Adhesion Barrier Market by Product (Regenerated Cellulose, Hyaluronic Acid, PEG), Type (Film, Gel, Liquid), Procedure (Abdominal, Cardiovascular, Gynae, Neurology), End User (Hospitals, Clinics & ASC), Region - Global Forecast to 2028

Market Growth Outlook Summary

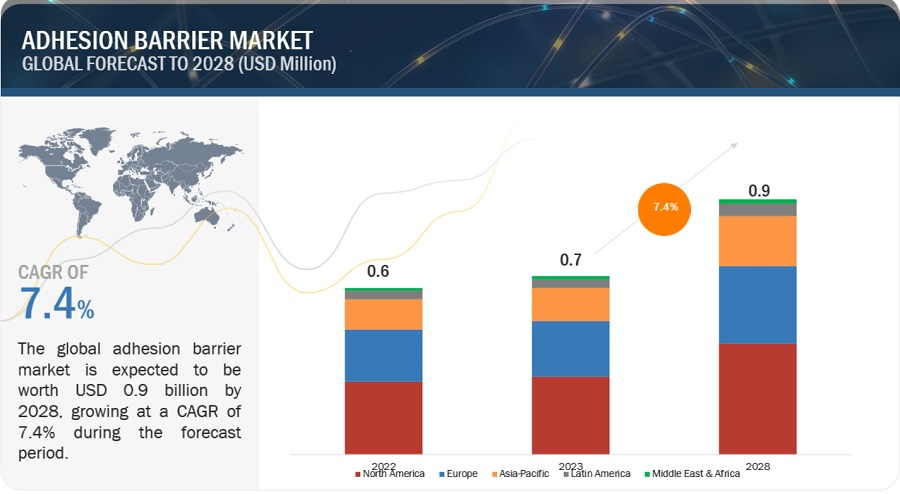

The global adhesion barrier market, valued at US$0.6 billion in 2022, stood at US$0.7 billion in 2023 and is projected to advance at a resilient CAGR of 7.4% from 2023 to 2028, culminating in a forecasted valuation of US$0.9 billion by the end of the period. The major factors promoting the continued development of this market are the rise in geriatric population, an increasing number of surgeries and sports-related injuries, and the growing awareness for development of adhesions and complications associated with adhesion formation. On the other hand, during the forecast period, the resistance of surgeons to using adhesion barriers is anticipated to impede market expansion.

Global Adhesion Barrier Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Adhesion Barrier Market Dynamics

Driver: Increase in the volume of surgeries and sports-related injuries

Adhesion formation is a major post-surgical complication and requires repeat surgeries for treatment in affected patients. Post-surgical adhesions lead to different complications in different surgeries, such as severe abdominal pain in the case of abdominal surgeries, infertility in women after gynecological surgeries, and physical impairment of patients after neurological surgeries. Considering the severe effects of post-surgery adhesions in patients, the importance of products such as adhesion barriers is increasing in the market. Also, considering the growth in the number of surgeries performed globally, the importance of these products will be more pronounced in the coming years.

Restraint: Reluctance of surgeons to use adhesion barriers

Even though surgeons are aware of these risks, they are reluctant to use adhesion barriers owing to the lack of/limited reliable clinical evidence supporting the safety and efficacy of commercialized adhesion barrier products. Also, due to issues regarding the safety and efficacy of adhesion barriers, companies find it difficult to get marketing approvals for their products. Also, over the last few years, the market has witnessed the discontinuation of approved adhesion barrier products due to poor clinical outcomes.

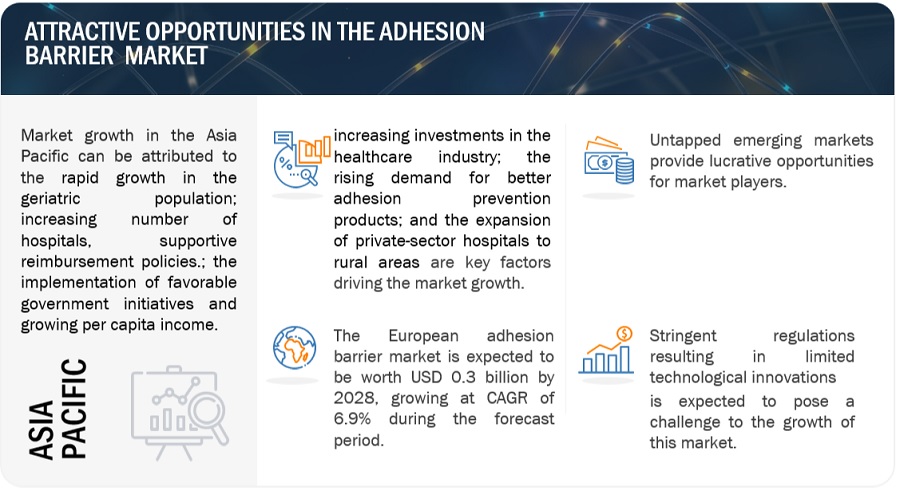

Opportunity: Untapped emerging markets

The penetration of adhesion barriers is very low in the Asia Pacific, Latin America, and the Middle East and Africa. In the coming years, countries such as South Korea, China, India, Mexico, and Brazil are expected to offer significant growth opportunities for players operating in the adhesion barriers market as these countries have a large patient base for target indications, such as cardiovascular, orthopedic, general/abdominal, and gynecological disorders. The number of surgical procedures, such as cardiac surgeries, general and abdominal surgeries, urological surgeries, gynecological surgeries, and orthopedic surgeries, is also on the rise in countries across emerging markets. Also, the number of surgeries being performed across APAC and the Middle East is increasing, owing to an increased influx of medical tourists in these regions. The increasing disease burden and volume of surgical procedures performed in emerging markets are expected to create growth opportunities for key players operating in the adhesion barriers market.

Challenge: Stringent regulations leading to limited technological innovations

The development of new adhesion barriers requires significant investments, and new products generally take more than 7–8 years to gain marketing approval. The cost and time required for a product to enter the clinical trial stage and then clear the clinical trials are very high, with minimum chances of the product gaining approval. Also, the possibility of obtaining clinically significant data showing efficacy and safety has been low for most adhesion barriers, barring a few. Hence, despite huge investments in R&D, the risk of failure is very high in the case of adhesion barriers. This is a major factor limiting the development of novel adhesion barriers in the market.

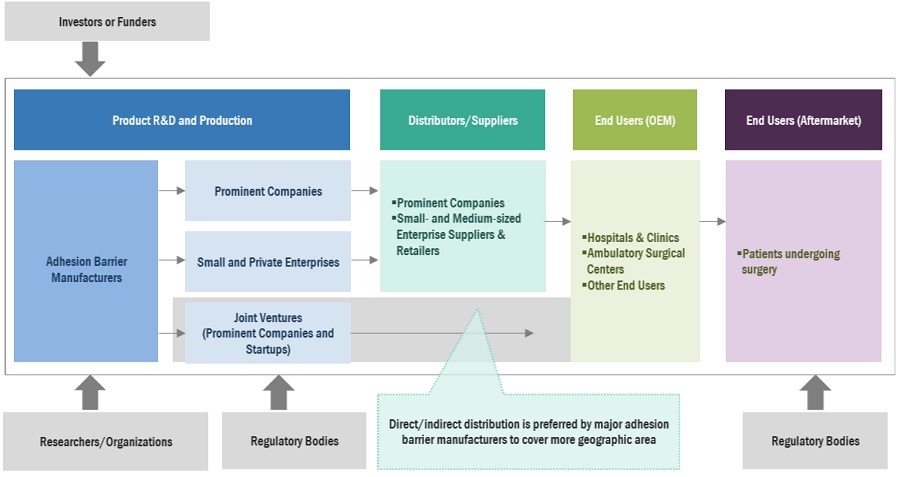

Adhesion Barrier Market Ecosystem

The prominent players operating in the adhesion barriers market are Baxter International (US), Johnson & Johnson (J&J) (US), and Becton, Dickinson and Company (US), Integra LifeSciences (US), Anika Therapeutics (US), Atrium Medical Corporation (US), FzioMed (US), MAST Biosurgery (Switzerland), Innocoll (Ireland), Betatech Medical (Turkey), CorMatrix Cardiovascular, Inc. (US), Terumo Corporation (Japan), BiosCompass (US), W.L.Gore & Associates (US), GUNZE Limited (Japan), Leader Biomedical (Netherlands), Xlynk Surgical (US), Luna Solutions (US), PlantTec Medical GmbH (Germany), Actamax Surgical Materials, LLC (US), Arc Medical Devices, INC. (US), CG Bio INC. (Korea), Seikagaku Corporation (Japan), Hangzhou Singclean Medical Products Co.,Ltd (China)and Allosource (US).

The synthetic adhesion barrier product segment of the adhesion barrier industry is expected to grow the fastest during the forecast period.

Synthetic adhesion barriers are the most widely used post-surgical adhesion prevention products this segment accounted for the largest share of the adhesion barrier market in 2022 and is growing at the fastest rate with the highest CAGR. Owing to their resorbable features, synthetic barriers help prevent the requirement for a second surgery for implant removal. they are more cost-effective than natural adhesion barriers.

By formulation, the film-based formulations accounted for the largest share of the adhesion barrier industry in 2022

Depending on formulation type, the adhesion barrier market is segmented into film formulations, gel formulations, and liquid formulations. In 2022, film formulations dominated this market. The large share of this segment can be attributed to the availability of a wide range of film-form adhesion barriers and the strong clinical evidence supporting the safety and efficacy of these adhesion barriers. These factors, coupled with their ease of use, have increased the adoption of film-form adhesion barriers among surgeons as compared to gel- and liquid-form adhesion barriers.

By End User, the hospital and clinics accounted for the largest share of the adhesion barrier industry in 2022

Depending on end user, the adhesion barrier market is segmented hospitals & clinics, ambulatory surgical centers and other end users. In 2022, hospitals & clinics dominated this market. The large share of this segment can be attributed to the fact that the large number of surgerical procedures are performed in the hospitals.

APAC region of the adhesion barrier industry will grow at the fastest rate during the forecast period.

The adhesion barrier market, by region, is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. The Asia Pacific is the most lucrative healthcare market, owing to its large population and growing healthcare sector. Factors such as the rapid economic growth in China and Japan, presence of a universal healthcare reimbursement policy, large and growing population in countries like China and India, overall increasing disease prevalence at an alarming rate is leading Asia Pacific to grow at the fastest rate. Moreover, the government initiatives, such as the setting up of new healthcare systems for the aging population and increasing funds for infrastructural improvements in healthcare facilities and the increased demand for surgical interventions are driving the demand for better healthcare facilities, medical devices, and technologies in the region.

Geographic Snapshot: Adhesion Barrier Market

To know about the assumptions considered for the study, download the pdf brochure

The prominent players operating in the adhesion barriers market are Baxter International (US), Johnson & Johnson (US), Becton, Dickinson and Company (US), Integra LifeSciences (US), Anika Therapeutics (US), Atrium Medical Corporation (US), FzioMed (US), MAST Biosurgery (Switzerland), Innocoll (Ireland), Betatech Medical (Turkey), CorMatrix Cardiovascular, Inc. (US), Terumo Corporation (Japan), BiosCompass (US), W.L. Gore & Associates (US), GUNZE Limited (Japan), Leader Biomedical (Netherlands), Xlynk Surgical (US), Luna Solutions (US), PlantTec Medical GmbH (Germany), Actamax Surgical Materials, LLC (US), Arc Medical Devices, Inc. (US), CG Bio Inc. (South Korea), Seikagaku Corporation (Japan), Hangzhou Singclean Medical Products Co., Ltd. (China), AlloSource (US).

Scope of the Adhesion Barrier Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.7 billion |

|

Projected Revenue by 2028 |

$0.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.4% |

|

Market Driver |

Increase in the volume of surgeries and sports-related injuries |

|

Market Opportunity |

Untapped emerging markets |

The research report categorizes adhesion barrier market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Synthetic Products

- Hyaluronic Acid

- Regenerated Cellulose

- Polyethylene Glycol

- Other Synthetic Adhesion Barriers

- Natural Products

By Formulation

- Film Formulations

- Gel Formulations

- Liquid Formulations

By Application Area/Surgical Procedure

- Gynecological Surgeries

- General/Abdominal Surgeries

- Orthopedic Surgeries

- Cardiovascular Surgeries

- Neurological Surgeries

- Urological Surgeries

- Reconstructive Surgeries

- Other Surgeries

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Other End Users

By Country

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East and Africa

Recent Developments of Adhesion Barrier Industry

- In February 2020, Baxter’s acquired the Seprafilm Adhesion Barrier and related assets from Sanofi to strengthen its hemostate and sealant portfolio and company’s presence in this market.

- In January 2021, Integra Lifesciences Holdings Corporation acquired Acell Inc. This acquisition enables integra to provide more comprehensive complex wound management solutions

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global adhesion barrier market?

The global adhesion barrier market boasts a total revenue value of $0.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global adhesion barrier market?

The global adhesion barrier market has an estimated compound annual growth rate (CAGR) of 7.4% and a revenue size in the region of $0.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICS: ADHESION BARRIER MARKETDRIVERS- Rapid growth in geriatric population globally- Increase in volume of surgeries and sports-related injuries- Increasing awareness about medical implications of adhesionsRESTRAINTS- Reluctance of surgeons to use adhesion barriersOPPORTUNITIES- Untapped markets in emerging economiesCHALLENGES- Stringent regulations and limited technological innovations

-

5.3 INDUSTRY TRENDSRISING FOCUS ON GEL-FORM OF ADHESION BARRIERS FOR SURGERIES

-

5.4 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

- 5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 ECOSYSTEM MAPPING

-

5.9 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ADHESION BARRIERSADHESION BARRIER MARKET: TOP APPLICANTSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 PRICING ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS (2023–2025)

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 SYNTHETIC ADHESION BARRIERSHYALURONIC ACID- Greater biocompatibility and higher bioresorbability to drive segmentREGENERATED CELLULOSE- Non-reactive and bacteriostatic nature of regenerated cellulose to drive use in gynecological surgeriesPOLYETHYLENE GLYCOL- Ability to decrease post-surgical adhesions after abdominal and peritoneal surgeries to drive segmentOTHER SYNTHETIC ADHESION BARRIERS

-

6.3 NATURAL ADHESION BARRIERSGREATER TIME REQUIRED AND DIFFICULTY IN APPLICATIONS DURING SURGERIES TO LIMIT MARKET

- 7.1 INTRODUCTION

-

7.2 FILM FORMULATIONSFILM FORMULATIONS DOMINATED ADHESION BARRIER MARKET IN 2022

-

7.3 GEL FORMULATIONSHIGHER PREFERENCE FOR GEL-BASED FORMULATIONS OVER FILM-BASED BARRIERS TO DRIVE MARKET

-

7.4 LIQUID FORMULATIONSLIQUID FORMULATIONS TO BE WIDELY USED IN GYNAECOLOGICAL, PELVIC, AND ABDOMINAL SURGERIES

- 8.1 INTRODUCTION

-

8.2 GENERAL/ABDOMINAL SURGERIESINCREASING FORMATION OF POST-OPERATIVE ADHESIONS AND RISING COMPLICATIONS AMONG PATIENTS TO DRIVE MARKET

-

8.3 GYNECOLOGICAL SURGERIESRISING INCIDENCES OF PELVIC AND UTERINE CANCER AND INCREASING NUMBER OF C-SECTIONS TO DRIVE MARKET

-

8.4 CARDIOVASCULAR SURGERIESINCREASING NUMBER OF POST-OPERATIVE COMPLICATIONS TO DRIVE MARKET

-

8.5 ORTHOPEDIC SURGERIESGROWING NUMBER OF SPORT-RELATED INJURIES TO DRIVE MARKET

-

8.6 NEUROLOGICAL SURGERIESRISING INCIDENCES OF PHYSICAL PAINS AND IMPAIRMENTS AFTER NEUROLOGICAL SURGERIES TO DRIVE MARKET

-

8.7 RECONSTRUCTIVE SURGERIESHIGHER INSURANCE COVERAGE FOR COSMETIC SURGERIES TO DRIVE MARKET

-

8.8 UROLOGICAL SURGERIESGROWING INCIDENCES OF POST-OPERATIVE ADHESION FORMATION TO DRIVE MARKET

- 8.9 OTHER SURGERIES

- 9.1 INTRODUCTION

-

9.2 HOSPITALS AND CLINICSGROWING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES AND RISING ADOPTION OF SAFETY MEASURES TO DRIVE MARKET

-

9.3 AMBULATORY SURGICAL CENTERSINCREASING NUMBER OF OUTPATIENT VISITS AND FAVORABLE REIMBURSEMENT POLICIES TO DRIVE MARKET

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US dominated North American adhesion barrier market in 2022CANADA- Increasing number of C-section surgeries to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany accounted for largest share of European adhesion barrier market in 2022FRANCE- Rising number of advanced orthopedic surgeries to drive marketUK- Rising number of cardiovascular, gynecological, and orthopedic surgeries to drive marketITALY- Rising geriatric population and increasing prevalence of chronic diseases to drive marketSPAIN- High cost of surgical procedures to limit marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Rising geriatric population and increasing number of surgical procedures performed to drive marketCHINA- Rapid economic growth and increasing disposable income of middle-class population to drive marketINDIA- Rising focus of multinational companies and improving urban healthcare infrastructure to drive marketAUSTRALIA- Growing government awareness campaigns and rising funding and grants for medical research to drive marketSOUTH KOREA- Growing geriatric population and increasing disposable incomes to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Brazil to command largest market share for adhesion barriers in Latin AmericaMEXICO- Rising burden of chronic diseases and well-organized healthcare system to drive marketREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAINCREASING NUMBER OF GYNECOLOGICAL AND GENERAL SURGERIES TO DRIVE MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN ADHESION BARRIER MARKET (JANUARY 2020– JULY 2023)

- 11.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

- 11.7 COMPETITIVE BENCHMARKING

- 11.8 COMPANY GEOGRAPHICAL FOOTPRINT

-

11.9 COMPETITIVE SITUATION AND TRENDSKEY PRODUCT LAUNCHES AND APPROVALSKEY ACQUISITIONS

-

12.1 KEY PLAYERSBAXTER INTERNATIONAL INC.- Business overview- Products offered- Recent developments- MnM viewJOHNSON & JOHNSON- Business overview- Products offered- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- MNM viewINTEGRA LIFESCIENCES HOLDINGS CORPORATION- Business overview- Products offered- Recent developmentsANIKA THERAPEUTICS INC.- Business overview- Products offeredATRIUM MEDICAL CORPORATION- Business overview- Products offeredTERUMO CORPORATION- Business overview- Products offeredFZIOMED, INC.- Business overview- Products offeredMAST BIOSURGERY- Business overview- Products offeredINNOCOLL- Business overview- Products offeredBETATECH MEDICAL- Business overview- Products offeredCORMATRIX CARDIOVASCULAR, INC.- Business overview- Products offeredBIOSCOMPASS, INC.- Business overview- Products offeredW.L. GORE & ASSOCIATES, INC.- Business overview- Products offeredALLOSOURCE- Business overview- Products offered

-

12.2 OTHER PLAYERS (ADHESION BARRIER PRODUCTS UNDER DEVELOPMENT)XLYNK SURGICALLUNA INNOVATIONSACTAMAX SURGICAL MATERIAL, LLCARC MEDICAL INC.CG BIO INC.LEADER BIOMEDICALPLANTTEC MEDICAL GMBHHANGZHOU SINGCLEAN MEDICAL PRODUCTS CO., LTD.SEIKAGAKU CORPORATIONGUNZE LIMITED

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 RISK ASSESSMENT: ADHESION BARRIER MARKET

- TABLE 3 GROWTH RATE IN GERIATRIC POPULATION, BY REGION, 2020–2050

- TABLE 4 LIST OF COMMON SPECIALTIES AND PROCEDURES IN OLDER ADULTS

- TABLE 5 US: PERCENTAGE INCREASE IN NUMBER OF SURGICAL PROCEDURES PERFORMED (2010 VS. 2020)

- TABLE 6 AVERAGE ADHESION FORMATION RATE IN LAPAROSCOPIC SURGERIES

- TABLE 7 CLASSIFICATIONS OF MEDICAL DEVICES BY US FDA

- TABLE 8 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY IN JAPAN

- TABLE 9 NMPA MEDICAL DEVICES CLASSIFICATION

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER’S FIVE FORCES ANALYSIS

- TABLE 14 ANTI-ADHESION BARRIERS AS SUBJECT OF RECENT RESEARCH

- TABLE 15 AVERAGE SELLING PRICE OF ADHESION BARRIER PRODUCTS OFFERED BY KEY PLAYERS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ADHESION BARRIER PRODUCTS

- TABLE 17 KEY BUYING CRITERIA FOR ADHESION BARRIER PRODUCTS

- TABLE 18 ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 19 KEY BRANDS OF SYNTHETIC ADHESION BARRIERS

- TABLE 20 ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 21 ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 HYALURONIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 REGENERATED CELLULOSE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 POLYETHYLENE GLYCOL MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 OTHER SYNTHETIC ADHESION BARRIERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LIST OF NATURAL ADHESION BARRIERS AVAILABLE

- TABLE 27 ADHESION BARRIER MARKET FOR NATURAL ADHESION BARRIERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 ADOPTION OF DIFFERENT ADHESION BARRIER FORMULATIONS IN SURGERIES

- TABLE 29 ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 30 INDICATIVE LIST OF COMMERCIALLY AVAILABLE ADHESION BARRIERS WITH FILM FORMULATIONS

- TABLE 31 ADHESION BARRIER MARKET FOR FILM FORMULATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 INDICATIVE LIST OF COMMERCIALLY AVAILABLE ADHESION BARRIERS WITH GEL FORMULATIONS

- TABLE 33 ADHESION BARRIER MARKET FOR GEL FORMULATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 INDICATIVE LIST OF COMMERCIALLY AVAILABLE ADHESION BARRIERS WITH LIQUID FORMULATIONS

- TABLE 35 ADHESION BARRIER MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 37 ADHESION BARRIER MARKET FOR GENERAL/ABDOMINAL SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 PREVALENCE OF INTRAUTERINE ADHESIONS ACROSS DIFFERENT GYNAECOLOGICAL PROCEDURES (IN %)

- TABLE 39 COUNTRIES WITH HIGHEST C-SECTION RATES (2022)

- TABLE 40 ADHESION BARRIER MARKET FOR GYNECOLOGICAL SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 INDICATIVE LIST OF COMMERCIALLY AVAILABLE ADHESION BARRIERS FOR CARDIOVASCULAR SURGICAL APPLICATIONS

- TABLE 42 ADHESION BARRIER MARKET FOR CARDIOVASCULAR SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ADHESION BARRIER MARKET FOR ORTHOPEDIC SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 ADHESION BARRIER MARKET FOR NEUROLOGICAL SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ADHESION BARRIER MARKET FOR RECONSTRUCTIVE SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 ADHESION BARRIER MARKET FOR UROLOGICAL SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ADHESION BARRIER MARKET FOR OTHER SURGERIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 ADHESION BARRIER MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 ADHESION BARRIER MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ADHESION BARRIER MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 ADHESION BARRIER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 US: ARTHROPLASTY PROCEDURAL VOLUME, BY YEAR (N = 1,787,914)

- TABLE 54 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY (USD BILLION)

- TABLE 55 NORTH AMERICA: ADHESION BARRIER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 US: KEY MACROINDICATORS

- TABLE 62 US: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 US: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 US: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 65 US: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 US: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: KEY MACROINDICATORS

- TABLE 68 CANADA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 73 EUROPEAN COUNTRIES WITH HIGHEST C-SECTION RATE (2021)

- TABLE 74 EUROPE: ADHESION BARRIER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 GERMANY: KEY MACROINDICATORS

- TABLE 81 GERMANY: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 FRANCE: KEY MACROINDICATORS

- TABLE 87 FRANCE: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 FRANCE: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 FRANCE: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 90 FRANCE: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 UK: PERCENTAGE SHARE OF AGING POPULATION (2019–2036)

- TABLE 93 UK: KEY MACROINDICATORS

- TABLE 94 UK: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 95 UK: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 UK: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 97 UK: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 UK: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 ITALY: KEY MACROINDICATORS

- TABLE 100 ITALY: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 101 ITALY: SYNTHETIC ADHESION BARRIERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 ITALY: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 103 ITALY: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 104 ITALY: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 SPAIN: KEY MACROINDICATORS

- TABLE 106 SPAIN: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 107 SPAIN: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 SPAIN: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 109 SPAIN: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 SPAIN: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ADHESION BARRIER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 JAPAN: KEY MACROINDICATORS

- TABLE 123 JAPAN: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 124 JAPAN: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 JAPAN: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 CHINA: KEY MACROINDICATORS

- TABLE 129 CHINA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 130 CHINA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 CHINA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 132 CHINA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 133 CHINA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 134 INDIA: KEY MACROINDICATORS

- TABLE 135 INDIA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 136 INDIA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 INDIA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 138 INDIA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 INDIA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 140 AUSTRALIA: KEY MACROINDICATORS

- TABLE 141 AUSTRALIA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 142 AUSTRALIA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 AUSTRALIA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 144 AUSTRALIA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 145 AUSTRALIA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 147 SOUTH KOREA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 148 SOUTH KOREA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 SOUTH KOREA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 150 SOUTH KOREA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 SOUTH KOREA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 152 NEW ZEALAND: REGISTERED JOINT ARTHROPLASTIES CONDUCTED FROM 2015–2021

- TABLE 153 REST OF ASIA PACIFIC: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: ADHESION BARRIER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 164 BRAZIL: KEY MACROINDICATORS

- TABLE 165 BRAZIL: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 166 BRAZIL: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 BRAZIL: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 168 BRAZIL: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 169 BRAZIL: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 170 MEXICO: KEY MACROINDICATORS

- TABLE 171 MEXICO: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 172 MEXICO: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 MEXICO: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 174 MEXICO: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 175 MEXICO: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 176 REST OF LATIN AMERICA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 177 REST OF LATIN AMERICA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ADHESION BARRIER MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: ADHESION BARRIER MARKET, BY FORMULATION, 2021–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ADHESION BARRIER MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ADHESION BARRIER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 186 PRODUCT PORTFOLIO ANALYSIS: ADHESION BARRIER MARKET

- TABLE 187 FORMULATION PORTFOLIO ANALYSIS: ADHESION BARRIER MARKET

- TABLE 188 APPLICATION PORTFOLIO ANALYSIS: ADHESION BARRIER MARKET

- TABLE 189 END USER PORTFOLIO ANALYSIS: ADHESION BARRIER MARKET

- TABLE 190 OVERALL PORTFOLIO ANALYSIS: ADHESION BARRIER MARKET

- TABLE 191 REGIONAL REVENUE MIX: ADHESION BARRIER MARKET

- TABLE 192 KEY PRODUCT LAUNCHES AND APPROVALS

- TABLE 193 BAXTER INTERNATIONAL INC: COMPANY OVERVIEW

- TABLE 194 JOHNSON & JOHNSON: COMPANY OVERVIEW

- TABLE 195 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 196 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 197 ANIKA THERAPEUTICS INC.: COMPANY OVERVIEW

- TABLE 198 ATRIUM MEDICAL CORPORATION: COMPANY OVERVIEW

- TABLE 199 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 200 FZIOMED, INC.: COMPANY OVERVIEW

- TABLE 201 MAST BIOSURGERY: COMPANY OVERVIEW

- TABLE 202 INNOCOLL: COMPANY OVERVIEW

- TABLE 203 BETATECH MEDICAL: COMPANY OVERVIEW

- TABLE 204 CORMATRIX CARDIOVASCULAR, INC.: COMPANY OVERVIEW

- TABLE 205 BIOSCOMPASS, INC.: COMPANY OVERVIEW

- TABLE 206 W. L. GORE & ASSOCIATES, INC.: COMPANY OVERVIEW

- TABLE 207 ALLOSOURCE: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND-SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: BAXTER INTERNATIONAL

- FIGURE 8 SUPPLY-SIDE ANALYSIS: ADHESION BARRIER MARKET

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 BOTTOM-UP APPROACH

- FIGURE 11 US: ORTHOPEDIC SURGERIES APPROACH

- FIGURE 12 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ADHESION BARRIER MARKET (2023–2028)

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 DATA TRIANGULATION METHODOLOGY

- FIGURE 15 ADHESION BARRIER MARKET, BY PRODUCT, 2022 VS. 2028 (USD MILLION)

- FIGURE 16 ADHESION BARRIER MARKET FOR SYNTHETIC ADHESION BARRIERS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 ADHESION BARRIER MARKET, BY FORMULATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 ADHESION BARRIER MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 ADHESION BARRIER MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 GEOGRAPHICAL SNAPSHOT OF ADHESION BARRIER MARKET

- FIGURE 21 INCREASING VOLUME OF SURGERIES RISING GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 22 SYNTHETIC BARRIERS ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ADHESION BARRIER MARKET IN 2022

- FIGURE 23 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 NORTH AMERICA TO DOMINATE ADHESION BARRIER MARKET IN 2028

- FIGURE 25 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 26 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

- FIGURE 27 APPROVAL PROCESS FOR CLASS III MEDICAL DEVICES IN CANADA

- FIGURE 28 CE APPROVAL PROCESS IN EUROPE FOR BIOSURGERY PRODUCTS

- FIGURE 29 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING COMPONENT AND PRODUCT MANUFACTURING PHASE

- FIGURE 30 ADHESION BARRIER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 ADHESION BARRIER MARKET: ECOSYSTEM MAPPING

- FIGURE 32 ADHESION BARRIER MARKET: GLOBAL PATENT PUBLICATION TRENDS (2015–2023)

- FIGURE 33 TOP APPLICANTS FOR ADHESION BARRIER PATENTS (2015–2023)

- FIGURE 34 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ADHESION BARRIER PATENTS (2015–2023)

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ADHESION BARRIER PRODUCTS

- FIGURE 36 KEY BUYING CRITERIA FOR ADHESION BARRIER PRODUCTS

- FIGURE 37 NORTH AMERICA: ADHESION BARRIER MARKET SNAPSHOT

- FIGURE 38 GERIATRIC POPULATION IN US (65 YEARS AND ABOVE IN MILLION)

- FIGURE 39 ASIA PACIFIC: ADHESION BARRIER MARKET SNAPSHOT

- FIGURE 40 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN ADHESION BARRIER MARKET (2018–2022)

- FIGURE 41 ADHESION BARRIER MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 42 ADHESION BARRIER MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 43 ADHESION BARRIER MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 44 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2022)

- FIGURE 46 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 47 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 48 ANIKA THERAPEUTICS INC.: COMPANY SNAPSHOT (2022)

- FIGURE 49 ATRIUM MEDICAL CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 50 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

The study involved four major activities in estimating the current size of the adhesion barrier market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering adhesion barrier and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the adhesion barrier market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the adhesion barrier market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from adhesion barrier manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, customer/end users who are using adhesion barrier were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of adhesion barrier and future outlook of their business which will affect the overall market.

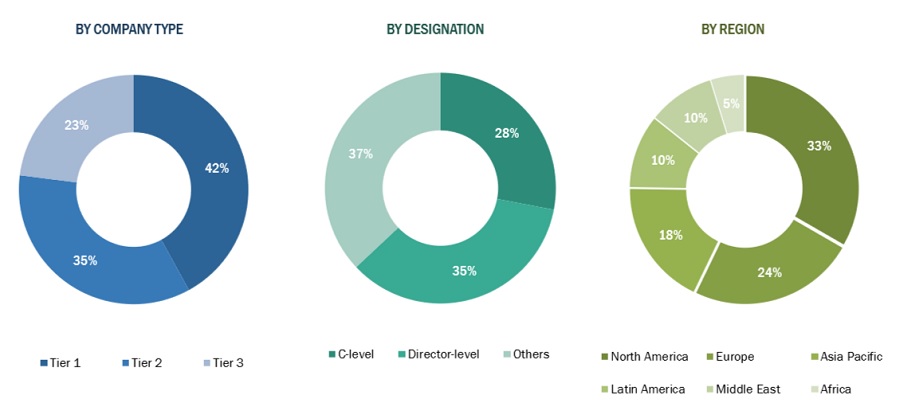

Breakdown of Primary Interviews : Supply-Side Participants, By Company Type, Designation, and region

Note1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note2: Other primaries include sales managers, marketing managers, and product managers.

Note3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1billion, Tier 2=USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the adhesion barrier market includes the following details.

The market sizing of the market was undertaken from the global side.

Country level Analysis: The size of the adhesion barrier market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall adhesion barrier market was obtained from secondary data and validated by primary participants to arrive at the total adhesion barrier market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall adhesion barrier market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Digital Diabetes Management Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Adhesion barrier is a medical device implant that is used to prevent the formation of internal scaring between organs and internal tissues during the post-surgery period. They are available in gels, physical film?mesh, fabric and in other forms. Adhesion barrier plays a critical role to prevent a patient from post-surgical complications.

Key Stakeholders

- Senior Management

- Doctors/surgeons

- Finance/Procurement Department

Report Objectives

- To define, describe, and forecast the global adhesion barrier market on the basis of product, formulation, application, end user and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the adhesion barrier market with respect to six main regions (along with countries), namely, North America, Europe, Asia Pacific, Latin America and The Middle East and Africa

- To profile the key players in the global adhesion barrier market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, regulatory approvals, and R&D activities of the leading players in the global adhesion barrier market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe adhesion barrier market into the Netherlands, Austria, Belgium, and others

- Further breakdown of the Rest of Asia Pacific adhesion barrier market into Singapore, Malaysia, and others

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Adhesion Barrier Market