Apiculture Market by Product type (Honey, Beeswax, Live-Bee, and Others), by Application (Medical, Food beverages, Cosmetics, and Others), by Method (Traditional Beekeeping, and Modern Beekeeping) and Region (North America, Europe, Asia-Pacific, South America, Rest of the world) -Global forecast to 2027

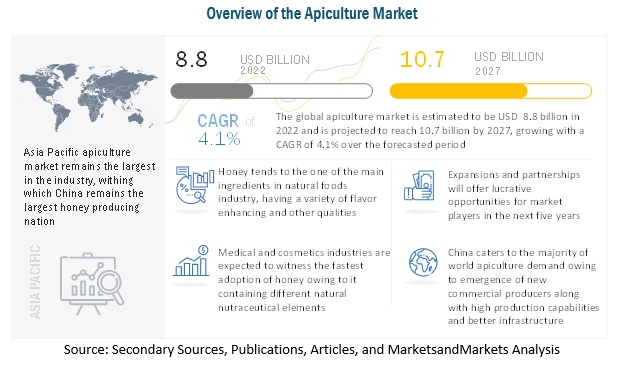

According to MarketsandMarkets, the global apiculture market is estimated to be valued at USD 8.8 billion in 2022. It is projected to reach USD 10.7 billion by 2027, with a CAGR of 4.1%, in terms of value between 2022 and 2027. Apiculture includes maintenance of bee colonies for the collection of different products, such as honey, beeswax, and other related products.

Apiculture Market Dynamics

Drivers: Increase in health consciousness drives a demand for natural sugar substitutes

There has been an increase in population demanding natural and healthy alternatives to processed sugar and artificial sugar substitutes. Since apiculture products, such as honey, are considered as highly nutritious and beneficial for health, there is a rising demand for the same to be used as a naturally occurring sugar substitute.

Restraints: Protection and nurturing the bees turns out to be the biggest constraint

The market is also being restrained due to increased honey adulteration and decrease in number of beehives and beekeepers along with scarcity of improved agricultural equipment. Honey adulterations especially prohibit the market from growing at its full potential.

Opportunities: Rising consumer interest towards apiculture products

Consumers are increasingly demanding immunity boosting products, especially since the COVID-19 pandemic. Honey being a natural ingredient for immunity boosting remedies, its market size is expected to witness a healthy growth over the forecasted period. Furthermore, use of honey is also growing in the pharmaceutical sector due to presence of various amino acids, enzymes, minerals and other natural substances.

Challenges: Managing live bees for apiculture tends to be cost intensive

Managing the live bees happens to be cost intensive, as maintenance and protection of the live bees is increasingly tending to be a high maintenance affair. This is owing to them being affected by rising local temperatures along with rising prevalence of pathogens in commercially managed bees.

By product, honey is projected to witness the fastest growth rate during the forecast period.

Honey is increasingly being accepted as a natural sugar substitute amongst health-conscious consumers. Presence of antibacterial and antioxidant properties has also made the product a good substitute for artificial sweeteners. Furthermore, it has a longer shelf life which further attracts consumers to purchase it.

By application, medical and cosmetics is expected to showcase the fastest growth

Owing to different natural nutraceutical elements found in honey, its usage in pharma industry is expected to witness a boost during the forecasted period. Honeyís anti-inflammatory and antioxidant properties make it a competitive proponent against other products in the market for health and anti-ageing benefits.

Asia Pacific has the largest market share in 2022 with China being the most dominant producer of honey and other apiculture products in the region. Higher yields of China are driven by emergence of new commercial producers along with high production capabilities and better infrastructure, when compared to other countries in the region.

Key Market Players:

Key players in this market include Betterbee (US), Dabur India Ltd. (India), Milerís Honey Company (US), Thomas Apiculture (France), and Georgia Honey Farm (US), amongst others.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMERíS BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.1 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTERíS FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 APICULTURE MARKET, BY PRODUCT TYPE

7.1 INTRODUCTION

7.2 HONEY

7.3 BEESWAX

7.4 LIVE-BEE

7.5 OTHER PRODUCT TYPE

8 APICULTURE MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 MEDICAL

8.3 FOOD BEVERAGES

8.4 COSMETICS

8.5 OTHER APPLICATIONS

9 APICULTURE MARKET, BY METHOD

9.1 INTRODUCTION

9.2 TRADITIONAL BEEKEEPING

9.3 MODERN BEEKEEPINGS

10 APICULTURE MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS*

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

12 COMPANY PROFILES

12.1 BETTERBEE

12.2 DABUR INDIA LTD.

12.3 MILERíS HONEY COMPANY

12.4 THOMAS APICULTURE

12.5 GEORGIA HONEY FARM

12.6 CLEARSKYS

12.7 BEEHIVE BOTANICALS

12.8 BARTNIK

12.9 EURL ATLANTIC APICULTURE

Note: Currently, list of only 9 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon clientís interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Apiculture Market