Collaborative Combat Aircraft Market by Platform (Manned and Unmanned), by Application (Air Superiority, Ground Attack, Intelligence, surveillance, and Reconnaissance (ISR), and Electronic Warfare), by System (Sensor System, Communication System, Weapon System, and Navigation System), by End Users (Air Forces, Navy/Naval Aviation, and Special Operations Forces (SOF)), and Region - Global Forecast to 2030

The Collaborative Combat Aircraft (CCA) market is reshaping modern air warfare by integrating uncrewed aerial systems with traditional manned fighter jets through manned-unmanned teaming (MUM-T). These aircraft, often referred to as "loyal wingmen," enhance mission capability by taking on roles such as surveillance, electronic warfare, and precision strikes. Designed with advanced AI, secure communication systems, and sensor fusion technology, CCAs can operate independently or in coordination with manned platforms. Their flexible design and autonomous features allow them to perform high-risk missions, extend the reach of fighter jets, and support operations in denied or contested airspace.

Globally, the demand for CCAs is accelerating. North America remains the dominant region, driving large-scale programs and testing prototypes to integrate with next-generation fighters. Europe is also advancing its efforts, aligning CCA development with multinational defense collaborations, while Asia-Pacific nations are investing heavily in indigenous technologies to modernize their air forces. Across regions, the emphasis is on increasing combat effectiveness, reducing pilot risk, and adopting cost-efficient solutions for modern aerial threats. The CCA market is expected to play a central role in the future of air combat strategies, reshaping how missions are conducted in both peacetime and high-intensity conflicts.

By Platform

The CCA market revolves around Manned-Unmanned Teaming (MUM-T), where uncrewed aircraft (commonly referred to as "loyal wingmen") operate alongside manned fighter jets. These drones act as force multipliers, extending the capabilities of legacy and next-generation aircraft. Development is focused on platforms that can perform air combat, surveillance, and strike missions autonomously or semi-autonomously.

By System / Technology

Collaborative combat aircraft rely on advanced systems including AI-based decision-making, sensor fusion, and secure communication networks. These aircraft are often designed to be attritable—low-cost enough to risk in contested environments, but capable enough to deliver meaningful mission results. Emphasis is placed on interoperability with existing fighter fleets and network-centric warfare systems.

By Application

Key applications include air superiority, electronic warfare, intelligence, surveillance, reconnaissance (ISR), and precision strike missions. CCAs can be used to absorb threats in high-risk zones, protect manned aircraft, extend sensor coverage, and execute coordinated attacks. They also reduce operational risks to human pilots and enable new strategies in contested airspace.

Regional Analysis

- North America is leading development with multiple government and private sector initiatives focused on integrating CCAs with current and future combat aircraft.

- Europe is actively developing collaborative combat systems as part of its next-gen fighter programs, with multinational partnerships aimed at creating manned-unmanned integrated solutions.

- Asia-Pacific is experiencing fast growth in CCA initiatives, with countries like India and others focusing on developing indigenous drone technologies and teaming systems for defense modernization.

- Other Regions are exploring collaborative technologies to improve defense capabilities, although at varying levels of technological maturity and investment.

FAQ

What is a Collaborative Combat Aircraft (CCA)?

A Collaborative Combat Aircraft (CCA) is an uncrewed aerial vehicle designed to operate alongside manned fighter jets as part of a manned-unmanned teaming system. It supports missions like surveillance, electronic warfare, target acquisition, and even direct combat, often controlled or coordinated via AI or secure data links.

How is a CCA different from a traditional drone?

Unlike traditional drones, CCAs are equipped with advanced autonomy, real-time decision-making capabilities, and are designed to actively collaborate with crewed aircraft. They are mission-flexible, more survivable in combat zones, and often feature secure communication and sensor fusion systems for seamless coordination.

Which sectors or forces are the primary users of CCAs?

CCAs are primarily used by air forces and defense organizations seeking to enhance their aerial combat capabilities. They are also integrated into next-generation fighter programs and are of interest to military aerospace contractors and government defense agencies worldwide.

What are the main benefits of using CCAs in modern air combat?

CCAs increase combat effectiveness, reduce the risk to human pilots, and provide greater operational flexibility. Their lower cost and expendable nature make them ideal for high-threat environments, while their advanced systems enhance surveillance, targeting, and response time.

Which regions are leading in CCA development and deployment?

North America is at the forefront of CCA development, with major defense programs and investments. Europe is pursuing CCA integration through joint fighter initiatives, while Asia-Pacific countries, including India and China, are investing in indigenous CCA capabilities to modernize their air forces.

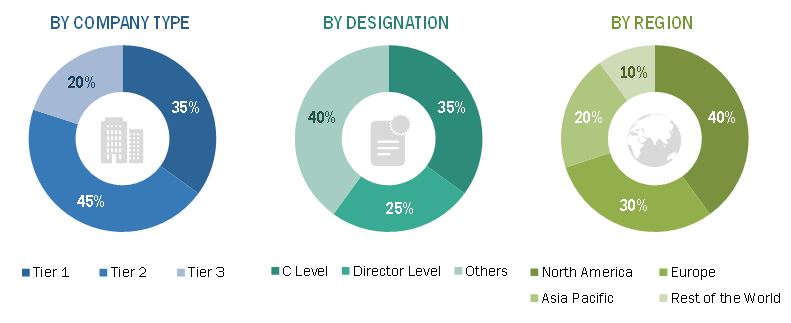

Exhaustive secondary research was done to collect information on collaborative combat aircraft market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, Business Week, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and research papers.

Primary Research

Extensive primary research was conducted after acquiring information regarding the collaborative combat aircraft market scenario through secondary research. The market for collaborative combat aircraft is being driven by a range of stakeholders, including aircraft manufacturers, infrastructure providers, and governments. The demand-side of this market is characterized by various end users, such as military forces, defense contractors, and international defense organizations. The supply side is characterized by technological advancements and the development in collaborative combat aircraft. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the collaborative combat aircraft market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the collaborative combat aircraft market based on platform, application, system, end users, and region.

- To forecast the size of different segments of the market with respect to five key regions, namely, North America, Europe, Asia Pacific, and Rest of the World, along with their key countries

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To identify technology trends currently prevailing in the collaborative combat aircraft market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the key market trends

- To profile the leading market players and comprehensively analyze their market share and core competencies.

- To analyze the degree of competition in the market by identifying the key growth strategies, such as acquisitions, new product launches, contracts, and partnerships, adopted by the leading market players.

- To identify detailed financial positions, key products, and unique selling points of the leading companies in the market

- To provide a detailed competitive landscape of the market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Application, By System, By End Users |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

Lockheed Martin Corporation (US), Boeing Company (US), Airbus SE (Netherlands), Northrop Grumman Corporation (US), Saab AB (Sweden), BAE Systems plc (UK), Dassault Aviation SA (France), Leonardo S.p.A. (Italy), Textron Inc. (US), General Dynamics Corporation (US) are some of the major players of Collaborative Combat Aircraft market. (25 Companies) |

Collaborative Combat Aircraft Market Highlights

The study categorizes the collaborative combat aircraft market based on Platform, Application, System, End Users, and Region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Application |

|

|

By System |

|

|

By End Users |

|

|

By Region |

|

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Company Information

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the collaborative combat aircraft market.

Growth opportunities and latent adjacency in Collaborative Combat Aircraft Market