Calf Milk Replacer Market - Global Forecast to 2030

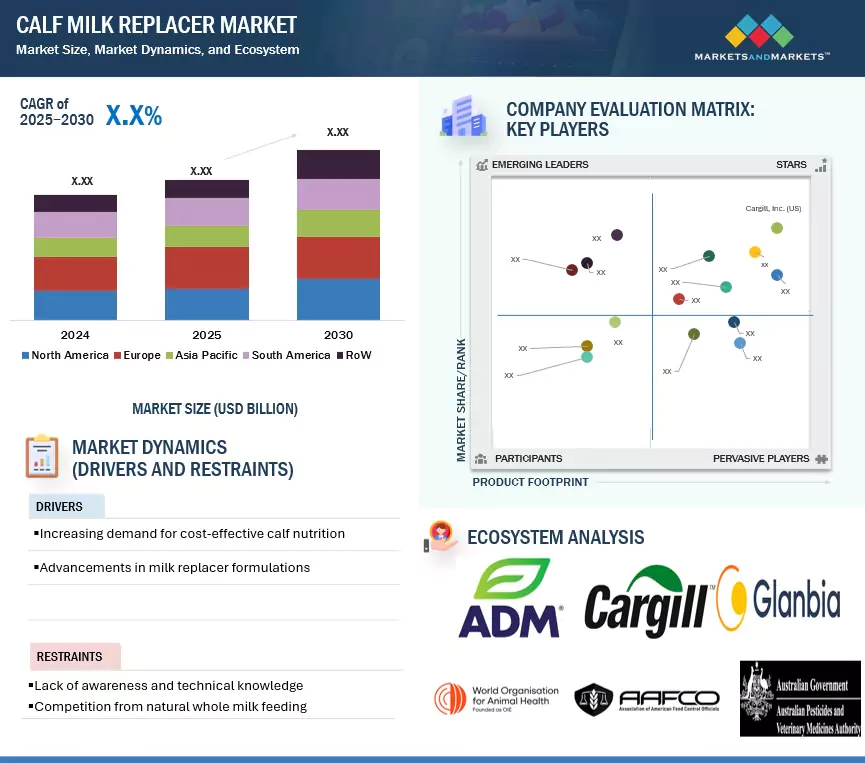

The global market for calf milk replacers has been estimated to be USD XX billion in 2025 and is projected to grow at XX% between 2025 and 2030.

The global calf milk replacers market is rapidly transforming the landscape of modern animal husbandry, offering scientifically formulated nutrition to support healthier, faster-growing calves. As dairy and beef producers seek ways to improve early-life performance, immune resilience, and feeding efficiency, calf milk replacers have emerged as a cost-effective and performance-enhancing alternative to whole milk feeding.

With a projected market value exceeding USD XX.XX billion by 2035 and an expected CAGR of over X-X%, the sector is witnessing robust growth driven by innovations in animal nutrition, the expansion of commercial dairy farming, and rising adoption in emerging economies such as India, China, and Brazil.

Backed by advancements in functional ingredients, automation-compatible feeding systems, and eco-friendly formulations, calf milk replacers are no longer just substitutes—but critical tools in ensuring sustainable and profitable livestock production. From organic dairy farms to large-scale beef operations, this market is evolving to meet the demands of a new generation of responsible agriculture.

Market Dynamics

Drivers: Rising Demand for Nutrient-Enriched Formulations

Modern dairy and beef farming increasingly prioritize early-life nutrition for calves, which is critical for optimal growth, immune system development, and future milk yield. Milk replacers are fortified with essential amino acids, probiotics, fats, vitamins, and minerals, designed to mimic colostrum and whole milk. Producers like Land O’Lakes (United States) and Trouw Nutrition (Netherlands) have introduced advanced formulations like Excelerate® and Sprayfo VITAL, enriched with immunoglobulins and gut health promoters. Significant R&D investment by feed and nutrition companies is enhancing the bioavailability and digestibility of milk replacers.

Significant R&D investment by feed and nutrition companies is enhancing the bioavailability and digestibility of milk replacers. Companies such as Cargill and Archer Daniels Midland (ADM) are integrating enzymes, organic trace minerals, and encapsulated fats to improve energy metabolism and gut microbiome development. Scientific trials from Journal of Dairy Science (2022) report that calves fed enhanced replacers gain up to 12% more weight by weaning.

The rise of automated calf feeding systems and its integration with is transforming the calf rearing practices. Calf Milk Replacers are highly compatible with automated calf feeders such as Forster- Technik and DeLeval VMS sytems. These sytems enable accurate portioning and hygienic feeding. Automation can reduce labor time by 50% while also improvimg the calf growth rates by ensuring consistent feeding intervals.

Restraints: High Cost of High Quality Calf Milk Replacers

One of the major restraints in the global calf milk replacers market is the high cost of premium formulations, which limits adoption among small and mid-sized farms, especially in price-sensitive regions like Africa, Southeast Asia, and Latin America.

Calf milk replacers enriched with high-quality protein sources (whey protein concentrate, skimmed milk powder, hydrolyzed fats, and immune supplements like IgG) are significantly more expensive than traditional whole milk feeding. A 2023 report by Teagasc Dairy Calf-to-Beef Programme (Ireland) suggests that cost per calf/day for replacers can be up to 25–30% higher than feeding whole milk, depending on milk prices and replacer composition.

Farmers in developing regions may continue to rely on home-grown feed alternatives or non-standardized formulations, thereby restraining the global penetration of nutritionally balanced commercial milk replacers.

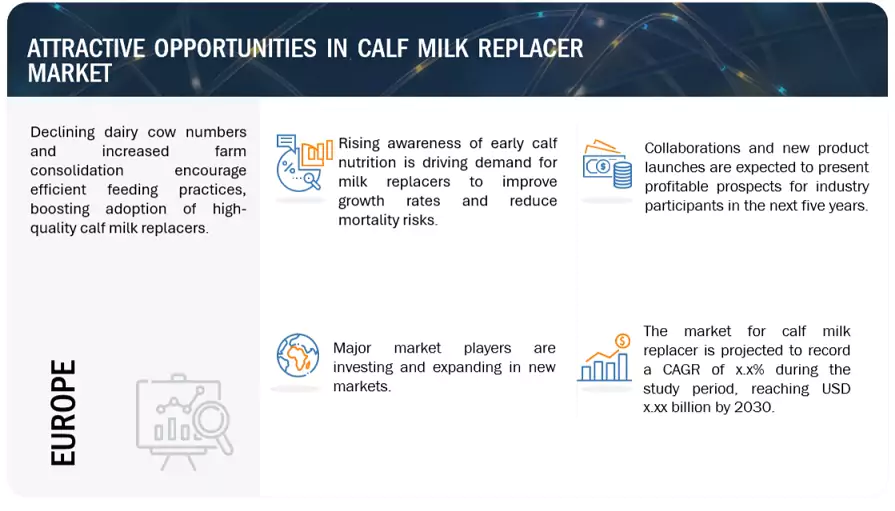

Opportunities: Expanding Dairy Operations in Emerging Economies

The rapid expansion of dairy farming in emerging markets such as India, Brazil, China, and Vietnam presents a major growth opportunity for the calf milk replacers market. These regions are experiencing rising demand for dairy products, along with government initiatives to boost productivity. As small-scale farmers modernize operations, the shift toward cost-effective and scalable calf feeding solutions like milk replacers is gaining momentum. According to the FAO, Asia will account for over 55% of new dairy production by 2030, making it a prime target for calf nutrition solutions.

The development of value-added milk replacer formulas—enriched with prebiotics, probiotics, essential oils, and immune boosters—is opening new avenues in calf health management. These enhanced replacers not only support faster weaning and higher weight gain but also reduce veterinary costs by improving disease resistance. Companies like Milk Specialties Global and Trouw Nutrition are investing in functional ingredient platforms to differentiate products and meet specific calf development needs, including gut health and respiratory protection.

The rising global emphasis on sustainable agriculture and organic livestock management is creating demand for non-GMO, antibiotic-free, and plant-based calf milk replacers. Regulatory support, especially in the EU and North America, is pushing for greener formulations and transparent sourcing. This trend is fueling innovation in eco-friendly milk replacer manufacturing, with companies offering organic-certified products to meet both environmental and consumer-driven standards.

Challenges: Limited adoption amognst the small scale farmers

Despite their nutritional benefits, calf milk replacers remain underutilized among small and marginal dairy farmers in developing regions due to lack of awareness, poor access to distribution channels, and mistrust in product quality. Many farmers continue to rely on traditional feeding methods using whole milk or low-cost homemade alternatives. According to the International Farm Comparison Network (IFCN), over 60% of calf raisers in South Asia and Sub-Saharan Africa do not use commercial milk replacers due to cost concerns and knowledge gaps.

The global market for calf milk replacers faces hurdles due to inconsistent regulations, import duties, and feed additive standards across different countries. In regions like the EU, strict guidelines exist on permissible ingredients (e.g., ban on certain antibiotics), while other regions lack clear regulatory oversight, leading to quality disparities and restricted cross-border trade. This hampers the scalability and standardization of product offerings by multinational players looking to expand into developing markets.

The global calf milk replacers market is heavily dependent on dairy-derived raw materials such as whey protein, skimmed milk powder, and fat concentrates. Fluctuations in global dairy commodity prices—driven by droughts, trade policies, or supply chain disruptions—directly affect production costs. For instance, the FAO Dairy Price Index reported a 10% YoY spike in global whey prices in 2023, impacting the affordability of high-protein milk replacers. This unpredictability makes it difficult for manufacturers to maintain stable pricing strategies, particularly in emerging markets.

Market Ecosystem

The calf milk replacers ecosystem is a dynamic and interconnected value chain that spans raw material suppliers, feed manufacturers, dairy and beef producers, veterinary services, technology providers, and end-market distributors. At its core, this ecosystem supports the vital goal of enhancing calf health and performance during the critical pre-weaning phase. With growing emphasis on sustainable livestock production, biosecurity, and precision feeding, stakeholders across the ecosystem are investing in high-performance formulations, automated delivery systems, and data-driven calf management platforms. As global dairy demand rises and herd productivity becomes increasingly essential, a resilient and collaborative calf nutrition ecosystem is key to ensuring long-term profitability, animal welfare, and food security.

By Type: Non-Medicated Milk Replacers Lead Market Share

In 2024, non-medicated calf milk replacers account for the largest share of the global market—estimated to hold over xx.x% of total revenue—and are projected to grow at a CAGR of x.x% through 2030. The increasing adoption of preventive animal healthcare practices, coupled with rising concerns over antibiotic resistance and residue in milk, is shifting preference toward non-medicated, nutritionally enriched formulations. Non-medicated products are widely preferred in organic and antibiotic-free dairy systems, especially in North America and Europe, where stringent regulations favor cleaner label alternatives. Moreover, the availability of advanced formulations with probiotics, enzymes, and essential oils that promote gut health without pharmaceutical additives further supports their market dominance.

By Ingredient: Milk-Based Formulas Dominate, Whey-Based Gaining Traction

Milk-based calf milk replacers, including those made with skimmed milk powder and whey protein concentrate, dominate the ingredient segment, contributing to more than xx.xx% of the global volume demand in 2024. These replacers closely mimic the nutrient composition of cow’s milk, offering high digestibility and better calf acceptance—especially during the critical pre-weaning phase. However, whey-based ingredients are emerging as the fastest-growing sub-segment (CAGR of x.x%), driven by their cost-effectiveness, high protein bioavailability, and increasing production from global dairy processors. The rise in cheese production, particularly in the U.S. and EU, ensures abundant whey availability, reducing input costs for manufacturers. Additionally, the growing shift towards plant-blended replacers is gaining traction in sustainability-conscious markets, but they still lag in digestibility and growth performance compared to milk-based counterparts.

By Livestock Type: Dairy Calves Drive Bulk of Demand

Dairy calves represent the largest end-use segment, accounting for over xx.xx% of global calf milk replacer consumption in 2024, with sustained growth expected through 2030 at a CAGR of x.x%. This is largely due to the intensification of dairy farming and the need to preserve marketable whole milk for human consumption while ensuring optimal calf development. High-producing dairy farms in Europe, North America, and increasingly in Asia (especially India and China) are shifting toward automated calf rearing systems that favor the use of precisely mixed milk replacers. Furthermore, early weaning programs and performance-based nutrition strategies aimed at improving first-lactation milk yield are increasing reliance on scientifically formulated replacers. While beef calf milk replacers also see demand in colder climates and large-scale feedlots, growth in this segment is comparatively moderate due to shorter rearing cycles.

By Region: Europe Leads, Asia-Pacific Fastest-Growing.

Europe dominates the global calf milk replacers market in 2024, accounting for over XX.X% of total revenue, owing to its well-established dairy industry, widespread use of automated feeding systems, and stringent regulations on antibiotic-free livestock production. Countries like Germany, France, the Netherlands, and the UK are at the forefront of adopting high-quality non-medicated milk replacers, particularly in organic and sustainable dairy operations. EU feed regulations mandating traceability and clean-label ingredients continue to boost demand for premium replacers.

Meanwhile, Asia-Pacific is projected to be the fastest-growing region, with a CAGR of X.X% through 2030. Rapid growth in countries such as India, China, and Vietnam is driven by increasing dairy consumption, government-backed dairy modernization programs, and rising awareness of early-life calf nutrition. In India alone, the National Dairy Development Board has launched several calf health initiatives, accelerating adoption of cost-effective, milk-based replacers in large and cooperative-owned dairy farms. Moreover, the regional shift from traditional whole-milk feeding toward commercial, performance-based formulas is accelerating as farm sizes scale up.

In North America, the market continues to mature, supported by widespread integration of calf health management systems, automated feeders, and probiotic-fortified milk replacers. The region also benefits from high output of whey protein and dairy byproducts, ensuring raw material availability. Latin America and MEA (Middle East & Africa) are emerging markets, with growth primarily led by Brazil, South Africa, and Saudi Arabia, where investments in dairy infrastructure and livestock efficiency are gradually increasing demand for replacers.

Key Market Players

The key players in the calf milk replacers market include Cargill, Inc., Land O’Lakes, Inc., Archer Daniels Midland (ADM), Trouw Nutrition (a Nutreco company), Milk Specialties Global, Glanbia PLC, Calva Products LLC, Provimi, BV Science, Lactalis Ingredients, Schaumann Agri, Bonanza Calf Nutrition, Saprogal S.A., Volac International Ltd., and Avitech Nutrition Pvt. Ltd. These companies are engaged in producing both medicated and non-medicated milk replacers, leveraging advancements in functional additives, digestive enzymes, and immune support compounds to deliver nutritionally optimized solutions for early calf growth.

Recent Developments

- In February 2024, Trouw Nutrition launched a next-generation milk replacer line under the Sprayfo Delta brand, which incorporates gut health modulators and micro-encapsulated fats to support enhanced energy absorption and feed efficiency in pre-weaning calves. The formulation is tailored for high-yield dairy operations utilizing automated calf feeding systems.

- In July 2023, Cargill unveiled a plant-based calf milk replacer prototype at the World Dairy Expo, aimed at markets prioritizing sustainability and cost-efficiency. This innovation includes soy protein isolates, probiotics, and fermented amino acid complexes, providing a viable alternative to traditional milk-based formulations, particularly in developing regions.

- In October 2022, Land O’Lakes Animal Nutrition expanded its product line with Amplifier Max, a performance milk replacer fortified with essential oils and bovine colostrum to reduce early calf mortality and support immune development during seasonal health challenges.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the calf milk replacer market?

Europe dominated the calf milk replacer market, worth USD XX billion in 2024, and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the forecast period.

What is the current size of the global calf milk replacer market?

The global calf milk replacer market was valued at USD XX billion in 2024. It is projected to reach USD XX billion by 2029, recording a CAGR of XX% during the forecast period.

Who are the key players in the market?

The key players in the calf milk replacers market include Cargill, Inc., Land O’Lakes, Inc., Archer Daniels Midland (ADM), Trouw Nutrition (a Nutreco company), Milk Specialties Global, Glanbia PLC, Calva Products LLC, Provimi, BV Science, Lactalis Ingredients, Schaumann Agri, Bonanza Calf Nutrition, Saprogal S.A., Volac International Ltd., and Avitech Nutrition Pvt. Ltd.

What are the factors driving the calf milk replacer market?

- Rising demand for early-life calf nutrition to boost dairy productivity.

- Increasing adoption of automated calf feeding systems in modern farms.

- Growing awareness of disease prevention and immune development in calves.

- High cost of whole milk encouraging farmers to opt for replacers.

- Expansion of commercial dairy farms in emerging economies.

- Innovation in nutrient-enriched, medicated, and probiotic-rich formulas.

- Shift towards sustainable and antibiotic-free animal nutrition.

Which segment accounted for the largest calf milk replacer market share?

In 2024, non-medicated calf milk replacers account for the largest share of the global market—estimated to hold over xx.x% of total revenue—and are projected to grow at a CAGR of x.x% through 2030. .

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

-

1.3 STUDY SCOPEMARKET SEGMENTATIONINCLUSIONS & EXCLUSIONSREGIONS COVEREDYEARS CONSIDERED

-

1.4 UNIT CONSIDEREDCURRENCY/ VALUE UNIT

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

-

2.1 RESEARCH DATASECONDARY DATA- Key data from secondary sourcesPRIMARY DATA- Key data from primary sources- Key insights from industry experts- Breakdown of Primary Interviews

-

2.2 MARKET SIZE ESTIMATIONBOTTOM-UP APPROACHTOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

-

2.4 RESEARCH ASSUMPTIONSASSUMPTIONS OF THE STUDY

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

-

5.3 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.4 IMPACT OF GEN AI ON ANTI FOAMING AGENT

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

-

6.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- KEY TECHNOLOGY 1- KEY TECHNOLOGY 2COMPLEMENTARY TECHNOLOGIESADJACENT TECHNOLOGIESAVERAGE SELLING PRICE TREND OF KEY PLAYERS, TYPEAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND, BY REGION

-

6.6 ECOSYSTEM ANALYSIS/ MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

-

6.8 PATENT ANALYSISLIST OF MAJOR PATENTS PERTAINING TO THE MARKET

- 6.9 KEY CONFERENCES & EVENTS IN 2024-2025

-

6.10 TARIFF & REGULATORY LANDSCAPEUS TARIFF IMPACTS - 2025TARIFF RELATED TO ANTI FOAMING AGENTREGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 7.1 INTRODUCTION

- 7.2 MEDICATED MILK REPLACERS

- 7.3 NON -MEDICATED MILK REPLACERS

- 8.1 INTRODUCTION

- 8.2 MILK BASED

- 8.3 NON- MILK BASED

- 8.4 WHEY PROTEIN CONCENTRATE

- 8.5 SKIMMED MILK POWDER

- 8.6 FAT & ENERGY SOURCES

- 8.7 ADDITIVES (VITAMINS, PROBIOTICS, ENZYMES)

- 9.1 INTRODUCTION

- 9.2 POWDER

-

9.3 LIQUIDCALF MILK REPLACER MARKET, BY LIVESTOCK TYPE

- 10.1 INTRODUCTION

- 10.2 DAIRY CALVES

- 10.3 BEEF CALVES

- 11.1 INTRODUCTION

- 11.2 ONLINE RETAILERS

- 11.3 OFFLINE RETAILERS

-

12.1 NORTH AMERICAUSCANADAMEXICO

-

12.2 EUROPEGERMANYUKFRANCEITALYSPAINBENELUXNORDICSREST OF EUROPE

-

12.3 ASIA PACIFICCHINAINDIAJAPANAUSTRALIA & NEW ZEALANDSOUTH KOREAREST OF ASIA PACIFIC

-

12.4 SOUTH AMERICABRAZILARGENTINACHILEREST OF SOUTH AMERICA

-

12.5 REST OF THE WORLDAFRICAMIDDLE EAST

-

13.1 OVERVIEW

-

13.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

-

13.3 REVENUE ANALYSIS

-

13.4 MARKET SHARE ANALYSIS, 2024

-

13.5 BRAND/ PRODUCT COMPARISON

-

13.6 KEY PLAYER ANNUAL REVENUE VS GROWTH

-

13.7 KEY PLAYER EBIT/EBITDA

-

13.8 COMPANY VALUATION AND FINANCIAL METRICES

-

13.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

13.10 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYER, 2024- COMPANY FOOTPRINT- REGION FOOTPRINT- TYPE FOOTPRINT- APPLICATION FOOTPRINT

-

13.11 COMPANY EVALUATION MATRIX: START-UP/SME, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: START-UPS. SMES, 2024- DETAILED LIST OF KEY STARTUPS/SME- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME

-

13.12 COMPETITIVE SCENARIO AND TRENDSNEW PRODUCT LAUNCHESDEALSOTHERSOTHER DEVELOPMENTS

-

14.1 KEY PLAYERSCARGILL, INC.LAND O LAKESARCHER DANIELS MIDLAND (ADM)TROUW NUTRIION (NUTRECO)GLANBIA PLCMILK SPECIALITIES GLOBALLACTALIS INGREDIENTSCALVA PRODUCTS LLCBV SCIENCEPROVIMIOTHER PLAYERS

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Calf Milk Replacer Market