Surgical Simulation Market

Surgical Simulation Market by Offering (General [Laparoscopic], Robotic, Cardio [Interventional], Neuro [Cranial, Spine], Software), Type (High fidelity), Technology (AR/VR), Use Case (Training, R&D), End User (Hospitals) - Global Forecast by 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

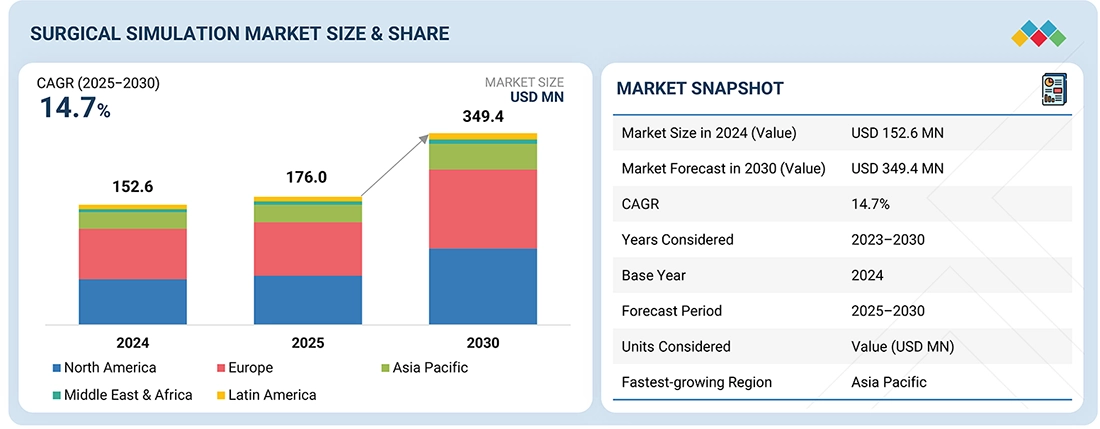

The surgical simulation market is projected to reach USD 349.4 million by 2030 from USD 176.0 million in 2025, at a CAGR of 14.7% from 2025 to 2030. Fueled by the emphasis on patient safety, the surge of complex and minimally invasive surgical procedures, and the need for standardized competency-based training for surgical professionals. Market growth can also be attributed to the fast adoption of advanced simulation technologies such as virtual reality, augmented reality, haptics, and artificial intelligence-based performance analytics that provide immersive and risk-free training opportunities with objective measures of surgical competency. Other contributors to driving the market forward include global surgeon talent shortages, increased regulation on surgical outcomes, rising investments in healthcare education infrastructure, and the adoption of simulation for surgical credentialing, training for medical devices, and other medical education programs.

KEY TAKEAWAYS

-

By RegionThe North American surgical simulation market accounted for the largest share of 42.9% of the market in 2024.

-

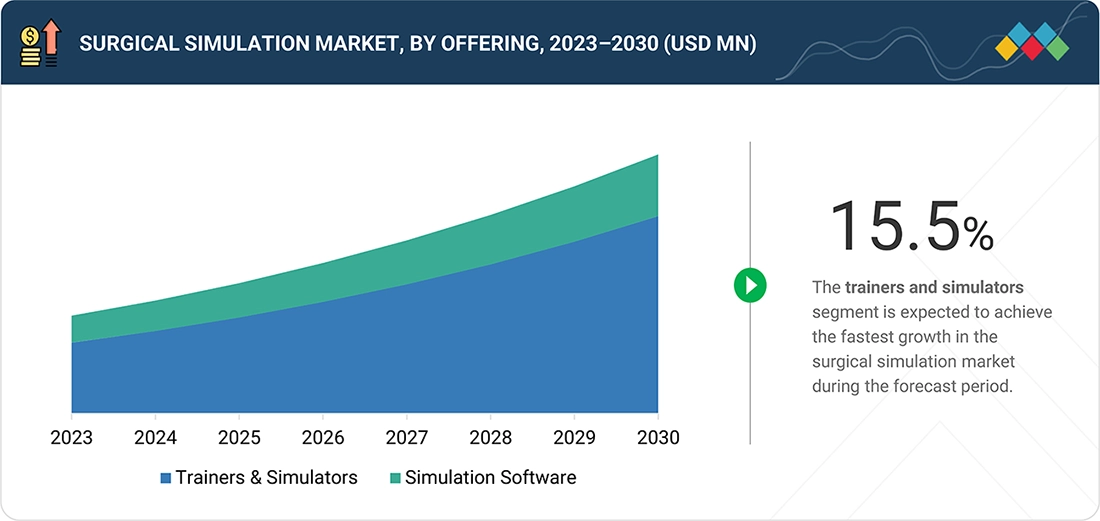

By OfferingThe trainers & simulators segment is projected to register the highest CAGR of 15.5% during the forecast period.

-

By TypeThe hybrid surgical simulators segment is projected to grow at the fastest rate from 2025 to 2030, at a CAGR of 15.5%.

-

By TechnologyThe augmented & virtual reality (AR/VR) segment is projected to dominate the market during the forecast period.

-

By Use CaseThe surgical procedure rehearsal & planning segment is projected to grow at the fastest rate during the forecast period.

-

By End UserThe hospitals segment is projected to dominate the market during the forecast period.

-

Competitive Landscape: Key PlayersSurgical Science Sweden AB, Laerdal Medical, Intuitive Surgical, Mentice AB, and Virtamed AG were identified as some of the star players in the surgical simulation market (global), given their strong market share and product footprint.

-

Competitive Landscape:MIRAI 3D SRL and SurgeonsLab AG, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The rapid growth of the surgical simulation market is driven by increased interest among healthcare systems and training institutions in improving surgical proficiency, patient safety, and procedural outcomes. Advanced virtual and augmented reality, haptic technologies, AI performance analytics, and cloud-based simulation platforms can enable realistic, data-driven, and scalable training for minimally invasive, robotic, and complex surgery. Moreover, increased collaborations among simulation vendors, medical device companies, and academic hospitals, unprecedented investments in modernizing surgical education infrastructure, and the integration of simulation into certification, credentialing, and device training programs-these are the other major restructuring forces working for the global surgical training ecosystem.

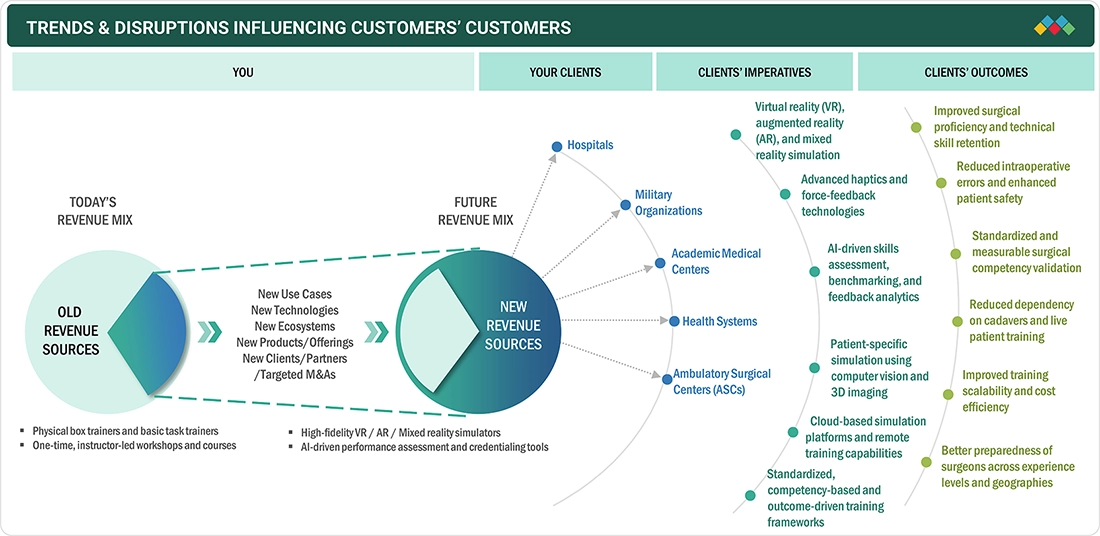

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The surgical simulation market is presently undergoing a significant paradigm shift as hospitals, academic medical institutions, military organizations, and medical device companies are increasingly realizing the urgent need for simulation-based surgical training to enhance surgical skills, patient safety, and outcomes. As the pressure is mounting on the surgical field to minimize surgical errors while cutting the learning curve for various types of surgical procedures, simulation-based surgical training tools such as AR/VR, mixed reality, haptics, and AI-based performance analysis are revolutionizing the surgical training domain. The introduction of immersive surgical simulation-based training is revolutionizing the conventional surgical training model from an apprentice-based model to a competency-based learning curve, with the surgical simulation market witnessing a significant endorsement of next-generation high-fidelity simulation-based surgical training tools independent of the operating rooms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of minimally invasive and robotic-assisted surgical procedures requiring specialized training

-

Increasing focus on patient safety and reduction of preventable surgical errors

Level

-

High initial capital investment requirements for advanced surgical simulation systems

-

Lack of standardization in simulation validation metrics and regulatory frameworks

Level

-

Integration of artificial intelligence and machine learning for personalized, adaptive surgical training

-

Development of cloud-based platforms enabling remote, scalable, and subscription-based training solutions

Level

-

Economic downturns and healthcare budget constraints reducing discretionary simulation spending

-

Cybersecurity threats and data breach risks in cloud-based and networked simulation systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of minimally invasive and robotic-assisted surgical procedures requiring specialized training

One of the major drivers that is expected to lead to the implementation of surgical simulation solutions is the fact that more and more operations are being performed through minimally invasive and robot-assisted surgeries that involve high technical skills and require long learning curves. The growing replacement of open surgeries by laparoscopic, endoscopic, and robotic surgeries has greatly increased the complexity of training since physicians are obliged to learn advanced hand-eye coordination, depth planes, and instrument movement, in addition to the mediated workflow through technology. There is a lack of traditional apprenticeship-based training models and exposure to the operating room to facilitate this transition, particularly in the face of patient safety issues and lack of training time. Surgical simulation provides solutions to these issues by allowing the practice of multifaceted procedures, robotic control, and device-specific training, as well as basic practice in a risk-free environment, to be repeated. Enabling surgeon proficiency, minimizing procedural error, and reducing learning curves without negatively impacting patient outcomes, simulation technologies are important in facilitating the safe and scalable adoption of minimally invasive and robot-assisted surgeries, and thus make significant contributions to the acceleration of demand in the surgical simulation market.

Restraint: High initial capital investment requirements for advanced surgical simulation systems

One of the important barriers to the adoption of advanced surgical simulation systems includes the high capital investment required, which can restrain the adoption of high-fidelity/immersive surgical simulation systems. Advanced surgical simulation systems require significant funding, which may include the purchase of specialized computer systems, VR/AR headsets, haptic devices, robotic systems, high-performance computing systems, and simulation environments. For many hospital administrations, academic institutions, and training centers, especially in developing or resource-constrained healthcare environments, it can be rather challenging to fund the high costs associated with the purchase of surgical simulation systems. As such, it will be important to understand that the adoption rate of surgical simulation systems can be slowed down due to the lack of investment in the required systems.

Opportunity: Integration of artificial intelligence and machine learning for personalized, adaptive surgical training

The integration of artificial intelligence with machine learning is a good opportunity for surgical simulation to grow. Surgical procedures are getting more complicated with time. There are many skills required to master as a surgical resident, and the extent of these skills required to be mastered varies from individual to individual. Previous training methods were universal, i.e., one-size-fits-all. These are not required anymore. AI-based simulation systems will be able to collect a range of data from each of the surgical residents undergoing the training, such as accuracy, speed required to master each procedure, error rates, as well as the decision-making skills of the particular individual. Such a personalized method will enhance the rate of skill acquisition through the system. Hence, there is a good opportunity here for the surgical simulation market.

Challenge: Economic downturns and healthcare budget constraints reducing discretionary simulation spending

The economic recession or downturn is a factor that negatively impacts the growth of the surgical simulation market. Surgical simulation is considered a discretionary or capital expenditure. During an economic recession, healthcare facilities or even institutions focus more on addressing immediate healthcare needs than ensuring that they incorporate new technology in their operations. Budget constraints affect the rate at which institutions can adopt new or advanced healthcare simulation solutions. Although the importance of these solutions in providing better educational experience and ensuring better care is immense, economic recession implies that institutions may take their time to invest in better simulation solutions. Budget constraints may even be exacerbated by diminished funding in medical school and training programs.

SURGICAL SIMULATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-fidelity VR and robotic surgical simulation for minimally invasive and robotic procedure training, performance assessment, and credentialing | Accelerates skill acquisition | Reduces learning curves for robotic surgery | Improves procedural safety and readiness |

|

Simulation-based surgical and perioperative training using manikins, task trainers, and integrated learning platforms | Enhances clinical competence | Improves patient safety | Supports standardized, team-based training |

|

Cloud-based surgical simulation management platforms for curriculum delivery, performance tracking, and competency assessment | Enables scalable training programs | Improves training efficiency | Supports competency-based education |

|

Endovascular and cardiovascular procedural simulation using high-fidelity VR and patient-specific case libraries | Improves procedural planning | Reduces procedural errors | Enhances complex catheter-based skill development |

|

Minimally invasive surgery (MIS) and ultrasound simulation with validated metrics and procedural realism | Improves MIS proficiency | Enables objective skills assessment | Reduces complication risk |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The surgical simulation market ecosystem comprises major simulation technology providers, medical device manufacturers, regulatory and accreditation bodies, and leading healthcare and training institutions working collaboratively to advance simulation-based surgical education. Major players (Surgical Science Sweden AB, Laerdal Medical, Intuitive Surgical, Mentice AB, Virtamed AG, and Medtronic) provide high-fidelity VR, robotic, and procedure-specific simulators, while innovators (Osso VR, FundamentalXR, ImmersiveTouch, SimX, Inovus, Avkin, and Elevate Healthcare) are expanding access through immersive XR, AI-enabled performance analytics, and portable platforms. Regulatory and accreditation bodies such as the ACGME and Royal Colleges are increasingly integrating simulation into competency-based training requirements. On the demand side, leading hospitals and academic medical centers (Mayo Clinic, Cleveland Clinic, Johns Hopkins Hospital, and Mass General Brigham) are embedding surgical simulation into residency programs, credentialing pathways, and continuous professional development to reduce reliance on operating-room training, improve surgeon readiness, and enhance patient safety outcomes.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Surgical Simulation Market, By Offering

The trainers & simulators segment accounted for the largest share of the surgical simulation market in 2024. This is primarily because of the large market share of procedure- or specialty-specific simulators, such as general surgery, robotic, cardiovascular, neurosurgery, and gyn & ob simulators. These are extremely significant as they are specifically used as tools for acquiring skills through hands-on experiences. Trainers/simulators are considered the preferred mode of acquiring training, as they provide anatomical realism, tactile feedback, and workflow accuracy closest to natural surgical conditions, with specific reference to minimally invasive and robotic procedures. These factors are the main reason the trainers/simulators segment is the largest offering for surgical simulation.

Surgical Simulation Market, By Type

The share of the hybrid surgical simulators segment was significant in the surgical simulation market in 2024. This was mainly because hybrid simulators can combine physical task trainers and anatomical models with advanced digital technologies such as VR/AR, computer-based simulation, and performance analytics. A hybrid system provides a well-balanced medium of training since realism and tactile feedback are complemented with other advanced technologies such as computerized simulations, visualization, and performance analytics, making the system highly effective for training both basic and advanced knowledge. These simulators are highly effective for training practitioners in a number of procedures and can achieve cost and space efficiency as well as effectiveness. Moreover, hybrid simulators provide hospitals and educational institutions with a highly effective solution for competency-based training and assessment due to their capability to mimic realistic procedures, repetitions, and standardized performance analytics.

Surgical Simulation Market, By Technology

The augmented reality & virtual reality (AR & VR) segment accounted for the largest share of the surgical simulation market in 2024 due to the widespread adoption of various AR & VR platforms for simulation-based learning that closely emulates the real-world conditions of a physical operating room setting. The overwhelming advantages offered by these technologies for the conduct of training and educational programs have made the AR & VR segment of the market a clear leader among the various technologies used for surgical simulation. Further, the continued advancements in the use of AR & VR technologies in the field of surgery are driving the use of these technologies in the surgical simulation market.

Surgical Simulation Market, By Use Case

Training held the largest share of the surgical simulation market in 2024. It is due to the increased adoption rate for simulation-based education to enhance the proficiency level in surgeries. In the surgical simulation market, training is predominantly used for residents, continuing education for medical practitioners, and upskilling for surgeons in specialty segments like general surgery, cardiovascular surgery, neurosurgery, and gynecology. High adoption rates for training programs based on simulation have greatly influenced the overall acceptance by prominent teaching hospitals and medical institutions like the Mayo Clinic, Cleveland Clinic, and Johns Hopkins Hospital. However, the simulator training programs provide benefits for repetitive, standardized practice with objective feedback, which has also contributed to the training aspect of the simulator usage as the primary aspect of the surgical simulation market. Furthermore, the ACGME's strong emphasis on simulation-based credentialing and education is also influencing the training component as a primary driver of the market.

Surgical Simulation Market, By End User

The hospitals segment captured the largest market share in 2024 due to the widespread adoption of the simulation-based tools of training and assessment in the hospital environments of the world, which is expected to increase as better surgical skills, decreasing procedural errors, and enhanced patient safety are major objectives of the integration of the surgical simulation tools in the hospital settings of the world. Hospitals have increasingly adopted surgical simulators as tools of resident training, procedure credentialing, new surgical technology, and minimally invasive or robotic surgical procedures. Large multi-specialty hospitals and integrated health systems have always been key influencers of the adoption of surgical simulators, and examples can be drawn from Mayo Clinic, Cleveland Clinic, Mass General Brigham, and Apollo Hospitals due to high procedural volume under their responsibility, coupled with the increasing prescriptive regulation of competency-based resident education and postgraduate professional development programs.

REGION

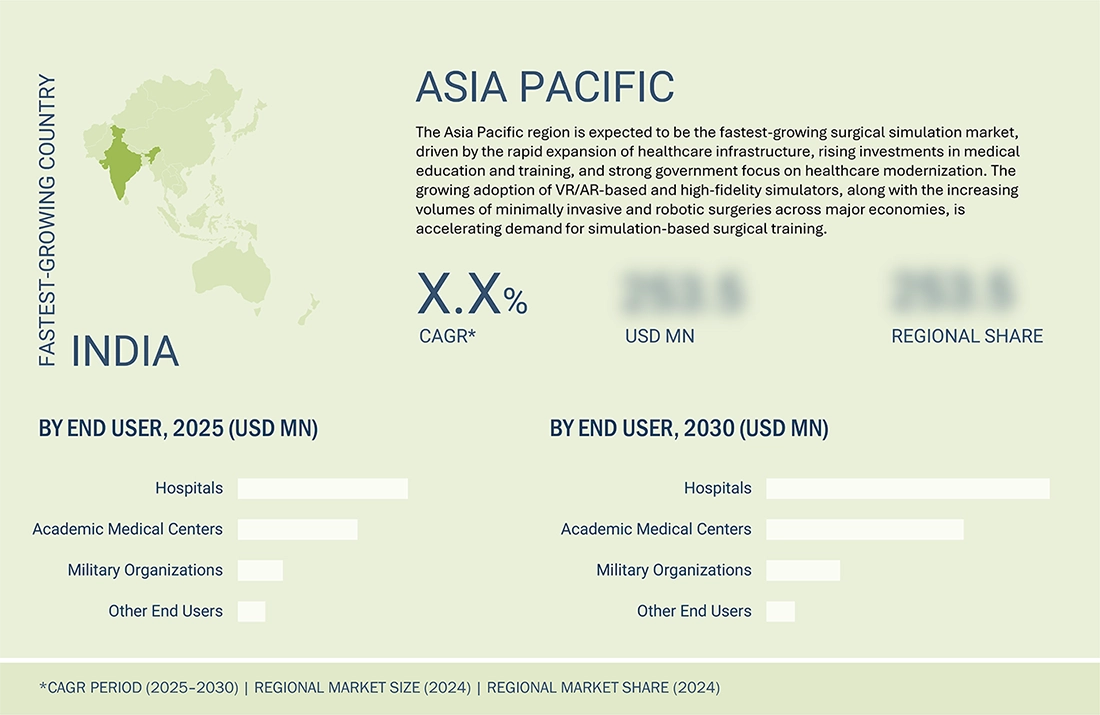

Asia Pacific to be fastest-growing region in surgical simulation market during forecast period

The Asia Pacific is projected to show the highest growth rate in the Asia Pacific market for surgical simulation during the forecast period. Asia Pacific is a promising market for the growth of the surgical simulation market due to the faster development of healthcare infrastructure, increasing number of surgeries, and the increased focus on enhancing better training and safety standards in the Asia Pacific region. Better cooperation from the governments towards the advancement of medical education is also adding to the growth in the Asia Pacific market. Investments in teaching clinics, medical universities, and robotic surgeries are also favoring the Asia Pacific market. In addition, the higher demand for minimally invasive surgeries and robotic techniques is also creating a better market for Asia Pacific to show the highest growth in the market for surgical simulations.

SURGICAL SIMULATION MARKET: COMPANY EVALUATION MATRIX

Surgical Science Sweden AB (Star) is a powerful player in the surgical simulation marketplace since it possesses a large, high-fidelity simulation solution in the laparoscopic, endoscopic, and robot surgery training, with high-quality analytics of performance and high usage in hospitals and academic health centers across the globe. Comparatively, Inovus Limited (Emerging Leader) is climbing the ladder with its affordable, portable, and specialty-based simulators that increase access to affordable surgical training, particularly in unexploited and resource-limited markets. Unlike Surgical Science Sweden AB, which is clinging to the leadership position based on its technological profundity, globalization, and high number of installed base, Inovus Limited is steadily getting market share because of increased demand for low-cost and scalable surgical simulation systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Surgical Science Sweden AB (Sweden)

- Laerdal Medical (Norway)

- Elevate Healthcare (US)

- Intuitive Surgical (US)

- Mentice AB (Sweden)

- VirtaMed AG (Switzerland)

- Gaumard Scientific (US)

- Simulab Corporation (US)

- Limbs & Things Ltd. (UK)

- Medtronic (Ireland)

- Osso VR (US)

- 3B Scientific (Germany)

- SIMULAIDS (US)

- TruCorp (UK)

- ImmersiveTouch, Inc. (US)

- Fundamental XR (UK)

- Kyoto Kagaku Co., Ltd. (Japan)

- SimX (Madison Industries) (US)

- Inovus Limited (UK)

- Avkin (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 152.6 MN |

| Market Forecast in 2030 (Value) | USD 349.4 MN |

| Growth Rate | 14.7% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

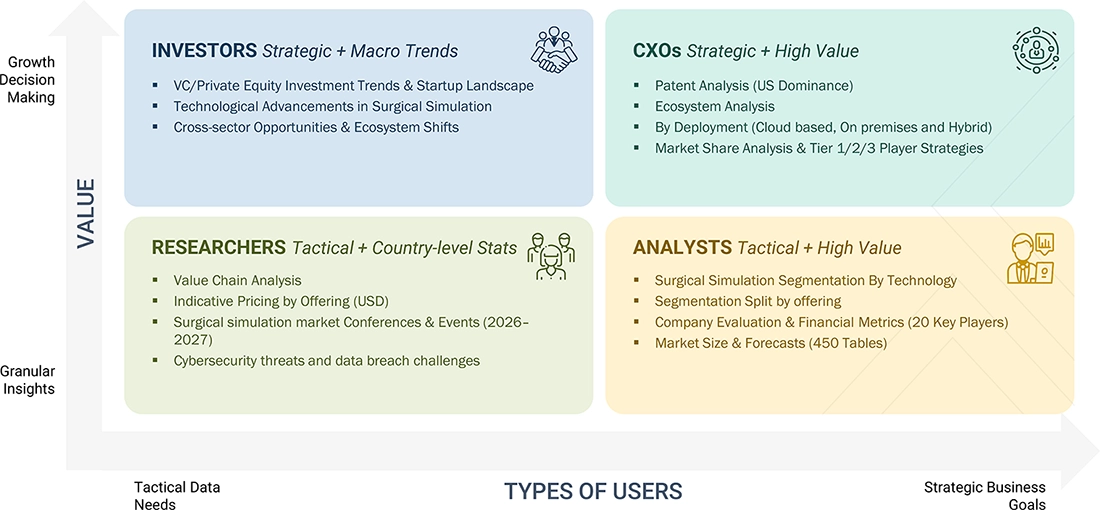

WHAT IS IN IT FOR YOU: SURGICAL SIMULATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Competitive Landscape Mapping | Profiles and comparative analysis of leading surgical simulation vendors across procedure types and care settings, including general surgery, minimally invasive surgery, robotic surgery, cardiovascular, orthopedic, and neurosurgical training: The assessment covers simulator fidelity (VR, AR, mixed reality, haptics), curriculum integration, assessment and analytics capabilities, deployment models (on-premise, portable, cloud-enabled), scalability, and depth of procedural libraries. Vendor portfolios are evaluated for partnerships with hospitals, academic medical centers, medical device companies, and defense organizations, along with coverage of hardware, software, and service offerings, and recent M&A or strategic collaborations. |

|

| Market Entry & Growth Strategy | Analysis at regional and market-segment levels for surgical simulation adoption across North America, Europe, and the Asia Pacific; evaluation of key growth drivers such as rising surgical volumes, shift toward minimally invasive and robotic procedures, competency-based medical education, patient safety mandates, and workforce training gaps; end user adoption trends are analyzed for hospitals, academic medical centers, military organizations, and training institutes, along with purchasing behavior of healthcare systems, medical schools, and device manufacturers investing in simulation-based education. |

|

| Regulatory, Data Privacy & Operational Risk Analysis | Assessment of regulatory and accreditation considerations impacting surgical simulation deployment, including medical education standards, device training compliance, and institutional credentialing requirements; analysis of data privacy, trainee performance data handling, validation of simulation outcomes, and AI-driven assessment tools where applicable; operational risk analysis includes simulator utilization rates, clinician adoption, curriculum integration challenges, technology obsolescence, and long-term maintenance and upgrade considerations |

|

RECENT DEVELOPMENTS

- March 2024 : Intuitive Surgical (US) received 510(k) clearance from the US FDA for the next-gen robotic surgery system, the da Vinci 5. At the time of commercialization, the company installed 362 da Vinci 5 systems in the US market. The company also marked a notable milestone in the year as it saw more than 2,500 surgeons use the system to perform over 32,000 procedures across more than 40 clinical procedure types.

- March 2024 : Surgical Science Sweden AB (Sweden) declared that its simulation software will be integrated into each da Vinci 5 robotic system, encouraged by FDA approval of this new robotic platform. This is an expansion into the robotic space where simulation is now a part of this system, opening up a wide array of training, skill development, and competency assessment aligned to current robotic surgery.

Table of Contents

Methodology

The study involved five major activities to estimate the current size of the Surgical Simulation Market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the Securities and Exchange Commission (SEC) filings of companies. The market for companies providing healthcare simulation solutions is assessed using secondary data from paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases. The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of healthcare simulation vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of healthcare simulation solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends by product and service, technology, end user, and region).

Data Triangulation

After arriving at the overall market size, the market size estimation processes split the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Surgical Simulation Market.

Market Definition

Healthcare simulation uses virtual patients, mannequins, task trainers, or computer-based environments to replicate real-life clinical situations for training, education, evaluation, or system improvement without risking patient safety. It is a strategic tool that enables safe, repeatable, and immersive learning experiences, enhancing clinical performance, reducing medical errors, and improving healthcare delivery outcomes.

Stakeholders

- Healthcare simulation vendors

- Government bodies

- Healthcare service providers

- Clinical/physician centers

- Healthcare professionals

- Health IT service providers

- Healthcare associations/institutes

- Ambulatory care centers

- Venture capitalists

- Distributors and resellers

- Maintenance and support service providers

- Integration service providers

- Healthcare payers

- Military organizations

- Advocacy groups

- Investors and financial institutions

- Industry associations and trade groups

Report Objectives

- To define, describe, and forecast the global Surgical Simulation Market by product & service, technology, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Surgical Simulation Market

- To assess the Surgical Simulation Market with regard to Porter’s five forces, regulatory landscape, value chain, ecosystem map, patent protection, impact of 2025 US tariff and AI/Gen AI on the market under study, and key stakeholders’ buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the Surgical Simulation Market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the Surgical Simulation Market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the Surgical Simulation Market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Surgical Simulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Surgical Simulation Market