Civil Aircraft Outlook 2035: Market Overview (Ecosystem, Macroeconomics, Regulatory, Programs, Expenditure, Alliances, Dynamics), Industry Trends (Technologies, Use Cases, Maturity Curve), Market Segments (Commercial and Business Aircraft), Customer Insights (Operators, OEMs, Shifts, initiatives, Business Models, Market Position), Competitive Landscape (Competitors, Partners, Evaluation Matrix, Key Profiles) and Future Opportunities (Future Landscape, Technology Roadmap, Major Projects, Top Opportunities)

The civil aviation industry is set to undergo a transformative evolution by 2035, driven by technological advancements, environmental considerations, and shifting market dynamics. With growing passenger demand, increased sustainability regulations, and the integration of next-generation aircraft, the landscape of civil aviation will be markedly different from today. This article provides a detailed analysis of the market outlook, industry trends, customer insights, competitive landscape, and future opportunities for civil aircraft by 2035.

Market Overview

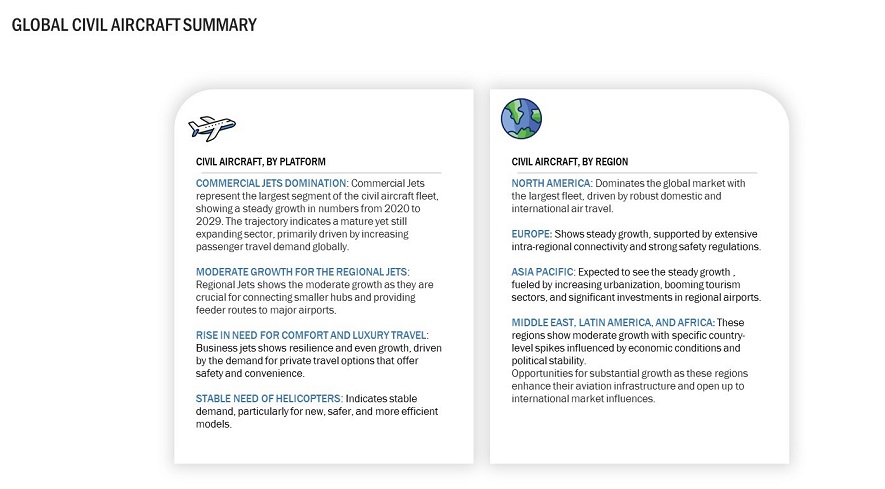

By 2035, the global civil aircraft market is projected to grow significantly, fueled by rising air travel demand, economic growth, and advancements in aircraft design and fuel efficiency. The demand for new aircraft is expected to reach over 40,000 units, with Asia-Pacific leading the expansion, followed by North America and Europe. The rise of low-cost carriers (LCCs) and emerging markets will further drive fleet expansion, requiring more fuel-efficient, long-range, and technologically advanced aircraft.

Key market segments include:

- Narrow-body Aircraft – Expected to dominate fleet expansions due to high demand for short- to medium-haul travel.

- Wide-body Aircraft – Driven by long-haul international travel and increasing demand from airlines for fuel-efficient models.

- Regional Jets – Supporting connectivity in secondary markets with improved operational efficiency.

- Freighter Aircraft – E-commerce growth and global supply chain disruptions will drive demand for modern cargo aircraft.

Industry Trends

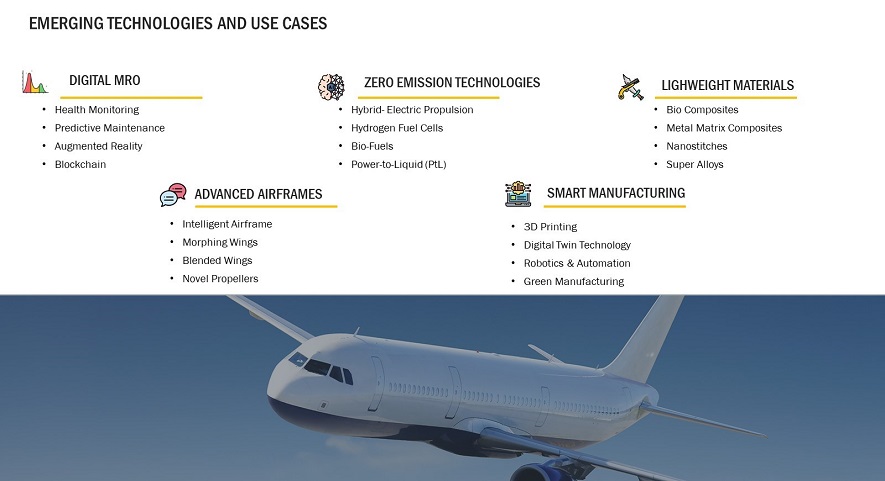

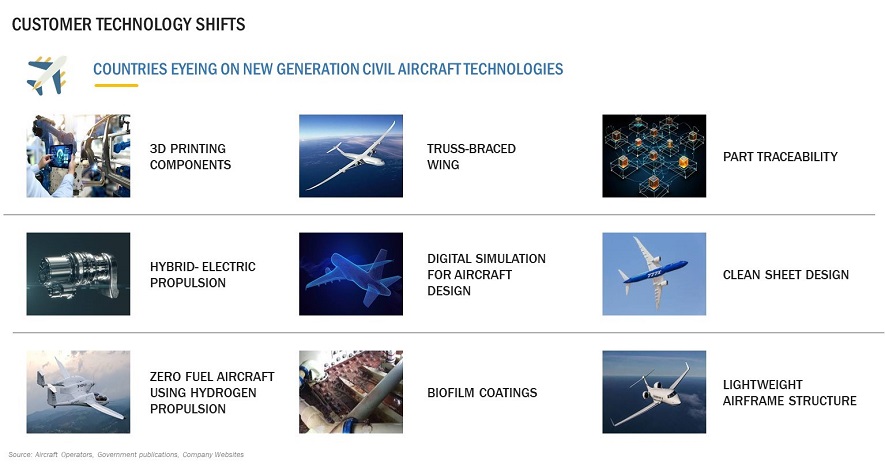

- Sustainable Aviation Initiatives – The push for carbon-neutral aviation is accelerating the development of hydrogen-powered aircraft, sustainable aviation fuel (SAF), and hybrid-electric propulsion systems.

- Next-Generation Aircraft Technology – Advancements in aerodynamics, lightweight composite materials, and high-bypass turbofan engines will enhance fuel efficiency and reduce emissions.

- Digitalization and Smart Aircraft – AI-driven predictive maintenance, digital twins, and automation will enhance aircraft operations and reduce costs.

- Rise of Urban Air Mobility (UAM) – The intersection of traditional aviation with eVTOLs and autonomous aerial systems could reshape urban connectivity.

- Fleet Modernization and Retirement of Older Aircraft – Airlines will continue replacing older, less fuel-efficient models to meet environmental regulations and improve operational efficiency.

Customer Insights

The passenger experience is becoming a focal point for aircraft design and airline operations. Key insights include:

- Demand for Comfort and Space – Airlines are investing in more spacious cabins, improved seat designs, and enhanced in-flight entertainment systems.

- Sustainability Preferences – Eco-conscious travelers are favoring airlines with lower carbon footprints, pushing for greener aviation solutions.

- Cost Sensitivity – While premium travel remains strong, budget-conscious passengers continue to drive the success of low-cost carriers.

- Post-Pandemic Travel Behavior – The return of business travel, the growth of leisure travel, and an increased preference for direct flights are shaping airline strategies.

Competitive Landscape

Major players in the civil aircraft sector include:

- Aircraft Manufacturers – Boeing, Airbus, Embraer, and COMAC continue to dominate the market, with intense competition in new aircraft programs.

- Engine Manufacturers – Rolls-Royce, Pratt & Whitney, and GE Aviation are leading the charge in fuel-efficient and hybrid-electric propulsion technologies.

- Airlines and Lessors – Airlines are focusing on fleet modernization, while leasing companies play a critical role in aircraft financing and availability.

- Regulatory and Safety Bodies – Organizations like the FAA, EASA, and ICAO are shaping safety standards and environmental policies.

Future Opportunities

- Breakthrough Propulsion Systems – Hydrogen-electric and hybrid propulsion systems present significant opportunities for reducing aviation emissions.

- Growth in Emerging Markets – Asia, Africa, and Latin America will see increased air traffic and infrastructure investments.

- Advanced Air Traffic Management – AI-driven air traffic control and automation will enhance flight efficiency and reduce congestion.

- Sustainable Aviation Fuel (SAF) Scaling – Governments and industry players are investing in large-scale SAF production and infrastructure.

- New Business Models – Subscription-based airline services, on-demand charter flights, and supersonic travel could redefine air travel.

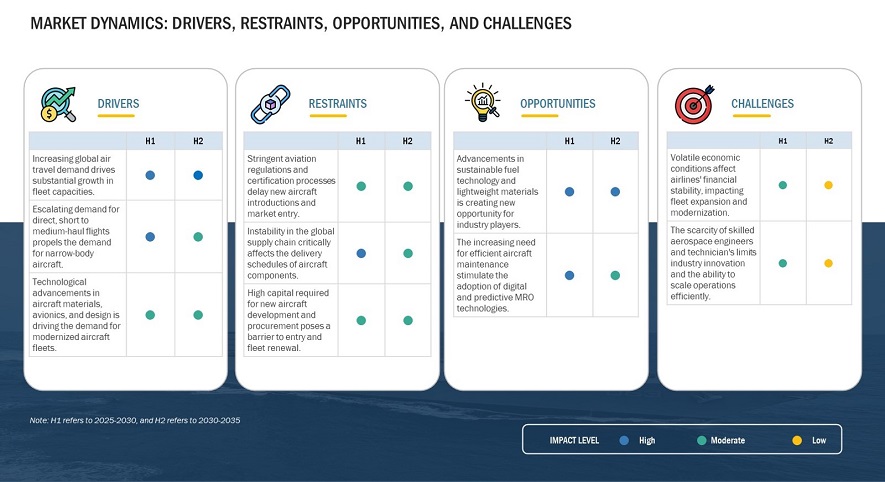

By 2035, civil aviation will be shaped by a convergence of sustainability efforts, next-generation aircraft innovations, and evolving passenger preferences. While challenges remain in regulatory compliance, infrastructure readiness, and technology adoption, the industry is poised for a greener, more efficient, and more connected future. Collaboration among airlines, manufacturers, policymakers, and technology providers will be key to unlocking the full potential of civil aviation in the coming decade.

Growth opportunities and latent adjacency in Civil Aircraft Outlook 2035: Market