Automotive Lighting Market for ICE & Electric Vehicle by Technology (Halogen, LED, Xenon), Position and Application (Front, Rear, Side, Interior), Adaptive Lighting, Electric Vehicle, Two-Wheeler Position Type and Region - Global Forecast to 2030

Automotive Lighting Market Size, Growth Report & Forecast

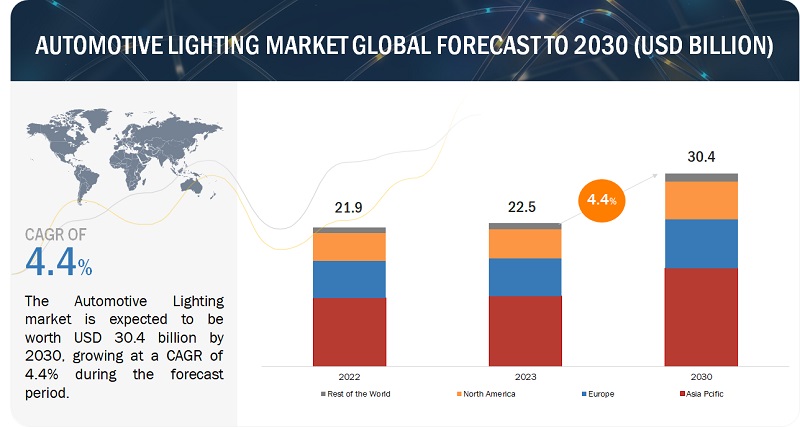

[378 Pages Report] Automotive Lighting market worldwide size was valued at USD 22.5 billion in 2023 and is expected to reach USD 30.4 billion by 2030, at a CAGR of 4.4%. Automotive Lighting is undergoing a transformative evolution driven by technological advancement, increasing safety concerns among car users and changing consumer preferences. The market for automotive lighting has been pushed by governments' adoption of sophisticated safety measures and the rise in demand for luxury vehicles, thereby driving the Automotive Lighting market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automotive Lighting Market Growth Dynamics

DRIVER: Lighting Regulations for better visibility and on-road safety.

Globally, stricter lighting regulations in developed nations like Europe and North America illuminate the path for a safer future on the road. According to the World Health Organization (WHO), nearly 1.3 million lives are lost annually due to traffic accidents; governments are prioritizing improved driving conditions with advanced automotive lighting systems, which play a crucial role. Driving in heavy traffic, especially in areas with limited daylight, demands clear visibility. Here's where regulations like the 2011 European Union mandate for daytime running lights (DRLs) come into play. These aren't meant to increase the driver’s visibility but to make vehicles highly visible to other road users, reducing the risk of collisions. In such cases, the impact of DRLs is undeniable. According to the US National Highway Traffic Safety Administration (NHTSA), there is a reduction in fatal crashes by 13.8%. The recent legalization of adaptive lighting in the US paves the way for even greater safety advances. In a proactive move, Japan became the first country to mandate automatic headlights in 2020.

These regulations are more than just lines on paper; they're turning roads into safer spaces for everyone. Advanced automotive lighting systems, fueled by stricter regulations, are shining a beacon of hope on a future where driving is not just about getting somewhere but about getting there safely and efficiently.

RESTRAINT: High Cost of LED Lights

The high cost of LED lights is a key concern for the automotive lighting market. Halogen and Xenon/HID have become less popular with the introduction of new technologies. Halogen lights have the major disadvantage of heating and wastage of energy, whereas Xenon light is more complex and requires some time to achieve full brightness. LED, on the other hand, is small and allows significant manipulation for various shapes and designs. It consumes less energy and emits brighter light than halogen. However, LED is more expensive than other technologies due to its high production cost. Materials such as indium gallium nitride, aluminum gallium indium phosphide, and aluminum gallium arsenide are the major cost-incurring materials for manufacturers. Nowadays, LEDs are used with a projector, compared to conventional lights requiring reflectors. Projector headlights are more expensive than reflector headlights and require more space within the vehicle. Latest advancements, such as OLED and matrix LEDs, are costlier than normal and have only restricted adoption in previous cars.

Although LED headlights have numerous advantages, their high production expenses and closing pricing currently confine their usage to high-end or premium vehicles, mainly in cost-sensitive countries. However, as the LED light market expands and reaches mass customers, it will likely notice the fall in prices and enable LED lighting suppliers to improve their profit margins.

OPPORTUNITY: Advancement in Lighting Technologies

Matrix LED, OLED, laser, and adaptive lighting are new and promising technologies for automotive lighting manufacturers. OLED is an emerging solid-state lighting technology that has the potential to emit light across large surfaces. It is a niche technology still in the research and development phase. OLED is likely to be introduced in the premium segment vehicles shortly. However, the technology would require 10 to 15 years to gain a significant market share. Adaptive driving beam (ADB) systems are glare-free lighting systems that provide permanent high beams without dazzling oncoming vehicle drivers. The feature that makes the adaptive driving beam headlights stand out is that this system can adjust to the conditions and point the beam in a way that won’t produce a glare on other drivers’ windshields. With the National Highway Traffic Safety Administration's (NHTSA) approval, automakers can install this technology in vehicles in the United States, creating a safer and more convenient future on the road. In August 2023, Valeo introduced its Premium Adaptive Driving Beam (ADB) technology, which helps maximize the light in all road conditions for improved comfort and safety, directing the beam of light only where it is needed and reducing the glare for oncoming drivers. This Premium Adaptive Driving Beam (ADB) technology is available for Passenger cars, buses, and Robo taxis. Automotive adaptive lighting is also expected to grow globally, especially in developed countries. In countries like India and China, there is a growing trend of equipping luxury vehicles with adaptive headlights. Recently, Audi announced updates to its e-tron GT Quattro electric sports car, including an improved lighting system with Matrix LED headlights and dynamic light sequencing. Other brands, such as Porsche, have its Dynamic Light System, and Lexus offers Bladescan Adaptive Headlights in their vehicles. The efficient performance of these technologies has attracted the attention of major automakers, which will create futuristic growth opportunities for the global Automotive Lighting market in the coming years.

CHALLENGE: Less penetration of advanced lighting in commercial vehicles

Commercial vehicles such as freight trucks operate thousands of miles every day. Owing to this factor, using advanced lighting technologies may not be feasible for manufacturers. High cost discourages them from providing advanced lighting systems in commercial vehicle segments. Also, the durability and reliability of advanced lighting systems in diverse and demanding conditions might concern fleet managers. Heavy vehicles are continuously driven for long routes without much breaks; advanced lighting technologies like adaptive driving beams and matrix LEDs will be helpful to avoid accidents with better visibility for drivers. However, these advanced lighting systems are significantly more expensive than traditional halogen or xenon headlights. This is a major barrier for cost-conscious commercial vehicle fleets, which prioritize operational efficiency and profit margins.

Various organizations have laid stringent regulations for better visibility and safety in commercial vehicles. According to the Economic Commission for Europe (ECE), trucks in Europe must have automatic leveling. Trucks must be installed with LED headlamps, and if the headlamps are equipped with light sources > 2,000 lumens (usually xenon), automatic leveling and a headlamp cleaning system must be installed. Hence, even with several benefits of advanced lighting for commercial vehicles that run continuously without any time bar, whether day or night, only a few commercial vehicle manufacturers have introduced advanced lighting systems in their vehicles. This results in less penetration of advanced lighting installation in commercial vehicles.

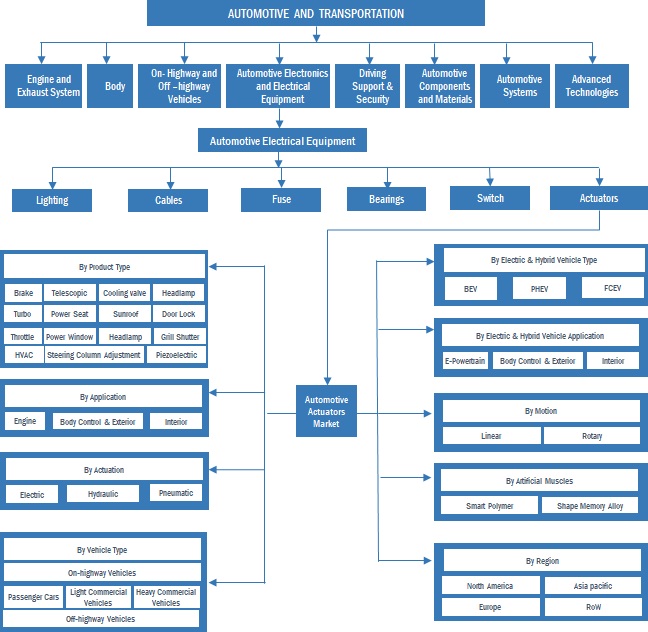

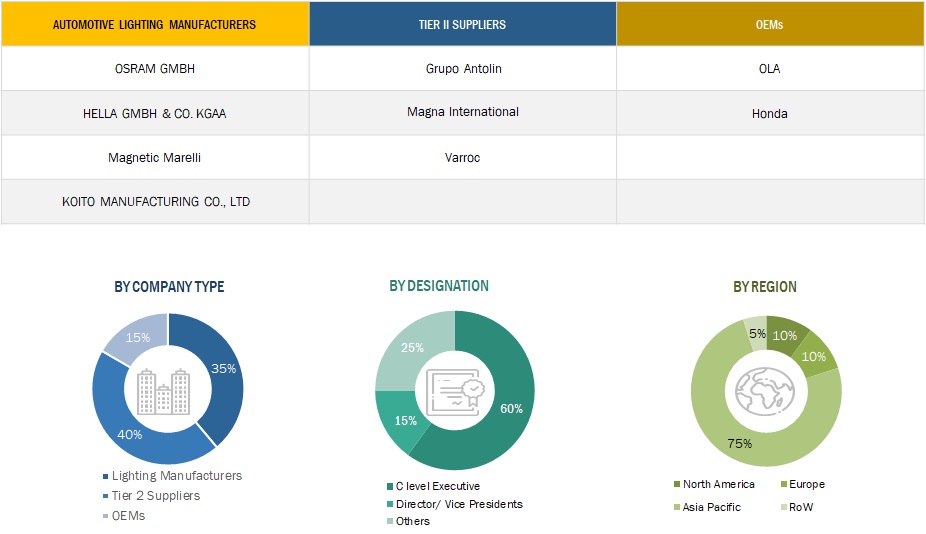

Automotive Lighting Market Ecosystem.

The major OEMs of the Automotive Lighting Market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the Automotive Lighting Market include Robert Bosch (Germany), HELLA GmbH & Co. KGaA (Germany), Johnson Electric (China), Denso Corporation (Japan), and Continental AG (Germany).

Halogen leads the automotive lighting market by technology segment.

Halogen holds the largest share in the automotive lighting market during the forecast period by volume. The growth is mainly due to the cost-effective nature of production and purchase and simple design. Due to this, OEMs prefer halogen lights for affordable vehicles to a broad consumer base, especially in developing Asian countries like China, India, and Thailand, which have higher demand for Class A, B, and C segment vehicles. Due to lower cost, Automotive lights that fit in Class A and Class B vehicles are mostly halogen for front, rear, and interior applications. Class C and D segment cars can be offered in a mix of halogen and LED lights. However, with the changing trend, the top-end variants of newly developed Class C & D cars are provided with all LED setups for better and sharper illumination.

Further, LCVs such as pickup trucks & delivery vans, heavy trucks, and buses are still dominated by halogen lights and will likely remain dominant over the coming years. Halogen lighting provides an adequate balance of cost, reliability, and practicality with ease of replacement and lower maintenance. Hence, it will remain a prominent technology in lower to mid-range cars and commercial vehicles.

Battery electric vehicles (BEVs) hold the largest lighting market share in electric & hybrid vehicle types.

BEVs lead the electric & hybrid vehicle lighting market during the forecast period owing to the largest share of this segment among all other EV types globally. According to the annual Global Electric Vehicle Outlook, the sales of electric vehicles exceeded 10 million in 2022 with exponential growth, and a total of 14% of all new cars were electric, which is higher than in 2021, which was around 9%. Advancements in battery technology & lowering lithium prices, including higher energy density and faster charging capabilities, government push to shift towards green mobility solutions, and improving charging infrastructure enable OEMs to launch vehicles with long-range driving abilities. Tesla, Nissan, and BMW are some automakers who have launched high-performance vehicles globally. Currently, halogen holds the largest market. However, by 2030, it will be replaced with LED technology due to several advantages such as superior energy efficiency, sharp & clear illumination, and lower power consumption than halogen and xenon lights. LED requires less power than other lights and provides better performance without impacting the battery performance and driving range. More efficient and powerful cars with long driving range are likely to be launched globally equipped with adaptive lighting and various lighting functions for exterior & interior applications such as tail lamps, side indicators, headlamps, parking lights, reverse lights, fog lights, daytime running lights (DRL), and interior cabin lights, the demand of advanced LED lighting solutions such as matrix LED, microLED, and OLED are expected to grow in the coming years.

Headlights are expected to witness the fastest growth in the two-wheeler lighting market.

The headlights segment will grow at a higher rate for the two-wheeler lighting market. The higher growth of the headlight segment is mainly influenced by the rising adoption of LED technology for front lighting. Halogen lights hold the maximum share for headlamps. However, LED lights have grown at a promising pace in recent years. Earlier, LED headlamps were limited to expensive bikes only. Now, two-wheelers sold in developing countries are also equipped with LED headlamps owing to various advantages, including power saving, sharp & bright view, and improved appearance. In recent years, many motorbikes and scooters have launched with LED front lighting in the global market. For instance, in June 2023, KTM launched the KTM 200 Duke, equipped with LED headlamps. In Oct 2023, Royal Enfield launched its Super Meteor 650 in the US and Canada. This bike has a circular LED headlamp, the company’s triple navigation system, Bluetooth connectivity, and a USB charging port. In August 2023, Hera launched its Hero Karizma XMR, equipped with LED projector lights and an H-shaped DRL pattern. In 2022, OLA launched its Ola S1 Pro is equipped with two projector lamps and the smiley-faced LED daytime running light. Modern two-wheeler OEMs increasingly focus on using LED lights for headlights, creating futuristic opportunities for the two-wheeler lighting suppliers.

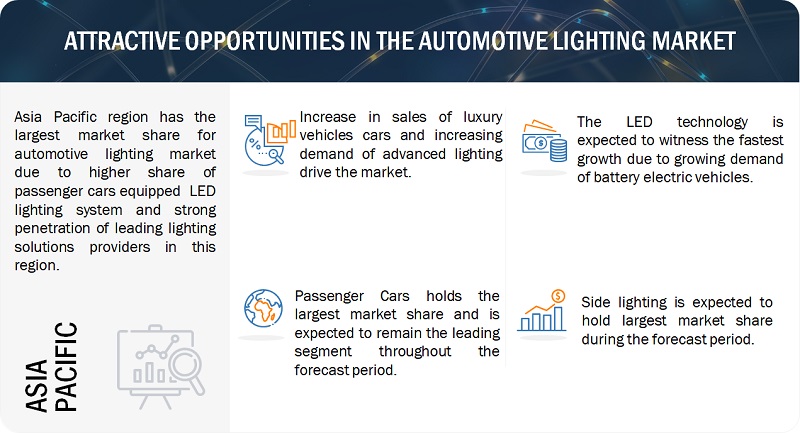

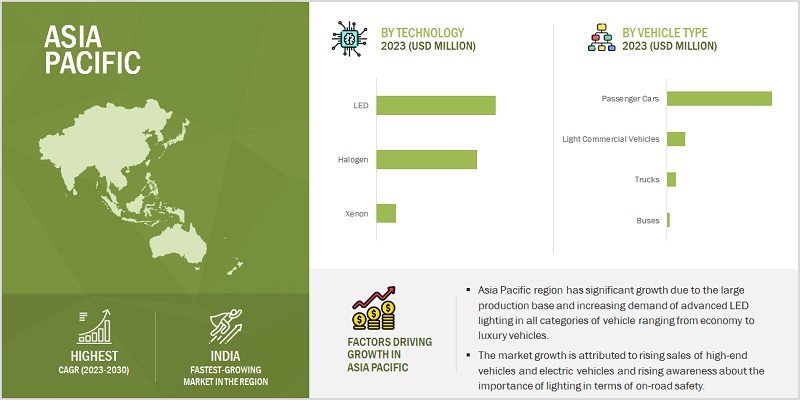

Asia Pacific is the largest region in the Automotive Lighting market.

Asia Pacific is expected to be the most lucrative market for automotive lighting during the forecast period. Asia Pacific nations such as India and China have witnessed significant automotive production and sales growth over the past few years, mainly in the medium to premium luxury cars. According to MarketsandMarkets analysis, the passenger car production in Asia Pacific is expected to grow from ~42 million units in 2023 to ~47 million units by 2030, with India witnessing the fastest growth rate. The region has an adequate mix of economy to high-end vehicles depending upon the country's economic condition. For instance, India and China have higher production of economy and mid-range vehicles, due to which halogen, Xenon/HID, and LED have considerably significant demand. Alternatively, Japan and South Korea have higher adoption rates of premium vehicles, mostly equipped with LED lighting technologies. However, with increasing disposable income and changing consumer preferences, the demand for premium vehicles is growing, resulting in higher growth of advanced automotive lighting solutions in the region. Key automotive lighting suppliers in the region such as Varroc (India), Lumax Industries Ltd. (India), Hyundai Mobis (South Korea), Denso Corporation (Japan), Koito Manufacturing Co., Ltd. (Japan), and Keboda (China) support the R&D and supply demand of automotive lighting in the region.

Key Market Players

The Automotive Lighting market is consolidated with players such as Koito Manufacturing (Japan), Magnetic Marelli (Italy), Valeo (France), HELLA GmbH & Co. KGaA (Germany), Stanley Electric (Japan), are the prominent players in the Automotive Lighting market. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the Automotive Lighting market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Market Growth forecast |

USD 30.38 billion by 2030 from USD 22.53 billion in 2023 at a CAGR of 4.4% |

|

Forecast period |

2023–2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By technology type, by application, by position, by vehicle type, by electric & hybrid application, by electric & hybrid vehicle technology, by electric & hybrid vehicle type, by two-wheeler position type, and by region |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World. |

|

Top Players |

Koito Manufacturing Co., Ltd. (Japan), Magnetic Marelli (Italy), Valeo SA (France), HELLA GmbH & Co. KGaA (Germany) and Stanley Electric Co., Ltd (Japan). |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the Automotive Lighting Market:

Automotive Lighting Market, By Technology Type

- HALOGEN

-

LED

- OLED

- MATRIX LED

- XENON/HID

Automotive Lighting Market, By Application

- Front Lighting

- Rear Lighting

- Side Lighting

- Interior Lighting

Automotive Lighting Market, By Vehicle Type

- Passenger cars

- Light Commercial Vehicles

- Trucks

- Buses

Automotive Adaptive Lighting Market, By Type

-

Front Adaptive Lighting

- Auto On/Off

- Bending/Cornering Lights

- High Beam Assists

- Headlight Levelling

- Rear Adaptive Lighting

- Ambient Lighting

Electric & Hybrid Lighting Market, By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Vehicle (PHEV)

- Fuel-cell Electric Vehicle (FCEV)

Electric & Hybrid Lighting Market, By Technology

- HALOGEN

- LED

- XENON/HID

Electric & Hybrid Lighting Market, By Application

- Exterior Lighting

- Interior Lighting

Two-Wheeler Lighting Market, By Position

- Font

- Side

- Rear

Automotive Lighting Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- in November 2023, HELLA launched its new HELLA Value Fit BLADE auxiliary headlamp series primarily for trucks and off-road vehicles. These auxiliary headlamps are equipped with innovative LED lighting technology and provide a new growth path entry into the world of LED vehicle lighting.

- In July 2023, HELLA and Porsche launched the world's first high-resolution headlamp powered by matrix LED technology. This raised automotive lighting technology to a new level.

- In July 2022, HELLA introduced the next generation of ambient lighting. The new HELLA Slim Light System can indirectly set the interior scene and enable wide-area lighting, such as in the door. The most striking feature of this system is its slim design and lightweight. It can be embedded between several layers, not exceeding a thickness of eight millimeters. By way of comparison, current systems measure around 20 millimeters.

Frequently Asked Questions (FAQ):

What is the current size of the Automotive Lighting Market?

The automotive lighting market is estimated to be worth USD 22.5 billion in 2023 and is projected to reach USD 30.4 billion by 2030 at a CAGR of 4.4%.

Which adaptive lighting applications (On/Off, bending/curve, high beam assist, headlight leveling, rear adaptive, ambient light) will fare ahead of the others?

Ambient lighting is expected to lead the automotive lighting market in the type segment.

What are the key market trends impacting the growth of the automotive lighting market?

Increased R&D by automakers to develop advanced lighting systems, such as front adaptive lighting with better illumination and enhanced safety and visibility, is expected to boost the automotive lighting market. Also, global OEMs continuously collaborate with domestic players in emerging economies to develop products tailored to customer needs.

Which technologies (halogen, LED, xenon) will likely be implemented the most during the next eight years?

The automotive lighting market for LED technology is estimated to be the fastest-growing market. LED is the most convenient technology for adaptive lighting features, especially in cars. And as the market share of premium cars increases, the demand for LED is expected to grow further. However, cheaper technologies are expected to remain popular in cost-sensitive regions as LED is more expensive than halogen and xenon.

What are the key challenges for the seamless growth of the automotive lighting market?

Shortages in semiconductor chip production, volatility of raw material prices, growing competitive rivalry from local companies, and comparatively lower penetration of advanced lighting in commercial vehicles are expected to present challenges for the automotive lighting market.

Which vehicle type dominates the Automotive Lighting market?

The passenger cars segment market is estimated to dominate with a more than 77% market share.

What are the trends in the Automotive Lighting market?

Stringent government regulations for automotive lighting and technological advancement will generate opportunities for the automotive lighting market, which is expected to see growth opportunities as the Automotive Lighting ecosystem develops.

Which position type is dominating the two-wheeler lighting market?

The side lighting segment is estimated to dominate the two-wheeler lighting market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study of the Automotive Lighting Market. The study involved four main activities in estimating the current size of the Automotive Lighting Market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the existing vehicle models & their light technologies, upcoming technologies, and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the Automotive Lighting Market. Secondary sources include company annual reports/presentations, press releases, and industry association publications such as publications of the American Lighting Association (ALA), Canadian Automobile Association (CAA), China Association of Automobile Manufacturers (CAAM), Automotive Component Manufacturers Association of India (ACMA), and European Automobile Manufacturers Association (EAMA) among others. Additionally, secondary research has been carried out to understand the average count of various lights by vehicle type, historical production, and sales of new vehicles.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as ICE vehicle production and electric vehicle sales forecast, Automotive Lighting Market forecast and penetration rate, future technology trends, and upcoming technologies in the Automotive Lighting industry. Data triangulation was then done with the information gathered from secondary research. Stakeholders from the demand and supply side have been interviewed to understand their views on the points mentioned above.

Primary interviews have been conducted with market experts from Automotive Lighting manufacturers and technology providers across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. A similar percentage of primary interviews have been conducted with automotive lighting manufacturers, respectively. The data from primary interviews has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, manufacturing, and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

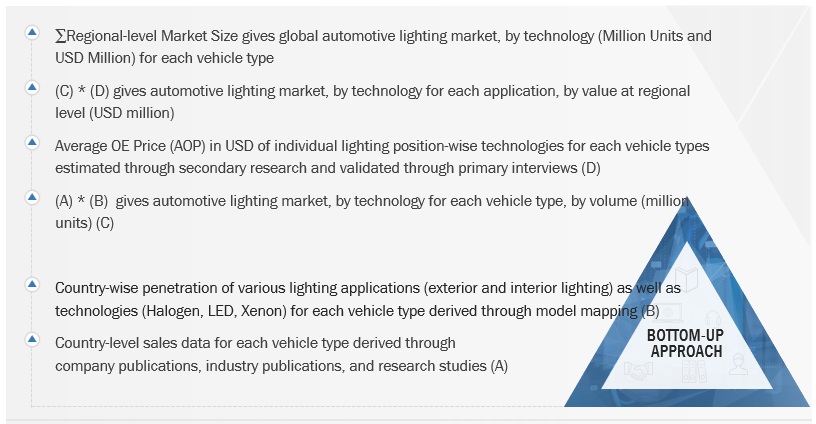

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the Automotive Lighting Market and other dependent submarkets, as mentioned below:

- Key players in the Automotive Lighting Market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included studying annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for Automotive Lighting were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Lighting Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and sub-segments—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends.

Market Definition

Automotive Lighting: An automotive lighting system consists of various lights and signaling devices that are fitted on the front, rear, side, and interior of the vehicle. These lights perform the primary function of providing illumination to the driver to drive safely in the dark. They may be used to enhance the visibility of an automobile, illuminate the interior, and act as a warning system for other vehicles. Automotive lighting ensures the vehicle's on-road safety and the pedestrian's by alerting the pedestrian about the vehicle's presence through exterior lighting.

Stakeholders

- Automotive OEMs

- Automotive lighting manufacturers and suppliers

- Automotive components and raw material suppliers for Automotive Lighting

- Traders and distributors of Automotive Lighting

- Automobile organizations/associations and government bodies

- Automotive software manufacturers and providers

- Authorized service centers and independent aftermarket service providers

- National and Regional Environmental Regulatory Agencies or Organizations

Report Objectives

-

To define, describe, and forecast the size of the Automotive Lighting market in terms of value (USD million) and volume (million units) as follows:

- Vehicle type (passenger car, light commercial vehicles, trucks, and buses)

- Technology (halogen, xenon/HID, LED, OLED, Matrix LED, LASER))

- Application {exterior (headlights, fog lights, daytime running lights (DRL), taillights, Center high mount stop lamp (CHMSL), and sidelights) and interior (dashboard, glove box, reading lights, and dome lights)}

- Electric & Hybrid vehicle lighting market, vehicle type (BEV, PHEV and FCEV)

- Electric & Hybrid vehicle lighting market, technology (halogen, xenon/HID, and light emitting diode (LED))

- Electric & Hybrid vehicle lighting market, application (Interior Lighting and Exterior Lighting)

- Two-wheeler automotive lighting market, by position (front, rear, and side)

- Automotive Adaptive lighting market, by type (front adaptive lighting (auto on/off, high beam assist, bending/cornering lights, and headlight leveling), rear adaptive lighting, and ambient lighting)

- Region [Asia Pacific, Europe, North America, and Rest of the World]

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market and provide the average selling price (ASP) analysis, and patent analysis.

- To evaluate the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To evaluate the dynamics of competitors in the Automotive Lighting market and distinguish them into stars, emerging leaders, pervasive players, and participants.

- To understand the dynamics of start-ups/SMEs prevalent in the market ecosystem of the Automotive Lighting market and distinguish them into progressive companies, responsive companies, dynamic companies, and starting blocks.

- To analyze the recent new developments, expansion strategies, collaborations, partnerships, joint ventures, mergers & acquisitions, and other activities carried out by key players in the Automotive Lighting market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Adaptive Module Market, By Function And Country

- Auto On/Off Function

- Bending/Cornering

- High Beam Assist

- Headlight Levelling

Two-Wheeler Automotive Lighting Market, By Vehicle Type

- Motorcycle

- Scooter/Moped

(Note: Countries included in the study: China, India, Japan, South Korea, Thailand, Germany, UK, France, Spain, Italy, US, Canada, Mexico, Brazil, Russia.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Lighting Market

We were wondering if the report has historical yearly market sizes from 2010 to the current year (e.g. market sizes for total automotive lighting and LED lighting for 2010, 2011, 2012...2016)?

I am looking for a automotive lighting market analysis for my MMBA thesis. Thanks for any support.

I am looking for a reliable source of clear and conclusive quantitative data. Your report above seems to contain what I need, but also many other items of information that I certainly do not need. Main topics of interest:- Car Interior Lighting Market size and growth - Car Interior technologies and their relative importance over time - Main players (designers and makers of car interior lighting solutions in terms of market share). Supply chain of car interior lighting (for the most common applications/functions). I was wondering if you could offer a customised report with this information and if so, under what conditions. Please contact my by email, phone is not preferred due to frequent traveling and meetings. Thank you in advance!

We are a supplier to the Automotive Lighting Industry and I am interested to see if this report is specific with trends by manufacture and or information on Tier 2 suppliers.

Current status and future outlook of the car lighting market, including a split between different technologies: LED, halogen, Xenon. Ideally also a split by brand (which brand will use which technology)

Understand the automotive light market specifically for India with Global Trends in Automotive Lighting

Hi would require this today for preparation for an interview with Osram Market size in UK and growth area for automotive lighting and online platform how to target

1/In which form is the report delivered? 2/Can we also get the raw data in form a database excel? 3/For passenger car would it be possible to have an analyzis by vehicle segments (A, B, C, D, .....)?

Automotive front lighting technologies, specifically penetration rates of LEDs going forward (e.g. by 2018, 2023, etc.)

Before ordering the report, I would like to get the sample for evaluation. Thanks in advance, Best regards,