Advanced Magnetic Materials Market by Type (Permanent Magnet Materials, Semi-Hard Magnetic Materials, Soft Magnetic Materials), End-Use Industry (Automotive, Electronics, Industrial, Power Generation, Medical), And Region - Global Forecast to 2028

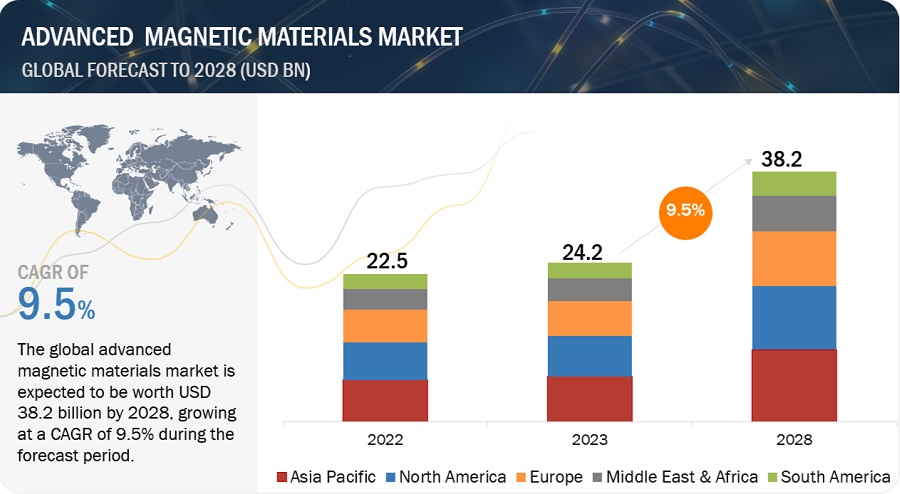

The advanced magnetic materials market is projected to grow from USD 24.2 billion in 2023 and is projected to reach USD 38.2 billion by 2028, at a CAGR of 9.5%. Over the world, the advanced magnetic materials market is expanding significantly, and during the forecast period, a similar trend is anticipated. The demand for advanced magnetic materials has been driven by several factors, including the increasing demand for high efficiency motors and actuators in automotive and industrial applications. The major end-use segments of advanced magnetic materials include automotive, electronics, industrial, power generation, medical and others.

In the automotive industry, with a significant increase in usage of electric vehicles over the years, the need for increasing the energy efficiency of the motors. The advanced magnetic materials requirement will be driven by the new-generation motors and sensors for improved energy efficiency and self driving assistance in these electric vehicles. The companies are actively developing newer advanced AlNiCo and ferrite based magnets for electric motors which are energy efficient and light weight to reduce the dependence over rare earth magnets as the recycling of the rare earth magnets is a challenge for environmental conservation.

In the electronics industry, the advanced magnets are used in several applications such as semiconductor manufacturing, flash memory, sensors and high quality loudspeakers. The advanced magnets are used in semiconductor chip manufacturing for sorting the raw materials based on its size, separation of unwanted particles and maintain the concentration of the raw materials for ensuring the quality of the end product. It is also used in aligning and keeping the particles in its place during the lithography process. The need for advanced storage systems to meet the requirements of the advanced computing power and complement it, the magnetic materials are used for developing the flash storage systems using its magnetic properties like magnetic spin for storing the data from high speed advanced computers.

Attractive Opportunities in Advanced Magnetic Materials Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced magnetic materials Market Dynamics

Driver: Development of new industrial robots

According to industrial federation of robotics, The World Robotics report found that a record-breaking 517,385 new industrial robots were installed in factories around the world in 2021. It also represented 31 percent of year-on-year growth. Industrial robots require fast response, high torque, and accurate positioning. Advanced magnets enable precision movements in robotic arms, hands, and actuators by providing the necessary magnetic force.

Advanced magnets are essential for the development of highly compact, powerful servomotors and actuators that are used in a variety of motion control systems, including industrial robots that require fast response, high torque, and accurate positioning. Increasing demand of industrial robots drive the advanced magnetic materials market.

Restraint: Recent trade bans imposed by Chinese government on new technologies which affect the market

China produces more than two-thirds of the world's rare earth magnets and controls the majority of the global refining and processing capacity. China has dominant position in the global rare earth magnets market and countries like the US, Japan, Netherlands, South Korea, Italy, and other countries rely on China for rare earth magnets. Japan is the largest importer of rare earth magnets from China. In 2021, Japan’s import accounts for almost 36 percent of exports of China.

The majority of rare earth magnets mined in the US are refined in China before being sent back to the United States. In 2023, China plans to impose ban on the exports of certain rare earth magnet technologies to counter the US's advantage in the high-tech arena. This move can affect the advanced magnetic material market of US, Japan, and other countries.

Opportunity: Development of magneto calorific materials for HVAC

The Heating, Ventilation, and Air Conditioning (HVAC) systems are essential for thermal comfort and indoor air quality, but they also contribute to climate change. Greenhouse gases (GHGs) trap heat in the atmosphere, causing global warming. The Intergovernmental Panel on Climate Change (IPCC) estimates that GHGs are responsible for about 1 degree Celsius of warming since the pre-industrial era. Countries are working to reduce their emissions of GHGs, and HVAC systems are a major source of these emissions.

The current HVAC system is based on a 130-year-old technology that is energy-inefficient. This means that it uses more energy than necessary to heat and cool buildings. As a result, it produces more GHG emissions. There are new HVAC technologies that are more efficient and less harmful to the environment. These technologies are becoming more affordable, and they are being adopted by businesses and governments around the world.

Magnetocaloric materials (MCMs) are materials that change their temperature significantly when exposed to a magnetic field. This phenomenon is known as the magnetocaloric effect. The magnetocaloric effect is caused by the alignment of the magnetic moments of the atoms in the material with the magnetic field. When the magnetic field is applied, the magnetic moments align, which releases heat. When the magnetic field is removed, the magnetic moments become disordered, which absorbs heat.

Challenge: Huge investments required in R&D

Advanced magnets are used in small quantities for miniaturization or other purposes. The research and development cost is high in terms of manpower, materials, and technology. There are limited elements that can be used to manufacture certain permanent magnets, and the resulting permanent magnets must meet minimum performance requirements under different conditions to be considered for use. The product must deliver optimum efficiency that has both long-term and short-term benefits. Many market players do not have access to advanced technology, capital, and human expertise to manufacture environmentally friendly, efficient, and effective advanced magnets at a competitive price.

The advanced magnetic materials market is facing a number of challenges, including the high cost of manufacturing, the need for constant research and development, and the demands of different industries. One of the biggest challenges is the high cost of manufacturing. The production of permanent magnets requires the use of rare earth minerals, which are a limited resource. This drives up the cost of production and makes it difficult for smaller companies to enter the market. Another challenge is the need for constant research and development. New technologies are constantly being developed that can improve the performance of permanent magnets. This means that manufacturers need to invest heavily in research and development in order to stay ahead of the curve. Finally, the demands of different industries are also a challenge. Permanent magnets are used in a wide variety of applications, each of which has different requirements. This means that manufacturers need to be able to customize their products to meet the specific needs of each industry.

All of these challenges are making it difficult for the permanent magnet market to grow. However, the market is still expected to grow in the coming years, albeit at a slower pace than in previous years.

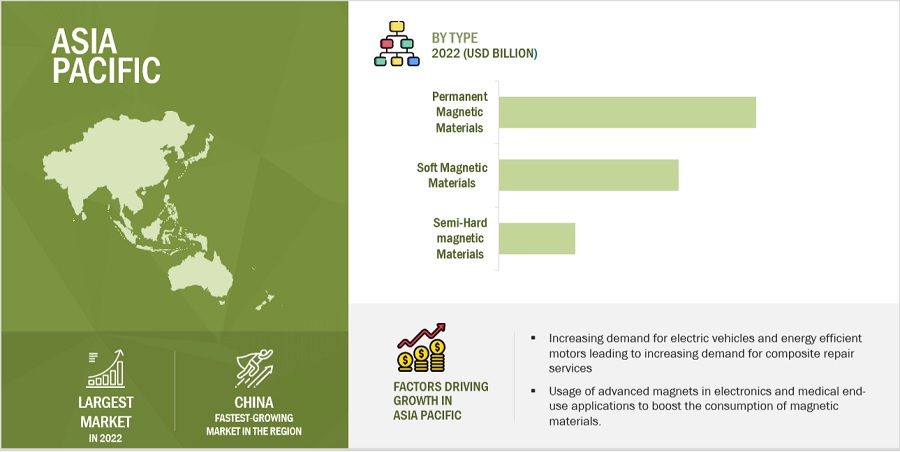

Permanent magnetic material type of advanced magnetic materials products to be the fastest growing market by 2028, in terms of value.

The permanent magnetic material segment is expected to witness the highest CAGR in the next five years with the significant increase in the usage of magnets in automobiles and power generation in order to increase the energy efficiency. In permanent magnet, the applications. Permanent magnets are categorized into four types, namely, alnico, hard ferrite, samarium cobalt (SmCo), and neodymium iron boron (NdFeB). Permanent magnets are critical components in various modern technologies, enabling efficient energy conversion, motion control, and magnetic sensing systems. This type of magnet retains its magnetic strength even after removal of the external magnetizing force. This magnet exhibits high magnetic flux density, high coercivity, which makes it suitable for various high-end applications.

Power generation end-use industry segment to be the second largest segment in the advanced magnetic materials market, in terms of value.

The use of advanced magnets in the global power generation industry is still small. The requirements of the industry to develop highly efficient generators and transformers to reduce the energy loss during the generation and transmission of power to the consumer. The advanced magnetic materials are used to develop the generators which has the less energy loss during the power generation from mechanical work. The magnets are designed in different shapes and sizes to test the energy loss during the conversion of mechanical energy to electrical energy and changes are made to the magnetic wire woundings also to tap the magnetic flux generated by these new magnets developed using advanced magnetic materials. Similarly, the companies are testing the usage of advanced magnetic materials to improve the efficiency of energy transfer during transmission of power from the point of generation or transmission to the consumers.

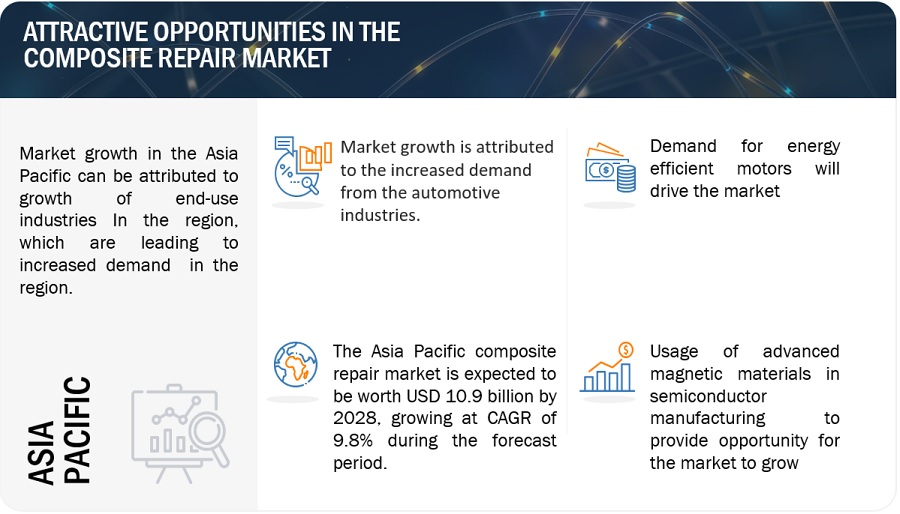

Asia Pacific to be the fastest growing market in the advanced magnetic materials market.

Asia Pacific holds the largest market share in the advanced magnetic materials market. The growth of the advanced magnetic materials market in this region is mainly driven by the automotive, increasing use of renewable energy for power generation and demand from medical and healthcare industry. Low interest rates, the presence of established players, and stringent environmental regulations emphasizing the use of electric vehicles, which are expected to drive the market. The country has the presence of automobile manufacturers in the region. The growing EVs market drives advanced magnetic materials in Asia Pacific. The end-use industries in the country has been involved in research and development of advanced applications using the advanced magnetic materials to improve the efficiency of the applications. The demand for improving the efficiency in the automotive, power generation and industrial end-use segments is expected to boost the consumption of advanced magnetic material in the country. China is the leading manufacturer of permanent magnets in the world, as the country has the major source of rare earth metals in the world.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The advanced magnetic materials market is dominated by a few globally established players such as Hitachi Metals Ltd. (Japan), TDK Corporation (Japan), Daido Steel Ltd. (Japan), Shin-Etsu Chemicval Co. Ltd. (Japan), Arnold magnetic Technologies (US), Electron Energy Corporation (US), Anhuui Sinomag Technology Co. Ltd. (China), Neo (Canada), Yantai Dongxing Magnetic Materials Inc. (China), Dexter Magnetic Technologies, DMEGC (China), Master Magnetics Inc. (), Adams Magnetic Products Co. Inc. (US), Viona Magnetics, Guangdong Lingyl Co. Ltd. (China), Tengam, Engineering, Bogen Magnetics GmbH, Bunting Magnetics Co., Ningbo Yunsheng Co. Ltd. (China), Vacuumschmelze GmbH & Co. KG (Germany), among others, are the key manufacturers that secured major contracts in the last few years.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the advanced magnetic materials market. The research includes a detailed competitive analysis of these key players in the advanced magnetic materials market, including company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020 - 2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023 – 2028 |

|

Units considered |

Value (USD billion/million) |

|

Segments Covered |

By Type, By End-Use Industries, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, South America, the Middle East, and Africa |

|

Companies covered |

Hitachi Metals Ltd. (Japan), TDK Corporation (Japan), Daido Steel Ltd. (Japan), Shin-Etsu Chemical Co. Ltd. (Japan), Arnold magnetic Technologies (US), Electron Energy Corporation (US), Anhuui Sinomag Technology Co. Ltd. (China), Neo (Canada), Yantai Dongxing Magnetic Materials Inc. (China), Dexter Magnetic Technologies, DMEGC (China), Master Magnetics Inc. (), Adams Magnetic Products Co. Inc. (US), Viona Magnetics, Guangdong Lingyl Co. Ltd. (China), Tengam, Engineering, Bogen Magnetics GmbH, Bunting Magnetics Co., Ningbo Yunsheng Co. Ltd. (China), Vacuumschmelze GmbH & Co. KG (Germany). |

The study categorizes the advanced magnetic materials market based on Glass type, Product type, Application, and Region.

By Type:

- Permanent Magnetic Materials

- Semi-Hard Magnetic Materials

- Soft Magnetic Materials

By End-User:

- Automotive

- Electronics

- Industrial

- Power Generation

- Medical

- Others

By Region:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In June 2023, Neo Performance Materials, Inc. entered into a subscription agreement to purchase shares of Magnet Venture Pte Ltd. worth USD 84.7 million.

- In April 2023, Neo Performance Materials, Inc. acquired a controlling interest in SG Technologies Group Limited to expand neo’s rare earth processing and magnet manufacturing footprint in Europe.

- In August 2022, Neo Performance Materials, Inc. signed an agreement with HUDSON RESOURCES, INC. to acquire exploration license from HUDSON RESOURCES, INC. covering the Sarfartoq Carbonatite Complex in southwest Greenland.

- In August 2021, Anhui Sinomag Technology Co., Ltd. signed a contract with CPC Lujiang County Committee on the Sinomag Science Park project. This project has supplemented and strengthened the magnetic material industry. It will build four new projects which will provide the annual production of 15000 tons of dry pressed powder of permanent ferrite, and 10000 tons of high-performance wet pressed magnetic tile.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the advanced magnetic materials market?

Increasing demand for efficiency and miniaturization

Which is the largest country-level market for advanced magnetic materials market?

China is the largest advanced magnetic materials market due to high demand from well-established end-use industries.

What are the challenges in the advanced magnetic materials market?

Recycling of magnetic materials the advanced magnetic materials market.

Which type of advanced magnetic materials type holds the largest market share?

Permanent magnetic material type holds the largest share in terms of value, in the advanced magnetic materials market.

How is the advanced magnetic materials market aligned?

The market is growing at a faster pace. It is a potential market and many service providers are undertaking business strategies to expand their business.

Who are the major manufacturers?

Hitachi Metals Ltd. (Japan), TDK Corporation (Japan), Daido Steel Ltd. (Japan), Shin-Etsu Chemical Co. Ltd. (Japan), Arnold magnetic Technologies (US), Electron Energy Corporation (US), Anhuui Sinomag Technology Co. Ltd. (China), Neo (Canada), Yantai Dongxing Magnetic Materials Inc. (China), Dexter Magnetic Technologies, DMEGC (China), Master Magnetics Inc. (), Adams Magnetic Products Co. Inc. (US), Viona Magnetics, Guangdong Lingyl Co. Ltd. (China), Tengam, Engineering, Bogen Magnetics GmbH, Bunting Magnetics Co., Ningbo Yunsheng Co. Ltd. (China), Vacuumschmelze GmbH & Co. KG (Germany).

What is the biggest restraint in the advanced magnetic materials market?

Fluctuating raw material cost is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased use of EVs with higher energy efficiency- Development of new industrial robots- Rising demand for efficiency and miniaturization- Development and modernization of infrastructureRESTRAINTS- Trade bans imposed by China government on new technologies- Fluctuating raw material cost- Lack of quality control in emerging economiesOPPORTUNITIES- Usage of advanced materials in wafer processing and lithography- Development of magneto calorific materials for HVAC- Use of AlNiCo and ferrite materials to enhance efficiency of electrical motorsCHALLENGES- Recycling of magnetic materials- High cost of rare earth magnets- Huge investments required in R&D

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 TECHNOLOGY ANALYSIS

-

5.5 ECOSYSTEM: ADVANCED MAGNETIC MATERIALS MARKET

-

5.6 VALUE CHAIN ANALYSISMINING & EXTRACTIONSEPARATIONMANUFACTURINGEND-USE INDUSTRIES

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY TYPE (KEY PLAYERS)AVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY END-USE INDUSTRYAVERAGE SELLING PRICE TREND

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 KEY MARKETS FOR IMPORT/EXPORTCHINAUSGERMANYFRANCEJAPAN

-

5.10 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS’ ANALYSISPATENTS BY TDK CORPORATIONPATENTS BY SANYO SPECIAL STEEL CO. LTD.TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.13 TARIFFS AND REGULATIONS

-

5.14 KEY CONFERENCESDETAILED LIST OF CONFERENCES & EVENTS RELATED TO ADVANCED MAGNETIC MATERIALS AND RELATED MARKETS

-

6.1 INTRODUCTIONAUTOMOTIVE- Improvements in efficiency of electric motors to drive marketELECTRONICS- Emerging applications in semiconductor and flash memory to drive marketINDUSTRIAL- Rapid industrialization in emerging countries to boost marketPOWER GENERATION- Demand for energy-efficient power generators to boost marketMEDICAL- Demand for implantable and scanning devices to drive market- Scanning devices- Implantable devicesOTHER END-USE INDUSTRIES- Aerospace & defense- Household equipment- Scientific and laboratory equipment

-

7.1 INTRODUCTIONPERMANENT MAGNETIC MATERIALS- Demand for high-end applications to drive marketSEMI-HARD MAGNETIC MATERIALS- Demand for balance of magnetic strength and ductility to drive marketSOFT MAGNETIC MATERIALS- Applications requiring frequent changes in magnetic flux to drive market

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPENORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRYNORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRYUS- Increasing demand from automotive and electronics industries to boost marketCANADA- Rising demand for electric vehicles to boost marketMEXICO- Demand for renewable energy to boost market

-

8.3 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPEEUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRYEUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRYGERMANY- Increased production of electric vehicles to boost marketFRANCE- Automotive and power generation sectors to drive marketUK- Medical sector to drive marketITALY- Government incentives for wind turbine installation to boost marketREST OF EUROPE

-

8.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPEASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRYASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRYCHINA- Growth of automotive and electronics industries to drive marketINDIA- Improving business conditions across sectors to drive marketJAPAN- Growing automotive sector to drive marketSOUTH KOREA- Automotive and industrial sectors to boost marketREST OF ASIA PACIFIC

-

8.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPEMIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRYSAUDI ARABIA- Stringent regulations to drive marketUAE- Renewable energy segment to drive marketREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICASOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPESOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRYSOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRYBRAZIL- Availability of raw materials to drive marketARGENTINA- Growing automotive industry to drive marketREST OF SOUTH AMERICA

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- 9.3 MARKET RANKING

- 9.4 MARKET EVALUATION FRAMEWORK

- 9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

9.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

-

9.7 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.1 KEY COMPANIESHITACHI METALS, LTD.- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewTDK CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewDAIDO STEEL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSHIN-ETSU CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Other developments- MnM viewVACUUMSCHMELZE GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewNINGBO YUNSHENG CO, LTD.- Business overview- Products/Solutions/Services offered- MnM viewANHUI SINOMAG TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewNEO- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewDMEGC- Business overview- Products/Solutions/Services offered- Other developments- MnM viewARNOLD MAGNETIC TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM view

-

10.2 OTHER PLAYERSDEXTER MAGNETIC TECHNOLOGIESYANTAI DONGXING MAGNETIC MATERIALS INCADAMSMAGNETIC.COMMASTER MAGNETICS, INC.VIONA MAGNETICSGUANGDONG LINGYI CO., LTD.TENGAMBOGEN MAGNETICS GMBHBUNTINGELECTRON ENERGY CORPORATION

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 PORTER’S FIVE FORCES ANALYSIS: ADVANCED MAGNETIC MATERIALS MARKET

- TABLE 2 ADVANCED MAGNETIC MATERIALS: AVERAGE SELLING PRICE, BY REGION

- TABLE 3 SUPPLY CHAIN: ADVANCED MAGNETIC MATERIALS MARKET

- TABLE 4 ADVANCED MAGNETIC MATERIALS MARKET: GLOBAL PATENTS

- TABLE 5 CURRENT STANDARD CODES FOR ADVANCED MAGNETIC MATERIALS

- TABLE 6 ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 7 ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 8 ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 9 ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 10 ADVANCED MAGNETIC MATERIALS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 11 ADVANCED MAGNETIC MATERIALS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 12 ADVANCED MAGNETIC MATERIALS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 13 ADVANCED MAGNETIC MATERIALS MARKET IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 14 ADVANCED MAGNETIC MATERIALS MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 15 ADVANCED MAGNETIC MATERIALS MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 ADVANCED MAGNETIC MATERIALS MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 17 ADVANCED MAGNETIC MATERIALS MARKET IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 18 ADVANCED MAGNETIC MATERIALS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 19 ADVANCED MAGNETIC MATERIALS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 ADVANCED MAGNETIC MATERIALS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 21 ADVANCED MAGNETIC MATERIALS MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 22 ADVANCED MAGNETIC MATERIALS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 23 ADVANCED MAGNETIC MATERIALS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 ADVANCED MAGNETIC MATERIALS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 25 ADVANCED MAGNETIC MATERIALS MARKET IN POWER GENERATION END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 26 ADVANCED MAGNETIC MATERIALS MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2020–2022 (USD MILLION)

- TABLE 27 ADVANCED MAGNETIC MATERIALS MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 ADVANCED MAGNETIC MATERIALS MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2020–2022 (KILOTON)

- TABLE 29 ADVANCED MAGNETIC MATERIALS MARKET IN MEDICAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 30 ADVANCED MAGNETIC MATERIALS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 31 ADVANCED MAGNETIC MATERIALS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 ADVANCED MAGNETIC MATERIALS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2022 (KILOTON)

- TABLE 33 ADVANCED MAGNETIC MATERIALS MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 34 ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 35 ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 36 ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 38 PERMANENT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 39 PERMANENT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 40 PERMANENT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PERMANENT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 42 SEMI-HARD ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 43 SEMI-HARD ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 44 SEMI-HARD ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 SEMI-HARD ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 46 SOFT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 47 SOFT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 48 SOFT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 SOFT ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 50 ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 51 ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 53 ADVANCED MAGNETIC MATERIALS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 54 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 57 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 58 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 61 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 62 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 65 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 66 US: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 67 US: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 US: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 69 US: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 70 CANADA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 71 CANADA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 73 CANADA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 74 MEXICO: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY. 2020–2022 (USD MILLION)

- TABLE 75 MEXICO: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 MEXICO: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 77 MEXICO: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 78 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 79 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 81 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 82 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 83 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 85 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 86 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 87 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 89 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 90 GERMANY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 91 GERMANY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 93 GERMANY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 94 FRANCE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 95 FRANCE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 FRANCE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 97 FRANCE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 98 UK: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 99 UK: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 UK: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 101 UK: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 102 ITALY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 103 ITALY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 ITALY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 105 ITALY: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 106 REST OF EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 109 REST OF EUROPE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 110 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 113 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 114 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 117 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 118 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 121 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 122 CHINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 123 CHINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 125 CHINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 126 INDIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 127 INDIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 INDIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 129 INDIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 130 JAPAN: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 131 JAPAN: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 132 JAPAN: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 133 JAPAN: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 134 SOUTH KOREA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH KOREA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 137 SOUTH KOREA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 138 REST OF ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 141 REST OF ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 154 SAUDI ARABIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 155 SAUDI ARABIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 156 SAUDI ARABIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 157 SAUDI ARABIA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 158 UAE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 159 UAE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 160 UAE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 161 UAE: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 166 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 167 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 168 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 169 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 170 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 171 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 172 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 173 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 174 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 175 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 176 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 177 SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 178 BRAZIL: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 179 BRAZIL: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 180 BRAZIL: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 181 BRAZIL: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 182 ARGENTINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 183 ARGENTINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 184 ARGENTINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 185 ARGENTINA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 186 REST OF SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 187 REST OF SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 188 REST OF SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 189 REST OF SOUTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 190 ADVANCED MAGNETIC MATERIALS MARKET: DEALS, 2018–2022

- TABLE 191 ADVANCED MAGNETIC MATERIALS MARKET: OTHERS, 2018–2022

- TABLE 192 COMPANY PRODUCT FOOTPRINT

- TABLE 193 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 194 COMPANY REGION FOOTPRINT

- TABLE 195 HITACHI METALS, LTD.: COMPANY OVERVIEW

- TABLE 196 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 197 DAIDO STEEL CO., LTD.: COMPANY OVERVIEW

- TABLE 198 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 199 VACUUMSCHMELZE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 200 NINGBO YUNSHENG CO., LTD.: COMPANY OVERVIEW

- TABLE 201 ANHUI SINOMAG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 202 NEO: COMPANY OVERVIEW

- TABLE 203 DMEGC: COMPANY OVERVIEW

- TABLE 204 ARNOLD MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 205 DEXTER MAGNETIC TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 206 YANTAI DONGXING MAGNETIC MATERIALS INC: COMPANY OVERVIEW

- TABLE 207 ADAMSMAGNETIC.COM: COMPANY OVERVIEW

- TABLE 208 MASTER MAGNETICS, INC.: COMPANY OVERVIEW

- TABLE 209 VIONA MAGNETICS: COMPANY OVERVIEW

- TABLE 210 GUANGDONG LINGYI CO., LTD.: COMPANY OVERVIEW

- TABLE 211 TENGAM: COMPANY OVERVIEW

- TABLE 212 BOGEN MAGNETICS GMBH: COMPANY OVERVIEW

- TABLE 213 BUNTING: COMPANY OVERVIEW

- TABLE 214 ELECTRON ENERGY CORPORATION: COMPANY OVERVIEW

- FIGURE 1 ADVANCED MAGNETIC MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 ADVANCED MAGNETIC MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 5 PERMANENT MAGNETIC MATERIAL TYPE DOMINATED ADVANCED MAGNETIC MATERIALS MARKET IN 2022

- FIGURE 6 AUTOMOTIVE END-USE INDUSTRY DOMINATED ADVANCED MAGNETIC MATERIALS MARKET IN 2022

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 8 DEMAND FROM END-USE INDUSTRIES TO DRIVE ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 9 SOFT MAGNETIC MATERIAL TYPE SEGMENT DOMINATED OVERALL MARKET IN 2022

- FIGURE 10 AUTOMOTIVE END-USE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 13 PORTER’S FIVE FORCES ANALYSIS: ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 14 ADVANCED MAGNETIC MATERIALS MARKET: ECOSYSTEM

- FIGURE 15 VALUE CHAIN ANALYSIS: ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 16 AVERAGE SELLING PRICE OF KEY PLAYERS FOR DIFFERENT TYPES OF ADVANCED MAGNETIC MATERIALS (USD/KG)

- FIGURE 17 AVERAGE SELLING PRICE BASED ON TYPE (USD/KG)

- FIGURE 18 AVERAGE SELLING PRICE BASED ON END-USE INDUSTRY (USD/KG)

- FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 20 GLOBAL PATENT PUBLICATION TRENDS: 2012–2022

- FIGURE 21 ADVANCED MAGNETIC MATERIALS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 22 GLOBAL JURISDICTION ANALYSIS

- FIGURE 23 TDK CORPORATION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 24 AUTOMOTIVE SEGMENT LARGEST END-USE INDUSTRY IN ADVANCED MAGNETIC MATERIALS MARKET IN 2022

- FIGURE 25 NORTH AMERICA AUTOMOTIVE END-USE INDUSTRY SEGMENT TO GROW AT FASTEST RATE IN ADVANCED MAGNETIC MATERIALS MARKET BETWEEN 2023 AND 2028

- FIGURE 26 ASIA PACIFIC TO BE LARGEST MARKET FOR ADVANCED MAGNETIC MATERIALS IN ELECTRONICS END-USE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 27 ASIA PACIFIC TO LEAD ADVANCED MAGNETIC MATERIALS MARKET IN INDUSTRIAL SEGMENT BETWEEN 2023 AND 2028

- FIGURE 28 ASIA PACIFIC TO LEAD ADVANCED MAGNETIC MATERIALS MARKET IN POWER GENERATION END-USE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 29 NORTH AMERICA TO BE LARGEST MARKET FOR ADVANCED MAGNETIC MATERIALS IN MEDICAL INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 30 ASIA PACIFIC TO LEAD MARKET FOR ADVANCED MAGNETIC MATERIALS IN OTHER END-USE INDUSTRIES BETWEEN 2023 AND 2028

- FIGURE 31 PERMANENT MAGNETIC MATERIALS SEGMENT TO LEAD ADVANCED MAGNETIC MATERIALS MARKET IN 2028

- FIGURE 32 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF PERMANENT ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 33 ASIA PACIFIC TO LEAD SEMI-HARD ADVANCED MAGNETIC MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC TO BE LARGEST SOFT ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 35 NORTH AMERICA: ADVANCED MAGNETIC MATERIALS MARKET SNAPSHOT

- FIGURE 36 EUROPE: ADVANCED MAGNETIC MATERIALS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: ADVANCED MAGNETIC MATERIALS MARKET SNAPSHOT

- FIGURE 38 SHARE OF TOP COMPANIES IN ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN ADVANCED MAGNETIC MATERIALS MARKET

- FIGURE 40 ADVANCED MAGNETIC MATERIALS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 ADVANCED MAGNETIC MATERIALS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 42 HITACHI METALS, LTD.: COMPANY SNAPSHOT

- FIGURE 43 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 DAIDO STEEL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 45 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 NEO: COMPANY SNAPSHOT

- FIGURE 47 ARNOLD MAGNETIC TECHNOLOGIES: COMPANY SNAPSHOT

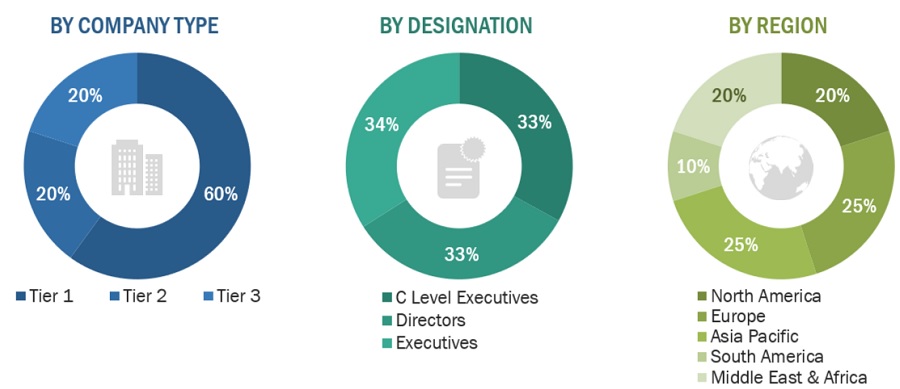

The study involves two major activities in estimating the current size of the advanced magnetic materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information has been sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; and databases. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. These have also been utilized to obtain information about the key developments from a market-oriented perspective. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The stakeholders in the value chain of the advanced magnetic materials market include raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries in the advanced magnetic materials market. Primary sources from the supply side include experts from companies involved in the advanced magnetic materials.

The Breakup of Primary Research :

To know about the assumptions considered for the st udy, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the advanced magnetic materials market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in advanced magnetic materials in different applications of the advanced magnetic materials industry at a regional level. Such procurements provide information on the demand aspects of the advanced magnetic materials industry for each application. For each application, all possible segments of the advanced magnetic materials market were integrated and mapped.

Advanced magnetic materials Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced magnetic materials Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Fiber-reinforced composites are used in end-use industries including aerospace & defense, wind energy, automotive & transportation, marine, construction, pipe & tank, electrical & electronics, and sporting goods. However, due to several reasons such as lightning, collision, bird strike, erosion, corrosion, or manufacturing defects, the composite structure gets damaged. As composite parts replacement is costlier, advanced magnetic materials is performed on disbands or delamination, holes or punctures, cracks, and other damages to bring back the part to its previous working condition.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To analyze and forecast the global advanced magnetic materials market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on type, and end-use industry.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the advanced magnetic materials market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Advanced Magnetic Materials Market