Antibody Drug Conjugates (ADC) Market by Product (Kadcyla, Enhertu, Padcev, Polivy), Linker Type (Cleavable, Non-Cleavable), Payload Type (Calicheamicin, MMAE), Target (HER2, CD30, CD22), Disease, Region - Global Forecast to 2028

Antibody Drug Conjugates Market Size, Growth Drivers & Restraints

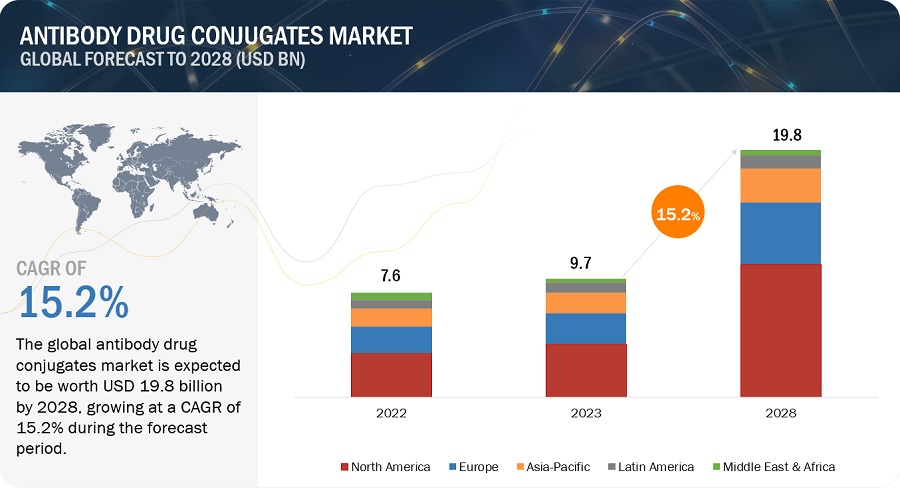

The global antibody drug conjugates market, valued at US$7.6 billion in 2022, stood at US$9.7 billion in 2023 and is projected to advance at a resilient CAGR of 15.2% from 2025 to 2028, culminating in a forecasted valuation of US$19.8 billion by the end of the period. Growth in the market can be attributed to various factors such as including the growing prevalence of cancer, and increasing R&D activities for the development of novel ADCs by key market players. Antibody-drug conjugates represent a highly potent approach to treating cancer patients. They harness the precision of monoclonal antibodies, directing them towards specific antigens, to deliver potent cytotoxic drugs. This approach enhances drug effectiveness while minimizing the adverse effects typically associated with traditional chemotherapy.

Attractive Opportunities in the Antibody Drug Conjugates Market.

To know about the assumptions considered for the study, Request for Free Sample Report

Antibody Drug Conjugates Market Dynamics

Driver: Increased investment and collaborations by key market players for the development of novel ADCs

Antibody drug conjugate is a rapidly growing field. Significant investments are needed for R&D, clinical trials, and manufacturing of ADCs. Large biopharmaceutical companies are heavily investing in expansion of development and manufacturing capabilities for ADCs, deals including licensing and collaboration agreements and mergers between a big pharmaceutical company and a biotech firm specializing in antibody-based cancer therapies. According to data from Biomedtracker, between January 2018 and March 2023, there have been around 100 licensing deals for ADCs. There were only 4 ADC licensing agreements recorded in 2018, which reached 33 in 2022. 11 ADC-focused licensing deals were announced in the first three months of 2023. For instance, in April 2023, BioNTech signed a USD 170 million licensing deal with Duality Biologics (China) for exclusive access to two ADCs.

Restraint: Side effects associated with ADCs

ADCs have a reasonable side-effect profile due to high selectivity. Among the approved 11 ADCs, the most common severe side effect is hematotoxicity, which includes neutropenia, thrombocytopenia, leukopenia, and anemia. Hematotoxicity, combined with hepatotoxicity and gastrointestinal reactions, is probably induced due to the premature release of cytotoxic payloads into blood circulation. Moreover, the immune response induced by the antibody part of ADC may cause secondary injuries, resulting in nephrotoxicity. According to recent clinical observations, potential lung toxic effects like ILD have been observed during the ADC treatment period, particularly in anti-HER2 ADCs. Several death cases have been reported to be related to ILD during the clinical trials of T-DM1 and DS-8201. The detailed mechanism of action of ILD, however, remains unclear. Therefore, the corresponding optimizations of next-generations of ADC are expected to minimize side effects.

Opportunity: Adoption of combination therapies

Combination therapies utilizing antibody-drug conjugates offer significant market growth potential and are an appealing strategy for both existing and growing pharmaceutical & biotechnology businesses. ADCs have been actively studied in combination with other anticancer agents such as chemotherapy, targeted therapy, immunotherapy, and anti-angiogenic agents in recent years. The drug combinations including anti-angiogenic medicines, HER2-targeted medications, DNA damage response agents, and immune checkpoint inhibitors (ICIs) are currently in active research. More recently, strategies for combining immunotherapy with ADCs have also entered clinical studies. There is growing evidence that ADCs can improve immunotherapy efficacy by inducing immunogenic cell death, dendritic cell maturation, increased T-lymphocyte infiltration, enhanced immunological memory, and the production of immunomodulatory proteins such as PD-L1 and MHC.

Challenge: Technical complexities

ADCs comprise a tumor antigen-specific antibody, a potent cytotoxic payload and a stable chemical linker that joins the antibody to the cytotoxic drug. The individual characteristics and risks associated with these three components present unique challenges and pose considerable risks at multiple levels. Achieving an optimal balance between the potency of the cytotoxic drug and the specificity of the antibody is one of the major issues. Another challenge is the potential for toxicity, particularly in non-target tissues. The cytotoxic payload can cause damage to healthy cells, leading to adverse effects and limiting the potential use of ADCs in treating certain cancers. Further, the process of bioconjugation is complex, and there are numerous factors that can affect the stability of the final product which can impact the efficacy and safety of the ADC. The advancements in linker and payload technologies and the emergence of new manufacturing technologies helped to overcome such challenges in ADC development.

Ecosystem Analysis Antibody Drug Conjugates Market

The Kadcyla segment of the antibody drug conjugates industry held the dominant position in 2022.

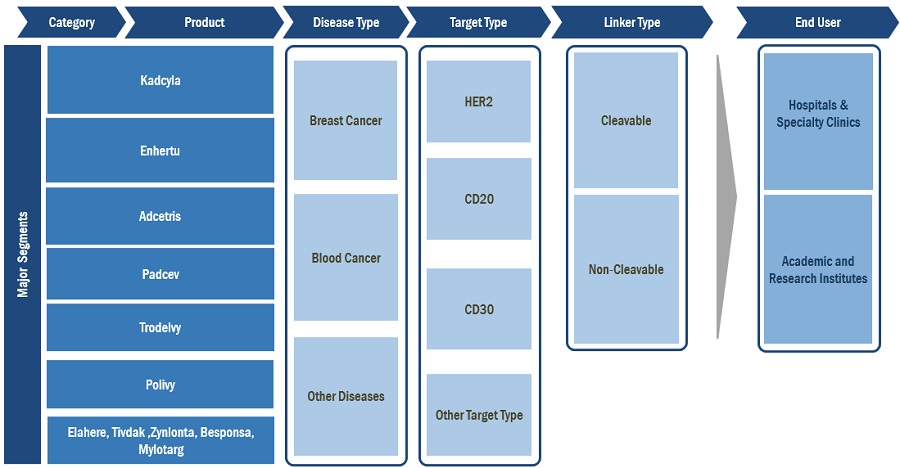

On the basis of product, the global antibody drug conjugates market is segmented into Kadcyla, Enhertu, Adcetris, Padcev, Trodelvy, Polivy and Others. The Kadcyla segment dominated the antibody drug conjugate market during the forecast period. The rising prevalence of breast cancer coupled with increased approvals for the ADCs for breast cancer treatment are some of the factors driving the market growth.

Blood Cancer Segment of the antibody drug conjugates is likely to grow at significant CAGR during the forecast period.

On the basis of disease type, the global antibody drug conjugates market is segmented into breast cancer, blood cancer and others. The breast cancer segment dominated the market in 2022 owing to various factors such as increased adoption of ADCs for treatment by patient population. The increasing number of clinical trials on ADCs for breast cancer and the recent approvals of ADCs target indications, such as blood cancer, lung cancer, cervical cancer, and ovarian cancer among others is further expected to project the market growth at faster pace.

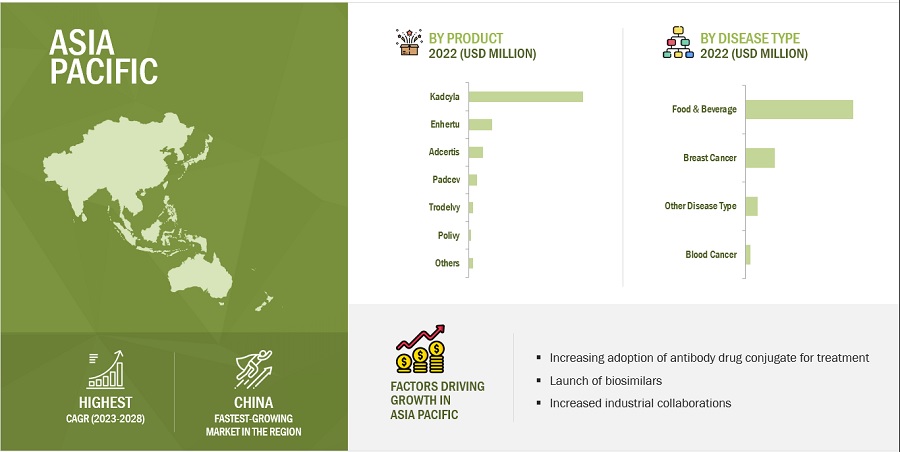

Asia Pacific region of the antibody drug conjugates industry is likely to grow at the highest CAGR during the forecast period of 2023-2028.

The antibody drug conjugates market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America accounted for the largest share of the market, and this trend is expected to continue during the forecast period. A robust product pipeline and increased regulatory approvals of ADCs are likely to propel the market growth in the region. Asia Pacific segment is likely to grow at a higher CAGR owing to various factors such as the increasing number of cancer cases coupled with the rise in the use of ADCs for the treatment of cancer. Furthermore, the launch of biosimilar Ujivra by Zydus is likely to have a positive impact on the market growth in the coming years.

Source: Expert Interviews, Secondary Research, Whitepapers, Journals, Magazines, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

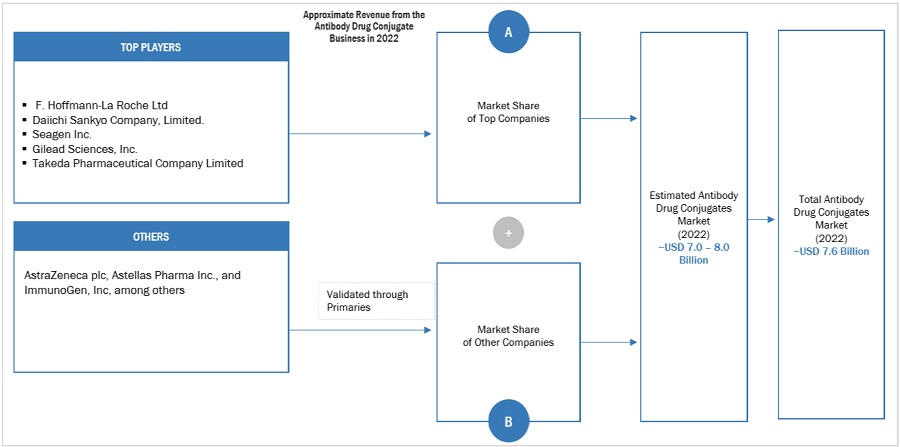

Key players in the antibody drug conjugates market include F. Hoffmann-La Roche Ltd (Switzerland) Daiichi Sankyo Company, Limited (Japan) Seagen Inc. (US) Gilead Sciences, Inc. (US) Takeda Pharmaceutical Company Limited (Japan) Pfizer Inc. (US) Astellas Pharma Inc (Japan) AstraZeneca (UK) ADC Therapeutics SA (Switzerland) ImmunoGen, Inc. (US) Zydus Group (India)

Scope of the Antibody Drug Conjugates Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$9.7 billion |

|

Estimated Value by 2028 |

$19.8 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 15.2% |

|

Market Driver |

Increased investment and collaborations by key market players for the development of novel ADCs |

|

Market Opportunity |

Adoption of combination therapies |

This report categorizes the antibody drug conjugates market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Kadcyla

- Enhertu

- Adcetris

- Padcev

- Trodelvy

- Polivy

- Others

By Disease Type

- Breast Cancer

- Blood Cancer

- Others

By Linker Type

- Non-Cleavable

- Cleavable

By Target

- HER2

- CD22

- CD30

- Others

By Payload Type

- MMAE/auristatin

- calicheamicin

- Maytansinoids

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa

Recent Developments of Antibody Drug Conjugates Industry

- In July 2023, ImmunoGen, Inc., entered into a multi-target license and option agreement with ImmunoBiochem to develop next-generation antibody-drug conjugates.

- In July 2023, BeiGene and DualityBio entered into a partnership to advance differentiated antibody drug conjugate (ADC) therapy for solid tumors.

- In June 2023, Lonza acquired Synaffix B.V. a biotechnology company involved in commercializing clinical-stage technology platforms for the development of antibody drug conjugates.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global antibody drug conjugates market?

The global antibody drug conjugates market boasts a total revenue value of $19.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global antibody drug conjugates market?

The global antibody drug conjugates market has an estimated compound annual growth rate (CAGR) of 15.2% and a revenue size in the region of $9.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of cancer- Increasing investments for ADC development- Growing number of ADCs in clinical trials- Favorable regulatory supportRESTRAINTS- High manufacturing costs- Side effects associated with ADCs- High attrition rate in product developmentOPPORTUNITIES- Adoption of combination therapies- High growth in emerging economies- Emergence of advanced ADCsCHALLENGES- Technical complexities

- 5.3 PIPELINE ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSISROLE IN ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

-

5.7 REGULATORY ASSESSMENTFDA REGULATIONS ON ANTIBODY DRUG CONJUGATES- CLINICAL PHARMACOLOGY CONSIDERATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.11 PRICING ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 KADCYLALAUNCH OF BIOSIMILARS TO DRIVE MARKET

-

6.3 ENHERTURISING INCIDENCE OF BREAST CANCER TO PROPEL MARKET

-

6.4 ADCETRISGROWING CASES OF HODGKIN LYMPHOMA TO DRIVE MARKET

-

6.5 PADCEVRISING INCIDENCE OF UROTHELIAL CANCER TO DRIVE MARKET

-

6.6 TRODELVYINCREASING GOVERNMENT APPROVALS FOR BREAST CANCER TO DRIVE MARKET

-

6.7 POLIVYRISING PREVALENCE OF NON-HODGKIN LYMPHOMA TO PROPEL MARKET

- 6.8 OTHER PRODUCTS

- 7.1 INTRODUCTION

-

7.2 CLEAVABLE LINKERSHIGH COMPATIBILITY WITH BROAD RANGE OF DRUGS TO DRIVE MARKET

-

7.3 NON-CLEAVABLE LINKERSLOW TOXICITY LEVELS TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 HER2RISING PREVALENCE OF BREAST CANCER TO DRIVE MARKET

-

8.3 CD22INCREASING CASES OF B-CELL LYMPHOMAS TO DRIVE MARKET

-

8.4 CD30INCREASING CLINICAL TRIALS FOR PRODUCT LAUNCHES TO SUPPORT MARKET GROWTH

- 8.5 OTHER TARGET TYPES

- 9.1 INTRODUCTION

-

9.2 MONOMETHYL AURISTATIN ECYTOTOXIC PAYLOAD FOR ADC DEVELOPMENT TO DRIVE MARKET

-

9.3 CALICHEAMICINLAUNCH OF CALICHEAMICIN-BASED ADCS TO PROPEL MARKET

-

9.4 MAYTANSINOIDSINNOVATIVE PRODUCT PIPELINE TO SUPPORT MARKET GROWTH

- 9.5 OTHER PAYLOAD TYPES

- 10.1 INTRODUCTION

-

10.2 BREAST CANCERRISING CASES OF INFLAMMATORY BREAST CANCER TO DRIVE MARKET

-

10.3 BLOOD CANCERINCREASING FOCUS ON CLINICAL TRIALS FOR ADVANCED CONJUGATES TO PROPEL MARKET

- 10.4 OTHER DISEASE TYPES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Rising regulatory approvals for ADCs to drive marketCANADA- High R&D investments for novel ADCs to propel marketNORTH AMERICA: RECESSION IMPACT

-

11.3 EUROPEGERMANY- Increasing collaborations among market players for cancer therapeutics to propel marketFRANCE- Growing demand for personalized therapeutics to drive marketUK- Increasing cancer burden to support market growthITALY- Rising industrial collaborations for ADC production to drive marketSPAIN- Rising focus on drug discovery to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

11.4 ASIA PACIFICCHINA- Rising initiatives for advanced therapies to drive marketJAPAN- Favorable regulatory support to propel marketINDIA- Emergence of innovative biosimilars to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

11.5 LATIN AMERICABRAZIL- Regulatory approvals for breast cancer therapeutics to drive marketREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

11.6 MIDDLE EAST & AFRICARISING PRODUCT LAUNCHES FOR CANCER THERAPEUTICS TO SUPPORT MARKET GROWTH

- 11.7 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE SHARE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 COMPETITIVE BENCHMARKING OF 25 PLAYERSPRODUCT FOOTPRINT OF 11 COMPANIESREGIONAL FOOTPRINT OF 26 COMPANIES

-

12.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 12.8 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

-

12.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Product pipeline- Recent developments- MnM viewDAIICHI SANKYO COMPANY, LIMITED- Business overview- Products offered- Product pipeline- Recent developments- MnM viewSEAGEN INC.- Business overview- Products offered- Product pipeline- Recent developments- MnM viewGILEAD SCIENCES, INC.- Business overview- Products offered- Product pipeline- Recent developmentsTAKEDA PHARMACEUTICAL COMPANY LIMITED- Business overview- Products offered- Product pipelinePFIZER INC.- Business overview- Products offeredASTELLAS PHARMA INC.- Business overview- Products offered- Product pipeline- Recent developmentsASTRAZENECA- Business overview- Products offered- Product pipeline- Recent developmentsADC THERAPEUTICS SA- Business overview- Products offered- Product pipeline- Recent developmentsIMMUNOGEN, INC.- Business overview- Products offered- Product pipeline- Recent developmentsZYDUS GROUP- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSABBVIE INC.- Business overview- Product PipelineAMBRX- Business overview- Product pipelineLEGOCHEM BIOSCIENCES, INC.- Business overview- Product pipelineBYONDIS- Business overview- Product pipelinePROFOUNDBIO- Business overview- Product pipelineREMEGEN- Business overview- Products offered- Product pipelineSUTRO BIOPHARMA, INC.- Business overview- Product pipelineLEPU BIOPHARMA CO., LTD.- Business overview- Product pipelineZYMEWORKS INC.- Business overview- Product pipelineMERSANA THERAPEUTICS- Business overview- Product pipelineDUALITY BIOLOGICS- Business overview- Product pipelineLANOVA MEDICINES- Business overview- Product pipelineEXELIXIS, INC.- Business overview- Product pipelineBIONECURE THERAPEUTICS INC.- Business overview- Product pipelineTRIPARTITE THERAPEUTICS, INC.- Business overview- Product pipeline

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2024–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 ANTIBODY DRUG CONJUGATES MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 5 GLOBAL INCREASE IN NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

- TABLE 6 ASSET RANKING FOR LEADING ADC DEVELOPERS (2019 VS. 2023)

- TABLE 7 LIST OF DISCONTINUED ANTIBODY DRUG CONJUGATES (2020−2022)

- TABLE 8 LEADING TECHNOLOGICAL ADVANCEMENTS FOR ADC GENERATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ANTIBODY DRUG CONJUGATES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 ANTIBODY DRUG CONJUGATES MARKET: PRICING ANALYSIS OF ADC PRODUCTS, BY REGION

- TABLE 16 ANTIBODY DRUG CONJUGATES MARKET: PRICING ANALYSIS OF ADC PRODUCTS, BY KEY PLAYERS

- TABLE 17 ANTIBODY DRUG CONJUGATES MARKET: DETAILED LIST OF EVENTS AND CONFERENCES (2023−2024)

- TABLE 18 ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 19 ANTIBODY DRUG CONJUGATES MARKET FOR KADCYLA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR KADCYLA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR KADCYLA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR KADCYLA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR KADCYLA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ANTIBODY DRUG CONJUGATES MARKET FOR ENHERTU, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR ENHERTU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR ENHERTU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR ENHERTU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR ENHERTU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ANTIBODY DRUG CONJUGATES MARKET FOR ADCETRIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR ADCETRIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR ADCETRIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR ADCETRIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR ADCETRIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ANTIBODY DRUG CONJUGATES MARKET FOR PADCEV MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR PADCEV, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR PADCEV, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR PADCEV, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR PADCEV, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 ANTIBODY DRUG CONJUGATES MARKET FOR TRODELVY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR TRODELVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR TRODELVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR TRODELVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR TRODELVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 ANTIBODY DRUG CONJUGATES MARKET FOR POLIVY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR POLIVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR POLIVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR POLIVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR POLIVY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PRODUCTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PRODUCTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 55 ANTIBODY DRUG CONJUGATES MARKET FOR CLEAVABLE LINKERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 ANTIBODY DRUG CONJUGATES MARKET FOR NON-CLEAVABLE LINKERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR NON-CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR NON-CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR NON-CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR NON-CLEAVABLE LINKERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 66 ANTIBODY DRUG CONJUGATES MARKET FOR HER2, BY REGION, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR HER2, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR HER2, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR HER2, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR HER2, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ANTIBODY DRUG CONJUGATES MARKET FOR CD22, BY REGION, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CD22, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR CD22, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR CD22, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CD22, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 ANTIBODY DRUG CONJUGATES MARKET FOR CD30, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CD30, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR CD30, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR CD30, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CD30, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 ANTIBODY DRUG CONJUGATES MARKET FOR OTHER TARGET TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER TARGET TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER TARGET TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER TARGET TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER TARGET TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 87 ANTIBODY DRUG CONJUGATES MARKET FOR MONOMETHYL AURISTATIN E, BY REGION, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR MONOMETHYL AURISTATIN E, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR MONOMETHYL AURISTATIN E, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR MONOMETHYL AURISTATIN E, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR MONOMETHYL AURISTATIN E, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 ANTIBODY DRUG CONJUGATES MARKET FOR CALICHEAMICIN, BY REGION, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CALICHEAMICIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR CALICHEAMICIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR CALICHEAMICIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR CALICHEAMICIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ANTIBODY DRUG CONJUGATES MARKET FOR MAYTANSINOIDS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR MAYTANSINOIDS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR MAYTANSINOIDS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR MAYTANSINOIDS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR MAYTANSINOIDS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PAYLOAD TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PAYLOAD TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PAYLOAD TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PAYLOAD TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER PAYLOAD TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 108 PROJECTION OF BREAST CANCER RATES

- TABLE 109 ANTIBODY DRUG CONJUGATES MARKET FOR BREAST CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR BREAST CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR BREAST CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR BREAST CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR BREAST CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 114 GLOBAL INCIDENCE OF BLOOD CANCER

- TABLE 115 ESTIMATED NEW BLOOD CANCER CASES IN US (2023)

- TABLE 116 ANTIBODY DRUG CONJUGATES MARKET FOR BLOOD CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR BLOOD CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR BLOOD CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR BLOOD CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR BLOOD CANCER, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 ANTIBODY DRUG CONJUGATES MARKET FOR OTHER DISEASE TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER DISEASE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 EUROPE: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER DISEASE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER DISEASE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET FOR OTHER DISEASE TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 ANTIBODY DRUG CONJUGATES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 127 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 133 US: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 134 US: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 135 US: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 136 US: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 137 US: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 138 CANADA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 139 CANADA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 140 CANADA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 141 CANADA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 142 CANADA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 143 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 145 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 146 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 147 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 148 EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 149 GERMANY: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 150 GERMANY: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 151 GERMANY: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 152 GERMANY: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 153 GERMANY: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 154 FRANCE: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 155 FRANCE: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 156 FRANCE: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 157 FRANCE: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 158 FRANCE: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 159 UK: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 160 UK: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 161 UK: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 162 UK: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 163 UK: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 164 ITALY: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 165 ITALY: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 166 ITALY: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 167 ITALY: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 168 ITALY: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 169 SPAIN: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 170 SPAIN: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 171 SPAIN: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 172 SPAIN: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET, 2021–2028 (USD MILLION)

- TABLE 173 SPAIN: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 174 REST OF EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 175 REST OF EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 176 REST OF EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 177 REST OF EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 178 REST OF EUROPE: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 185 CHINA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 186 CHINA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 187 CHINA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 188 CHINA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 189 CHINA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 190 JAPAN: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 191 JAPAN: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 192 JAPAN: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 193 JAPAN: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 194 JAPAN: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 195 INDIA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 196 INDIA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 197 INDIA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 198 INDIA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 199 INDIA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 211 BRAZIL: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 212 BRAZIL: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 213 BRAZIL: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 214 BRAZIL: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET, 2021–2028 (USD MILLION)

- TABLE 215 BRAZIL: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 216 REST OF LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 217 REST OF LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 218 REST OF LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 220 REST OF LATIN AMERICA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2021–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2021–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2021–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 226 ANTIBODY DRUG CONJUGATES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 227 ANTIBODY DRUG CONJUGATES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 228 ANTIBODY DRUG CONJUGATES MARKET: COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 229 ANTIBODY DRUG CONJUGATES MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 230 ANTIBODY DRUG CONJUGATES MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 231 ANTIBODY DRUG CONJUGATES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 232 ANTIBODY DRUG CONJUGATES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 233 ANTIBODY DRUG CONJUGATES MARKET: PRODUCT LAUNCHES (JANUARY 2020–JUNE 2023)

- TABLE 234 ANTIBODY DRUG CONJUGATES MARKET: DEALS (JANUARY 2020−JUNE 2023)

- TABLE 235 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 236 DAIICHI SANKYO COMPANY, LIMITED: BUSINESS OVERVIEW

- TABLE 237 SEAGEN INC.: BUSINESS OVERVIEW

- TABLE 238 GILEAD SCIENCES, INC.: BUSINESS OVERVIEW

- TABLE 239 TAKEDA PHARMACEUTICAL COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 240 PFIZER INC.: BUSINESS OVERVIEW

- TABLE 241 ASTELLAS PHARMA INC.: BUSINESS OVERVIEW

- TABLE 242 ASTRAZENECA: BUSINESS OVERVIEW

- TABLE 243 ADC THERAPEUTICS SA: BUSINESS OVERVIEW

- TABLE 244 IMMUNOGEN, INC.: BUSINESS OVERVIEW

- TABLE 245 ZYDUS GROUP: BUSINESS OVERVIEW

- TABLE 246 ABBVIE INC.: BUSINESS OVERVIEW

- TABLE 247 AMBRX: BUSINESS OVERVIEW

- TABLE 248 LEGOCHEM BIOSCIENCES, INC.: BUSINESS OVERVIEW

- TABLE 249 BYONDIS: BUSINESS OVERVIEW

- TABLE 250 PROFOUNDBIO: BUSINESS OVERVIEW

- TABLE 251 REMEGEN: BUSINESS OVERVIEW

- TABLE 252 SUTRO BIOPHARMA, INC.: BUSINESS OVERVIEW

- TABLE 253 LEPU BIOPHARMA CO., LTD.: BUSINESS OVERVIEW

- TABLE 254 ZYMEWORKS INC.: BUSINESS OVERVIEW

- TABLE 255 MERSANA THERAPEUTICS: BUSINESS OVERVIEW

- TABLE 256 DUALITY BIOLOGICS: BUSINESS OVERVIEW

- TABLE 257 LANOVA MEDICINES: BUSINESS OVERVIEW

- TABLE 258 EXELIXIS, INC.: BUSINESS OVERVIEW

- TABLE 259 BIONECURE THERAPEUTICS INC.: BUSINESS OVERVIEW

- TABLE 260 TRIPARTITE THERAPEUTICS, INC.: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 ANTIBODY DRUG CONJUGATES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 ANTIBODY DRUG CONJUGATES MARKET: MARKET SIZE ESTIMATION FOR SUPPLY-SIDE ANALYSIS (2022)

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS)

- FIGURE 5 ANTIBODY DRUG CONJUGATES MARKET: REVENUE SHARE ANALYSIS OF F-HOFFMAN LA ROCHE LTD.

- FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 ANTIBODY DRUG CONJUGATES MARKET: CAGR PROJECTION ANALYSIS

- FIGURE 9 ANTIBODY DRUG CONJUGATES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 ANTIBODY DRUG CONJUGATES MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 ANTIBODY DRUG CONJUGATES MARKET, BY DISEASE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 ANTIBODY DRUG CONJUGATES MARKET, BY LINKER TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 ANTIBODY DRUG CONJUGATES MARKET, BY TARGET TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 ANTIBODY DRUG CONJUGATES MARKET, BY PAYLOAD TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF ANTIBODY DRUG CONJUGATES MARKET

- FIGURE 17 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 18 BREAST CANCER SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN ANTIBODY DRUG CONJUGATES MARKET IN 2022

- FIGURE 19 KADCYLA SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH RATES FROM 2023 TO 2028

- FIGURE 21 ANTIBODY DRUG CONJUGATES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ANTIBODY DRUG CONJUGATES MARKET: CLINICAL TRIALS

- FIGURE 23 ANTIBODY DRUG CONJUGATES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 GROWING USE OF ACDS FOR ONCOLOGY AND OTHER CHRONIC DISEASES TO DRIVE MARKET

- FIGURE 25 KEY STAKEHOLDERS IN PHARMACEUTICAL COMPANIES AND INFLUENCE ON BUYING PROCESS

- FIGURE 26 KEY BUYING CRITERIA FOR ADC PRODUCTS AMONG END USERS

- FIGURE 27 NORTH AMERICA: ANTIBODY DRUG CONJUGATES MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: ANTIBODY DRUG CONJUGATES MARKET SNAPSHOT

- FIGURE 29 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2019–2022)

- FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 31 ANTIBODY DRUG CONJUGATES MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 32 ANTIBODY DRUG CONJUGATES MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 33 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 34 DAIICHI SANKYO COMPANY, LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 35 SEAGEN INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 GILEAD SCIENCES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 38 PFIZER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 ASTELLAS PHARMA INC: COMPANY SNAPSHOT (2022)

- FIGURE 40 ASTRAZENECA: COMPANY SNAPSHOT (2022)

- FIGURE 41 ADC THERAPEUTICS SA: COMPANY SNAPSHOT (2022)

- FIGURE 42 IMMUNOGEN, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 43 ZYDUS GROUP: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the antibody drug conjugates market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the antibody drug conjugates market. The secondary sources used for this study include the World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), the Global Cancer Observatory (GLOBOCAN), the National Institutes of Health (NIH), the Center for Disease Control & Prevention (CDC), US Department of Health and Human Services, National Institutes of Health (NIH), National Library of Medicine, National Center for Biotechnology Information (NCBI), World Cancer Research Fund International (WCRF International), European Medicines Agency (EMA), The National Medical Products Administration (NMPA), The Central Drugs Standard Control Organisation (CDSCO); ACS Journals; Corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global antibody drug conjugates market, which was validated through primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the antibody drug conjugates market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The major players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the antibody drug conjugates business of players operating in the market have been determined through secondary research and primary analysis.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach-

Data Triangulation

After estimating the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

An antibody-drug conjugate (ADC) is a specialized type of pharmaceutical compound consisting of three key components: a monoclonal antibody, a linker molecule, and a cytotoxic drug (chemotherapy agent). The monoclonal antibody component is designed to target and bind to specific antigens or proteins found on the surface of cancer cells. The linker molecule connects the antibody to the cytotoxic drug. Once the antibody attaches to the cancer cell, the ADC is internalized by the cell, and the linker releases the cytotoxic drug directly into the cancer cell, causing cell death. This targeted approach enhances the effectiveness of the chemotherapy while minimizing damage to healthy cells, reducing side effects compared to traditional chemotherapy. ADCs have emerged as a promising and precise treatment option for certain types of cancer.

Key Stakeholders

- Antibody drug conjugate manufacturers

- Antibody drug conjugates associations

- Cancer research institutes

- Antibody drug conjugates raw material suppliers

- Biotechnology & biopharmaceutical companies

- Drug manufacturers, vendors, and distributors

- Academic & government research institutes

- Venture capitalists & investors

- Government organizations

- Private research firms

- Research & development (R&D) companies

- Hospitals and Speciality Clinics

The main objectives of this study are as follows:

- To define, describe, and forecast the antibody drug conjugates market by product, disease type, linker type, target, payload type and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall antibody drug conjugates market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific (APAC), Latin America (LATAM), and the Middle East & Africa (MEA)

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments, such as product launches, acquisitions partnerships, agreements, and collaborations

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

- Country-wise Information:

- Analysis for additional countries (up to five)

- Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Antibody Drug Conjugates (ADC) Market