Asia Pacific Pharmacy Automation Market by Product Type (Dispensing, Storage - Robotic, Carousel, Cabinet), Packaging & Labelling, Table top, Medication Compounding], End User (Inpatient, Outpatient, Hospital Retail, PBM, Mail-order) & Country - Global Forecast to 2028

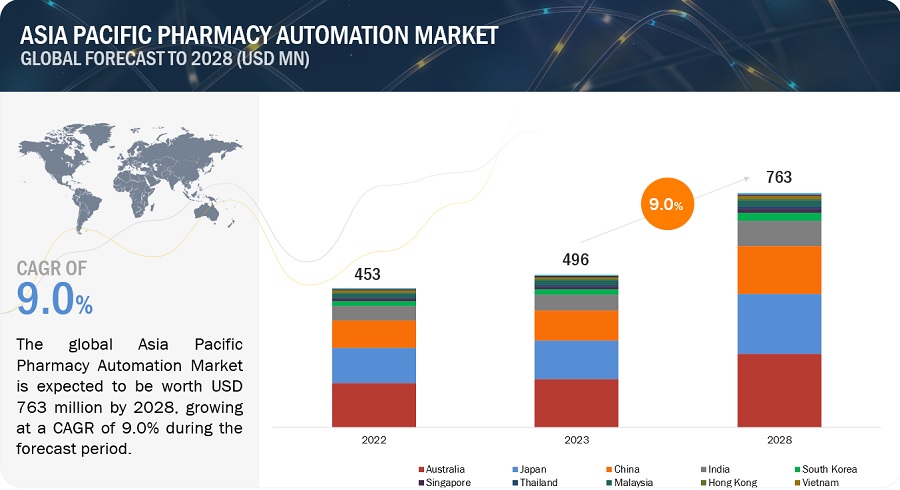

The global asia pacific pharmacy automation market, valued at US$453 million in 2022, stood at US$496 million in 2023 and is projected to advance at a resilient CAGR of 9.0% from 2023 to 2028, culminating in a forecasted valuation of US$763 million by the end of the period. The significant growth potential in emerging markets such as China, India, Japan, Singapore, India, growing focus on automation to reduce labour costs, and increasing speciality drug dispensing are some of the critical factors offering opportunities to the market.

However, lack of technical expertise and high cost of implementation are key factors challenging the growth of the Asia Pacific pharmacy automation market.

To know about the assumptions considered for the study, Request for Free Sample Report

Asia Pacific pharmacy automation Market Dynamics

Driver: Technological advancements and integration with healthcare systems

Technological advancements and integration with healthcare systems play a vital role in driving the adoption of pharmacy automation in the Asia Pacific region. The rapid progress in automation technologies, such as robotics, artificial intelligence (AI), and machine learning, has revolutionized the capabilities of pharmacy automation systems. These advancements enable sophisticated medication dispensing, automated inventory management, robotic prescription filling, and intelligent medication verification processes. With high-speed robotic systems, pharmacies can achieve precise medication counting and reduce the risk of errors. AI and machine learning algorithms optimize inventory management, predict medication demand, and improve overall workflow efficiency. Integration with hospital information systems enables seamless prescription verification, real-time inventory tracking, and efficient medication distribution within the hospital. Improved interoperability and data exchange standards further enhance the integration of pharmacy automation with healthcare systems. Common standards like Health Level Seven (HL7) facilitate the seamless exchange of patient data, medication orders, and medication-related information, reducing manual data entry and enhancing patient safety. Furthermore, the integration of pharmacy automation with healthcare systems leads to enhanced workflow efficiency and cost savings. Additionally, electronic billing and claims processing capabilities improve revenue cycle management for pharmacies and healthcare providers.

Restraint: Lack of skilled personnel

The pharmacy automation industry in the Asia Pacific region is constantly evolving with advancements in automation technologies. Highly skilled professionals must keep pace with these continuing changes. Experienced professionals must know how to utilize and handle technical systems like automated dispensing cabinets and automated packaging systems to ensure safety, efficacy, and accuracy during the medication dispensing process. Many countries face the issue of insufficiently skilled pharmacy professionals. The adoption of automation in pharmacies has saved time and minimized errors associated with dispensing prescriptions. On the other hand, some countries are experiencing a substantial deficit of untapped human capital due to insufficient education and training. This shortage of skilled professionals may hamper the adoption of automation in pharmacies, thereby limiting the growth of the Asia Pacific pharmacy automation market.

Opportunity: Increasing awareness among pharmacists

The systems for managing medicines have remained unchanged for decades, while medications have increased in number and complexity, resulting in a potentially more significant risk for error. In addition, with the traditional methods of operation within pharmacies, pharmacists have witnessed various issues such as increased medication errors and growing patient waiting times due to the increasing patient load. Owing to this, pharmacists have now started implementing technologically advanced automation solutions in pharmacies. These solutions help address the prevailing issues regarding capacity & inventory management and ensure minimization of dispensing and medication errors. Thus, rising awareness regarding the effective management of pharmacy workloads through automated systems is expected to provide significant growth opportunities for the pharmacy automation market across the Asia Pacific region.

Challenge: Risk of cross-contamination

The risk of drug-drug cross-contamination in drug dispensing robots in hospital pharmacies causes serious concern. The possibility of medication cross-contamination during automated pill counting is becoming a major safety concern across healthcare facilities and pharmacies. Manufacturers of semi-automated and fully automated counting technology systems used by various end users now consider cross-contamination a major issue. Pill residues present in drug dispensing robots are not always the residue of one drug but are a mixture of dust from many drugs stored in the machine. Residue from pills is sometimes very harmful, especially from chemotherapy drugs, which can be toxic. Similarly, drugs like penicillin and sulfides can trigger severe allergic reactions.

One machine processing many different medications must be cleaned between operations to avoid cross-contamination. Currently, this task falls to the pharmacy staff, making them reluctant to adopt such systems in-house. However, pharmacy automation providers are currently incorporating innovative technologies into these systems to overcome the challenge of cross-contamination. For instance, the ScriptPro SP series of robotic prescription dispensing systems do not use air pressure or a vacuum to move pills. Instead, the system fills vials directly from the dispensing cells.

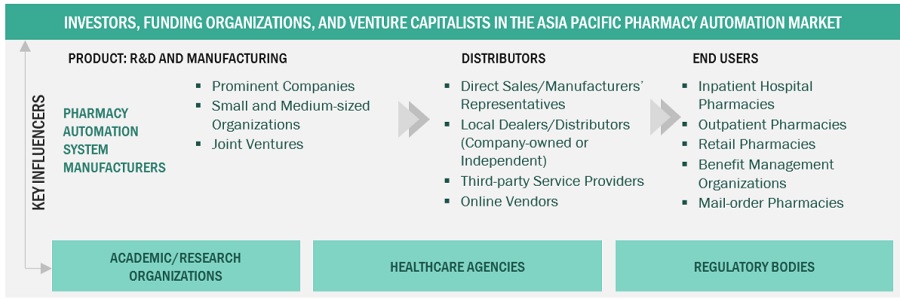

Asia Pacific Pharmacy Automation Market Ecosystem

The ecosystem market map of the Asia Pacific pharmacy automation market comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. The end users of pharmacy automation solutions include inpatient hospital pharmacies, outpatient pharmacies, retail pharmacies, benefit organizations, and mail-order pharmacies. The manufacturers of pharmacy automation solutions include the organizations involved in the entire process of research, product development, optimization, and launch.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

Centralized pharmacies segment accounted to hold a significant share of asia pacific pharmacy automation industry, by application/operation

Centralized pharmacies segment accounted to hold a significant share of asia pacific pharmacy automation market, by application/operation. The growth of this segment is accounted to the advantages offered by these type of systems such as reduced inventory costs, streamlined workflows, and reduced expenses. The growing need to optimize inventory levels to reduce stock-outs, minimize errors related to manual stocking, and improve drug shortage management is a key factor driving the growth of this segment.

Acute care systems segment accounted for a considerable share in the Asia Pacific pharmacy automation industry, for inpatient pharmacies, by type in 2022”

In 2022, the acute care systems segment accounted for a considerable share in the Asia Pacific pharmacy automation market, for inpatient pharmacies, by type. The large share of this segment can be attributed to the minimized losses associated with pilferage, misuse, and other missing charges by using automated pharmacy systems. Also, most healthcare insurers cover expenses for acute care services provided at hospitals. Hence, with the expanding insurance coverage across Asian countries, the workload in acute care systems is expected to increase and drive health service utilization. Consequently, the demand for better pharmacy management will grow and support the adoption of automation in acute care.

Australia dominated the Asia Pacific pharmacy automation industry in 2022

Australia accounted for the largest share of the Asia Pacific pharmacy automation market. The large share of Australia can be attributed to the developed infrastructure and growth in the demand for digitalized technologies across the country drive the implementation of different analytical solutions among pharmacies. Additionally, the presence of well-equipped hospitals and other healthcare facilities further drives the demand for and adoption of advanced solutions such as pharmacy automation systems in Australia.

To know about the assumptions considered for the study, download the pdf brochure

Prominent companies in this market include Becton, Dickinson and Company (BD) (US), Yuyama Co., Ltd/Yuyama Mfg Co., Ltd (Japan), Omnicell, Inc. (US), KUKA AG (Swisslog Healthcare) (Germany), TOSHO Co, Inc. (Japan), Oracle Corporation (US), TouchPoint Medical Solutions (US), Takazono Corporation (Japan), Capsa Healthcare (US), ARxIUM, Inc. (US), Mckesson Corporation (US), ATS Corporation (Canada), ScriptPro LLC (US), Hanmi Pharma Co., Ltd. (South Korea), NIHON CHOUZAI Co., Ltd. (Japan), and GETECH (Singapore).

Scope of the Asia Pacific Pharmacy Automation Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$496 million |

|

Projected Revenue by 2028 |

$763 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 9.0% |

|

Market Driver |

Technological advancements and integration with healthcare systems |

|

Market Opportunity |

Increasing awareness among pharmacists |

The study categorizes the Asia Pacific pharmacy automation market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Automated Medication Dispensing and Storage Systems

-

Automated Medication Dispensing and Storage Systems, by Type

- Robots/robotic automated dispensing systems

- Carousels

- Automated Dispensing Cabinets

-

Automated Medication Dispensing and Storage Systems, by Application/Operation

- Centralized Pharmacies

- Decentralized Pharamcies

-

Automated Medication Dispensing and Storage Systems, by Type

- Automated Packaging & Labelling Systems

- Automated Table-top Counters

- Automated Medication Compounding Systems

- Other Pharmacy Automation Systems

By End User

-

Inpatient Pharmacies

- Acute Care Systems

- Long-term Care Facilities

-

Outpatient Pharmacies

- Outpatient/Fast-track Clinics

- Hospital Retail Settings

- Retail Pharmacies

- Pharmacy Benefit Management Organizations and Mail-order Pharmacies

By Country

- Australia

- Japan

- China

- India

- South Korea

- Singapore

- Thailand

- Malaysia

- HongKong

- Vietnam

- Philippines

- Indonesia

- Bangladesh

- Rest of Asia Pacific

Recent Developments of Asia Pacific Pharmacy Automation Industry

- In October 2022, Omnicell launched Specialty Pharmacy Services to help health systems establish and optimize specialty pharmacy programs. The offering aimed to improve access to specialty medications, generate financial outcomes through a value-based service model, and provide comprehensive technology and expertise for medication management.In July 2022, BD acquired MedKeeper, a provider of cloud-based pharmacy management applications. This acquisition strengthens BD's presence in the pharmacy sector and enhances its medication management capabilities, particularly in the preparation of compounded medications.

- In June 2022, Oracle Corporation completed the acquisition of Cerner Corporation, with approximately 69.2% of Cerner's outstanding shares being tendered. The acquisition aimed to revolutionize the healthcare industry by combining clinical capabilities with enterprise platforms, analytics, and automation expertise.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global asia pacific pharmacy automation market?

The global asia pacific pharmacy automation market boasts a total revenue value of $763 million by 2028.

What is the estimated growth rate (CAGR) of the global asia pacific pharmacy automation market?

The global asia pacific pharmacy automation market has an estimated compound annual growth rate (CAGR) of 9.0% and a revenue size in the region of $496 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need to minimize medication errors- Adoption of decentralized distribution models by pharmacies- Technological advancements and increased integration in healthcare systems- Growing investments for healthcare infrastructural development- Increasing specialty drug dispensing through mail and central-fill pharmaciesRESTRAINTS- Reluctance to adopt pharmacy automation systems- High initial capital investments for pharmacy automation systems- Lack of skilled personnel in emerging economiesOPPORTUNITIES- Increasing implementation of technologically advanced automation solutions among pharmacists- High growth opportunities in emerging economies- Implementation of healthcare cost-reduction measures by pharmacistsCHALLENGES- Stringent regulatory procedures by government bodies- Risk of cross-contamination in drug dispensing robots in hospital pharmacies

- 6.1 INTRODUCTION

-

6.2 OVERVIEW OF KEY INDUSTRY TRENDSCUSTOMIZABLE DRUG DISPENSING CABINETSPHARMACY ROBOTIC DISPENSING MACHINESRADIOFREQUENCY IDENTIFICATION IN PHARMACY AUTOMATIONELECTRONIC HEALTH RECORD INTEGRATION AND INTEROPERABILITY THROUGH PHARMACY AUTOMATION SYSTEMS

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 REGULATORY ANALYSISINDIAAUSTRALIAJAPANCHINA

- 6.6 VALUE CHAIN ANALYSIS

-

6.7 TECHNOLOGY ANALYSISMACHINE LEARNINGROBOTICS AND ARTIFICIAL INTELLIGENCEVIRTUAL CONTROLBLOCKCHAIN

-

6.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR PHARMACY AUTOMATION SYSTEMS IN ASIA PACIFICINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

-

6.9 ECOSYSTEM MARKET MAP

-

6.10 CASE STUDY ANALYSISCASE STUDY 1CASE STUDY 2

-

6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMSAUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE- Robots/Robotic automated dispensing systems- Carousels- Automated dispensing cabinetsAUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION- Centralized pharmacies- Decentralized pharmacies

-

7.3 AUTOMATED PACKAGING AND LABELING SYSTEMSNEED FOR IMPROVED AND ACCURATE MEDICATION DISPENSING WITH REDUCED LABOR COSTS TO DRIVE SEGMENT

-

7.4 AUTOMATED TABLETOP COUNTERSINCREASING NUMBER OF PATIENT VISITS AND GROWING DEMAND FOR PRESCRIPTION MEDICATIONS TO DRIVE MARKET

-

7.5 AUTOMATED MEDICATION COMPOUNDING SYSTEMSNEED TO REDUCE COST PER DOSE OF MEDICATION AND MEDICATION OUTSOURCING TO DRIVE MARKET

- 7.6 OTHER PHARMACY AUTOMATION SYSTEMS

- 8.1 INTRODUCTION

-

8.2 INPATIENT PHARMACIESACUTE CARE SYSTEMS- Growing investments for improving acute care service quality to drive marketLONG-TERM CARE FACILITIES- Increasing patient admissions in long-term care facilities to drive segment

-

8.3 OUTPATIENT PHARMACIESOUTPATIENT/FAST-TRACK CLINICS- Growing need for automated medication dispensing and reduced medication errors to drive marketHOSPITAL RETAIL SETTINGS- Need for more accurate medication dispensing and faster inventory management to drive market

-

8.4 RETAIL PHARMACIESINCREASING NEED FOR FASTER PRESCRIPTION FILLING AND BETTER MEDICATION DISPENSING TO DRIVE MARKET

-

8.5 PHARMACY BENEFIT MANAGEMENT ORGANIZATIONS AND MAIL-ORDER PHARMACIESINCREASED NEED TO REDUCE LABOR COSTS FOR MEDICATION PACKAGING AND SUPPLY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 AUSTRALIAGROWING ADVANCED MEDICAL INFRASTRUCTURE AND INCREASING HEALTHCARE EXPENDITURE TO DRIVE MARKET

-

9.3 JAPANRAPID GROWTH IN GERIATRIC POPULATION WITH INCREASED NUMBER OF CHRONIC DISEASES TO DRIVE MARKET

-

9.4 CHINAGROWING GOVERNMENT INVESTMENTS FOR HEALTHCARE INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

-

9.5 INDIAIMPROVING HEALTHCARE INFRASTRUCTURE AND RISING GERIATRIC POPULATION TO DRIVE MARKET

-

9.6 SOUTH KOREAGROWING GERIATRIC POPULATION AND INCREASING PER CAPITA HEALTHCARE EXPENDITURE TO DRIVE MARKET

-

9.7 SINGAPOREIMPROVING HEALTHCARE INFRASTRUCTURE AND RISING ADOPTION OF AUTOMATED PHARMACY SYSTEMS TO DRIVE MARKET

-

9.8 THAILANDRISING ADOPTION OF AUTOMATED SYSTEMS AND ROBOTICS IN HEALTHCARE FACILITIES TO DRIVE MARKET

-

9.9 MALAYSIAINCREASING NEED TO MINIMIZE DISPENSING AND MEDICATION ERRORS TO DRIVE MARKET

-

9.10 HONG KONGINCREASING GERIATRIC POPULATION AND GROWING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET

-

9.11 VIETNAMRISING NUMBER OF STRINGENT GOVERNMENT REGULATIONS AND INCREASING GERIATRIC POPULATION TO DRIVE MARKET

-

9.12 PHILIPPINESIMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING NUMBER OF HOSPITAL ADMISSIONS TO DRIVE MARKET

-

9.13 INDONESIARAPIDLY INCREASING GERIATRIC POPULATION AND INCREASING NUMBER OF GOVERNMENT INITIATIVES TO DRIVE MARKET

-

9.14 BANGLADESHIMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING NEED TO REDUCE MEDICATION ERRORS TO DRIVE MARKET

- 9.15 REST OF ASIA PACIFIC

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS, 2022

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPETITIVE BENCHMARKING

-

10.6 COMPANY FOOTPRINTPRODUCT FOOTPRINTEND-USER FOOTPRINT

-

10.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 COMPETITIVE SCENARIOS AND TRENDSKEY PRODUCT LAUNCHES AND ENHANCEMENTSKEY DEALSOTHER KEY DEVELOPMENTS

-

11.1 KEY PLAYERSBECTON, DICKINSON AND COMPANY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewYUYAMA CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewOMNICELL, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKUKA AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTOSHO INC.- Business overview- Products/Services/Solutions offered- MnM viewORACLE- Business overview- Products/Services/Solutions offered- Recent developmentsTOUCHPOINT MEDICAL, INC.- Business overview- Products/Services/Solutions offeredTAKAZONO CORPORATION- Business overview- Products/Services/Solutions offeredCAPSA HEALTHCARE- Business overview- Products/Services/Solutions offered- Recent developmentsARXIUM- Business overview- Products/Services/Solutions offeredMCKESSON CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsATS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsNIHON CHOUZAI CO., LTD.- Business overview- Products/Services/Solutions offeredSCRIPTPRO, LLC- Business overview- Products/Services/Solutions offeredJVM CO., LTD.- Business overview- Products/Services/Solutions offeredGETECH- Business overview- Products/Services/Solutions offered

-

11.2 OTHER PLAYERSTENSION CORPORATIONMEDITECH PHARMACY MANAGEMENT SOLUTIONSWILLACH GROUPSTÄUBLI INTERNATIONAL AGSYSMEX ASIA PACIFIC PTE LTD.INFOSYS LIMITED

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: ASIA PACIFIC PHARMACY AUTOMATION MARKET

- TABLE 3 IMPACT ANALYSIS: DRIVERS

- TABLE 4 IMPACT ANALYSIS: RESTRAINTS

- TABLE 5 IMPACT ANALYSIS: OPPORTUNITIES

- TABLE 6 IMPACT ANALYSIS: CHALLENGES

- TABLE 7 EXAMPLES OF RFID IN PHARMACY AUTOMATION SYSTEMS

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 CHINA: NMPA CLASSIFICATION OF MEDICAL DEVICES

- TABLE 10 LIST OF PATENTS/PATENT APPLICATIONS IN PHARMACY AUTOMATION MARKET, 2022–2023

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PHARMACY AUTOMATION SYSTEMS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE PHARMACY AUTOMATION SYSTEMS

- TABLE 13 ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 14 KEY AUTOMATED MEDICATION DISPENSING SYSTEMS AVAILABLE

- TABLE 15 KEY AUTOMATED MEDICATION STORAGE SYSTEMS AVAILABLE

- TABLE 16 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 KEY ROBOTS/ROBOTIC AUTOMATED DISPENSING SYSTEMS AVAILABLE

- TABLE 19 ROBOTS/ROBOTIC AUTOMATED DISPENSING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 KEY CAROUSELS AVAILABLE

- TABLE 21 CAROUSELS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 KEY AUTOMATED DISPENSING CABINETS AVAILABLE

- TABLE 23 AUTOMATED DISPENSING CABINETS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 25 CENTRALIZED PHARMACIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 DECENTRALIZED PHARMACIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 KEY AUTOMATED PACKAGING AND LABELING SYSTEMS AVAILABLE

- TABLE 28 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED PACKAGING AND LABELING SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 KEY AUTOMATED TABLETOP COUNTERS AVAILABLE

- TABLE 30 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED TABLETOP COUNTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 KEY AUTOMATED COMPOUNDING SYSTEMS AVAILABLE

- TABLE 32 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION COMPOUNDING SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OTHER PHARMACY AUTOMATION SYSTEMS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 35 KEY PHARMACY AUTOMATION SOLUTIONS USED FOR HOSPITAL INPATIENT PHARMACIES

- TABLE 36 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ACUTE CARE SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 KEY PHARMACY AUTOMATION SOLUTIONS FOR LONG-TERM CARE FACILITIES

- TABLE 40 LONG-TERM CARE FACILITIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 KEY PHARMACY AUTOMATION SOLUTIONS USED IN OUTPATIENT PHARMACIES

- TABLE 42 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 OUTPATIENT/FAST-TRACK CLINICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 HOSPITAL RETAIL SETTINGS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR RETAIL PHARMACIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 KEY PHARMACY AUTOMATION SOLUTIONS USED IN MAIL-ORDER PHARMACIES

- TABLE 48 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR PHARMACY BENEFIT MANAGEMENT ORGANIZATIONS AND MAIL-ORDER PHARMACIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 51 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 53 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 54 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 AUSTRALIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 57 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 59 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 60 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 JAPAN: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 65 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 CHINA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 69 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 71 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 INDIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 75 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 77 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 78 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 SOUTH KOREA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 81 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 83 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 SINGAPORE: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 87 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 89 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 THAILAND: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 95 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 MALAYSIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 99 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 101 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 HONG KONG: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 105 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 107 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 VIETNAM: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 111 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 113 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 114 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 PHILIPPINES: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 117 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 119 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 INDONESIA: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 123 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 125 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 126 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 BANGLADESH: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2021–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR INPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR OUTPATIENT PHARMACIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ASIA PACIFIC PHARMACY AUTOMATION MARKET

- TABLE 135 ASIA PACIFIC PHARMACY AUTOMATION MARKET: DEGREE OF COMPETITION

- TABLE 136 ASIA PACIFIC PHARMACY AUTOMATION MARKET: DETAILED LIST OF PLAYERS

- TABLE 137 OVERALL COMPANY FOOTPRINT IN ASIA PACIFIC PHARMACY AUTOMATION MARKET

- TABLE 138 PRODUCT FOOTPRINT OF COMPANIES IN ASIA PACIFIC PHARMACY AUTOMATION MARKET

- TABLE 139 END-USER FOOTPRINT OF COMPANIES IN ASIA PACIFIC PHARMACY AUTOMATION MARKET

- TABLE 140 KEY PRODUCT LAUNCHES AND ENHANCEMENTS, 2021–2023

- TABLE 141 KEY DEALS, 2021–2023

- TABLE 142 OTHER KEY DEVELOPMENTS, 2021–2023

- TABLE 143 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 144 YUYAMA CO., LTD.: COMPANY OVERVIEW

- TABLE 145 OMNICELL, INC.: COMPANY OVERVIEW

- TABLE 146 KUKA AG: COMPANY OVERVIEW

- TABLE 147 TOSHO INC.: COMPANY OVERVIEW

- TABLE 148 ORACLE: COMPANY OVERVIEW

- TABLE 149 TOUCHPOINT MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 150 TAKAZONO CORPORATION: COMPANY OVERVIEW

- TABLE 151 CAPSA HEALTHCARE: COMPANY OVERVIEW

- TABLE 152 ARXIUM: COMPANY OVERVIEW

- TABLE 153 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 154 ATS CORPORATION: COMPANY OVERVIEW

- TABLE 155 NIHON CHOUZAI CO., LTD.: COMPANY OVERVIEW

- TABLE 156 SCRIPTPRO, LLC: COMPANY OVERVIEW

- TABLE 157 JVM CO., LTD.: COMPANY OVERVIEW

- TABLE 158 GETECH: COMPANY OVERVIEW

- FIGURE 1 ASIA PACIFIC PHARMACY AUTOMATION MARKET SEGMENTATION

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND COUNTRY

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION: BECTON, DICKINSON AND COMPANY

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 11 ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 ASIA PACIFIC PHARMACY AUTOMATION MARKET FOR AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS, BY APPLICATION/OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 ASIA PACIFIC PHARMACY AUTOMATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT: ASIA PACIFIC PHARMACY AUTOMATION MARKET

- FIGURE 16 GROWING NEED TO AUTOMATE WORKFLOWS AND REDUCE HEALTHCARE COSTS TO DRIVE MARKET

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE IN ASIA PACIFIC PHARMACY AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 18 AUTOMATED MEDICATION DISPENSING AND STORAGE SYSTEMS AND AUSTRALIA DOMINATED ASIA PACIFIC PHARMACY AUTOMATION MARKET IN 2022

- FIGURE 19 INPATIENT PHARMACIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 20 ASIA PACIFIC PHARMACY AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: ASIA PACIFIC PHARMACY AUTOMATION MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS: ASIA PACIFIC PHARMACY AUTOMATION MARKET

- FIGURE 23 PATENT PUBLICATION TRENDS (JANUARY 2011–JULY 2023)

- FIGURE 24 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR PHARMACY AUTOMATION SYSTEMS (JANUARY 2011–JULY 2023)

- FIGURE 25 ECOSYSTEM MARKET MAP: ASIA PACIFIC PHARMACY AUTOMATION MARKET

- FIGURE 26 REVENUE SHIFT IN ASIA PACIFIC PHARMACY AUTOMATION MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE PHARMACY AUTOMATION SYSTEMS

- FIGURE 29 ASIA PACIFIC: PHARMACY AUTOMATION MARKET SNAPSHOT

- FIGURE 30 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 31 ASIA PACIFIC PHARMACY AUTOMATION MARKET SHARE, BY KEY PLAYER, 2022

- FIGURE 32 COMPANY EVALUATION MATRIX OF PLAYERS IN ASIA PACIFIC PHARMACY AUTOMATION MARKET (2022)

- FIGURE 33 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT, 2022

- FIGURE 34 OMNICELL, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 35 KUKA AG: COMPANY SNAPSHOT, 2022

- FIGURE 36 ORACLE: COMPANY SNAPSHOT, 2022

- FIGURE 37 MCKESSON CORPORATION: COMPANY SNAPSHOT, 2022

- FIGURE 38 ATS CORPORATION: COMPANY SNAPSHOT, 2023

- FIGURE 39 NIHON CHOUZAI CO., LTD.: COMPANY SNAPSHOT, 2022

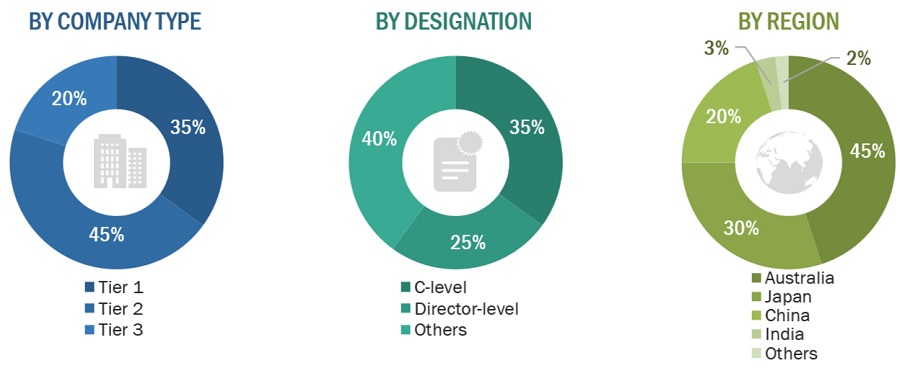

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, annual reports, and companies’ house documents, investor presentations; and the SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the LIMS market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

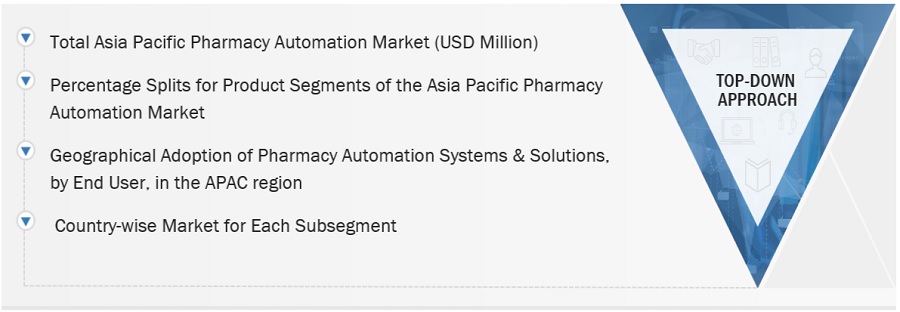

Market Size Estimation

The total size of the APAC pharmacy automation market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach. The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by product, end user, and country).

Global Asia Pacific pharmacy automation Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Supply Side Analysis (Revenue Share Analysis)

The size of the Asia Pacific pharmacy automation market was arrived at by using the revenue share analysis of leading players. The methodology used is as given below:

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the Asia Pacific pharmacy automation market were gathered from secondary sources to the extent available. In some instances, shares of Asia Pacific pharmacy automation businesses have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the Asia Pacific pharmacy automation market was determined by extrapolating the Market share data of major companies.

Market Definition

Pharmacy automation refers to a variety of systems and software solutions designed to increase the productivity of pharmacies and the precision of the medication compounding process by reducing human intervention. Automated systems mechanize various procedures in pharmacies, including the storage, packaging, dispensing, pickup, delivery, and distribution of drugs.

Key Stakeholders

- Pharmacy automation system vendors/service providers

- Pharmacy automation system manufacturers

- Healthcare institutions (hospitals, medical schools, diagnostic centers, and outpatient clinics)

- Venture capitalists and investors

- Healthcare IT service providers

- Research and consulting firms

- Government agencies

- Academic research institutes

Objectives of the Study

- To define, describe, and forecast the global Asia Pacific pharmacy automation market based on product, end user, and country

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To estimate the market size and growth potential of the pharmacy automation market in the Asia Pacific region

- To profile key market players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as acquisitions; product launches and upgrades; expansions; agreements, partnerships, and acquisitions; and R&D activities in the Asia Pacific pharmacy automation market

- To benchmark players within the Asia Pacific pharmacy automation market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Asia Pacific Pharmacy Automation Market