Construction Repair Composites Market by Fiber Type (Glass, Carbon), Resin Type, Product type (Fabric, Plate, Rebar, Mesh, Adhesive), Application (Bridge, Water Structure, Industrial Structure, Commercial), and Region - Global Forecast to 2026

Updated on : April 16, 2024

Construction Repair Composites Market

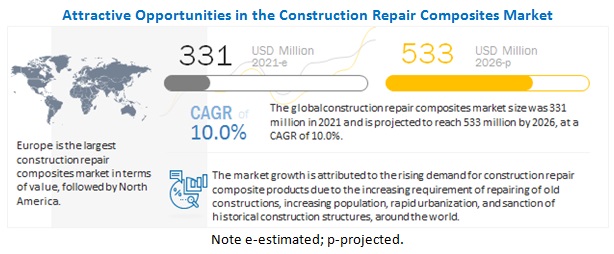

Construction Repair Composites Market was valued at USD 331 million in 2021 and is projected to reach USD 533 million by 2026, growing at 10.0% cagr from 2021 to 2026. The construction repair composites industry is growing due to the rise in demand for construction repair projects from various applications, globally. The demand for construction repair composites showed decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the end-use industries will stimulate the demand during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global construction repair composites market

The construction repair composites market is has witnessed a decline in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the North American and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities. This has led to a reduction in the consumption of construction repair composites across residential, commercial, silo fluepipe, bridge, oil & natural gas pipeline, water structure, industrial structure other applications.

Construction Repair Composites Market Dynamics

Increasing demand from the commercial end-use application to drive the demand for construction repair composites

The commercial application is one of the highest growing application area in the construction repair composites market in terms of and value volume. Construction repair composites find wide applications in the repairs, including offices, schools, universities, and hospitals. The structural engineering from these non-residential construction projects uses construction composites due to its potential benefits along with the cost-effectiveness used to repair critical components of wind turbines. Growing population, and need of commercial construction repairs in APAC countries such as China and India are expected to boost the demand for construction repairs during the forecast period. This is expected to drive the construction repair composites market in this application. The recovery in construction repair industry post Covid-19 era is expected to drive the construction repair composites market.

Higher costs compared to traditional substitutes is a major restrain for the construction repair composites market

Construction composites are comparatively more expensive than traditional substitutes, which have been used for the same range of applications. The prices of construction composites depend majorly on the cost of the fibers. The prices of construction CFRP products are comparatively much higher than GFRP and BFRP products. Due to the large-scale production of glass fibers for meeting the increase in demand for glass fiber and GFRP products globally, the price of construction GFRP products are lower. In the construction industry, composite products are currently used in the form of bars, rods, mesh, fabrics, etc. The average price of these products is more than that of the traditional products due to the high cost of fibers. In many developing countries, the higher prices of such products create a bigger impact as the consumers would opt for more traditional alternatives. As construction composite products are still not very widespread and common, especially in the emerging markets, it will be difficult to compete with the more traditional alternatives, such as steel or aluminum. The prices can go down with the increase in mass production and evolution in manufacturing technology.

Development of low-cost carbon, glass and basalt fibers can reduce the cost of construction composites is one of the major opportunity for the construction repair composites market

The main raw materials used to produce carbon fiber, glass fiber or basalt fiber composites are polymeric resins and the respective fibers. The cost of fibers is directly proportional to the cost of precursor raw materials from which they are obtained. Carbon fibers are currently obtained from polyacrylonitrile (PAN), whose cost varies according to the applications. Glass fibers and basalt fibers are also obtained from precursor materials. The development of low-cost and high-yield precursors for making industrial-grade fibers (carbon/glass/basalt) would significantly reduce the cost of these fibers. These low-cost precursors for fibers would bring down the cost of industrial-grade fibers. The reduction in the cost of fibers would reduce the cost of fiber composites, thereby directly reducing the cost of manufacturing construction composite products used, which then the companies can offer at lower and more affordable prices to the consumers.

Availability of low-cost substitute, low adoption, and acceptance of construction composites is a major challenge for the construction repair composites market

Construction composite products face tough competition from low-cost substitutes available in the market, which include solid stainless steel, epoxy-coated, and galvanized (zinc-coated) and stainless-steel clad. Construction composites are much superior to traditional substitutes. However, due to their higher costs, they have a lower acceptability rate. Construction industry professionals also have more experience with traditional products like steel compared to composites. Though the market is growing in the emerging markets, steel or any traditional substitute is still more preferred due to the cost. All these factors pose an important challenge to the growth of the construction repair composites market. These factors, along with limited budgets for construction repair projects, curtail the growth of the construction repair composites market.

Market recovery post COVID-19

The COVID-19 outbreak has drastically altered the demand for construction repair composites materials across the globe due to a decline in demand from the bridge, industrial structure, silo flue pipe, and other applications. The pandemic has abruptly interrupted the operations and global supply chain across various industries, which in turn has slowed down the growth of the construction repair composites market. Various countries have imposed lockdown to prevent the further spread of the virus. Europe and North America are the most severely affected regions due to COVID-19. Companies need to cope with this sudden impact brought by the pandemic and have to efficiently work on their supply chain and improve their distribution network to capture the demand for construction repair composites materials in the near future and tackle the sudden fluctuations in the market.

Need to maintain uninterrupted supply chain and operate at full capacity post COVID-19

The global bridge, water structure, industrial structure, oil & natural gas pipeline and other applications have witnessed adverse and immediate consequences of the COVID-19 pandemic. These are the one of the worst-affected applications, and the biggest challenge for construction repair composites manufacturers is to resume the projects and production at their original capacities and make up for the revenue loss and damage caused by the pandemic. The COVID-19 pandemic has created ripples across the global construction repair composites industries due to the closure of national and international borders, leading to disrupted supply chains. The challenges in the current and future scenarios for the construction repair composites industry are to ensure the smooth flow of global supply chains, responsible for rapidly transporting materials and components across borders. These applications have to make up for the delays or non-arrival of raw materials.

To know about the assumptions considered for the study, download the pdf brochure

Europe held the largest market share in the construction repair composites market

Europe is the largest market for construction repair composites market in terms of value. The large market size in this region is attributed to the high demand from the building & construction repair sector that has adopted construction composites products for restoration and strengthening. These composites offer good strength-to-weight ratio over traditional substitutes.

APAC is expected to witness the highest growth between 2021 and 2026. The increasing economic growth and rapid increase in population are expected to significantly boost the construction repair composites market in this region.

Construction Repair Composites Market Players

The key players in the global construction repair composites market are:

- Sika (Switzerland)

- Mapei SpA (Italy)

- Fosroc (UAE)

- Master Builders Solutions (Germany)

- Simpson Strong-Tie Company Inc. (US)

- Fyfe (US)

- AB-SCHOMBURG Yapi Kimyasallari A.S. (Turkey)

- DowAksa (Turkey)

- Dextra Group (Thailand)

- Chomarat Group (France)

- Sireg Geotech S.r.l. (Italy)

- Owens Corning (US)

Construction Repair Composites Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 331 million |

|

Revenue Forecast in 2026 |

USD 533 million |

|

CAGR |

10.0% |

|

Years considered for the study |

2018–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Fiber Type, Resin type, Product type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Sika (Switzerland), Mapei SpA (Italy), Fosroc (UAE), Master Builders Solutions (Germany), Simpson Strong-Tie Company Inc. (US), are some of the key players in the construction repair composites market. Other players include Fyfe (US), AB-SCHOMBURG Yapý Kimyasallarý A.Þ. (Turkey), DowAksa (Turkey), Dextra Group (Thailand), Chomarat Group (France), Sireg Geotech S.r.l. (Italy), Owens Corning (US). |

This research report categorizes the construction repair composites market based on fiber type, resin type, product type, end-use application, and region.

Construction Repair Composites Market by Fiber Type:

- Glass Fiber

- Carbon Fiber

- Others

Construction Repair Composites Market by Resin Type:

- Vinyl Easter

- Epoxy

- Others

Construction Repair Composites Market by Product Type:

- Textile/ Fabric

- Plate

- Rebar

- Mesh

- Adhesive

Construction Repair Composites Market by Application:

- Residential

- Commercial

- Bridge

- Silo Flue Pipe

- Oil & Natural Gas Pipe line

- Water Structure

- Industrial Structure

- Others

Construction Repair Composites Market by Region:

- North America

- Europe

- APAC

- MEA

- Latin America

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the construction repair composites industry. The study includes an in-depth competitive analysis of these key players in the construction repair composites market, with their company profiles, recent developments, and key market strategies.

Recent Developments

- In July 2017, Owens Corning acquired Aslan FRP, the concrete reinforcement business of Hughes Brothers Inc. Aslan FRP makes and markets glass and carbon fiber-reinforced composite rebars which are used to reinforce concrete in new and restorative infrastructure projects such as roads, bridges, marine structures, buildings, and tunnels. With this acquisition, the company strengthened and expanded its geographical presence in the FRP rebar market.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the construction repair composites market?

Growing demand of construction repair projects Across the world is driving the construction repair composites market.

Which is the fastest-growing region-level market for construction repair composites?

APAC is the fastest-growing construction repair composites market due to the presence of major construction repair composites manufacturers and the burgeoning growth of various end-use applications.

What are the factors contributing to the final price of construction repair composites?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of construction repair composites.

What are the challenges in the construction repair composites market?

Availability of low cost substitutes and lower adoption & acceptance of construction composites is the major challenge in the construction repair composites market.

Which type of fiber holds the largest market share?

Glass fiber construction repair composites in terms of value and volume hold the largest share due to wide uses in multiple end-use applications.

How is the construction repair composites market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Sika (Switzerland), Mapei SpA (Italy), Fosroc (UAE), Master Builders Solutions (Germany), Simpson Strong-Tie Company Inc. (US) are a few of the key players in the construction repair composites market.

Which type of resin is largely used in the production of construction repair composites?

Vinyl ester resin type dominates the construction repair composites market.

What are the major applications for construction repair composites?

The major applications of construction repair composites include residential, commercial, bridge, silo flue pipe, water structure, industrial structure, oil & natural gas pipeline, and others.

Which product type dominates the construction repair composites market?

Rebar product type holds the major market share in the construction repair composites market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 CONSTRUCTION REPAIR COMPOSITES MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED IN THE REPORT

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY–SIDE APPROACH

2.1.2 DEMAND–SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY–SIDE

2.2.2 DEMAND–SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – Top construction repair composites manufacturers

2.3.2.2 Breakdown of primary interviews

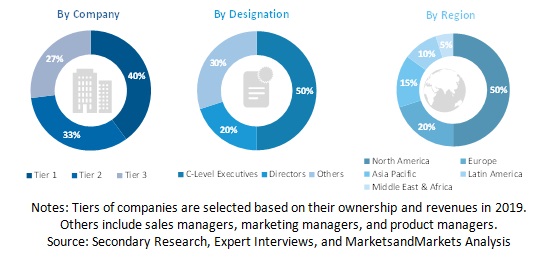

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM–UP APPROACH

FIGURE 2 CONSTRUCTION REPAIR COMPOSITES MARKET: BOTTOM–UP APPROACH

2.4.2 TOP–DOWN APPROACH

FIGURE 3 CONSTRUCTION REPAIR COMPOSITES MARKET: TOP–DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 CONSTRUCTION REPAIR COMPOSITES MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH CONSTRUCTION REPAIR COMPOSITES MARKET

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 5 GLASS FIBER LED OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET

FIGURE 6 VINYL ESTER RESIN LED THE OVERALL MARKET

FIGURE 7 REBAR PRODUCT LED OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET

FIGURE 8 COMMERCIAL APPLICATION TO REGISTER HIGHEST CAGR IN CONSTRUCTION REPAIR COMPOSITES MARKET

FIGURE 9 NORTH AMERICA AND EUROPE DOMINATED CONSTRUCTION REPAIR COMPOSITES MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CONSTRUCTION REPAIR COMPOSITES MARKET

FIGURE 10 SIGNIFICANT GROWTH EXPECTED IN CONSTRUCTION REPAIR COMPOSITES MARKET BETWEEN 2021 AND 2026

4.2 CONSTRUCTION REPAIR COMPOSITES MARKET, BY FIBER TYPE AND BY REGION (VOLUME)

FIGURE 11 EUROPE TO DRIVE CONSTRUCTION REPAIR COMPOSITES MARKET BETWEEN 2021 AND 2026

4.3 CONSTRUCTION REPAIR COMPOSITES MARKET, BY RESIN TYPE (VOLUME)

FIGURE 12 VINYL ESTER RESIN TO DOMINATE CONSTRUCTION REPAIR COMPOSITES MARKET

4.4 CONSTRUCTION REPAIR COMPOSITES MARKET, BY PRODUCT TYPE

FIGURE 13 TEXTILE/ FABRIC ACCOUNTED FOR LARGER SHARE IN CONSTRUCTION REPAIR COMPOSITES MARKET

4.5 CONSTRUCTION REPAIR COMPOSITES MARKET, BY APPLICATION (VOLUME)

FIGURE 14 BRIDGE APPLICATION TO DOMINATE OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET

4.6 CONSTRUCTION REPAIR COMPOSITES MARKET, BY COUNTRY

FIGURE 15 CHINA TO REGISTER THE HIGHEST CAGR IN CONSTRUCTION REPAIR COMPOSITES MARKET

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE CONSTRUCTION REPAIR COMPOSITES MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand for construction composites due to its advantages over traditional substitutes

5.2.1.2 High growth of construction sector

TABLE 1 CONSTRUCTION INVESTMENT STATISTICS, BY REGION (2019)

5.2.1.3 Increasing usage of construction composites in residential and commercial sector

5.2.2 RESTRAINTS

5.2.2.1 Lack of experienced professionals related to construction composite products in emerging markets

5.2.2.2 Higher costs compared to traditional substitutes

5.2.2.3 Lower demand due to global health crisis

5.2.3 OPPORTUNITIES

5.2.3.1 Development of low–cost carbon, glass, and basalt fibers can reduce cost of construction composites

5.2.3.2 Growing demand from emerging markets

TABLE 2 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019–2030)

5.2.4 CHALLENGES

5.2.4.1 Availability of low–cost substitutes and lower adoption and acceptance of construction composites

5.2.4.2 Maintaining an uninterrupted supply chain due to COVID–19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: CONSTRUCTION REPAIR COMPOSITES MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 CONSTRUCTION REPAIR COMPOSITES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.5 ECOSYSTEM: CONSTRUCTION REPAIR COMPOSITES MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 CONSTRUCTION REPAIR COMPOSITES MARKET: VALUE CHAIN ANALYSIS

5.7 RAW MATERIAL SELECTION

5.8 IMPACT OF COVID–19

5.8.1 IMPACT OF COVID–19 ON CONSTRUCTION INDUSTRY

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 19 CONSTRUCTION REPAIR COMPOSITES MARKET: SUPPLY CHAIN ANALYSIS

TABLE 4 CONSTRUCTION REPAIR COMPOSITES MARKET: SUPPLY CHAIN

5.10 CONSTRUCTION REPAIR COMPOSITES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIO

TABLE 5 CONSTRUCTION REPAIR COMPOSITES MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC AND OPTIMISTIC SCENARIO

5.10.1 OPTIMISTIC SCENARIO

5.10.2 PESSIMISTIC SCENARIO

5.10.3 REALISTIC SCENARIO

5.11 PRICING ANALYSIS

5.12 KEY MARKET FOR IMPORT/EXPORT

5.12.1 CHINA

5.12.2 US

5.12.3 GERMANY

5.12.4 UK

5.12.5 FRANCE

5.12.6 JAPAN

5.13 CASE STUDY ANALYSIS

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

TABLE 6 CONSTRUCTION REPAIR COMPOSITES MARKET: GLOBAL PATENTS

FIGURE 20 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 21 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 11 YEARS

5.14.4 INSIGHTS

5.14.5 JURISDICTION ANALYSIS

FIGURE 22 GLOBAL JURISDICTION ANALYSIS

5.14.6 TOP APPLICANTS’ ANALYSIS

FIGURE 23 PAREXGROUP SA HAS HIGHEST NUMBER OF PATENTS

5.14.7 LIST OF PATENTS, BY TOP APPLICANTS/COMPANIES

5.15 AVERAGE SELLING PRICE

TABLE 7 AVERAGE SELLING PRICE, BY REGION

5.16 TARIFF AND REGULATIONS

TABLE 8 CURRENT STANDARD CODES FOR CONSTRUCTION COMPOSITES

5.17 CONSTRUCTION REPAIR COMPOSITES MARKET: YC AND YCC SHIFT

6 CONSTRUCTION REPAIR COMPOSITES MARKET, BY FIBER TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 24 GLASS FIBER–BASED CONSTRUCTION COMPOSITES DOMINATE OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET

6.1.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE

TABLE 9 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 10 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

6.2 GLASS FIBER CONSTRUCTION COMPOSITES

FIGURE 25 APAC PROJECTED TO BE FASTEST–GROWING GLASS FIBER CONSTRUCTION REPAIR COMPOSITES MARKET

6.2.1 GLASS FIBER CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 11 GLASS FIBER CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 GLASS FIBER CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (KILOTON)

6.3 CARBON FIBER CONSTRUCTION COMPOSITES

6.3.1 CARBON FIBER CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 13 CARBON FIBER CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 14 CARBON FIBER CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (KILOTON)

6.4 OTHER FIBER–BASED CONSTRUCTION COMPOSITES

6.4.1 OTHER FIBERS BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 15 OTHER FIBERS BASED CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 OTHER FIBERS BASED CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION, 2019–2026 (KILOTON)

7 CONSTRUCTION REPAIR COMPOSITES MARKET, BY RESIN TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 26 VINYL ESTER RESIN–BASED CONSTRUCTION COMPOSITES DOMINATE THE OVERALL MARKET

7.1.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE

TABLE 17 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 18 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

7.2 VINYL ESTER

FIGURE 27 APAC IS FASTEST–GROWING MARKET FOR VINYL ESTER RESIN–BASED CONSTRUCTION COMPOSITES

7.2.1 VINYL ESTER RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 19 VINYL ESTER RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 VINYL ESTER RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.3 EPOXY

7.3.1 EPOXY RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 21 EPOXY RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 EPOXY RESIN–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.4 OTHERS

7.4.1 OTHER RESINS–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 23 OTHER RESINS–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (USD THOUSAND)

TABLE 24 OTHER RESINS–BASED CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8 CONSTRYCTION REPAIR COMPOSITES MARKET, BY PRODUCT TYPE (Page No. - 81)

8.1 INTRODUCTION

FIGURE 28 REBAR TO DOMINATE OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET, 2021–2026

TABLE 25 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 26 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

8.2 TEXTILE/ FABRIC

FIGURE 29 NORTH AMERICA TO DOMINATE MARKET IN CARBON FABRIC SEGMENT, 2021–2026

TABLE 27 TEXTILE/ FABRIC MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 TEXTILE/ FABRIC MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.3 PLATE

FIGURE 30 EUROPE TO DOMINATE MARKET FOR CARBON PLATE SEGMENT, 2021–2026

TABLE 29 PLATE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 PLATE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.4 REBAR

FIGURE 31 EUROPE TO DOMINATE REBAR SEGMENT, 2021–2026

TABLE 31 REBAR MARKET SIZE, BY REGION, 2019–2026 (USD MILLION )

TABLE 32 REBAR MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.5 MESH

TABLE 33 MESH MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 MESH MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.6 ADHESIVE

TABLE 35 ADHESIVE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 ADHESIVE MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9 CONSTRUCTION REPAIR COMPOSITES MARKET, BY APPLICATION (Page No. - 90)

9.1 INTRODUCTION

FIGURE 32 BRIDGE APPLICATION TO DOMINATE OVERALL CONSTRUCTION REPAIR COMPOSITES MARKET

9.1.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION

TABLE 37 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2 RESIDENTIAL

9.2.1 WIDE RANGE OF PROPERTIES MAKE CONSTRUCTION COMPOSITE PRODUCTS IDEAL IN REPAIR OF RESIDENTIAL PROJECTS

FIGURE 33 EUROPE TO DOMINATE RESIDENTIAL APPLICATIONS IN CONSTRUCTION REPAIR COMPOSITES MARKET

9.2.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN RESIDENTIAL APPLICATION, BY REGION

TABLE 39 CONSTRUCTION REPAIR COMPOSITES MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 CONSTRUCTION REPAIR COMPOSITES MARKET IN RESIDENTIAL APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.3 COMMERCIAL

9.3.1 CONSTRUCTION COMPOSITES ARE USED IN SCHOOLS, UNIVERSITIES, AND HOSPITALS FOR THEIR HIGH TENSILE STRENGTH

FIGURE 34 APAC TO DOMINATE CONSTRUCTION REPAIR COMPOSITES MARKET IN COMMERCIAL APPLICATION

9.3.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN COMMERCIAL APPLICATION, BY REGION

TABLE 41 CONSTRUCTION REPAIR COMPOSITES MARKET IN COMMERCIAL APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 CONSTRUCTION REPAIR COMPOSITES MARKET IN COMMERCIAL APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.4 BRIDGE

9.4.1 COMPOSITE REBARS, MESH, AND FABRIC INCREASE THE STRENGTH OF BRIDGES

FIGURE 35 EUROPE TO DOMINATE CONSTRUCTION REPAIR COMPOSITES MARKET IN BRIDGE APPLICATION

9.4.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN BRIDGE APPLICATION, BY REGION

TABLE 43 CONSTRUCTION REPAIR COMPOSITES MARKET IN BRIDGE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 CONSTRUCTION REPAIR COMPOSITES MARKET IN BRIDGE APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.5 SILO–FLUE PIPE

9.5.1 CONSTRUCTION COMPOSITES USED IN SILO–FLUE PIPES TO PREVENT CORROSION AND FOR REPAIR ACTIVITIES

FIGURE 36 APAC TO DOMINATE CONSTRUCTION REPAIR COMPOSITES MARKET IN SILO–FLUE PIPE APPLICATION

9.5.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN SILO–FLUE PIPE APPLICATION, BY REGION

TABLE 45 CONSTRUCTION REPAIR COMPOSITES MARKET IN SILO–FLUE PIPE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 CONSTRUCTION REPAIR COMPOSITES MARKET IN SILO–FLUE PIPE APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.6 OIL AND NATURAL GAS PIPELINE

9.6.1 DEMAND FOR CONSTRUCTION COMPOSITES FOR REPAIR OF OIL AND NATURAL GAS PIPELINES TO BOOST THE MARKET

TABLE 47 CRUDE OIL PRODUCTION, BY COUNTRY, 2019

TABLE 48 NATURAL GAS CONSUMPTION, BY COUNTRY, 2019

FIGURE 37 MEA TO LEAD CONSTRUCTION REPAIR COMPOSITES MARKET IN OIL AND NATURAL GAS PIPELINE APPLICATION

9.6.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN OIL AND NATURAL GAS PIPELINE APPLICATION, BY REGION

TABLE 49 CONSTRUCTION REPAIR COMPOSITES MARKET IN OIL AND NATURAL GAS PIPELINE, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 CONSTRUCTION REPAIR COMPOSITES MARKET IN OIL AND NATURAL GAS PIPELINE, BY REGION, 2019–2026 (KILOTON)

9.7 WATER STRUCTURE

9.7.1 CONSTRUCTION COMPOSITE WRAPS STRENGTHEN, REPAIR, AND RESTORE WATER STORAGE STRUCTURES

FIGURE 38 EUROPE TO LEAD CONSTRUCTION REPAIR COMPOSITES MARKET IN WATER STRUCTURE APPLICATION

9.7.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN WATER STRUCTURE APPLICATION, BY REGION

TABLE 51 CONSTRUCTION REPAIR COMPOSITES MARKET IN WATER STRUCTURE, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 CONSTRUCTION REPAIR COMPOSITES MARKET IN WATER STRUCTURE, BY REGION, 2019–2026 (KILOTON)

9.8 INDUSTRIAL STRUCTURE

9.8.1 CONSTRUCTION COMPOSITE PRODUCTS OFFER HIGH ELASTIC MODULUS, FATIGUE STRENGTH IN INDUSTRIAL STRUCTURES

FIGURE 39 APAC TO LEAD CONSTRUCTION REPAIR COMPOSITES MARKET IN INDUSTRIAL STRUCTURE APPLICATION

9.8.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN INDUSTRIAL STRUCTURE APPLICATION, BY REGION

TABLE 53 CONSTRUCTION REPAIR COMPOSITES MARKET IN INDUSTRIAL STRUCTURE, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 CONSTRUCTION REPAIR COMPOSITES MARKET IN INDUSTRIAL STRUCTURE, BY REGION, 2019–2026 (KILOTON)

9.9 OTHERS

FIGURE 40 EUROPE TO LEAD CONSTRUCTION REPAIR COMPOSITES MARKET IN OTHER APPLICATIONS

9.9.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 55 CONSTRUCTION REPAIR COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 CONSTRUCTION REPAIR COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

10 CONSTRUCTION REPAIR COMPOSITES MARKET, BY REGION (Page No. - 108)

10.1 INTRODUCTION

FIGURE 41 CHINA PROJECTED TO BE FASTEST–GROWING CONSTRUCTION REPAIR COMPOSITES MARKET (2021–2026)

10.1.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION

TABLE 57 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

10.2 NORTH AMERICA

FIGURE 42 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SNAPSHOT

10.2.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN NORTH AMERICA, BY FIBER TYPE

TABLE 59 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.2.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN NORTH AMERICA, BY RESIN TYPE

TABLE 61 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

10.2.3 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN NORTH AMERICA, BY PRODUCT TYPE

TABLE 63 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10.2.4 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN NORTH AMERICA, BY APPLICATION

TABLE 65 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.2.5 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN NORTH AMERICA, BY COUNTRY

TABLE 67 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

10.2.6 US

10.2.6.1 Construction repair composites market in US, by application

TABLE 69 US: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 70 US: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.2.7 CANADA

10.2.7.1 Construction repair composites market in Canada, by application

TABLE 71 CANADA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 CANADA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3 EUROPE

FIGURE 43 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SNAPSHOT

10.3.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN EUROPE, BY FIBER TYPE

TABLE 73 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 74 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.3.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN EUROPE, BY RESIN TYPE

TABLE 75 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

10.3.3 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN EUROPE, BY PRODUCT TYPE

TABLE 77 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10.3.4 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN EUROPE, BY APPLICATION

TABLE 79 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.5 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN EUROPE, BY COUNTRY

TABLE 81 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY 2019–2026 (USD MILLION)

TABLE 82 EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

10.3.6 GERMANY

10.3.6.1 Construction repair composites market in Germany, by application

TABLE 83 GERMANY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 GERMANY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.7 UK

10.3.7.1 Construction repair composites market in UK, by application

TABLE 85 UK: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 UK: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.8 FRANCE

10.3.8.1 Construction repair composites market in France, by application

TABLE 87 FRANCE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 FRANCE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.9 ITALY

10.3.9.1 Construction repair composites market in Italy, by application

TABLE 89 ITALY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 ITALY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.10 SPAIN

10.3.10.1 Construction repair composites market in Spain, by application

TABLE 91 SPAIN: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 SPAIN: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.11 RUSSIA

10.3.11.1 Construction repair composites market in Russia, by application

TABLE 93 RUSSIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 RUSSIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.12 TURKEY

10.3.12.1 Construction repair composites market in Turkey, by application

TABLE 95 TURKEY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 96 TURKEY: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.3.13 REST OF EUROPE

10.3.13.1 Construction repair composites market in rest of Europe, by application

TABLE 97 REST OF EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 REST OF EUROPE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4 APAC

FIGURE 44 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SNAPSHOT

10.4.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN APAC, BY FIBER TYPE

TABLE 99 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 100 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.4.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN APAC, BY RESIN TYPE

TABLE 101 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 102 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

10.4.3 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN APAC, BY PRODUCT TYPE

TABLE 103 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 104 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10.4.4 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN APAC, BY APPLICATION

TABLE 105 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 106 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.5 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN APAC, BY COUNTRY

TABLE 107 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY 2019–2026 (USD MILLION)

TABLE 108 APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

10.4.6 CHINA

10.4.6.1 Construction repair composites market in China, by application

TABLE 109 CHINA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 110 CHINA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.7 JAPAN

10.4.7.1 Construction repair composites market Japan, by application

TABLE 111 JAPAN: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 112 JAPAN: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.8 INDIA

10.4.8.1 Construction repair composites market India, by application

TABLE 113 INDIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 INDIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.9 SOUTH KOREA

10.4.9.1 Construction repair composites market in South Korea, by application

TABLE 115 SOUTH KOREA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 116 SOUTH KOREA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.4.10 REST OF APAC

10.4.10.1 Construction repair composites market in rest of APAC, by application

TABLE 117 REST OF APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 REST OF APAC: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5 MEA

10.5.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN MEA, BY FIBER TYPE

TABLE 119 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 120 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.5.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN MEA, BY RESIN TYPE

TABLE 121 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 122 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

10.5.3 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN MEA, BY PRODUCT TYPE

TABLE 123 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 124 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10.5.4 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN MEA, BY APPLICATION

TABLE 125 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5.5 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN MEA, BY COUNTRY

TABLE 127 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY 2019–2026 (USD MILLION)

TABLE 128 MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

10.5.6 SAUDI ARABIA

10.5.6.1 Construction repair composites market in Saudi Arabia, by application

TABLE 129 SAUDI ARABIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 SAUDI ARABIA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5.7 UAE

10.5.7.1 Construction repair composites market in UAE, by application

TABLE 131 UAE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 UAE: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5.8 SOUTH AFRICA

10.5.8.1 Construction repair composites market in South Africa, application

TABLE 133 SOUTH AFRICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 SOUTH AFRICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.5.9 REST OF MEA

10.5.9.1 Construction repair composites market in rest of MEA, by application

TABLE 135 REST OF MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 136 REST OF MEA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.6 LATIN AMERICA

10.6.1 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN LATIN AMERICA, BY FIBER TYPE

TABLE 137 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (USD MILLION)

TABLE 138 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.6.2 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN LATIN AMERICA, BY RESIN TYPE

TABLE 139 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 140 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

10.6.3 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN LATIN AMERICA, BY PRODUCT TYPE

TABLE 141 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 142 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KILOTON)

10.6.4 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN LATIN AMERICA, BY APPLICATION

TABLE 143 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 144 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.6.5 CONSTRUCTION REPAIR COMPOSITES MARKET SIZE IN LATIN AMERICA, BY COUNTRY

TABLE 145 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY 2019–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

10.6.6 MEXICO

10.6.6.1 Construction repair composites market in Mexico, by application

TABLE 147 MEXICO: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 148 MEXICO: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY FIBER TYPE, 2019–2026 (KILOTON)

10.6.7 BRAZIL

10.6.7.1 Construction repair composites market in Brazil, by application

TABLE 149 BRAZIL: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 150 BRAZIL: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

10.6.8 REST OF LATIN AMERICA

10.6.8.1 Construction repair composites market in rest of Latin America, by application

TABLE 151 REST OF LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 152 REST OF LATIN AMERICA: CONSTRUCTION REPAIR COMPOSITES MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 161)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS

FIGURE 45 MARKET SHARE OF TOP COMPANIES IN CONSTRUCTION REPAIR COMPOSITES MARKET

TABLE 153 DEGREE OF COMPETITION: FRAGMENTED

11.3 MARKET RANKING

FIGURE 46 RANKING OF TOP FIVE PLAYERS IN CONSTRUCTION REPAIR COMPOSITES MARKET

11.4 MARKET EVALUATION FRAMEWORK

TABLE 154 CONSTRUCTION REPAIR COMPOSITES MARKET: DEALS, 2016–2021

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 155 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2020 (USD MILLION)

11.6 COMPANY EVALUATION MATRIX

TABLE 156 COMPANY PRODUCT FOOTPRINT

TABLE 157 COMPANY APPLICATION FOOTPRINT

TABLE 158 COMPANY REGION FOOTPRINT

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 PARTICIPANTS

11.6.4 EMERGING LEADERS

FIGURE 47 CONSTRUCTION REPAIR COMPOSITES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 48 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 49 BUSINESS STRATEGY EXCELLENCE

11.7 SMALL AND MEDIUM–SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 50 CONSTRUCTION REPAIR COMPOSITES MARKET: SMALL AND MEDIUM–SIZED ENTERPRISES MAPPING, 2020

12 COMPANY PROFILES (Page No. - 172)

12.1 KEY COMPANIES

(Business Overview, Products Offered, MnM View, Current focus and strategies, Threat from competition, Right to win)*

12.1.1 SIKA

TABLE 159 SIKA: COMPANY OVERVIEW

FIGURE 51 SIKA: COMPANY SNAPSHOT

12.1.2 MAPEI SPA

TABLE 160 MAPEI SPA: COMPANY OVERVIEW

FIGURE 52 MAPEI SPA: COMPANY SNAPSHOT

12.1.3 FOSROC

TABLE 161 FOSROC: COMPANY OVERVIEW

12.1.4 MASTER BUILDERS SOLUTIONS

TABLE 162 MASTER BUILDERS SOLUTIONS: COMPANY OVERVIEW

12.1.5 FYFE

TABLE 163 FYFE: COMPANY OVERVIEW

12.1.6 AB–SCHOMBURG YAPI KIMYASALLARI A.Þ.

TABLE 164 AB–SCHOMBURG YAPI KIMYASALLARI A.Þ.: COMPANY OVERVIEW

12.1.7 DOWAKSA

TABLE 165 DOWAKSA: COMPANY OVERVIEW

12.1.8 DEXTRA GROUP

TABLE 166 DEXTRA GROUP: COMPANY OVERVIEW

12.1.9 RHINO CARBON FIBER REINFORCEMENT PRODUCTS

TABLE 167 RHINO CARBON FIBER REINFORCEMENT PRODUCTS: COMPANY OVERVIEW

12.1.10 CHOMARAT GROUP

TABLE 168 CHOMARAT GROUP: COMPANY OVERVIEW

12.1.11 SIREG GEOTECH S.R.L.

TABLE 169 SIREG GEOTECH S.R.L.: COMPANY OVERVIEW

12.1.12 OWENS CORNING

TABLE 170 OWENS CORNING: COMPANY OVERVIEW

FIGURE 53 OWENS CORNING: COMPANY SNAPSHOT

12.1.13 ANTOP GLOBAL TECHNOLOGY CO., LTD.

TABLE 171 ANTOP GLOBAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.1.14 STEKLONIT JSC

TABLE 172 STEKLONIT JSC: COMPANY OVERVIEW

12.1.15 STRONGWELL

TABLE 173 STRONGWELL: COMPANY OVERVIEW

12.1.16 TECHNOBASALT–INVEST, LLC

TABLE 174 TECHNOBASALT–INVEST, LLC: COMPANY OVERVIEW

12.1.17 SIMPSON STRONG–TIE COMPANY INC.

TABLE 175 SIMPSON STRONG–TIE COMPANY INC.: COMPANY OVERVIEW

12.2 OTHER COMPANIES

12.2.1 COMPOSITE GROUP CHELYABINSK

12.2.2 SCHÖCK BAUTEILE GMBH

12.2.3 PULTRON COMPOSITES

12.2.4 ZHONGAO CARBON

12.2.5 PULTRALL INC.

12.2.6 ARMATSEK

12.2.7 FIREP GROUP

12.2.8 GALEN LLC

*Details on Business Overview, Products Offered, MnM View, Current focus and strategies, Threat from competition, Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 216)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the construction repair composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The construction repair composites market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly construction industry and various applications such as residential, commercial, silo flue pipes, bridge, oil & natural gas pipeline, water structure, industrial structures, and others. Advancements in technology and diverse applications in various end-use industry describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total construction repair composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall construction repair composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the residential, commercial, silo flue pipes, bridge, oil & natural gas pipeline, water structure, industrial structures, and others applications.

Report Objectives

- To analyze and forecast the global construction repair composites market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on fiber type, resin type, product type, and application

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC construction repair composites market

- Further breakdown of Rest of European construction repair composites market

- Further breakdown of Rest of North American construction repair composites market

- Further breakdown of Rest of MEA construction repair composites market

- Further breakdown of Rest of Latin American construction repair composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Construction Repair Composites Market