Edge Computing Market Size, Share, Industry Analysis

Edge Computing Market by Component (Edge Hardware (Servers, Gateways, Sensors, Devices), Edge Software (Data Management)), Edge Application (Edge AI & Inference, Real-Time Processing & Control, Immersive & Interactive Experiences) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global edge computing market size is estimated at USD 168.40 billion in 2025 and is expected to reach USD 248.96 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. The market is expanding as enterprises adopt AI democratization and real-time analytics to enable localized decision-making. Rising deployment of autonomous systems, growing sustainability mandates, OT-IT convergence, and stricter data sovereignty requirements in BFSI, healthcare & life sciences, and public services further strengthen the demand for edge computing.

KEY TAKEAWAYS

- Asia Pacific will grow the fastest and is expected to achieve a CAGR of 10.5% during the forecast period, driven by its dense urban population, accelerating smart city programs in countries such as China, India, and Singapore, and strong government investment in 5G and digital infrastructure.

- By component, services, including managed and professional services, are set to grow fastest in the edge computing market, achieving a growth rate of 13.3%, as enterprises require specialized expertise to deploy edge nodes, manage low-latency networks, and secure distributed infrastructures.

- By application, immersive and interactive experiences are projected to experience the highest growth in the edge computing market, with a CAGR of 16.2% during the forecast period, driven by the real-time processing needs of augmented reality (AR), virtual reality (VR), and gaming.

- By organization size, SMEs are expected to grow the fastest in the edge computing market as they adopt localized processing to overcome bandwidth and latency constraints without investing in large-scale data centers.

- Cloud edge is expected to grow the fastest as organizations prioritize distributed, on-demand computing models that combine hyperscale cloud capabilities with localized edge nodes.

- Healthcare and life sciences are expected to grow the fastest, driven by the need for real-time diagnostics, remote patient monitoring, and AI-enabled imaging at the edge.

- Major players in the edge computing market are pursuing both organic and inorganic strategies, including partnerships, product enhancements, and ecosystem investments. For instance, Hewlett Packard Enterprise (US), Amazon Web Services (US), Dell Technologies (US), Cisco Systems (US), and Microsoft (US) have expanded their edge portfolios to strengthen real-time processing, AI-driven analytics, and 5G-enabled applications across industries.

- ZTE Corporation, Vapor IO, and Litmus Automation have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

The edge computing market is experiencing steady growth, fueled by increased demand for low-latency processing to support real-time applications, the rapid rise of IoT devices producing vast amounts of data, and the integration of 5G, AI, and machine learning to facilitate intelligent, autonomous decision-making at the edge. The need for resilient, decentralized infrastructure further boosts enterprise investments in advanced edge deployments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on businesses results from customer trends and disruptions, with telecom, retail, healthcare, and manufacturing serving as key clients of edge computing providers, while their customers are the ultimate beneficiaries. Changes in low-latency services, AI-driven insights, and 5G integration will influence end-user revenues, further increasing revenues for edge computing providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Exponential scale of IOT and endpoint intelligence

-

Rising demand for low latency applications

Level

-

Economic & policy constraints in emerging markets

-

Complex nature of edge computing infrastructure

Level

-

Advent of 5G network to provide open avenues for large-scale 5G network deployment

-

Remote & mission-critical edge deployment

Level

-

Increasing data privacy and security concerns

-

Skill gap & operational expertise

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Exponential scale of IOT and endpoint intelligence

The growth of the edge computing market is fueled by the increase in Internet of Things (IoT) devices and the rise of endpoint intelligence. Processing data locally decreases dependence on centralized infrastructure, reduces latency, and protects data privacy, which boosts enterprise adoption. Incorporating artificial intelligence (AI) and machine learning (ML) into edge devices further supports automation and resilience, directly driving demand for scalable edge computing solutions across industries.

Restraint: Economic & policy constraints in emerging markets

The adoption of edge computing in emerging markets is limited by high capital spending, poor infrastructure, and few financing options. Unreliable power, weak connectivity, and underdeveloped data center ecosystems increase deployment costs and reduce returns. Regulatory uncertainty around data sovereignty, spectrum allocation, and outdated telecom policies also discourage investment. Along with skill shortages and limited institutional backing, these issues prevent scalability and deepen the digital divide.

Opportunity: Remote & mission critical edge deployment

Remote and mission-critical edge deployments present a major opportunity by enabling autonomous, real-time operations in isolated or high-risk environments such as offshore rigs, defense sites, mining facilities, and remote healthcare. By reducing reliance on cloud connectivity, these solutions ensure uninterrupted performance for predictive maintenance, situational awareness, and autonomous control. With ruggedized hardware, AI acceleration, and advanced cybersecurity, they deliver resilience, safety, and strategic autonomy for critical industries.

Challenge: Skill gap & operational expertise

The shortage of specialized skills in edge computing has emerged as a critical challenge, as enterprises struggle to deploy and manage complex, decentralized environments. Expertise is required across distributed systems, low-latency networking, and real-time analytics, yet talent remains scarce. This gap leads to inefficiencies, higher costs, and security risks, compelling organizations to invest in training, automation, and partnerships to scale edge adoption effectively.

Edge Computing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Akamai helped Matrimony.com achieve website optimization and increased user retention | User retention rate increased, website revisit rate increased, new user attraction and addition witnessed a 10% half-yearly growth, surge in the number of matches made successfully vis-à-vis paid/premium members. |

|

ESPN adopted Microsoft’s innovative technologies to reshape the future of sports production | There was a 50% reduction in closed-captioning costs, substantial savings in various other areas, and cloud technology, providing fans with even greater access to ESPN’s vast sports insights, statistics, and media files. |

|

VMware helped Northern Beaches Council drive and digitalize regional municipal services | Unleashing IoT capabilities and improving reliability, the system helps identify and eliminate outages, remotely monitor incidents and connection issues in any region, aiding the Northern Beaches Council in setting the pace for digitizing municipal services across Australia. |

|

Maserati MSG Racing automated workflow enablement with Hewlett Packard Enterprise to optimize team performance | It gained speed and efficiency in the competition, optimized team performance and energy management, leveraged AI and edge technologies to accelerate data-driven insights, sped up image processing time by 8x (30 min vs. 4 hrs.), and delivered AI-driven video and audio analytics for real-time insight into competitors’ strategies. |

|

99Bridges helped Human Habits restore and protect the environment with Cisco’s IoT Operations Dashboard | Enhanced features such as Secure Equipment Access for monitoring and maintenance activities, the IoT Operations Dashboard is used to provision and monitor the Cisco routers in parallel while providing visibility of connectivity right through to the connected IoT controllers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The edge computing ecosystem is a layered framework made up of hardware vendors, software and platform providers, network connectivity providers, and system integrators. Hardware leaders supply edge servers and AI-optimized chips, while platform providers offer orchestration, analytics, and hybrid cloud features. Network connectivity providers enable low-latency 5G and IoT connections, and system integrators assist with deployment, customization, and ensuring compatibility. Collectively, they drive decentralized processing, real-time intelligence, and scalable innovation across various industry applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Edge Computing Market, By Component

Edge hardware is expected to dominate the edge computing market. Enterprises are deploying rugged, compact, and energy-efficient systems with advanced connectivity and storage to handle large data volumes from IoT and Industrial Internet of Things (IIoT) devices. These hardware platforms, including Edge servers, edge gateways, edge devices, and edge sensors, are built for real-time analytics, decision-making, and operational resilience in tough environments. By supporting localized data collection, analysis, and control, edge hardware enhances efficiency, lowers cloud reliance, and ensures dependable performance for mission-critical applications.

Edge Computing Market, By Application

IoT and industrial automation will capture the largest share of the edge computing market. Millions of connected endpoints in factories, energy and utilities, logistics and transportation, and oil and gas constantly produce real-time data that centralized systems cannot process efficiently. Edge nodes handle this by performing local analytics and instant control functions, ensuring asset safety, energy efficiency, and operational reliability. With support for protocols like OPC-UA (Open Platform Communications – Unified Architecture) and MQTT (Message Queuing Telemetry Transport), edge platforms offer interoperability, security, and compliance, enabling predictive, autonomous, and resilient industrial operations.

Edge Computing Market, By Organization Size

Large enterprises will hold the major market share in the edge computing sector. These companies are quickly adopting edge solutions to handle large data volumes and provide real-time access across dispersed offices. By utilizing advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), Big Data analytics, Augmented Reality (AR), and Virtual Reality (VR), large enterprises improve operational efficiency, agility, and innovation. Edge deployments reduce latency, boost application performance, enhance control over sensitive data, and deliver predictive insights, giving them a competitive edge in evolving digital markets.

Edge Computing Market, By Deployment Type

Device Edge is poised to hold the largest market share in the edge computing industry. By integrating compute and storage directly into endpoints like sensors, cameras, robots, industrial controllers, and autonomous vehicles, device edge facilitates real-time, localized processing with ultra-low latency, high reliability, and offline capabilities. These systems independently perform analytics, Artificial Intelligence (AI) inference, and control tasks outside of the cloud, making them perfect for mission-critical uses such as defect detection, autonomous navigation, and biometric authentication. Designed for efficiency in power, cost, and space, device edge is essential for expanding intelligent Internet of Things (IoT), mobility, and consumer-grade smart solutions.

Edge Computing Market, By Vertical

Manufacturing will hold the largest share in the edge computing market. With the rise of IoT sensors on factory floors, companies face massive data volumes that need real-time analysis. Edge computing solves this by allowing local processing, which reduces downtime and boosts production efficiency. It also provides low latency in limited connectivity situations, supports remote monitoring, and improves disaster recovery, making it vital for smart manufacturing environments.

REGION

Asia Pacific to be the fastest-growing region in the global edge computing market during the forecast period

Asia Pacific is projected to be the fastest-growing region in the global edge computing market, fueled by digitalization and 5G rollout. Countries like China, Japan, India, Australia, and Singapore are boosting edge adoption through smart-city initiatives and infrastructure development. National programs such as Digital India, Smart Nation, and China’s New Infrastructure Plan support real-time processing and local compliance. In November 2024, Toyota and NTT announced a joint USD 3.3 billion investment to create a Mobility AI Platform using edge computing, highlighting opportunities for vendors to develop modular platforms and managed services.

Edge Computing Market: COMPANY EVALUATION MATRIX

In the edge computing market matrix, HPE (Star) leads with a strong market share and comprehensive solution portfolio, driven by its Edgeline systems, GreenLake edge-to-cloud services, and deep penetration across telecom, manufacturing, and enterprise sectors. Intel (Emerging Leader) is gaining momentum with its specialized edge processors, AI accelerators, and developer ecosystem, strengthening its role in enabling real-time computing at scale. While HPE dominates through breadth and integration, Intel shows strong potential to advance toward the leaders' quadrant as demand for high-performance, silicon-driven edge solutions grows.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 153.50 Billion |

| Market Forecast in 2030 (value) | USD 248.96 Billion |

| Growth Rate | CAGR of 8.1% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Edge Computing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Hyperscaler (US) | Competitive Deployment Benchmarking: Analysis of edge data center rollouts, partnerships with telcos, and hardware/software stack strategies | Enables hyperscaler to refine their edge strategy and identify gaps vs. competitors |

| Cloud Service Provider (US) | Deep Regional Analysis: Tailored assessment of edge adoption drivers, regulatory environment, infrastructure readiness, competitive landscape, and local vendor ecosystem for client’s chosen geography | Provides granular insights into market maturity, barriers, and opportunities, enabling precise investment and go-to-market strategies |

| Emerging Cloud Service Provider (Asia Pacific) | Extra Vendor Profiling: Inclusion of innovative edge startups in AI inference, IoT gateways, and edge orchestration platforms | Expands client awareness of disruptive players and facilitates partnership opportunities |

RECENT DEVELOPMENTS

- June 2025 : HPE and KDDI announced a partnership to launch the Osaka Sakai AI Data Center by early 2026. The center will feature NVIDIA GB200 NVL72 rack-scale systems with HPE’s hybrid cooling, supporting AI application development and LLM training. It will combine sustainable infrastructure with NVIDIA-accelerated services through KDDI’s WAKONX platform.

- June 2025 : VAST Data and Cisco expanded their partnership by integrating VAST’s A?Operating?System with Cisco?UCS servers, Nexus switches, and Hyperfabric?AI to create a ready-to-deploy, zero-trust infrastructure blueprint that connects data pipelines from edge to core to cloud, simplifies enterprise AI deployment, and speeds up real-time, intelligent decision-making worldwide now.

- May 2025 : AWS launched a Wavelength Zone inside Verizon’s 5G network in Lenexa, Kansas, integrating EC2, EBS, VPC, and other services at the network edge. The joint site allows Midwest customers to run latency-sensitive finance, healthcare, gaming, and public-sector workloads locally while satisfying data residency and resiliency standards.

- March 2025 : Qualcomm’s AI Hub and Cloud AI accelerators will include IBM Granite 3.1 models, while IBM Watson governance will incorporate policy controls. The partners guarantee efficient, low-power, privacy-preserving generative AI inference on Snapdragon devices and OpenShift-certified accelerator cards, providing scalable enterprise AI from edge endpoints to cloud data centers.

- January 2025 : Google and Synaptics collaborated to integrate Google’s MLIR-compliant ML core into Astra™ AI-Native hardware, enabling on-device multimodal edge AI (vision, voice, sound). This enhanced context-aware IoT product development, supporting wearables, appliances, and industrial edge devices.

Table of Contents

Methodology

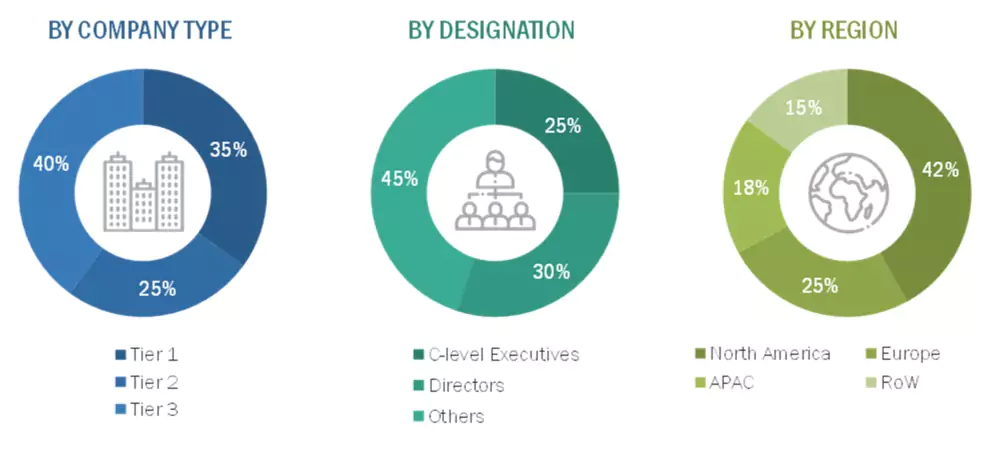

This research study on the edge computing market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred edge computing providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the edge computing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and edge computing providers. It also included key executives from edge computing vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Notes: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

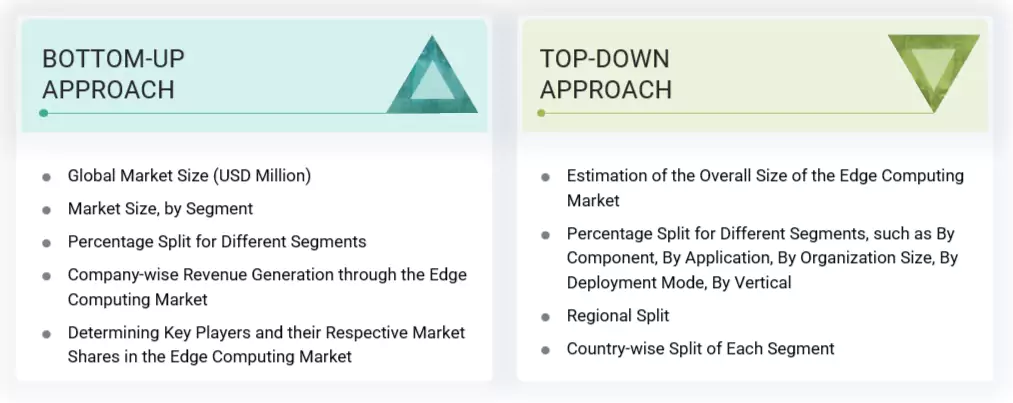

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the edge computing market. The first approach involved estimating the market size by companies’ revenue generated through the sale of edge computing services.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the edge computing market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach identified the adoption rate of edge computing services among different verticals in key countries, considering their regions contributing the most to the market share. For cross-validation, the adoption of edge computing services among enterprises and other use cases for their regions was identified and extrapolated. Use cases identified in different areas were weighed for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the edge computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major edge computing service providers, and organic and inorganic business development activities of regional and global players were estimated.

Edge Computing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Edge computing is a distributed computing paradigm that processes and stores data closer to its source, rather than relying solely on centralized cloud servers. By bringing computation and analysis to the network’s edge, such as IoT devices, sensors, or local servers, edge computing minimizes latency, reduces bandwidth usage, and enhances data privacy. This approach enables real-time decision-making and supports applications that demand immediate responsiveness, such as autonomous vehicles, industrial automation, smart cities, and immersive media. Edge computing is vital in managing the explosion of data generated by connected devices, facilitating faster insights, increased security, and improved reliability across diverse industries.

Stakeholders

- Training and consulting service providers

- Information Technology (IT) infrastructure providers

- Component providers

- System Integrators (SI)

- Support service providers

- Cloud Service Providers (CSPs)

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the edge computing market based on component {edge hardware (edge servers, edge gateways, edge sensors, edge devices), edge software (data management, device management, application management, network management) and services (professional services, and managed services)}, by application {real-time processing & control, edge-AI & inference, IoT & industrial automation, content delivery & media, immersive & interactive experiences, and other applications (security & access control, healthcare & telemedicine, consumer & smart living)}, by organization size (large enterprises, small & medium sized enterprises), by deployment mode (cloud edge, on-premises edge, device edge), by vertical {manufacturing/industrial, energy & utilities, software & IT services, telecommunications, automotive, media & entertainment, retail & consumer goods, transportation & logistics, healthcare & life sciences, and other verticals (education, government & public sector, BFSI)} and region.

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market.

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market.

- To analyze industry trends, patents and innovations, and pricing data related to the market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To analyze the impact of AI/generative AI on the market.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American edge computing market

- Further breakup of the European edge computing market

- Further breakup of the Asia Pacific edge computing market

- Further breakup of the Middle East & African edge computing market

- Further breakup of the Latin American edge computing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is edge computing?

According to the Institute of Electrical and Electronics Engineers (IEEE), edge computing is a distributed model where data processing and storage occur near the point of data generation, such as sensors, devices, or local servers, rather than relying on distant cloud data centers. This approach supports faster response times, reduced latency, and lower bandwidth use by enabling real-time analytics and decision-making at the network’s edge. Edge computing is essential for applications in industrial automation, smart cities, connected vehicles, and real-time monitoring systems, delivering speed, efficiency, and localized intelligence.

What are the different deployment modes for edge computing services?

Edge computing services can be deployed in three primary modes based on data processing needs. Cloud edge places compute resources near users through infrastructure managed by cloud providers, offering low latency with cloud-scale benefits. On-premises edge refers to servers or micro data centers within the organization’s premises, providing greater control and data security. Device edge involves processing directly on endpoints such as sensors or gateways, enabling real-time responsiveness for critical industrial, automotive, and remote applications.

What are the major factors driving the growth of the edge computing industry?

The edge computing industry is expanding rapidly due to the increasing adoption of IoT devices, rising demand for real-time data processing, and the need to minimize latency across critical applications. Integrating AI and ML at the edge enables smarter, more localized decision-making. Growth is further fueled by stricter data security and regulatory requirements, widespread 5G network rollout, and significant investments from governments and enterprises seeking improved operational efficiency, resilience, and compliance across diverse sectors.

What challenges are hindering the widespread adoption of edge computing services?

Edge computing adoption faces key challenges such as rising security risks from data processing done at the edge rather than a centralized data center, a lack of standardized protocols, and complex integration with legacy systems. Ensuring data compliance across different regional regulations adds further difficulty, especially for global enterprises. Limited access to skilled professionals and high infrastructure costs also slow down deployment. Inconsistent network connectivity in remote areas affects reliability, making it harder to scale edge solutions for real-time, mission-critical applications across diverse industries.

Who are the key vendors in the edge computing market?

The key vendors in the global edge computing market include HPE (US), AWS (US), Dell Technologies (US), Cisco (US), Microsoft (US), IBM (US), Google (US), Nvidia (US), Intel (US), and Huawei (China).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Edge Computing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Edge Computing Market