Application Programming Interface (API) Security Market by Offering (Platforms & Solutions and Services), Deployment Mode (On-Premises, Hybrid, and Cloud), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2028

Application Programming Interface (API) Security Market Size - Worldwide

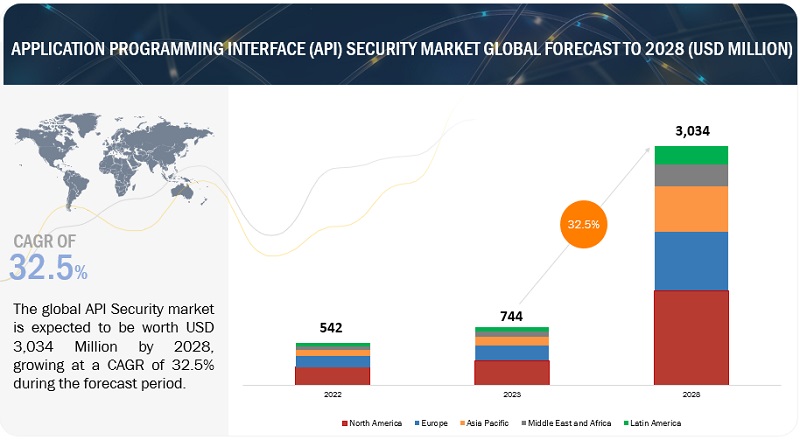

[257 Pages Report] The global Application Programming Interface Security (API) Security Market size as per revenue was surpassed $744 million in 2023. Throughout the projection period, the API Security Industry is anticipated to increase at a CAGR of 32.5% in between 2023-2029 to reach around $3,034 million in 2028.

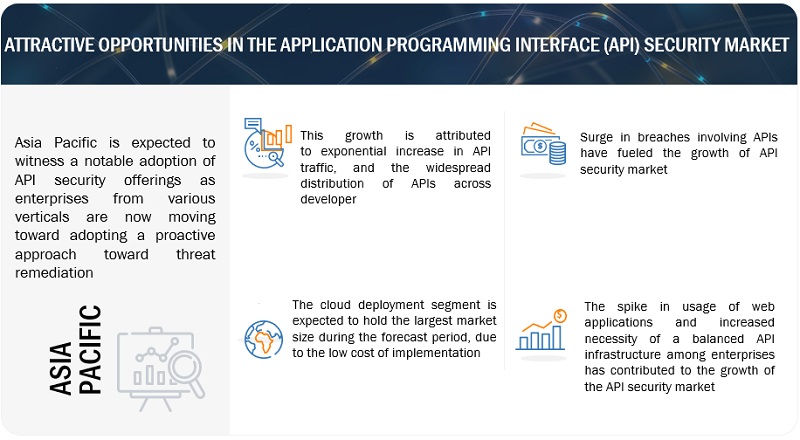

The expansion of the API security market is driven by the rise in API breaches, creating a strong demand for robust API security solutions. These solutions protect applications and integrations, effectively countering evolving risks. Additionally, the rapid growth of application ecosystems has played a significant role in promoting the adoption of API security measures. Hackers are increasingly targeting APIs due to their widespread usage and access to valuable data, further bolstering the growth of the API security market.

Moreover, ongoing investments and the growing demand for APIs are contributing to the expansion of the API security market. These factors indicate a promising growth trajectory for the market as organizations actively seek improved security and governance measures. Consequently, the demand for API security solutions is expected to witness a significant upsurge shortly.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Application Programming Interface Security Market Dynamics

Driver: APIs have become a prime target for threat actors

APIs have become attractive targets for hackers due to their widespread use and access to valuable data. Common attacks on APIs include injection attacks, cross-site scripting, and authentication bypass. However, the focus on securing APIs often overlooks the importance of the authentication process. Static API keys, and long-lived credentials, can lead to vulnerabilities when employees leave an organization. Additionally, certain authentication mechanisms can unintentionally introduce API vulnerabilities. Therefore, APIs should be designed to enforce regular authentication and verify token validity within an identity or secret store. These measures help organizations strengthen API security, reducing the risks of unauthorized access and data breaches.

Restraint: Lack of skilled professionals for implementing API security solutions

Implementing API security solutions in an organization’s existing infrastructure requires assessing the API’s quality, flexibility, and stability. It is crucial to find a skilled developer with knowledge of software development and current API security trends, which can be time-consuming and costly in hiring and training. Additionally, integrating API security solutions across multiple platforms necessitates expertise and a well-established infrastructure.

Opportunity: Continuous rise in investment across API security vendors

The increasing demand for robust protection against data breaches and the recognition of API security as a major challenge for CIOs have led to rising investments in API security solutions. Traditional fragmented solutions are being replaced by more comprehensive and effective options offered by companies like Wib and Salt Security. These investments support innovative teams and technologies that address the growing API security blind spot. They enable API security companies to enhance their offerings, develop new technologies, and expand globally. This demonstrates the market's potential for development, innovation, and the creation of integrated API security platforms to address the critical need for protection in today's digital landscape.

Challenge: Traditional security controls may not provide sufficient protection for APIs

Traditional security controls like WAFs and SIEM systems are inadequate for securing APIs, as they struggle to detect disguised malicious activities. APIs bypass centralized controls, enabling attackers to exploit vulnerabilities unnoticed. Organizations with multiple data centers and cloud environments face challenges securing high volumes of east-west API traffic. Weak input validation for APIs poses risks to sensitive data. To effectively protect critical information, APIs require tailored security measures to mitigate these issues and enhance their overall security.

Application Programming Interface Security Market Ecosystem

By vertical, the Healthcare segment is to grow at the highest CAGR during the forecast period.

The widespread adoption of APIs in healthcare enables secure data exchange among different systems and applications. However, this increased usage also expands the potential attack surface for cybercriminals. Moreover, the sensitive nature of patient data, often stored within APIs, makes them an attractive target for hackers aiming to steal information or disrupt healthcare operations. As cyber threats become more sophisticated and targeted, healthcare organizations recognize the importance of safeguarding their APIs. This growth in API security is further fueled by the rise of telehealth and telemedicine, which rely on APIs for remote patient care and data exchange. Additionally, the adoption of cloud-based healthcare solutions and the proliferation of connected medical devices, both reliant on APIs, contribute to the increased focus on protecting these crucial interfaces in the healthcare industry.

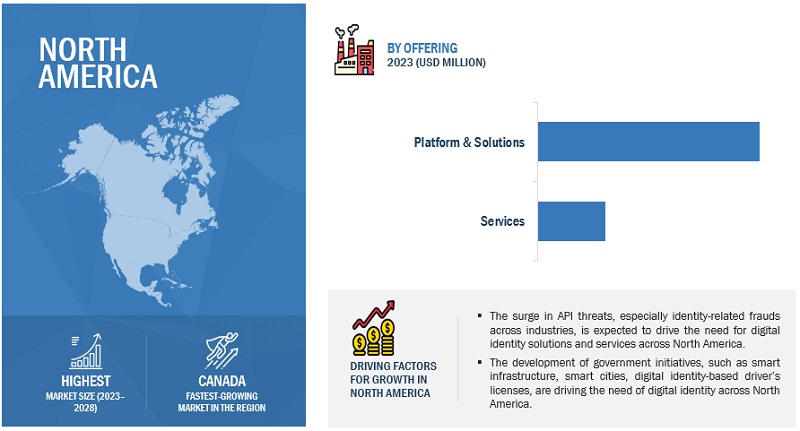

By region, North America accounts for the highest market size during the forecast period.

The North American region accounts for the highest market size due to several key factors, such as stringent regulatory compliance, strong cybersecurity preparedness, collaborative initiatives by market players, increasing cyber threats, and economic and technological advancements. These factors drive the adoption of API solutions and services in the region to protect business and customer data and enhance overall cybersecurity. Key advancements in this field include cloud-based testing, mobile app security testing, and IoT security solutions. In collaboration with industry standards and training initiatives, governments are actively working to enhance application security.

API Security Companies

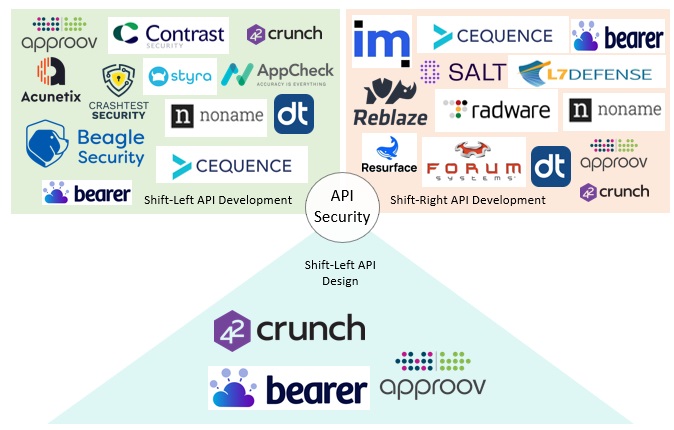

Google (Apigee) (US), Salt (US), Noname (US), Akamai (US), Data Theorem (US), Axway (US), Imperva (US), Traceable (US), Palo Alto Networks (US), Fortinet (US), Red Hat (US), Airlock by Ergon (Switzerland), Akana by Perforce (US), WS02 (UK), Forum Systems (UK), Cequence (US), Sensidia (Brazil), Spherical Defense (US), Neosec (US), Signal Sciences (US), Firetail (US), Resurface Labs (US), 42Crunch (Ireland), Aiculus (Australia), Gravitee (France) and Nevatech (Georgia) are the key players and other players in the API security market.

Want to explore hidden markets that can drive new revenue in Application Programming Interface (API) Security Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Application Programming Interface (API) Security Market?

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

Offering, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

List of API Security Companies |

Major vendors in the global API security market include Google (Apigee) (US), Salt (US), Noname (US), Akamai (US), Data Theorem (US), Axway (US), Imperva (US), Traceable (US), Palo Alto Networks (US), Fortinet (US), Red Hat (US), Airlock by Ergon (Switzerland), Akana by Perforce (US), WS02 (UK), Forum Systems (UK), Cequence (US), Sensidia (Brazil), Spherical Defense (US), Neosec (US), Signal Sciences (US), Firetail (US), Resurface Labs (US), 42Crunch (Ireland), Aiculus (Australia), Gravitee (France) and Nevatech (Georgia). |

The study categorizes the API security market by offering, deployment mode, organization size, SME type, verticals, and regions.

By Offering:

- Platform & Solutions

- Services

By Deployment Mode:

- On-Premises

- Cloud

- Hybrid

By Organization Size:

- SMEs

- Large Enterprise

By Vertical:

- BFSI

- IT and ITeS

- Telecom

- Government

- Manufacturing

- Healthcare

- Retail and eCommerce

- Media and Entertainment

- Energy and Utilities

- Other Verticals (Transportation and Logistics; Travel and Hospitality; and Research and Academia)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Developments

- In June 2022, Google (Apigee) (US) introduced Apigee Advanced API Security, a robust solution designed to assist customers in addressing their increasing API security requirements. This comprehensive set of API security features is built on Apigee, Google's API management platform. With Advanced API Security, organizations gain enhanced capabilities for detecting and mitigating security threats within their APIs.

- In July 2022, Salt Security (US) introduced significant enhancements to its advanced API Protection Platform. The updates strengthen threat detection and pre-production API testing capabilities, offering deeper insights into attacker behaviors, visual representations of API call sequences, and the ability to simulate attacks before deploying APIs into production. With these new features, Salt empowers organizations with comprehensive API usage visibility, enhances incident response speed, and improves overall business understanding.

- In April 2023, Noname (US) partnered strategically with MindPoint Group, a reputable cybersecurity consulting firm. Together, they developed an advanced API security platform in a secure OVA deployment format. This collaboration offers customers a simplified and quick approach to securing their API inventory while ensuring the platform is inherently protected.

- In March 2022, Imperva (US) introduced Imperva API Security, offering continuous API discovery and data classification. This product ensures data visibility and safeguarding across traditional and cloud-native applications. It can also be used alongside Imperva Cloud Web Application Firewall (WAF) or as a standalone solution, effectively protecting APIs in developer environments prone to security vulnerabilities and unintended exposure.

- In January 2021, Palo Alto Networks (US) launched Prisma Cloud 2.0, introducing the Web Application and API Security (WAAS) module. This module enables the discovery and protection of web applications and APIs across various clouds, offering customizable OWASP Top 10 protection, API security, and runtime protection. It provides security teams with a single dashboard integrated with the Defender unified agent framework for easy deployment and enabling protection for cloud-native applications.

Frequently Asked Questions (FAQ):

What are the opportunities in the global API security market?

The continuous rise in investment across API security vendors and the growing demand for APIs to meet business needs are a few factors contributing to the growth and creating new opportunities for the API security market.

What is the definition of the API security market?

API security is the process of safeguarding APIs against unauthorized access, data breaches, and malicious attacks. It involves protecting the connections between various applications and systems used by businesses. API security solutions assist in detecting and addressing vulnerabilities, enforcing access control, and monitoring API traffic for signs of harmful activity. The API security market encompasses solutions and services designed to help organizations shield their APIs from cybercriminals who target these critical connections.

Which region is expected to show the highest market share in the API security market?

North America is expected to account for the largest market share during the forecast period.

Which are the top API Security Companies covered in the report?

Major API Security Companies include Google (Apigee) (US), Salt (US), Noname (US), Akamai (US), Data Theorem (US), Axway (US), Imperva (US), Traceable (US), Palo Alto Networks (US), Fortinet (US), Red Hat (US), Airlock by Ergon (Switzerland), Akana by Perforce (US), WS02 (UK), Forum Systems (UK), Cequence (US), Sensidia (Brazil), Spherical Defense (US), Neosec (US), Signal Sciences (US), Firetail (US), Resurface Labs (US), 42Crunch (Ireland), Aiculus (Australia), Gravitee (France) and Nevatech (Georgia).

What is the current size of the global API security market?

The global API security market size is projected to grow from USD 744 million in 2023 to USD 3,034 million by 2028 at a Compound Annual Growth Rate (CAGR) of 32.5% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONTYPES OF APIAPI PROTOCOLS AND ARCHITECTURESOPEN WEB APPLICATION SECURITY PROJECT (OWASP): TOP 10 API VULNERABILITIES IN 2023

-

5.2 MARKET DYNAMICSDRIVERS- Surge in API breaches across industries- Exploitation by hackers- Growing complexity of ecosystem- Need to safeguard applications and protect sensitive dataRESTRAINTS- Impact of regulatory restraints- Lack of skilled professionalsOPPORTUNITIES- Rapid demand for APIs to meet business needs- Increased awareness and rising investmentsCHALLENGES- Safeguarding sensitive data in decentralized architectures- Traditional security controls limiting protection against API attacks

-

5.3 USE CASESCASE STUDY 1: NOV INC. IMPLEMENTED PINGINTELLIGENCE AND AXWAY FOR ENHANCED API SECURITY AND GOVERNANCECASE STUDY 2: OFX ENHANCED APPLICATION SECURITY WITH SIGNAL SCIENCES FOR API AND MICROSERVICES PROTECTIONCASE STUDY 3: PAIDY IMPLEMENTED APISEC FOR AUTOMATED API SECURITY TESTING, IMPROVING COVERAGE, AND EFFICIENCYCASE STUDY 4: THREATX SECURED SEGPAY'S APPS AND APIS WITH PRECISION AND VISIBILITYCASE STUDY 5: DATA THEOREM ASSISTED WILDFLOWER IN ADDRESSING SECURITY ISSUES AND MEETING CUSTOMER DEMAND

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 APPLICATION SECURITY MARKET ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGAPI SECURITY TESTING TOOLSZERO TRUST ARCHITECTUREWEB APPLICATION FIREWALLS (WAFS)CONTAINERIZATION AND MICROSERVICESBEHAVIORAL ANALYTICS AND THREAT INTELLIGENCE

-

5.9 PATENT ANALYSIS

- 5.10 EMERGING TRENDS IN API SECURITY MARKET

-

5.11 TARIFF AND REGULATORY LANDSCAPEHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTPAYMENT CARD INDUSTRY DATA SECURITY STANDARDSARBANES-OXLEY ACT (SOX)EUROPEAN UNION GENERAL DATA PROTECTION REGULATIONNIS DIRECTIVEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.1 INTRODUCTIONOFFERING: API SECURITY MARKET DRIVERS

-

6.2 PLATFORM AND SOLUTIONSSMART TECHNOLOGIES TO MITIGATE ADVANCED CYBERATTACKS

-

6.3 SERVICESINTEGRATION AND HYBRID DEPLOYMENT OF API SECURITY SERVICES TO PROPEL GROWTHDESIGN AND IMPLEMENTATIONCONSULTING, TRAINING, AND EDUCATIONSUPPORT AND MAINTENANCE

-

7.1 INTRODUCTIONDEPLOYMENT MODE: API SECURITY MARKET DRIVERS

-

7.2 ON-PREMISESCUSTOMIZATION OF ON-PREMISES SOLUTIONS TO BOOST DEMAND

-

7.3 CLOUDCOST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY TO DRIVE DEMAND

-

7.4 HYBRIDSTRENGTHENING HYBRID CONNECTIVITY ACROSS ENTERPRISES TO DRIVE DEMAND

-

8.1 INTRODUCTIONORGANIZATION SIZE: API SECURITY MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISESFLEXIBILITY AND AFFORDABILITY TO BOOST SALES OF SECURITY SOLUTIONS

-

8.3 LARGE ENTERPRISESRISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION

-

9.1 INTRODUCTIONVERTICAL: API SECURITY MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCERISING DEMAND FOR DATA PROTECTION SERVICES IN BANKING COMPANIES TO DRIVE MARKET

-

9.3 IT AND ITESGROWING CONCERNS OF FRAUD AND COMPLIANCE TO PROPEL MARKET

-

9.4 TELECOMADVANCED TECHNOLOGIES TO HELP WITH API ADOPTION

-

9.5 GOVERNMENTRISING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO DRIVE MARKET

-

9.6 MANUFACTURINGAPI SECURITY TO BOOST MANAGED API SECURITY INFRASTRUCTURE

-

9.7 HEALTHCARENEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT TO BOOST DEMAND

-

9.8 RETAIL AND E-COMMERCEAUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO BOOST MARKET

-

9.9 MEDIA AND ENTERTAINMENTNEED TO SECURE DIGITAL ASSETS TO FUEL GROWTH

-

9.10 ENERGY AND UTILITIESNEED TO SECURE CRITICAL INFRASTRUCTURE TO DRIVE GROWTH

- 9.11 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: API SECURITY MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Rising cybersecurity threats and vulnerabilities to drive marketCANADA- Growing digital landscape to drive focus on robust api security

-

10.3 EUROPEEUROPE: API SECURITY MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUNITED KINGDOM- Government initiatives to drive adoption of API security with comprehensive guidelinesGERMANY- Digitalization and industrial growth to drive demandFRANCE- Digital revolution and e-commerce to drive demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: API SECURITY MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Digital economy to drive demandJAPAN- Cybersecurity challenges and digital infrastructure to boost marketINDIA- Initiatives taken by government to promote api securityREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: API SECURITY MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Cloud computing and digital infrastructure to drive demandAFRICA- Technological advancements to fuel cloud services and api security growth

-

10.6 LATIN AMERICALATIN AMERICA: API SECURITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Evolving tech landscape to boost demandMEXICO- Strengthening digital infrastructure to boost demandREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 11.3 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

- 11.5 RANKING OF KEY PLAYERS

-

11.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 COMPETITIVE BENCHMARKINGKEY COMPANY EVALUATION CRITERIASME/STARTUP COMPANY EVALUATION CRITERIA

-

11.8 SME/STARTUP COMPANY EVALUATION QUADRANTDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.9 VALUATION AND FINANCIAL METRICS OF API SECURITY VENDORS

-

11.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

-

12.1 KEY PLAYERSGOOGLE (APIGEE)- Business overview- Products/solutions/services offered- Recent developments- MnM viewSALT SECURITY- Business overview- Products/solutions/services offered- Recent developments- MnM viewNONAME- Business overview- Products/solutions/services offered- Recent developments- MnM viewAKAMAI- Business overview- Products/solutions/services offered- Recent developments- MnM viewDATA THEOREM- Business overview- Products/solutions/services offered- MnM viewAXWAY- Business overview- Products/solutions/services offeredIMPERVA- Business overview- Products/solutions/services offered- Recent developmentsTRACEABLE- Business overview- Products/solutions/services offeredPALO ALTO NETWORKS- Business overview- Products/solutions/services offered- Recent developmentsFORTINET- Business overview- Products/solutions/services offered

-

12.2 OTHER PLAYERSRED HATAIRLOCK BY ERGONAKANA BY PERFORCEWSO2FORUM SYSTEMSCEQUENCE SECURITYSENSEDIASPHERICAL DEFENSENEOSECSIGNAL SCIENCESFIRETAILRESURFACE LABS42CRUNCHAICULUSGRAVITEE.IONEVATECH

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 APPLICATION PROGRAMMING INTERFACE SECURITY ECOSYSTEM AND ADJACENT MARKETS

-

13.4 WEB APPLICATION FIREWALL MARKETADJACENT MARKET: WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE

-

13.5 API MANAGEMENT MARKETADJACENT MARKET: API MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 API SECURITY MARKET: ECOSYSTEM ANALYSIS

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON API SECURITY MARKET

- TABLE 7 PRICING/PRICING MODELS OF APISEC

- TABLE 8 PRICING/PRICING MODELS OF SALT SECURITY

- TABLE 9 PRICING/PRICING MODELS OF IMPERVA

- TABLE 10 PRICING/PRICING MODELS OF AICULUS

- TABLE 11 PRICING/PRICING MODELS OF WSO2

- TABLE 12 PRICING/PRICING MODELS OF NEOSEC

- TABLE 13 PRICING/PRICING MODELS OF RED HAT

- TABLE 14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 16 API SECURITY MARKET: KEY CONFERENCES AND EVENTS

- TABLE 17 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 18 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 19 PLATFORM AND SOLUTIONS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 PLATFORM AND SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MARKET, BY SERVICES, 2017–2022 (USD MILLION)

- TABLE 24 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 25 DESIGN AND IMPLEMENTATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 DESIGN AND IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 CONSULTING, TRAINING, AND EDUCATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 CONSULTING, TRAINING, AND EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 32 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 33 ON-PREMISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 HYBRID: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 HYBRID: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 40 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 LARGE ENTERPRISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 46 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 IT AND ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 IT AND ITES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 GOVERNMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 MANUFACTURING: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 HEALTHCARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 RETAIL AND E-COMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 RETAIL AND E-COMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 ENERGY AND UTILITIES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 ENERGY AND UTILITIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 APPLICATION PR0GRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 80 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 81 US: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 82 US: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 83 US: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 84 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 85 US: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 86 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 87 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 88 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 90 CANADA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 91 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 93 CANADA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 94 CANADA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 106 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 UK: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 108 UK: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 109 UK: MARKET, BY ORGANIZATION SIZE,2017–2022 (USD MILLION)

- TABLE 110 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 111 UK: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 112 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 115 GERMANY: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 116 GERMANY: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 117 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 119 GERMANY: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 120 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 121 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 122 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 123 FRANCE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 124 FRANCE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 125 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 126 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 127 FRANCE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 128 FRANCE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 132 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 134 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 147 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 148 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 150 CHINA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 151 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 152 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 153 CHINA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 154 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 155 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 156 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 JAPAN: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 158 JAPAN: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 159 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 160 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 161 JAPAN: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 162 JAPAN: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 163 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 164 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 165 INDIA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 166 INDIA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 167 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 168 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 169 INDIA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 170 INDIA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 190 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 191 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 194 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 195 MIDDLE EAST: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 197 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 198 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 199 AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 200 AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 201 AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 202 AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 203 AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 204 AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 206 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 208 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: MARKET, BY VERTICAL,2023–2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 214 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 215 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 218 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 219 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 220 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 221 BRAZIL: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 222 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 223 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 224 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 225 MEXICO: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 226 MEXICO: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 227 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 228 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 229 MEXICO: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 230 MEXICO: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 235 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 236 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 239 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET: DEGREE OF COMPETITION

- TABLE 240 KEY COMPANY INDUSTRY FOOTPRINT

- TABLE 241 KEY COMPANY REGION FOOTPRINT

- TABLE 242 DETAILED LIST OF STARTUPS

- TABLE 243 SME/STARTUP INDUSTRY FOOTPRINT

- TABLE 244 SME/STARTUP REGION FOOTPRINT

- TABLE 245 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2022

- TABLE 246 MARKET: DEALS, 2020–2023

- TABLE 247 GOOGLE (APIGEE): BUSINESS OVERVIEW

- TABLE 248 GOOGLE (APIGEE): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 GOOGLE (APIGEE): PRODUCT LAUNCHES

- TABLE 250 SALT SECURITY: BUSINESS OVERVIEW

- TABLE 251 SALT SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 SALT SECURITY: PRODUCT LAUNCHES

- TABLE 253 NONAME: BUSINESS OVERVIEW

- TABLE 254 NONAME: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 NONAME: PRODUCT LAUNCHES

- TABLE 256 NONAME: DEALS

- TABLE 257 AKAMAI: BUSINESS OVERVIEW

- TABLE 258 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 AKAMAI: DEALS

- TABLE 260 DATA THEOREM: BUSINESS OVERVIEW

- TABLE 261 DATA THEOREM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 AXWAY: BUSINESS OVERVIEW

- TABLE 263 AXWAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 IMPERVA: BUSINESS OVERVIEW

- TABLE 265 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 IMPERVA: PRODUCT LAUNCHES

- TABLE 267 IMPERVA: DEALS

- TABLE 268 TRACEABLE: BUSINESS OVERVIEW

- TABLE 269 TRACEABLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 271 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 273 FORTINET: BUSINESS OVERVIEW

- TABLE 274 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 ADJACENT MARKETS AND FORECASTS

- TABLE 276 WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 277 WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 278 SMALL AND MEDIUM-SIZED ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 279 SMALL AND MEDIUM-SIZED ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 280 LARGE ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 281 LARGE ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 282 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 283 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

- TABLE 284 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 285 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 286 LARGE ENTERPRISES MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 287 LARGE ENTERPRISES MARKET, BY REGION, 2021–2027 (USD MILLION)

- FIGURE 1 GLOBAL APPLICATION PROGRAMMING INTERFACE MARKET: RESEARCH DESIGN

- FIGURE 2 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY— APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN API SECURITY MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 API SECURITY— MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1— BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES IN API SECURITY MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2— BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 8 STUDY LIMITATIONS

- FIGURE 9 GLOBAL MARKET AND Y-O-Y GROWTH RATE

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 API SECURITY OFFERINGS TO ADDRESS GROWING THREAT ACROSS WEB APPLICATIONS

- FIGURE 12 BFSI SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 13 PLATFORM AND SOLUTIONS SEGMENT TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 CLOUD SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS BY 2028

- FIGURE 17 API SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 UNDERLYING FACTORS CONTRIBUTING TO API SECURITY INCIDENTS

- FIGURE 19 API SECURITY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 API SECURITY MARKET ECOSYSTEM

- FIGURE 21 API SECURITY MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 PATENT ANALYSIS: API SECURITY

- FIGURE 23 MAJOR YCC TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN API SECURITY MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 25 SERVICES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 26 SUPPORT AND MAINTENANCE SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 27 CLOUD DEPLOYMENT MODE SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 28 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 MARKET: REVENUE ANALYSIS

- FIGURE 34 APPLICATION PROGRAMMING INTERFACE SECURITY PROVIDERS: HISTORICAL THREE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY PUBLIC SECTORS

- FIGURE 35 KEY PLAYERS’ RANKING

- FIGURE 36 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 38 REGIONAL SNAPSHOT OF KEY MARKET PLAYERS AND THEIR HEADQUARTERS

- FIGURE 39 EVALUATION QUADRANT FOR SME/STARTUP: CRITERIA WEIGHTAGE

- FIGURE 40 EVALUATION MATRIX FOR SME/STARTUP, 2023

- FIGURE 41 VALUATION AND FINANCIAL METRICS OF VENDORS

- FIGURE 42 GOOGLE (APIGEE): COMPANY SNAPSHOT

- FIGURE 43 AKAMAI: COMPANY SNAPSHOT

- FIGURE 44 AXWAY: COMPANY SNAPSHOT

- FIGURE 45 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 46 FORTINET: COMPANY SNAPSHOT

The study involved major activities in estimating the current market size for the API security market. Exhaustive secondary research was done to collect information on the API security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the API security market.

Secondary Research

The market for the companies offering API security platforms, solutions, and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as The SANS Institute, Information Systems Security Association (ISSA), Information Security Forum (ISF), European Cyber Security Organization (ECSO), European Union Agency for Cybersecurity (ENISA), UK Cyber Security Association (UKCSA), Association of Information Security Professionals (AISP), Japan Network Security Association (JNSA), National Association of Software and Services Companies (NASSCOM), Professional Information Security Association (PISA), Australian Information Security Association (AISA), Information Systems Security Association (ISSA), and National Cyber Security Authority (NCA).

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the API security market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of API security solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

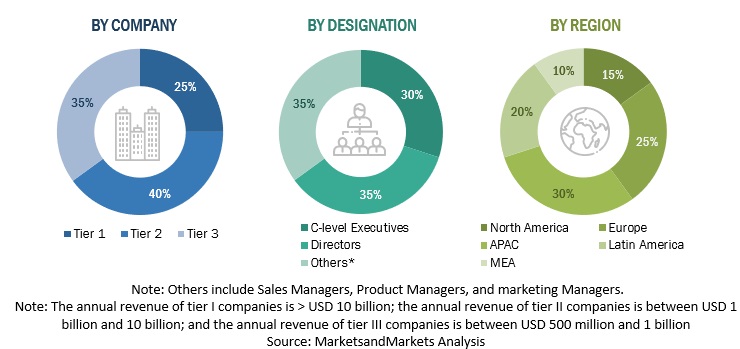

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global API security market and estimate the size of various other dependent sub-segments in the overall API security market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Palo Alto Networks defines API Security as “API security is the practice of protecting the application programming interface (API) from attacks that would maliciously use or attempt to exploit an API to steal sensitive data or disrupt services. API security employs strategies, techniques, and solutions to ensure that only authorized users can access and use an API and that the data transmitted through the API is protected from unauthorized access or manipulation.”

Key Stakeholders

- API Security/WAF/WAAP vendors

- Government agencies

- Independent Software Vendors (ISVs)

- System integrators

- Value-Added Resellers (VARs)

- IT security agencies

- System Integrators (SIs)

- Resellers and Distributors

- Information Technology (IT) Professionals

- Consultants/Consultancies/Advisory Firms

- Technology Providers

- Venture Capitalists, Private Equity Firms, and Startup Companies

Report Objectives

- To define, describe, and forecast the API security market based on offering, deployment mode, organization size, verticals, and regions

- To define, describe, and forecast the Application Programming Interface (API) security market by offering, deployment mode, organization size, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the API security market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the API security market

- To profile the key players of the API security market and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global API security market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Application Programming Interface (API) Security Market