Agricultural Activator Adjuvants Market by Adoption Stage (In-formulation and Tank-mix), Type (Surfactants and Oil-based Adjuvants), Application (Herbicides, Insecticides, Fungicides), Crop Type, and Region - Global Forecast to 2028

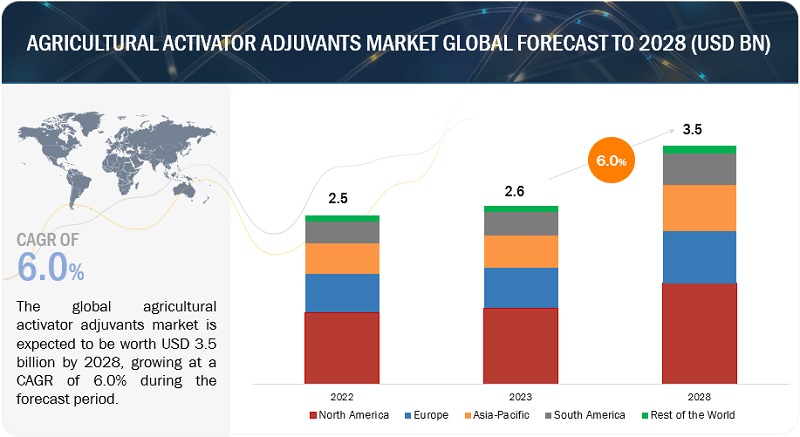

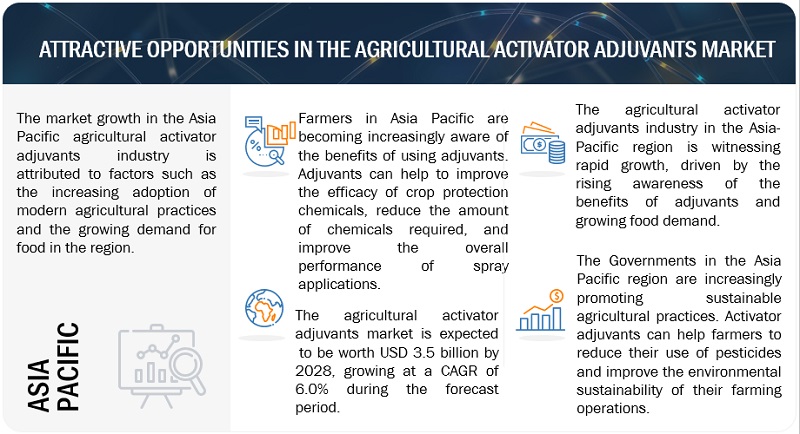

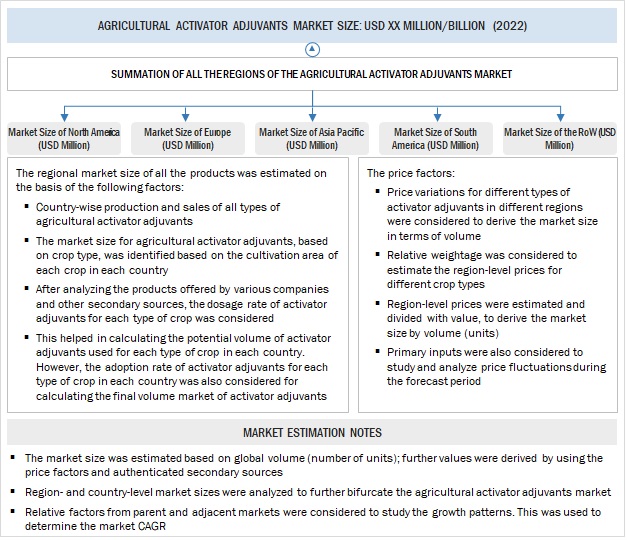

[616 Pages Report] The global agricultural activator adjuvants market is projected to reach USD 3.5 billion by 2028 from USD 2.6 billion by 2023, at a CAGR of 6.0% during the forecast period in terms of value. Agricultural activator adjuvants are essential components in modern agriculture, as they enhance the performance of pesticides, herbicides, and other crop protection products. They are used to improve the efficacy and overall effectiveness of these agrochemicals, which helps in increasing crop yields and reducing the environmental impact of farming. These are added to crop protection products or agrochemicals to enhance the efficacy of active ingredients and improve the product’s overall performance. The effectiveness of a pesticide increases manifold with the addition of adjuvants, wherein agrochemicals and agricultural adjuvants are formulated to be compatible with each other. Adjuvant aids in the compatibility of different pesticides, facilitating tank-mixing and reducing the need for separate applications. This compatibility simplifies spraying, saves time and labor, and allows for more efficient pest management strategies. These activators adjuvants also help in overcoming challenging environmental conditions that impact pesticide performance.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Increase in demand for green solutions

Consumers are becoming more aware of the environmental and health impacts of conventional agricultural practices, and they are demanding products that are produced in a more sustainable way. This includes the use of green adjuvants, which are less harmful to the environment and human health than traditional adjuvants. Governments around the world are increasingly regulating the use of conventional adjuvants. This is due to the growing awareness of the environmental and health risks associated with these products. As a result, there is a growing demand for green adjuvants that meet these regulations.

In recent years, companies have been developing eco-friendly, bio-based adjuvants, such as methylated seed oil (MSO), modified vegetable oils, and organo-modified siloxanes. Such biologically derived adjuvants are considered eco-friendly due to their high levels of safety and biodegradability. Manufacturers are, therefore, keen on adapting to this changing trend of utilizing green adjuvants in their products. Players such as Wilbur-Ellis Holdings, Inc. (US) and Precision Laboratories, LLC (US) offer methylated seed oil products.

Restraints: Increase in oil prices

The increase in demand for oil prices has a significant impact on the cost of agricultural activator adjuvants. Agricultural activator adjuvants are a type of additive that is used to improve the performance of pesticides and herbicides. They are typically made from petroleum-based products, such as mineral oil and vegetable oil. As a result, the price of agricultural activator adjuvants is directly tied to the price of oil. The rising cost of oil has led to an increase in the price of agricultural activator adjuvants. This has made it more difficult for farmers to afford these important products, which can lead to a decrease in crop yields and an increase in the cost of food.

Moreover, the adjuvants industry observed a high demand for crop and vegetable oil concentrates due to the continuous fluctuations observed in petroleum/crude oil prices. This has restricted manufacturers from investing in petroleum-based oil concentrates and increased the shift toward crop oil concentrates such as methylated soybean oil. Hence, changes in raw material prices have a huge impact on the final cost of an agricultural adjuvant product, which affects the demand for products at the end-user level.

Opportunities: Development of low-impact formulations of oil-based adjuvants

The development of low-impact formulations of oil-based adjuvants in agriculture is a crucial aspect of sustainable farming practices. Oil-based adjuvants are used to enhance the effectiveness of pesticides, herbicides, and other agricultural chemicals. However, traditional oil-based adjuvants can have negative environmental impacts, such as excessive residue buildup and harm to non-target organisms. The development of low-impact formulations seeks to mitigate these issues while maintaining the benefits of adjuvants.

In recent years, a few low-impact oil-based adjuvants were developed such as Vegetable oil-based adjuvants and plant-based adjuvants, that are developed from vegetable oils (soya bean oil and rapeseed oil) and plant-based materials (chitosan and lignin). They are less harmful to the environment than mineral oil-based adjuvants and they can also improve the effectiveness of pesticides and herbicides.

Sustainable and non-oil adjuvants are required to maintain the viability and pesticide efficiency of agricultural biostimulants and biofertilizers. Hence, there is a scope for the market’s growth with the increase in demand for adjuvants for biological products.

Challenges: Rising environmental concerns

Agricultural activator adjuvants are commonly used due to rising environmental health concerns because they can help to reduce the amount of pesticide that is needed to be applied to crops. This is because activator adjuvants improve the effectiveness of pesticides by helping them to spread and adhere to plant surfaces more easily. This can lead to a reduction in the overall amount of pesticide that needs to be used, which can help to reduce the environmental impact of agriculture.

In recent years, there has been a growing interest in developing more sustainable and environmentally friendly agricultural practices. This includes the development of new types of activator adjuvants that are less toxic to aquatic life and less irritating to humans and animals. There is also a growing interest in using natural products, such as plant extracts, as activator adjuvants.

Market Ecosystem

Fungicides are one of the agricultural activator adjuvants applications which accounted for the second highest market share in 2022.

Activator adjuvants are commonly used with fungicides because they can help to improve the effectiveness of the fungicide and reduce the need for higher application rates. This can lead to several benefits, including improved crop protection, reduced pesticide use, reduced environmental impact, and increased crop yields.

Adjuvants are added to fungicides to ensure that fungicide powders are easily wettable and evenly dispersed in the tank. Non-ionic surfactants are increasingly used with fungicides. These surfactants help fungicides to stick to plant surfaces, which are also called stickers. With the increased adhesion to the leaf surface, the absorption of fungicides in the leaf remains high, which increases the efficacy of fungicides. In addition, stickers decrease the rate at which rain washes off the fungicide or sunlight breaks down the fungicide (photodegradation).

China is one of the largest growing markets for agricultural activator adjuvants in Asia pacific

China is the largest growing market for agricultural activator adjuvants in the Asia Pacific region. This is due to several factors, including the large and growing agricultural sector, increasing awareness of the benefits of activator adjuvants, and government support for the agricultural sector. Chinese farmers are becoming more aware of the benefits of activator adjuvants, such as improved crop yields, reduced pesticide and fertilizer use, and increased resistance to pests and diseases. This is leading to increased adoption of activator adjuvants in China. The Chinese government is supportive of the agricultural sector and is investing in research and development of new agricultural technologies, including activator adjuvants. This is helping to drive the growth of the activator adjuvant market in China. Additionally, increasing urbanization and rising incomes, growing awareness of food safety, and stricter environmental regulations are also contributing to the growth of the agricultural activator adjuvants market in China.

Key Market Players

The key players in this market include Corteva. (US), Evonik (Germany), Solvay (Belgium), BASF SE (Germany), CHS Inc. (US), Corda International Plc (UK), Nufarm (Australia), Clariant (Switzerland), and Stepan Company (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Adoption Stage, Type, Application, Crop Type, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

This research report categorizes the agricultural activator adjuvants market, based on adoption stage, type, application, crop type, and region.

Target Audience

- Pesticide manufacturers, formulators, and blenders

- Pesticide traders, suppliers, distributors, importers, and exporters

- Government Agricultural Authorities

- Chemical Intermediate and Technology Providers

- Agricultural adjuvant manufacturers

- Commercial research & development (R&D) organizations and financial institutions

- Government agricultural departments and regulatory bodies such as the US Environmental Protection Agency (EPA), US Department of Agriculture (USDA), Food Standards Australia New Zealand (FSANZ), Pest Management Regulatory Agency (PMRA), Government agencies and NGOs, and Food and Agriculture Organization (FAO).

Report Scope:

Agricultural activator adjuvants Market:

By Adoption Stage

- In-formulation

- Tank-mix

By Type

- Surfactants

- Oil-based Adjuvants

By Application

-

Oil-based Adjuvants

- Herbicides

- Insecticides

- Fungicides

- Other Applications

-

Surfactants

- Herbicides

- Insecticides

- Fungicides

- Other Applications

By Crop Type

-

Cereals & Grains

- Corn

- Wheat

- Rice

- Other Cereals & Grains

-

Oilseeds & Pulses

- Soya beans

- Other Oilseeds & Pulses

-

Fruits & Vegetables

- Banana

- Citrus Fruits (Orange, Lime, and Grapefruit, among others)

- Root & Tuber Vegetables

- Leavy Vegetables

- Pome Fruits

- Berries

- Other Fruits & Vegetables

- Other Crop Types

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In April 2023, INNVICTIS introduced a new adjuvant technology called ‘Inntero.’ The new technology provides seven unique, multi-functional, and full-strength adjuvants for a low application rate.

- In March 2023, Precision Laboratories introduced a versatile granular soil surfactant called ‘Precip G.’ The product improves the soil hydration length, saving labor costs and water. The product is versatile and is used on home lawns.

- In April 2022, Clariant introduced a new adjuvant technology approach, DropForward, to drone-specific adjuvants and formulations called Synergen DRT. This adjuvant helps to control the drift and volatility of droplets, while also improving the coverage and penetration of the actives in the leaves. This boosts biological performance and makes drone spraying more sustainable and environmentally friendly.

- In August 2021, CHS introduced Advatrol, designed for use with a broad range of herbicides where a high surfactant oil concentrate adjuvant is recommended. It is a highly concentrated blend of emulsifiers and methylated seed oil.

- In April 2021, Nufarm Group Mexico partnered with Attune Agriculture, a US-based developer of performance-based agricultural products using hydrocolloid technology. Under the partnership, Nufarm is distributing Attune’s Ampersand adjuvant across Mexico.

- In January 2021, Precision Laboratories launched Activo, a novel activator adjuvant developed with a green pigment to enhance the efficacy of pesticides and the appearance of turfgrass. The product is developed in partnership with Michigan State University. The product offers enhanced pesticide performance that makes it perfect for application on wide tracts of land in combination with fungicides and plant growth regulators.

Frequently Asked Questions (FAQ):

What is the current size of the agricultural activator adjuvants market?

The agricultural activator adjuvants market is estimated at USD 2.6 Billion in 2023 and is projected to reach USD 3.5 Billion by 2028, at a CAGR of 6.0% from 2023 to 2028.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Corteva. (US), Evonik (Germany), Solvay (Belgium), BASF SE (Germany), CHS Inc. (US), Corda International Plc (UK), Nufarm (Australia), Clariant (Switzerland), and Stepan Company (US).

The agricultural activator adjuvants market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of agricultural activator adjuvants are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the agricultural activator adjuvants market?

The market is expected to grow in North America and is expected to dominate during the forecast period. The North American region is home to some of the world's most populous countries, including the US and Canada. This large and diverse consumer base creates significance for agricultural activator adjuvants to meet the increasing food demand.

Which are the major agricultural activator adjuvant types considered in the study and which segments are projected to have promising growth rates in the future?

All the major types of agricultural activator adjuvants include surfactants and oil-based adjuvants. Oil-based adjuvants are anticipated to witness the highest growth rate with a CAGR of 6.3% during the forecast period.

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM views to elaborate analyst views on the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSPOPULATION GROWTH AND DECREASE IN ARABLE LANDINCREASE IN FARM EXPENDITURE

-

5.3 MARKET DYNAMICSDRIVERS- Increasing awareness of farmers about sustainable agriculture- Increasing demand for green solutions- Adoption of precision farming and protected agriculture- Increasing adoption of pesticidesRESTRAINTS- Limited use of water-based pesticides- Stringent regulations for manufacturing adjuvants- Rising oil pricesOPPORTUNITIES- Development of low-impact formulations of oil-based adjuvants- Adoption of cost-effective production techniquesCHALLENGES- Adoption of adjuvants to impact on production cost- Rising environmental concerns

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTMANUFACTURINGPRODUCTION & PROCESSINGDISTRIBUTIONMARKETING, SALES, LOGISTICS, AND RETAIL

-

6.3 TECHNOLOGY ANALYSISDEVELOPMENT OF NEW SURFACTANTSDEMAND FOR SILICONE ADJUVANTS

-

6.4 PATENT ANALYSIS

-

6.5 ECOSYSTEM ANALYSISDEMAND SIDESUPPLY SIDE

- 6.6 TRADE ANALYSIS

-

6.7 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF AGRICULTURAL ACTIVATOR ADJUVANTS, BY TYPEAVERAGE SELLING PRICE TREND OF AGRICULTURAL ACTIVATOR ADJUVANTS, BY REGION

-

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/CLIENTS’ BUSINESSES

- 6.9 KEY CONFERENCES & EVENTS, 2023–2024

-

6.10 TARIFFS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY LANDSCAPE- North America- Europe- Asia Pacific- South Africa

-

6.11 CASE STUDY ANALYSISEVONIK DEVELOPED SUSTAINABLE SURFACTANTS FOR CROP PROTECTIONWILBUR-ELLIS DEVELOPED NONIONIC SURFACTANTS TO IMPROVE DEPOSITION QUALITY OF ORGANIC PRODUCTS

-

6.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 IN-FORMULATIONNEED TO BOOST SOLUBILITY, REDUCE VOLATILITY, PROLONG SHELF LIFE, AND ENHANCE HERBICIDE COMPATIBILITY TO DRIVE MARKET

-

7.3 TANK MIXTANK MIX ADJUVANTS TO IMPROVE EFFECTIVENESS OF PESTICIDES AND OFFER INCREASED FLEXIBILITY

- 8.1 INTRODUCTION

-

8.2 SURFACTANTSCOMMON USE OF NONIONIC SURFACTANTS AND THEIR INCREASING COMPATIBILITY WITH AGROCHEMICALS TO DRIVE MARKET

-

8.3 OIL-BASED ADJUVANTSOIL-BASED ADJUVANTS TO LOWER SURFACE TENSION OF SPRAY SOLUTIONS AND HELP INCREASE HERBICIDE ABSORPTION RATE

- 9.1 INTRODUCTION

-

9.2 SURFACTANTSHERBICIDES- Demand for increased efficiency of leaf cuticles to drive use of surfactants in herbicidesFUNGICIDES- Focus on strengthening performance of fungicides through use of surfactants to drive marketINSECTICIDES- Surfactants to enhance performance of insecticides and augment pest controlOTHER APPLICATIONS

-

9.3 OIL-BASED ADJUVANTSHERBICIDES- Oil-based adjuvants to improve effectiveness of herbicides and increase penetration of herbicides into plantsFUNGICIDES- Oil-based adjuvants to enhance efficacy and coverage of fungicidesINSECTICIDES- Demand for botanical insecticides to increase due to their compatibility with IPM strategiesOTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 CEREALS & GRAINSGROWING EMPHASIS ON CROP PROTECTION TO DRIVE USE OF SURFACTANTS IN CEREALS AND GRAINS- Corn- Wheat- Rice- Other cereals & grains

-

10.3 OILSEED & PULSESINCREASING GLOBAL PRODUCTION OF OILSEED AND PULSES AND NEED TO PREVENT PESTS TO DRIVE MARKET- Soybean- Other oilseed & pulses

-

10.4 FRUITS & VEGETABLESINCREASING CONSUMPTION OF FRUITS AND VEGETABLES AND NEED TO PREVENT BACTERIAL AND FUNGAL INFECTIONS IN THEM TO DRIVE MARKET- Banana- Citrus fruits- Root & tuber vegetables- Leafy vegetables- Pome fruits- Berries- Other fruits & vegetables

- 10.5 OTHER CROP TYPES

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

-

11.3 NORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing demand for high-quality & uniform products and adoption of modern farming practices to drive marketCANADA- Easy availability of agricultural commodities, strong government research system, and proximity to US to drive marketMEXICO- Initiatives from regulatory organizations to ensure safety and efficacy of agricultural adjuvants to propel market

- 11.4 EUROPE

-

11.5 EUROPE: RECESSION IMPACT ANALYSISGERMANY- Government initiatives & funding and organic & environmentally friendly farming practices to drive marketUK- Rising demand for effective pest management and environmentally sustainable agricultural practices to drive marketFRANCE- Advanced R&D and use of modern and innovative solutions to drive marketSPAIN- Need for better crop yield and crop quality and pesticide reduction to boost demand for agricultural activator adjuvantsITALY- Growing use of precision farming technology and demand for better yield crops to drive marketREST OF EUROPE

- 11.6 ASIA PACIFIC

-

11.7 ASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Rising demand for food, government initiatives to promote sustainable agriculture, and adoption of precision agriculture technologies to drive marketINDIA- Growing agrochemical sector and need to enhance farm yield while mitigating crop losses to drive marketJAPAN- Rising demand for high-quality and safe agricultural products to propel marketAUSTRALIA & NEW ZEALAND- Need for improved crop yield and enhanced agricultural productivity to drive marketMALAYSIA- Sustainable agricultural practices and demand for exports to drive marketREST OF ASIA PACIFIC

- 11.8 SOUTH AMERICA

-

11.9 SOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increasing cultivation of stacked trait crops to drive marketARGENTINA- Government funds to increase use of pesticides to drive demand for agricultural activator adjuvantsREST OF SOUTH AMERICA

- 11.10 ROW

-

11.11 ROW: RECESSION IMPACT ANALYSISSOUTH AFRICA- Growing need to expand agricultural land and increasing awareness regarding agricultural activator adjuvants to drive marketTURKEY- Expanding farm area and focus on enhancing crop yield to drive marketOTHER ROW COUNTRIES

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 REVENUE ANALYSIS

- 12.5 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 12.6 EBITDA OF KEY PLAYERS

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.8 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.9 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERSCORTEVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVONIK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCRODA INTERNATIONAL PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNUFARM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCLARIANT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINNVICTIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELENA AGRI-ENTERPRISES, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSTEPAN COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMIILLER CHEMICAL & FERTILIZER, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRECISION LABORATORIES, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWINFIELD UNITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKALO- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERS/STARTUPS & SMESADJUVANTS PLUSWILBUR-ELLIS COMPANY LLCBRANDT, INC.NOURYONINTERAGROLAMBERTI S.P.A.

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 AGRICULTURAL SURFACTANTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2018–2022

- TABLE 3 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 COMPARISON OF SURFACTANT-TREATED AND UNTREATED CORN

- TABLE 5 PRICE OF PESTICIDES AND ADJUVANTS, 2019 (USD/GALLON)

- TABLE 6 KEY PATENTS PERTAINING TO AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, 2021–2023

- TABLE 7 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 8 TOP 10 EXPORTERS AND IMPORTERS OF HS CODE 3808 PRODUCTS, 2022 (USD THOUSAND)

- TABLE 9 TOP 10 EXPORTERS AND IMPORTERS OF HS CODE 3808 PRODUCTS, 2022 (TON)

- TABLE 10 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET: AVERAGE SELLING PRICE (ASP), BY TYPE, 2020–2022 (USD/LITER)

- TABLE 11 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/LITER)

- TABLE 12 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 20 KEY BUYING CRITERIA FOR AGRICULTURAL ACTIVATOR ADJUVANT TYPES

- TABLE 21 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 22 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 23 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 24 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 25 IN-FORMULATION: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 IN-FORMULATION: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 IN-FORMULATION: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 28 IN-FORMULATION: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 29 TANK MIX: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 TANK MIX: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 TANK MIX: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 32 TANK MIX: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 34 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 36 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 37 SURFACTANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 SURFACTANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 SURFACTANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 40 SURFACTANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 OIL-BASED ADJUVANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 OIL-BASED ADJUVANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OIL-BASED ADJUVANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 44 OIL-BASED ADJUVANTS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 46 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 48 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 49 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 50 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 52 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 53 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 56 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 57 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 60 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 61 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 64 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 68 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 69 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 72 HERBICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 73 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 76 FUNGICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 77 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 80 INSECTICIDES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 81 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 84 OTHER APPLICATIONS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 85 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 86 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 87 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 88 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 89 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 90 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 91 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 92 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 93 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 94 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 95 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 96 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 97 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 98 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 99 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 100 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 101 CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 102 CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 104 CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 105 CORN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 106 CORN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 CORN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 108 CORN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 109 WHEAT: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 110 WHEAT: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 WHEAT: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 112 WHEAT: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 113 RICE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 114 RICE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 RICE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 116 RICE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 117 OTHER CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 118 OTHER CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 OTHER CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 120 OTHER CEREALS & GRAINS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 121 OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 122 OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 124 OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 125 SOYBEAN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 126 SOYBEAN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 127 SOYBEAN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 128 SOYBEAN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 129 OTHER OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 130 OTHER OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 OTHER OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 132 OTHER OILSEED & PULSES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 133 FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 134 FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 135 FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 136 FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 137 BANANA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 138 BANANA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 139 BANANA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 140 BANANA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 141 CITRUS FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 142 CITRUS FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 143 CITRUS FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 144 CITRUS FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 145 ROOT & TUBER VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 146 ROOT & TUBER VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 147 ROOT & TUBER VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 148 ROOT & TUBER VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 149 LEAFY VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 150 LEAFY VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 151 LEAFY VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 152 LEAFY VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 153 POME FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 154 POME FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 155 POME FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 156 POME FRUITS: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 157 BERRIES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 158 BERRIES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 159 BERRIES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 160 BERRIES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 161 OTHER FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 162 OTHER FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 OTHER FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 164 OTHER FRUITS & VEGETABLES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 165 OTHER CROP TYPES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 166 OTHER CROP TYPES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 167 OTHER CROP TYPES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 168 OTHER CROP TYPES: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 169 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 170 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 171 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 172 AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 173 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 174 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 175 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 176 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 177 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 178 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 179 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 180 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 181 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 182 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 184 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 185 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 186 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 188 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 189 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 190 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 191 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 192 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 193 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 194 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 195 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 196 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 197 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 198 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 199 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 200 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 201 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 202 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 203 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 204 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 205 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 206 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 207 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 208 NORTH AMERICA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 209 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 210 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 211 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 212 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 213 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 214 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 215 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 216 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 217 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 218 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 219 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 220 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 221 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 222 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 223 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 224 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 225 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 226 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 227 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 228 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 229 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 230 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 231 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 232 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 233 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 234 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 235 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 236 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 237 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 238 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 239 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 240 US: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 241 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 242 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 243 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 244 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 245 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 246 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 248 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 249 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 250 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 251 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 252 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 253 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 254 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 255 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 256 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 257 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 258 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 259 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 260 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 261 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 262 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 263 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 264 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 265 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 266 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 267 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 268 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 269 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 270 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 271 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 272 CANADA: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 273 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 274 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 275 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 276 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 277 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 278 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 280 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 281 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 282 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 283 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 284 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 285 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 286 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 287 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 288 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 289 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 290 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 291 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 292 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 293 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 294 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 295 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 296 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 297 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 298 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 299 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 300 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 301 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 302 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 303 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 304 MEXICO: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 305 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 306 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 307 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2018–2022 (KT)

- TABLE 308 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY COUNTRY, 2023–2028 (KT)

- TABLE 309 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 310 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 311 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 312 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 313 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 314 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 315 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 316 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 317 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 318 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 319 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 320 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 321 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 322 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 323 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 324 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 325 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 326 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 327 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 328 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 329 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 330 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 331 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 332 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 333 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 334 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 335 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 336 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 337 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 338 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 339 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 340 EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 341 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 342 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 343 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 344 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 345 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 346 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 347 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 348 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 349 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 350 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 351 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 352 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 353 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 354 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 355 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 356 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 357 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 358 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 359 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 360 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 361 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 362 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 363 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 364 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 365 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 366 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 367 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 368 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 369 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 370 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 371 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 372 GERMANY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 373 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 374 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 375 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 376 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 377 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 378 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 379 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 380 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 381 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 382 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 383 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 384 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 385 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 386 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 387 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 388 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 389 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 390 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 391 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 392 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 393 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 394 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 395 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 396 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 397 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 398 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 399 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 400 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 401 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 402 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 403 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 404 UK: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 405 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 406 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 407 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 408 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 409 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 410 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 411 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 412 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 413 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 414 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 415 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 416 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 417 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 418 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 419 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 420 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 421 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 422 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 423 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 424 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 425 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 426 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 427 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 428 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 429 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 430 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 431 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 432 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 433 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 434 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 435 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 436 FRANCE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 437 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 438 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 439 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 440 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 441 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 442 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 443 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 444 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 445 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 446 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 447 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 448 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 449 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 450 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 451 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 452 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 453 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 454 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 455 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 456 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 457 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 458 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 459 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 460 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 461 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 462 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 463 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 464 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 465 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 466 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 467 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 468 SPAIN: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 469 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 470 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 471 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 472 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 473 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 474 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 475 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 476 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 477 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 478 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 479 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 480 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 481 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 482 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 483 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 484 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 485 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 486 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 487 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (KT)

- TABLE 488 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (KT)

- TABLE 489 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (USD MILLION)

- TABLE 490 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (USD MILLION)

- TABLE 491 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2018–2022 (KT)

- TABLE 492 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CEREALS & GRAINS TYPE, 2023–2028 (KT)

- TABLE 493 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (USD MILLION)

- TABLE 494 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (USD MILLION)

- TABLE 495 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2018–2022 (KT)

- TABLE 496 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OILSEED & PULSES TYPE, 2023–2028 (KT)

- TABLE 497 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (USD MILLION)

- TABLE 498 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (USD MILLION)

- TABLE 499 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2018–2022 (KT)

- TABLE 500 ITALY: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY FRUITS & VEGETABLES TYPE, 2023–2028 (KT)

- TABLE 501 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (USD MILLION)

- TABLE 502 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (USD MILLION)

- TABLE 503 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2018–2022 (KT)

- TABLE 504 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY ADOPTION STAGE, 2023–2028 (KT)

- TABLE 505 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 506 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 507 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 508 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 509 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 510 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 511 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2018–2022 (KT)

- TABLE 512 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY SURFACTANTS APPLICATION, 2023–2028 (KT)

- TABLE 513 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (USD MILLION)

- TABLE 514 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (USD MILLION)

- TABLE 515 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2018–2022 (KT)

- TABLE 516 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY OIL-BASED ADJUVANTS APPLICATION, 2023–2028 (KT)

- TABLE 517 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 518 REST OF EUROPE: AGRICULTURAL ACTIVATOR ADJUVANTS MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)