Cloud Encryption Market by Component (Solution and Service), Service Model (Infrastructure-as-a-Service, Software-as-a-Service, and Platform-as-a-Service), Organization Size, Vertical, and Region - Global Forecast to 2022

[168 Pages Report] The cloud encryption market size is expected to grow from USD 645.4 million in 2017 to USD 2,401.9 million by 2022, at a CAGR of 30.1% during the forecast period. Cloud encryption solutions secure data at rest and in motion through various standards and protocols. The proliferation in cloud adoption and virtualization, cloud environments risks due to big data analytics, and regulations have led to growth of the cloud encryption market. The growth of the cloud encryption market is also propelled by the need to combat with advanced threats and vulnerabilities, and secure the enterprise cloud. The base year for the study is 2016 and the forecast period is considered to be 2017 to 2022.

Market Dynamics

Drivers

- Proliferation in cloud adoption and virtualization

- Risks related to cloud environments, due to big data analytics

- Regulations to increase the adoption of cloud encryption solutions

Restraints

- Lack of budget for the adoption of the best-in-class cloud encryption solution

- Lack of awareness about cloud encryption and performance concerns among enterprise

Opportunities

- Proliferation in the demand for integrated, cloud-based encryption solutions in SME

- Increase in the demand for cloud-based services in the healthcare vertical

Challenges

- Complexities in the management of encryption keys

- Lack of technical expertise among enterprise workforce

- Dynamicity of organizations and IT infrastructure

Proliferation in cloud adoption and virtualization is driving the global cloud encryption market

Enterprises that store corporate data in on-premises workstations and servers rely on network security and endpoint security solutions for data protection. The management of large data volumes is likely to incur significant costs. Enterprises can increase their availability, scalability, and operational efficiency by moving to the cloud or adopting virtualization. Adherence to compliance regulations, reduction in business complexities, increased efficiency, and enhanced employee productivity are guaranteed by cloud deployments. The service models offered by Cloud Service Providers (CSPs) include Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). SaaS is more widely used as compared to IaaS and PaaS. By adopting virtualization, enterprises can gain access to virtual servers, virtual storage, and virtual networks. The proliferation of cloud services and virtualization, and increased instances of cyber-attacks have increased the need for encrypting cloud solutions.

The following are the major objectives of the study.

- To define, describe, and forecast the cloud encryption market on the basis of components (solutions and services), service models, organization size, verticals, and regions

- To provide detailed information regarding the major factors influencing the growth of the cloud encryption market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to the individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the cloud encryption market

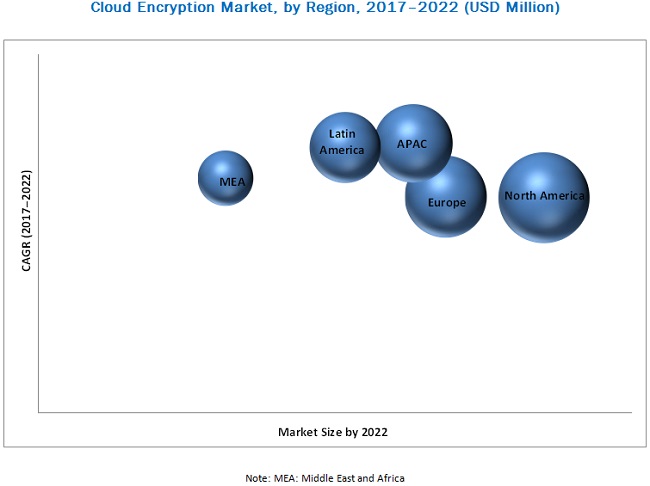

- To forecast the market size of the segments with respect to five main regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players in the cloud encryption market and comprehensively analyze their market size and core competencies2

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, and partnerships, agreements, and collaborations in the global cloud encryption market

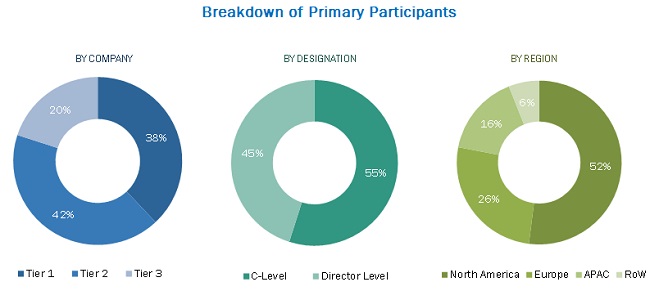

The research methodology used to estimate and forecast the cloud encryption market begins with collection and analysis of data on key vendor revenues through secondary sources such as company website, press releases, annual reports, the SANS Institute, SC Magazine, and Cloud Security Alliance (CSA),. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global cloud encryption market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The cloud encryption market comprises key vendors, such as Thales e-Security (La Defense, France), Gemalto N.V. (Amsterdam, Netherlands), Sophos Group plc (Abingdon, UK), Symantec Corporation (California, US), Skyhigh Networks (California, US), Netskope Inc. (California, US), CipherCloud (California, US), Randtronics (New South Wales, Australia), Stormshield (Paris, France), HyTrust, Inc. (California, US), StratoKey (Texas, US), Secomba GmbH (Augsburg, Germany), Dell (Texas, US), Hewlett Packard Enterprise Development LP (California, US), IBM Corporation (New York, US), Trend Micro Incorporated (Tokyo, Japan), Cisco Systems, Inc. (California, US), Protegrity USA, Inc. (Connecticut, US), Vaultive, Inc. (Massachusetts, US), DataLocker Inc. (Kansas, US), Parablu Inc. (California, US), Hitachi Solutions, Ltd. (Tokyo, Japan), PerfectCloud Corp. (Ontario, Canada), Tresorit (Budapest, Hungary), Bitglass, Inc. (California, US), Spamina (Madrid, Spain), and TWD Industries AG (Unteriberg, Switzerland). These vendors sell cloud encryption market to end-users to cater to their unique business requirements and security needs.

Major Market Developments

- In March 2017, Thales e-Security entered into an agreement with BT, under which BT would be delivering Vormetric Transparent Encryption solution to its customers across the globe. Vormetric Transparent Encryption solution helps customers in safeguarding their data with data at rest encryption.

- In July 2017, HyTrust acquired Data Gravity, a data security company, to automate and quicken its policy enforcement for workload data. With this acquisition, HyTrust strengthens its position in the cloud security domain.

- In February 2017, CipherCloud partnered with BlackBerry to deliver end-to-end cloud security to customers who are relying on the BYOD trend in an organization. With this partnership, authorized users can access the critical information stored in the cloud environment.

Key Target Audience

- Cloud encryption vendors

- Network solution providers

- Defense organizations

- Government agencies

- Cybersecurity vendors

- Cloud security vendors

- Independent software vendors

- Consulting firms

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

“Study answers several questions for the stakeholders, primarily which market segments to focus in the next 2–5 years for prioritizing the efforts and investments”.

Scope of the Report

The research report segments the cloud encryption market into the following submarkets:

By Component

- Solution

- Service

- Professional Service

- Support and Maintenance

- Training and Education

- Planning and Consulting

- Managed Service

- Professional Service

By Service Model

- Infrastructure-as-a-Service

- Software-as-a-Service

- Platform-as-a-Service

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government and Public Utilities

- Telecom and IT

- Retail

- Aerospace and Defense

- Others (manufacturing, education, and media and entertainment)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Others

- APAC

- China

- Australia and New Zealand

- Singapore

- Others

- MEA

- Middle East

- Africa

- Latin America

- Mexico

- Brazil

- Others

Critical questions which the report answers

- What are new application areas which the cloud encryption companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America cloud encryption market

- Further breakdown of the Europe cloud encryption market

- Further breakdown of the APAC cloud encryption market

- Further breakdown of the MEA cloud encryption market

- Further breakdown of the Latin America cloud encryption market

Company Information

- Detailed analysis and profiling of additional market players

The cloud encryption market size is expected to grow from USD 645.4 million in 2017 to USD 2,401.9 million by 2022, at a CAGR of 30.1% during the forecast period. The major growth drivers of the cloud encryption market include proliferation in cloud adoption and virtualization, risks related to cloud environments, due to big data analytics, and regulations to increase the adoption of cloud encryption solutions.

Cloud encryption is the process of transforming the customer’s data stored in the cloud environment into cipher text, which ensures only authorized people with the correct decryption key can access the data. Cloud encryption can be applied to data at rest and data in transit. Companies across the globe are increasingly adopting the cloud technology. Organizations are categorically embracing diverse cloud environments, ranging from private and hybrid clouds to public cloud for the storage of enterprise data. However, the risks associated with content protection and data compliance continue to be the prime factors hindering cloud embracement across businesses. Moreover, computer hackers and the voluminous increase in the number of cyber-attacks have further increased data security concerns for organizations that have adopted cloud for data storage. Therefore, organizations are increasingly adopting cloud encryption solutions to safeguard sensitive information from data breaches and thefts, and to adhere to industry-specific compliances and standards. Cloud encryption offers solutions and services that strengthen an organization’s security portfolio through strong encryption capabilities

The cloud encryption market by component has been segmented, on the basis of solution and services. The market for services segment is expected to grow at the highest CAGR between 2017 and 2022. The high adoption of cloud encryption solutions and services by the global organizations contribute to the rapid growth of the market.

The cloud encryption market by service model has been segmented into SaaS, IaaS, and PaaS. The IaaS segment is expected to have the largest market size in the service model market by 2022. The SaaS segment is expected to grow at the highest CAGR during the forecast period in the cloud encryption market due to the increasing need to protect cloud applications from cyber-attacks. The SaaS segment is gaining traction due to the increase in the usage of cloud-based applications among the industry verticals

The telecom and IT vertical is the fastest-growing vertical in the cloud encryption market. The usage of cloud encryption technology supports in improving the proficiency of clinical and IT staff, and providing real-time access in case of emergency. The retail vertical is expected to grow at a significant rate during the forecast period owing to their adherence to various compliance mandates through regulatory standards such as PCI DSS and TR-39.

Risks related to cloud environments, due to big data analytics drive the growth of cloud encryption market

Banking, Financial Services, and Insurance (BFSI)

BFSI is an industry term for commercial banks, insurance institutes, and non-banking financial organizations, which provide financial products and services. These service providers are expanding their offerings to maintain a competitive edge, save costs, and improve customer experience with value-added services. Moreover, with strict regulations governing the BFSI sector and the pressure on IT teams to address the dynamic needs of the businesses, this sector is exploring possibilities of exploiting cloud computing as a mechanism to deliver faster services to the businesses and at the same time reduce the cost of delivering such services. However, with this evolution arises the need to protect sensitive data that is being acquired and transmitted. This can be achieved using the cloud encryption technology, encrypting confidential data in transit as well as at rest. Furthermore, regulatory requirements such as GLBA, and PCI DSS have led companies in this sector to deliver security solutions with encryption software

Government

The government vertical consists of four institutional units, namely, central government, state government, local government, and social security funds. Public utilities are those businesses which fulfill the everyday needs of human beings. The government and public utilities lack trust when it comes to movement of sensitive data of its citizens from on-premises to the cloud environment due to privacy concerns. However, over the passage of time, these agencies are dependent on the file transfer capabilities as various documents are now available for downloading. But these file transfer sites are open and unsecured that may cause data leakage. The cloud encryption services enable these agencies to encrypt and control the data every time, collaborate securely with other agencies, state, and foreign partners, and limit the users to download, print, and edit the programming files and folders. Cloud encryption vendors offer various services to this vertical to protect the valuable cloud applications.

Telecom and IT

The telecommunication sector is a key target for hackers due to vast and increasing amount of personal data being managed on cell phones, satellites, and the internet. Information Technology (IT) deals with the use of the computers and networking devices to produce, process, preserve, and protect various forms of the electronic data. Together, telecom and IT is considered a subset of Information and Communications Technology (ICT). In today’s rapidly changing technology landscape, telecom and IT is a constantly developing industry and is the epicenter for innovation and growth. The transformation has brought security issues and regulatory compliances that are affecting the working of companies in this sector. This vertical involves high usage of cloud-based applications for their business operations and is thus frequently attacked by cybercriminals. Companies in this sector are adopting cloud encryption solutions to provide their customers risk-free services. The usage of cloud encryption has allowed users to save their important information on their mobile devices and use that information through cloud without any risk.

Healthcare

The healthcare sector covers personal health information and critical data about patient that needs high security, therefore, data security has been of utmost importance for this industry. With the proliferation of cloud technology, healthcare providers are starting to take advantage of it to keep their data secure. Cloud adoption has significantly increased and is expected to accelerate among healthcare organizations, driving agility and flexibility. Moreover, the healthcare industry is very conscientious about data privacy and some of these issues can be addressed through cloud encryption and cloud key management. Some of the major hacking cases in the healthcare industry have led to increased security against threats in this sector; for example, the recent attack on AHMC Healthcare office near Los Angeles, which leaked 7 hundred thousand patient records. Financial data has always been the primary target of criminals, but these days medical data is also becoming one of the lucrative targets. Furthermore, the usage of cloud encryption technology supports in improving the proficiency of clinical and IT staff, and providing real-time access in case of emergency.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the applications areas of cloud encryption?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Lack of awareness about cloud encryption and performance concerns among enterprise is a major challenge in the growth of the market. Most enterprises have the notion that encryption is an expensive activity which may lead to performance issues. Lack of knowledge about cloud encryption and the belief of performance issues caused by encryption act as barriers to the adoption of cloud encryption solutions and services. Some enterprises are of the opinion that encryption will not aid in safeguarding the cloud data. Due to this misbelief and the lack of awareness about cloud encryption, the cloud encryption security practice has not gained much pace as compared to the other security solutions and standards. Awareness about the advantages of cloud encryption will help organizations ensure data protection along with scalability and flexibility, thereby boosting the business operations

The key players in cloud encryption market include Thales e-Security (La Defense, France), Gemalto N.V. (Amsterdam, Netherlands), Sophos Group plc (Abingdon, UK), Symantec Corporation (California, US), Skyhigh Networks (California, US), Netskope Inc. (California, US), CipherCloud (California, US), Randtronics (New South Wales, Australia), Stormshield (Paris, France), HyTrust, Inc. (California, US), StratoKey (Texas, US), Secomba GmbH (Augsburg, Germany), Dell (Texas, US), Hewlett Packard Enterprise Development LP (California, US), IBM Corporation (New York, US), Trend Micro Incorporated (Tokyo, Japan), Cisco Systems, Inc. (California, US), Protegrity USA, Inc. (Connecticut, US), Vaultive, Inc. (Massachusetts, US), DataLocker Inc. (Kansas, US), Parablu Inc. (California, US), Hitachi Solutions, Ltd. (Tokyo, Japan), PerfectCloud Corp. (Ontario, Canada), Tresorit (Budapest, Hungary), Bitglass, Inc. (California, US), Spamina (Madrid, Spain), and TWD Industries AG (Unteriberg, Switzerland).

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions and Limitations

2.4.1 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Growth Opportunities

4.2 Top Three Service Models and Regions of Market, 2017

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Market, By Vertical

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Proliferation in Cloud Adoption and Virtualization

5.2.1.2 Risks Related to Cloud Environments Due to Big Data Analytics

5.2.1.3 Regulations to Drive Higher Adoption of Cloud Encryption Solutions

5.2.2 Restraints

5.2.2.1 Budgetary Constraints for Adoption of Best-In-Class Cloud Encryption Solutions

5.2.2.2 Lack of Awareness About Cloud Encryption and Performance Concerns Among Enterprise

5.2.3 Opportunities

5.2.3.1 Growing Demand for Integrated, Cloud-Based Encryption Solutions Among SMES

5.2.3.2 Increased Demand for Cloud-Based Services From Healthcare Vertical

5.2.4 Challenges

5.2.4.1 Complexities in Management of Encryption Keys

5.2.4.2 Lack of Technical Expertise Among Enterprise Workforce

5.3 Cloud Encryption Scalability for IaaS, SaaS, and PaaS Cloud Services

5.4 Cloud Encryption for Public, Private, and Hybrid Clouds

5.5 Regulatory Implications

5.5.1 Payment Card Industry Data Security Standard (PCI-DSS)

5.5.2 Health Insurance Portability and Accountability Act (HIPAA)

5.5.3 Federal Information Security Management Act (FISMA)

5.5.4 Sarbanes–Oxley Act (SOX)

5.5.5 Gramm–Leach–Bliley Act (GLBA)

5.5.6 Federal Information Processing Standards (FIPS)

5.5.7 General Data Protection Regulation (GDPR)

5.6 Innovation Spotlight

5.7 Use Cases

5.7.1 Large-Scale Adoption of Cloud Encryption By Defense Companies

5.7.2 Major Banks in APAC Adopt Encryption for Commercial-Grade Security

5.7.3 Major Stock Exchange in APAC Adopts Encryption Practice

5.7.4 Enterprises’ Dependence on Cloud Email Encryption and Data Loss Prevention Solutions

5.7.5 Healthcare Vertical Relying on Cloud-Based Encryption Solutions

6 Cloud Encryption Market Analysis, By Component (Page No. - 50)

6.1 Introduction

6.2 Solutions

6.2.1 Types of Data Encrypted

6.2.1.1 Data at Rest

6.2.1.2 Data in Transit

6.2.2 Types of Encryption

6.2.2.1 Symmetric Encryption

6.2.2.2 Asymmetric Encryption

6.2.3 Key Management

6.2.4 Types of Encryption Algorithms

6.2.4.1 Data Encryption Standard (DES)

6.2.4.2 Triple Data Encryption Standard (Triple DES)

6.2.4.3 Advanced Encryption Standard (AES)

6.2.4.4 Blowfish

6.2.4.5 RSA

6.2.4.6 Diffie-Hellman

6.3 Services

6.3.1 Professional Services

6.3.1.1 Support and Maintenance

6.3.1.2 Training and Education

6.3.1.3 Planning and Consulting

6.3.2 Managed Services

7 Market Analysis, By Service Model (Page No. - 62)

7.1 Introduction

7.2 Infrastructure-as-a-Service (IaaS)

7.3 Software-as-a-Service (SaaS)

7.4 Platform-as-a-Service (PaaS)

8 Market Analysis, By Organization Size (Page No. - 67)

8.1 Introduction

8.2 Large Enterprises

8.3 Small and Medium-Sized Enterprises (SMES)

9 Cloud Encryption Market Analysis, By Vertical (Page No. - 71)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance (BFSI)

9.3 Healthcare

9.4 Telecom and IT

9.5 Government and Public Utilities

9.6 Aerospace and Defense

9.7 Retail

9.8 Others

10 Geographic Analysis (Page No. - 80)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 France

10.3.4 Others

10.4 Asia Pacific (APAC)

10.4.1 China

10.4.2 Australia and New Zealand (ANZ)

10.4.3 Singapore

10.4.4 Others

10.5 Middle East and Africa (MEA)

10.5.1 Middle East

10.5.2 Africa

10.6 Latin America

10.6.1 Mexico

10.6.2 Brazil

10.6.3 Others

11 Competitive Landscape (Page No. - 102)

11.1 Microquadrant Overview

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

11.2.1 Strength of Product Portfolio in Cloud Encryption Market

11.2.2 Business Strategy Excellence Adopted in Market

12 Company Profiles (Page No. - 106)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

12.1 Ciphercloud

12.2 Gemalto

12.3 Hytrust

12.4 IBM

12.5 Netskope

12.6 Secomba

12.7 Skyhigh Networks

12.8 Sophos

12.9 Symantec

12.10 Thales E-Security

12.11 Trend Micro

12.12 Vaultive

12.13 TWD Industries AG

12.14 Parablu

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 161)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (65 Tables)

Table 1 Evaluation Criteria

Table 2 Cloud Encryption Market Size and Growth Rate, 2015–2022 (USD Million, Y-O-Y %)

Table 3 Innovation Spotlight: Latest Cloud Encryption Innovations

Table 4 Market Size, By Component, 2015–2022 (USD Million)

Table 5 Solutions: Market Size, By Region, 2015–2022 (USD Million)

Table 6 Services: Market Size, By Region, 2015–2022 (USD Million)

Table 7 Services: Market Size, By Type, 2015–2022 (USD Million)

Table 8 Professional Services Market Size, By Region, 2015–2022 (USD Million)

Table 9 Professional Services Market Size, By Type, 2015–2022 (USD Million)

Table 10 Support and Maintenance Market Size, By Region, 2015–2022 (USD Million)

Table 11 Training and Education Market Size, By Region, 2015–2022 (USD Million)

Table 12 Planning and Consulting Market Size, By Region, 2015–2022 (USD Million)

Table 13 Managed Services Market Size, By Region, 2015–2022 (USD Million)

Table 14 Cloud Encryption Market Size, By Service Model, 2015–2022 (USD Million)

Table 15 IaaS Service Model: Market Size, By Region, 2015–2022 (USD Million)

Table 16 SaaS Service Model: Market Size, By Region, 2015–2022 (USD Million)

Table 17 PaaS Service Model: Market Size, By Region, 2015–2022 (USD Million)

Table 18 Market Size, By Organization Size, 2015–2022 (USD Million)

Table 19 Large Enterprises Segment: Market Size, By Region, 2015–2022 (USD Million)

Table 20 SMES Segment: Market Size, By Region, 2015–2022 (USD Million)

Table 21 Cloud Encryption Market Size, By Vertical, 2015–2022 (USD Million)

Table 22 BFSI Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 23 Healthcare Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 24 Telecom and IT Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 25 Government and Public Utilities Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 26 Aerospace and Defense Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 27 Retail Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 28 Others Vertical: Market Size, By Region, 2015–2022 (USD Million)

Table 29 Cloud Encryption Market Size, By Region, 2015–2022 (USD Million)

Table 30 North America: Market Size, By Component, 2015–2022 (USD Million)

Table 31 North America: Market Size, By Service, 2015–2022 (USD Million)

Table 32 North America: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 33 North America: Market Size, By Service Model, 2015–2022 (USD Million)

Table 34 North America: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 35 North America: Market Size, By Vertical, 2015–2022 (USD Million)

Table 36 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 37 Europe: Cloud Encryption Market Size, By Component, 2015–2022 (USD Million)

Table 38 Europe: Market Size, By Service, 2015–2022 (USD Million)

Table 39 Europe: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 40 Europe:Market Size, By Service Model, 2015–2022 (USD Million)

Table 41 Europe: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 42 Europe: Market Size, By Vertical, 2015–2022 (USD Million)

Table 43 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 44 APAC: Cloud Encryption Market Size, By Component, 2015–2022 (USD Million)

Table 45 APAC: Market Size, By Service, 2015–2022 (USD Million)

Table 46 APAC: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 47 APAC: Market Size, By Service Model, 2015–2022 (USD Million)

Table 48 APAC: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 49 APAC: Market Size, By Vertical, 2015–2022 (USD Million)

Table 50 APAC: Market Size, By Country, 2015–2022 (USD Million)

Table 51 MEA: Market Size, By Component, 2015–2022 (USD Million)

Table 52 MEA: Market Size, By Service, 2015–2022 (USD Million)

Table 53 MEA: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 54 MEA: Market Size, By Service Model, 2015–2022 (USD Million)

Table 55 MEA: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 56 MEA: Market Size, By Vertical, 2015–2022 (USD Million)

Table 57 MEA: Cloud Encryption Market Size, By Country, 2015–2022 (USD Million)

Table 58 Latin America: Market Size, By Component, 2015–2022 (USD Million)

Table 59 Latin America: Market Size, By Service, 2015–2022 (USD Million)

Table 60 Latin America: Market Size, By Professional Service, 2015–2022 (USD Million)

Table 61 Latin America: Market Size, By Service Model, 2015–2022 (USD Million)

Table 62 Latin America: Market Size, By Organization Size, 2015–2022 (USD Million)

Table 63 Latin America: Market Size, By Vertical, 2015–2022 (USD Million)

Table 64 Latin America: Market Size, By Country, 2015–2022 (USD Million)

Table 65 Market Ranking of Players in Cloud Encryption Market, 2017

List of Figures (36 Figures)

Figure 1 Cloud Encryption Market: Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cloud Encryption Market: Assumptions

Figure 8 Market Size, By Component (2017 vs 2022)

Figure 9 Global Market: North America to Hold Largest Share in 2017

Figure 10 Top 3 Revenue Segments of Market

Figure 11 Need for Stringent Compliance to Boost Market Growth

Figure 12 IaaS and North America to Hold Largest Shares

Figure 13 APAC Market Offers Immense Growth Opportunities

Figure 14 APAC to Emerge as Best Market for Investment Over Next Five Years

Figure 15 BFSI Vertical to Hold Largest Share in 2017

Figure 16 Cloud Encryption Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Security Technologies Used for Protecting Data on the Cloud

Figure 18 Enterprises’ Plan for Adoption of Encryption

Figure 19 Growing Practice of Data Encryption By Csps

Figure 20 Management of Encryption Keys By Enterprise Workforce

Figure 21 Services Segment to Record Highest Growth During Forecast Period (USD Million)

Figure 22 Managed Services to Record Highest Growth During Forecast Period (USD Million)

Figure 23 Training and Education Services to Record Highest Growth During Forecast Period (USD Million)

Figure 24 SaaS Segment to Record Highest Growth During Forecast Period (USD Million)

Figure 25 SMES Segment to Record Higher Growth During Forecast Period (USD Million)

Figure 26 Telecom and IT Vertical to Record Highest Growth During Forecast Period (USD Million)

Figure 27 North America to Dominate Global Market During Forecast Period (USD Million)

Figure 28 North America: Market Snapshot

Figure 29 APAC: Market Snapshot

Figure 30 Global Market: Competitive Leadership Mapping, 2017

Figure 31 Gemalto: Company Snapshot

Figure 32 IBM: Company Snapshot

Figure 33 Sophos: Company Snapshot

Figure 34 Symantec: Company Snapshot

Figure 35 Thales E-Security: Company Snapshot

Figure 36 Trend Micro: Company Snapshot

Growth opportunities and latent adjacency in Cloud Encryption Market