Auto Dimming Mirror Market by Fuel Type (BEV, ICE, Hybrid), Application (IRVM and ORVM), Functionality (Connected and Non-Connected), Vehicle Type (PC and LCV), and Region (Asia Pacific, Europe, North America, and RoW) - Global Forecast to 2025

The auto dimming mirror market size was estimated to be USD 1.64 Billion in 2016 and is projected to grow USD 2.11 Billion by 2025, at a CAGR of 3.20% during the forecast period. The base year for the report is 2016 and the forecast period is 2017–2025. The global market is primarily driven by the increasing awareness about vehicle and passenger safety. Also, the trend of integrating additional features in rear-view mirrors has led to a rise in demand for auto dimming mirrors. OEMs have launched new variants in mirrors with advanced features for driver assistance.

Objectives of the Study:

- To define, describe, and project the market by fuel type (BEV, ICE and others (hybrid))

- To define, describe, and project the market by application of mirror (outer mirrors and interior mirrors)

- To define, describe, and project the market by functionality (connected and non-connected dimming mirrors)

- To identify the market dynamics including drivers, restraints, opportunities, and challenges and analyze their impact on the market

- To analyze the competitive leadership map for the key players based on their strength of product offerings and business strategies to identify the dynamic differentiators, innovators, visionary leaders, and emerging companies in the market

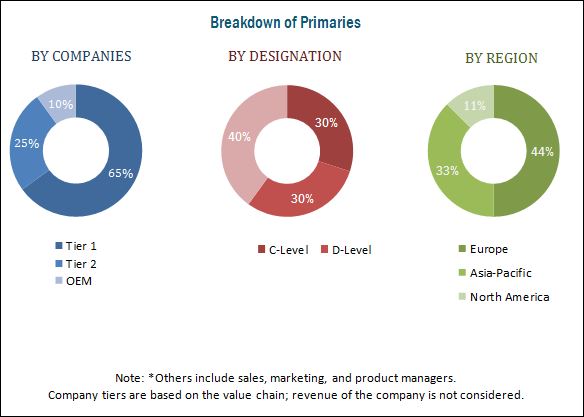

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for data triangulation. The study involves country-level OEM and model-wise analysis of the market in various vehicle types. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production, regulations about the minimum number of rear-view mirrors to be installed in various type of vehicles, and technological advancements in various countries. The analysis has been discussed and validated with primary respondents, which include experts from the auto dimming mirror industry, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the auto dimming mirror market comprises manufacturers such as Gentex (US), Samvardhana Motherson Reflectec (Germany), Magna (Canada), Ficosa (Spain), Murakami (Japan), and others. These automotive manufacturers supply auto dimming mirrors to automotive OEMs such as Volkswagen (Germany), General Motors (US), and Ford Motor (US).

Target Audience

- Auto dimming mirror manufacturers and component suppliers

- Distributors and suppliers of auto dimming mirrors

- Automotive OEMs

- Industry associations and other driver assistance systems manufacturers

- The automobile industry and related end-user industries

Scope of the Report

Market By Application

Market By Fuel

Market By Functionality

Market By Vehicle Type

Market By Region

-

- Inside Rear-View Mirror

- Outside Rear-View Mirror

- BEV

- ICE

- Others (Hybrid)

- Connected Auto Dimming Mirror

- Non-Connected Auto Dimming Mirror

- Passenger Cars

- Light Commercial Vehicles

- Asia Pacific (China, Japan, South Korea, and India)

- Europe (Germany, France, UK, and Italy)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil and Russia)

Available Customizations

Market, By Application and Country

-

-

Asia Pacific

- China

- Japan

- India

-

Europe

- Germany

- France

- UK

- Italy

-

North America

- US

- Mexico

- Canada

-

Rest of the World (RoW)

- Russia

- Brazil

-

Asia Pacific

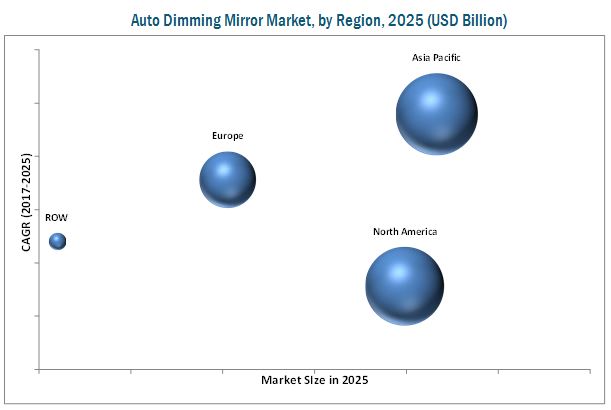

The auto dimming mirror market is projected to grow at a CAGR of 3.20% from 2017 to 2025, to reach a market size of USD 2.11 Billion by 2025. The increasing awareness about vehicle and passenger safety is expected to drive the demand for auto dimming mirrors. The safety of passengers and vehicles has become the prime concern for vehicle buyers. According to the global status report on road safety 2015, more than 1.2 million road traffic deaths occur each year globally. To reduce these accidents, OEMs are integrating different safety features in automotive mirrors. This integration of safety features is expected to drive this market.

The outer mirror segment is the fastest growing segment of the auto dimming mirror market, during the forecast period. The use of outer dimming mirrors is imperative in all types of vehicles. Passenger cars commonly have two outer dimming mirrors. However, in the case of LCVs, the number of outer dimming mirrors is higher than passenger cars. Outer dimming mirrors often comprise features such as blind spot detection and turn signal indicator. OEMs are increasingly offering these features in outer dimming mirrors.

The connected mirror is estimated to be the fastest growing product of this auto dimming mirror market. On the other hand, the non-connected dimming mirror segment is estimated to be the largest market. The market for connected dimming mirrors is in the high growth stage. Leading OEMs are adding new features in the auto dimming mirror and are adopting connected dimming mirror to gain competitive advantage. While the connected dimming mirror market is estimated to grow at the fastest pace, the non-connected mirror has the largest market size.

Asia Pacific is estimated to dominate the auto dimming mirror market during the forecast period. The region has emerged as a major automotive hub with the majority of the market share of vehicle production as well as sales. Almost every major automotive mirror manufacturer is present in the Asia Pacific region. The demand for auto dimming mirrors is directly linked to the vehicle production in this region. To cater the growing demand and capitalize on cost efficiencies, the companies involved in the production of auto dimming mirrors and their components have started focusing on the Asia Pacific market. Being the largest market for automobiles, the Asia Pacific region is estimated to witness the largest demand for auto dimming mirrors in coming years.

A key factor restraining the growth of the auto dimming mirror market is the high installing cost and growing demand for camera and display systems. The connected dimming mirror involves complex interlinking of electronic systems. It also increases the overall cost of the vehicle. If the conventional mirror gets damaged, it is easy to replace and cost-effective. Moreover, if camera and display systems become cheaper and adopted by the OEMs, then this technology can hinder the market for auto dimming mirrors and might make this technology obsolete in future years. Thus, high cost involved and substitutes such as camera and display system is restraining the growth of the market. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Magna (Canada), Samvardhana Motherson Reflectec (Germany), Gentex (US), Ficosa (Spain), and urakami (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Auto Dimming Mirror Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Growing Vehicle Production Across the Globe

2.4.3 Supply-Side Analysis

2.4.3.1 Focus on Safety and Convenience Features in Vehicles

2.5 Auto Dimming Mirror Market Size Estimation

2.5.1 Bottom-Up Approach

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in this Market

4.2 Market Share of Auto Dimming Mirror Market, By Region

4.3 Market, By Application

4.4 Market, By Functionality

4.5 Market, By Fuel Type

4.6 Market, By Vehicle Type

5 Auto Dimming Mirror Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Auto Dimming Mirror: Market Segmentation

5.3 Macro Indicator Analysis

5.3.1 Introduction

5.3.1.1 Premium Vehicle Sales as Percentage of Total Sales

5.3.1.2 GDP (USD Billion)

5.3.1.3 GNI Per Capita, Atlas Method (USD)

5.3.1.4 GDP Per Capita, PPP (USD)

5.3.2 Macro Indicators Influencing the Market for Top 3 Countries

5.3.2.1 United States

5.3.2.2 Germany

5.3.2.3 China

5.4 Mirror Market Dynamics

5.4.1 Drivers

5.4.1.1 Awareness to Curb the Need the Night Accidents Due to Blind Spots on Highways

5.4.1.2 Usage of Mirrors By Oem's as A Differentiating Product

5.4.2 Restraints

5.4.2.1 Increasing Use of Camera and Display Based Systems as A Mirror

5.4.3 Opportunities

5.4.3.1 Integration of Infotainment and Navigation Applications and Other Advanced Features

5.4.3.2 Growing Focus of Mid and Small Segment Vehicles on Advanced Safety and Convenience Features

5.4.4 Challenges

5.4.4.1 Pressure on Manufacturers to Cut Down the Cost of Mirror

5.4.4.2 Preference for Conventional Mirrors Over Mirror

6 Technological Overview (Page No. - 45)

6.1 Introduction

6.2 Current Technologies in the Market

6.2.1 Outer Mirrors

6.2.2 Inside Mirrors

7 Auto Dimming Mirror Market, By Fuel Type (Page No. - 48)

7.1 Introduction

7.2 Ice

7.3 BEV

7.4 Others (Hybrid)

8 Auto Dimming Mirror Market, By Vehicle Type (Page No. - 53)

8.1 Introduction

8.2 Light Commercial Vehicles

8.3 Passenger Vehicles

9 Auto Dimming Mirror Market, By Application Type (Page No. - 58)

9.1 Introduction

9.2 Outer Rear View Dimming Mirror

9.3 Inside Rear View Dimming Mirror

10 Auto Dimming Mirror Market, By Functionality Type (Page No. - 63)

10.1 Introduction

10.2 Connected Auto Dimming Mirror

10.3 Non-Connected Auto Dimming Mirror

11 Auto Dimming Mirror Market, By Region (Page No. - 69)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China: Market

11.2.2 India: Market

11.2.3 Japan: Market

11.2.4 Rest of Asia Pacific

11.3 Europe

11.3.1 France: Market

11.3.2 Germany: Market

11.3.3 Italy: Market

11.3.4 UK: Market

11.3.5 Rest of Europe

11.4 North America

11.4.1 Canada: Market

11.4.2 Mexico: Market

11.4.3 US: Market

11.5 Rest of the World

11.5.1 Brazil: Market

11.5.2 Russia: Market

12 Competitive Landscape (Page No. - 94)

12.1 Introduction

12.2 Auto Dimming Mirror Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 Expansions

12.3.2 New Product Development

12.3.3 Mergers & Acquisitions

12.3.4 Supply Contracts/Agreements/ Collaborations/Partnerships/Joint Ventures

13 Company Profiles (Page No. - 101)

(Overview, Product Offering, Recent Developments, SWOT Analysis, MnM View)*

13.1 Gentex

13.2 Samvardhana

13.3 Magna

13.4 Ficosa

13.5 Ichikoh

13.6 Murakami

13.7 Tokai Rika

13.8 SL Corporation

13.9 Honda Lock

13.10 Flabeg

13.11 Germid

13.12 Konview

*Details on Overview, Product Offering, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 129)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.4.1 Detailed Analysis and Profiling of Regions By Application

14.5 Related Reports

14.6 Author Details

List of Tables (70 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Luxury Passenger Car Sales of Key Manufacturers in China, India, Germany, & Uk, 2014–2015

Table 3 Auto Dimming Mirror Market Size, By Fuel Type, 2015–2025 (‘000 Units)

Table 4 Market Size, By Fuel Type, 2015–2025 (USD Thousand)

Table 5 Ice: Market Size, By Region, 2015–2025 (‘000 Units)

Table 6 Ice: Market Size, By Region, 2015–2025 (USD Thousand)

Table 7 BEV: Market Size, By Region, 2015–2025 (‘000 Units)

Table 8 BEV: Market Size, By Region, 2015–2025 (USD Thousand)

Table 9 Others (Hybrid): Market Size, By Region, 2015–2025 (‘000 Units)

Table 10 Others (Hybrid): Market Size, By Region, 2015–2025 (USD Thousand)

Table 11 Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 12 Market, By Vehicle Type, 2015–2025 (USD Million)

Table 13 Light Commercial Vehicles: Market, By Region, 2015–2025 (’000 Units)

Table 14 Light Commercial Vehicles: Market, By Region, 2015–2025 (USD Million)

Table 15 Passenger Vehicles: Market, By Region, 2015–2025 (’000 Units)

Table 16 Passenger Vehicles: Market, By Region, 2015–2025 (USD Million)

Table 17 Auto Dimming Mirror Market, By Application, 2015–2025 (‘000 Units)

Table 18 Market, By Application, 2015–2025 (USD Million)

Table 19 Outer Mirror: Market, By Region, 2015–2025 (‘000 Units)

Table 20 Outer Mirror: Market, By Region, 2015–2025 (USD Million)

Table 21 Inside Mirror: Market, By Region, 2015–2025 (‘000 Units)

Table 22 Inside Mirror: Market, By Region, 2015–2025 (USD Million)

Table 23 Market, By Functionality Type, 2015–2025 (’000 Units)

Table 24 Market, By Functionality Type, 2015–2025 (USD Million)

Table 25 Connected : Market, By Region, 2015–2025 (’000 Units)

Table 26 Connected : Market, By Region, 2015–2025 (USD Million)

Table 27 Non-Connectedl: Market, By Region, 2015–2025 (’000 Units)

Table 28 Non-Connected: Market, By Region, 2015–2025 (USD Million)

Table 29 Mirror Market, By Region, 2015–2025 (’000 Units)

Table 30 Market, By Region, 2015–2025 (USD Million)

Table 31 Asia Pacific: Market, By Country, 2015–2025 (’000 Units)

Table 32 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 33 China: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 34 China: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 35 India: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 36 India: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 37 Japan: Mirror Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 38 Japan: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 39 Rest of Asia Pacific: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 40 Rest of Asia Pacific: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 41 Europe: Market, By Country, 2015–2025 (’000 Units)

Table 42 Europe: Market, By Country, 2015–2025 (USD Million)

Table 43 France: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 44 France: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 45 Germany: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 46 Germany: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 47 Italy: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 48 Italy: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 49 UK: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 50 UK: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 51 Rest of Europe: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 52 Rest of Europe: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 53 North America: Market, By Country, 2015–2025 (’000 Units)

Table 54 North America: Market, By Country, 2015–2025 (USD Million)

Table 55 Canada: Mirror Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 56 Canada: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 57 Mexico: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 58 Mexico: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 59 US: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 60 US: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 61 Rest of the World: Market, By Country, 2015–2025 (’000 Units)

Table 62 Rest of the World: Market, By Country, 2015–2025 (USD Million)

Table 63 Brazil: Mirror arket, By Vehicle Type, 2015–2025 (’000 Units)

Table 64 Brazil: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 65 Russia: Market, By Vehicle Type, 2015–2025 (’000 Units)

Table 66 Russia: Market, By Vehicle Type, 2015–2025 (USD Million)

Table 67 Expansions, 2013–2017

Table 68 New Product Development, 2015–2017

Table 69 Mergers & Acquisitions, 2012–2017

Table 70 Supply Contracts/Collaborations/Partnerships/Joint Ventures, 2013–2017

List of Figures (46 Figures)

Figure 1 Auto Dimming Mirror Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Growing Vehicle Production & Sales to Drive the Market

Figure 5 Market, By Type: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market, By Region, 2017 vs 2025 (Value)

Figure 8 Mirror Market, By Application, 2017 vs 2025 (Value)

Figure 9 Market, By Vehicle Type, 2017 vs 2025 (Value)

Figure 10 Non-Connected Mirror to Dominate this Market, By Functionality Type, 2017 vs 2025 (Value)

Figure 11 Ice Segment is Expected to Lead the Market, By Fuel Type, 2017 vs 2025 (Value)

Figure 12 Increase in Trend of Integrating Additional Safety Features in Mirror is Anticipated to Boost the Growth of Market From 2017 to 2025

Figure 13 North America is Estimated to Hold the Largest Share of this Market in 2017

Figure 14 IRVM is Estimated to Have the Largest Market Size, 2017 vs 2025

Figure 15 Non-Connected Mirror is Estimated to Hold the Largest Market Share in 2017

Figure 16 Ice Vehicle is Estimated to Hold the Largest Market Share, 2017 vs 2025

Figure 17 Passenger Car is Estimated to Hold the Largest Market Share, 2017 vs 2025

Figure 18 Rising GNI Per Capita and Increased Consumer Spending are Expected to Have A Positive Impact on the Demand for Premium Vehicles

Figure 19 The German Automotive Industry Would Be Positively Impacted By Reduced Cost and Technological Innovations

Figure 20 Highly Increasing GDP Per Capita and Increasing Focus on Innovation in the Automotive Industry Have Made China A Strong Market for Exporting Vehicles

Figure 21 Mirror Market: Market Dynamics

Figure 22 Road Traffic Death Rates, Per 1,00,000 Population, 2015

Figure 23 Technological Evolution of Rear-View Mirrors

Figure 24 Market, By Vehicle Type, 2017 vs 2025 (USD Million)

Figure 25 Market, By Application, 2017 vs 2025 (USD Million)

Figure 26 Market, By Functionality Type, 2017 vs 2025 (USD Million)

Figure 27 Market, By Region, 2017 (USD Million)

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Europe: Market, 2017 vs 2025 (USD Million)

Figure 30 North America: Mirror Market Snapshot

Figure 31 RoW: Market, 2017 vs 2025 (USD Million)

Figure 32 Companies Adopted Expansion as the Key Growth Strategy From 2013 to 2017

Figure 33 Market Ranking: 2017

Figure 34 Gentex: Company Snapshot

Figure 35 Gentex: SWOT Analysis

Figure 36 Samvardhana: Company Snapshot

Figure 37 Samvardhana: SWOT Analysis

Figure 38 Magna.: Company Snapshot

Figure 39 Magna: SWOT Analysis

Figure 40 Ficosa: Company Snapshot

Figure 41 Ficosa SA: SWOT Analysis

Figure 42 Ichikoh.: Company Snapshot

Figure 43 Ichikoh.: SWOT Analysis

Figure 44 Murakami: Company Snapshot

Figure 45 Tokai Rika.: Company Snapshot

Figure 46 SL Corporation: Company Snapshot

Growth opportunities and latent adjacency in Auto Dimming Mirror Market