US Medical Simulation Market Size, Growth, Share & Trends Analysis

US Medical Simulation Market by offering (Anatomical Models [Patient {High Fidelity}, Surgical {Laparoscopic, Ortho, Gynec, Spine}, Trainers, Ultrasound], Software), Technology (3D Printing, Virtual Patient, Procedural Rehearsal), End User - Forecast 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US Medical Simulation market, valued at USD 1.20 billion in 2024, stood at USD 1.40 billion in 2025 and is projected to advance at a resilient CAGR of 15.2% from 2025 to 2030, culminating in a forecasted valuation of USD 2.83 billion by the end of the period. The market is driven by increasing emphasis on patient safety, competency-based medical training, and workforce upskilling. Hospitals, medical schools, and nursing programs are rapidly adopting simulation technologies such as high-fidelity mannequins, virtual reality (VR), and AI-enabled platforms to enable risk-free clinical training in the US.

KEY TAKEAWAYS

-

By OfferingBy offering, the web-based simulation segment is projected to register the highest CAGR of 16.8%

-

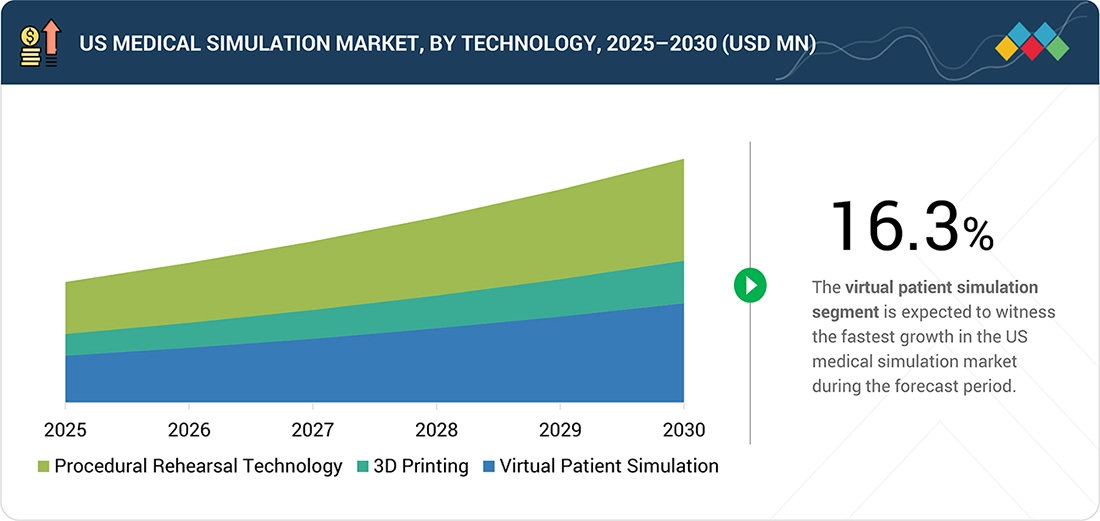

By TechnologyBy technology, the virtual patient simulation segment is estimated to register the highest CAGR of 16.3%

-

By End UserBy end user, the academic institutes segment held the largest share of 55.9% in 2024.

-

Competitive LandscapeSurgical Science Sweden AB, Laerdal Medical, and Kyoto Kagaku were identified as some of the star players in the US medical simulation market, given their strong market share and product footprint.

-

Competitive LandscapeHaag-Streit AG and HRV Simulation, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The US medical simulation market continues to expand, supported by rising demand for advanced clinical training, stricter regulatory and accreditation requirements, and a growing healthcare workforce. The shift toward digital learning, remote simulation, and advanced procedural training continues to support strong market expansion, positioning the US as the largest and most mature market globally.

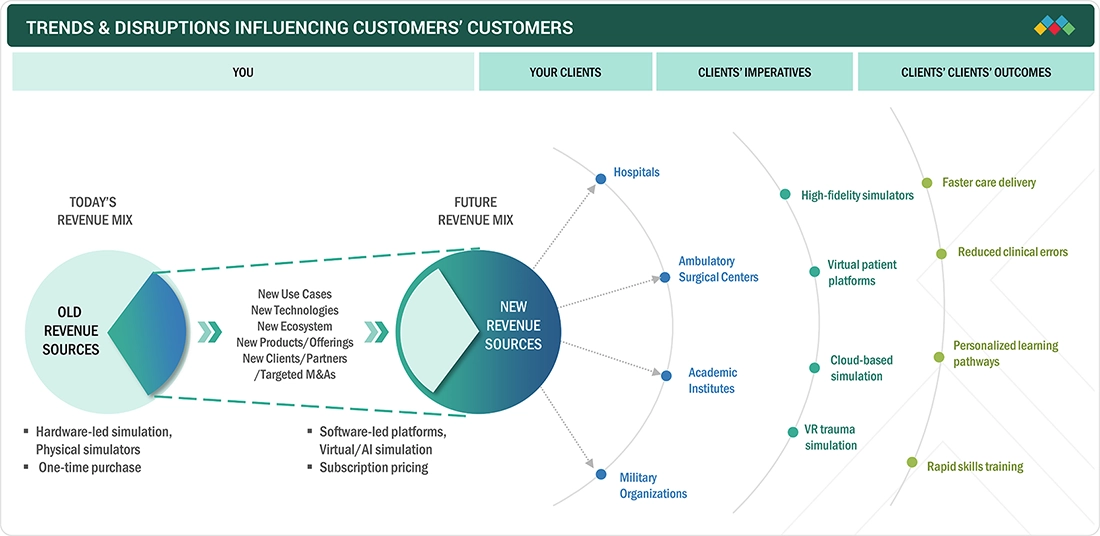

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the US medical simulation market, key trends include a shift from hardware-based simulators to software, cloud, and VR-driven platforms. Hospitals, ambulatory surgical centers, academic institutes, and military healthcare organizations are adopting these solutions to enable faster skills training, reduce clinical errors, and deliver scalable, personalized education.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for realistic and risk-free training environments in US medical education

-

Rapid technological advancements in US medical education

Level

-

Limited availability of funding for establishing simulation training centers in the US

-

Surging demand for minimally invasive treatments

Level

-

Widening healthcare workforce gaps in the US driving demand for simulation-based training solutions

-

Growing awareness and adoption of simulation-based training across US healthcare institutions

Level

-

High cost of simulators

-

Operational challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for realistic and risk-free training environments in US medical education

The increasing need for real and risk-free simulation environments in US medical training is catalyzing the growth of the medical simulation market, with various medical schools and healthcare systems using simulation-based training sessions for advanced clinical competency development. For example, well-established institutions such as the Mayo Clinic and the US Department of Veterans Affairs have advanced simulation centers with high-fidelity simulators, VR/AR solutions, and simulation-based training solutions with a view to enabling risk-free training sessions and standardized training and upskilling of US healthcare professionals.

Restraint: Limited availability of funding for establishing simulation training centers in the US

The limited availability of funding for establishing simulation training centers in the US remains a significant restraint on market growth, especially for smaller hospitals, community healthcare providers, and academic institutions with constrained budgets. High upfront capital requirements for high-fidelity simulators, VR/AR systems, dedicated infrastructure, faculty training, and ongoing maintenance increase the total cost of ownership. In addition, competing priorities such as EHR upgrades, staffing costs, and regulatory compliance often limit available capital, slowing the pace of simulation center expansion despite clear clinical and educational benefits.

Opportunity: Widening healthcare workforce gaps in the US driving demand for simulation-based training solutions

The increasing healthcare talent gap in the US is accelerating the need for simulation-based training solutions as the shortage of nurses, doctors, and healthcare professionals continues to strain the delivery of care. Large healthcare institutions such as the US Department of Veterans Affairs and HCA Healthcare have increasingly turned to simulations to train personnel rapidly and enable seamless induction without impacting patient care. Simulation-enabled training solutions can even upskill existing personnel to retain productivity and quality in healthcare delivery amid constant shortages of talent.

Challenge: High cost of simulators

The high cost of simulation solutions is one of the factors that constitute a major growth challenge for the US medical simulation market, since most of the advanced high-fidelity solutions, such as mannequin simulators, VR/AR simulation solutions, and AI simulation solutions, are extremely expensive and present a high cost of entry for a company or institution wishing to implement such solutions. The cost of solutions provided by some of the best simulation solution providers, such as Laerdal Medical and CAE Healthcare, includes both equipment cost and additional ongoing cost related to software, training, and services, which tends to increase the overall cost of ownership.

US MEDICAL SIMULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides VR-based surgical simulators used by US hospitals and medical schools for minimally invasive and robotic surgery training | Improves surgical precision | Reduces procedural errors | Accelerates surgeon competency |

|

Supplies high-fidelity mannequins and simulation solutions for US EMS, nursing schools, and hospitals for emergency and critical care training | Enhances patient safety | Supports standardized training | Improves emergency response outcomes |

|

Develops advanced patient simulators widely used in US medical education for obstetrics, pediatrics, and acute care training | Enables realistic clinical scenarios | Improves clinical decision-making | Reduces training risk |

|

Provides VR-based simulation platforms for image-guided interventional training in US hospitals and medical education centers | Improves clinician skills | Reduces procedural risk | Supports safe, efficient adoption of complex interventional procedures |

|

Offers procedural simulators for US residency programs and skills labs focused on surgical and interventional training | Accelerates skill acquisition | Supports competency-based education | Reduces clinical errors |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The US medical simulation market ecosystem includes key vendors (Surgical Science Sweden, Gaumard Medical, Laerdal Medical), startups (Symgery, Inovus Limited), regulatory bodies such as the US Food and Drug Administration, American Medical Association, and end users, including academic institutes, hospitals, and military organizations. These stakeholders collectively use simulation for clinical skills training, patient safety drills, medical education, emergency preparedness, disaster response, and staff upskilling.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Medical Simulation Market, By Offering

In 2024, the anatomical models segment held the largest share of the US medical simulation market due to their extensive adoption across US medical schools, nursing colleges, and teaching hospitals, particularly within programs aligned with the Association of American Medical Colleges and the National League for Nursing. Commonly used in skills labs and undergraduate training, these models, supplied by vendors such as Laerdal Medical, remain preferred for anatomy and basic procedures due to their cost-effectiveness, durability, and low maintenance requirements.

US Medical Simulation Market, By Technology

In 2024, virtual patient simulation held the largest share of the US medical simulation market, driven by its ability to support standardized clinical training, objective skills assessment, and remote learning across medical schools and teaching hospitals. National training initiatives within large health systems, such as the US Department of Veterans Affairs, along with broader shifts toward digital and simulation-first education models, are accelerating uptake.

US Medical Simulation Market, By End User

In 2024, academic institutes held the largest share for the US medical simulation market, driven by widespread use of simulation-based learning across US medical schools, nursing colleges, and allied health programs. Accreditation and training initiatives led by the Association of American Medical Colleges, National League for Nursing, and Accreditation Council for Graduate Medical Education are driving investments in simulation labs, virtual patient platforms, and anatomical models, reinforcing their strong adoption across the US market.

US MEDICAL SIMULATION MARKET: COMPANY EVALUATION MATRIX

In the US medical simulation market matrix, Laerdal Medical (Star Player) leads with a dominant presence, with a broad portfolio of high-fidelity patient simulators, virtual training platforms, and educational solutions adopted by major hospitals, medical schools, and EMS training programs. VirtaMed AG (Emerging Leader) is known for its high-precision mixed-reality surgical simulators used in orthopedics, gynecology, urology, and other procedural specialties.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Surgical Science Sweden AB (Sweden)

- Laerdal Medical (Norway)

- Gaumard Scientific Co (US)

- Mentice AB (Sweden)

- Limbs & Things (UK)

- Kyoto Kagaku Co., Ltd. (Japan)

- Simulab Corporation (US)

- Simulaids (US)

- Anatomage (US)

- Operative Experience, Inc. (US)

- Nasco Healthcare (US)

- 3B Scientific (Germany)

- VirtaMed AG (Switzerland)

- SYNBONE AG (Switzerland)

- IngMar Medical (US)

- Medical-X (Netherlands)

- KaVo Dental (Germany)

- Atlay Scientific (Italy)

- Trucorp (Ireland)

- Simendo (Netherlands)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.20 Billion |

| Market Forecast, 2030 (Value) | USD 2.83 Billion |

| Growth Rate | CAGR of 15.2% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Parent & Related Segment Reports |

Healthcare Simulation Market North America Healthcare Simulation Market Europe Healthcare Simulation Market Asia Pacific Healthcare Simulation Market Trauma Simulation Market Surgical Simulation Market |

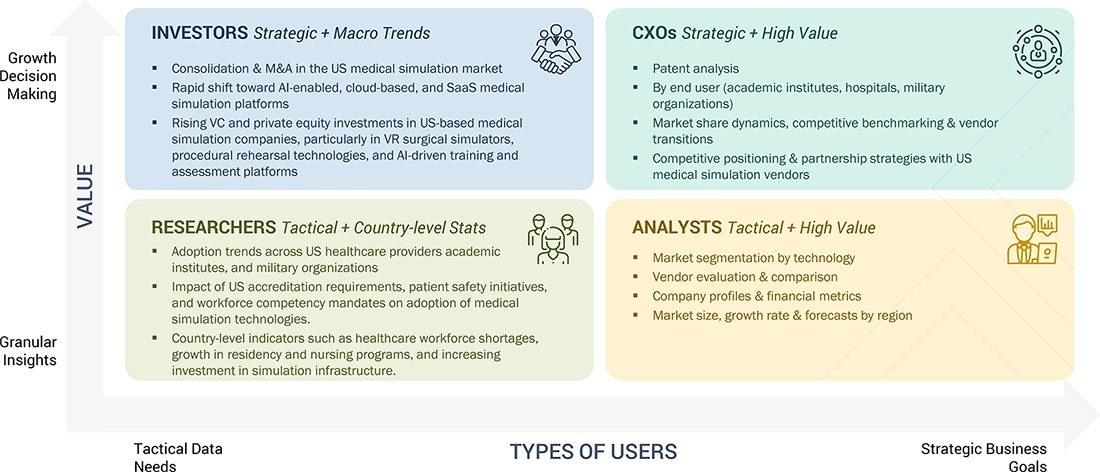

WHAT IS IN IT FOR YOU: US MEDICAL SIMULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Benchmarking of US medical simulation vendors by simulator type (anatomical models, virtual patients, high-fidelity mannequins, VR/AR), technology maturity, pricing, and end-user focus | Supports vendor selection, competitive positioning, and partnership decisions |

| Regional Market Entry Strategy | Analysis of US regulatory bodies, accreditation requirements (medical & nursing education), reimbursement influence, and adoption trends across hospitals and academic institutes | Enables faster market entry and compliant go-to-market execution |

| Local Risk & Opportunity Assessment | Assessment of funding constraints, simulator costs, workforce shortages, technology adoption barriers, and high-growth simulation segments in the US | Improves risk mitigation and investment prioritization |

| Technology Adoption by Region | Mapping adoption of anatomical models, virtual patient simulation, VR/AR, AI-enabled simulators, and cloud-based training platforms across US end users | Guides product strategy, innovation focus, and technology-led growth |

RECENT DEVELOPMENTS

- July 2025 : Mentice AB announced the consolidation of all research and development and manufacturing activities for its physical simulation portfolio into a new facility in Denver, Colorado, strengthening its US operations.

- November 2024 : Operative Experience Inc. secured a second procurement from the Air National Guard (ANG) to complete the installation of OEI’s latest high-fidelity male and female TCCS Plus Pro patient simulators at 103 ANG sites throughout the US.

- January 2024 : ANKYRAS received 510(k) clearance from the US Food and Drug Administration (FDA). The approval of Mentice AB’s product by the FDA demonstrates the safety and effectiveness of ANKYRAS and confirms the commitment to providing innovative and high-quality healthcare solutions.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

The study involved five major activities to estimate the current size of the US Medical Simulation Market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the Securities and Exchange Commission (SEC) filings of companies. The market for companies providing healthcare simulation solutions is assessed using secondary data from paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases. The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of healthcare simulation vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of healthcare simulation solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends by product and service, technology, end user, and region).

Data Triangulation

After arriving at the overall market size, the market size estimation processes split the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the US Medical Simulation Market.

Market Definition

Medical/Healthcare simulation uses virtual patients, mannequins, task trainers, or computer-based environments to replicate real-life clinical situations for training, education, evaluation, or system improvement without risking patient safety. It is a strategic tool that enables safe, repeatable, and immersive learning experiences, enhancing clinical performance, reducing medical errors, and improving healthcare delivery outcomes.

Stakeholders

- Healthcare simulation vendors

- Government bodies

- Healthcare service providers

- Clinical/physician centers

- Healthcare professionals

- Health IT service providers

- Healthcare associations/institutes

- Ambulatory care centers

- Venture capitalists

- Distributors and resellers

- Maintenance and support service providers

- Integration service providers

- Healthcare payers

- Military organizations

- Advocacy groups

- Investors and financial institutions

- Industry associations and trade groups

Report Objectives

- To define, describe, and forecast the US Medical Simulation Market by product & service, technology, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the US Medical Simulation market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall US Medical Simulation Market

- To assess the US Medical Simulation Market with regard to Porter’s five forces, regulatory landscape, value chain, ecosystem map, patent protection, impact of 2025 US tariff and AI/Gen AI on the market under study, and key stakeholders’ buying criteria

- To analyze opportunities in the US Medical Simulation market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the US Medical Simulation Market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the US Medical Simulation Market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Medical Simulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in US Medical Simulation Market