AI in Life Science Market - Global Forecast 2030

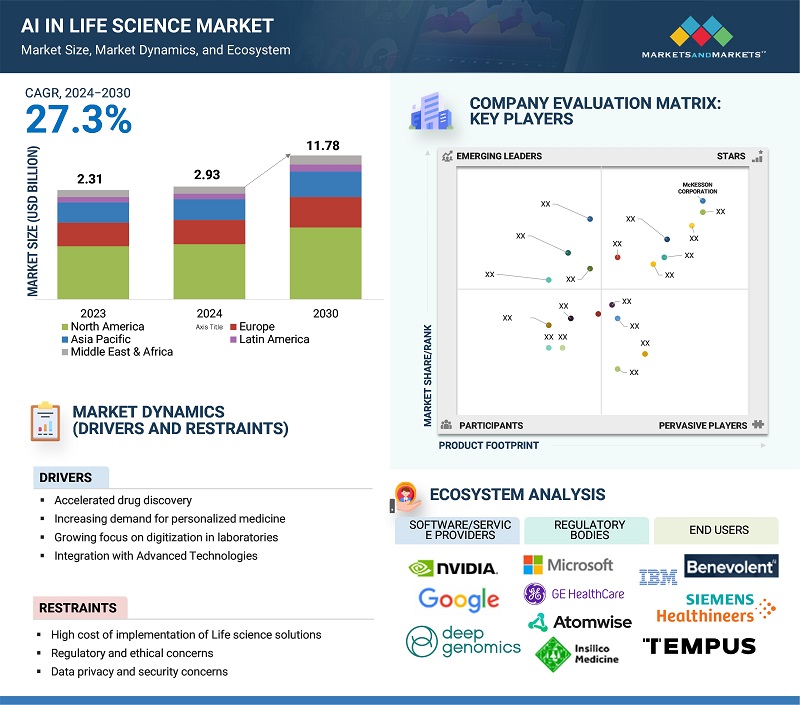

The global AI in life sciences market, valued at US$2.31 billion in 2023, is forecasted to grow at a robust CAGR of 27.3%, reaching US$2.93 billion in 2024 and an impressive US$11.78 billion by 2030. Growth is driven by AI’s role in accelerating drug discovery, significantly reducing the time and cost of identifying and developing new therapies. The growing demand for personalized medicine drives the adoption since AI analyses complex datasets in order to provide customized treatment options. AI integration with advanced technologies improves the process of laboratory digitization as it streamlines workflows and data management. Companies like Exscientia, using AI to optimize drugs, and Tempus, applying AI to offer personalized oncology solutions, show the real potential of AI to transform the life sciences industry.

Global AI in Life Science Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global AI in Life Science Market Dynamics

Driver: The acceleration of drug discovery is a key driver of AI adoption in the life sciences market.

The transformative impact of artificial intelligence on drug discovery and development is a major driver of adoption in the life sciences industry. The traditional approach to drug discovery is typically time-consuming and costly, taking more than a decade and hundreds of billions of dollars. AI addresses these issues by quickly and accurately identifying targets, designing molecules, and predicting drug efficacy. AI algorithms are increasingly being used by pharmaceutical companies to parse large complex datasets such as genomics and proteomics in order to identify ideal candidates for optimization in preclinical studies. The time-to-market decreases significantly, raising the chances of success in clinical trials that start early enough to identify the risks involved. With the potential to substantially decrease costs and improve outcomes, AI-driven drug discovery is emerging as a key driver of innovation in the life sciences sector, attracting significant investment and accelerating market growth.

Restraint: High Cost of Implementation of Life Science Solutions

A very high implementation cost of AI technology is a significant restraining factor in the adoption of AI in the life sciences market. The integration of such technologies with existing infrastructures involves upfront costs, which include investment in hardware and software and personnel. A high upfront cost may substantially burden small life sciences firms or firms in resource-scarce regions. The cost of acquiring, and more importantly, maintenance, the sophisticated AI technologies along with the need to continually update the system or train them also adds an enormous amount to the bills. Most organizations find difficult decisions when they have immediate returns from such investments on most counts. Therefore, though AI holds enormous promise to increase efficiencies, speed drug discovery, and revolutionize patient care, its implementation cost is one of the major challenges. Such costs may be too expensive, delaying the wide-scale introduction of AI into life sciences, especially where the pockets are not that fat, and the decision to invest in AI for an extended period of time seems too high-risk.

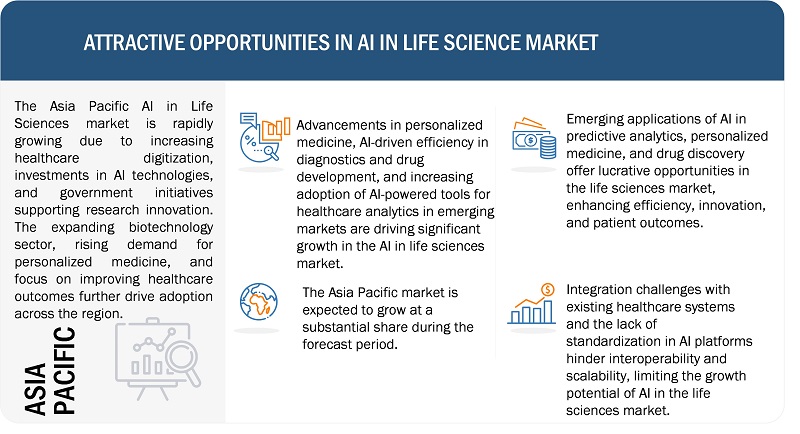

Opportunity: Expanding Personalized Medicine

One of the key driving opportunities for AI growth in the life sciences market relates to the increasing use of personalized medicine. Increasing patient data, genetic, clinical, and lifestyle information is analysed with more use of AI technologies towards developing tailor-made treatments and therapies. From such information, AI can aid in pattern recognition and correlations to form a basis for developing more efficient, targeted healthcare solutions that suit the specific needs of each patient. These targeted approaches are better outcomes for patients while also helping make treatment procedures more efficient in cutting out some trial-and-error processes that come with most forms of conventional medicine. Additionally, this will contribute to the development of new biomarkers and therapeutic targets, advancing the cause of precision medicine. There is a growing demand for more personalized healthcare solutions, and AI's role in drug development, diagnostics, and treatment planning represents a huge opportunity for innovation and growth in the life sciences industry. This shift toward personalized medicine is expected to transform healthcare delivery by making it more effective, cost-effective, and patient-centred, accelerating the adoption of AI technologies across the life sciences industry.

Challenge: Data Quality and Integration Challenges in AI for Life Sciences

Data quality and integration pose the greatest challenges to AI adoption in the life sciences market. AI algorithms require huge amounts of data to generate precise and meaningful insights, yet data used in life sciences are mostly inconsistent and fragmented. This means that siloing electronic health records, clinical trials, genomics, and wearable devices in incompatible formats makes it difficult for AI to aggregate and standardize them. Health data might also be noisy, incomplete, or biased, which could result in the wrong prediction and decision by AI.

Poor quality data can undermine effective solutions offered by AI especially in the sensitive areas, for example, drug development, diagnostics, and treatment planning of patients. In the wake of embracing AI into life sciences, there arises an imperative need to ensure that abundant data is clean, standardized, and interoperable across all different platforms and systems. Without addressing these data-related challenges, the full potential of AI in the life sciences market will remain restricted in development, thereby limiting the achievement of reliable, actionable insights, thereby further limiting the broader impact of AI in healthcare innovation.

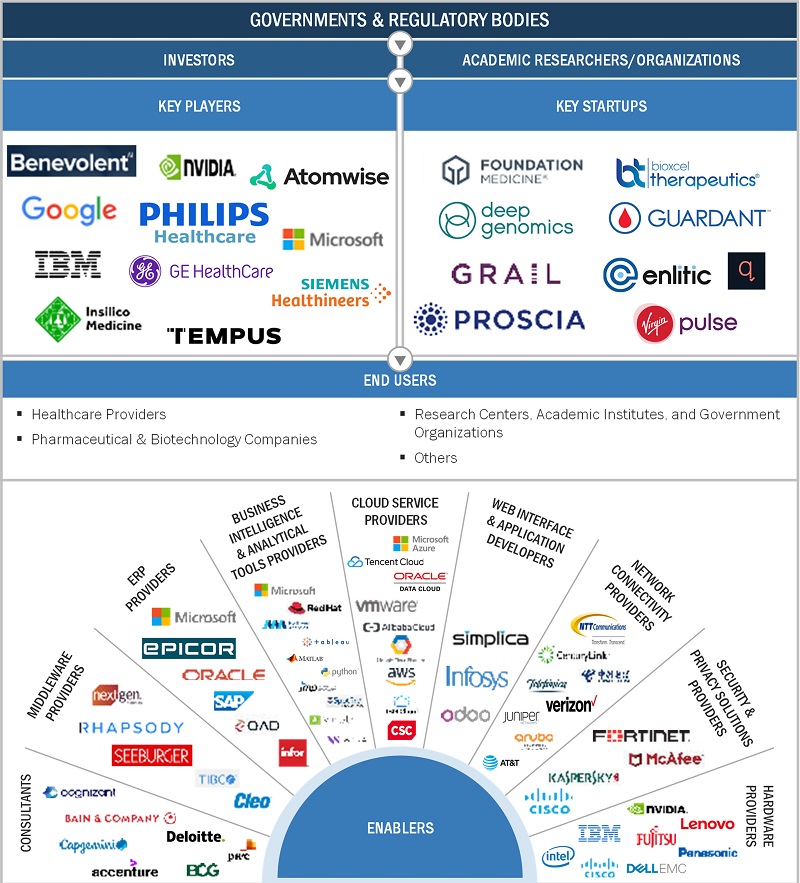

Global AI in Life Science Market Ecosystem Analysis

AI in life sciences is changing the face of the industry with such massive datasets, genomic, clinical, and real-world evidence to optimize drug discovery, diagnostics, and patient care. This ecosystem consists of advanced analytics platforms, machine learning models, and partnerships with pharmaceutical, biotechnology, and technology firms. These would include AI-based medical diagnosis, the infusion of AI in R&D pharmaceutical activities, and digital health environments through integrating EHRs and predictive analytics. The success of this ecosystem is strictly contingent upon interoperability, security in data, and regulations and makes it possible to have innovative concepts despite crossing the realms of ethics and technology. This requires the interconnected participation of stakeholders for a much more enhanced argument in the eventual upscaling of adoption and the impact of AI within the life sciences.

To know about the assumptions considered for the study, download the pdf brochure

By offering, the end-to-end solution providers segment accounted for the largest share of the market for AI in life science market in 2023

On the basis of offering, the market for AI in life science market is segmented into end-to-end solution providers, niche/point solution providers, AI technology providers and business process service provider. In 2023, the end-to-end solution providers segment accounted for the largest share of the market for AI in life science market, due to comprehensive platforms that help streamline a process across the entire value chain. The solutions have integrated AI technologies to bring efficiency gains and cost cuts in drug discovery, precision medicine, clinical trials, and diagnostics. The end-to-end platforms optimize complex workflows such as data integration, patient stratification, and regulatory compliance with advanced analytics, machine learning, and automation, which further aids in providing solutions to problems of scalability and interoperability while showing seamless support for large projects. Major players in this trend include Medidata AI and Exscientia, both of which excel at data-driven decision-making, predictive modelling, and real-time monitoring. Their comprehensive approach enables pharmaceutical companies to speed up drug development, improve outcomes, and outperform the competition. Thus, end-to-end solution providers are central to the AI in life sciences market.

The pharmaceutical and biotechnology companies segment is set to register the highest CAGR during the forecast period.

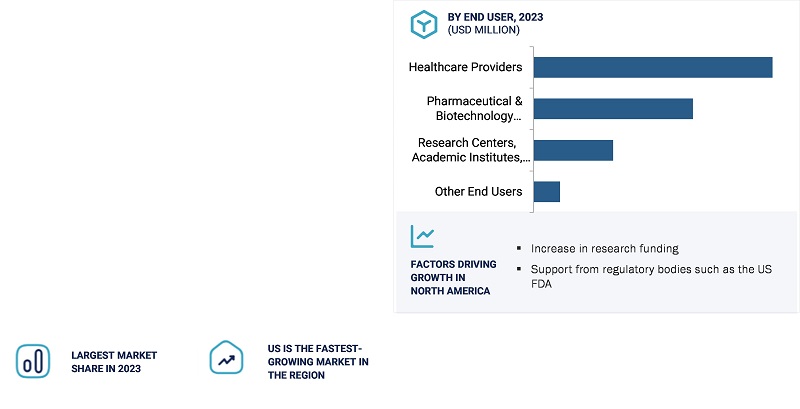

Based on end user, the market for Al in life science is segmented into healthcare providers, pharmaceutical and biotechnology companies, research centres, academic institutes, & government organizations. The pharmaceutical and biotechnology companies segment registered the highest growth rate during the forecast period, due to the high investment made by companies in drug discovery through AI, optimal clinical trials, and individualized medicine. These companies use AI to scan complex biological data and identify novel drug candidates for the prediction of therapeutic outcomes, thus accelerating the R&D process while reducing costs. Moreover, increased demand for targeted therapies as well as the need for urgent responses to the emergent health challenges have encouraged these companies to integrate AI into their operations. This also gives the pharmaceutical and biotechnology companies efficiency gains with competitors and maintains competitiveness due to strategic partnerships with AI solution providers along with advances in data analytics technology, thus bringing about this rapid growth in the segment.

North America accounted for the largest share of the market for AI in life science in 2023.

The AI in life science market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The advanced healthcare infrastructure, massive investments for research and development, as well as the early implementation of advanced technologies, primarily in North America, enabled this segment to lead the market share in 2023. Big players like IBM Watson Health and Medidata host a lot of innovation leaders in this region, powered by AI solutions in drug discovery, clinical trials, and patient care. Government initiatives, such as funding for AI research and a more progressive FDA stance on the adoption of AI/ML in healthcare, have catalyzed the growth in this market. North America focuses a lot on EHR and RWE platforms. This further develops and validates a strong AI model. Additionally, a structured and diverse population of patients makes it possible for the proper application of AI in dealing with complex diseases, such as oncology, and chronic illnesses. Such collaboration by tech companies, academic institutions, and healthcare organizations shows the leadership of the region in the AI in life sciences market.

Key Market Players

- NVIDIA Corporation (US)

- Google, Inc. (US)

- Microsoft (US)

- IBM (US)

- Atomwise Inc.(US)

- Koninklijke Philips N.V. (Netherlands)

- Insilico Medicine (US)

- GE Healthcare (US)

- Tempus AI, Inc. (US)

- Siemens Healthiness AG (Germany)

- Bio Xcel Therapeutics, Inc. (US)

- Benevolent AI (UK)

- PathAI, Inc. (US)

- Guardant Health (US)

- GRAIL, Inc. (US)

- FOUNDATION MEDICINE, INC. (US)

- FLATIRON HEALTH (US)

- Proscia Inc. (US)

- DEEP GENOMICS.

- Verge Genomics (US)

- Recursion (US)

- Qure.ai (Israel)

- Enlitic, Inc. (US)

- Virgin Pulse (US)

- Viz.ai (US)

Recent Developments in the AI in Life Science Market

- In June 2024, Medidata, a Dassault Systèmes brand, launched Medidata Clinical Data Studio, a unified platform enhancing clinical research data management. This innovation empowers stakeholders to improve data quality and accelerate safer trials for patients.

- In April 2024, IQVIA and Salesforce, the leading AI-powered CRM, announced an expanded partnership to advance Salesforce’s Life Sciences Cloud, a next-generation customer engagement platform for the life sciences sector.

- In March 2024, Clarivate Plc announced an agreement to acquire the most assets of MotionHall, a Silicon Valley start-up specializing in AI solutions for life sciences. This move aligns with Clarivate’s strategy to enhance its Life Sciences & Healthcare offerings through generative AI and proprietary industry-focused solutions.

- In August 2022, Atomwise announced a strategic and exclusive research collaboration with Sanofi. This partnership aims to utilize Atomwise's AtomNetss platform for computational discovery and research across up to five drug targets.

Frequently Asked Questions (FAQ):

1. Who are the major market players covered in the report?

The key players in the AI in life science market include NVIDIA Corporation (US), Google, Inc. (US), Microsoft (US), IBM (US), and Atomwise Inc.(US)

2. Define the market for AI in life science.

The AI in life sciences market refers to the use of artificial intelligence technologies in the life sciences industry, which include machine learning, natural language processing, predictive analytics, and other related technologies. As a result, these technologies are being used in a variety of phases, including drug discovery, precision medicine, diagnostics, clinical trials, and healthcare analytics. AI will scrutinize big and complex data sets for better decision-making, speed-to-market for new drugs, and improved individualized care of patients. It makes the lab processes more efficient and inspires research and development innovations. Trends in the market are determined by data integration, regulatory framework, and partnerships between technology providers and life sciences companies.

3. Which region is projected to account for the largest market share for AI in life science?

The AI in life science market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is projected to account for the largest share of the market for AI in life science during the forecast period.

4. Which end-user segments have been included in the AI in life science market report?

The report contains the following end-user segments:

- Healthcare providers

- Pharmaceutical & biotechnology companies

- Research centers, academic institutes, and government organizations

- Others

5. How big is the global AI in life science market today?

The global AI in life science market is projected to grow from USD 2.93 billion in 2024 to USD 11.78 billion by 2030, at a CAGR of 27.3%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in AI in Life Science Market