Airborne Defense Outlook 2035: Market Overview (Ecosystem, Macroeconomics, Regulatory, Programs, Expenditure, Alliances, Dynamics), Industry Trends (Technologies, Use Cases, Maturity Curve), Market Segments (Military Aircraft, Military Drones and Airborne Missiles), Customer Insights (Operators, OEMs, Shifts, initiatives, Business Models, Market Position), Competitive Landscape (Competitors, Partners, Evaluation Matrix, Key Profiles) and Future Opportunities (Future Landscape, Technology Roadmap, Major Projects, Top Opportunities)

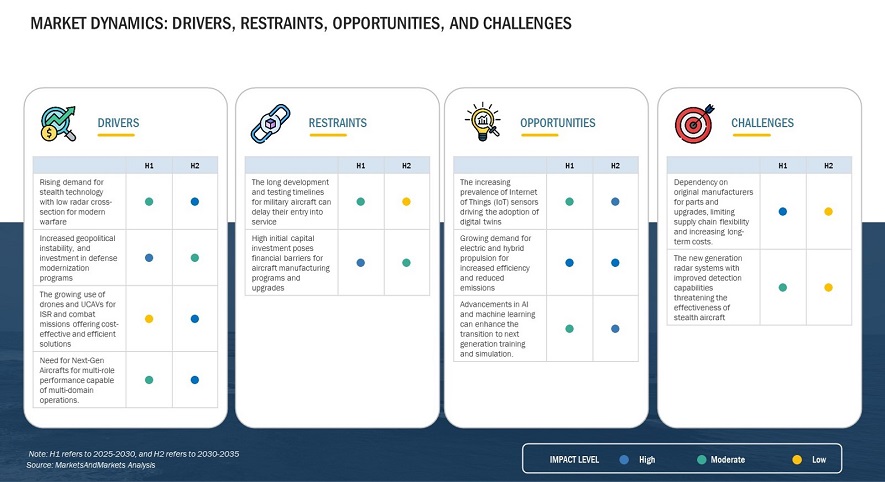

The global airborne defense market is undergoing a transformative shift, driven by rapid technological advancements, evolving geopolitical landscapes, and increasing defense budgets. By 2035, the airborne defense sector is expected to be dominated by next-generation fighter jets, unmanned aerial systems (UAS), directed-energy weapons, and AI-driven battlefield strategies. This article provides a comprehensive overview of the market outlook for airborne defense, examining key industry trends, customer insights, competitive dynamics, and future opportunities.

Market Overview

The airborne defense market is projected to reach significant growth levels by 2035, with an estimated valuation of over $500 billion. Factors contributing to this expansion include:

- Rising defense budgets of major global powers such as the United States, China, and India.

- Increased demand for advanced air defense systems to counter hypersonic and drone threats.

- Ongoing modernization programs for aging fleets of fighter jets and surveillance aircraft.

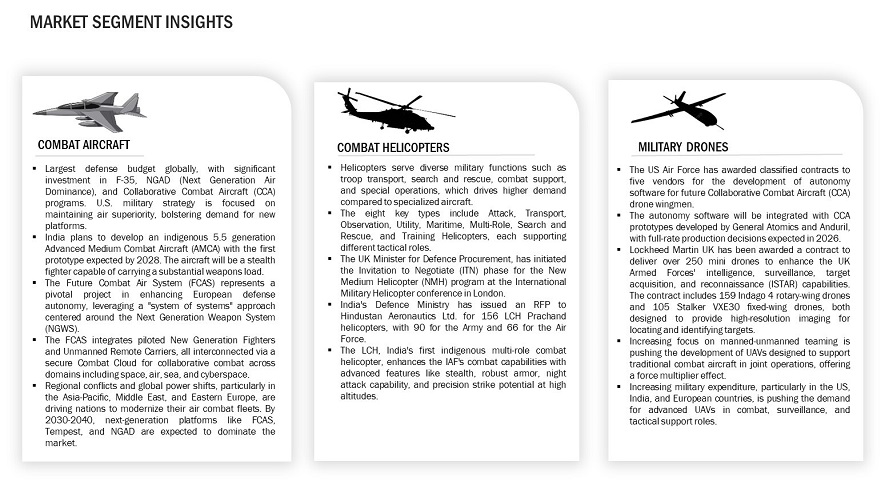

- Proliferation of unmanned aerial combat vehicles (UCAVs) and autonomous air warfare technologies.

North America and Europe remain the dominant players in the market, but Asia-Pacific is witnessing accelerated growth due to regional tensions and emerging defense capabilities of countries like China, Japan, and South Korea. The Middle East also remains a key region for airborne defense investments due to persistent security threats.

Industry Trends

Several emerging trends are shaping the future of airborne defense:

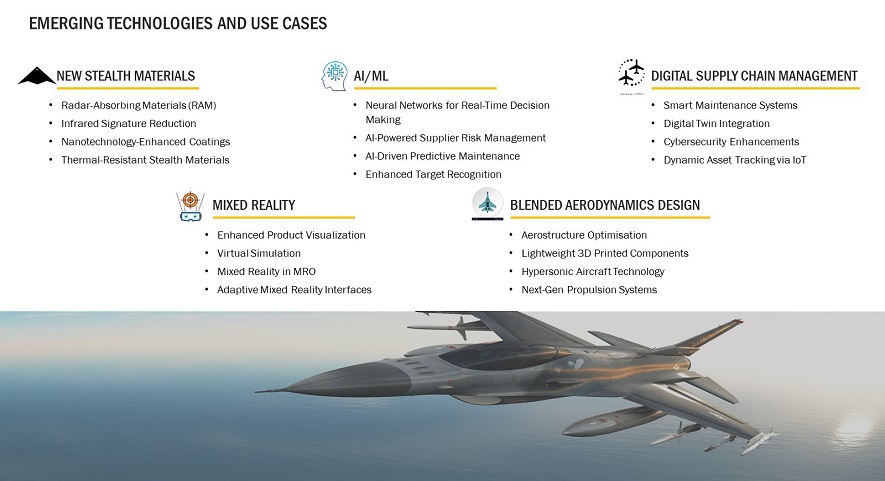

1. AI and Autonomy in Air Combat

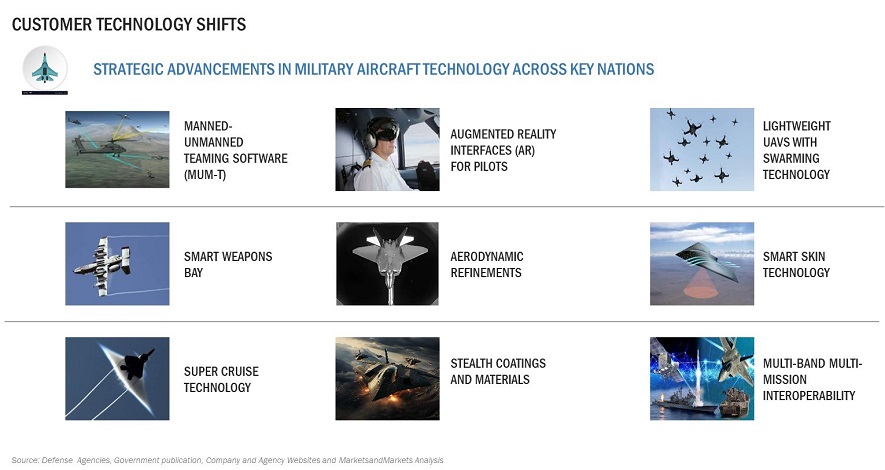

Artificial intelligence (AI) is revolutionizing air combat with autonomous decision-making capabilities in fighter jets and drones. AI-driven swarm technologies enable multiple UAVs to operate collaboratively in combat scenarios.

2. Hypersonic Weaponry

Hypersonic missiles capable of traveling at speeds exceeding Mach 5 are becoming a critical area of development. Nations are investing heavily in hypersonic defense and countermeasures.

3. Directed-Energy Weapons (DEWs)

Laser-based and microwave weapons are emerging as viable alternatives to traditional air defense systems, providing cost-effective solutions for countering drone and missile threats.

4. Stealth and Next-Gen Aircraft

Fifth- and sixth-generation fighter jets with stealth capabilities, advanced avionics, and superior maneuverability are in development, with projects like the U.S. NGAD (Next-Generation Air Dominance) and Europe's FCAS (Future Combat Air System) leading the way.

5. Space-Based Air Defense Systems

The increasing militarization of space has led to the development of space-based surveillance and air defense systems, enhancing real-time threat detection and response capabilities.

Customer Insights

Military customers and defense agencies are shifting their procurement strategies based on evolving threats and operational requirements:

- Emphasis on Multi-Domain Operations (MDO): Armed forces are integrating air, land, sea, cyber, and space capabilities to achieve battlefield superiority.

- Demand for Interoperability: Defense procurement agencies seek systems that can seamlessly integrate with allied forces' platforms.

- Reliability and Cost Efficiency: Customers prioritize solutions that offer long-term operational sustainability and cost-effectiveness.

- Growth in Private Sector Participation: Defense contractors are collaborating with tech companies to enhance AI, cybersecurity, and network-centric warfare capabilities.

Competitive Landscape

The airborne defense industry is highly competitive, with leading defense contractors investing in R&D to maintain technological superiority. Some key players include:

- Lockheed Martin: A leader in fighter jets (F-35), hypersonic weaponry, and AI-driven combat solutions.

- Boeing: Known for its aerial refueling tankers, advanced drones, and next-gen fighter concepts.

- Northrop Grumman: Specializes in stealth technology and airborne surveillance systems.

- Raytheon Technologies: A major player in missile defense, radars, and electronic warfare.

- BAE Systems: A key European defense contractor focusing on sixth-generation fighter jets.

- Chinese and Russian Firms: State-backed companies like AVIC (China) and Sukhoi (Russia) are advancing their indigenous capabilities to compete with Western manufacturers.

Future Opportunities

Several factors will drive new opportunities in the airborne defense market through 2035:

1. Growth in Unmanned Systems

The development of autonomous drones and UCAVs presents significant investment opportunities for both military and private defense contractors.

2. Expansion of Airborne Electronic Warfare (EW)

As cyber and electronic threats become more sophisticated, the demand for EW capabilities such as jamming, spoofing, and electronic countermeasures is set to rise.

3. Investment in Sustainable Aviation Technologies

Countries are exploring sustainable aviation fuels and hybrid-electric propulsion systems to reduce the carbon footprint of defense aviation.

4. Rise of Private Sector Defense Innovations

Companies like SpaceX and Palantir are entering the defense sector, bringing new capabilities in satellite-based air defense, AI-driven warfare analytics, and next-gen communication networks.

5. Strategic Alliances and Defense Pacts

The increasing collaboration between NATO, QUAD, AUKUS, and other defense alliances is fostering joint R&D initiatives, technology sharing, and multinational defense projects.

The airborne defense sector is on a trajectory of rapid growth, driven by technological advancements, evolving military strategies, and rising geopolitical tensions. By 2035, autonomous air combat, hypersonic weapons, and AI-driven warfare will define the competitive landscape. Companies that invest in cutting-edge innovations, interoperability, and sustainability will gain a strategic advantage in this evolving industry. As nations prepare for the future battlefield, the demand for superior airborne defense capabilities will continue to surge, presenting lucrative opportunities for defense contractors, governments, and investors alike.

Growth opportunities and latent adjacency in Airborne Defense Outlook 2035: Market