Aerospace PCB Market by Platform (Aircraft, Helicopters, Satellite, Space Launch vehicle, UAVs, Rovers and Probes), PCB Type (Double-Sided PCB, Multi-Layer, Single-Sided), Function (Rigid PCB, Flexible PCB, Rigid-flex PCB, Others), Application (Radio Communication, Radars, Health Monitoring Sensors, Power Converters, Power Supplies, Engine Control Systems Others), Point of Sale, and Region - Global Forecast to 2025

Exhaustive secondary research was undertaken to obtain information on the aerospace PCB market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing by industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and aircraft parts and component research papers.

Primary Research

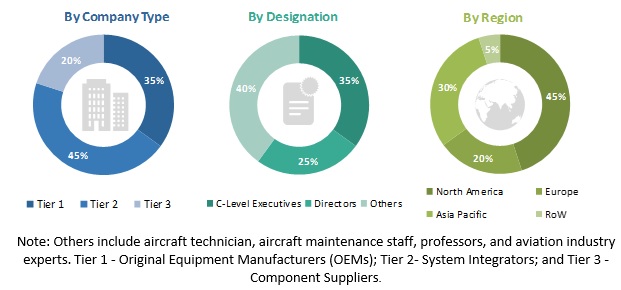

The Aerospace PCB market comprises several stakeholders, such as OEMs, electronics hardware and software suppliers, electronics system integrators, PCB manufacturers and regulatory organizations in the supply chain. The demand-side of this market is characterized by various end users, such as component manufacturers as well as facility providers and OEMs. The supply-side is characterized by technology advancements in aerospace PCB. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace PCB market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the aircraft manufacturing industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aerospace PCB market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for 5 regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, acquisitions, and new product developments

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By End-Use Industry, PCB Type, Function, Application, Point of Sale, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, and Rest of the World |

|

Companies covered |

Epec, LLC. (US), Amitron Corp. (US), TechnoTronix (US), Saline Lectronics (US), Advanced Circuits (US), Excello Circuits Inc (US), NexLogic Technologies Inc. (US), SCHMID Group (Germany), Corintech Ltd (UK) |

This research report categorizes the Aerospace PCB market based on End-Use Industry, PCB Type, Function, Application, Point of Sale and Region.

On the basis of End-Use Industry, the Aerospace PCB market has been segmented as follows:

- Aircraft

- Commercial Aviation

- Narrow Body Aircraft

- Regional Transport Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- General Aviation

- Business Aircraft

- Light Aircraft

- Military Aviation

- Fighter Aircraft

- Transport Aircraft

- Wide Aircraft

- Commercial Aviation

- Helicopters

- Civil Helicopters

- Satellite

- Small

- Medium

- Large

- Space Launch vehicle

- Small Lift Launch Vehicles (<350,000 Kg)

- Medium to Heavy Vehicles (>350,000 Kg)

- UAVs

- Rovers and Probes

On the basis of PCB Type, the aerospace PCB market has been segmented as follows:

- Double-Sided PCB

- Multi-Layer

- Single-Sided

On the basis of Function, the Aerospace PCB market has been segmented as follows:

- Rigid PCB

- Flexible PCB

- Rigid-flex PCB

- RF PCB

- High-Speed PCB

- Metal core PCB

- Aluminum PCB

- HDI PCB

On the basis of Application, the Aerospace PCB market has been segmented as follows:

- Radio Communication System

- Radars

- Health Monitoring Sensors

- Power Converters

- Power Supplies

- Engine Control Systems

- LED Lighting Systems

- Electronic Flight Instrumentation

- Flight Data Recorder

On the basis of Point of Sale, the Aerospace PCB market has been segmented as follows:

- OEM

- After Market

On the basis of Region, the Aerospace PCB market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Aerospace PCB Market