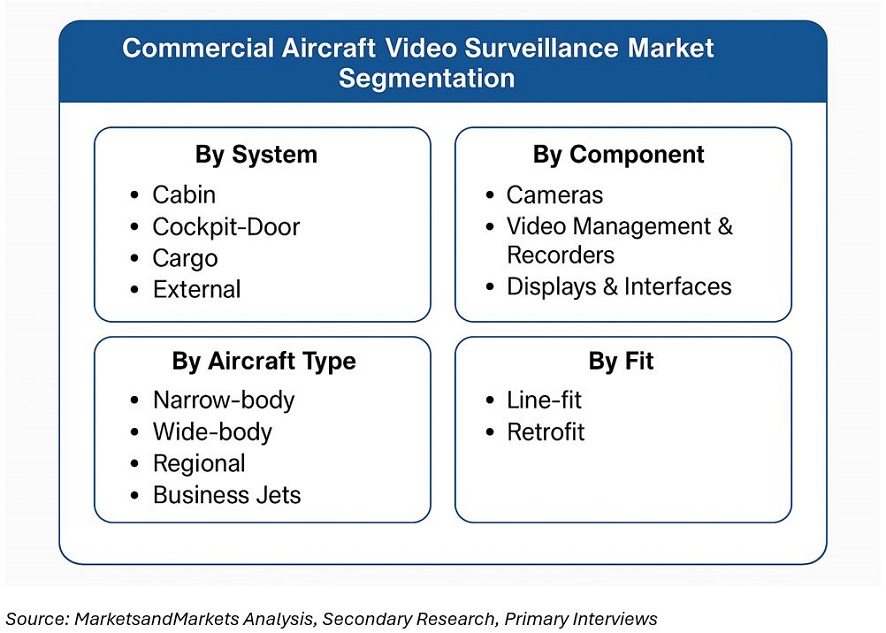

Commercial Aircraft Video Surveillance Market by System (Cabin, Cockpit-Door, Cargo, External), by Component (Cameras, Video Management & Recorders, Displays & Interfaces, Network & Storage), by Aircraft Type (Narrow-body, Wide-body, Regional, Business Jets), by Fit (Line-fit, Retrofit), and by Region - Global Forecast to 2035

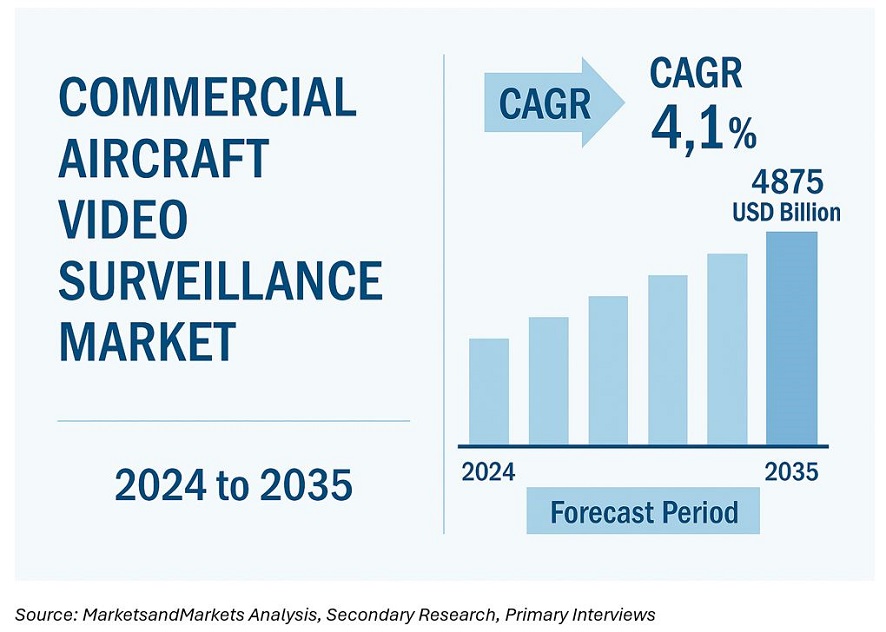

The commercial aircraft video surveillance market has shifted from simple deterrence to an integrated layer of safety, security, and operational efficiency across the modern fleet. Based on a scope that includes cameras, video management/recording, displays, storage, networking, integration, and certification services, the market is estimated at USD 0.92 billion in 2024 and is projected to reach USD 1.42 billion by 2035, reflecting a CAGR of 4.1 %.

Growth is shaped by three durable forces: sustained narrow-body production and cabin densification, airline safety-management systems that formalize continuous monitoring and evidencing, and the transition to IP-based, HD/4K, low-latency architectures that enable analytics while meeting aviation certification constraints. Line-fit demand remains tied to OEM build rates, while retrofit programs expand as operators harmonize mixed-age fleets for standardized cockpit-door monitoring, galley/aisle coverage, cargo-hold surveillance, and external zone awareness for pushback and ramp operations.

Market Dynamics

The demand profile continues to broaden as video becomes a multi-use data source. Airlines are increasingly employing evidence-grade recordings for incident reconstruction, crew training, and process auditing. Ground-time reductions drive interest in external and cargo-bay views, which speed up turnaround checks and loading verification. Meanwhile, cyber-secure networking and DO-160/DO-178C/DO-254 aligned software and hardware lifecycles raise barriers to entry but also extend service revenues through updates and controlled feature releases. Constraints remain regarding weight/power budgets, certification lead times, and the need for careful governance to ensure passenger privacy; however, these are progressively mitigated through the use of lighter sensors, edge compression, role-based access, and tamper-evident storage.

Segmentation Insights

By System

Cabin surveillance continues to hold the most extensive installed base as operators standardize aisle, galley, and door views for incident documentation and crew safety. Cockpit-door monitoring remains a non-discretionary layer—triggered by access requests and recorded with elevated integrity requirements. Cargo-hold surveillance gains relevance for lithium-battery risk management, load integrity, and smoke event triage. External/aircraft-exterior views—typically mounted near doors, gear wells, or tail/wing roots—support ramp situational awareness, pushback alignment, and maintenance inspections, with adoption rising in wide-bodies and long-haul narrow-bodies.

By Component

Cameras migrate from SD analog to IP-based HD and low-light HDR modules, with ruggedized housings and anti-fog/anti-vibration designs. Video management & recorders (VMR) are consolidating functions—such as ingest, encryption, event tagging, and synchronized multi-stream playback—while supporting remote health monitoring and predictive failure flags. Displays & crew interfaces integrate into cockpit MFDs or dedicated panels with quick-select views and event overlays. Network & storage encompasses PoE switches, airborne-qualified SSD arrays, and secure removable media; here, lifecycle service and replacement cycles drive recurring revenue. Integration services—encompassing wiring harnesses, brackets, EMI shielding, and certification paperwork—remain a significant margin lever in both line-fit and retrofit channels.

By Aircraft Type

Narrow-body aircraft (A320neo, 737 families) dominate volumes and set the pace for IP architectures due to their high production rates and uniform specifications. Wide-body aircraft typically feature more advanced multi-camera suites, particularly for cargo, galley, and exterior coverage during long-haul operations. Regional jets and turboprops emphasize lightweight, low-power kits with minimal cabin disruption, while business jets increasingly specify compact, high-definition packages that align with corporate security and VIP care protocols.

By Fit

Line-fit remains the principal channel by value as OEMs bundle standardized kits with avionics options, easing certification and warranty alignment. Retrofit growth is underpinned by fleet harmonization, post-event policy changes, and IP upgrades that replace legacy analog cabling with lighter Ethernet-based backbones. Airlines often phase retrofits by base-visit opportunity to minimize downtime, which sustains a steady multi-year project pipeline.

By Technology and Resolution (Analyst View)

The technology mix is tilting toward 1080p/60 and 4K sensors with wide dynamic range and integrated de-warping. At the same time, analytics move cautiously to the edge for event detection (tamper, smoke-like obscuration, zone intrusion). Compression standards (H.265/HEVC and emerging low-latency profiles) reduce storage without compromising evidentiary quality. Thermal and NIR assist in cargo-bay, overnight, and low-illumination use cases, though adoption is selective due to cost and certification overhead.

By End User

Airlines & operators account for the most significant lifetime value through spares, storage media refresh, and periodic component replacement aligned with maintenance checks. OEMs anchor baseline volumes and drive platform standardization. MROs and STC houses play a growing role in integration engineering, cabin modification, and cross-fleet harmonization, capturing services revenue as airlines outsource retrofit execution.

Regional Insights

North America leads in installed base and aftermarket due to large fleets and mature safety-management programs. Europe exhibits intense line-fit penetration and steady retrofit growth, aided by stricter documentation/auditing practices, as well as robust MRO networks. The Asia Pacific region delivers the fastest growth, driven by fleet expansion and longer stage lengths that favor multi-camera configurations. Middle East carriers emphasize exterior and galley coverage for premium long-haul operations, while Latin America grows through cost-optimized retrofits focused on cockpit-door and critical-zone monitoring.

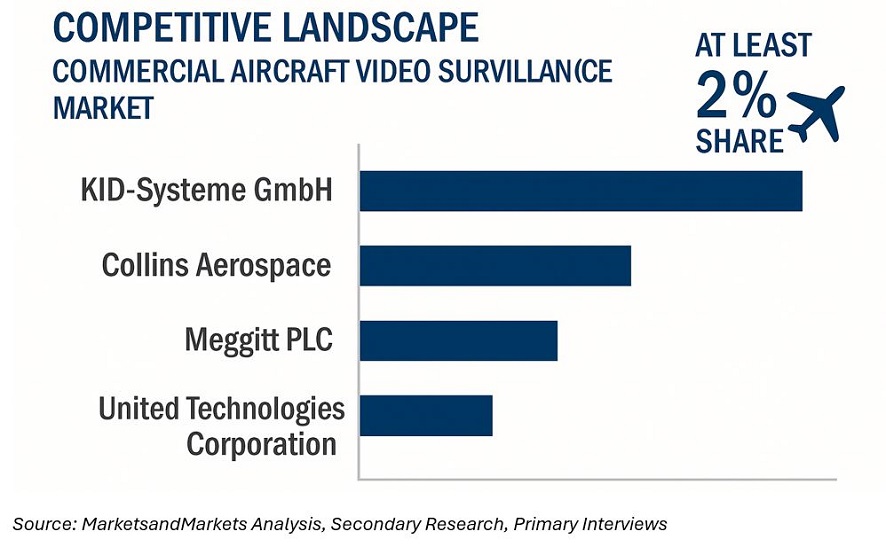

Competitive Landscape

The ecosystem includes avionics primes, cabin-system specialists, and niche camera/recorder vendors with deep certification portfolios. Competitive differentiation increasingly relies on certified IP architectures, weight/power efficiency, encryption and key management, maintenance analytics, and upgrade paths that preserve wiring and mounting. Long-term service agreements covering recorder health checks, storage media rotation, and software updates are becoming central to vendor selection.

Sustainability & Lifecycle Considerations

Modern IP systems reduce wiring mass through PoE, consolidate LRU counts, and extend mean-time-between-failure with solid-state storage—lowering replacement waste and maintenance travel. Video-supported turnaround checks can cut APU runtime and ground-handling delays, indirectly reducing emissions. Vendors are increasingly publishing RoHS/REACH conformity and offering take-back programs for end-of-life recorders and media.

Forecast Summary (2024–2035)

|

Year |

Market Size (USD Billion) |

CAGR (2024–2035) |

|

2024 |

0.92 |

|

|

2030 |

1.16 |

|

|

2035 |

1.42 |

4.1 % |

The commercial aircraft video surveillance market is transitioning from isolated security feeds to a certified, networked data layer that enhances safety, speeds ground operations, and strengthens incident governance. As fleets renew and IP backbones standardize, airlines will prioritize upgradeable, cyber-secure systems with proven certification pedigrees and low lifecycle cost. Vendors that pair evidence-grade recording with lightweight sensors, open interfaces, and long-term service programs are positioned to outgrow hardware-only competitors.

Frequently Asked Questions (FAQs)

Q1. What is the market size, and what is its outlook?

The market is valued at USD 0.92 billion in 2024 and is expected to reach USD 1.42 billion by 2035, growing at a 4.1% CAGR.

Q2. Which system area leads adoption?

Cabin and cockpit-door monitoring remain the most common baselines; cargo and external views are the fastest-expanding add-ons for operational efficiency.

Q3. What technologies are gaining share?

IP-based HD/4K cameras with low-light HDR, secured networking, edge compression, and tamper-evident solid-state recorders.

Q4. Where is growth fastest?

The Asia Pacific region exhibits the highest growth, driven by fleet additions and a growing demand for retrofitting; North America leads in aftermarket value.

Q5. What selection criteria matter most to airlines?

Certification pedigree, cyber-security, weight/power efficiency, recorder reliability, analytics-ready architectures, and total lifecycle cost.

Table Of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Geographic Scope

1.3.2 Study Years

1.4 Currency & Pricing

1.5 Package Sizes

1.6 Distribution Channel Participants

1.7 Study Limitations

1.8 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Increasing Aircraft Demand and Passenger Traffic

2.2.2.2 Increase In Return on Investments by Airlines

2.2.3 Supply Side Analysis

2.2.3.1 Cameras Acting As a Deterrent

2.2.3.2 Better In-Flight Crew Management

2.2.3.3 Enhanced External Aircraft Surveillance

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the CAVSS Market

4.2 CAVSS Market Growth, By System Type

4.3 CAVSS Market Share In the APAC Region

4.4 CAVSS Market Analysis, 2014

4.5 CAVSS Market: Emerging V/S Matured Economies

4.6 Europe Analysis, By Countries, By Assembly

4.7 Life Cycle Analysis, By Regions

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 CAVSS Market, By Assembly Type

5.3.2 Commercial Aircraft Video Surveillance Systems Market, By System Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 CAVSS Market Is More Dominantly Mandate Driven

5.4.1.2 From Air Rage To Aviation Security

5.4.1.3 Need for Enhanced Security Solutions

5.4.1.4 Surveillance Cameras Set To Keep Watch in Airlines

5.4.2 Restraints

5.4.2.1 Poor Economic Health of The Aviation And Airlines Sector

5.4.2.2 Placement of Video Cameras In The Cabin Is Controversial

5.4.2.3 Breach of Privacy

5.4.3 Opportunities

5.4.3.1 Scope of Increasing Operational Efficiency of An Aircraft

5.4.3.2 Rising Demand for Advanced HD

5.4.4 Challenges

5.4.4.1 Matching the Demand for Environmental Cameras by OEMS

5.4.4.2 Certification for the Video Surveillance System

5.4.5 Burning Issues

5.4.5.1 Cost-Versus-Value Issue

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.3.1 Prominent Companies

6.3.2 Small & Medium Enterprises

6.3.3 End-Users (Aircraft Manufacturers & Airline Companies)

6.3.4 Key Influencers

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat from New Entrants

6.5.2 Threat from Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 New Product Development Strategy Adopted By Leading Players

6.6.2 CAVSS Market Retention through Contracts & Agreements

7 Commercial Aircraft Video Surveillance Market, By System Type (Page No. - 58)

7.1 Introduction

7.2 Cockpit Door Surveillance System: Cockpit Door Monitoring For In-Flight Security

7.3 Cabin Surveillance System: Eye on the Cabin

7.4 Environmental Camera System: Camera for External Safety

8 Commercial Aircraft Video Surveillance Systems Market, By Assembly (Page No. - 65)

8.1 Introduction

8.2 Retro-Fit CAVSS Market: Projected To Expand As Airlines Take On New Orders

8.3 Line-Fit CAVSS Market: Service & Line-Fit Opportunities Increases with Large Delivery Backlogs

9 Geographic Analysis (Page No. - 71)

9.1 Introduction

9.2 Asia-Pacific: World’s Biggest Air Transport Market

9.2.1 China: Worlds’ Largest Domestic Aviation Market By 2023

9.2.2 India: Voices Concern over Aviation Safety

9.2.3 Singapore: A Major Aerospace Hub

9.2.4 Others: Malaysia and Thailand Issues Mandates for CDSS in Commercial Airplanes

9.3 Europe: Global Financial Crisis Strapped Aviation Investments

9.3.1 Germany: Most Innovative and Best Performing Aerospace Industry

9.3.2 France: Airbus to Install CDSS for All Airbus Production Aircraft Platforms

9.3.3 U.K.: Mushrooming Growth of Aircraft Despite Shortage Of Runway Capacity

9.3.4 The Netherlands: Huge MRO Market Provides Untapped Opportunity for Retro Fit

9.3.5 Others: Italy and Russia To Provide A Substantial Growth For CDSS

9.4 North America: Increasing Awareness towards Aircraft Safety and Security

9.4.1 U.S.: American Airlines Inc. And Us Airways Inc. Merged to Create One of the World’s Largest Airlines

9.4.2 Canada: Business Jets Are Paramount

9.5 Latin America: Current and Future Aviation Outlook Remains Positive

9.5.1 Mexico: Government Adopted the Rule Requiring Video Surveillance on Aircraft A Decade Ago

9.5.2 Others: Brazilian Embraer Looks to Wider Security

9.6 Rest of the World (Row): Mix of High GDP, Purchasing Power Parity, Inadequate Infrastructure

9.6.1 The Middle East: Premium Airlines Focus On Enhanced Operational Efficiency

9.6.2 Israel: Mandate Changing the Aviation Safety Landscape

9.6.3 Others: UAE and Qatar to Provide Retrofit Opportunity in CAVSS

9.6.4 Africa: Advent of the Middle Class, Demographic Boom, & Strong Economic Growth

10 Competitive Landscape (Page No. - 113)

10.1 Overview

10.2 Market Share Analysis, CAVSS Market

10.3 Competitive Scenario

10.4 New Product Launches

10.5 Contracts

10.6 Agreements, Partnerships, Collaborations & Joint Ventures

10.7 Expansions

10.8 Other Developments

11 Company Profiles (Page No. - 119)

11.1 Introduction (Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 Meggitt Plc.

11.3 United Technologies Corporation.

11.4 Ad Aerospace Plc.

11.5 Global Epoint, Inc.

11.6 Groupe Latecoere SA

11.7 Orbit Technologies Ltd.

11.8 Strongpilot Software Solutions

11.9 Cabin Avionics Ltd.

11.10 Navaero, Inc.

11.11 Aerial View Systems, Inc.

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Companies.

12 Governing Authorities and Countries Mandating CDSS (Page No. - 139)

13 Appendix (Page No. - 141)

13.1 Discussion Guide

13.2 Introducing RT: Real Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

List Of Tables (81 Tables)

Table 1 Cameras Act As a Deterrent to Prevent or Avert Catastrophes Impels the CAVSS Market

Table 2 Breach of Privacy Makes It Controversial, Which Will Restrains The CAVSS Market Growth

Table 3 Scope of Increasing Operational Efficiency Of An Aircraft Is Paving A Way For New Growth Avenues In CAVSS Market

Table 4 Certification of CAVSS and Matching Demand By OEMS Pose A Challenge For Growth

Table 5 Commercial Aircraft Video Surveillance Systems Market Size, By System Type, 2012–2020 ($Million) 59

Table 6 Cockpit Door Surveillance System Market Size, By Region, 2012–2020 ($Million) 61

Table 7 Cabin Surveillance System Market Size, By Region, 2012–2020 ($Million)

Table 8 Environmental Camera System Market Size, By Region, 2012–2020 ($Million) 64

Table 9 Geographic Distribution Of Airbus Aircraft Deliveries

Table 10 Airbus Total Aircrafts: Deliveries Vs Operational

Table 11 Geographic Distribution of Boeing Aircraft Deliveries

Table 12 Boeing Total Aircrafts: Deliveries Vs Operational

Table 13 CAVSS Market Size, By Retro-Fit, By Region, 2012-2020 ($Million)

Table 14 CAVSS Market Size, By Line-Fit, By Region, 2012-2020 ($Million)

Table 15 CAVSS Market Size, By Region, 2012–2020 ($Million)

Table 16 Legislation Mandates for CDSS around the World & Respective Civil Aviation Authority

Table 17 Pending Legislation Mandates for CDSS

Table 18 Asia-Pacific: CAVSS Market Size, By Country, 2012–2020 ($Million)

Table 19 Asia-Pacific: CAVSS Line-Fit Market Size, By Countries, 2012–2020 ($Million) 76

Table 20 Asia-Pacific: CAVSS Retro-Fit Market Size, By Countries,2012–2020 ($Million) 76

Table 21 Asia-Pacific: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 22 APAC CDSS Market, By Countries, 2012-2020 ($Million)

Table 23 China: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 24 China: CAVSS Market Size, By System Type, 2012–2020($Million)

Table 25 India: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 26 India: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 27 Singapore: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 28 Singapore: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 29 Europe: CAVSS Market Size, By Country, 2012–2020($Million)

Table 30 Europe CDSS Market, By Countries, 2014-2020 ($Million)

Table 31 Europe: CAVSS Line-Fit Market Size, By Countries, 2012–2020 ($Million)

Table 32 Europe: CAVSS Retro-Fit Market Size, By Countries, 2012–2020 ($Million)

Table 33 Europe: CAVSS Market Size, By System Type, 2012–2020($Million)

Table 34 Germany: CAVSS Market Size, By Assembly, 2012–2020($Million)

Table 35 Germany: CAVSS Market Size, By System Type, 2012–2020($Million)

Table 36 France: CAVSS Market Size, By Assembly, 2012–2020($Million)

Table 37 France: CAVSS Market Size, By System Type, 2012–2020($Million)

Table 38 U.K.: CAVSS Market Size, By Assembly, 2012–2020($Million)

Table 39 U.K.: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 40 The Netherlands: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 41 The Netherlands: CAVSS Market Size, By System Type,2012–2020 ($Million) 91

Table 42 North America: CAVSS Market Size, By Country, 2012–2020 ($Million)

Table 43 North America: CAVSS Line-Fit Market Size, By Countries,2012–2020 ($Million) 94

Table 44 North America: CAVSS Retro-Fit Market Size, By Countries,2012–2020 ($Million) 94

Table 45 North America: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 46 North America CDSS Market, By Countries, 2012-2020 ($Million)

Table 47 U.S. CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 48 U.S. CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 49 Canada: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 50 Canada: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 51 Latin America: CAVSS Market Size, By Country, 2012-2020 ($Million)

Table 52 Latin America: CAVSS Line-Fit Market Size, By Countries,2012–2020 ($Million) 99

Table 53 Latin America: CAVSS Retro-Fit Market Size, By Countries,2012–2020 ($Million) 100

Table 54 Latin America: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 55 Latin America CDSS Market, By Countries, 2012-2020 ($Million)

Table 56 Mexico: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 57 Mexico: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 58 Row: CAVSS Market Size, By Region, 2012–2020 ($Million)

Table 59 Row: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 60 Row: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 61 The Middle East: CAVSS Market Size, By Country, 2012-2020 ($Million)

Table 62 Middle East: CAVSS Line-Fit Market Size, By Countries,2012–2020 ($Million) 107

Table 63 Middle East: CAVSS Retro-Fit Market Size, By Countries,2012–2020 ($Million) 107

Table 64 The Middle East: CAVSS Market Size, By System Type,2012–2020 ($Million) 108

Table 65 Middle East CDSS Market, By Countries, 2012-2020

Table 66 Israel: CAVSS Market Size, By Assembly, 2012–2020 ($Million)

Table 67 Israel: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 68 Africa: CAVSS Line-Fit Market Size, By Countries, 2012–2020 ($Million)

Table 69 Africa: CAVSS Retro-Fit Market Size, By Countries, 2012–2020 ($Million)

Table 70 Africa: CAVSS Market Size, By System Type, 2012–2020 ($Million)

Table 71 Africa CDSS Market, By Countries, 2014-2020

Table 72 New Product Launches, 2010–2014

Table 73 Contracts, 2010–2014

Table 74 Agreements, Partnerships, Collaborations, & Joint Ventures,2010–2014 117

Table 75 Expansions, 2010-2014

Table 76 Other Developments, 2010-2014

Table 77 Legislation Mandates for CDSS in Europe

Table 78 Legislation Mandates for CDSS in Asia-Pacific

Table 79 Legislation Mandates for CDSS in the Middle East

Table 80 Legislation Mandates for CDSS in North America

Table 81 Pending Legislation Mandates for CDSS

List Of Figures (71 Figures)

Figure 1 Market Covered

Figure 2 CAVSS Market: Research Design

Figure 3 Key Data from Secondary Sources

Figure 4 Key Data from Primary Sources

Figure 5 Break Down Of Primary Interviews: By Company Type, Designation & Region

Figure 6 Passenger Traffic Y-O-Y Growths By Regions

Figure 7 Aircraft Deliveries and Airline Industry ROIC To Affect Investments on Safety Parameters

Figure 8 Growing Number of Unruly Passenger Incidents Demands Better In-Flight Crew Management, Globally

Figure 9 Increasing Collision Incidents Demands Enhanced External Aircraft Surveillance

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Market Size Estimation Methodology: Top-Down Approach

Figure 12 Data Triangulation Methodology

Figure 13 CAVSS Market Snapshot (2014 Vs 2020): Mandates for CDSS Is Expected To Increase & Drive the CAVSS Market The Most In The Next Six Years

Figure 14 China & India Are the Most Luctrative Market to Invest In During The Forecast Period

Figure 15 CAVSS Regional Market Share, 2014

Figure 16 Attractive Market Opportunities in The CAVSS Market, 2014-2020

Figure 17 Cabin Surveillance System Has the Highest Growth In The CAVSS Market, By System Type (2014-2020)

Figure 18 The APAC Region Estimated To Capture A Major Share In The Commercial Aircraft Video Surveillance Systems Market In 2014

Figure 19 APAC Accounts for The Highest Estimated Market Share In The Commercial Aircraft Video Surveillance Systems Market In 2014

Figure 20 Emerging Markets to Grow At A Faster Rate Than The Matured Economies By 2020

Figure 21 Aggregate Demand For Countries In Europe, By Assembly (2014-2020)

Figure 22 The APAC Market Is Projected To Lead The Exponential Growth Phase In The Coming Years

Figure 23 Cabin Security Came Into Limelight Following the 9/11 Terrorist Assault

Figure 24 Commercial Aircraft Video Surveillance Systems Market, By Assembly Type 40

Figure 25 Commercial Aircraft Video Surveillance Systems Market, By System Type 41

Figure 26 CAVSS Market Is More Dominantly Mandate Driven

Figure 27 Value Chain Analysis (2014): Major Value Is Added During Production & Assembly Phase of The CAVSS

Figure 28 Supply Chain (2014): Direct Distribution Is the Most Preferred Strategy Followed By Prominent Manufacturers Of CAVSS

Figure 29 Demand For Nextgen HD Camera Is Set To Increase Due To Increasing Demand For High Resolution Video Clarity

Figure 30 Porter’s Five Force Analysis (2013): Continuous Efforts Involved in Up- Gradation of CAVSS Affects This Market Positively

Figure 31 Strategic Benchmarking: Securaplane & UTC Aerospace Systems Largely Adopted New Product Launch & Development Strategy For Attracting Aircraft Manufacturer

Figure 32 Strategic Benchmarking: Global Airworks Majorly Adopted the Market Retention Strategy

Figure 33 CDSS Dominates the CAVSS Market With The Largest Market Share Amongst System Market

Figure 34 The Asia-Pacific Is Expected To Dominates The CDSS Market During The Forecast Period

Figure 35 CSS Market in Asia-Pacific Is Expected To Grow Rapidly Due To Increasing Aircraft Delivery and Strict Government Mandates

Figure 36 Europe Domanates The ECS Market But Asia-Pacific Is Expected To Show Maximum Growth During The Forecast Period

Figure 37 CAVSS Key Drivers, By Aircraft Assembly

Figure 38 Asia-Pacific to Dominate The Retro-Fit CAVSS Market Due To Increasing Aircraft Deliveries

Figure 39 Europe to Dominate The Line-Fit CAVSS Market Due To Presence Of CAVSS Mandates

Figure 40 Geographic Snapshot (2014) –CAVSS Market Is Growing Very Rapidly In Asia-Pacific Region

Figure 41 Emerging Economies to Project A High Growth Rate

Figure 42 Asia-Pacific CAVSS Market Snapshot (2014) - India Is the Most Lucrative Market

Figure 43 The CAVSS Market In China Shall Become The Largest By 2020 ($Million)

Figure 44 Increase In Aircraft Deliveries Boosts The Indian CAVSS Market During The Forecast Period

Figure 45 The Netherlands Leaps Forward In The CAVSS Market To Help Europe Grow By 2020

Figure 46 North American CAVSS Market Snapshot: Increasing Concerns For In-Flight and External Aircraft Security Is Expected To Drive CAVSS Market

Figure 47 Mexico Will Dominate the CAVSS Market In Latin America, 2014

Figure 48 Retro-Fit Dominates the Latin American CAVSS Market, 2014 Vs. 2020

Figure 49 CDSS Dominates the Market in the Latin American Region, 2014 Vs. 2020

Figure 50 Video Camera in the Cockpit Being Controversial Is a Major Restraint For The CAVSS Market In Row, 2014

Figure 51 Retro-Fit Dominates the Row CAVSS Market, 2014 Vs. 2020

Figure 52 CDSS Dominates the Row CAVSS Market, 2014 Vs. 2020

Figure 53 New Airlines in This Region Brings Greater Ambition and Desire to Grow

Figure 54 Retro-Fit Projects a High Growth Rate in the Middle East, 2014 Vs. 2020

Figure 55 CDSS Dominates the CAVSS Market In The Middle East, 2014 Vs. 2020

Figure 56 Retro-Fit Is Growing At the Highest CAGR In Africa From 2014 To 2020

Figure 57 CDSS Has the Highest Market Share In Africa, 2014 Vs. 2020

Figure 58 Companies That Adopted Product Innovation as The Key Growth Strategy Over Four Years

Figure 59 United Technologies Corporation Grew At the Fastest Rate between 2011-2013

Figure 60 CAVSS Market Evolution Framework, 2011-2013

Figure 61 Commercial Aircraft Video Surveillance Systems Market Share: Contracts Was the Key Strategy, 2010-2014

Figure 62 Geographic Revenue Mix of Top 5 Players

Figure 63 Competitive Benchmarking Of Key Market Players (2011-2013): United Technologies Emerged As A Champion Owing To Its Diversified Cavs Product Portfolio

Figure 64 Meggitt PLC.: Business Overview

Figure 65 Meggitt PLC: SWOT Analysis

Figure 66 United Technologies Corp.: Business Overview

Figure 67 United Technologies Corporation.: Swot Analysis

Figure 68 Groupe Latecoere SA: Business Overview

Figure 69 Groupe Latecoere SA: SWOT Analysis

Figure 70 Orbit Technologies Ltd.: Business Overview

Figure 71 Orbit Technologies Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Commercial Aircraft Video Surveillance Market