Cloud Microservices Market by Component (Platform and Services), Deployment Mode (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Large Enterprises and SMEs), Vertical, and Region - Global Forecast to 2023

[140 Pages Report] The cloud microservices market extrapolated to grow from $683.2 million in 2018 to reach $1,880.0 million by 2023 at a Compound Annual Growth Rate (CAGR) of 22.4%. The major factors driving the market are digital transformations, proliferation of the microservices architecture and, customer-oriented business. In this study, 2017 has been considered as the base year and 2018-2023 as the forecast period.

Cloud Microservices Market Dynamics

Drivers

- Digital transformations

- Proliferation of the microservices architecture

- Customer-oriented business

Restraints

- Security and compliance

Opportunities

- Increasing adoption of cloud-based applications

- Emergence of IoT applications

Challenges

- Organizational challenges while implementing microservices

Digital transformations drives the global cloud microservices market

In today’s business environment, with the rapid advancements in technologies, there is an increase in the use of digital solutions, connected devices, and IT systems. This rapid rise in technological innovations has paved the way for the growth of digital transformation. Organizations across the globe are eagerly implementing new applications across their verticals to engage customers in innovative and captivating ways. Moreover, to fulfill the organizational needs entirely, these new applications must be deployed in an agile environment, leading to a rapid and responsive development while keeping the security performance and cost-effectiveness optimal. The microservices architecture helps enterprises rapidly build and deploy business applications. It provides greater flexibility in developing applications as compared to the monolithic architecture. It has a range of benefits, such as faster Time to Market (TTM), scalability, and lower operational cost. In addition to this, microservices are helping businesses in reducing the complexity of the software development process. Hence, businesses are adopting the cloud microservices approach, which is essential in developing advanced business applications.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the global cloud microservices market on the basis of platform, services, deployment types, organization sizes, verticals, and regions. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report aims to strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market. The report attempts to forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product developments, and Research & Development (R&D) activities in the cloud microservices market.

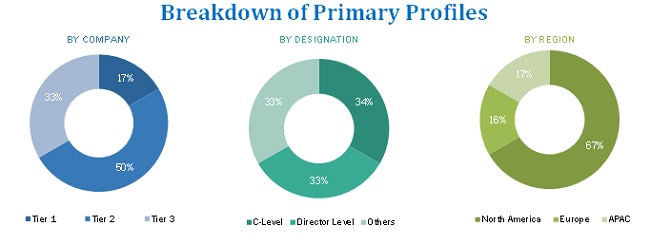

The research methodology used to estimate and forecast the cloud microservices market begins with capturing data on key vendor’s revenues through a secondary research using sources such as Uptime Institute and IEEE. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud microservices market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The cloud microservices market ecosystem comprises vendors such as AWS (US), CA Technologies (US), Contino (UK), CoScale (Belgium), IBM (US), Idexcel (US), Infosys (India), Kontena (Finland), Macaw (US), Marlabs (US), Microsoft (US), Netifi (US), NGINX (US), OpenLegacy (US), Oracle (US), Pivotal Software (US), RapidValue Solutions (US), RoboMQ (US), Salesforce (US), SmartBear Software (US), Software AG (Germany), Syntel (US), TCS (India), Unifyed (US), and Weaveworks (UK).

Major Developments

- In November 2017, CA Technologies announced enhancements to CA’s DevOps portfolio by introducing new releases in the Continuous Delivery portfolio and CA Digital Experience Monitoring. It would accelerate and automate development and release, improve testing, and provide unprecedented visibility into digital experiences.

- In May 2017, IBM, Lyft, and Google announced the introduction of Istio, an open source technology that helps developers securely manage a network of microservices. Istio runs on Kubernetes

- In March 2016, Microsoft introduced Azure Service Fabric, a microservices platform for developing business applications on cloud

Target Audiences for Cloud Microservices Market Report:

- Cloud microservices platform and solution vendors

- Cloud services providers

- Cloud microservices providers

- Application developers

- Container services providers

- System integrators

- Third-party vendors

- Cloud microservices end-users

- Government agencies and organizations

- Regulatory and compliance agencies

- DevOps services providers

“Study answers several questions for the stakeholders, primarily which market segments will focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Cloud Microservices Market Report:

The research report categorizes the cloud microservices market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component:

- Paltform

- Services

Cloud Microservices Market By Services:

- Consulting services

- Integration services

- Training, support and maintained services

By Deployment Type:

- Public

- Hybrid

- Private

Cloud Microservices Market By Organization Size:

- SMEs

- Large Enterprises

By Industry:

- BFSI

- IT and ITeS

- Telecommunications

- Government

- Healthcare

- Retail and eCommerce

- Media and Entertainment

- Transportation and Logistics

- Manufacturing

- Others (Education, Energy & Utilities, and Travel & Hospitality)

Cloud Microservices Market By Region:

- North America

- Europe

- Middle East and Africa (MEA)

- Asia-Pacific (APAC)

- Latin America

Critical questions which the report answers

- What are the industries which the cloud microservices companies are exploring?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for cloud microservices?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis:

Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis:

- Further breakdown of the North America cloud microservices market

- Further breakdown of the Europe market

- Further breakdown of the APAC cloud microservices market

- Further breakdown of the MEA market

- Further breakdown of the Latin America cloud microservices market

Company Information:

Detailed analysis and profiling of additional market players

The cloud microservices market is expected to grow from USD 683.2 million in 2018 to USD 1,880.0 million by 2023, at a Compound Annual Growth Rate (CAGR) of 22.4% during the forecast period. The major factors driving the cloud microservices market are digital transformations, proliferation of the microservices architecture and, customer-oriented business.

Traditionally, monolithic approach was being followed in the organizations that was built as a single, autonomous unit. In monolithic approach, to scale specific functions of an application, the developer has to scale the entire application instead of just the desired components. Whereas, cloud microservices architecture gives developers the freedom to independently develop and deploy service applications that are built through HTTP/REST language and APIs. Enterprises are rapidly adopting cloud microservices platform and services included in it. The rise in demand for cloud microservices architecture is due to its various features such as less development time, easy deployment, reusability in different projects, better fault isolation, works well with containers, integration with third-party services, and easy to understand.

The report provides detailed insights into the global cloud microservices market, which is segmented on the basis of component (platform and service), deployment mode, organization size, vertical, and region. Among components, the platform segment is expected to hold a larger market size during the forecast period, as there is an increasing need for cloud microservices architecture in every vertical for scaling functions at a very granular level that results in an efficient system optimization and organization.

Digital transformations and proliferation of the microservices architecture is expected to drive the growth of cloud microservices market

Retail and eCommerce

The Retail is one of the fastest-growing verticals due to the rising consumer purchasing power. With the proliferation of the online market, retailers are adopting innovative technologies, such as cloud computing, big data analytics, digital stores, and social media networks. With the ever-increasing competition in this sector, customer experience proves to be a very vital differentiating factor among the array of online shopping options. Online retailers or eCommerce vendors risk losing out on their users because of negative customer experience. Hence, there has been a high adoption of cloud microservices methodologies in the eCommerce and retail vertical due to its benefits, such as improved operational efficiency, simple architecture, easy deployment, faster time-to-market, and enhanced customer experience. The need to improve sales, customer satisfaction, and brand image, and the increasing data generation are also forcing enterprises in the retail and eCommerce vertical to adopt cloud microservices. These factors are influencing retailers to evolve with updated technologies, thus driving the adoption of cloud microservices to provide enhanced customer satisfaction. In order to achieve these goals, the retailers need to have scalability to handle the big data workloads and offer on-demand availability of appropriate information. Hence, retailers are keen on adopting cloud-based microservices, as these services offer various benefits, such as reduced time-to-market and seamless delivery of application updates.

Healthcare

Healthcare vertical comprises hospitals, health clinics, medical and dental practices, healthcare equipment and services, pharmaceuticals, and biotechnology. The increasing adoption of business applications in this vertical has empowered enterprises by smoothening their business processes and improving the operational efficiencies. The healthcare vertical has witnessed an immense surge in data generation in the recent years. The adoption of cloud microservices is transforming the way healthcare applications are being deployed, and the way information is being collected and distributed. The healthcare vertical is now focused on value creation rather than volume. Government and private healthcare organizations are facing pressure to improve their systems and enhance the population health while reducing costs. cloud microservices are being increasingly adopted by enterprises in this vertical, as they enable the health IT and DevOps teams to quickly and securely deploy applications in a HIPAA-compliant cloud environment and deliver a superior experience to customers.

Media and entertainment

The cloud microservices architecture helps organizations manage large volumes of complex processes efficiently, which enhances the customer experience. Using the cloud microservices platform, media and entertainment companies are developing new and better ways of enhancing their digital supply chain while reducing the OPEX and offering a better customer experience. Moreover, cloud-based microservices help enterprises keep a check on containerized applications, in case there is a surge in the number of users accessing the digital content at any point of time. SMEs and large enterprises, operating in this vertical, are rapidly getting inclined toward adopting cloud microservices methodologies because of the benefits they offer. Companies in this vertical, such as Netflix, BBC, Hulu, and Sony Pictures Entertainment, are using the cloud microservices architecture.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

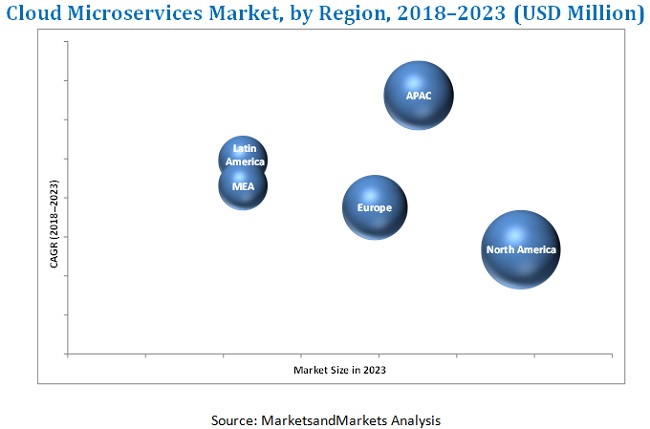

The report covers all the major aspects of the cloud microservices market and provides an in-depth analysis across the regions of North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and Latin America. North America is expected to hold the largest share in the market. The APAC region is projected to have great opportunities in this market and would grow at the highest CAGR by 2023, due to digital transformations, proliferation of the microservices architecture and, customer-oriented business.

However, security and compliance may act as the restraining factor for the market. Various vendors are coming up with innovative cloud microservices solutions due to the emerging demand for cloud microservices architecture. The players have formed various inorganic and organic growth strategies to make their focus strong in cloud microservices platform.

Frequently Asked Questions (FAQ):

How big is the Cloud Microservices Market?

What is growth rate of the Cloud Microservices Market?

What are the top trends in Cloud Microservices Market?

Who are the key players in Cloud Microservices Market?

Who will be the leading hub for Cloud Microservices Market?

What is scope of the Cloud Microservices Market report?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Cloud Microservices Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Cloud Microservices Market

4.2 Market Share of Top 3 Verticals and Regions

4.3 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digital Transformations

5.2.1.2 Proliferation of the Microservices Architecture

5.2.1.3 Customer-Oriented Business

5.2.2 Restraints

5.2.2.1 Security and Compliance

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Cloud-Based Applications

5.2.3.2 Emergence of IoT Applications

5.2.4 Challenges

5.2.4.1 Organizational Challenges While Implementing Microservices

5.3 Strategic Benchmarking

5.4 Use Cases

5.4.1 Use Case 1: AWS

5.4.2 Use Case 2: NGINX

5.4.3 Use Case 3: Mulesoft

6 Cloud Microservices Market, By Component (Page No. - 39)

6.1 Introduction

6.2 Platform

6.3 Services

6.3.1 Consulting Services

6.3.2 Integration Services

6.3.3 Training, Support, and Maintenance Services

7 Cloud Microservices Market By Organization Size (Page No. - 46)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Cloud Microservices Market, By Deployment Mode (Page No. - 50)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Cloud Microservices Market By Vertical (Page No. - 54)

9.1 Introduction

9.2 Retail and Ecommerce

9.3 Healthcare

9.4 Media and Entertainment

9.5 Banking, Financial Services, and Insurance

9.6 IT and ITes

9.7 Government

9.8 Transportation and Logistics

9.9 Manufacturing

9.10 Telecommunication

9.11 Others

10 Cloud Microservices Market, By Region (Page No. - 64)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 84)

11.1 Overview

11.2 Key Players Operating in the Cloud Microservices Market

11.3 Competitive Scenario

11.3.1 Partnerships, Agreements, and Collaborations

11.3.2 New Product/Service Launches and Product Upgradations

11.3.3 Mergers and Acquisitions

11.3.4 Business Expansions

12 Company Profiles (Page No. - 90)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Introduction

12.2 AWS

12.3 CA Technologies

12.4 IBM

12.5 Microsoft

12.6 Salesforce

12.7 Infosys

12.8 NGINX

12.9 Oracle

12.10 Pivotal Software

12.11 Syntel

12.12 SmartBear Software

12.13 Marlabs

12.14 RapidValue Solutions

12.15 Kontena

12.16 Macaw Software

12.17 Unifyed

12.18 RoboMQ

12.19 Idexcel

12.20 Weaveworks

12.21 Contino

12.22 OpenLegacy

12.23 CoScale

12.24 Software AG

12.25 Netifi

12.26 TCS

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 133)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (60 Tables)

Table 1 Cloud Microservices Market Size, By Component, 2016–2023 (USD Million)

Table 2 Platform: Market Size By Region, 2016–2023 (USD Million)

Table 3 Services: Market Size By Region, 2016–2023 (USD Million)

Table 4 Services: Market Size By Type, 2016–2023 (USD Million)

Table 5 Consulting Services Market Size, By Region, 2016–2023 (USD Million)

Table 6 Integration Services Market Size, By Region, 2016–2023 (USD Million)

Table 7 Training, Support, and Maintenance Services Market Size, By Region, 2016–2023 (USD Million)

Table 8 Cloud Microservices Market Size, By Organization Size, 2016–2023 (USD Million)

Table 9 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 10 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 11 Cloud Microservices Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 12 Public Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 13 Private Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 14 Hybrid Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 15 Cloud Microservices Market Size, By Vertical, 2016–2023 (USD Million)

Table 16 Retail and Ecommerce: Market Size, By Region, 2016–2023 (USD Million)

Table 17 Healthcare: Market Size By Region, 2016–2023 (USD Million)

Table 18 Media and Entertainment: Market Size By Region, 2016–2023 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 20 IT and ITes: Market Size By Region, 2016–2023 (USD Million)

Table 21 Government: Market Size By Region, 2016–2023 (USD Million)

Table 22 Transportation and Logistics: Market Size By Region, 2016–2023 (USD Million)

Table 23 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 24 Telecommunication: Market Size By Region, 2016–2023 (USD Million)

Table 25 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 26 Cloud Microservices Market Size, By Region, 2016–2023 (USD Million)

Table 27 North America: Market Size By Component, 2016–2023 (USD Million)

Table 28 North America: Market Size By Service, 2016–2023 (USD Million)

Table 29 North America: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 30 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 31 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 32 North America: Market Size By Country, 2016–2023 (USD Million)

Table 33 Europe: Cloud Microservices Market Size, By Component, 2016–2023 (USD Million)

Table 34 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 35 Europe: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 36 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 37 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 38 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 39 Asia Pacific: Cloud Microservices Market Size, By Component, 2016–2023 (USD Million)

Table 40 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 42 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 45 Middle East and Africa: Cloud Microservices Market Size, By Component, 2016–2023 (USD Million)

Table 46 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 47 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 48 Middle East and Africa: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 49 Middle East and Africa: Market Size By Vertical, 2016–2023 (USD Million)

Table 50 Middle East and Africa: Market Size By Country, 2016–2023 (USD Million)

Table 51 Latin America: Cloud Microservices Market Size, By Component, 2016–2023 (USD Million)

Table 52 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 53 Latin America: Market Size By Deployment Mode, 2016–2023 (USD Million)

Table 54 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 55 Latin America: Market Size By Vertical, 2016–2023 (USD Million)

Table 56 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 57 Partnerships, Agreements, and Collaborations, 2017

Table 58 New Product/Service Launches and Product Upgradations, 2017–2018

Table 59 Mergers and Acquisitions, 2015–2018

Table 60 Business Expansions, 2016–2018

List of Figures (41 Figures)

Figure 1 Cloud Microservices Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Cloud Microservices Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cloud Microservices Market: Assumptions

Figure 8 Market Size, 2016–2023

Figure 9 Cloud Microservices Market By Component, 2018 vs 2023

Figure 10 Market By Service, 2018 vs 2023

Figure 11 Cloud Microservices Market By Organization Size, 2018 vs 2023

Figure 12 Market By Deployment Mode, 2018 vs 2023

Figure 13 Cloud Microservices Market By Vertical, 2018 vs 2023

Figure 14 North America is Estimated to Hold the Largest Market Share in the Global Cloud Microservices Market in 2018

Figure 15 Proliferation of the Microservices Architecture is Expected to Drive the Growth of the Global Market

Figure 16 Retail and Ecommerce Vertical, and North American Region are Estimated to Have the Largest Market Shares in 2018

Figure 17 Asia Pacific is Expected to Emerge as the Best Market for Investments Over the Next 5 Years

Figure 18 Cloud Microservices Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Companies Adopted Different Strategies to Gain Competitive Advantage

Figure 20 Services Segment is Expected to Exhibit A Higher CAGR During the Forecast Period

Figure 21 Training, Support, and Maintenance Services Segment is Expected to Register the Highest CAGR During the Forecast Period

Figure 22 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Hybrid Cloud Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 IT and ITes Vertical is Expected to Register the Highest CAGR During the Forecast Period

Figure 25 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Asia Pacific is Expected to Exhibit the Fastest Growth Rate During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Key Strategies Adopted By the Leading Players in the Cloud Microservices Market During 2016–2018

Figure 30 Market Evaluation Framework

Figure 31 Geographic Revenue Mix of the Top Market Players

Figure 32 AWS: Company Snapshot

Figure 33 CA Technologies: Company Snapshot

Figure 34 IBM: Company Snapshot

Figure 35 Microsoft: Company Snapshot

Figure 36 Salesforce: Company Snapshot

Figure 37 Infosys: Company Snapshot

Figure 38 Oracle: Company Snapshot

Figure 39 Syntel: Company Snapshot

Figure 40 Software AG : Company Snapshot

Figure 41 TCS: Company Snapshot

Growth opportunities and latent adjacency in Cloud Microservices Market