Composite AI Market by Offering (Software, Hardware, Services), Technique (Data Processing, Pattern Recognition), Application (Product Design & Development, Customer Service), Vertical and Region - Global Forecast to 2028

Composite AI Market Analysis, Industry Size & Forecast

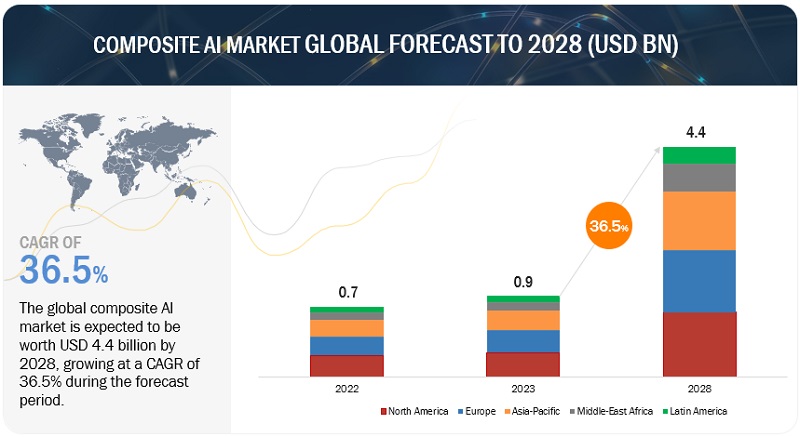

[280 Pages Report] The Composite AI Market is estimated to grow from USD 0.9 billion in 2023 to USD 4.4 billion by 2028, at a CAGR of 36.5% during the forecast period. Integration with edge computing and IoT for real-time decision-making and rising demand for explainable AI and trustworthiness across major sectors offer opportunities to the end users to leverage composite AI solutions. Moreover, the growing intricacy of AI applications for better performance and increasing demand for more customized and flexible solutions to improve efficiency and productivity boost the market growth in coming years.

Composite AI Market Technology Roadmap till 2030

The composite AI market report covers the composite AI technology roadmap till 2030, with insights around the initiation, development, and commercialization of technologies across AI-driven autonomous systems, AI ethics, and responsible AI. Some of the key findings from the technology roadmap include:

Composite AI Market Short-term Technology Roadmap (2023-2025)

- Advancements in explainable AI to foster trust in Composite AI solutions

- Commercialization of Composite AI enhancing human intelligence in a wide range of applications

Composite AI Market Mid-term Technology Roadmap (2026-2028)

- Development of AI ethics and responsible AI to shape the development, deployment, and adoption of composite AI solutions in the market

- Integration of personalized AI assistants with Composite AI solutions to provide tailored and intelligent experiences to users

Composite AI Market Long-term Technology Roadmap (2029-2030)

- Advanced neural networks and models for developing intelligent and effective composite AI applications across a wide range of industries and use cases

- The emergence of next-generation composite AI platforms

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Composite AI Market Growth Dynamics

Driver: Growing intricacy of AI applications for better performance and accuracy

AI applications are becoming more complex, requiring the integration of multiple AI technologies and models to solve intricate problems. Currently, organizations are facing the reality that training a massive neural network using ML does not always scale to solve problems of increased complexity. The pure ML approach works for many classification and recognition tasks but is not always sufficient for solving deeper understanding problems. ML also generates an unending need for training data and computation power. Composite AI solutions provide a way to leverage the strengths of different AI algorithms and components, enabling organizations to tackle complex challenges and achieve better performance. Furthermore, composite AI solutions can leverage the strengths of various AI models and algorithms, resulting in improved performance and accuracy compared to standalone AI approaches. Organizations can achieve more robust and precise results by combining different techniques, leading to enhanced decision-making and problem-solving capabilities.

Restraint: Concerns related to data privacy and security

Some organizations may hesitate to adopt composite AI solutions due to lacking trust in AI technology or a limited understanding of its capabilities and limitations. Concerns about data privacy, security, and potential biases in AI models can also create obstacles to implementation. The main privacy concerns around AI comprises of data breaches and unauthorized access to personal information. The collected data is collected and then processed to gain key insights which lead to the rise in high risk as it may fall into the wrong hands and can cause that data to get breached easily. . With the advancements in AI technology pave the way for more increase in the data breaches and security issues. For instance, generative AI technology can be exploited to create fake profiles or misused to generate unauthorized images. As per the latest stats, cybercrimes affect the security of 80% of businesses worldwide, and personal data falling into the wrong hands can have severe consequences.

Opportunity: Integration with edge computing and IoT for real-time decision-making

The proliferation of Internet of Things (IoT) devices and the need for real-time decision-making are driving the adoption of edge computing. Composite AI solutions integrated with edge devices can process and analyze data locally, reducing latency and enabling faster insights and responses. This integration presents opportunities for deploying composite AI solutions in edge computing environments. Edge computing is the key support for intelligent applications and 5G/6G Internet of Things (IoT) networks. It offers various advantages such as low latency, fast response, context-aware services, mobility, and privacy preservation. This technology extends the cloud by providing intermediate services at the edge of the network and improving the quality of service for latency-sensitive applications. The adoption of new emerging technologies such as IoT, wireless sensor networks (WSNs), cloud/edge computing, and 5G/6G communication networks in various fields such as healthcare, agriculture, education, and transportation can bring many opportunities in improving people’s quality of life, thus building intelligent systems that deliver high-quality, innovative services to the consumers. In the IoT environment, many interconnected devices, such as sensors, mobiles, and memory units, lead to voluminous, heterogeneous, highly noisy, spatiotemporal-correlated, and real-time data streams that need intelligent learning for efficient data analysis and meaningful insight extraction.

Challenge: Data availability and quality

Composite AI solutions heavily rely on large and diverse datasets to train and optimize models. However, organizations may face challenges acquiring high-quality, labeled, and relevant data, especially for specific use cases or industries. Data privacy concerns and regulatory restrictions further complicate data access and sharing. The availability of high-quality data is considered critical, as it is used to train AI algorithms. When developing AI applications that can deliver value, the quality of the data fed into such algorithms is of great importance. Moreover, biased data during labeling and training can potentially result in biased AI applications, posing significant challenges to practitioners in leveraging their data assets into AI applications.

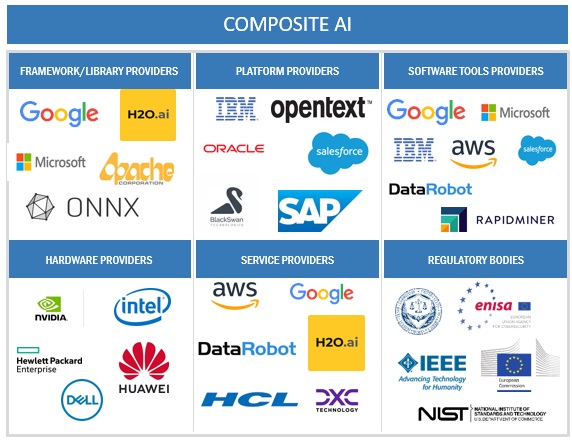

Composite AI Market Ecosystem

By offering, hardware to register at the highest CAGR during the forecast period

Composite AI hardware comprises hardware components and infrastructure that support the implementation and execution of composite AI solutions. It involves utilizing specialized hardware devices, processors, accelerators, and infrastructure configurations designed to handle composite AI workloads' computational requirements and complexities. Composite AI hardware plays a crucial role in enabling the efficient processing and execution of various AI models, algorithms, and techniques that are integrated within a composite AI solution. These hardware components are optimized to handle the computational demands of tasks such as machine learning, deep learning, natural language processing, computer vision, and more.

By application, product design & development to account for the largest market size during the forecast period

Product design and development business applications plays a crucial role in implementing composite AI solutions in the market. Product design & development applications provide tools and functionalities to generate innovative ideas and concepts. These applications enable businesses to explore new product possibilities and identify areas where composite AI can add value. Using composite AI in product design & development offers significant benefits for companies looking to enhance their product development capabilities, reduce costs, and bring innovative products to market more efficiently.

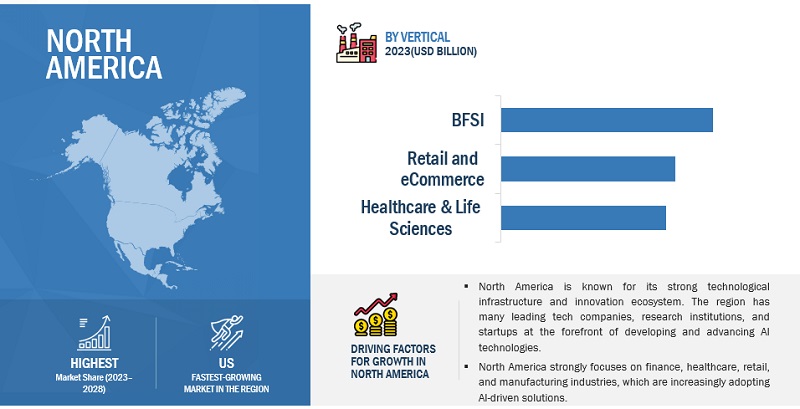

North America to account for the largest market size during the forecast period

North America is a leading region in adopting and growing composite AI solutions. The presence of advanced AI technology companies, robust R&D capabilities, and a mature market ecosystem contribute to the rapid growth of composite AI solutions in this region. Major industries such as healthcare, BFSI, retail, and manufacturing embrace composite AI to drive innovation, enhance customer experiences, and improve operational efficiency. . These factors are also responsible for adopting composite AI solutions across the region. Moreover, various industry verticals, such as telecom, healthcare, media and entertainment, retail and eCommerce, and BFSI, are leveraging composite AI solutions to enhance productivity and better performance.

Key Market Players

The composite AI market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Key players operating in the composite AI market include IBM (US), SAS Institute (US), Microsoft (US), Google (US), AWS (US), Salesforce (US), BlackSwan Technologies (Israel), Oracle (US), OpenText (Canada), SAP (Germany), HPE (US), Pega s (US), NVIDIA (US), Intel (US), UiPath (US), Zest AI (US), Dynamic Yield(US), DataRobot(US), H2O.ai(US), Squirro (Switzerland), CognitiveScale (US), SparkCognition (US), Diwo(US), ACTICO (Germany), Kyndi (US), Nauto (US), Netra (US), and Exponential AI (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

By offering, method, application, vertical, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

|

Companies covered |

IBM (US), SAS Institute (US), Microsoft (US), Google (US), AWS (US), Salesforce (US), BlackSwan Technologies (Israel), Oracle (US), OpenText (Canada), SAP (Germany), HPE (US), Pega (US), NVIDIA (US), Intel(US), UiPath(US), Zest AI(US), Dynamic Yield (US), DataRobot (US), H2O.ai (US), Squirro (Switzerland), CognitiveScale (US), SparkCognition (US), Diwo (US), ACTICO (Germany), Kyndi (US), Nauto (US), Netra(US), and Exponential AI(US). |

This research report categorizes the composite AI market based on offering, method, application, vertical, and region.

By Offering:

-

Hardware

- Processors

- Memory Units

- Networks

- Other Hardware (Tensor Processing Units (TPUs), Field-Programmable Gate Arrays (FPGAs), Application-Specific Integrated Circuits (ASICs), and Central Processing Units (CPUs))

-

Software

- AI Development Platforms and Tools

- ML Frameworks

- AI Middleware

- Other Software (Computer Vision Software, Data Management Tools, Monitoring software, and Security and Governance tools)

-

Services

- Training and Consulting

- System Integration and Implementation

- Support and Maintenance

By Technique:

- Conditioned Monitoring

- Pattern Recognition

- Data Processing

- Proactive Mechanism

- Data Mining & Machine Learning

- Other Methods (AutoML and model building, model stacking & ensemble, and transfer learning)

By Application:

- Product Design & Development

- Quality Control

- Predictive Maintenance

- Security & Surveillance

- Customer Service

- Other Applications (Fraud Detection & prevention, and Supply Chain Management)

By Vertical:

- BFSI

- Retail and eCommerce

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Healthcare and Life Sciences

- Media and Entertainment

- Government and Defense

- Telecom

- Other Verticals (Construction & real estate, Automotive, IT and ITeS, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2023, Amazon SageMaker announced Collections, a new capability to organize machine learning models in the Amazon SageMaker Model Registry. Collections may gather relevant registered models and organize them hierarchically to improve model discoverability at scale.

- In July 2022, AWS partnered with Hugging Face to make it easier for companies to leverage state-of-the-art machine learning models, and ship cutting-edge NLP features faster. Through this partnership, Hugging Face is leveraging Amazon Web Services as its preferred cloud provider to deliver customer services.

- In May 2022, BlackSwan Technologies and Refinitiv entered a strategic agreement. The agreement enables next-generation customer risk assessment through an advanced compliance solution incorporating comprehensive financial crime data and ground-breaking AI technologies for KYC, transaction monitoring, and screening.

- In March 2022, Microsoft announced the acquisition of Nuance. This acquisition will offer customers improved consumer, patient, clinician, and employee experiences and better productivity and financial results.

- In September 2021, SAS announced an expansion for its SAS Viya platform, which analyzes data and builds AI models.

Frequently Asked Questions (FAQ):

What is Composite AI?

According to RapidMiner, Composite AI refers to the combination of various AI technologies. Traditional AI is a broad sector of machine intelligence with a wide range of applications, including automation, predictive analytics, machine learning, natural language processing (NLP), etc.

Which countries are considered in the European region?

The countries such as the UK, Germany, France, Spain, and Italy are the major economies in the region that leverage composite AI solutions.

Which vertical is expected to witness a higher market share in the composite AI market?

BFSI is the leading sector that leverages composite AI solutions to enhance risk management capabilities, identify and mitigate potential risks, detect fraudulent activities, and improve compliance with regulatory requirements.

Which are key verticals adopting Composite AI solutions and services?

Some key verticals like retail and eCommerce, healthcare & life sciences, BFSI, and Telecom are leveraging Composite AI solutions to provide personalized customer experiences.

Who are the key vendors in the Composite AI market?

IBM (US), Microsoft (US), SAS Institute (US), BlackSwan Technologies (Israel), Google (US), and AWS (US) are the key vendors that offer composite AI solutions for improved operational efficiency, enhanced customer experiences, better decision-making, and the optimization of various processes across different sectors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

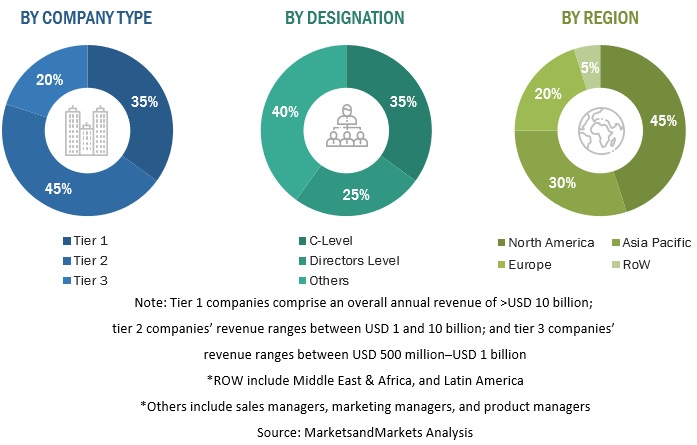

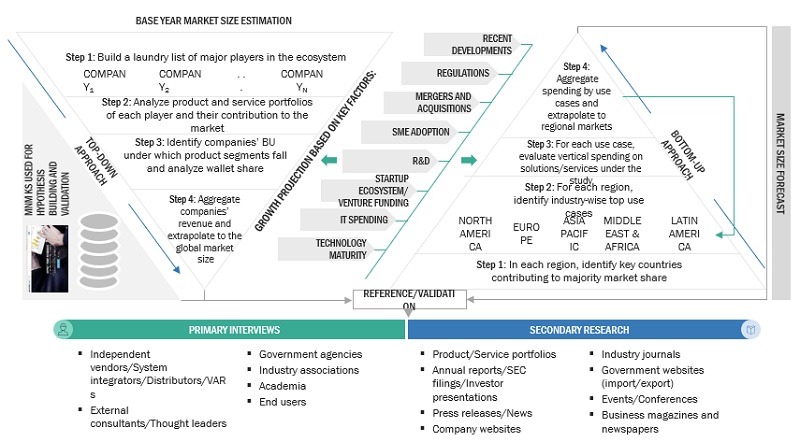

The study involved four major activities in estimating the current market size of the composite AI market. Extensive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the composite AI market.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, Composite AI spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, verticals, and regions, and key developments from both markets- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and Composite AI expertise; related key executives from Composite AI solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using composite AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Composite AI solutions and services, which would impact the overall Composite AI market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the composite AI market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the composite AI market. The bottom-up approach was used to arrive at the overall market size of the global composite AI market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Top Down and Bottom-up Approach for Composite AI market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to BlackSwan Technologies, Composite AI is a breakthrough approach combining multiple AI techniques to interpret data more deeply and efficiently solve a wider range of business problems. The techniques applied may include knowledge graphs, natural language processing (NLP), contextual analysis, machine learning (ML), deep learning, and other methods. Composite AI is most effective when integrated into a complete enterprise software platform incorporating insight-driven alerts and workflows, data visualization and situational dashboards, organizational policies, and privacy protections.

Key Stakeholders

- Composite AI vendors

- Composite AI hardware vendors

- Composite AI service vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the composite AI market by offering (Hardware, Software, and services), technique, application, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments concerning five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments in the composite AI market, such as partnerships, new product launches, and mergers and acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Composite AI market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Composite AI Market