Car as a Connected Living Ecosystem - Global Forecast to 2035

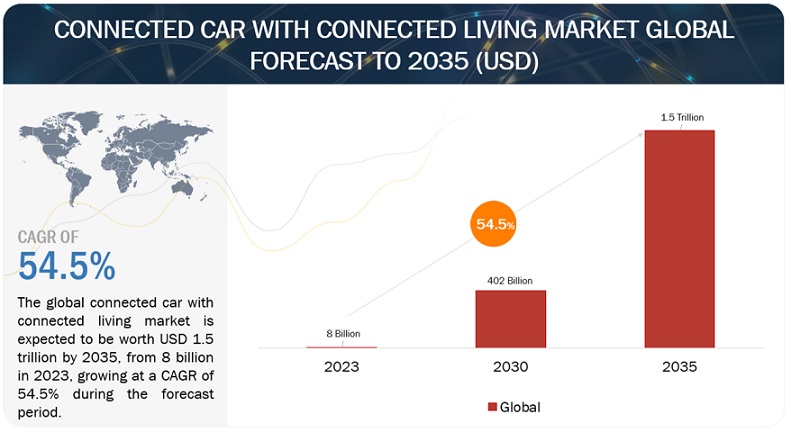

OEMs can earn up to $1,600 per vehicle annually by 2035 across the vehicle’s lifetime by offering advanced connectivity features such as AI led interactive digital assistants, autonomous features, safety & security, connected home, connected health, connected energy, and connected aftermarket services. The total market for connected living services is estimated to grow from $8 Billion in 2023 to more than $1.5 Trillion by 2035, at the CAGR of 54.5%.

The connected car is all about the customer experience and how easily & effectively can customers interact with vehicle. Customers, especially the GenZ, are willing to pay a premium for the smart sensor and AI led unmatched in-car experiences services and seamless interaction with the outside world from within the car. Customers are becoming more brand agnostics with advanced connectivity levels and

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Advanced Technologies & Customer Propensity to Adopt

Almost every OEM has launched a separate division to exploit the potential of connected cars. Stellantis, through its Dare Forward strategy, expects to have 34 billion connected vehicles that will bring in an additional EUR 20 Bn in revenue by 2030, while GM and Ford expect to have ~$20 bn in revenue from connected vehicles by 2030. Key pillars include subscriptions from connected living services, features on demand, and data as a service. VW’s strategic framework for the future of connected cars is hinged upon architecture, battery & charging, software and mobility. Through its recent Arc Strategy, Nissan’s long term focus is undertaking strategic cross industry partnerships (software and product driven), new revenue streams and differentiated innovations. Hyundai and Renault (BeyonCa) are focusing on in-car health.

Restraint: Cost of Technology & Pricing Models

OEMs need to invest in connected living technologies and an extensive stakeholder ecosystem. Additionally, some OEMs such as Toyota, GM, VW, and Tesla offer services as integrated packages, where each package consists of a range of features across different segments. Mercedes Benz and BMW, on the other hand, offer services on a piecemeal basis – every cluster of service has a specific cost and customers can choose which clusters of service they want access to. Given the nascency of the market, arriving at the optimal packages for customers at effective prices will be critical for gaining car as a connected living ecosystem share.

Opportunity: Greenfield Market

OEMs stand to gain further through developing competencies in the wider automotive ecosystem such as energy management services and connected insurance. Tesla, Hyundai, GM, and Ford are not just selling EVs but the entire spectrum of services such as renewable energy generation, energy storage, V2G technology, and energy usage optimization required for energy independence. Connected insurance is yet another revenue generating service for OEMs by reducing insurance premiums paid by customers and maximizing gains for insurance companies by minimizing wear & tear. Data monetization partnerships with various stakeholders such as cities, utility companies, automotive workshops, advertising and others are some of the other revenue generating streams for OEMs. Several other revenue streams could emerge from a single connected car.

Challenge:Competitive Market

New age OEMs are potentially better positioned to capture the connected living market, especially the EV market, given their streamlined operations as opposed to legacy OEMs with established processes. Furthermore, Xiaomi’s entry into connected vehicle space re-establishes the potential of connected cars. The imminent entry of technology players implies competition to the automakers given their deep pockets and expertise in connectivity technology.

Connected Cars will Offer Connected Home Services

Various home functionalities that are expected to be controlled from the car and vice versa. While on the road, the car creates a refrigerator stock update and notifies the owner or orders it online. The car checks on the automatic locking system and places an emergency video call to the owner in the event of a visitor or potential hazard. The home heating system can be turned on before the owners return from work. What is important here is the integration of these home systems with the car’s operating system.

What Does Connected Work Mean?

Similar to workflow management connected work services offered include work diary management, journey planning & auto navigation, video calls that include transcription, and others. Future solutions include CO2 tracking, connected platforms for sustainable commuting, and integrated mobility budget solutions. This can have significant impact on corporate fleet management services.

Connected City Services

OEMs can leverage the data from its connected car and customers by not only selling subscription services for in-car tolling and taxation, energy services, and parking services to customers but also by selling the data to critical city service such as traffic systems, environmental regulators, emergency services, urban planners, and insurance service providers.

Key Market Players

The car as a connected living ecosystem market is led by OEMs such as Mercedes Benz, BMW, VW, Stellantis, Hyundai, Toyota, GM, Ford, Nio, Xpeng, and others.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2035 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2035 |

|

Forecast units |

Value ($ Billion) |

|

Segments covered |

Connected Living (through the car) Market by Segments – In-car connectivity, Connected Energy, Connected Aftermarket, Connected Health, and other |

|

Geographies covered |

Global |

|

Companies Covered |

Mercedes Benz, BMW, Stellantis, VW, GM, Ford, Toyota, Hyundai, and others |

This research report categorizes the connected car features based on connected living solutions.

Based on Connected Living Solutions:

- In-car connectivity

- Connected Energy

- Connected Aftermarket

- Connected Health

- Connected Work

- Others

Recent Developments

- In January 2024, Mercedes Benz unveiled its AI powered MBUX Virtual Assistant

- In January 2024, Stellantis acquired Artificial Intelligence Technologies and IP from CloudMade for advanced connectivity features

- In January 2024, GM introduced OnStar connectivity features in Saudi Arabia

Frequently Asked Questions (FAQ):

What is the current size of the connected car - connected living market by volume?

The current size of the market is estimated to be $8 billion as of 2023.

Who are the winners in the car as a connected luving ecosystem market?

The market is dominated by OEMs such as Mercedes Benz, BMW, VW, Hyundai, GM, XPeng, and among others.

Which connected living segment is expected to have the largest share of the market?

The in-car connectivity segment is expected to have the largest share of the market in 2035.

What are the key drivers impacting the growth of the future of hydrogen in atutomotive market?

The market is expected to be driven by new connected vehicle technologies, OEM initiatives, and customer expectations.

What are different regions covered in the study?

The study represents a global view of the connected car-connected living market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

Introduction to Connected Living

Enablers for Connected Living to 2035

Defining Connected Living

Concept of Car as a Connected Living Ecosystem

Car As A Connected Living Ecosystem

Key Elements of a Connected Car – Mapping Connected Living Elements from Pre-Buying to End-of-Life Management

- Digital Retailing

- Vehicle Ownership

- In-car Experiences

- Connected Home

- Connected Work

- Connected Health

- Connected Lifestyle

- Connected City

- Connected Energy

- Connected Aftermarket

- Connected Mobility

- Connected End-of-Life-Management

Evolution Potential of the Car’s Connected Living Ecosystem

Connected Living through the Connected Car – Target Timelines

Leading Industry Examples

Car as a Connected Living Ecosystem – Market Potential

Total Addressable Market

- Digital Connected Living Services - Market Potential

- Digital Connected Living Ecosystem Services – Market Potential

Business & Financial Case

- Pricing Models

- High Growth Segments

- Data Monetization Opportunities

Car as a Connected Living Ecosystem – Competitive Landscape

OEM Comparative Analysis

Customer Analysis

Service Adoption Potential

Technology Requirements

Conclusion & Recommendations

The study involved four major activities in estimating the current size of the car as a connected living ecosystem. Exhaustive secondary research was done to collect information on the market. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, ACEA) have been used to identify and collect information useful for an extensive commercial study of the car as a connected living ecosystem.

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the connected living solutions. In this approach, the vehicle sales statistics, connected living feature penetration, and price ranges for connected living fetaures have been considered at the global level.

To determine the market size, in terms of volume, a mapping of digital connected living services was carried out. After this, the penetration rate per connected living service and ecosystem service categories were determined. This penetration rate applied to the connected car sales determines the total digital connected living car parc for each connected living category and the total ecosystem service vehicle parc.

In terms of value, the price per connected living category and ecosystem service were multiplied with the respective vehicle parcs to arrive at the category level market size. These when added gives the total digital connected living market and the ecosystem service market; which further add up to the total connected living market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and trends from both the demand- and supply-side participants.

Market Definition

A connected car in the connected living context implies a connected car that is capable of offering services such as in-car connectivity (wi-fi, entertainment, safety, security), connected home features, connected energy management services, connected aftermarket service, and others.

List of Key Stakeholders

- Automobile OEMs

- Tier 1 Suppliers

- Technology providers

- Energy Companies

- Utilities

- Charging Infrastructure Companies

- Cities/Governments

Report Objectives

- To understand the connected living ecosystem and various use cases

- To understand the shift in service requirements and key focus areas for customers and OEMs

- To determine the business model and pricing analysis of the connected living solutions

- To study the technology roadmap and trends for the market

- To outline the ecosystem players and undertake competitor benchmarking

- To determine the market potential for connected living solutions

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Future of Car as a Connected Living Ecosystem, Country Level

- Competitor Benchmarking & Profiling

Growth opportunities and latent adjacency in Car as a Connected L