Aircraft Fairings Market by Application (Flight Control Surface, Fuselage, Engine, Nose, Cockpit, Wings, and Landing Gear), Material (Composite, Metallic, and Alloy), End User (OEM and Aftermarket), Platform, and Region (2017-2023)

The aircraft fairings market was valued at USD 1.47 billion in 2017 and projected to reach USD 2.13 billion by 2023, at a CAGR of 7.38% during the forecast period.

The objectives of this study are to analyze the aircraft fairings market, along with the provision of statistics. It also aims to define, describe, and forecast the aircraft fairings market on the basis of the application, material, platform, end user, and region. The year 2017 has been considered the base year for this study, whereas 2018 to 2023 is considered the forecast period.

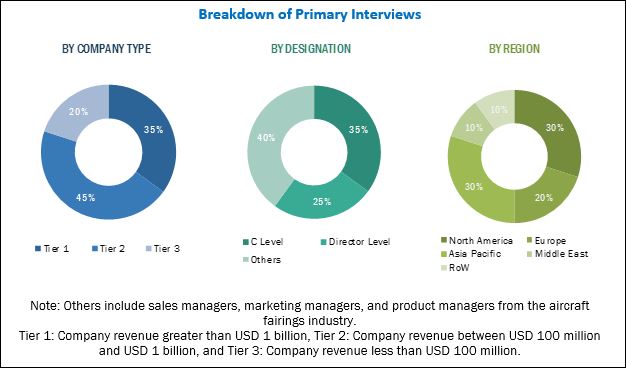

The research methodology that has been used to estimate and forecast the aircraft fairings market begins with capturing data on the revenues of the key aircraft fairings players through secondary sources, such as International Air Transport Association (IATA), Department of Defense (DoD), and paid databases. Aircraft fairings offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the aircraft fairings market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives of the leading companies operating in the aircraft fairings market. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The aircraft fairings ecosystem providers, such as ShinMaywa (Japan), Strata Manufacturing (UAE), Malibu Aerospace (US), FACC AG (Austria), Daher (France) NORDAM (US), Airbus (France), Boeing (US), Avcorp (Canada), and Barnes Group (US), among others, and the innovators of different types of aircraft fairings, such as Royal Engineered Composites (US), Fiber Dynamics Inc. (US), FDC Composites (Canada), and Kaman Aerosystems (US), among others.

Contracts, March, 2010- June, 2017

|

Date |

Company Name |

Description |

|

June 2017 |

FACC AG (Austria) |

FACC AG received a contract worth USD 119 million from Bombardier to produce composite wing-to-body fairings for Bombardier Aerospace’s new CSeries family of regional aircraft. |

|

July 2016 |

Strata Manufacturing (UAE) |

Strata Manufacturing received a contract from the Boeing Company to manufacture vertical fins for flap track fairings for the 787 Dreamliner. |

Agreements/Partnerships, June, 2014–May, 2018

|

Date |

Company Name |

Approach |

Description |

|

May 2018 |

Strata Manufacturing (UAE) |

Partnership |

Strata Manufacturing partnered with Pilatus Aircraft Ltd. to manufacture Belly Fairings for the PC-24 twin-engine business jet. |

|

January 2017 |

Strata Manufacturing (UAE) |

Partnership |

Strata Manufacturing partnered with Siemens to develop 3D printed technology for aircraft fairing parts to help airlines improve their designs, including manufacturing complex parts. |

Source: Press Releases

Target Audience for this Report:

- Manufacturers of Aircraft Fairings

- Providers or Suppliers of Aircraft Fairings Parts

- Manufacturers of Sub-components

- Retailers, Distributors, and Wholesalers of Aircraft Fairings

- Technology Support Providers

- Manufacturers of Defense Components

- Manufacturers of Aerospace Components

- System Integrators

- Governmental Bodies

“This study on the aircraft fairings market answers several questions for stakeholders, primarily which market segments they need to focus upon during the next 2 to 5 years to prioritize their efforts and investments.”

Scope of the Report

This research report categorizes the aircraft fairings market into the following segments:

Aircraft Fairings Market, by End User

- OEM

- Aftermarket

Aircraft Fairings Market, by Application

- Flight Control Surface

- Fuselage

- Engine

- Nose

- Cockpit

- Wings

- Landing Gear

Aircraft Fairings Market, by Material

- Composite

- Metallic

- Alloy

Aircraft Fairings Market, by Platform

- Commercial

- Narrow Body Aircraft (NBA)

- Wide Body Aircraft (WBA)

- Very Large Aircraft (VLA)

- Regional Transport Aircraft (RTA)

- Business Jets

- Military

- Fighter Aircraft

- Military Transport

- General Aviation

Aircraft Fairings Market, by Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report on the aircraft fairings market:

Regional Analysis

- Further breakdown of the Rest of the World aircraft fairings market

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The aircraft fairings market is projected to grow from an estimated USD 1.49 billion in 2018 to USD 2.13 billion by 2023, at a CAGR of 7.38% from 2018 to 2023. The factor that is expected to act as a major driver is the growing use of advanced composite materials in aircraft fairings. This, in turn, is expected to drive the growth of the aircraft fairings market during the forecast period from 2018 to 2023. The aircraft fairings market has been segmented based on application, material, platform, end user, and region.

Based on the application, the aircraft fairings market has been segmented into flight control surface, fuselage, wings, nose, landing gear, and other. The fuselage segment is estimated to be the largest in the aircraft fairings market in 2018. The fuselage is the main and central body of a fixed-wing aircraft. It provides space for cargo, controls, accessories, passengers, and other equipment. It includes bulkheads, frames, floor beams, and stringers. In single-engine aircraft, the fuselage houses the power plant, whereas, in multi-engine aircraft, the engines may either be attached to the fuselage, or suspended from the wing structure.

Based on the end user, the aircraft fairings market has been segmented into OEM and aftermarket. The aftermarket segment is expected to lead the aircraft fairings market in 2018. Various components of aircraft fairings, such as fuselage, flight control surface, nacelles, wheels, flaps, trailing edge are required to be replaced during maintenance procedures. Maintenance, Repair, and Overhaul (MRO) services are offered by companies as part of aftermarket support services.

The aircraft fairings market has been studied for North America, Europe, Asia Pacific, and Rest of the World (RoW). The North America region is estimated to account for largest share of the aircraft fairings market in 2018. North America is expected to be a leading aircraft fairings market, due to the high demand for newer aircraft and replacement of aging fleets.

Whereas, Asia Pacific region is expected to be the fastest-growing region in aircraft fairings market during the forecast period. This is due to the increase in modernization programs in the Asia Pacific aviation industry, which is leading to the high adoption of advanced aircraft fairings. These factors are anticipated to further propel the demand for aircraft fairingss in the APAC region. Some of the global key players operating in the aircraft fairings market in the Asia Pacific region are ShinMaywa (Japan) and Verdant (India).

The significant investment required for the development of different types of aircraft fairings is a major factor restraining the growth of the aircraft fairings market across the globe. High investments are required at different stages of the value chain of the aircraft fairings industry (especially in R&D, manufacturing, system integration, and assembly stages).

Products offered by various companies operating in the aircraft fairings market have been listed in the report. The recent developments section of the report provides information on the strategies adopted by various companies between November 2011 and October 2018 to strengthen their positions in the aircraft fairings market. Major players in the aircraft fairings market are ShinMaywa (Japan), Strata Manufacturing (UAE), Malibu Aerospace (US), FACC AG (Austria), Daher (France) NORDAM (US), Airbus (France), Boeing (US), Avcorp (Canada), and Barnes Group (US) among others, and the innovators of different types of aircraft fairings, such as Royal Engineered Composites (US), Fibre Dynamics Inc. (US), FDC Composites (Canada), and Kaman Aerosystems (US), among others. These companies have significant geographic reach and distribution channels.

Drivers

Growing use of Advanced Composite Materials in Aircraft Fairings

Composite materials have become an important component in the construction of aircraft structures. Aircraft parts, such as fairings, spoilers, and flight controls, are made of composite materials for reduced weight. The primary advantages of composite materials include their high strength, relatively low weight, and corrosion resistance. General aviation (GA) has had a long history with composites in flight-control surfaces and some empennage skins, as well as aerodynamic fairings around the wings and stabilizers. These applications represent 6 to 20 percent of an aircraft’s airframe.

Increasing Number of Aircraft Deliveries

There has been an increase in air passenger traffic which, in turn, leads to demand for new aircraft deliveries. According to CAPA - Centre for Aviation, the commercial aircraft fleet increased by 4% in 2017 as compared to 2016, globally. The global commercial aircraft fleet in service is expected to grow by 81% to 49,940 aircraft in 2035. The growth of the global commercial aircraft fleet is attributed to the high passenger growth rate of around 5% in the Asia Pacific region.

Growing Adoption of UAVs in Commercial & Military Applications

UAVs are increasingly used in various commercial and military applications, such as agriculture, real estate, mining, photography, oil & gas, product delivery, greenhouse emission monitoring, and wildlife research & preservation. The agricultural industry has been the largest end user of UAVs. UAVs have revolutionized the precision farming to offer several applications, such as crop health & irrigation equipment monitoring and weed identification, among others.

Opportunities

Reduction in the Cost of Composite Materials

An aircraft fairing helps improve aircraft performance by eliminating weight penalty. And the usage of composite materials in aircraft fairing helps reduce the cost of aircraft structure manufacturing. The cost of composite materials has been high ever since their introduction over 30 years ago. However, the rapid commercialization of these materials in the aviation industry in recent years has reduced their cost. An increase in the adoption of composites directly affects the cost of components made of composite materials.

Adoption of 3D Printing in Aircraft Fairing Manufacturing

Technological advancements in the field of aircraft fairing have led to the introduction of digital manufacturing, which is sourcing advanced 3D printers to help manufacture aircraft structural components, such as nacelles, pylons, flight control surfaces, empennages, wings, fuselage parts, and other small spares. 3D printing helps reduce the cycle time of the manufacturing process. Additionally, complex aircraft fairing parts can be easily manufactured using the 3D printing technology. This technology can be used to a great extent by aircraft fairing manufacturers for composite materials.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Aircraft Fairing Market, 2018-2023

4.2 Aircraft Fairing Market, By Application

4.3 Aircraft Fairing Market, By End User

4.4 Aircraft Fairing Market, By Platform

4.5 Aircraft Fairing Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Growing Use of Advanced Composite Materials in Aircraft Fairings

5.3.2 Increasing Number of Aircraft Deliveries

5.3.3 Growing Adoption of UAVS in Commercial & Military Applications

5.4 Opportunities

5.4.1 Reduction in the Cost of Composite Materials

5.4.2 Adoption of 3D Printing in Aircraft Fairing Manufacturing

5.5 Challenges

5.5.1 Recyclability Issue of Composite Materials

5.5.2 Complex Design of Aircraft Fairings Leading to Maintenance Difficulties

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Development of Aircraft Fairing By Top Manufacturers

6.3 Aircraft Fairing Material Evolution

6.4 Technology Trends

6.4.1 Plasma Fairing Technology to Reduce Aircraft Landing Gear Noise

6.4.2 3-D Printing

6.4.3 Smart Aircraft Structure

6.5 Material Trends

6.5.1 Advanced Composite Materials

6.5.2 Metal Materials

6.5.2.1 Metallic Materials

6.5.2.1.1 Alloy

6.5.2.1.2 Aluminum

6.5.2.1.3 Magnesium

6.5.2.1.4 Titanium

6.5.2.2 Non-Metallic Materials

6.5.2.2.1 Transparent Plastic

6.5.2.2.2 Reinforced Plastic

6.6 Regulatory Landscape

6.7 Component Design

6.7.1 Airline Operation and Maintainability

6.7.1.1 Durability

6.7.1.2 Reparability

6.7.2 Manufacturing

6.7.2.1 Raw Material

6.7.2.2 Reproducibility

6.8 Patent Listings, 2011

7 Aircraft Fairing Market, By End User (Page No. - 47)

7.1 Introduction

7.2 Original Equipment Manufacturer (OEM)

7.3 Aftermarket

8 Aircraft Fairing Market, By Material (Page No. - 50)

8.1 Introduction

8.2 Composite Material

8.2.1 Glass Fiber

8.2.2 Quartz

8.2.3 Others

8.3 Metallic Material

8.3.1 Aluminum

8.3.2 Titanium

8.3.3 Others

8.4 Alloy

9 Aircraft Fairing Market, By Application (Page No. - 55)

9.1 Introduction

9.2 Flight Control Surface

9.3 Fuselage

9.4 Nose

9.5 Engine

9.6 Landing Gear

9.7 Wings

9.8 Cockpit

10 Aircraft Fairing Market, By Platform (Page No. - 62)

10.1 Introduction

10.2 Commercial

10.2.1 Narrow Body Aircraft (NBA)

10.2.2 Regional Transport Aircraft (RTA)

10.2.3 Very Large Aircraft (VLA)

10.2.4 Wide Body Aircraft (WBA)

10.2.5 Business Jet

10.3 Military

10.3.1 Fighter Aircraft

10.3.2 Military Transport

10.4 General Aviation

11 Regional Analysis (Page No. - 68)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Russia

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Latin America

11.5.2 Africa

12 Competitive Landscape (Page No. - 94)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Contracts

12.3.2 Agreements/Partnerships

13 Company Profile (Page No. - 99)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Shinmaywa

13.2 Strata Manufacturing

13.3 Malibu Aerospace

13.4 FACC AG

13.5 Daher

13.6 Nordam

13.7 Airbus

13.8 Boeing

13.9 Avcorp

13.10 Barnes Group

13.11 AAR Corporation

13.12 Royal Engineered Composites

13.13 Fiber Dynamics, Inc.

13.14 Innovators

13.14.1 FDC Composites

13.14.2 Mcfarlane Aviation

13.14.3 Kaman Aerosystems

13.14.4 Arnprior Aerospace Inc.

13.14.5 CTRM Aero Composites

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 121)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customization

14.4 Related Reports

14.5 Author Details

List of Tables (72 Tables)

Table 1 Innovation & Patent Registrations, 2011

Table 2 Aircraft Fairing Market, By End User, 2016-2023 (USD Million)

Table 3 OEM: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 4 Aftermarket: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 5 Aircraft Fairing Market, By Material, 2016-2023 (USD Million)

Table 6 Composite Material: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 7 Metallic Material: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 8 Alloy: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 9 Aircraft Fairing Market, By Application, 2016-2023 (USD Million)

Table 10 Flight Control Surface: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 11 Fuselage: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 12 Nose: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 13 Engine: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 14 Landing Gear: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 15 Wings: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 16 Cockpit: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 17 Aircraft Fairing Market, By Platform, 2016-2023 (USD Million)

Table 18 Commercial: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 19 Commercial: Aircraft Fairing Market, By Type, 2016-2023 (USD Million)

Table 20 Military: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 21 Military Aircraft: Aircraft Fairing Market, By Type, 2016-2023 (USD Million)

Table 22 General Aviation: Aircraft Fairing Market, By Region, 2016-2023 (USD Million)

Table 23 Aircraft Fairing Market Size, By Region, 2018-2023 (USD Million)

Table 24 North America Aircraft Fairing Market Size, By Material, 2016-2023 (USD Million)

Table 25 North America Market Size, By Application, 2016-2023 (USD Million)

Table 26 North America Market Size, By Platform, 2016-2023 (USD Million)

Table 27 North America Market Size, By End User, 2016-2023 (USD Million)

Table 28 North America: Market Size, By Country, 2016-2023 (USD Million)

Table 29 US Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 30 US Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 31 Canada Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 32 Canada Market Size, By Application, 2016-2023 (USD Million)

Table 33 Europe Market Size, By Material, 2016-2023 (USD Million)

Table 34 Europe Market Size, By Application, 2016-2023 (USD Million)

Table 35 Europe Market Size, By Platform, 2016-2023 (USD Million)

Table 36 Europe Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 37 Europe Aircraft Fairing Size, By Country, 2016-2023 (USD Million)

Table 38 France Market Size, By End User, 2016-2023 (USD Million)

Table 39 France Market Size, By Application, 2016-2023 (USD Million)

Table 40 Germany Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 41 Germany Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 42 Italy Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 43 Italy Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 44 Russia Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 45 Russia Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 46 Rest of Europe Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 47 Rest of Europe Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 48 Asia Pacific Market Size, By End User, 2016-2023 (USD Million)

Table 49 Asia Pacific Market Size, By Application, 2016-2023 (USD Million)

Table 50 Asia Pacific Market Size, By Material, 2016-2023 (USD Million)

Table 51 Asia Pacific Market Size, By Platform, 2016-2023 (USD Million)

Table 52 Asia Pacific Aircraft Fairing Size, By Country, 2016-2023 (USD Million)

Table 53 China Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 54 China Market Size, By Application, 2016-2023 (USD Million)

Table 55 India Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 56 India Market Size, By Application, 2016-2023 (USD Million)

Table 57 Japan Market Size, By End User, 2016-2023 (USD Million)

Table 58 Japan Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 59 Rest of Asia Pacific Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 60 Rest of Asia Pacific Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 61 Rest of the World Market Size, By End User, 2016-2023 (USD Million)

Table 62 Rest of the World Market Size, By Application, 2016-2023 (USD Million)

Table 63 Rest of the World Market Size, By Material, 2016-2023 (USD Million)

Table 64 Rest of the World Market Size, By Platform, 2016-2023 (USD Million)

Table 65 Rest of the World Aircraft Fairing Size, By Region, 2016-2023 (USD Million)

Table 66 Latin America Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 67 Latin America Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 68 Africa Aircraft Fairing Market Size, By End User, 2016-2023 (USD Million)

Table 69 Africa Aircraft Fairing Market Size, By Application, 2016-2023 (USD Million)

Table 70 Ranking of Players in Aircraft Fairing Market

Table 71 Contracts, March, 2010- June, 2017

Table 72 Agreements/Partnerships, June, 2014–May, 2018

List of Figures (34 Figures)

Figure 1 Research Flow

Figure 2 Research Design: Aircraft Fairing Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Composite Segment Projected to Lead Aircraft Fairing Market During Forecast Period

Figure 8 Aftermarket Segment Projected to Lead Market During Forecast Period

Figure 9 North America Projected to Account for Highest Share in Aircraft Fairing Market During Forecast Period

Figure 10 Emerging Demand for Plasma Aircraft Fairing Technology for Landing Gear is the Fastest-Growing in Aircraft Fairing Market

Figure 11 Flight Control Surface Segment Projected to Lead Aircraft Fairing Market During Forecast Period

Figure 12 Aftermarket Segment Projected to Lead Aircraft Fairing Market During Forecast Period

Figure 13 Military Segment Expected to Grow at Highest CAGR During Forecast Period

Figure 14 North America Estimated to Account for Largest Share in Aircraft Fairing Market in 2018

Figure 15 Aircraft Fairing: Market Dynamics

Figure 16 Airbus and Boeing Aircraft Fleet Forecast Comparison By 2035, By Region

Figure 17 Increasing Demand for UAVS in Military & Commercial Applications

Figure 18 Reduction in the Cost of Composite Fairing Material

Figure 19 Aftermarket Segment Estimated to Lead Aircraft Fairing Market During Forecast Period

Figure 20 Composite Segment Projected to Lead Aircraft Fairing Market During Forecast Period

Figure 21 Flight Control Surface Segment Estimated to Lead Aircraft Fairing Market During Forecast Period

Figure 22 Commercial Segment Projected to Lead Aircraft Fairing Market During Forecast Period

Figure 23 US in North America Region Estimated to Account for Largest Share of Aircraft Fairing Market in 2018

Figure 24 North America Snapshot: the US to Account for Highest Growth Potential During Forecast Period

Figure 25 Aircraft Fairing Market Europe Snapshot

Figure 26 Asia Pacific Aircraft Fairing Market Snapshot

Figure 27 Companies Adopted Contracts as A Key Growth Strategy From March 2010 to June 2017

Figure 28 Shinmaywa: Company Snapshot

Figure 29 FACC AG: Company Snapshot

Figure 30 Airbus: Company Snapshot

Figure 31 Boeing: Company Snapshot

Figure 32 Avcorp: Company Snapshot

Figure 33 Barnes Group: Company Snapshot

Figure 34 AAR Corporation: Company Snapshot

Growth opportunities and latent adjacency in Aircraft Fairings Market