Blockchain in Agriculture and Food Supply Chain Market by Application (Product Traceability, Payment and Settlement, Smart Contracts, and Governance, Risk and Compliance Management), Provider, Organization Size, and Region - Global Forecast to 2025

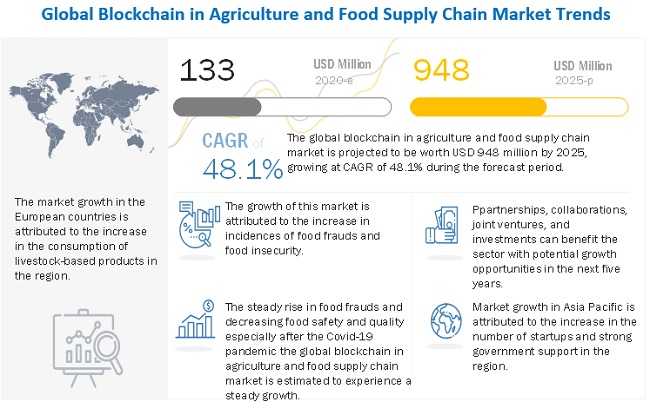

[179 Pages Report] The global blockchain in agriculture and food supply chain market size is estimated at USD 133 million in 2020; it is projected to grow at a CAGR of 48.1% to reach USD 948 million by 2025. This growth is driven by the increasing demand among stakeholders to trace and track the raw materials and final products which increases the trust among all stakeholders. The consumers are becoming more aware of provenance and hence players in food industry are now relying more on blockchain technology. Moreover, after COVID-19 pandemic most of the consumers have shifted on online platforms and so have the players. Blockchain technology helps these players to have safe payment transactions online. These factors are projected to boost the market growth during the review period.

Every year around one-third of the food produced across the world is wasted according to the Food and Agriculture Organization (FAO). Around 40% of food loss occurs at the processing stage in developing nations. Blockchain helps in reducing the food loss as it allows organizations to control the storage and transportation conditions on a real-time basis from processing to retailers. This minimize the amount of food wasted. One of the major focus of governments across the globe is to increase agricultural and food production and thus blockchain has attracted attention of many governments. Increasing initiatives from governments to incorporate blockchain technology presents ample opportunities for the key players in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Blockchain in agriculture and food supply chain Market

Amid the spread of the COVID-19 pandemic, the global food supply chains' numerous inefficiencies were realized globally. This has led to the probable opening of opportunities in the mid and long-term technological markets. The blockchain platform offers a repeatable framework for end-to-end digital trade executions. According to the World Economic Forum, blockchain technology is a highly effective solution to cope with the inefficiencies in supply chains surfaced by the pandemic. Alliances were conducted between companies such as Cargill and Agrocrop with Rabobank and other logistics and supplier organizations to pilot blockchain for faster cross-continental commodity trading. The imposition of lockdowns has made it further difficult to track many food products' origin, resulting in more hazardous food. According to the Global Food Safety Initiative (GFSI), food retailers across the world are also demanding certifications of suppliers to ensure food safety for every stakeholder in the value chain. Thus, the spread of the COVID-19 pandemic has led to the increasing use of blockchain in the food sector for traceability and transparency.

Blockchain in agriculture and food supply chain Market Dynamics

Driver: Rising concerns for food safety among consumers demanding transparency in the supply chain

Consumers to the present markets are aware of and demand full transparency in terms of their food product processes. With a view of fighting this issue of food safety, many companies have come up with pilot studies to use blockchain technology to determine and control the food product conditions throughout the supply chain. Food giants such as Nestle (Switzerland), Tyson Foods (US), Dole Food Company, and McCormick & Company have joined IBM (US) in a blockchain collaboration to explore blockchain applications for food safety.

Restraint: Uncertainty in regulations and standards

Even though blockchain technology's application holds great potential, the lack of regulations is posing a hindrance to its complete adoption. Governments can benefit by understanding that their intervention in the ecosystem can benefit the stakeholders by standardizing and regulating the technology. Still, it will also help the government collect taxes and limit distributed ledgers for criminal activities. Due to uncertain regulations, the blockchain technology market is also adversely impacted, as there is a lack of a common set of standards for carrying out transactions on the blockchain.

Opportunity: Increase in funding and investments in agri-food blockchain

The exponential growth of blockchain technology over the years, around different industry verticals, has fetched a huge amount of funding in the past few years. According to TechCrunch, from January to May 2018, the total capital raised through venture funds in blockchain technology amounted to USD 1.3 billion. This proves that venture capitalists see a promising future of blockchain technology. Similarly, major investments are also being made in the organizations offering blockchain solutions and platforms to the food and agriculture industry.

Challenge: Data mismanagement among growers during precision farming

The data obtained from farms using smart agricultural tools is of high importance as it helps make productive decisions. There is no industry standard for managing the agricultural data due to which this makes the task difficult for the growers. Many growers or farmers are not aware of the effective use of data for decision-making purposes. Therefore, it is important to provide farmers and growers with proper data management tools and techniques to acquire effectively, manage, process, and use data.

The application and solution providers sub-segment is estimated to account for the fastest growth in the by provider segment for Blockchain in agriculture and food supply chain market.

The application and solution providers majorly include the SME’ and startup companies that focus upon providing customizable and flexible products powered by innovation. As the number of startups rises in the market, it drives the number of applications and solution providers in the blockchain in the agriculture and food supply chain market.

The small and medium-sized enterprises sub-segment is estimated to observe the fastest growth in Blockchain in agriculture and food supply chain market by organization size.

The businesses are looking forward to tapping the high untapped potential of the agriculture and food sector market, with technology integration; thus, larger enterprises are heavily investing in improving their existing solutions while new companies are coming up with exclusive solutions according to the need for their national and regional markets. As per NASSCOM’s 2019 report, India has more than 450 agri-tech startups, growing at a rate of 25% annually. Despite the lockdown and supply-chains being impacted worldwide, the governments are working overtime to ensure easy availability of vegetables, fruits, dairy, and other essentials, which is expected to drive the use of highly efficient blockchain technologies in the sector in the near future.

The product traceability, tracking and visibility sub-segment is estimated to account for the largest market share by the application segment of blockchain in agriculture and food supply chain market over the forecast period.

Using this technology, processors will identify potential contamination sources during the supply chain and take precautionary steps. Companies have started investing in a blockchain to gain consumer trust, which provides transparency to the consumer to know the food product's complete journey. All the information related to the provenance of the ingredients used, to the shelf, can be viewed by the consumers, which will allow them to gain trust in the product.

To know about the assumptions considered for the study, download the pdf brochure

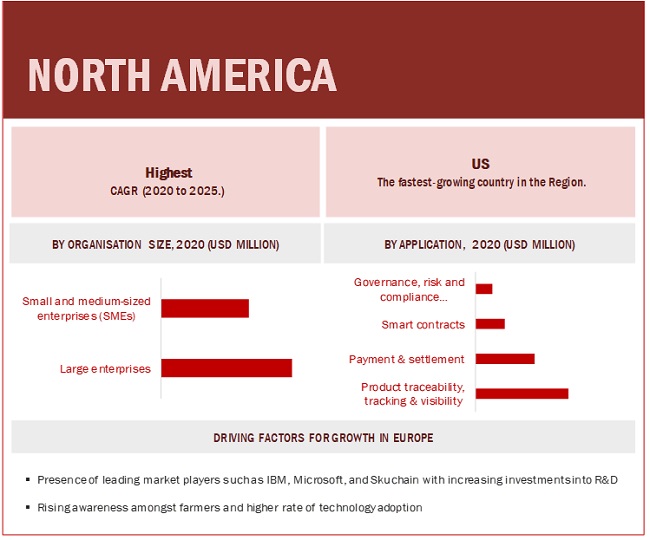

The increasing adoption of advanced technology for managing the agriculture and food supply chains in the North American region accounts for the region's high market share.

North America is considered the most advanced region in terms of technology adoption and infrastructure. The regional presence of blockchain technology solution providers such as IBM and Microsoft in North America is the main factor driving the North American blockchain in the food and agriculture supply chain market. The US Federal Government has not regularized blockchain technology, because of which the states in the US are free to introduce their own rules and regulations. Specifically, retailers in this region have realized blockchain technology’s potential to deliver enhanced customer experience and efficient supply chain systems; hence, the region has started adopting the technology to develop business applications.

Key Market Players

Key players in this market include major players such as IBM (US), TE-FOOD International GmbH (Europe), Microsoft (US), ACR-NET (Ireland), Ambrosus (Switzerland), SAP SE (Germany), OriginTrail (Slovenia), and Provenance (UK). These major players in this market focus on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) |

|

Segments covered |

Type, Stakeholder, Providers, Organisation size, Application, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

|

Companies studied |

The major market players include IBM (US), TE-FOOD International GmbH (Europe), Microsoft (US), ACR-NET (Ireland), Ambrosus (Switzerland), SAP SE (Germany), Chainvine (UK), Ripe.io (US), and AgriDigital (Australia), OriginTrail (Slovenia), and Provenance (UK). (Total 20 companies) |

This research report categorizes the Blockchain in agriculture and food supply chain market based on type, stakeholder, providers, organization size, application, and region.

Based on type:

- Public

- Private

- Hybrid/Consortium

Based on stakeholders:

- Growers

- Food manufacturers/processors

- Retailers

Based on providers:

- Application providers

- Middleware providers

- Infrastructure providers

Based on organization size:

- Small and medium-sized enterprises

- Large enterprises

Based on the application:

- Product traceability, tracking, and visibility

- Payment and settlement

- Smart contract

- Governance, risk, and compliance management

Based on the region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In June 2020, Atea, IBM, and Sjømatbedriftene, the Norwegian Seafood Association, announced a new cross-industry collaboration to use blockchain technology and share supply chain data throughout Norway's seafood industry and provide safer, better seafood to consumers across the globe. This blockchain technology would help to provide high-quality, fully traceable products.

- In April 2020, IBM and Nestle entered into a partnership to enable Nestle to use the IBM Food Trust enterprise blockchain to trace its Zoégas coffee brand. Zoégas coffee would come with a QR code scanned by consumers to trace coffee beans to their origin. The IBM Food Trust enterprise blockchain will record data about farmers, time of harvest, transaction certificate for specific shipments, as well as the roasting period.

- In May 2019, Microsoft launched Azure blockchain services, a fully managed service that allows for the formation, management, and governance of the consortium blockchain network. It is integrated with the Azure activity directory and offers tools to add new members, set permissions, and monitor network health and activity.

- In April 2019, Albertsons Companies (US) joined the IBM Food Trust blockchain network to track romaine lettuce from farm to store. Albertsons' addition to the IBM Food Trust network will help bring blockchain-based food traceability to both consumers and industry players.

- In March 2019, Bumble Bee Foods (US) used the newly launched SAP SE blockchain technology to trace fish so that customers can have complete transparency in food safety and food sourcing.

- In July 2018, Ambrosus launched an AMB-NET software solution that allows sensors to store and distribute data in real-time.

- In March 2018, Ambrosus partnered with Swiss Coffee Alliance (Switzerland) to build a sustainable supply chain for coffee by providing them with their platform for tracing the entire journey of the coffee and its supply chain.

- In May 2018, SAP SE expanded its work with blockchain into the supply chain space. The company is looking to apply blockchain technology to agricultural supply chains through its Farm to Consumer initiative.

- In May 2018, SAP partnered with Maple Leaf (Canada), Johnsonville (US), and Naturipe Farms (US) to use blockchain technology and help key players track their food products.

Frequently Asked Questions (FAQ):

What are some of the key drivers to the Blockchain in the agriculture and food supply chain market?

The key drivers to blockchain in agriculture and food supply chain market are an increase in demand for the agricultural produce output surge, the use of smart agriculture among the growers or producers, government initiatives to support modern techniques that can be used in agriculture, rising concerns for food safety among the consumers driving the increase in demand for the transparency in the supply chain, increase in the popularity of blockchain among retailers/ distributors is due to rise in the tracking and tracing of various food products, due to the Pandemic COVID-19, consumers are getting more conscious about the food that they are eating hence the uses of blockchain can help them to understand and fulfill their demand, rise in cases of food fraud drives the market for blockchain in agriculture.

What are the major stakeholders to the blockchain in the agriculture and food supply chain market?

The agriculture and food supply chain generally consists of stakeholders, namely, growers/farmers, manufacturers/processors, and retailers, which are studied below in blockchain technology. Farmers/Growers generally get their output at the peak season of crop harvest. This technology can help farmers find a market for their produce. The blockchain technology enables a real-time marketplace, which farmers can utilize to get fair pricing and incentives. Food manufacturers are safeguarded in terms of sharing information regarding their practices, formulation, and methods. For the retail businesses, blockchain technology enables the recording of transactions on distributed ledgers, thus offering several potential applications in various agencies involved in increasing transparency, preventing frauds, and improving efficiency.

What are the key players and the market scenarios in the Blockchain in the agriculture and food supply chain market?

IBM (US), Microsoft (US), ACR-NET (Ireland), Ambrosus (Switzerland), SAP SE (Germany), OriginTrail (Slovenia), and Provenance (UK) are the major players in the Blockchain in agriculture and food supply chain market. Being a growing market, the existing players are fixated upon improving their market shares while their newer startups being established rapidly in the market. This can be classified as a fragmented market due to the presence of a large number of organized players accounting for more than 50% at the global level and unorganized players present at the local level in several countries. There are numerous existing and emerging companies, especially in the North American and European markets.

Which region is a high growth market for blockchain in agriculture technology?

The European region is estimated to observe the highest growth in the blockchain in the agriculture and food supply chain market. Factors such as the increasing need to lower operational costs in financial transactions and the reduction of the number of layers required for data sharing and risk management by providing a standardized framework for recording complex transactions, thus making it easier to manage risks and positions in real-time; and the regulatory compliances that automate and conduct only authorized transactions are driving the technology adoption in the region. The regulatory bodies and policymakers in European countries such as the UK, Germany, and France are taking steps to understand, contextualize, and regulate digital currencies. The growing investments in the transaction-related applications are expected to support stakeholders such as suppliers, traders, farmers, distributors, and processors in the food and agriculture supply chain. The countries analyzed for the blockchain technology market in this region are the UK, Germany, and the Rest of Europe.

What are the key challenges to the blockchain in agriculture and food supply chain market?

Data management and data aggregation are major challenges in the precision farming market. Managing data pertaining to smart agriculture poses a major challenge for the market. Smart agricultural devices communicate through various interfaces, technologies, and protocols. The lack of standardization of these communication interfaces and protocols may result in the misrepresentation of the data. The lack of standardization with regard to technologies complicates the integration of systems and hinders the plug-and-play capabilities among unrelated systems. These are some of the key challenges faced by the blockchain in agriculture and food supply chain technology market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 1 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY TYPE & APPLICATION AREA: INCLUSIONS & EXCLUSIONS

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2019

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 31)

TABLE 3 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, 2018–2025 (USD MILLION)

FIGURE 8 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 EUROPE TO GROW AT THE HIGHEST CAGR IN THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET FROM 2020 TO 2025

FIGURE 12 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 OPPORTUNITIES IN THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET

FIGURE 13 FOOD PRODUCT TRACEABILITY TO DRIVE THE GROWTH OF THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET

4.2 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET: KEY COUNTRY

FIGURE 14 AUSTRALIA & NEW ZEALAND TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN THROUGH 2025

4.3 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY PROVIDER AND REGION

FIGURE 15 NORTH AMERICA IS ESTIMATED TO DOMINATE THE MARKET AND HOLD THE LARGEST SHARE IN VARIOUS ORGANISATION SIZES FOR BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN IN 2020

4.4 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY APPLICATION

FIGURE 16 PRODUCT TRACEABILITY, TRACKING, AND VISIBILITY IS ESTIMATED TO DOMINATE THE MARKET IN 2020

4.5 DEVELOPED VS. DEVELOPING MARKETS FOR BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN

FIGURE 17 DEVELOPING COUNTRIES TO RECORD THE HIGHEST GROWTH RATES DURING THE FORECAST PERIOD

4.6 NORTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY PROVIDER AND COUNTRY

FIGURE 18 THE US IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE IN NORTH AMERICA IN 2020

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 BLOCKCHAIN IN AGRICULTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising concerns for food safety among consumers demanding transparency in the supply chain

FIGURE 20 TOTAL NUMBER OF FOOD PRODUCT RECALL FOR AUSTRALIA AND NEW ZEALAND, 2010–2019

5.2.1.1.1 Rise in food fraud cases

FIGURE 21 TYPES OF VIOLATION IN FOOD FRAUDS, 2018

5.2.1.2 Increase in popularity of blockchain among retailers/distributors for better supervision & data management

5.2.1.3 Growth in online trading and tracking systems enhancing the need for blockchain solutions during COVID-19

5.2.1.4 Growing food wastage and post-harvest losses

5.2.2 RESTRAINTS

5.2.2.1 Uncertainty in regulations and standards

5.2.2.2 Limited availability of technical skillset for implementing and managing blockchain applications

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in funding and investments in agri-food blockchain

5.2.3.2 Opportunity to adopt blockchain solutions to ease the supply chain complexities in the agriculture ecosystem

5.2.3.3 Fastest-growing smart agricultural systems creating an opportunity for the blockchain applications at growers’ level

5.2.3.4 Government initiatives to support modern techniques that can be used in agriculture to increase agricultural production

5.2.4 CHALLENGES

5.2.4.1 Data mismanagement among growers during precision farming

5.2.4.2 Agreement between all stakeholders of the supply chain to digitally connect

5.2.4.3 Lack of standardization of data is a challenge as it may misrepresent the data

5.3 BLOCKCHAIN ECOSYSTEM

5.3.1 BLOCKCHAIN ECOSYSTEM IN AGRICULTURE AND FOOD SUPPLY CHAIN

5.4 STEPS INVOLVED IN THE IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY

FIGURE 22 STEPS INVOLVED IN THE IMPLEMENTATION OF BLOCKCHAIN TECHNOLOGY IN ANY ORGANIZATION

5.5 BLOCKCHAIN ASSOCIATIONS AND CONSORTIUMS

5.5.1 R3 CONSORTIUM

5.5.2 KINAKUTA

5.5.3 HYPERLEDGER

5.5.4 WORLD BLOCKCHAIN ASSOCIATION

5.5.5 GLOBAL BLOCKCHAIN BUSINESS COUNCIL

5.5.6 TRACE ALLIANCE

5.5.7 BLOCKCHAIN ALLIANCE

5.5.8 BLOCKCHAIN INDUSTRY GROUP

5.5.9 BLOCKCHAIN COLLABORATIVE CONSORTIUM (BCC)

5.6 USE CASES

TABLE 4 USE CASES FOR BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN

6 IMPACT OF COVID-19 ON THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKETS (Page No. - 53)

FIGURE 23 COVID-19: GLOBAL PROPAGATION

FIGURE 24 COVID-19 PROPAGATION: SELECT COUNTRIES

6.1 COVID-19 IMPACT ON THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET

FIGURE 25 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SCENARIO WITH & WITHOUT COVID-19, 2020 (USD MILLION)

6.2 COVID-19 IMPACT ON THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET

7 BLOCKCHAIN IN AGRICULTURE MARKET, BY TYPE (Page No. - 56)

7.1 INTRODUCTION

TABLE 5 COMPARISON BETWEEN PUBLIC, PRIVATE, AND CONSORTIUM BLOCKCHAIN

7.2 PUBLIC BLOCKCHAIN

7.3 PRIVATE BLOCKCHAIN

7.4 CONSORTIUM/HYBRID BLOCKCHAIN

8 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY STAKEHOLDER (Page No. - 59)

8.1 INTRODUCTION

8.2 GROWERS

8.3 FOOD MANUFACTURERS/PROCESSORS

8.4 RETAILERS

9 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY PROVIDER (Page No. - 62)

9.1 INTRODUCTION

FIGURE 26 APPLICATION AND SOLUTION PROVIDERS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 6 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

9.2 APPLICATION AND SOLUTION PROVIDERS

TABLE 7 APPLICATION AND SOLUTION PROVIDERS: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 MIDDLEWARE PROVIDERS

TABLE 8 MIDDLEWARE PROVIDERS: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 INFRASTRUCTURE AND PROTOCOL PROVIDERS

TABLE 9 INFRASTRUCTURE AND PROTOCOL PROVIDERS: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 BLOCKCHAIN IN AGRICULTURE AND FOOD MARKET, BY ORGANISATION SIZE (Page No. - 67)

10.1 INTRODUCTION

FIGURE 27 BLOCKCHAIN IN AGRICULTURE AND FOOD MARKET SIZE, BY ORGANISATION SIZE, 2020 VS. 2026 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 10 BLOCKCHAIN IN AGRICULTURE AND FOOD MARKET SIZE, BY ORGANISATION SIZE, 2018–2025 (USD MILLION)

10.2.1 LARGE ENTERPRISES

TABLE 11 LARGE ENTERPRISES: BLOCKCHAIN IN AGRICULTURE AND FOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES): BLOCKCHAIN IN AGRICULTURE AND FOOD MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY APPLICATION AREA (Page No. - 71)

11.1 INTRODUCTION

FIGURE 28 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 13 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11.2 PRODUCT TRACEABILITY, TRACKING, AND VISIBILITY

FIGURE 29 PRODUCT TRACEABILITY, TRACKING, AND VISIBILITY: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 14 PRODUCT TRACEABILITY, TRACKING, AND VISIBILITY: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.3 PAYMENTS AND SETTLEMENTS

TABLE 15 PAYMENTS AND SETTLEMENTS: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.4 SMART CONTRACT

TABLE 16 SMART CONTRACT: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.5 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT

TABLE 17 GOVERNANCE, RISK, AND COMPLIANCE MANAGEMENT: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, BY REGION (Page No. - 78)

12.1 INTRODUCTION

FIGURE 30 COUNTRY-WISE INTERNET PENETRATION RATE IN %, 2020

FIGURE 31 GEOGRAPHIC SNAPSHOT (2020): US & UK ACCOUNT FOR THE HIGHEST MARKET SHARES IN THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAINS MARKET

TABLE 18 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 19 NORTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 NORTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

TABLE 22 NORTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.2.1 US

TABLE 23 US: BILLS AND LEGISLATIONS (PASSED/IN PROCESS) FOR REGULATING BLOCKCHAIN TECHNOLOGY

TABLE 24 US: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 25 US: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.2.2 CANADA

TABLE 26 CANADA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 27 CANADA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.2.3 MEXICO

TABLE 28 MEXICO: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 29 MEXICO: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.3 EUROPE

FIGURE 33 EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SNAPSHOT

TABLE 30 EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 31 EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

TABLE 32 EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 33 EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.1 UK

TABLE 34 UK: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 35 UK: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.2 GERMANY

TABLE 36 GERMANY: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 37 GERMANY: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.3 REST OF EUROPE

TABLE 38 REST OF EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 39 REST OF EUROPE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET

TABLE 40 ASIA PACIFIC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 ASIA PACIFIC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 42 ASIA PACIFIC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

TABLE 43 ASIA PACIFIC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.4.1 CHINA

TABLE 44 CHINA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 CHINA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.4.2 AUSTRALIA & NEW ZEALAND

TABLE 46 AUSTRALIA & NEW ZEALAND: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 47 AUSTRALIA & NEW ZEALAND: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.4.3 JAPAN

TABLE 48 JAPAN: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 JAPAN: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.4.4 SINGAPORE

TABLE 50 SINGAPORE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 SINGAPORE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANISATION SIZE, 2018–2025 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

TABLE 52 REST OF APAC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 REST OF APAC: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANISATION SIZE, 2018–2025 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 54 SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

TABLE 57 SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.5.1 BRAZIL

TABLE 58 BRAZIL: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 BRAZIL: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.5.2 ARGENTINA

TABLE 60 ARGENTINA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 ARGENTINA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.5.3 REST OF SOUTH AMERICA

TABLE 62 REST OF SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 REST OF SOUTH AMERICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.6 MIDDLE EAST & AFRICA

TABLE 64 MIDDLE EAST & AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY PROVIDER, 2018–2025 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.6.1 UAE

TABLE 68 UAE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 UAE: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

12.6.2 KENYA & NIGERIA

TABLE 70 KENYA & NIGERIA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 KENYA & NIGERIA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANISATION SIZE, 2018–2025 (USD MILLION)

12.6.3 SOUTH AFRICA

TABLE 72 SOUTH AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 SOUTH AFRICA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANISATION SIZE, 2018–2025 (USD MILLION)

12.6.4 REST OF MEA

TABLE 74 OTHERS IN MEA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 OTHERS IN MEA: BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 115)

13.1 OVERVIEW

13.2 MARKET RANKING

FIGURE 35 TOP FIVE COMPANIES IN THE BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET, 2019

13.2.1 MARKET EVALUATION FRAMEWORK

FIGURE 36 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET: TRENDS IN COMPANY STRATEGIES, 2016–2020

13.3 COMPETITIVE SCENARIO

13.3.1 EXPANSIONS, FUNDINGS & INVESTMENTS

TABLE 76 EXPANSIONS, FUNDINGS & INVESTMENTS, 2017–2018

13.3.2 NEW PRODUCT LAUNCHES

TABLE 77 NEW PRODUCT LAUNCHES, 2018-2019

13.3.3 AGREEMENTS, JOINT VENTURES, CO-OPERATIONS, COLLABORATIONS, AND PARTNERSHIPS

TABLE 78 AGREEMENTS, JOINT VENTURES, CO-OPERATIONS, COLLABORATIONS, AND PARTNERSHIPS, 2017–2020

14 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 121)

14.1 COMPANY EVALUATION MATRIX (OVERALL MARKET)

14.1.1 STARS

14.1.2 PERVASIVE PLAYERS

14.1.3 EMERGING LEADERS

14.1.4 PARTICIPANTS

FIGURE 37 BLOCKCHAIN IN AGRICULTURE AND FOOD SUPPLY CHAIN MARKET: COMPANY EVALUATION MATRIX, 2019

14.2 COMPANY PROFILES

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

14.2.1 IBM

FIGURE 38 IBM: COMPANY SNAPSHOT

FIGURE 39 IBM: SWOT ANALYSIS

14.2.2 MICROSOFT

FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

FIGURE 41 MICROSOFT: SWOT ANALYSIS

14.2.3 ARC-NET

FIGURE 42 ARC-NET: SWOT ANALYSIS

14.2.4 AMBROSUS

FIGURE 43 AMBROSUS: SWOT ANALYSIS

14.2.5 SAP SE

FIGURE 44 SAP SE: COMPANY SNAPSHOT

FIGURE 45 SAP SE: SWOT ANALYSIS

14.2.6 ORIGINTRAIL

FIGURE 46 ORIGINTRAIL: SWOT ANALYSIS

14.2.7 PROVENANCE

14.2.8 AGRIDIGITAL

14.2.9 ABACO GROUP

14.2.10 RIPE.IO

14.2.11 VECHAIN

14.2.12 CHAINVINE

14.2.13 AGRICHAIN

14.2.14 SKUCHAIN

14.2.15 BEXT360

14.2.16 FCE GROUP AG

14.2.17 COIN 22

14.2.18 TE-FOOD INTERNATIONAL GMBH

14.2.19 MODUM.IO AG

14.2.20 VIVEAT

14.2.21 EHARVESTHUB INC.

14.2.22 GRAINCHAIN

14.2.23 CARGOCHAIN

14.2.24 FARM2KITCHEN FOODS PVT. LTD.

14.2.25 GENUINO

14.2.26 AGRI 10X

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 170)

15.1 DISCUSSION GUIDE:

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATION

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

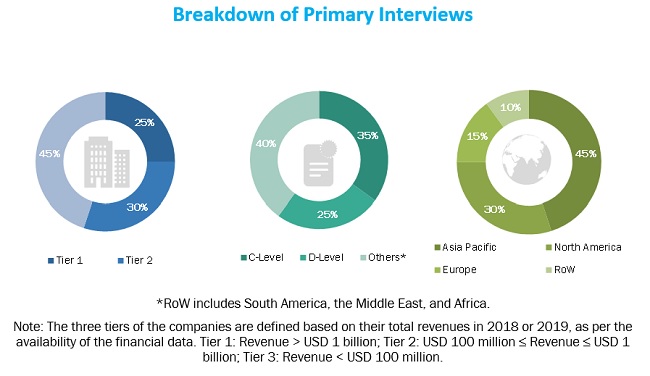

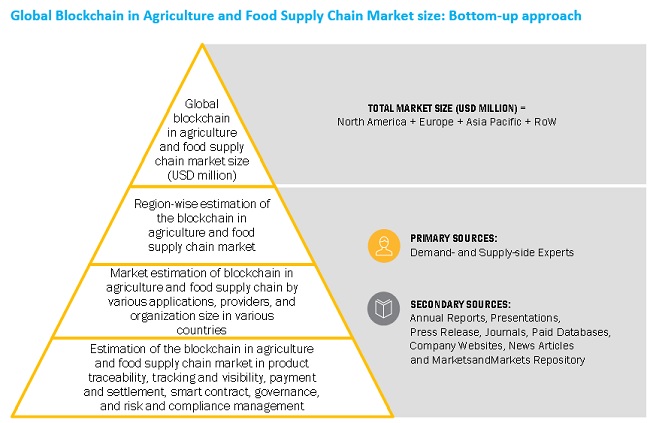

The study involved four major activities in estimating the blockchain in agriculture and food supply chain market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate segments and sub-segments' market size.

Secondary Research

In the secondary research process, various sources, such as the World Economic Forum (WEF), United States Food and Drug Administration (US FDA), Organisation for Economic Co-operation and Development (OECD), Food and Agriculture Organization, and the United States Department of Agriculture, were referred to identify and collect information for this study. The secondary sources also include technology and agriclutral journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, including infrastructure and protocol providers, Middleware providers, blockchain-as-a-service providers, and end-users. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include food manufacturers. Moreover, the demand-side's primary sources include agriculture and food producers, retailers, manufacturers, and end-consumers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Market size estimation involves determining segmental revenue sales for blockchain in agriculture and food supply chain market of the top 20 manufacturers operating in the global market and validating through a top-down approach.

- Approach 1:

- Mapping of key blockchain in agriculture and food supply chain solution providers operating in the market through taking into consideration several key factors such as annual revenue, annual production capacity, and its global presence

- Determining the segment revenue sales which is responsible for generating sales of blockchain in agriculture and food supply chain solution providers.

- Taking into on several factors such as market being fragmented comprising of more than 30 active players in the global market, ascertaining collective value share for top 20 players

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the blockchain's growth in agriculture and food supply chain were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into the type, stakeholder, provider, organization size, and application segment. To estimate the blockchain in agriculture and food supply chain market and arrive at the exact statistics for all subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the blockchain in agriculture and food supply chain market, in terms of type, stakeholder, provider, organization size, application, and region

- To describe and forecast the blockchain in agriculture and food supply chain market, in terms of value by region–Asia Pacific, Europe, North America, Latin America and the Middle East and Africa—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of blockchain in agriculture and food supply chain

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the blockchain in agriculture and food supply chain market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as acquisitions, expansions, product launches, and agreements & partnerships, in the blockchain in agriculture and food supply chain market

- This research report categorizes the blockchain in agriculture and food supply chain market based on type, stakeholder, provider, organization size, application, and region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of agriculture and food supply chain applications in the blockchain in agriculture and food supply chain market

Regional Analysis

- Further breakdown of the Rest of Europe specialty fats & oils market into Russia, Switzerland, and Poland

- Further breakdown of the Rest of Asia Pacific blockchain in agriculture and food supply chain market into India, Malaysia, South Korea, and Thailand.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Blockchain in Agriculture and Food Supply Chain Market