Blockchain in Telecom Market by Provider (Application Providers, Middleware Providers, and Infrastructure Providers), Application (OSS/BSS Processes, Identity Management, Connectivity Provisioning), Organization Size, and Region - Global Forecast to 2023

The global Blockchain in Telecom Market experienced substantial growth, starting from a size of USD 27.8 million in 2017 and is expected to reach USD 993.8 million by 2023, with a remarkable Compound Annual Growth Rate (CAGR) of 84.4% throughout the forecast period. This study considers 2017 as the base year and analyzes the market trends from 2018 to 2023, highlighting the tremendous potential for blockchain adoption within the telecom industry.

The objective of the report is to define, describe, and forecast the blockchain in telecom market by provider, application, organization size, and region. The report analyzes the opportunities in the market for stakeholders by identifying the high-growth segments of the market. It profiles the key players of the market and comprehensively analyzes their core competencies, such as new product launches, partnerships, agreements, and collaborations. The report also covers detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

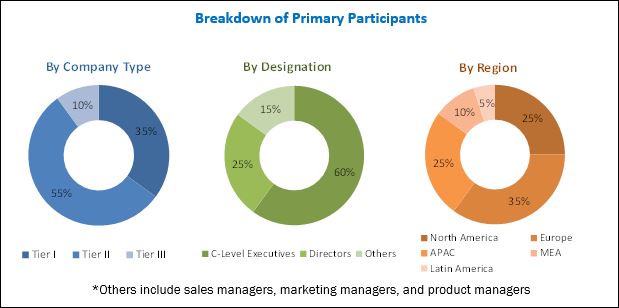

The research methodology used to estimate and forecast the blockchain in telecom market begins with capturing data from various industry associations and consortiums, such as R3CEV Blockchain Consortium, World Economic Forum, Hyperledger Foundation, Telecom Regulatory Authority of India (TRAI), Groupe Spéciale Mobile Association (GSMA), and other sources, including company financials, journals, press releases, paid databases, and annual reports. The bottom-up procedure was employed to arrive at the overall market size from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, executives, and blockchain technologists. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The blockchain in telecom market comprises major providers, such as AWS (US), Guardtime (Estonia), IBM (US), Microsoft (US), SAP (Germany), Bitfury (US), Cegeka (Netherlands), Clear (Singapore), Reply (Italy), ShoCard (US), Abra (US), Auxesis Group (India), Blockchain Foundry (Singapore), BlockCypher (US), Blocko (South Korea), Blockpoint (US), Blockstream (US), Chain (US), Filament (US), Huawei (China), Oracle (US), RecordsKeeper (Spain), Sofocle (India), SpinSys (US), and TBCASoft (US). The stakeholders include telecom vendors, payment gateway providers, Communication Service Providers (CSPs), blockchain technology vendors, independent software vendors, consulting firms, system integrators, Value-added Resellers (VARs), and Information Technology (IT) agencies.

Key target audience of the blockchain in telecom market report is given below:

- CSPs

- Regulatory bodies

- Blockchain technology solution vendors

- ISVs

- Consulting firms

- VARs

“The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing their efforts and investments.”

Scope of the Blockchain in Telecom Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Provider, Application, Organization Size, and Region |

|

Regions covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

AWS (US), Guardtime (Estonia), IBM (US), Microsoft (US), SAP (Germany), Bitfury (US), Cegeka (Netherlands), Clear (Singapore), Reply (Italy), ShoCard (US), Abra (US), Auxesis Group (India), Blockchain Foundry (Singapore), BlockCypher (US), Blocko (South Korea), Blockpoint (US), Blockstream (US), Chain (US), Filament (US), Huawei (China), Oracle (US), RecordsKeeper (Spain), Sofocle (India), SpinSys (US), and TBCASoft (US) |

The research report segments the market into the following submarkets:

By Provider

- Application Providers

- Middleware Providers

- Infrastructure Providers

Application

- OSS/BSS Processes

- Identity Management

- Payments

- Smart Contracts

- Connectivity Provisioning

- Others (Roaming and Digital Asset Management)

Blockchain in Telecom Market By Organization Size

- Large Enterprises

- SMEs

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American blockchain in telecom market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

Detailed analysis was performed to get detailed information regarding the competitors in the blockchain in telecom market, by their offerings and business strategies. The report reviews the major players offering blockchain technology solutions. In addition, the report will outline the findings and analysis on how well each blockchain technology solution provider performs within the MarketsandMarkets criteria.

The blockchain in telecom market is expected to grow from USD 46.6 million in 2018 to USD 993.8 million by 2023, at a Compound Annual Growth Rate (CAGR) of 84.4% during the forecast period. The major driving factors in the market are increasing support for Operation Support System/Business Support System (OSS/BSS) processes, and rising security concerns among telcos.

The blockchain in telecom market study aims at estimating the market size and future growth potential of the market across different segments, such as provider, application, organization size, and region. The application segment includes OSS/BSS process, identity management, payments, smart contracts, connectivity provisioning, and others (roaming and digital asset management). The connectivity provisioning segment is expected to grow at the highest CAGR during the forecast period. The connectivity provisioning segment covers 5G enablement, IoT connectivity, and M2M connectivity. With the help of blockchain technology, operators can provide device connection to multiple local hotspots and Wi-Fi based on permission. 5G enablement is also one of the important use cases of blockchain technology. The 3GPP (LTE, GPRS) and non-3GPP (WiMax, WLAN, and Wi-Fi) can be implemented using the blockchain network.

The blockchain in telecom market has been segmented on the basis of providers into 3 categories: application providers, middleware providers and infrastructure providers. Among these types, application providers are the fastest growing segment in the overall market. The introduction of technologically advanced blockchain solutions has witnessed a certain level of adoption in the telecom sector for various application areas thereby fueling the overall market growth.

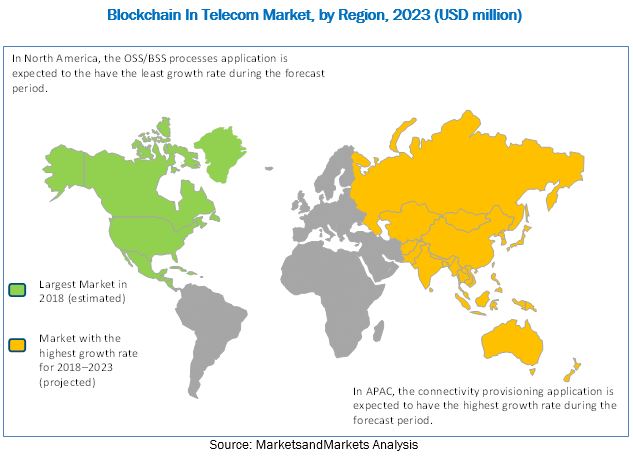

In terms of geographic coverage, the blockchain in telecom market has been segmented into 5 regions, namely, North America, Asia Pacific (APAC), Europe, the Middle East and Africa (MEA), and Latin America. North America is estimated to account for the largest market share in 2018. North America is considered the most advanced region in terms of technology adoption and infrastructure. The wide presence of key industry players of blockchain technology solutions in this region is the main driving factor for the growth of the market. Various telcos in the region are adopting the blockchain technology to reduce identity and roaming frauds and enhance customer experience.

Furthermore, APAC is expected to record the highest growth rate during the forecast period, due to the increase in venture capital funding, significant increase in the number of startups venturing into this market space and governments focusing on regulating the blockchain technology. Major telcos in Japan, Australia and New Zealand, India, and Singapore, provide huge opportunities for the adoption of the blockchain technology.

The major restraining factor in the growth of blockchain in telecom market include growing concerns related to the authenticity of users and uncertain regulatory status and the lack of common standards. Many enterprises believe identity theft done by criminals can help them to gain access of account details and blockchain would not be able to prevent it. Also, there is a notion among enterprises that data confidentiality, integrity, and availability can be affected seriously. Also, government bodies’ restriction in the adoption of blockchain technology and lack of common standards can hinder the growth of market.

The major blockchain in telecom market vendors include AWS (US), Guardtime (Estonia), IBM (US), Microsoft (US), SAP (Germany), Bitfury (US), Cegeka (Netherlands), Clear (Singapore), Reply (Italy), ShoCard (US), Abra (US), Auxesis Group (India), Blockchain Foundry (Singapore), BlockCypher (US), Blocko (South Korea), Blockpoint (US), Blockstream (US), Chain (US), Filament (US), Huawei (China), Oracle (US), RecordsKeeper (Spain), Sofocle (India), SpinSys (US), and TBCASoft (US). These players majorly adopted partnerships and new product launches as the key growth strategies to offer feature-rich blockchain in telecom solutions to their customers and further penetrate into regions with unmet needs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions and Limitations

2.3.1 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Blockchain in Telecom Market

4.2 Market Share of Top 3 Providers and Regions, 2018

4.3 Market By Organization Size, 2018

4.4 Market Investment Scenario

4.5 Market Top 3 Applications

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Support for OSS/BSS Processes

5.2.1.2 Rising Security Concerns Among Telcos

5.2.2 Restraints

5.2.2.1 Growing Concerns Related to the Authenticity of Users

5.2.2.2 Uncertain Regulatory Status and the Lack of Common Standards

5.2.3 Opportunities

5.2.3.1 Blockchain Technology Helps the Telecom Sector in Fraud Management

5.2.3.2 Extensive Use of Blockchain Solutions in IoT Space

5.2.3.3 Increasing Use of the Blockchain Technology for Implementing 5G Technology

5.2.4 Challenges

5.2.4.1 Lack of Awareness of the Blockchain Technology

5.2.4.2 Lack of Understanding About the Blockchain Concept, Skill Sets, and Technical Knowledge

5.3 Industry Trends

5.3.1 Types of Blockchain Technology

5.3.1.1 Private Blockchain

5.3.1.2 Public Blockchain

5.3.2 Blockchain Associations and Consortiums

5.3.2.1 Enterprise Ethereum Alliance (EEA)

5.3.2.2 Hyperledger Consortium

5.3.2.3 Global Blockchain Business Council

5.3.2.4 Blockchain Collaborative Consortium (BCCC)

5.3.2.5 R3CEV Blockchain Consortium

5.3.2.6 CLS Group

5.3.2.7 Global Payments Steering Group (HPSG)

5.3.2.8 Financial Blockchain Shenzhen Consortium (FBSC)

5.3.2.9 CU Ledger

5.4 Innovation Spotlight

6 Blockchain in Telecom Market, By Provider (Page No. - 42)

6.1 Introduction

6.2 Application Providers

6.3 Middleware Providers

6.4 Infrastructure Providers

7 Market By Application (Page No. - 47)

7.1 Introduction

7.2 OSS/BSS Processes

7.3 Identity Management

7.4 Payments

7.5 Smart Contracts

7.6 Connectivity Provisioning

7.7 Others

8 Market By Organization Size (Page No. - 55)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Blockchain in Telecom Market By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.2 Canada

9.3 Europe

9.3.1 United Kingdom

9.3.2 Germany

9.3.3 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Australia and New Zealand

9.4.3 India

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 Middle East

9.5.2 Africa

9.6 Latin America

9.6.1 Mexico

9.6.2 Brazil

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Competitive Situations and Trends

10.2.1 New Product Launches

10.2.2 Business Expansions

10.2.3 Partnerships, Agreements, and Collaborations

11 Company Profiles (Page No. - 81)

11.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, Solution Offered, SWOT Analysis, MnM View)*

11.2 AWS

11.3 Guardtime

11.4 IBM

11.5 Microsoft

11.6 SAP

11.7 Bitfury

11.8 Cegeka

11.9 Clear

11.10 Reply

11.11 Shocard

11.12 Abra

11.13 Auxesis Group

11.14 Blockchain Foundry

11.15 Blockcypher

11.16 Blocko

11.17 Blockpoint

11.18 Blockstream

11.19 Chain

11.20 Filament

11.21 Huawei

11.22 Oracle

11.23 Recordskeeper

11.24 Sofocle

11.25 Spinsys

11.26 Tbcasoft

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, Solution Offered, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 124)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (40 Tables)

Table 1 Blockchain in Telecom Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Innovation Spotlight: Latest Blockchain in Telecom Solutions

Table 3 Market Size By Provider, 2016–2023 (USD Million)

Table 4 Application Providers: Market Size By Region, 2016–2023 (USD Million)

Table 5 Middleware Providers: Market Size By Region, 2016–2023 (USD Million)

Table 6 Infrastructure Providers: Market Size By Region, 2016–2023 (USD Million)

Table 7 Blockchain in Telecom Market Size, By Application, 2016–2023 (USD Million)

Table 8 OSS/BSS Processes: Market Size By Region, 2016–2023 (USD Million)

Table 9 Identity Management: Market Size By Region, 2016–2023 (USD Million)

Table 10 Payments: Market Size By Region, 2016–2023 (USD Million)

Table 11 Smart Contracts: Market Size By Region, 2016–2023 (USD Million)

Table 12 Connectivity Provisioning: Market Size By Region, 2016–2023 (USD Million)

Table 13 Others: Market Size By Region, 2016–2023 (USD Million)

Table 14 Blockchain in Telecom Market Size, By Organization Size, 2016–2023 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 16 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 17 Market Size, By Region, 2016–2023 (USD Million)

Table 18 North America: Market Size By Provider, 2016–2023 (USD Million)

Table 19 North America: Market Size By Application, 2016–2023 (USD Million)

Table 20 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 21 North America: Blockchain in Telecom Market Size By Country, 2016–2023 (USD Million)

Table 22 Europe: Market Size, By Provider, 2016–2023 (USD Million)

Table 23 Europe: Market Size By Application, 2016–2023 (USD Million)

Table 24 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 25 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 26 Asia Pacific: Blockchain in Telecom Market Size, By Provider, 2016–2023 (USD Million)

Table 27 Asia Pacific: Market Size By Application, 2016–2023 (USD Million)

Table 28 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 29 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 30 Middle East and Africa: Market Size, By Provider, 2016–2023 (USD Million)

Table 31 Middle East and Africa: Market Size By Application, 2016–2023 (USD Million)

Table 32 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 33 Middle East and Africa: Market Size By Sub region, 2016–2023 (USD Million)

Table 34 Latin America: Blockchain in Telecom Market Size, By Provider, 2016–2023 (USD Million)

Table 35 Latin America: Market Size By Application, 2016–2023 (USD Million)

Table 36 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 37 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 38 New Product Launches, 2017–2018

Table 39 Business Expansions, 2017–2018

Table 40 Partnerships, Agreements, and Collaborations, 2017–2018

List of Figures (37 Figures)

Figure 1 Global Blockchain in Telecom Market Segmentation

Figure 2 Global Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Assumptions

Figure 8 Blockchain in Telecom Market Size, By Provider

Figure 9 North America is Estimated to Hold the Largest Market Share in 2018

Figure 10 Top 3 Revenue Segments of the Market

Figure 11 Support for OSS/BSS is Expected to Boost the Growth of the Market

Figure 12 Infrastructure Provider Segment and North American Region are Estimated to Have the Largest Market Shares in 2018

Figure 13 Large Enterprises Segment is Expected to Have the Larger Market Share in 2018

Figure 14 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 15 OSS/BSS Processes Application Area is Estimated to Have the Largest Market Size By 2023

Figure 16 Blockchain in Telecom Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Application Providers Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Connectivity Provisioning Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Key Developments By the Leading Players in the Blockchain in Telecom Market, 2017–2018

Figure 24 Geographic Revenue Mix of the Top Players

Figure 25 AWS: Company Snapshot

Figure 26 AWS: SWOT Analysis

Figure 27 Guardtime: SWOT Analysis

Figure 28 IBM: Company Snapshot

Figure 29 IBM: SWOT Analysis

Figure 30 Microsoft: Company Snapshot

Figure 31 Microsoft: SWOT Analysis

Figure 32 SAP: Company Snapshot

Figure 33 SAP: SWOT Analysis

Figure 34 Cegeka: Company Snapshot

Figure 35 Reply: Company Snapshot

Figure 36 Huawei: Company Snapshot

Figure 37 Oracle: Company Snapshot

Growth opportunities and latent adjacency in Blockchain in Telecom Market