vendors

- Government bodies

- Healthcare service providers

- Clinical/physician centers

- Healthcare professionals

- Health IT service providers

- Healthcare associations/institutes

- Ambulatory care centers

- Venture capitalists

- Distributors and resellers

- Maintenance and support service providers

- Integration service providers

- Healthcare payers

- Military organizations

- Advocacy groups

- Investors and financial institutions

- Industry associations and trade groups

Report Objectives

- To define, describe, and forecast the global Medical Simulation market by product & service, technology, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the global Medical Simulation market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall global Medical Simulation market

- To assess the global Medical Simulation market with regard to Porter’s five forces, regulatory landscape, value chain, ecosystem map, patent protection, impact of 2025 US tariff and AI/Gen AI on the market under study, and key stakeholders’ buying criteria

- To analyze opportunities in the global Medical Simulation market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global Medical Simulation market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global Medical Simulation market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the global Medical Simulation market

Frequently Asked Questions(FAQ)

Which are the top industry players in the global healthcare simulation market?

CAE Inc. (Canada), Laerdal Medical (Norway), Gaumard Scientific Co. (US), Kyoto Kagaku (Japan), Limbs & Things (UK), Mentice AB (Sweden), Simulab Corporation (US), and Surgical Science Sweden AB (Sweden).

Which products & services have been included in the healthcare simulation market report?

The report includes: Healthcare Simulation Anatomical Models, Patient Simulators (by type and application), Task Trainers, Interventional/Surgical Simulators (Laparoscopic, Gynecology, Cardiovascular, Orthopedic, Spine, Endovascular, Other), Ultrasound Simulators, Dental Simulators, Eye Simulators, Web-based Simulation, Healthcare Simulation Software, and Healthcare Simulation Training Services (Vendor-based Training, Educational Societies, Custom Consulting Services).

Which region is likely to dominate the global healthcare simulation market?

North America holds the largest share in the healthcare simulation market, while Asia Pacific is expected to register the highest CAGR during the forecast period.

Which end users have been included in the healthcare simulation market report?

Academic Institutes, Hospitals, Military Organizations, and Other End Users.

At what CAGR is the market expected to grow from 2025 to 2030?

The healthcare simulation market is projected to grow at a CAGR of 15.6% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Simulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Medical Simulation Market

John

Jun, 2022

Which are the top companies hold the market share in medical simulation market?.

Kahlill

Jun, 2022

What are the key trends in the healthcare simulation market report?.