Cloud Infrastructure Entitlement Management (CIEM) Market by Offering (Solution, Professional Services), Vertical (BFSI, Healthcare, Retail and eCommerce, Telecommunications, IT and ITeS) and Region - Global Forecast to 2028

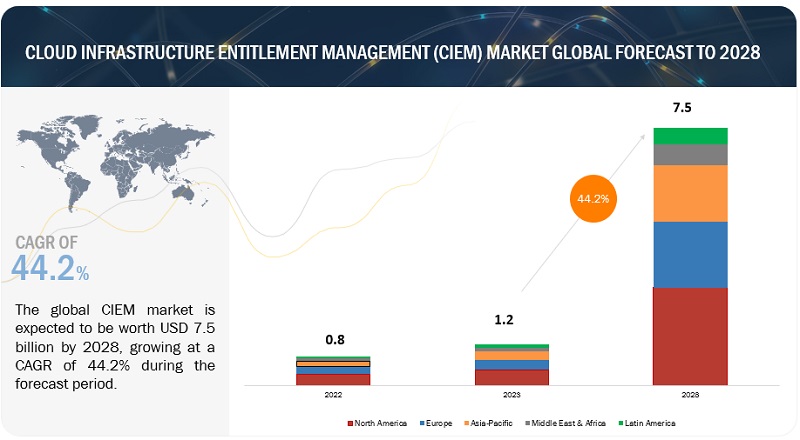

The global Cloud Infrastructure Entitlement Management Market size was surpassed $1.2 billion in 2023 and is poised to attain $7.5 billion by 2028, exhibiting a CAGR of 44.2% during forecast period 2023-2028.

The growth of the CIEM market is driven by factors such as increasing cloud adoption, increased cyber threats across the cloud, and the need to manage and monitor complex dynamic multi-cloud environments. There is a significant demand for CIEM across verticals such as BFSI, healthcare, IT and ITeS, among others.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cloud Infrastructure Entitlement Management Market Growth Dynamics

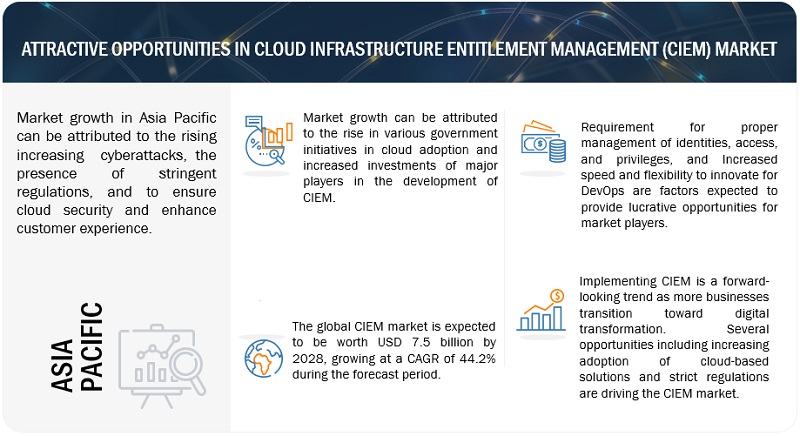

Driver: Need for proper management of identities, access, and privileges

Modern enterprises continue to migrate to the cloud by shifting most of the core operations. It includes processes and associated workloads, applications, and data across platforms from cloud service providers. Organizations are adopting CIEM solutions as it effectively manages access rights and privileges for the identities of a single or multi-cloud environment. CIEM helps identify and avoid risks resulting from privileges and their management. CIEM solutions have different approaches for an issue to ensure the identities' actions are as expected. The CIEM approach is also based on the principle of least privilege (POLP) to manage identities' private and public cloud permissions. With this approach, CIEM minimizes and mitigates risks of excessive privilege. The risks could be cloud leaks, data breaches, or insider threats. CIEM solutions can grant, resolve, enforces, or revokes the access rights or privileges of all the identities.

Restraint: Limited technical skilled expertise to implement CIEM

There are certain limitations regarding the actual usage of CIEM solutions. Also, CIEM is a moderately new market in cloud security, and the technology is mature enough. For implementing, processing, analyzing, and securing cloud solutions, the experts or the staff must have the required technical skills and knowledge. Organizations hiring security professionals lack the right skills to analyze and identify advanced security gaps while implementing and managing operations. The 2022 Application Security Report from Fortinet and Cybersecurity Insiders found that due to a lack of skilled personnel across the globe, 80% of organizations suffered one or more breaches that they could attribute to a lack of cybersecurity skills and awareness. This is a significant problem across the security industry.

Opportunity: Use of advanced technology to suggest the implementation of the least privileges for a specific type of task

Organizations are increasingly adopting CIEM solutions as it allows them to leverage advanced techniques, such as ML, to recommend least privileges for a particular work. End users can handle enormous amounts of entitlement data with AI and ML-powered analytics. Businesses can quickly spot excessive high-risk permissions and examine cloud identity setups by using a risk-based view of human and nonhuman identities. To find abnormalities in account entitlements, such as privilege accumulation and inactive and unnecessary entitlements, CIEM uses analytics, machine learning (ML), and other technologies. CIEM provides the ideal implementation of least privilege approaches. Therefore, leveraging advanced techniques such as ML to recommend the least privileges is an opportunity for the growth of the cloud infrastructure entitlement management market.

Challenge: High initial investment

Investments in cloud security solutions are elevated right now. CIEM is a moderately new market in cloud security, and the technology is not developed. The solutions are built to target specific gaps in product managing access and identity governance. Still, due to its advantages, CIEM solutions are a significant investment as enterprises onboard the solution. CIEM solutions are built for complex cloud environments. At the same time, it would require the proper support for implementing the solution. Though, with CIEM solutions, the efficiency of enterprises has increased, the initial investments for CIEM are high for the organizations, limiting the prospects of this market.

Cloud Infrastructure Entitlement Management Market Ecosystem

Based on offerings, the professional services segment is to grow at the highest CAGR during the forecast period.

This section covers various services in the CIEM market. Services play a crucial role in implementing and deploying CIEM solutions in an enterprise. Professional services are considered a core component of services as these services support day-to-day business operations. Currently, cybersecurity attacks are on the rise, and there is a requirement for holistic standards-based security solutions and services. Professional services are crucial in implementing and deploying CIEM solutions in an enterprise. Professional services include implementation services, integration services, training, and post support services. Companies such as CyberArk, Check Point, CrowdStrike, SailPoint, BeyondTrust, Rapid7, Palo Alto Networks, among others are the key CIEM service providers. Currently, cybersecurity attacks are on the rise, and there is a requirement for holistic standards-based security solutions.

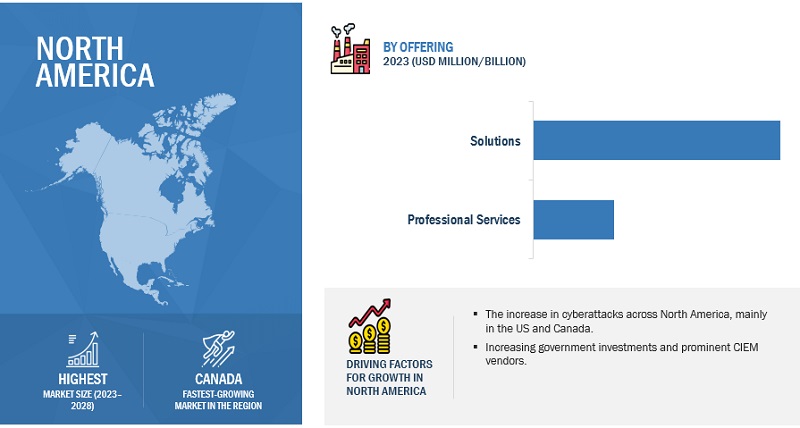

Based on regions, North America holds the largest market size during the forecast period.

North America accounts for the largest market size due to several key factors. North America comprises strong economic countries like the US and Canada. It offers the most significant and advanced technological infrastructure. North America is the most mature market, as most large enterprises are in this region. The US contributes the maximum share of the cloud infrastructure entitlement management market. The CIEM market has been steadily showing positive trends in the region as several companies and industries are adopting cloud services and solutions at various levels as part of their business strategy to sustain themselves in the market and increase their productivity. CIEM contributes to enterprises that must avoid risks such as attacks by malicious users and data breaches caused by excessive permissions on this type of infrastructure.

Key Market Players

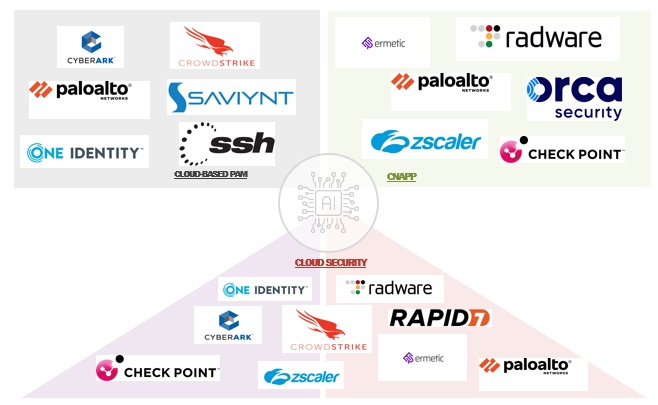

Microsoft (US), CyberArk (US), Palo Alto Networks (US), Check Point (Israel), Zscaler (US), BeyondTrust (US), Rapid7 (US), CrowdStrike (US), SailPoint (US), Saviynt (US), Orca Security (US), EmpowerID (US), Senhasegura (Brazil), Sysdig (US), NextLabs (US), Britive (US), StrongDM (US), Solvo (Israel), Ermetic (US), One Identity (US), Authomize (US), Sonrai Security (US), Radware (Israel), SecurEnds (US), and SSH Communications Security (Finland) are the key players and other players in the Cloud Infrastructure Entitlement Management (CIEM) Market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Offering, Verticals, and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global CIEM market include Microsoft (US), CyberArk (US), Palo Alto Networks (US), Check Point (Israel), Zscaler (US), BeyondTrust (US), Rapid7 (US), CrowdStrike (US), SailPoint (US), Saviynt (US), Orca Security (US), EmpowerID (US), Senhasegura (Brazil), Sysdig (US), NextLabs (US), Britive (US), StrongDM (US), Solvo (Israel), Ermetic (US), One Identity (US), Authomize (US), Sonrai Security (US), Radware (Israel), SecurEnds (US), and SSH Communications Security (Finland). |

Cloud Infrastructure Entitlement Management (CIEM) Market Highlights

This research report categorizes the Cloud Infrastructure Entitlement Management (CIEM) Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments

- In September 2022, CrowdStrike announced new Cloud Native Application Protection Platform (CNAPP) capabilities for CrowdStrike Cloud Security, including CIEM features and the integration of CrowdStrike Asset Graph. By preventing identity-based threats caused by misconfigured cloud entitlements, CIEM empowers organizations to enhance their cloud security posture. Meanwhile, Asset Graph delivers comprehensive visibility of the cloud attack surface.

- In August 2022, CyberArk (US) acquired C3M, a cloud security posture management (CSPM) software company that supports Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

- In February 2022, Check Point (Israel) acquired Spectral. With this acquisition, Check Point will increase the developer-first security capabilities of its cloud solution, Check Point CloudGuard, and offer the broadest spectrum of cloud application security use cases.

- In July 2021, Microsoft (US) acquired CloudKnox Security, a pioneer in CIEM. CloudKnox provides total visibility into privileged access and assists organizations in right-sizing permissions and enforcing least-privilege principles. It also offers Azure AD customers continuous monitoring, granular visibility, and automatic hybrid and multi-cloud rights remediation.

- In April 2021, Zscaler (US) acquired Trustdome, a CIEM company, to address cloud workload issues. Trustdome's development team and CIEM technology will be integrated with Zscaler's current CSPM platform, resulting in a holistic solution for minimizing public cloud attack surfaces and enhancing security posture. With its first development center in Israel, Zscaler also broadens its geographic scope.

Frequently Asked Questions (FAQ):

What are the opportunities in the global CIEM market?

The growing adoption of AI/ML-powered CIEM solutions and the increasing adoption of CIEM across enterprises are a few factors contributing to the growth and creating new opportunities for the CIEM market.

What is the definition of the CIEM market?

CIEM solutions manage identities & access rights and privileges across single-cloud or multi-cloud environments. CIEM solutions apply the principle of least privilege access to cloud infrastructure, providing IT and security organizations with fine-grained control over cloud permissions and complete visibility into entitlements. They help businesses strengthen security and accelerate the adoption of cloud-native applications by identifying and removing excessive permissions.

Which region is expected to show the largest market share in the CIEM market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include Microsoft (US), CyberArk (US), Palo Alto Networks (US), Check Point (Israel), Zscaler (US), BeyondTrust (US), Rapid7 (US), CrowdStrike (US), SailPoint (US), Saviynt (US), Orca Security (US), EmpowerID (US), Senhasegura (Brazil), Sysdig (US), NextLabs (US), Britive (US), StrongDM (US), Solvo (Israel), Ermetic (US), One Identity (US), Authomize (US), Sonrai Security (US), Radware (Israel), SecurEnds (US), and SSH Communications Security (Finland).

What is the current size of the global CIEM market?

The global CIEM market size is projected to grow from USD 1.2 billion in 2023 to USD 7.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 44.2% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for proper management of identities, access, and privileges- Maintains visibility and ensures compliance across multiple cloud infrastructure- Increased speed and flexibility to innovate for DevOpsRESTRAINTS- Lack of awareness of cloud resources, cloud security architecture, and strategy- Limited technical skilled expertise to implement CIEMOPPORTUNITIES- Leverage advanced techniques to recommend least privileges for specific workCHALLENGES- High initial investment- Transitory nature of cloud

-

5.3 ECOSYSTEM ANALYSIS

-

5.4 CASE STUDY ANALYSISCASE STUDY 1: ING USED ONE IDENTITY SOLUTIONS TO ENSURE ITS IDENTITY GOVERNANCE WAS ROBUSTCASE STUDY 2: RAPID7 SOLUTION ENABLES CONTINUOUS MULTI-CLOUD SECURITY AND COMPLIANCE FOR COSTAR DURING MERGER AND ACQUISITION PROCESSESCASE STUDY 3: FORTUNE 50 TECHNOLOGY ADOPTED SAILPOINT’S IDENTITYNOW PLATFORM AND AI-DRIVEN IDENTITY SECURITY CAPABILITIESCASE STUDY 4: CYBERARK IDENTITY SECURITY PLATFORM HELPED HEALTHFIRST REINFORCE IDENTITY PROTECTION

-

5.5 TARIFF AND REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARDGENERAL DATA PROTECTION REGULATIONCALIFORNIA CONSUMER PRIVACY ACTPERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTINTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY CONFERENCES AND EVENTS, 2023–2024

-

5.6 PORTER’S FIVE FORCES MODELTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSCOMPETITIVE RIVALRY

-

5.7 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESINNOVATION AND PATENT APPLICATIONS- Top applicantsIMPACT OF CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT ON ADJACENT TECHNOLOGIES- AI/ML- BIG DATA ANALYTICS- IoT- DEVSECOPSPRICING ANALYSIS

- 5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.9 SUPPLY CHAIN ANALYSISCIEM SOLUTION PROVIDERSCIEM SERVICE PROVIDERSRETAIL/DISTRIBUTIONVERTICALS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 GRANULAR VISIBILITY AND IDENTITY MANAGEMENT

- 6.3 RIGHT-SIZED PERMISSIONS

- 6.4 INTEGRATION WITH EXISTING SYSTEMS

- 6.5 COST SAVING

- 6.6 ACCESS GOVERNANCE AND COMPLIANCE

- 7.1 INTRODUCTION

-

7.2 SOLUTIONCIEM SOLUTIONS TO MITIGATE ACCESS RISKS POSED BY EXCESSIVE PERMISSIONSSOLUTION: MARKET DRIVERS

-

7.3 PROFESSIONAL SERVICESNEED FOR TECHNICAL EXPERTISE TO DEPLOY CIEMPROFESSIONAL SERVICES: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCEINCREASING NEED FOR CIEM SOLUTIONS TO MANAGE ACCESS PRIVILEGES IN CLOUDBANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

-

8.3 HEALTHCARENEED FOR SECURELY MANAGING PATIENT DATAHEALTHCARE: MARKET DRIVERS

-

8.4 RETAIL & ECOMMERCENEED FOR ENHANCING CUSTOMER EXPERIENCES TO DRIVE MARKETRETAIL & ECOMMERCE: MARKET DRIVERS

-

8.5 IT AND ITESADOPTION OF CIEM SOLUTIONS FOR CLOUD SECURITYIT AND ITES: MARKET DRIVERS

-

8.6 TELECOMMUNICATIONSCIEM SOLUTIONS HELP MANAGE USER ACCESS TO SYSTEMSTELECOMMUNICATIONS: MARKET DRIVERS

-

8.7 OTHER VERTICALSOTHER VERTICALS: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: IMPACT OF RECESSIONNORTH AMERICA: REGULATORY LANDSCAPEUS- Rising adoption of cloud to drive CIEM adoptionCANADA- Increasing government initiatives to support CIEM

-

9.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: IMPACT OF RECESSIONEUROPE: REGULATORY LANDSCAPEUK- Increasing use of cloud computingGERMANY- Increasing cyberattacks and strict regulations drive enterprises to adopt CIEMFRANCE- Increased spending by French government to boost adoption of cloud security solutionsREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONASIA PACIFIC: REGULATORY LANDSCAPECHINA- Increase in government initiatives and regulations in cloud technologyJAPAN- Ensures cloud security legislation and guidelinesINDIA- Increasing cyberattacks to provide opportunities for CIEM adoptionSINGAPORE- Strong cybersecurity measures in SingaporeREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: IMPACT OF RECESSIONMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Government support to boost adoption of CIEM solutionsAFRICA- Heavy investments in cloud computing technologies

-

9.6 LATIN AMERICALATIN AMERICA: CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Increasing cyberattacksMEXICO- Adoption of cloud to improve CIEM adoptionREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 10.3 MARKET SHARE ANALYSIS OF KEY MARKET PLAYERS

- 10.4 MARKET RANKING OF KEY PLAYERS

-

10.5 COMPETITIVE BENCHMARKING FOR KEY PLAYERSEVALUATION CRITERIA FOR KEY COMPANIES

-

10.6 EVALUATION QUADRANT FOR KEY PLAYERS, 2023DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023DEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE BENCHMARKING FOR STARTUPS/SMESEVALUATION CRITERIA FOR STARTUPS/SMES

- 10.9 VALUATION AND FINANCIAL METRICS OF CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT VENDORS

-

10.10 COMPETITIVE SCENARIONEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

-

11.1 KEY PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCYBERARK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZSCALER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBEYONDTRUST- Business overview- Products/Solutions/Services offered- Recent developmentsRAPID7- Business overview- Products/Solutions/Services offered- Recent developmentsCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developmentsSAILPOINT- Business overview- Products/Solutions/Services offeredSAVIYNT- Business overview- Products/Solutions/Services offeredORCA SECURITY- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSEMPOWERIDSENHASEGURASYSDIGNEXTLABSBRITIVESTRONGDMSOLVOERMETICONE IDENTITYAUTHOMIZESONRAI SECURITYRADWARESECURENDSSSH COMMUNICATIONS SECURITY

- 12.1 INTRODUCTION TO ADJACENT MARKETS

- 12.2 LIMITATIONS

-

12.3 ADJACENT MARKETSCLOUD SECURITY MARKETCLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET AND GROWTH, 2021–2028 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET: ECOSYSTEM

- TABLE 5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 7 PORTER’S FIVE FORCES MODEL

- TABLE 8 PATENTS FILED, 2020–2023

- TABLE 9 PATENTS GRANTED IN CIEM MARKET, 2020–2023

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 12 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 13 SOLUTION: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 PROFESSIONAL SERVICES: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 16 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 HEALTHCARE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 RETAIL & ECOMMERCE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 IT AND ITES: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 TELECOMMUNICATIONS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 OTHER VERTICALS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 US: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 27 US: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 28 CANADA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 29 CANADA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 30 EUROPE: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 31 EUROPE: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 UK: CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 34 UK: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 35 GERMANY: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 36 GERMANY: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 37 FRANCE: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 38 FRANCE: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 39 REST OF EUROPE: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 40 REST OF EUROPE: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 CHINA: CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 45 CHINA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 46 JAPAN: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 47 JAPAN: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 48 INDIA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 49 INDIA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 50 SINGAPORE: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 51 SINGAPORE: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 52 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 53 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 54 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 55 MIDDLE EAST & AFRICA: CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 56 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 MIDDLE EAST: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 58 MIDDLE EAST: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 59 AFRICA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 60 AFRICA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 61 LATIN AMERICA: CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 62 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 63 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 BRAZIL: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 65 BRAZIL: CIEM MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 66 MEXICO: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 67 MEXICO: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 68 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 69 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2021–2028 (USD MILLION)

- TABLE 70 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 71 COMPANY FOOTPRINT, BY REGION

- TABLE 72 COMPANY FOOTPRINT, BY OFFERING

- TABLE 73 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 74 OVERALL COMPANY FOOTPRINT

- TABLE 75 LIST OF STARTUPS/SMES

- TABLE 76 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 77 MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, 2021—2023

- TABLE 78 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: DEALS, 2021—2023

- TABLE 79 MICROSOFT: BUSINESS OVERVIEW

- TABLE 80 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 MICROSOFT: PRODUCT LAUNCHES

- TABLE 82 MICROSOFT: DEALS

- TABLE 83 CYBERARK: BUSINESS OVERVIEW

- TABLE 84 CYBERARK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 85 CYBERARK: PRODUCT LAUNCHES

- TABLE 86 CYBERARK: DEALS

- TABLE 87 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 88 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 89 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 90 CHECK POINT: BUSINESS OVERVIEW

- TABLE 91 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 92 CHECK POINT: PRODUCT LAUNCHES

- TABLE 93 CHECK POINT: DEALS

- TABLE 94 ZSCALER: BUSINESS OVERVIEW

- TABLE 95 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 96 ZSCALER: DEALS

- TABLE 97 BEYONDTRUST: BUSINESS OVERVIEW

- TABLE 98 BEYONDTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 99 BEYONDTRUST: PRODUCT LAUNCHES

- TABLE 100 RAPID7: BUSINESS OVERVIEW

- TABLE 101 RAPID7: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 RAPID7: DEALS

- TABLE 103 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 104 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 106 SAILPOINT: BUSINESS OVERVIEW

- TABLE 107 SAILPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 108 SAVIYNT: BUSINESS OVERVIEW

- TABLE 109 SAVIYNT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 ORCA SECURITY: BUSINESS OVERVIEW

- TABLE 111 ORCA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 ORCA SECURITY: PRODUCT LAUNCHES

- TABLE 113 ADJACENT MARKETS AND FORECASTS

- TABLE 114 CLOUD SECURITY MARKET, BY SECURITY TYPE, 2015–2020 (USD MILLION)

- TABLE 115 CLOUD SECURITY MARKET, BY SECURITY TYPE, 2020–2026 (USD MILLION)

- TABLE 116 CLOUD SECURITY MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 117 CLOUD SECURITY MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

- TABLE 118 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY OFFERING, 2020–2027 (USD MILLION)

- TABLE 119 PLATFORM: CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 120 PROFESSIONAL SERVICES: CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 121 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 122 CLOUD-NATIVE APPLICATION PROTECTION PLATFORM MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 3 MARKET: RESEARCH FLOW

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH (SUPPLY SIDE): REVENUE OF SOLUTIONS/PROFESSIONAL SERVICES OF CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP(DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 7 MARKET AND Y-O-Y GROWTH RATE (2021–2028)

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: SEGMENTS WITH HIGHEST GROWTH RATES

- FIGURE 10 INCREASE IN GOVERNMENT INVESTMENTS FOR CLOUD ADOPTION TO DRIVE MARKET

- FIGURE 11 SOLUTION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 12 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 EUROPE TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 14 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 ECOSYSTEM: MARKET

- FIGURE 16 MARKET: PORTER’S FIVE FORCE ANALYSIS

- FIGURE 17 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2023

- FIGURE 18 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2023

- FIGURE 19 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 20 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 23 PROFESSIONAL SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 IT & ITES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 28 CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT MARKET: REVENUE ANALYSIS

- FIGURE 29 MARKET RANKING OF KEY CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT PLAYERS, 2023

- FIGURE 30 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 31 EVALUATION QUADRANT FOR KEY PLAYERS, 2023

- FIGURE 32 EVALUATION QUADRANT FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 33 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023

- FIGURE 34 VALUATION AND FINANCIAL METRICS OF CLOUD INFRASTRUCTURE ENTITLEMENT MANAGEMENT VENDORS

- FIGURE 35 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 36 CYBERARK: COMPANY SNAPSHOT

- FIGURE 37 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 38 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 39 ZSCALER: COMPANY SNAPSHOT

- FIGURE 40 RAPID7: COMPANY SNAPSHOT

- FIGURE 41 CROWDSTRIKE: COMPANY SNAPSHOT

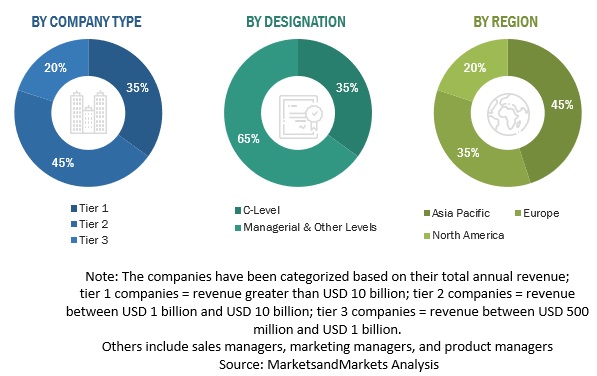

The study used extensive secondary sources, directories, several research papers, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global CIEM market. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, industry consultants, and C-level executives of multiple companies offering CIEM solutions and services, to obtain and verify critical qualitative and quantitative information, as well as assess market prospects and industry trends.

The primary sources were industry experts from core and related industries, preferred suppliers, developers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of the CIEM market’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

The market was estimated by analyzing various driving factors, including the increasing adoption of digitalization and cloud-based services. These interviews helped the analysts obtain and verify critical qualitative and quantitative information and assess the market’s prospects. The key players in the CIEM market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This research includes the study of annual reports of the top companies and interviews with key opinion leaders, such as Chief Executive Officers (CEOs), business directors, and marketing personnel.

Secondary Research

The market size of the companies offering CIEM solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality. Secondary research was used to obtain key information about the industry’s supply chain, country-wise technology spending, the total pool of key players, market classification and segmentation, key developments from both market and technology-oriented perspectives, economic trends, and currency exchange rates. For instance, the market size of companies offering CIEM solutions is based on the secondary data available through paid databases and publicly available information. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the CIEM market. Extensive primary research was conducted during the study to gather information and verify and validate the critical numbers. The primary analysis was also undertaken to identify the segmentation types; industry trends; the competitive landscape of the CIEM market players; and the fundamental market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the CIEM market. In the market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and sub-segments listed in this report. The top-down and bottom-up approaches were used to estimate and validate the size of the global CIEM market and the size of various other dependent subsegments.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

CIEM solutions manage identities & access rights and privileges across single-cloud or multi-cloud ecosystems. The notion of least privilege access is applied to cloud infrastructure with the help of CIEM solutions, providing IT and security organizations with fine-grained with fine-grained control over cloud permissions and complete visibility into entitlements. They help businesses strengthen security and accelerate the adoption of cloud-native applications by identifying and removing excessive permissions.

Key Stakeholders

- CIEM Solutions/Service Providers

- Information Technology (IT) Professionals

- Cloud Service Providers

- Professional Service Providers

- Independent Software Vendors

- Consultants/Consultancies/Advisory Firms

- System Integrators

- Third-Party Providers

- Value-added Resellers (VARs)

- Project Managers

- Business Analysts

- Chief Technology and Data Officers

- Cloud Security Professionals

- IT Security Agencies

- Investors And Venture Capitalists

Report Objectives

- To define, describe, and forecast the CIEM market based on offerings, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the CIEM market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the CIEM market

- To profile the key players of the CIEM market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global CIEM market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cloud Infrastructure Entitlement Management (CIEM) Market