Alpha-Methylstyrene Market by Application(ABS, Para-Cumylphenol, Adhesives & Coatings, Waxes), Purity(Assay above 99.5% and Between 95% to 99.5%), Region(Asia Pacific, Europe, North America, Middle East & Africa, South America) - Global Forecast to 2024

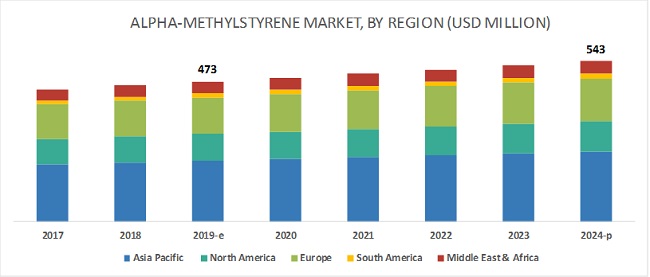

[144 Pages Report] The alpha-methylstyrene market is projected to grow from USD 473 million in 2019 to USD 543 million by 2024, at a CAGR of 2.8% from 2019 to 2024. Surging demand for Acrylonitrile Butadiene Styrene (ABS) from the automotive and electronic appliances industries is fueling the growth of the market across the globe. Increasing demand for consumer goods from emerging economies acts as an opportunity for the growth of the alpha-methylstyrene market, worldwide.

Based on application, the ABS segment of the alpha-methylstyrene market is projected to grow at the highest CAGR in terms of both, value and volume from 2019 to 2024.

Based on application, the ABS segment of the market is projected to grow at the highest CAGR during the forecast period in terms of both, value and volume. Alpha-methylstyrene is primarily used in the production of ABS as it improves the heat stability and impact resistance of ABS resins. Increased demand for ABS resins from various end-use industries such as automotive and electronic appliances is driving the growth of the ABS segment of the alpha-methylstyrene market across the globe.

Based on purity, the assay above 99.5% segment of the alpha-methylstyrene market is projected to grow at a higher CAGR than the between 95% to 99.5% segment from 2019 to 2024 in terms of both, value and volume.

Based on purity, the alpha-methylstyrene market has been segmented into assay above 99.5% and between 95% and 99.5%. The assay above 99.5% segment is projected to lead the market during the forecast period in terms of both, value and volume. This segment is also projected to grow at a higher CAGR than the between 95% to 99.5% segment from 2019 to 2024 in terms of both, value and volume. The global industrial standard for the purity of alpha-methylstyrene is 98.5%. Most of the manufacturers of alpha-methylstyrene across the globe produce alpha-methylstyrene having a purity level of 98.5% and above. The rising demand for alpha-methylstyrene with purity above 99.5% for use as a heat stabilizer for ABS, as a solvent in the plastics industry, and as a pigment and paint adhesive agent in adhesives & coatings, waxes, and tackifier is expected to drive the growth of the assay above 99.5% segment of the market.

The Asia Pacific region is projected to lead the alpha-methylstyrene market during the forecast period in terms of both, value and volume.

The Asia Pacific region is estimated to be the largest market for alpha-methylstyrene in 2019. China, India, Japan, and South Korea are the major consumers of alpha-methylstyrene in this region. Innovations in production techniques of electronic appliances, rise in population, and increase in the income of the middle class population of the region, have resulted in increased demand for consumer durables and automobiles in Asia Pacific, thereby contributing to the growth of the alpha-methylstyrene market in this region.

Key Market Players

INEOS Group Holding S.A. (Switzerland), AdvanSix (US), Rosneft (Russia), Altivia Corp. (US), SI Group Inc. (US), DOMO Chemicals (Belgium), Kumho P&B Chemicals (South Korea), Taiwan Prosperity Chemical Corp. (Taiwan), Yangzhou Lida Chemicals (China), Mitsubishi Chemical Corporation (Japan), Solvay SA (Belgium), and Mitsui Chemicals, Inc. (Japan) are some of the leading players operating in the alpha-methylstyrene market. These players have adopted the strategies of expansions, new product developments, acquisitions, and joint ventures to enhance their position in the market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

20172024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

20192024 |

|

Forecast Units |

Volume (Kilotons) and Value (USD Million) |

|

Segments Covered |

Application, Purity, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

INEOS Group Holding S.A. (Switzerland), AdvanSix (US), Rosneft (Russia), Altivia Corp. (US), SI Group Inc. (US), DOMO Chemicals (Belgium), Kumho P&B Chemicals (South Korea), Taiwan Prosperity Chemical Corp. (Taiwan), Yangzhou Lida Chemicals (China), Mitsubishi Chemical Corporation (Japan), Solvay SA (Belgium), and Mitsui Chemicals, Inc. (Japan) |

This research report categorizes the alpha-methylstyrene market based on application, purity, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on Application, the alpha-methylstyrene market has been segmented into:

- Acrylonitrile Butadiene Styrene (ABS)

- Para-cumylphenol

- Adhesives & Coatings

- Waxes

- Others

- Inks

- Tackifiers

- Perfumes

- Antioxidants

- Intermediates

Based on Purity, the alpha-methylstyrene market has been segmented into:

- Assay above 99.5%

- Between 95% to 99.5%

Based on Region, the alpha-methylstyrene market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2018, INEOS Phenol, a subsidiary of INEOS Group Holdings S.A., built a world scale Cumene unit in Germany that is expected to be completed by 2020. The unit is to be located in Chemiepark in Marl (Germany) so that it can access existing pipeline connections between phenol acetone production site of INEOS in Gladbeck (Germany) and Evonik Chemiepark in Marl (Germany), in addition to the British Petroleum refinery and cracker complex in Gelsenkirchen (Germany). The establishment of this new cumene plant aimed at catering to the increased customer demand for phenol and acetone and improving the security of raw material supply to INEOS Phenol and acetone plants located in Gladbeck (Germany) and Antwerp (Belgium).

- In January 2019, Mitsui Chemicals, Inc. (Japan) announced its intention to begin the production of alpha-methylstyrene by 2020 at its Singapore-based subsidiary, Mitsui Phenols Singapore Pte. Ltd. This expansion aims at catering to the increased demand for alpha-methylstyrene across the globe due to rise in the consumption of ABS resins and petroleum resins in various end-use industries. The expansion is expected to enhance the 3-base network of the company comprising Japan, Singapore, and China.

Key Questions Addressed by the Report

- How developments undertaken by various companies are expected to affect the alpha-methylstyrene market in the mid- to long-term?

- What are the upcoming industry applications of alpha-methylstyrene?

- What is the impact of changes in government policies on the alpha-methylstyrene market?

- What is the estimated size of the alpha-methylstyrene market in 2019?

- What are the different applications of alpha-methylstyrene?

Frequently Asked Questions (FAQ):

What is Alpha-methyl Styrene?

What are the most promising high-growth opportunities for the global alpha-methyl styrene market by end-use industry?

How is the alpha-methyl styrene segmented according to purity levels?

Which are the key countries expected to fuel the global alpha-methyl styrene market?

What are the key driving factors for the global alpha-methyl styrene market? Why?

What are the major challenges which may hinder the growth of the alpha-methyl styrene market?

Who are the key players of the alpha-methyl styrene market and what strategic initiatives are being implemented by them for business growth?

What is the degree of competition in the global alpha-methyl styrene market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Report Description

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Break Down of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in Alpha-Methylstyrene Market

4.2 Alpha-Methylstyrene Market, By Region

4.3 Alpha-Methylstyrene Market in Asia Pacific, By Application and Country

4.4 Alpha-Methylstyrene Market: Major Countries

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Resins and Additives Using Alpha-Methylstyrene From the Asia Pacific Region

5.3.1.2 Rising Demand for ABS Resins From the Growing Electronic/Electrical Appliances and Automotive Industries

5.3.2 Restraints

5.3.2.1 Generation of Hazardous Wastes During the Production of Alpha-Methylstyrene

5.3.2.2 Lack of Compatibility With Oxidizing Agents

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Consumer Goods From Emerging Economies

5.3.3.2 Ongoing Shale Oil/Tight Oil Exploration Activities

5.3.4 Challenges

5.3.4.1 Health and Safety Concerns Associated With the Exposure to Alpha-Methylstyrene and Its Derivatives

5.3.4.2 Volatility in the Prices of Raw Materials

5.4 Economic Indicators

5.4.1 Industry Outlook

5.4.1.1 Automotive

5.4.1.2 Aerospace

5.4.1.3 Electronics

5.5 Porters Five Forces Analysis

5.5.1 Bargaining Power of Suppliers

5.5.2 Bargaining Power of Buyers

5.5.3 Threat of Substitutes

5.5.4 Threat of New Entrants

5.5.5 Rivalry Among Existing Competitors

6 Alpha-Methylstyrene Market, By Application (Page No. - 49)

6.1 Introduction

6.2 Acrylonitrile Butadiene Styrene (ABS) Resin

6.2.1 ABS is the Largest and Fastest Growing Application Segment

6.3 Para-Cumylphenol

6.3.1 Para-Cumylphenol Accounted for the Second Largest Share in the Global AMS Market

6.4 Adhesives & Coatings

6.4.1 Growing Demand for Adhesives and Coating From End-Use Industries Such as Automotive, Electronics, Building & Construction is Expected to Drive the AMS Market

6.5 Waxes

6.5.1 Waxes Application Segment Accounted for A Major Share in the Global AMS Market

6.6 Others

7 Alpha-Methylstyrene Market, By Purity (Page No. - 57)

7.1 Introduction

7.2 Assay Above 99.5%

7.2.1 Assay Above 99.5% Purity Segment Accounted for the Largest Share in the Global AMS Market

7.3 Between 95% and 99.5%

7.3.1 High Demand From the ABS, Styrene-Butadiene Rubber, and Adhesives is Expected to Drive the Between 95% to 99.5% Purity Segment

8 Alpha-Methylstyrene Market, By Region (Page No. - 61)

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.1.1 China Accounted for the Highest Share in the Global Alpha-Methylstyrene Market

8.2.2 India

8.2.2.1 Growing Demand for ABS From the Automotive and Electronic Appliances Industries is Expected to Drive the Indian AMS Market

8.2.3 Japan

8.2.3.1 Japan Accounted for the Second Largest Share in the Asia Pacific AMS Market

8.2.4 South Korea

8.2.4.1 High Demand for ABS is Expected to Drive the AMS Market in South Korea

8.2.5 Taiwan

8.2.5.1 Taiwan Being One of the Major Producer and Exporter of ABS has Ultimately Created A High Demand for AMS

8.2.6 Malaysia

8.2.6.1 High Demand for ABS in Malaysia is Expected to Drive the AMS Market

8.2.7 Rest of Asia Pacific

8.3 Europe

8.3.1 Germany

8.3.1.1 High Demand for ABS From the End-Use Industries Such as Automotive, Electronic Appliances and Aerospace is Expected to Drive the AMS Market

8.3.2 France

8.3.2.1 France Accounted for the Third Largest Share in the European AMS Market

8.3.3 Italy

8.3.3.1 Italy is One of the Major Producer of ABS, Thus Creating A High Demand for AMS

8.3.4 UK

8.3.4.1 UK Accounted for the Second Largest Share in the European AMS Market

8.3.5 Russia

8.3.5.1 Russia is One of the Major Producer of AMS in the European Region

8.3.6 Spain

8.3.6.1 Spain Being One of the Major Producer of ABS in the European Region is Expected High Demand for AMS

8.3.7 Rest of Europe

8.4 North America

8.4.1 Us

8.4.1.1 US Being One of the Major Producer and Exporter of ABS Globally, Accounted for the Highest Share in the North American AMS Market

8.4.2 Canada

8.4.2.1 Canada Accounted for the Second Largest Share in the North American AMS Market

8.4.3 Mexico

8.4.3.1 High Demand for ABS From the Growing Automotive Industry is Expected to Drive the AMS Market in Mexico

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Saudi Arabia Accounted for the Largest Share in the Middle East & Africa AMS Market

8.5.2 Qatar

8.5.2.1 Qatar Accounted for the Second Largest Share in the Middle East & Africa AMS Market

8.5.3 UAE

8.5.3.1 Rising Demand for ABS From the Automotive, Electronic, Buidling & Construction, Etc. Industries is Expected to Drive the UAE AMS Market

8.5.4 South Africa

8.5.4.1 The Rising Demand for ABS From Industries Such as Automotive and Electrical & Electronic Industries is Expected to Drive the South Africa AMS Market

8.5.5 Kuwait

8.5.5.1 Kuwait Aacounted for the Fourth Largest Share in the South Africa AMS Market

8.5.6 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Brazil Accounted for the Largest Share in the South America AMS Market

8.6.2 Argentina

8.6.2.1 Argentina Accounted for the Second Largest Share in the South America AMS Market

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 101)

9.1 Introduction

9.2 Competitive Landscape Mapping

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Competitive Benchmarking

9.3.1 Strength of Product Portfolio

9.3.2 Business Strategy Excellence

9.4 Overview

9.5 Competitive Situation & Trends

9.5.1 New Product Developments

9.5.2 Acquisitions & Joint Ventures

9.5.3 Expansions

9.6 Market Share Analysis

10 Company Profiles (Page No. - 110)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 INEOS Group Holdings S.A.

10.2 AdvanSix Inc.

10.3 Cepsa

10.4 Rosneft

10.5 Mitsubishi Chemical Holdings Corporation

10.6 Solvay SA

10.7 Mitsui Chemicals, Inc.

10.8 Kumho Petrochemical Co., Ltd.

10.9 Versalis SPA

10.10 Taiwan Prosperity Chemical Corp.

10.11 The Plaza Group Inc.

10.12 Novapex

10.13 DOMO Chemicals

10.14 Omskiy Kauchuk

10.15 SI Group, Inc.

10.16 Prasol Chemicals Private Limited

10.17 Yangzhou Lida Chemical Co. Ltd.

10.18 Altivia Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 138)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (97 Tables)

Table 1 Alpha-Methylstyrene Market Snapshot

Table 2 Alpha-Methylstyrene Market, By Application

Table 3 Alpha-Methylstyrene Market, By Purity

Table 4 Aircraft Deliveries, By Airplane Size and Region

Table 5 Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 6 Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 7 Alpha-Methylstyrene Market in ABS, By Region, 20172024 (USD Million)

Table 8 Alpha-Methylstyrene Market in ABS, By Region, 20172024 (Kilotons)

Table 9 Alpha-Methylstyrene Market in Para-Cumylphenol, By Region, 20172024 (USD Million)

Table 10 Alpha-Methylstyrene Market in Para-Cumylphenol, By Region, 20172024 (Kilotons)

Table 11 Alpha-Methylstyrene Market in Adhesives & Coatings, By Region, 20172024 (USD Million)

Table 12 Alpha-Methylstyrene Market in Adhesives & Coatings, By Region, 20172024 (Kilotons)

Table 13 Alpha-Methylstyrene Market in Waxes, By Region, 20172024 (USD Million)

Table 14 Alpha-Methylstyrene Market in Waxes, By Region, 20172024 (Kilotons)

Table 15 Alpha-Methylstyrene Market in Other Applications, By Region, 20172024 (USD Million)

Table 16 Alpha-Methylstyrene Market in Other Applications, By Region, 20172024 (Kilotons)

Table 17 Alpha-Methylstyrene Market, By Purity, 20172024 (USD Million)

Table 18 Alpha-Methylstyrene Market, By Purity, 20172024 (Kilotons)

Table 19 Assay Above 99.5% Alpha-Methylstyrene Market, By Region, 20172024 (USD Million)

Table 20 Assay Above 99.5% Alpha-Methylstyrene Market, By Region , 20172024 (Kilotons)

Table 21 Between 95% and 99.5% Alpha-Methylstyrene Market, By Region, 20172024 (USD Million)

Table 22 Between 95% and 99.5% Alpha-Methylstyrene Market , By Region, 20172024 (Kilotons)

Table 23 Alpha-Methylstyrene Market, By Region, 20172024 (USD Million)

Table 24 Alpha-Methylstyrene Market, By Region, 20172024 (Kilotons)

Table 25 Asia Pacific Alpha-Methylstyrene Market, By Country, 20172024 (USD Million)

Table 26 Asia Pacific Alpha-Methylstyrene Market, By Country, 20172024 (Kilotons)

Table 27 Asia Pacific Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 28 Asia Pacific Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 29 China Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 30 China Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 31 India Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 32 India Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 33 Japan Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 34 Japan Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 35 South Korea Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 36 South Korea Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 37 Taiwan Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 38 Taiwan Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 39 Malaysia Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 40 Malaysia Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 41 Rest of Asia Pacific Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 42 Rest of Asia Pacific Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 43 Europe Alpha-Methylstyrene Market, By Country, 20172024 (USD Million)

Table 44 Europe Alpha-Methylstyrene Market, By Country, 20172024 (Kilotons)

Table 45 Germany Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 46 Germany Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 47 France Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 48 France Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 49 Italy Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 50 Italy Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 51 UK Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 52 UK Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 53 Russia Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 54 Russia Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 55 Spain Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 56 Spain Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 57 Rest of Europe Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 58 Rest of Europe Alpha-Methylstyrene Market, By Application, 20172024 (Kilotons)

Table 59 North America Alpha-Methylstyrene Market, By Country, 20172024 (USD Million)

Table 60 North America Alpha-Methylstyrene Market, By Country, 2017-2024 (Kilotons)

Table 61 North America Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 62 North America Alpha-Methylstyrene Market, By Application, 2017-2024 (Kilotons)

Table 63 US Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 64 US Alpha-Methylstyrene Market, By Application, 2017-2024 (Kilotons)

Table 65 Canada Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 66 Canada Alpha-Methylstyrene Market, By Application, 2017-2024 (Kilotons)

Table 67 Mexico Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 68 Mexico Alpha-Methylstyrene Market, By Application, 2017-2024 (Kilotons)

Table 69 Middle East & Africa Alpha-Methylstyrene Market, By Country, 20172024 (USD Million)

Table 70 Middle East & Africa Alpha Methyl Styrene Market, By Country, 20172024 (Kilotons)

Table 71 Middle East & Africa Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 72 Middle East & Africa Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 73 Saudi Arabia Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 74 Saudi Arabia Alpha Methyl Styrene Market, By Application, 2017-2024 (Kilotons)

Table 75 Qatar Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 76 Qatar Alpha Methyl Styrene Market, By Application, 2017-2024 (Kilotons)

Table 77 UAE Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 78 UAE Alpha Methyl Styrene Market, By Application, 2017-2024 (Kilotons)

Table 79 South Africa Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 80 South Africa Alpha Methyl Styrene Market, By Application, 2017-2024 (Kilotons)

Table 81 Kuwait Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 82 Kuwait Alpha Methyl Styrene Market, By Application, 2017-2024 (Kilotons)

Table 83 Rest of Middle East & Africa Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 84 Rest of Middle East & Africa Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 85 South America Alpha-Methylstyrene Market, By Country, 20172024 (USD Million)

Table 86 South America Alpha Methyl Styrene Market, By Country, 20172024 (Kilotons)

Table 87 South America Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 88 South America Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 89 Brazil Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 90 Brazil Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 91 Argentina Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 92 Argentina Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 93 Rest of South America Alpha-Methylstyrene Market, By Application, 20172024 (USD Million)

Table 94 Rest of South America Alpha Methyl Styrene Market, By Application, 20172024 (Kilotons)

Table 95 New Product Developments, 20132018

Table 96 Acquisitions & Joint Ventures, 20132018

Table 97 Expansions, 20132018

List of Figures (44 Figures)

Figure 1 Alpha-Methylstyrene Market: Research Design

Figure 2 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Asia Pacific Led Alpha-Methylstyrene Market in 2018

Figure 6 ABS Segment Accounted for the Largest Share of Alpha-Methylstyrene Market in 2018

Figure 7 Alpha-Methylstyrene Market, By Region, 2018

Figure 8 Alpha-Methylstyrene Market Projected to Witness Moderate Growth Between 2019 and 2024

Figure 9 Alpha-Methylstyrene Market in Asia Pacific and Europe Projected to Grow at the Highest CAGR Between 2019 and 2024

Figure 10 ABS and China Accounted for the Largest Shares of Alpha-Methylstyrene Market in Asia Pacific in 2018

Figure 11 Alpha-Methylstyrene Market in China Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 12 Alpha-Methylstyrene Market, By Region

Figure 13 Alpha-Methylstyrene Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Global Automobile Production Data, 20112017

Figure 15 Average Crude Oil Prices in USD Per Barrel, 20112017

Figure 16 Global Car Sales, Million Units, 20082017

Figure 17 Production By Global Electronics and It Industries From 2015 to 2018

Figure 18 Porters Five Forces Analysis

Figure 19 Alpha-Methylstyrene Market, By Application, 2019 & 2024 (Kilotons)

Figure 20 AlphaMethylstyrene Market, By Purity, 2019 & 2024 (Kilotons)

Figure 21 Alpha-Methylstyrene Market in China to Grow at the Highest CAGR From 2019 to 2024

Figure 22 Asia Pacific Alpha-Methylstyrene Market Snapshot

Figure 23 Europe Alpha-Methylstyrene Market Snapshot

Figure 24 North America Alpha-Methylstyrene Market Snapshot

Figure 25 Competitive Landscape Mapping

Figure 26 Key Growth Strategies Adopted By Companies in Alpha-Methylstyrene Market Between 2013 and 2018

Figure 27 Alpha-Methylstyrene Market Ranking, By Company, 2018

Figure 28 INEOS Group Holdings S.A.: Company Snapshot

Figure 29 INEOS Group Holdings S.A.: SWOT Analysis

Figure 30 AdvanSix Inc.: Company Snapshot

Figure 31 AdvanSix Inc.: SWOT Analysis

Figure 32 Cepsa: Company Snapshot

Figure 33 Cepsa: SWOT Analysis

Figure 34 Rosneft: Company Snapshot

Figure 35 Rosneft: SWOT Analysis

Figure 36 Mitsubishi Chemical Holdings Corporation.: Company Snapshot

Figure 37 Mitsubishi Chemical Holdings Corporation.: Company Snapshot

Figure 38 Solvay SA: Company Snapshot

Figure 39 Solvay SA: SWOT Analysis

Figure 40 Mitsui Chemicals, Inc.: Company Snapshot

Figure 41 Mitsui Chemicals, Inc.: SWOT Analysis

Figure 42 Kumho Petrochemical Co., Ltd.: Company Snapshot

Figure 43 Versalis SPA: Company Snapshot

Figure 44 Taiwan Prosperity Chemical Corp.: Company Snapshot

The study involved 4 major activities in estimating the current size of the alpha-methylstyrene market. Exhaustive secondary research was undertaken to collect information on the alpha-methylstyrene market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the alpha-methylstyrene value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the alpha-methylstyrene market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study on the alpha-methylstyrene market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, monetary chain of the market, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology-oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both, supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the alpha-methylstyrene market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the alpha-methylstyrene market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the alpha-methylstyrene market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, demand and supply sides. In addition to this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the alpha-methylstyrene market based on application, purity, and region

- To forecast the size of the market and its segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as expansions, new product developments, acquisitions, and joint ventures in the alpha-methylstyrene market

The following customization options are available for the report:

- Further breakdown of the Asia Pacific and Europe alpha-methylstyrene markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Growth opportunities and latent adjacency in Alpha-Methylstyrene Market