Aviation MRO Market by Industry (Commercial Aviation, Military Aviation, Cargo), End User (OEM, Airlines, Leasing Company), Type (MRO Equipment, MRO Services, MRO Software) and Region - Global Forecast to 2025

Exhaustive secondary research was undertaken to obtain information on the Aviation MRO market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing by industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and aircraft parts and component research papers.

Primary Research

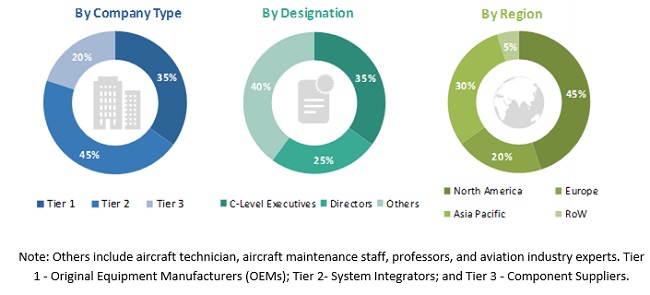

The Aviation MRO market comprises several stakeholders, such as raw material suppliers, processors and software solution providers, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by various end users, such as leasing companies, airlines, OEMs and third party facility providers. The supply-side is characterized by technology advancements in Aviation MRO and the developments in software and hardware maintenance, new software and hardware upgrades. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the Aviation MRO market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the aircraft MRO industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Aviation MRO market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for 5 regions, namely, North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, acquisitions, and new product developments

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Industry, End User, Type and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East and RoW |

|

Companies covered |

Luftancsa(Germany), SIA Engineering Company (Singapore),SR Technics (Switzerland),United Airlines (US),British Airways(UK),HAECO (Hongkong), AAR Corporation (US), etc. |

This research report categorizes the Aviation MRO market based on Industry, End User, Type and Region.

On the basis of Industry, the Aviation MRO market has been segmented as follows:

- Commercial Aviation

- Military Aviation

- Cargo

On the basis of End user, the Aviation MRO market has been segmented as follows:

- OEM’s

- Airlines

- Leasing Companies

On the basis of Type, the Aviation MRO market has been segmented as follows:

-

MRO Equipment

-

GSE Equipment

- Bulk Loaders/Conveyors

- Cabin Service Vehicles

- Boarding Stairs

- Lavatory Service Vehicles

- Passenger Boarding Bridges

- Passenger Buses

- Cargo/Container Loaders

-

Aircraft Equipment

- Engine

- Landing gear

- Airframe

- Interiors

- Others

-

GSE Equipment

-

MRO Services

- Engines Maintenance

- Line maintenance

- Component maintenance

- Airframe maintenance

- Modifications

-

MRO Software

- Enterprise Resource Planning (ERP) Solution

- Point Solution

On the basis of region, the Aviation MRO market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (RoW)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product and Solution Analysis

- Product and Solution matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

-

5.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY AIRCRAFT TYPE

-

5.4 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.5 TRENDS/DISRUPTION IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFT & NEW REVENUE POCKETS FOR AIRCRAFT MRO

-

5.6 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

5.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY REGULATIONS/ REGULATORY FRAMEWORK

-

5.8 CASE STUDY ANALYSIS

- 5.9 OPERATIONAL DATA

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS 2025-2026

- 5.12 INVESTMENT & FUNDING SCENARIO

- 5.13 TOTAL COST OF OWNERSHIP

- 5.14 BUSINESS MODEL

- 5.15 BILL OF MATERIALS

- 5.16 MACROECONOMIC OUTLOOK

- 5.17 IMPACT OF AI/GEN AI

- 5.18 TECHNOLOGY ROADMAP

-

5.19 TECHNOLOGY ANALYSISKEY TECHNOLOGIESCOMPLEMENTARY TECHNOLOGIESADJACENT TECHNOLOGIES

-

5.20 PATENT ANALYSIS

- 5.21 IMPACT OF 2025 US TARIFF – AIRCRAFT MRO

- 6.1 INTRODUCTION

- 6.2 ENGINE

- 6.3 WHEEL AND BRAKES

- 6.4 LANDING GEAR

- 6.5 AVIONICS

- 6.6 FUEL SYSTEM

- 6.7 HYDRAULIC SYSTEM

- 6.8 COCKPIT SYSTEMS

- 6.9 FLIGHT CONTROL

- 6.10 ELECTRICAL SYSTEMS

- 6.11 THRUST REVERSER

- 6.12 AEROSTRUCTURES

- 6.13 OTHERS

- 7.1 INTRODUCTION

- 7.2 AIRLINE

- 7.3 ORIGINAL EQUIPMENT MANUFACTURER (OEM)

- 7.4 LEASING COMPANY

- 8.1 INTRODUCTION

-

8.2 COMMERCIAL AVIATIONNARROW-BODY AIRCRAFTWIDE-BODY AIRCRAFTREGIONAL TRANSPORT AIRCRAFT

-

8.3 BUSINESS & GENERAL AVIATIONBUSINESS JETSLIGHT AIRCRAFTCOMMERCIAL HELICOPTER

-

8.4 MILITARY AIRCRAFTFIGHTER AIRCRAFTTRANSPORT AIRCRAFTMILITARY HELICOPTER

- 9.1 INTRODUCTION

- 9.2 INSPECTION

- 9.3 OVERHAUL

- 9.4 REPAIRS

- 9.5 OTHERS

- 10.1 INTRODUCTION

- 10.2 IN-HOUSE MRO

- 10.3 THIRD-PARTY MRO

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUSCANADA

-

11.3 EUROPEFRANCEGERMANYUKITALYSPAINREST OF EUROPE

-

11.4 ASIA PACIFICCHINAINDIAJAPANAUSTRALIASOUTH KOREAREST OF ASIA PACIFIC

-

11.5 MIDDLE EASTGCC COUNTRIES- UAE- SAUDI ARABIATURKEYREST OF THE MIDDLE EAST

-

11.6 LATIN AMERICABRAZILMEXICOREST OF LATIN AMERICA

-

11.7 AFRICASOUTH AFRICAREST OF AFRICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHTS TO WIN

- 12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2024

- 12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2024

- 12.5 COMPETITIVE OVERVIEW

-

12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- COMPANY FOOTPRINT- REGION FOOTPRINT- AIRCRAFT TYPE FOOTPRINT- COMPONENT FOOTPRINT- ENDUSER FOOTPRINT

-

12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- DETAILED LIST OF KEY STARTUPS/SMES- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

-

12.9 COMPETITIVE SCENARIODEALSCONTRACTSPARTNERSHIPS, AGREEMENTS, JOINT VENTURES, AND COLLABORATIONSPRODUCT LAUNCHES

- 12.10 BRAND/ PRODUCT/ TECHNOLOGY COMPARISON

- 13.1 INTRODUCTION

-

13.2 MRO PROVIDERSLUFTHANSA TECHNIKSIA ENGINEERING COMPANYAAR CORP.ST ENGINEERINGHAECO GROUPSR TECHNICSSTANDARDAEROTURKISH TECHNICAMETEK MRO- AIR WORKS GROUP- GMR AERO TECHNIC LIMITED

-

13.3 AIRLINE MRODELTA TECHOPSAIR FRANCE INDUSTRIES KLM ENGINEERING & MAINTENANCEEMIRATES ENGINEERINGTAP MAINTENANCE & ENGINEERINGBRITISH AIRWAYS ENGINEERINGAIR INDIA ENGINEERING SERVICES LTD (AIESL)

-

13.4 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) MROROLLS-ROYCE PLCGE AEROSPACEMTU AERO ENGINES AGSAFRAN SAAIRBUS SEBOEING GLOBAL SERVICESPRATT & WHITNEYBOMBARDIER MRONORDAM- OEMSERVICES

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATION

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- 14.6 COMPANY LONG LIST

Growth opportunities and latent adjacency in Aviation MRO Market