Web Application Firewall Market by Component (Solutions (Hardware Appliances, Virtual Appliances, Cloud-Based) and Services (Professional and Managed)), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2027

Web Application Firewall Market Size, Industry Share Forecast

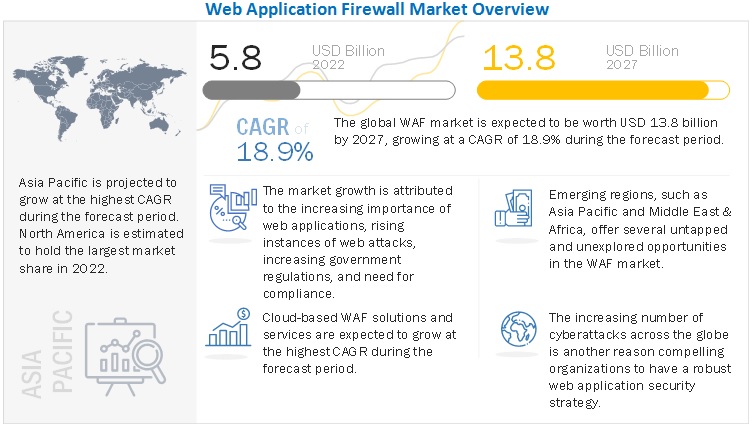

[265 Pages Report] The Web Application Firewall Market Size Is Projected To Reach USD 13.8 Billion By 2027, Exhibiting A CAGR Of 18.9%. The major factors fueling the WAF market include increasing importance of web applications. Moreover, the technological proliferation and increasing penetration of IoT is driving adoption of WAF solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

Web Application Firewall Market Dynamics

Driver: Technological proliferation and increasing penetration of IoT

The penetration of technologies, such as IoT, across various end-user applications is increasing as the world is becoming progressively interconnected. Rising the awareness and needs to protect the network and web application infrastructure. A large number of devices are getting connected to the internet, such as TVs, mobile devices, and printers. Organizations are increasingly using such connected devices in their processes to make their business operate optimally. With an increase in the number of devices and associated applications, various cyberattacks and security vulnerabilities are being added to the threat landscape. To deal with such situations, the majority of IoT technology and developer companies are deploying and recommending advanced security solutions, such as WAFs, Next-Generation Firewall (NGFW), and Runtime Application Self-Protection (RASP), for securing their business infrastructure, thereby driving the demand for the WAF market..

Restraint: Organizations considering runtime application self-protection as viable alternative

The increasing popularity and adoption of integrated RASP solutions across organizations are expected to restrain the industry growth in the web application firewall market. Both web application firewall and RASP solutions specialize in delivering top-notch cybersecurity to web applications. While both solutions share the same goal, they do so very differently. RASP is software that integrates with the application and tries to determine if something is attacking it by keeping track of calls made to the application and identifying them as threats or not. The difference between RASP and other protocols is that RASP instantly takes action and handles threats before they become a problem for the application. For instance, RASP can terminate a call and prevent the user that initiated it from logging back in or it could ban the IP address that they’re using. RASP solutions eliminate vulnerabilities and protect from unknown zero-day attacks automatically and efficiently. They’re helpful even for legacy applications with a minimum level of application security. They offer a proactive solution in the production environment.

Opportunity: Increasing adoption of cloud and virtual appliance-based WAFs

Most organizations are moving their businesses to the cloud and virtual infrastructures, resulting in a high rate of security breaches and cyberattacks. With the accelerated rise in the number of companies adopting cloud for running business applications and saving private data, cybercriminals have started to target web applications and websites. This has led to an ever-increasing need for WAFs. A cloud-based web application firewall is offered as a SaaS structure. With this option, the web application firewall is located entirely in the cloud, and everything is managed by the service provider. This creates the most simple way for organizations to deploy and maintain a web application firewall as the service provider will optimize and update as needed. This option may be best for organizations that have limited IT resources to maintain and manage their WAFs.

Challenge: Presence of traditional firewalls

The traditional firewall is also known as the first-generation firewall. The evolution of firewalls started in the early 1990s with the introduction of the traditional firewall, ranging from stateful firewalls to WAFs to NGFWs. Organizations are continuously transforming their businesses by adopting various advanced technologies, such as cloud computing, virtualization, and mobility, thus resulting in the sophistication of the threat landscape. A firewall provides basic functionalities, such as traffic control between public and private networks, packet filtering, application control, and monitoring, along with URL blocking. These firewalls were specifically designed on the basis of ports, i.e., the firewall that specifically controls the inflowing traffic through a particular port, such as Port 80, which is most often used by HTTP-based web servers. These firewalls are not capable of detecting potential threats and APTs, as they lack features, such as the absence of Deep Packet Inspection (DPI) technologies. Furthermore, the firewalls do not provide application-layer filtering. Even today, about 2 out of 5 organizations are using traditional firewalls for securing their network and application processes.

By vertical, BFSI vertical to grow at higher CAGR during the forecast period

New and enhanced financial products and services are frequently introduced by organizations to improve business operations and expand the customer base, making the industry a lucrative target for frauds. The financial sector is expanding due to the strong growth of existing financial service organizations and new entities entering the market. With the evolving technology, mobile applications for banking are being used extensively. Organizations in the BFSI industry vertical need security products and services to protect employees, customers, assets, offices, branches, and operations. With facilities such as smart banking, internet banking, and mobile banking, BFSI companies need to prioritize web application firewall security solutions. Attacks such as cross-site scripting, SQL injection, forceful browsing, cookie poisoning, botnets, and DDoS have been experienced in the BFSI industry vertical. BFSI industry vertical provides services through the web or financial service applications. The network security industry players are developing innovative security measures to meet the rising complexity of attacks.

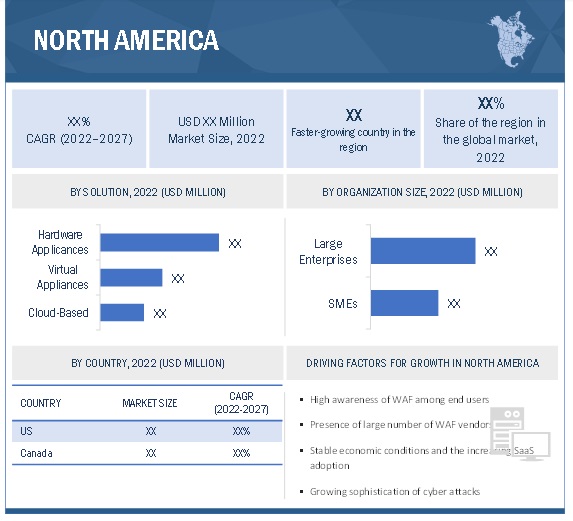

By region, North America to hold largest market share during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

North America tops the globe in terms of the presence of security vendors and security breach incidents. Therefore, the web application firewall market is dominated by North America, which is considered to be the most advanced region with regard to cybersecurity technology adoption and infrastructure.

As the world is becoming more connected and the IoT trend is gaining prominence, awareness about the need to protect network infrastructure is being identified as the most critical economic and security challenge in the region. The growing concern to ensure the protection of financial and sensitive data has increased government intervention in recent years. With an increasing number of connected devices, new forms and varieties of cyberattacks are joining the threat landscape. For instance, on 21st October 2016, a series of DDoS attacks introduced a widespread disturbance to internet activities in the US. The attack specifically targeted the DNS and affected all the activities associated with online transactions, including online shopping transactions and social media interactions. Moreover, a recent survey from ESET, an internet security solutions vendor, stated that more than 40% of Americans are not sure whether their IoT devices are safe and secure from advanced cyberattacks. The growing IoT trend and increasing internal and external threats are some of the key factors that are expected to fuel the growth of the web application firewall market in North America. The countries considered for analysis in the North America web application firewall market include the US and Canada. Some of the industry players who offer web application firewall solutions and services in North America are Barracuda, Fortinet, Sophos, F5 Networks, and Akamai. North America is expected to contribute a share of 38.7% to the global web application firewall marketin 2017.

Key Market Players:

The key players in the global web application firewall market include Imperva (US), Akamai (US), Barracuda (US), Citrix (US), Cloudflare (US), Rohde & Schwarz (Germany), Ergon Informatik (Switzerland), F5 Networks (US), Fortinet (US), and Radware (Israel), Cloudflare (US), Rohde & Schwarz (Germany), Ergon (Switzerlands), F5 Networks (US), Fortinet (US), Radware (Israel), Penta Security Systems (South Korea), Trustwave (US), NSFOCUS (US), Sophos (US), Positive Technologies (Russia), Oracle (US), Qualys (US), AWS (US), Fastly (US), Microsoft (US), Alibaba Cloud (China), Lumen (US), StackPath (US), Prophaze (India), Indusfase (India), Wallarm (US), HAProxy (US), Reblaze (US), Cloudbric (South Korea), Mlytics (Singapore), Expimont (Singapore), ThreatX (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 5.8 billion |

|

Revenue forecast for 2027 |

USD 13.8 billion |

|

Growth Rate |

18.9% CAGR |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, Organization Size, Vertical, and Region |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors include Imperva (US), Akamai (US), Barracuda (US), Citrix (US), and Cloudflare (US) (Total 32 companies) |

This research report categorizes the web application firewall market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

- Hardware appliances

- Virtual appliances

- Cloud-based

-

Services

- Managed Services

-

Professional Services

- Consulting

- Support & Maintenance

- Training & Education

- System Integration

By Organization Size:

- Large Enterprises

- Small & Medium Sized Enterprises

By Vertical:

- Banking, Financial Services & Insurance

- Retail

- IT & Telecommunications

- Government & Defense

- Healthcare

- Energy & Utilities

- Education

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Development

- In April 2022, Radware signed a distribution agreement with Entelar, a New Zealand-owned IT distributor. As part of the agreement, Entelar would offer Radware’s application and network security solutions, such as web application firewall, bot manager, API security, and DDoS protection solutions, to help businesses in New Zealand.

- November 2021, Radware expanded its partnership with MNIT to add Radware’s Cloud DDoS Protection, Cloud WAF, and Bot Management services.

- In August 2021, Radware expanded its partnership with INAP to expand INAP’s portfolio to meet rigorous cybersecurity requirements. INAP would deploy Radware’s Cloud web application firewall and DDoS Protection Services to organizations from various industries, including healthcare, entertainment & gaming, financial services, SaaS, and ISF.

- In June 2021, Radware partnered with Acantho to provide cloud web application security protection to businesses in Italy. Acantho would offer Radware’s Cloud web application firewall service, including Bot Manager, to enterprise customers for enhanced quality of service and application security.

Frequently Asked Questions (FAQ):

What are the upcoming trends in web application firewall market?

- Cloud-based WAF solutions

- AI and machine learning will be increasingly integrated into WAF solutions

- Integration with other security solutions such as DDoS protection and endpoint security

- The use of APIs to automate the deployment and management of WAFs

- The rise of zero-trust security models

How big is the web application firewall market?

Who are the key companies influencing the market growth of WAF?

Who are the emerging SMEs that are supporting significantly in the WAF market growth?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 WEB APPLICATION FIREWALL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 WEB APPLICATION FIREWALL MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM VENDORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY VENDORS FROM EACH APPLICATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT VERTICALS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 9 GLOBAL WEB APPLICATION FIREWALL MARKET, 2019–2027 (USD MILLION)

FIGURE 10 FASTEST-GROWING SEGMENTS IN MARKET, 2022–2027

FIGURE 11 HARDWARE APPLIANCES SOLUTION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 TOP VERTICALS IN MARKET

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 OVERVIEW OF WEB APPLICATION FIREWALL MARKET

FIGURE 16 STRINGENT GOVERNMENT REGULATIONS, NEED FOR COMPLIANCE, AND RISING INSTANCES OF WEB ATTACKS TO BOOST MARKET

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 17 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SOLUTION, 2022 VS. 2027

FIGURE 18 HARDWARE APPLIANCES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY PROFESSIONAL SERVICE, 2022 VS. 2027

FIGURE 19 CONSULTING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET, BY VERTICAL, 2022 VS. 2027

FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.7 WEB APPLICATION FIREWALL MARKET: REGIONAL SCENARIO, 2022–2027

FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WEB APPLICATION FIREWALL MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing importance of web applications

5.2.1.2 Rising instances of web attacks, such as cyber theft, espionage, vandalism, and fraud

FIGURE 24 TOP SECURITY VIOLATION TYPES IN 2021

FIGURE 25 TOP ATTACKED COUNTRIES IN 2021

FIGURE 26 MOST ATTACKED INDUSTRIES IN 2021

5.2.1.3 Government regulations and need for compliance to drive adoption of WAF solutions

5.2.1.4 Technological proliferation and increasing penetration of IoT

5.2.2 RESTRAINTS

5.2.2.1 Insufficient protection, false positives, and high cost of deployment

5.2.2.2 Organizations considering runtime application self-protection as viable alternative

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of cloud and virtual appliance-based WAFs

5.2.3.2 Introduction of ML/AI-powered WAFs

5.2.4 CHALLENGES

5.2.4.1 Lack of technical expertise

5.2.4.2 Presence of traditional firewalls

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: ELECTRONIC RECORDS AND PRACTICE MANAGEMENT SOFTWARE COMPANY RELIED ON IMPERVA FOR SECURITY AND EFFICIENCY

5.3.2 CASE STUDY 2: ASIAN PAINTS EMPOWERED TRANSFORMATION WITH F5 SILVERLINE WEB APPLICATION FIREWALL

5.3.3 CASE STUDY 3: PEACH BOOSTED SECURITY AND CUSTOMER CONFIDENCE USING AWS WAF

5.4 COVID-19-DRIVEN MARKET DYNAMICS

FIGURE 27 WEB APPLICATION-RELATED VULNERABILITIES BY CATEGORY (2018-2020)

5.4.1 DRIVERS AND OPPORTUNITIES

5.4.2 RESTRAINTS AND CHALLENGES

5.5 PRICING ANALYSIS

TABLE 3 WEB APPLICATION FIREWALL MARKET: PRICING LEVELS

5.6 VALUE CHAIN ANALYSIS

FIGURE 28 MARKET: VALUE CHAIN

5.7 TARIFF AND REGULATORY LANDSCAPE

5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.7.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.7.4 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.7.5 GRAMM-LEACH-BLILEY ACT

5.7.6 SARBANES-OXLEY ACT

5.7.7 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

5.7.8 EUROPEAN UNION GENERAL DATA PROTECTION REGULATION

5.8 PATENT ANALYSIS

TABLE 4 MARKET: PATENTS

TABLE 5 TOP 10 PATENT OWNERS (US)

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS

6 WEB APPLICATION FIREWALL MARKET, BY COMPONENT (Page No. - 74)

6.1 INTRODUCTION

FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

TABLE 6 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 7 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 31 CLOUD-BASED SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 SOLUTIONS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 9 SOLUTIONS: IREWALL MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 11 SOLUTIONS: WEB APPLICATION FIREWALL MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 HARDWARE APPLIANCES

TABLE 12 HARDWARE APPLIANCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 HARDWARE APPLIANCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 VIRTUAL APPLIANCES

TABLE 14 VIRTUAL APPLIANCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 VIRTUAL APPLIANCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 CLOUD-BASED

TABLE 16 CLOUD-BASED: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 CLOUD-BASED: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 SERVICES: WEB APPLICATION FIREWALL MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 33 TRAINING & EDUCATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Consulting

TABLE 26 CONSULTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Support & maintenance

TABLE 28 SUPPORT & MAINTENANCE: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.3 Training & education

TABLE 30 TRAINING & EDUCATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 TRAINING & EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.4 System integration

TABLE 32 SYSTEM INTEGRATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 SYSTEM INTEGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 34 MANAGED SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE (Page No. - 91)

7.1 INTRODUCTION

FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

7.1.1 ORGANIZATION SIZES: MARKET DRIVERS

7.1.2 ORGANIZATION SIZES: COVID-19 IMPACT

TABLE 36 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 37 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 LARGE ENTERPRISES

TABLE 40 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 WEB APPLICATION FIREWALL MARKET, BY VERTICAL (Page No. - 96)

8.1 INTRODUCTION

FIGURE 35 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

8.1.1 VERTICALS: MARKET DRIVERS

8.1.2 VERTICALS: COVID-19 IMPACT

TABLE 42 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 43 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 44 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 RETAIL

TABLE 46 RETAIL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 IT & TELECOMMUNICATIONS

TABLE 48 IT & TELECOMMUNICATIONS: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 IT & TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 GOVERNMENT & DEFENSE

TABLE 50 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 HEALTHCARE

TABLE 52 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 ENERGY & UTILITIES

TABLE 54 ENERGY & UTILITIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 ENERGY & UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 EDUCATION

TABLE 56 EDUCATION: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHER VERTICALS

TABLE 58 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 WEB APPLICATION FIREWALL MARKET, BY REGION (Page No. - 108)

9.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 60 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 62 NORTH AMERICA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.3 UNITED STATES

TABLE 76 UNITED STATES: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 77 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 78 UNITED STATES: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 79 UNITED STATES: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 80 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 81 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2.4 CANADA

TABLE 82 CANADA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 83 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 84 CANADA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: WEB APPLICATION FIREWALL MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

TABLE 88 EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.3 UNITED KINGDOM

TABLE 102 UNITED KINGDOM: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 103 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 104 UNITED KINGDOM: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 105 UNITED KINGDOM: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 106 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 107 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.3.4 GERMANY

TABLE 108 GERMANY: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.3.5 FRANCE

TABLE 114 FRANCE: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 119 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 120 REST OF EUROPE: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 125 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: WEB APPLICATION FIREWALL MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 126 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.3 CHINA

TABLE 140 CHINA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 141 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 142 CHINA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 143 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 144 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 145 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.4.4 JAPAN

TABLE 146 JAPAN: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 147 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 148 JAPAN: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 149 JAPAN: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 150 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 151 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.4.5 AUSTRALIA

TABLE 152 AUSTRALIA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 153 AUSTRALIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 154 AUSTRALIA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 155 AUSTRALIA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 156 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 157 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 158 REST OF ASIA PACIFIC: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA: WEB APPLICATION FIREWALL MARKET DRIVERS

9.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY SUB-REGION, 2018–2021 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY SUB-REGION, 2022–2027 (USD MILLION)

9.5.3 MIDDLE EAST

TABLE 178 MIDDLE EAST: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 179 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 180 MIDDLE EAST: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 181 MIDDLE EAST: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 182 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 183 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.5.4 AFRICA

TABLE 184 AFRICA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 185 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 186 AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 187 AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 188 AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 189 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: WEB APPLICATION FIREWALL MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 190 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.6.3 BRAZIL

TABLE 204 BRAZIL: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 205 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 206 BRAZIL: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 207 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 208 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 209 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.6.4 MEXICO

TABLE 210 MEXICO: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 211 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 212 MEXICO: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 213 MEXICO: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 214 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 215 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.6.5 REST OF LATIN AMERICA

TABLE 216 REST OF LATIN AMERICA: WEB APPLICATION FIREWALL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 217 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 218 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 219 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 220 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 221 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 170)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK, 2019–2021

10.3 REVENUE ANALYSIS

FIGURE 41 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

10.4 MARKET SHARE ANALYSIS

FIGURE 42 WEB APPLICATION FIREWALL MARKET SHARE ANALYSIS, 2021

TABLE 222 MARKET: DEGREE OF COMPETITION

10.5 COMPANY EVALUATION QUADRANT

TABLE 223 COMPANY EVALUATION QUADRANT: CRITERIA

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 43 WEB APPLICATION FIREWALL MARKET, KEY COMPANY EVALUATION MATRIX, 2022

10.5.5 OVERALL COMPANY FOOTPRINT ANALYSIS

TABLE 224 OVERALL COMPANY FOOTPRINT

TABLE 225 COMPANY COMPONENT FOOTPRINT

TABLE 226 COMPANY VERTICAL FOOTPRINT

TABLE 227 COMPANY REGION FOOTPRINT

10.6 RANKING OF KEY PLAYERS

FIGURE 44 RANKING OF KEY PLAYERS IN WEB APPLICATION FIREWALL MARKET, 2021

10.7 STARTUP/SME EVALUATION MATRIX

FIGURE 45 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 46 WEB APPLICATION FIREWALL MARKET (GLOBAL) STARTUP/SME COMPANY EVALUATION MATRIX, 2022

10.8 KEY MARKET DEVELOPMENTS

10.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

TABLE 228 PRODUCT LAUNCHES & ENHANCEMENTS, 2019–2022

10.8.2 DEALS

TABLE 229 DEALS, 2019–2022

10.8.3 OTHERS

TABLE 230 OTHERS, 2019–2022

11 COMPANY PROFILES (Page No. - 192)

11.1 INTRODUCTION

11.2 KEY PLAYERS

(Business Overview, Products, Solutions & Services, , Recent Developments, Response to COVID-19, MnM View)*

11.2.1 IMPERVA

TABLE 231 IMPERVA: BUSINESS OVERVIEW

TABLE 232 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 233 IMPERVA: NEW SOLUTION/SERVICE LAUNCHES

TABLE 234 IMPERVA: DEALS

11.2.2 AKAMAI

TABLE 235 AKAMAI: BUSINESS OVERVIEW

FIGURE 47 AKAMAI: COMPANY SNAPSHOT

TABLE 236 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 237 AKAMAI: NEW SOLUTION/SERVICE LAUNCHES

TABLE 238 AKAMAI: DEALS

11.2.3 BARRACUDA

TABLE 239 BARRACUDA: BUSINESS OVERVIEW

TABLE 240 BARRACUDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 241 BARRACUDA: NEW SOLUTION/SERVICE LAUNCHES

TABLE 242 BARRACUDA: DEALS

TABLE 243 BARRACUDA: OTHERS

11.2.4 CITRIX

TABLE 244 CITRIX: BUSINESS OVERVIEW

FIGURE 48 CITRIX: COMPANY SNAPSHOT

TABLE 245 CITRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 246 CITRIX: NEW SOLUTION/SERVICE LAUNCHES

TABLE 247 CITRIX: DEALS

11.2.5 CLOUDFLARE

TABLE 248 CLOUDFLARE: BUSINESS OVERVIEW

FIGURE 49 CLOUDFLARE: COMPANY SNAPSHOT

TABLE 249 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 250 CLOUDFLARE: DEALS

TABLE 251 CLOUDFLARE: OTHERS

11.2.6 ROHDE & SCHWARZ

TABLE 252 ROHDE & SCHWARZ: BUSINESS OVERVIEW

TABLE 253 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 254 ROHDE & SCHWARZ: NEW SOLUTION/SERVICE LAUNCHES

TABLE 255 ROHDE & SCHWARZ: DEALS

11.2.7 ERGON INFORMATIK

TABLE 256 ERGON INFORMATIK: BUSINESS OVERVIEW

TABLE 257 ERGON INFORMATIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 258 ERGON INFORMATIK: NEW SOLUTION/SERVICE LAUNCHES

TABLE 259 ERGON INFORMATIK: DEALS

11.2.8 F5 NETWORKS

TABLE 260 F5 NETWORKS: BUSINESS OVERVIEW

FIGURE 50 F5 NETWORKS: COMPANY SNAPSHOT

TABLE 261 F5 NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 262 F5 NETWORKS: DEALS

TABLE 263 F5 NETWORKS: OTHERS

11.2.9 FORTINET

TABLE 264 FORTINET: BUSINESS OVERVIEW

FIGURE 51 FORTINET: COMPANY SNAPSHOT

TABLE 265 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 266 FORTINET: NEW SOLUTION/SERVICE LAUNCHES

TABLE 267 FORTINET: DEALS

11.2.10 RADWARE

TABLE 268 RADWARE: BUSINESS OVERVIEW

FIGURE 52 RADWARE: COMPANY SNAPSHOT

TABLE 269 RADWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 270 RADWARE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 271 RADWARE: DEALS

TABLE 272 RADWARE: OTHERS

11.3 OTHER PLAYERS

11.3.1 PENTA SECURITY SYSTEMS

11.3.2 TRUSTWAVE

11.3.3 NSFOCUS

11.3.4 SOPHOS

11.3.5 POSITIVE TECHNOLOGIES

11.3.6 ORACLE

11.3.7 QUALYS

11.3.8 AWS

11.3.9 FASTLY

11.3.10 MICROSOFT

11.3.11 ALIBABA CLOUD

11.3.12 LUMEN

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, Response to COVID-19,

MnM View might not be captured in case of unlisted companies.

11.4 SME/STARTUPS

11.4.1 STACKPATH

11.4.2 PROPHAZE

11.4.3 INDUSFACE

11.4.4 WALLARM

11.4.5 HAPROXY

11.4.6 REBLAZE

11.4.7 CLOUDBRIC

11.4.8 MLYTICS

11.4.9 EXPIMONT

11.4.10 THREATX

12 ADJACENT MARKETS (Page No. - 248)

12.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 273 ADJACENT MARKETS AND FORECASTS

12.2 LIMITATIONS

12.3 WEB APPLICATION FIREWALL MARKET ECOSYSTEM AND ADJACENT MARKETS

12.4 CYBERSECURITY MARKET

12.4.1 CYBERSECURITY MARKET, BY COMPONENT

TABLE 274 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

12.4.2 CYBERSECURITY MARKET, BY SOFTWARE

TABLE 275 CYBERSECURITY MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

12.4.3 CYBERSECURITY MARKET, BY SECURITY TYPE

TABLE 276 CYBERSECURITY MARKET SIZE, BY SECURITY TYPE, 2020–2026 (USD MILLION)

12.4.4 CYBERSECURITY MARKET, BY DEPLOYMENT MODE

TABLE 277 CYBERSECURITY MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

12.4.5 CYBERSECURITY MARKET, BY ORGANIZATION SIZE

TABLE 278 CYBERSECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

12.4.6 CYBERSECURITY MARKET, BY VERTICAL

TABLE 279 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.4.7 CYBERSECURITY MARKET, BY REGION

TABLE 280 CYBERSECURITY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.5 MANAGED DNS SERVICES MARKET

12.5.1 MANAGED DNS SERVICES MARKET, BY DNS SERVICE

12.5.2 MANAGED DNS SERVICES MARKET, BY DNS SERVER

TABLE 281 MANAGED DNS SERVICES MARKET SIZE, BY DNS SERVER, 2019–2025 (USD MILLION)

12.5.3 MANAGED DNS SERVICES MARKET, BY DEPLOYMENT MODE

TABLE 282 MANAGED DNS SERVICES MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

12.5.4 MANAGED DNS SERVICES MARKET, BY CLOUD DEPLOYMENT

TABLE 283 MANAGED DNS SERVICES MARKET SIZE, BY CLOUD DEPLOYMENT, 2019–2025 (USD MILLION)

12.5.5 MANAGED DNS SERVICES MARKET, BY ORGANIZATION SIZE

TABLE 284 MANAGED DNS SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

12.5.6 MANAGED DNS SERVICES MARKET, BY END USER

TABLE 285 MANAGED DNS SERVICES MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

12.5.7 MANAGED DNS SERVICES MARKET, BY ENTERPRISE

TABLE 286 MANAGED DNS SERVICES MARKET SIZE, BY ENTERPRISE, 2019–2025 (USD MILLION)

12.5.8 MANAGED DNS SERVICES MARKET, BY REGION

TABLE 287 MANAGED DNS SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13 APPENDIX (Page No. - 258)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involves four major activities in estimating the current size of the WAF market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub segments of the WAF market.

Secondary Research

The market size of companies offering WAF solutions and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the WAF market.

Primary interviews were conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using WAF; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall WAF market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the WAF market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the top-down approach, an exhaustive list of all vendors in the WAF market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The market size was estimated from revenues generated by vendors from different WAF solutions and service offerings. Revenue generated from each component (solution and service) from different vendors was identified with the help of secondary and primary sources and combined to arrive at market size. Further, the procedure included an analysis of the WAF market’s regional penetration. With the data triangulation procedure and data validation through primaries, the exact values of the overall WAF market size and its segments’ market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption trend of WAF offerings among different verticals in key countries with respect to the regions that contribute most of the market share was identified. For cross-validation, the adoption trend of WAF solutions and service offerings, along with different use cases, with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in the different application areas for the calculation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global Web Application Firewall (WAF) market based on components (solutions and services), organization sizes, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the WAF market

- To analyze the impact of COVID-19 on components, organization sizes, verticals, and regions across the globe

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies2

-

To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

Company Information

-

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Detailed analysis and profiling of additional market players (up to 5)

-

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Web Application Firewall Market