Composites In Oil & Gas Industry Market by Resin Type (Epoxy, Composites, Polyester, Phenolic), Fiber Type (Carbon, Glass,), Application (Pipes, Tanks, Top Side Applications, Pumps & Compressors), and Region - Global Forecasts to 2028

Updated on : August 22, 2024

Composites in Oil and Gas Industry Market

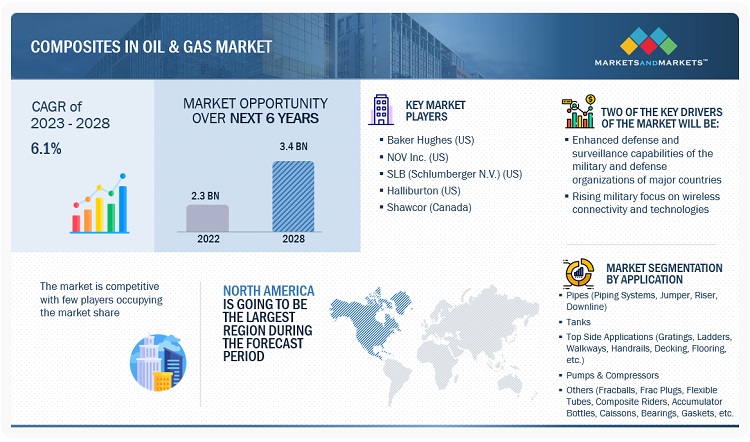

The global composites in oil gas industry market was valued at USD 2.3 billion in 2022 and is projected to reach USD 3.4 billion by 2028, growing at 6.1% cagr from 2023 to 2028. Over the world, the composites in oil gas industry market is expanding significantly, and during the forecast period, a similar trend is anticipated. The demand for composites in the oil and gas industry has been driven by several factors, including the need to increase the efficiency of operations, reduce maintenance costs, and enhance safety. One of the main applications of composites in the oil and gas industry is in the construction of pipelines. Composites are used to create high-pressure pipelines that are resistant to corrosion and erosion. Additionally, composites are used in the construction of risers, which are used to transport oil and gas from the seabed to the surface. Composites are also used in the construction of offshore platforms, where they provide durability and resistance to environmental factors such as saltwater, high winds, and harsh temperatures. In addition to their use in infrastructure, composites are also used in various components of drilling and production equipment, such as drilling pipes, blowout preventers, and wellheads. Composites are also used in the construction of storage tanks, which are used to store crude oil, natural gas, and other liquids. In the upcoming years, this is also anticipated to fuel market expansion. Throughout the projected period, the market growth is anticipated to increase due to the rising need for cost effective solutions for oil & gas industry.

Attractive Opportunities in Composites in Oil Gas Industry Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Composites In Oil Gas Industry Market Dynamics

Driver: Growing demand for lightweight and durable materials in the oil and gas industry

One of the major drivers of the oil and gas composites market is the growing demand for lightweight and durable materials in the oil and gas industry. Composites offer a range of advantages over traditional materials such as steel and aluminum, including their high strength-to-weight ratio, corrosion resistance, and ability to withstand high temperatures and pressures. Composites are also easier to install and require less maintenance, which can reduce costs for oil and gas companies.

Restraint: High cost of composite materials compared to traditional materials

One of the major restraints for the oil and gas composites market is the high cost of composite materials compared to traditional materials such as steel and aluminum. Composites are often more expensive to manufacture, and their installation may require specialized equipment and expertise, which can add to the overall cost of using them in oil and gas applications. Additionally, the long-term performance and durability of composites in harsh oil and gas environments is still relatively unknown, which may make some companies hesitant to adopt them.

Opportunity: Expanding natural gas market and growing use of composites in renewable energy sector

The natural gas market is expanding rapidly, and composite materials offer several advantages over traditional materials in the transportation and storage of natural gas. Composites are lighter, more durable, and more resistant to corrosion than steel, making them an attractive option for natural gas transportation and storage. oil and gas composites market is the increasing demand for renewable energy sources. As the world shifts towards cleaner energy, there is a growing need for materials that can withstand the unique demands of offshore wind farms and other renewable energy installations. Composites offer a range of benefits for these applications, including their high strength-to-weight ratio, corrosion resistance, and ability to withstand harsh environmental conditions.

Challenge: lack of uniform global standardization and regulations

Oil and gas composites market is the lack of standardization and regulation for composite materials in the industry. Unlike traditional materials such as steel and aluminum, there is no universally accepted standard for composite materials, which can make it difficult for companies to select and use them in a consistent and reliable manner. Additionally, there is a lack of standardization for testing and performance evaluation of composites in oil and gas environments, which can make it difficult to assess their long-term performance and durability.

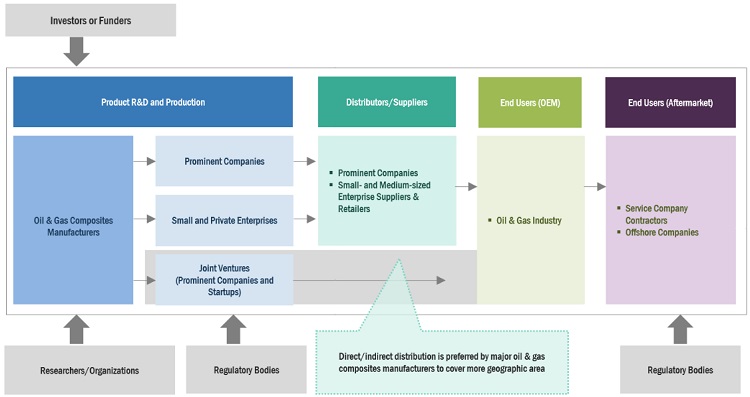

Composites In Oil Gas Industry Market Ecosystem

Asia Pacific to hold the largest market share in the recycled materials for mobility applications market

According to the World Bank, Asia Pacific is the fastest-growing region in terms of population and economic growth. The region has experienced significant growth in the last decade, accounting for over a third of the world’s GDP. The high economic growth, coupled with the mounting population, is expected to boost the industrial sector in the region, which will increase the need for recycled materials such as recycled plastic polymers and recycled composites from industries. Continuous and easy availability of recycled materials, low-cost labor, lower price, and environmental benefits drive the recycled materials for mobility applications market in the region.

Based on resin type, Epoxy resin segment is estimated to account for the largest market share of the composites in oil gas industry market

Based on resin type, epoxy resin segment is estimated to account for the largest market share. The demand of epoxy resin for pipes and pipeline coatings, storage tanks and vessels applications, Epoxy resin composites are used in the construction of offshore structures such as risers, platforms, and subsea equipment. They offer excellent corrosion resistance and durability in harsh marine environments, also epoxy resin used to manufacture various tools and equipment used in the oil and gas industry, such as drill bits, coiled tubing, and wireline cables. They offer high strength-to-weight ratio, stiffness, and durability. This factors will contribute to the market growth.

Based on application, pipes segment followed by tanks segement anticipated to dominate the market

Based on application, the market is segmented into the Pipes (piping systems, jumpers, risers, downline, etc.), tanks, top side applications (gratings, ladders, walkways, handrails, decking, flooring, etc.), pumps & compressors, and others (fracballs, frac plugs, flexible tubes, composite riders high pressure, accumulator bottels, caissons, etc.). Composite pipes are made up of a combination of materials, such as fiberglass, carbon fiber, and epoxy resins. These materials are selected based on the specific application requirements, and the resulting composite material can be tailored to meet specific performance criteria. In the oil and gas industry, pipes are primarily used for offshore applications such as deep-water drilling, production risers, and flowlines. Pipes can withstand harsh environmental conditions such as high pressure, high temperature, and corrosive fluids. They also have excellent fatigue resistance and can withstand cyclic loading and vibration. In November 2022 Strohm, a leading producer of Thermoplastic Composite Pipes (TCP), has been awarded a contract from ECOnnect to provide more than 11 km of TCP for the TES Wilhelmshaven Green Gas Terminal in Germany.

To know about the assumptions considered for the study, download the pdf brochure

Composites in Oil and Gas Industry Market Players

The composites in oil gas industry market is dominated by a few globally established players such as Baker Hughes (US), Strohm (Netherlands), NOV Inc. (US), SLB (Schlumberger N.V.) (US), Halliburton (US), Shawcor (Canada), TechnipFMC plc (UK), Weatherford (US), Future Pipe Industries (UAE), Saudi Arabian Amiantit Co. (Saudi Arabia) among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the composites in oil gas industry market. The research includes a detailed competitive analysis of these key players in the composites in oil gas industry market, including company profiles, recent developments, and key market strategies.

Composites in Oil and Gas Industry Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD million/ billion), Volume (Kiloton) |

|

Segments Covered |

By Fiber Type, By Resin Type, By Application, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, Middle East and Africa |

|

Companies covered |

Baker Hughes (US), Strohm (Netherlands), NOV Inc. (US), SLB (Schlumberger N.V.) (US), Halliburton (US), Shawcor (Canada), TechnipFMC plc (UK), Weatherford (US), Future Pipe Industries (UAE), Saudi Arabian Amiantit Co. (Saudi Arabia) |

The study categorizes the composite materials in oil & gas industry market based on Resin type, Fiber type, Application and Region.

By Resin Type:

- Epoxy

- Composites

- Polyester

- Phenolic

- Others

By Fiber Type:

- Glass

- Carbon

- Others (Aramid Fiber and Natural Fiber)

By Application Type:

- Pipes (piping systems, jumpers, risers, downline, etc.)

- Tanks

- Top Side Applications (gratings, ladders, walkways, handrails, decking, flooring, etc.)

- Pumps & Compressors

- Others (fracballs, frac plugs, flexible tubes, composite riders high pressure, accumulator bottels, caissons, bearings, gaskets, etc.)

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In November 2022, Strohm, a leading producer of Thermoplastic Composite Pipes (TCP), has been awarded a contract from ECOnnect to provide more than 11 km of TCP for the TES Wilhelmshaven Green Gas Terminal in Germany.

- In June 2022, NOV and Aker Solutions signed a new long-term technology cooperation agreement to optimize Subsea system solutions enabling sustainable oil and gas.

- In March 2022, The agreement will be instrumental in expanding the knowledge of the design, production and qualification standard from Strohm’s technology backbone – DNV (standard ST-F119), allowing operators to qualify and utilize TCP, instead of metallic pipes, creating substantial cost reduction potentials in all stages of oil and gas projects life cycle.

- In September 2021, TechnipFMC acquired Magma Global Ltd, a UK-based company specializing in the development and manufacture of carbon fiber and composite pipes for offshore and onshore oil and gas, and renewable energy applications.

- In July 2021, NOV Inc. announced the acquisition of CDS Engineering, a leading provider of downhole completion tools for the oil and gas industry. The acquisition is expected to enhance NOV's completions offering and expand its presence in the Permian Basin..

Frequently Asked Questions (FAQ):

Which are the major companies in the composites in oil gas industry market? What are their major strategies to strengthen their market presence?

Some of the key players in the composites in oil gas industry market are Baker Hughes (US), Strohm (Netherlands), NOV Inc. (US), SLB (Schlumberger N.V.) (US), Halliburton (US), Shawcor (Canada), among others. These companies have secured contracts and deals, which are key strategies to strengthen their presence in the composites in oil and gas industry market.

What are the drivers and opportunities for the composites in oil gas industry market?

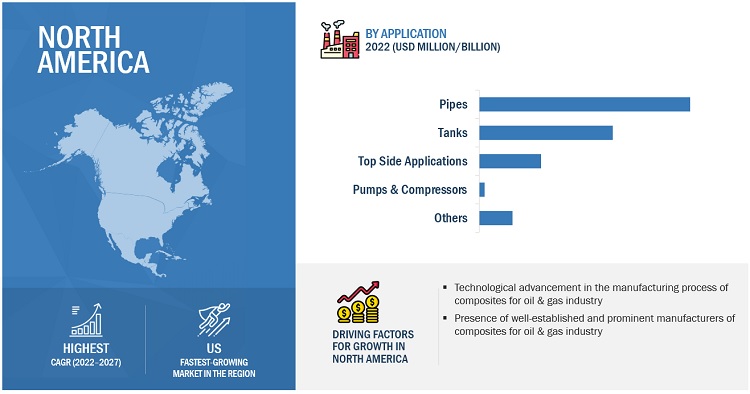

The need for composites in oil gas industry has increased significantly, especially in North America and Europe, where major composite manufacturers are present. Rising R&D efforts and growing technological advancements in manufacturing processes are expected to accelerate global market expansion.

Which region is expected to hold the highest market share?

The North American market is expected to dominate the market share in 2022, showcasing strong demand in the oil and gas sector. Major manufacturers in this region include Baker Hughes (US), NOV Inc. (US), SLB (Schlumberger N.V.) (US), Halliburton (US), and Shawcor (Canada).

What is the total CAGR expected to be recorded for the composites in oil gas industry market during 2023-2028?

The CAGR is expected to be 6.1% from 2023-2028.

How is the composites in oil gas industry market aligned?

The composites in oil and gas industry market is growing at a significant pace. Manufacturers are planning business strategies to expand their presence and capture the potential growth of the market.

How do composites benefit oil & gas operations?

Composites offer high strength-to-weight ratios, excellent corrosion resistance, and reduced maintenance needs, which extend equipment life and lower operational costs.

Why are composites important in the oil & gas industry?

Composites are important due to their high strength-to-weight ratios, corrosion resistance, and durability. These properties reduce maintenance costs and increase equipment lifespan, especially in harsh environments.

How are composites used in the oil and gas industry?

Composites are primarily used in tanks, pipelines, and offshore drilling applications due to their corrosion resistance, lightweight, and high strength properties.

Who are the leading companies in the UK composites market?

Leading companies in the UK composites market include Baker Hughes, NOV Inc., Schlumberger, TechnipFMC, and others, all of which focus on innovative product development and securing contracts in the industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET DYNAMICSDRIVERS- Increasing demand for non-corrosive and lightweight materials in oil & gas industry- Long life cycle and low maintenance costs of compositesRESTRAINTS- Variations in prices of crude oil- High processing and manufacturing costs- Lack of standardization in manufacturing technologies- Increasing focus on use of renewable energyOPPORTUNITIES- Boom in hydraulic fracturing offers new opportunities for composites- Rising demand from growing economies- New discoveries in Middle East & Africa- Reduction in cost of carbon fiber compositesCHALLENGES- High production cost and availability of low-cost substitutes- Issues related to recycling

-

5.2 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)AVERAGE SELLING PRICE TREND

-

5.5 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.6 TECHNOLOGY ANALYSIS

-

5.7 ECOSYSTEM

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.11 KEY MARKETS FOR IMPORT & EXPORTCHINAUSGERMANYINDIA

-

5.12 TRADE POLICIES AND TARIFF REGULATIONS FOR EXPORT/IMPORTUSJAPANEUROPECHINA

-

5.13 TARIFFS AND REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS FOR COMPOSITES IN OIL & GAS INDUSTRY MARKET

-

5.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

- 5.15 KEY CONFERENCES

- 6.1 INTRODUCTION

-

6.2 PIPESRISERSJUMPERSDOWNLINES

- 6.3 TANKS

-

6.4 TOP SIDE APPLICATIONSGRIDS/GRATINGSLADDERSHANDRAILSDECKING

-

6.5 PUMPS & COMPRESSORSPUMPSCOMPRESSORS

-

6.6 OTHERSFRAC PLUGS AND FRAC BALLSFLEXIBLE TUBESCOMPOSITE RISERSACCUMULATOR BOTTLESCAISSONSOTHERS

- 7.1 INTRODUCTION

-

7.2 GLASS FIBER COMPOSITESLONGER LIFESPAN AND SIGNIFICANT COST SAVINGS TO LEAD TO HIGH GROWTHGLASS FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

7.3 CARBON FIBER COMPOSITESTECHNOLOGICAL ADVANCEMENTS TO INCREASE COMPETITIVENESS AND REDUCE COST- Chopped carbon fiber- Continuous carbon fiberCARBON FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

7.4 OTHERSOTHER FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

8.1 INTRODUCTIONEPOXY RESIN COMPOSITES- Increasing demand from end-use applications in oil & gas industry to drive marketEPOXY RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

8.2 POLYESTER RESIN COMPOSITESCOST-EFFECTIVENESS AND USE IN HIGH-TEMPERATURE APPLICATIONS TO DRIVE MARKETPOLYESTER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

8.3 PHENOLIC RESIN COMPOSITESOIL & GAS INDUSTRY MOVING TOWARD SUSTAINABLE GROWTHPHENOLIC RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION

-

8.4 OTHER RESIN COMPOSITESPOLYETHYLENE RESINSPOLYAMIDE RESINSPEEK RESINSVINYL ESTER RESINS

- 9.1 INTRODUCTION

-

9.2 EUROPEIMPACT OF RECESSION IN EUROPEEUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPEEUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPEEUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATIONEUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRYUK- Increasing oil & gas exploration and production to drive marketNORWAY- Latest licensing round and growing exploration to drive marketNETHERLANDS- Discovery of F17a off the coast driving market growthDENMARK- Development of existing fields to boost demand for compositesRUSSIA- Exploration and development of new oil & gas fields to boost marketITALY- New offshore exploration project in the Adriatic Sea to boost market growthGERMANY- Shift toward gas-fired power plants to generate demand for composites in pipes and tanksREST OF EUROPE

-

9.3 NORTH AMERICAIMPACT OF RECESSION IN NORTH AMERICANORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPENORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPENORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATIONNORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRYUS- Increasing shale gas production to boost market growthCANADA- Proposed pipeline projects to drive market growth

-

9.4 ASIA PACIFICIMPACT OF RECESSION IN ASIA PACIFICASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPEASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPEASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATIONASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRYCHINA- Ongoing and upcoming oil & gas exploration projects to boost demand for compositesAUSTRALIA- Increased gas production leading to rising demand for composites in pipe and tank applicationsINDIA- Growing demand for energy to boost demand for composites in oil & gas applicationsTHAILAND- Upcoming exploration projects to drive market for composites in oil & gas applicationsMALAYSIA- Growing efforts by public sector toward energy security to boost marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICAIMPACT OF RECESSION ON LATIN AMERICALATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPELATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPELATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATIONLATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRYBRAZIL- Increasing investments by global players to boost marketMEXICO- Significant potential and production in offshore fields to increase demand for composites-based applicationsVENEZUELA- Offshore production activities to drive market growth during forecast periodREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPEMIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPEMIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRYSAUDI ARABIA- Increasing global supply of oil & gas to drive market during forecast periodUAE- Recent exploration and increased oil & gas production capacity to drive marketQATAR- New exploration agreements and involvement of global players to boost demand for composites in oil & gas industryNIGERIA- Exploration by countries such as China to open new avenues for oil & gas industryREST OF MIDDLE EAST & AFRICA

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET RANKING

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIX

-

10.6 COMPETITIVE LANDSCAPE MAPPINGSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERSSTRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- 10.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.1 KEY COMPANIESSTROHM- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewNOV INC.- Business overview- Products/Solutions/Services offered- Deals- MnM viewBAKER HUGHES- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewSLB- Business overview- Products/Solutions/Services offered- Deals- MnM viewSHAWCOR- Business overview- Products/Solutions/Services offered- Deals- MnM viewHALLIBURTON- Business overview- Products/Solutions/Services offered- Deals- MnM viewTECHNIPFMC PLC- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewSAUDI ARABIAN AMIANTIT CO.- Business overview- Products/Solutions/Services offered- Deals- MnM viewWEATHERFORD INTERNATIONAL PLC- Business overview- Products/Solutions/Services offered- Deals- MnM viewFUTURE PIPE INDUSTRIES- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM view

-

11.2 OTHER PLAYERSVELLO NORDIC ASENDURO COMPOSITES INC.FIBERGLASS GRATING SYSTEMSCONTAINMENT SOLUTIONS, INC.HENGRUN GROUP CO., LTD.LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP., LTD.L.F. MANUFACTURING, INC.PALMER MANUFACTURING & TANK INC.THE GUND COMPANY, INC.FLOWSERVE CORPORATIONSUNDYNETIMKEN COMPANYVALVTECHNOLOGIESWOLF KUNSTSTOFF-GLEITLAGER GMBHSEALMAX

- 12.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS

- TABLE 1 PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 SUPPLY CHAIN

- TABLE 3 AVERAGE SELLING PRICE TREND OF COMPOSITES IN OIL & GAS INDUSTRY, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF COMPOSITES, BY FIBER TYPE

- TABLE 5 AVERAGE SELLING PRICE OF COMPOSITES, BY RESIN TYPE

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 COMPARATIVE STUDY OF MAJOR COMPOSITES IN OIL & GAS INDUSTRY MANUFACTURING PROCESSES

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 CURRENT STANDARD CODES FOR COMPOSITES IN OIL & GAS INDUSTRY

- TABLE 11 LIST OF PATENTS BY SANUWAVE, INC.

- TABLE 12 LIST OF PATENTS BY MAGMA GLOBAL LTD.

- TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 15 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 16 OIL & GAS COMPOSITES MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 17 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 19 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PIPES APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PIPES APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 21 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PIPES APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PIPES APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 23 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TANKS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TANKS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 25 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TANKS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TANKS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 27 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TOP SIDE APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TOP SIDE APPLICATIONS, BY REGION, 2018–2022 (KILOTON)

- TABLE 29 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TOP SIDE APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN TOP SIDE APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 31 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PUMPS & COMPRESSORS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PUMPS & COMPRESSORS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 33 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PUMPS & COMPRESSORS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN PUMPS & COMPRESSORS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 35 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (KILOTON)

- TABLE 37 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 COMPOSITES IN OIL & GAS INDUSTRY MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 39 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (USD MILLION)

- TABLE 40 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (KILOTON)

- TABLE 41 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (USD MILLION)

- TABLE 42 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 43 GLASS FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 GLASS FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 45 GLASS FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 GLASS FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 47 CARBON FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 CARBON FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 49 CARBON FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 CARBON FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 51 OTHER FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 OTHER FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 53 OTHER FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHER FIBER COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 55 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 56 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 57 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 58 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 59 EPOXY RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 EPOXY RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 61 EPOXY RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 EPOXY RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 63 POLYESTER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 POLYESTER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 65 POLYESTER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 POLYESTER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 67 PHENOLIC RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 PHENOLIC RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 69 PHENOLIC RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 PHENOLIC RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 71 OTHER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 OTHER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 73 OTHER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 OTHER RESIN COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 75 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 77 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 79 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 80 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 81 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 83 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (KILOTON)

- TABLE 85 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 87 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 89 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 91 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 92 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 93 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 95 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 97 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 99 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (KILOTON)

- TABLE 101 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 103 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 105 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 107 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 109 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 111 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 113 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 115 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (KILOTON)

- TABLE 117 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 119 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 121 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 123 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 127 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 128 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 129 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 131 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022, (USD MILLION)

- TABLE 132 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022, (KILOTON)

- TABLE 133 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028, (USD MILLION)

- TABLE 134 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 135 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 136 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 137 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 139 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 140 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 141 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2018–2022 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY FIBER TYPE, 2023–2028 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 159 DEGREE OF COMPETITION

- TABLE 160 COMPANY PRODUCT FOOTPRINT

- TABLE 161 COMPANY APPLICATION FOOTPRINT

- TABLE 162 COMPANY REGION FOOTPRINT

- TABLE 163 DEALS, 2017–2023

- TABLE 164 OTHER DEVELOPMENTS, 2017–2023

- TABLE 165 KEY STARTUPS/SMES

- TABLE 166 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 167 STROHM: COMPANY OVERVIEW

- TABLE 168 NOV INC.: COMPANY OVERVIEW

- TABLE 169 BAKER HUGHES: COMPANY OVERVIEW

- TABLE 170 SLB: COMPANY OVERVIEW

- TABLE 171 SHAWCOR: COMPANY OVERVIEW

- TABLE 172 HALLIBURTON: COMPANY OVERVIEW

- TABLE 173 TECHNIPFMC PLC: COMPANY OVERVIEW

- TABLE 174 SAUDI ARABIAN AMIANTIT CO.: COMPANY OVERVIEW

- TABLE 175 WEATHERFORD INTERNATIONAL PLC: COMPANY OVERVIEW

- TABLE 176 FUTURE PIPE INDUSTRIES: COMPANY OVERVIEW

- TABLE 177 VELLO NORDIC AS: COMPANY OVERVIEW

- TABLE 178 ENDURO COMPOSITES INC: COMPANY OVERVIEW

- TABLE 179 FIBERGLASS GRATING SYSTEMS: COMPANY OVERVIEW

- TABLE 180 CONTAINMENT SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 181 HENGRUN GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 182 LIANYUNGANG ZHONGFU LIANZHONG COMPOSITES GROUP., LTD.: COMPANY OVERVIEW

- TABLE 183 L.F. MANUFACTURING, INC.: COMPANY OVERVIEW

- TABLE 184 PALMER MANUFACTURING & TANK INC.: COMPANY OVERVIEW

- TABLE 185 THE GUND COMPANY, INC.: COMPANY OVERVIEW

- TABLE 186 FLOWSERVE CORPORATION : COMPANY OVERVIEW

- TABLE 187 SUNDYNE: COMPANY OVERVIEW

- TABLE 188 TIMKEN COMPANY: COMPANY OVERVIEW

- TABLE 189 VALVTECHNOLOGIES: COMPANY OVERVIEW

- TABLE 190 WOLF KUNSTSTOFF-GLEITLAGER GMBH: COMPANY OVERVIEW

- TABLE 191 SEALMAX: COMPANY OVERVIEW

- FIGURE 1 COMPOSITES IN OIL & GAS INDUSTRY MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 GLASS FIBER COMPOSITES SEGMENT DOMINATED MARKET IN 2022

- FIGURE 7 EPOXY RESIN SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 8 PIPES SEGMENT ACCOUNTED FOR LARGEST SHARE OF COMPOSITES IN OIL & GAS INDUSTRY MARKET IN 2022

- FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF COMPOSITES IN OIL & GAS INDUSTRY MARKET IN 2022

- FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN COMPOSITES IN OIL & GAS INDUSTRY MARKET BETWEEN 2023 AND 2028

- FIGURE 11 GLASS FIBER COMPOSITES SEGMENT DOMINATED MARKET IN 2022

- FIGURE 12 EPOXY SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 13 PIPES LARGEST APPLICATION SEGMENT IN 2022

- FIGURE 14 NORTH AMERICA LARGEST MARKET IN TERMS OF VOLUME IN 2022

- FIGURE 15 CANADA TO BE FASTEST-GROWING COMPOSITES IN OIL & GAS INDUSTRY MARKET DURING 2023–2028

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 17 CRUDE OIL PRICES, 2015–2022

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 19 AVERAGE SELLING PRICES OF COMPOSITES OFFERED BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 22 PATENTS REGISTERED FOR CARBON FIBER, 2011–2023

- FIGURE 23 PATENT PUBLICATION TRENDS, 2011–2023

- FIGURE 24 CHINA ACCOUNTS FOR HIGHEST NUMBER OF PATENTS REGISTERED

- FIGURE 25 SANUWAVE, INC. REGISTERED HIGHEST NUMBER OF PATENTS FROM 2011 TO 2023

- FIGURE 26 PIPES TO BE LARGEST AND THIRD-FASTEST-GROWING APPLICATION, IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 27 NORTH AMERICA TO LEAD PIPES APPLICATION IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 28 NORTH AMERICA TO LEAD TANKS APPLICATION IN COMPOSITES IN OIL & GAS INDUSTRY

- FIGURE 29 NORTH AMERICA TO DOMINATE TOP SIDE APPLICATIONS SEGMENT IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 30 MARKET IN EUROPE TO GROW AT SECOND HIGHEST CAGR IN PUMPS & COMPRESSORS APPLICATION IN COMPOSITES IN OIL & GAS INDUSTRY

- FIGURE 31 GLASS FIBER COMPOSITES SEGMENT TO DOMINATE COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 32 NORTH AMERICA TO BE LARGEST GLASS FIBER COMPOSITES MARKET DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA TO BE LARGEST CARBON FIBER COMPOSITES MARKET BY 2028

- FIGURE 34 NORTH AMERICA TO BE LARGEST MARKET FOR OTHER FIBER COMPOSITES

- FIGURE 35 EPOXY RESIN COMPOSITES TO DOMINATE COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 36 NORTH AMERICA TO BE LARGEST EPOXY RESIN COMPOSITES MARKET

- FIGURE 37 NORTH AMERICA TO BE LARGEST POLYESTER RESIN COMPOSITES MARKET

- FIGURE 38 EUROPE TO BE SECOND-LARGEST PHENOLIC RESIN COMPOSITES MARKET

- FIGURE 39 MARKET IN CANADA TO GROW AT HIGHEST CAGR (2023-2028)

- FIGURE 40 EUROPE: COMPOSITES IN OIL & GAS INDUSTRY MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: COMPOSITES IN OIL & GAS INDUSTRY MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: COMPOSITES IN OIL & GAS INDUSTRY MARKET SNAPSHOT

- FIGURE 43 SHARE OF TOP COMPANIES IN COMPOSITES IN OIL & GAS INDUSTRY MARKET, 2021

- FIGURE 44 RANKING OF TOP FIVE PLAYERS IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 45 REVENUE ANALYSIS

- FIGURE 46 COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 47 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 48 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COMPOSITES IN OIL & GAS INDUSTRY MARKET

- FIGURE 49 SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 50 NOV INC.: COMPANY SNAPSHOT

- FIGURE 51 BAKER HUGHES: COMPANY SNAPSHOT

- FIGURE 52 SLB: COMPANY SNAPSHOT

- FIGURE 53 SHAWCOR: COMPANY SNAPSHOT

- FIGURE 54 HALLIBURTON: COMPANY SNAPSHOT

- FIGURE 55 TECHNIPFMC PLC: COMPANY SNAPSHOT

- FIGURE 56 SAUDI ARABIAN AMIANTIT CO.: COMPANY SNAPSHOT

- FIGURE 57 WEATHERFORD INTERNATIONAL PLC: COMPANY SNAPSHOT

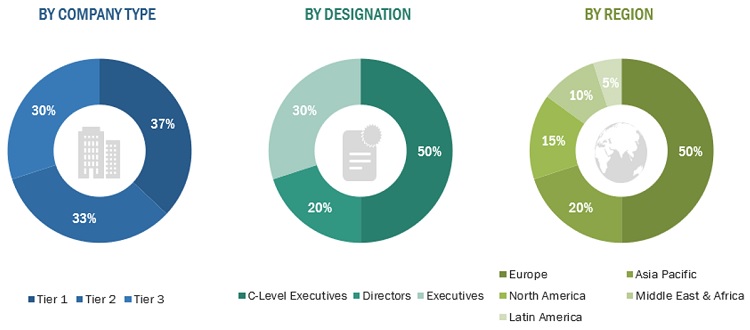

The study involves two major activities in estimating the current market size for composites in oil & gas industry market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering composites in oil & gas industry and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the composites in oil & gas industry market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the composites in oil & gas industry market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from composites in oil & gas industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using composites in oil & gas industry were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of composites in oil & gas industry and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Strohm |

Vice President |

|

Vello Nordic AS |

R&D Manager |

|

SLB (Schlumberger N.V.) |

Project Manager |

|

Sealmax |

CEO & Founder |

Market Size Estimation

The research methodology used to estimate the size of the composites in oil & gas industry market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in composites in different applications at a regional level. Such procurements provide information on the demand aspects of composites in gas & industry for each application. For each application, all possible segments where composites in gas & industry is integrated were mapped.

Global Composites In Oil & Gas Industry Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Composites In Oil & Gas Industry Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Composite materials are used in oil & gas industry applications such as pipes, risers, jumpers, tanks, downlines, gratings, platforms, and ladders. The most frequently used composites for the fabrication of primary and secondary constructions in the oil & gas industry are made of epoxy, polyester, phenolic, or polymer matrix combined with glass or carbon fiber. Composites are gaining wide importance in the oil & gas industry because these are light in weight and easy to construct and offer cost-effective, unfailing solutions where environmental conditions, weight, physical access, transportation, strength, cyclic loading, corrosion, and longer service life are required for new constructions. In addition, as the steel corrodes, it swells and increases the tensile load on the concrete, which begins to crack, creating openings that lead to further and earlier deterioration of the steel and concrete, thereby involving high maintenance cost for the oil & gas industry. Owing to these inherent properties of steel, nickel, copper, and titanium, composite materials are widely used in applications in the oil & gas industry and have arisen as potential substitutes.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the Composite in oil & gas industry market based on by fiber type, resin, Application, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region restraints, opportunities, and challenges) influencing the growth of the market

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Composite in oil & gas industry market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the Composite in oil & gas industry market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Composites In Oil & Gas Industry Market