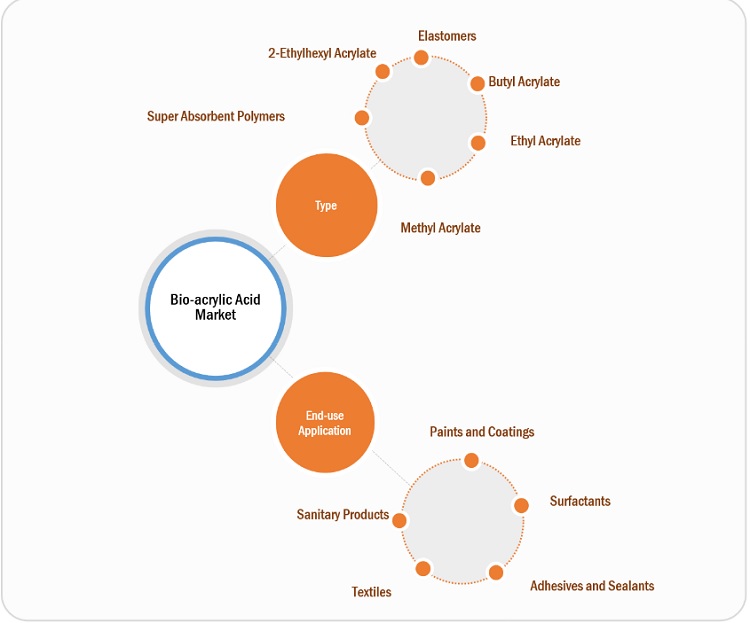

Bio-Acrylic Acid Market By Type (Methyl acrylate, ethyl acrylate, butyl acrylate, elastomers, 2-ethylhexyl acrylate, superabsorbent polymers), Application and Region (North America, Europe, the Asia Pacific, and the Rest of the World.) - Global Forecast to 2027

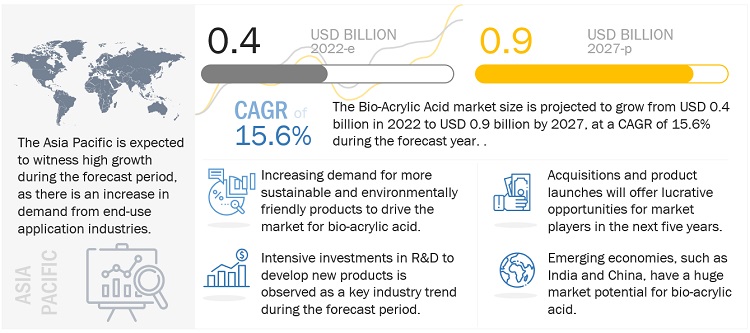

The Bio-Acrylic Acid market size is projected to grow from USD 0.4 billion in 2022 to USD 0.9 billion by 2027, at a CAGR of 15.6% during the forecast year. The growth of this market is ascribed to the growing demand for more sustainable and environmentally friendly products, and bio-acrylic acid offers a more sustainable alternative to traditional acrylic acids. Countries such as India, Taiwan, and Indonesia are also witnessing a fast-growing end-use application industry. These countries are welcoming foreign investments and global manufacturers to set up manufacturing facilities is a major opportunity in the market. However, the main challenge for bio-acrylic acid is the cost of production may hinder the growth of the market.

Attractive Opportunities in the Bio-Acrylic Acid Market

To know about the assumptions considered for the study, Request for Free Sample Report

Bio-Acrylic Acid Market Dynamics

Drivers- Rapid expansion and growing applications of superabsorbent polymers

- Increasing demand from end-use applications and newer applications due to extensive research & development are the major driving forces for strategic expansions, such as the deliberate and well-planned approach to expanding the production, distribution, and/or sales of bio-acrylic acid to capture a larger share of the market. The bio-acrylic acid market is expected to witness steady growth over the forecast period as economies around the world accelerate. The market for acrylates and superabsorbent polymers is rapidly expanding with the increasing demand from existing and emerging end-use applications. Superabsorbent polymers are plastics that have the capability to absorb and hold up the weight of salty body fluids, including urine, even under pressure. They are used in the form of grainy white powder in baby diapers and agricultural mulching. The US Environmental Protection Agency estimates that 16 billion disposable nappies are used every year in the US. Consumers have been showing a growing demand for superabsorbent materials. This has created a platform for the key producers of bio-acrylic acids to invest in expansions to meet the increasing demands.

Restraints- High production cost

- The technology for producing bio-acrylic acid is still relatively new and requires significant research and development. This research and development can be expensive, which can drive up the cost of bio-acrylic acid production. The feedstocks used to produce bio-acrylic acid, such as sugar and corn, can be more expensive than the petrochemicals used to produce traditional acrylic acid. The yield of bio-acrylic acid production is still relatively low, which means that more raw materials are required to produce the same amount of bio-acrylic acid as traditional acrylic acid. This can drive up the cost of bio-acrylic acid production.

Opportunities- Opportunities with new applications

- One of the main factors influencing the market is the rising demand for to produce sustainable coatings for various applications, such as automotive coatings, architectural coatings, and industrial coatings. Bio-acrylic acid can offer similar performance to traditional acrylic acid coatings while being more environmentally friendly. Bio-acrylic acid can be used to produce bio-based adhesives for applications such as woodworking, paper and packaging, and construction. Bio-acrylic acid can offer better adhesion properties and improved sustainability compared to traditional acrylic acid adhesives. These new applications can help to differentiate bio-acrylic acid from traditional acrylic acid and create new market opportunities. As companies seek to reduce their environmental footprint and meet sustainability goals, the demand for bio-acrylic acid-based products is expected to increase.

Challenges - Competition from traditional acrylic acid

-

Traditional acrylic acid, also known as petroleum-based acrylic acid, is a well-established product in the market and is widely used in various applications, including coatings, adhesives, superabsorbent polymers, and plastics. As a result, bio-acrylic acid faces significant competition from traditional acrylic acid.

One of the main challenges for bio-acrylic acid is the cost of production. Bio-acrylic acid is currently more expensive to produce than traditional acrylic acid due to the high cost of feedstocks and the complex fermentation process required to produce it. This makes it difficult for bio-acrylic acid to compete on price, especially in applications where cost is the primary consideration.

Bio- Acrylic Acid Market: Ecosystem

The Butyl Acrylate segment to register the highest CAGR during forecast period.

Demand for silanes to be driven by increasing investment in major infrastructure projects across the world especially in asia pacific region. Building & construction is a major end user of silanes. Silanes are widely used in buildings for the protection of the building environment from deterioration. This sector includes coating materials for construction areas such as food & beverage production facilities, hospitals, pharmaceutical manufacturing areas, and kitchens. Because of advancements in silanes coatings making it suitable for various infrastructure construction.

By Type, mono/chloro silanes segment accounted for the highest CAGR during the forecast period

The use of bio-based acrylic acid to produce butyl acrylate offers an opportunity to develop more sustainable and eco-friendly products, which can help meet the growing demand for sustainable solutions across various industries. Several companies and research institutes are working on developing new and innovative technologies to produce bio-based acrylic acid and its derivatives, including butyl acrylate. These technologies include fermentation-based and chemical catalysis-based processes. They offer the potential to produce bio-based chemicals in a more sustainable and eco-friendly way.

The Paint and coatings segment accounted the largest market share in 2022.

Bio-acrylic acid and its derivatives are increasingly being used as raw materials in the production of paints and coatings. Bio-acrylic acid is commonly used in the production of acrylic emulsion paints, which are water-based paints that are widely used in the construction industry. These paints are valued for their low odor, low VOC emissions, and easy clean-up with water. Acrylic emulsion paints made from bio-acrylic acid are also more resistant to fading and chalking, and they have excellent adhesion to various surfaces. Overall, the use of bio-acrylic acid in paints and coatings offers a promising pathway toward more sustainable and eco-friendly products, which can help meet the growing demand for sustainable solutions in the construction, automotive, and industrial sectors.

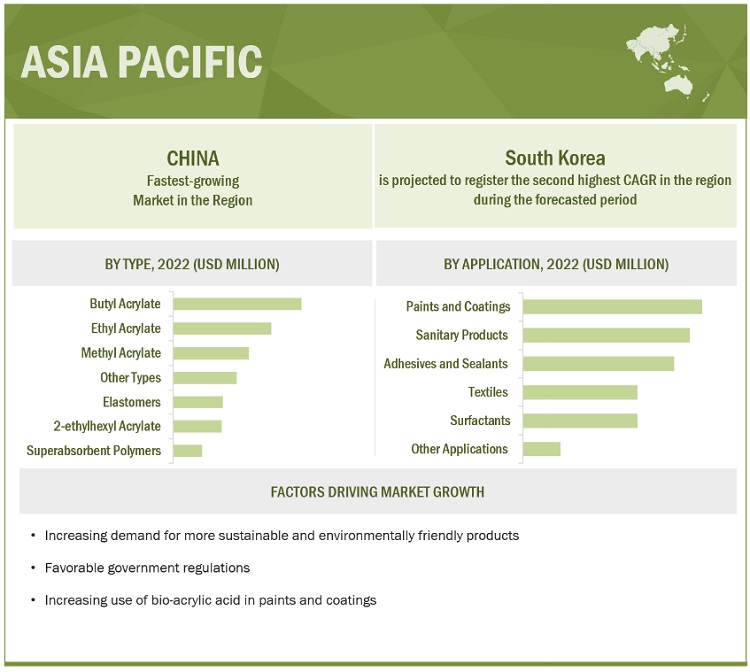

The Asia Pacific is the largest Bio- Acrylic Acid market during the forecast period.

The Asia Pacific market includes China, Japan, India, South Korea, Indonesia, Thailand, and Malaysia as major markets for bio-acrylic acid. Paints & coatings and sanitary products are the largest applications of bio-acrylic acid in terms of volume. The Asia Pacific recovered faster to the pre-COVID bio-acrylic acid market size than other regions due to the early opening of the Chinese economy, which is a major consumer of bio-acrylic acid. Growing industrial activities have increased the demand for bio-acrylic acid. Developments in the country’s economic activities have led to the increasing demand for bio-acrylic acid in paints and coating, surfactants, adhesives and sealants, and other applications. This trend is expected to continue in the future with the establishment of new plants and capacity additions in the present plants.

To know about the assumptions considered for the study, download the pdf brochure

Key players such as Arkema SA (France), BASF SE (Germany), LG Chem Ltd.(Korea), China Petroleum and Chemical Corporation (China), NIPPON SHOKUBAI CO., LTD(Japan), The Dow Chemical Company (US), Evonik Industries AG (Germany), and SIBUR (Russia) have adopted various growth strategies, such as acquisitions, contracts, agreements, and new projects to increase their market shares and enhance their product portfolios.

Arkema SA manufactures and distributes chemical products. High-performance Materials, Industrial Specialty, and Coating Solutions are the company’s business segments. The High-performance Materials segment, which includes the Technical Polymers, Filtration and Adsorption, and Organic Peroxides business units, offers high-value solutions used in a variety of industries, including transportation, oil extraction, renewable energies, consumer goods, electronics, construction, coatings, and water treatment. Thiochemicals, fluorochemicals, polymethyl methacrylate, and hydrogen peroxides are all part of the Industrials Specialty category. The Coating Solutions segment offers solutions for ornamental paints, industrial coatings, adhesives, and high-growth acrylic applications.

The Dow Chemical Company, commonly referred to as Dow, manufactures and supplies various chemicals used primarily as raw materials for manufacturing processes in industries such as appliance, automotive, agricultural, building & construction, electronics, furniture, chemical processing, houseware, oil & gas, packaging, paints, coatings & adhesives, personal care, pharmaceutical, processed foods, pulp & paper, textile & carpet, utilities, and water treatment. The company’s global operations are carried out through six global businesses, which are organized into the following operating segments: Industrial Intermediates & Infrastructure, Performance Materials & Coatings, and Packaging & Specialty Plastics. Bio-based plasticizers, ethylene copolymer resins, methacrylic acid copolymer resins, low-density polyethylene (LDPE), high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), ethylene vinyl acetate (EVA), polyethylene (PE), and elastomers are among the products offered by its packaging and specialty plastics business. Dow has over 109 manufacturing facilities in 31 countries across the globe. The strong global presence has allowed the company to develop strong value chains that have helped in the company’s survival.

Evonik Industries AG is engaged in the manufacturing of specialty chemical products. It operates through key business segments, including Nutrition & Care, Performance Materials, Smart Materials, Specialty Adhesives, and Technology & Infrastructure. The company’s Performance Materials division comprises the Performance Polymers and Intermediates business units. This segment serves various end-use industries, such as electronics, automotive, aviation, and photovoltaic (PV). The subsidiaries of the company are Evonik Degussa GmbH (Germany), Evonik Degussa Antwerpen NV (Belgium), and Evonik Degussa Canada, Inc. (Canada). It has manufacturing operations in 102 locations across 27 countries and a global footprint in 100 countries.

Recent Developments

- In March 2022, Evonik launched its first renewable isophorone-based products. The new eCO series helps to reduce CO2 emissions and enables more sustainable solvents, composites, and coatings.

- In February 2022, Mitsubishi Chemical announced plans to build a pilot plant for plant-based MMA monomers. Mitsubishi Chemical Corporation and its subsidiary Mitsubishi Chemical Methacrylates developed a manufacturing technology for methyl methacrylate (MMA) monomers that use plant-derived materials.

- In August 2021, As part of Dow’s efforts to improve reliability and access to raw materials through larger, centralized capacity, the company announced that it is making an investment in methyl acrylate production in the US Gulf Coast.

Frequently Asked Questions (FAQ):

What are your views on the growth prospects of the Bio- Acrylic Acid market?

The increased usage of bio acrylic acid in hygiene products and paints and coating applications will drive the Market.

What is the current scenario, and how will it change in the future?

In the current scenario bio acrylic acid Market is in starting stage / emerging stage. The usage of Bio acrylic acid in applications will generate demand.

What are the trends in the Bio- Acrylic Acid market? How do you see the market changing in the future?

North America is expected to have a significantly consistent revenue growth rate. This is due to the fast expansion of the superabsorbent polymer industry. This is projected to boost bio-based acrylic acid use and drive global revenue growth. Furthermore, increased knowledge of the environmental benefits of using renewable and bio-based products. This is projected to boost revenue growth in the industry.

Who are the major players in the Bio- Acrylic Acid market?

BASF SE, China Petroleum & Chemical Corporation (SINOPEC), Arkema S.A., Mitsubishi Chemical Holdings Corporation., The Dow Chemical Company, The Lubrizol Corporation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for more sustainable and environmentally friendly products- Rapid expansion and growing applications of superabsorbent polymers- Favorable government regulationsRESTRAINTS- High production costs- Technical restraintsOPPORTUNITIES- Increasing demand in emerging economies- Opportunities with new applicationsCHALLENGES- Competition from traditional acrylic acid

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.6 PRICING ANALYSIS

-

5.7 ECOSYSTEM MAP

- 5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 REGULATION LANDSCAPENORTH AMERICAEUROPEASIA PACIFIC

-

5.12 CASE STUDY ANALYSISCOLLABORATION BETWEEN CARGILL AND NOVOZYMES TO DEVELOP MORE SUSTAINABLE AND COST-EFFECTIVE PRODUCTION PROCESS FOR BIO-ACRYLIC ACID

-

5.13 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.14 CERTIFICATION LANDSCAPEINTERNATIONAL SUSTAINABILITY AND CARBON CERTIFICATION (ISCC)BIODEGRADABILITY CERTIFICATIONS, SUCH AS EUROPEAN STANDARD EN 13432 OR US STANDARD ASTM D6400USDA BIOPREFERRED PROGRAM OR EUROPEAN BIO-BASED INDUSTRIES CONSORTIUM (BIC) CERTIFICATION

- 5.15 ENVIRONMENTAL LANDSCAPE

- 6.1 INTRODUCTION

-

6.2 METHYL ACRYLATEADVANCEMENTS IN SUSTAINABLE PRODUCTION AND CONSUMPTION OF METHYL ACRYLATE TO SUPPORT MARKET GROWTH

-

6.3 ETHYL ACRYLATENEED FOR SUSTAINABLE MANUFACTURING TO DRIVE USE OF BIO-ACRYLIC ACID IN PRODUCTION OF ETHYL ACRYLATE

-

6.4 BUTYL ACRYLATELARGEST MARKET FOR BIO-ACRYLIC ACID IN TERMS OF VALUE AND VOLUME

-

6.5 2-ETHYLHEXYL ACRYLATELOW REACTIVITY AND VOLATILITY TO DRIVE DEMAND FOR 2-EHA

-

6.6 ELASTOMERSPRODUCTION OF ELASTOMERS FROM BIO-ACRYLIC ACID INVOLVES COPOLYMERIZATION WITH OTHER MONOMERS

-

6.7 SUPERABSORBENT POLYMERSUSED IN WIDE RANGE OF APPLICATIONS, INCLUDING HYGIENE PRODUCTS AND AGRICULTURAL APPLICATIONS

-

6.8 OTHER TYPESSPECIALTY ACRYLATEBENZYL ACRYLATEHYDROXYPROPYL ACRYLATEWATER TREATMENT POLYMERSACRYLIC POLYMERSAMMONIUM POLYACRYLATEPOLYCYANOACRYLATE

- 7.1 INTRODUCTION

-

7.2 PAINTS AND COATINGSECO-FRIENDLY AND SUSTAINABLE ALTERNATIVES TO PETROLEUM- BASED PRODUCTS

-

7.3 ADHESIVES AND SEALANTSHELP TO MEET INCREASING DEMAND FOR ECO-FRIENDLY SOLUTIONS IN VARIOUS INDUSTRIES

-

7.4 SURFACTANTSOFFER SEVERAL ADVANTAGES OVER TRADITIONAL SURFACTANTS DERIVED FROM PETROLEUM

-

7.5 TEXTILESGROWING TREND OF SUSTAINABILITY AND ECO-FRIENDLINESS TO DRIVE MARKET

-

7.6 SANITARY PRODUCTSDEMAND FOR SUSTAINABLE HYGIENE PRODUCTS TO SUPPORT MARKET GROWTH

-

7.7 OTHER APPLICATIONSADULT INCONTINENCE AND OTHER PERSONAL CARE PRODUCTSWATER TREATMENT (DISPERSANTS, ANTISCALANTS, AND THICKENERS)MINERAL PROCESSING

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICCHINA- Growing industrialization to drive demand for bio-acrylic acidJAPAN- Petrochemicals, pharmaceuticals, and textiles major industries contributing to consumption of bio-acrylic acidSOUTH KOREA- Increasing use of bio-acrylic acid in paints and coatings application to drive marketINDIA- Increasing investment in manufacturing sector to support market growthREST OF ASIA PACIFIC

-

8.3 EUROPEGERMANY- Presence of highly developed chemical industries to support market growthFRANCE- Growing interest and investment in development of bio-based chemicals to drive marketNETHERLANDS- Increasing demand from key bio-acrylic acid end-use industries to support market growthREST OF EUROPE

-

8.4 NORTH AMERICAUS- Largest market for bio-acrylic acid in North AmericaCANADA- Growing demand for sustainable products in various industries to drive marketMEXICO- Easy access to markets in US and Canada to support market growth

-

8.5 REST OF THE WORLDSOUTH AMERICA- Brazil key market in regionAFRICA- Offers growth opportunities for players in bio-acrylic acid marketMIDDLE EAST- Increasing demand from end-use applications to drive demand

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 STRATEGIC POSITIONING OF KEY PLAYERS

-

9.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

9.5 EVALUATION QUADRANT FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)RESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIES

- 9.6 REVENUE ANALYSIS OF TOP PLAYERS

- 9.7 COMPETITIVE BENCHMARKING

-

9.8 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewCHINA PETROLEUM AND CHEMICAL CORPORATION- Business overview- Products offered- Recent developments- MnM viewLG CHEM LTD.- Business overview- Products offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Products offered- Recent developments- MnM viewMITSUBISHI CHEMICAL HOLDINGS CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHE DOW CHEMICAL COMPANY- Business overview- Products offered- Recent developmentsARKEMA SA- Business overview- Products offered- Recent developments

-

10.2 OTHER PLAYERSNIPPON SHOKUBAI CO., LTD.THE LUBRIZOL CORPORATIONARCHER-DANIELS-MIDLAND COMPANYCARGILL, INCORPORATEDSASOL LIMITEDPOLYSCIENCES, INC.SAUDI ACRYLIC MONOMER COMPANY LIMITEDTOAGOSEI CO., LTD.ZHEJIANG SATELLITE PETROCHEMICAL CO. LTD.TAIXING JURONG CHEMICAL CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 BIO-ACRYLIC ACID MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 IMPORT SCENARIO FOR HS CODE 291611, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 3 EXPORT SCENARIO FOR HS CODE: 390330, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 4 BIO-ACRYLIC ACID: PRICING ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR BIO-ACRYLIC ACID IN TOP TWO END-USE INDUSTRIES

- TABLE 7 GRANTED PATENTS WERE 5% OF TOTAL COUNT IN LAST 10 YEARS

- TABLE 8 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 9 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 10 METHYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 11 METHYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 12 ETHYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 13 ETHYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 14 BUTYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 15 BUTYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 16 2-ETHYLHEXYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 17 2-ETHYLHEXYL ACRYLATE: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 18 ELASTOMERS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 19 ELASTOMERS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 20 SUPERABSORBENT POLYMERS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 21 SUPERABSORBENT POLYMERS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 22 OTHER TYPES: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 23 OTHER TYPES: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 24 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 25 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 26 PAINTS AND COATINGS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 27 PAINTS AND COATINGS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 28 ADHESIVES AND SEALANTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 ADHESIVES AND SEALANTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 30 SURFACTANTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 31 SURFACTANTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 32 TEXTILES: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 33 TEXTILES: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 34 SANITARY PRODUCTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 35 SANITARY PRODUCTS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 36 OTHER APPLICATIONS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 38 BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 39 BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 40 BIO-ACRYLIC ACID MARKET, BY FEEDSTOCK, 2021–2027 (TON)

- TABLE 41 BIO-ACRYLIC ACID MARKET, BY FEEDSTOCK, 2021–2027 (USD MILLION)

- TABLE 42 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (TON)

- TABLE 43 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 44 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 45 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 46 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 47 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 48 CHINA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 49 CHINA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 50 CHINA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 51 CHINA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 52 JAPAN: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 53 JAPAN: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 54 JAPAN: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 55 JAPAN: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 56 SOUTH KOREA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 57 SOUTH KOREA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 58 SOUTH KOREA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 59 SOUTH KOREA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 60 INDIA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 61 INDIA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 62 INDIA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 63 INDIA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 65 REST OF ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 66 REST OF ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 67 REST OF ASIA PACIFIC: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 68 EUROPE: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 69 EUROPE: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (TON)

- TABLE 70 EUROPE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 71 EUROPE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 72 EUROPE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 73 EUROPE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 74 GERMANY: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 75 GERMANY: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 76 GERMANY: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 77 GERMANY: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 78 FRANCE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 79 FRANCE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 80 FRANCE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 81 FRANCE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 82 NETHERLANDS: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 83 NETHERLANDS: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 84 NETHERLANDS: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 85 NETHERLANDS: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 86 REST OF EUROPE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 87 REST OF EUROPE: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 88 REST OF EUROPE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 89 REST OF EUROPE: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 90 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (TON)

- TABLE 91 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 93 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 95 NORTH AMERICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 96 US: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 97 US: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 98 US: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 99 US: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 100 CANADA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 101 CANADA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 102 CANADA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 103 CANADA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 104 MEXICO: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 105 MEXICO: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 106 MEXICO: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 107 MEXICO: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 108 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 109 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 110 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 111 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 112 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 113 REST OF THE WORLD: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 114 SOUTH AMERICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 115 SOUTH AMERICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 116 SOUTH AMERICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 117 SOUTH AMERICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 118 AFRICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 119 AFRICA: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 120 AFRICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 121 AFRICA: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 122 MIDDLE EAST: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 123 MIDDLE EAST: BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 124 MIDDLE EAST: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 125 MIDDLE EAST: BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 126 STRATEGIC POSITIONING OF KEY PLAYERS IN BIO-ACRYLIC ACID MARKET

- TABLE 127 BIO-ACRYLIC ACID MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 128 BIO-ACRYLIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 129 BIO-ACRYLIC ACID MARKET: KEY PRODUCT LAUNCHES

- TABLE 130 BIO-ACRYLIC ACID MARKET: KEY DEALS

- TABLE 131 BIO-ACRYLIC ACID MARKET: OTHER KEY DEVELOPMENTS

- TABLE 132 BASF SE: COMPANY OVERVIEW

- TABLE 133 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 134 LG CHEM LTD.: COMPANY OVERVIEW

- TABLE 135 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 136 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 137 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 138 ARKEMA SA: COMPANY OVERVIEW

- TABLE 139 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- TABLE 140 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 141 ARCHER-DANIELS-MIDLAND COMPANY: COMPANY OVERVIEW

- TABLE 142 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 143 SASOL LIMITED: COMPANY OVERVIEW

- TABLE 144 POLYSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 145 SAUDI ACRYLIC MONOMER COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 146 TOAGOSEI CO., LTD.: COMPANY OVERVIEW

- TABLE 147 ZHEJIANG SATELLITE PETROCHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 148 TAIXING JURONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 BIO-ACRYLIC ACID MARKET SEGMENTATION

- FIGURE 2 BIO-ACRYLIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 BIO-ACRYLIC ACID MARKET: DATA TRIANGULATION

- FIGURE 6 BUTYL ACRYLATE AND ETHYL ACRYLATE—LARGEST SEGMENTS OF BIO-ACRYLIC ACID MARKET, BY TYPE

- FIGURE 7 PAINTS & COATINGS AND SANITARY PRODUCTS DOMINATE BIO-ACRYLIC ACID APPLICATIONS MARKET

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 9 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES TO MARKET PLAYERS BETWEEN 2022 AND 2027

- FIGURE 10 BUTYL ACRYLATE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 BIO-ACRYLIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 BIO-ACRYLIC ACID MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 14 BIO-ACRYLIC ACID MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 15 BIO-ACRYLIC ACID MARKET: ECOSYSTEM MAP

- FIGURE 16 BIO-ACRYLIC ACID MARKET: TRENDS IMPACTING CUSTOMER BUSINESS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 18 KEY BUYING CRITERIA FOR PAINTS & COATINGS AND SANITARY PRODUCTS INDUSTRIES

- FIGURE 19 NUMBER OF PATENTS PUBLISHED FROM 2012–2022

- FIGURE 20 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 21 PATENT ANALYSIS, BY TOP JURISDICTION

- FIGURE 22 TOP 10 PATENT APPLICANTS

- FIGURE 23 BUTYL ACRYLATE ACCOUNTED FOR LARGEST SHARE OF BIO-ACRYLIC ACID MARKET IN 2022 (TON)

- FIGURE 24 PAINTS AND COATINGS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022 (TON)

- FIGURE 25 RAPIDLY GROWING MARKETS TO EMERGE AS NEW HOTSPOTS

- FIGURE 26 ASIA PACIFIC: BIO-ACRYLIC ACID MARKET SNAPSHOT

- FIGURE 27 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIO-ACRYLIC ACID MARKET

- FIGURE 28 BIO-ACRYLIC ACID MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 29 EVALUATION QUADRANT FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- FIGURE 30 REVENUE ANALYSIS OF KEY COMPANIES IN BIO-ACRYLIC ACID MARKET

- FIGURE 31 BASF SE: COMPANY SNAPSHOT

- FIGURE 32 CHINA PETROLEUM AND CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 33 LG CHEM LTD.: COMPANY SNAPSHOT

- FIGURE 34 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 35 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 37 ARKEMA SA: COMPANY SNAPSHOT

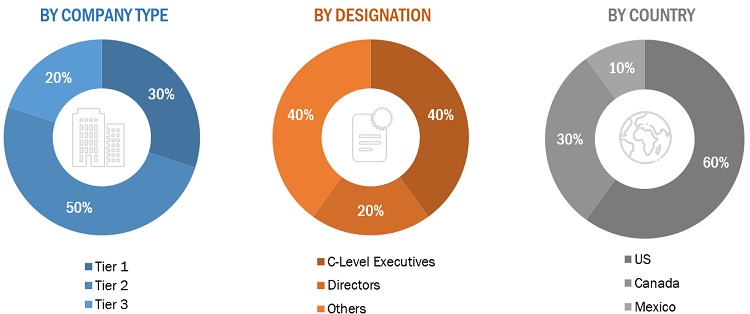

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Bio-Acrylic Acid market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Bio-Acrylic Acid market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Bio-Acrylic Acid market. Primary sources from the supply side include associations and institutions involved in the Bio-Acrylic Acid industry, key opinion leaders, and processing players. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Bio-Acrylic Acid market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives:

- To define, describe, and forecast the Bio-Acrylic Acid market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, reinforcement material, resin type, region, and end-use application.

- To forecast the market size, in terms of value and volume, with respect to region.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company.

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bio-Acrylic Acid Market