Content Disarm and Reconstruction Market by Component (Solutions and Services), Application Area (Email, Web, FTP, and Removable Devices), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2026

Content Disarm and Reconstruction Market Size

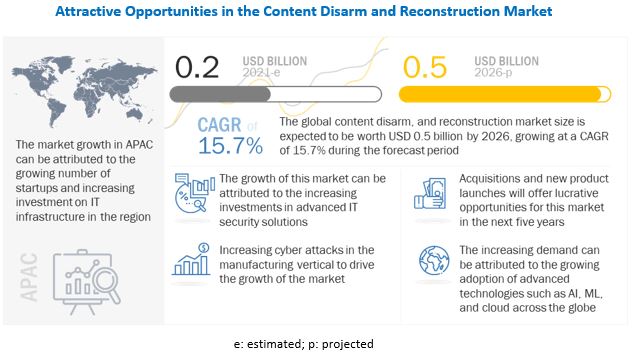

The size of global Content Disarm and Reconstruction Market is anticipated to increase at a CAGR of 15.7% over the course of the forecast period, from USD 0.2 billion in 2021 to USD 0.5 billion in 2026. Key factors that are expected to drive the growth of the market are the increasing cost of data breaches, growing stricter regulation and compliance for content security, and increasing number of zero day and file-based attacks.

The content disarm, and reconstruction market is growing due to the presence of global and emerging players in the market. The major factors that are driving the adoption of CDR solutions among the enterprises as well as SMEs across various verticals including government and defense, BFSI, IT and telecom, energy and utilities, manufacturing, healthcare, and others are due to significant adoption of cloud services and security infrastructure. Developing countries across APAC and MEA are expected to offer more opportunities for vendors in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Content Disarm and Reconstruction Market Dynamics

Driver: Increasing cost of data breaches.

With the increase in file-sharing between co-workers working remotely and customers, partners, and vendors – enterprises face elevated risks, threats, and vulnerabilities from file-borne malware, and many of these vulnerabilities are undetectable by traditional network security solutions. The consequences of malware attacks are significant. Companies suffer data loss, disruption of service, downtime, damage to enterprise reputation, and revenue loss. Thus, data breaches directly hamper the company’s overall market presence. The Accenture Annual Cost of Cybersecurity study states that the average cost of a malware attack on a company is USD 2.6 million, with the attacks costing the business an average of 50 days in lost time. According to IBM Cost of Data Breach Report 2020, the average cost of a data breach has increased for mid-sized organizations due to human errors, system glitches, and malicious attacks. With effective CDR solutions in place, companies can reduce the cost of data breaches.

Restraint: Lack of relevant skill and strategic planning.

The lack of skills among security professionals is a major concern prevalent across all major security companies. According to findings from the State of Cybersecurity 2021 Part 1 survey report from ISACA, the cyber security industry continues to experience ongoing challenges in hiring and retention. The shortage of the cyber security workforce in India is 9% higher than the global average. Security professionals require the latest know-how, advanced skills in analytics, forensic investigations, and cloud computing security to combat cyberattacks. The increasing cyber security threats and file-based attacks have given rise to the dearth of relevant IT security skills and professionals. Companies should opt for a proactive approach to deploy IT security infrastructure and train the staff to predict the attack by closely monitoring data and investigating. Preplanning helps enterprises in selecting the right CDR solution that has all the required functionalities and technologies. Thus, the lack of expertise and planning is a restraining factor in the content disarm and reconstruction market.

Opportunity: Increase in demand for cloud based security solutions among SMEs.

The cloud computing model is widely adopted due to its powerful and flexible infrastructure. Many organizations are shifting their preference toward cloud solutions to simplify the storage of data. Also, it provides remote server access on the internet, enabling access to unlimited computing power. The implementation of a cloud-based model enables organizations to manage all the applications as it provides exceptionally challenging analytics that runs in the background.

The implementation of the cloud can allow organizations to combine supplementary infrastructure technologies, such as software-defined perimeters, to create robust and highly secure platforms. Governments in many countries issue special guidelines and regulations for cloud platform security, which drives the cyber security market growth across the globe. SMEs are constantly seeking to modernize their applications and infrastructures by moving to cloud-based platforms, such as Software-as-a-Service (SaaS) and Infrastructure-as-a-Service (IaaS). Cloud-based solutions eliminate the need to install a stack of security equipment on-premises and can utilize cloud services to secure applications, data, users, and devices. The demand for cloud-based CDR solutions is expected to increase, presenting growth opportunities in the market as SMEs are planning to address data and information security concerns over the cloud.

Challenge: Implementing CDR solutions in existing infrastructure.

Deploying the CDR model on a new or existing infrastructure has various design and implementation challenges. The model enforces IT teams in enterprises to rethink their network security to transform from the network perimeter-based approach into a user-based and application-based security model. Redesigning and redeploying web- and mobile-based applications can become exhaustive and time-consuming. Most networks are not designed keeping cyber security in mind, and upgrading to the new IT security model requires an in-depth network analysis of network hardware, services, and traffic. Re-modeling networks using the CDR technology requires an accurate and clear understanding of every user, device, application, and resource.

Services segment to grow at a higher CAGR during the forecast period.

Based on the component, the market is segmented into two categories: solutions, and services. The services segment is expected to grow at a higher CAGR during the forecast period. Services, including consulting, integration and implementation, training and education, and support and maintenance, are required at various stages, starting from the pre-sale’s requirement assessment to post-sales product deployment and execution, thus enabling the client to get maximum RoI. Services constitute an integral part in deploying the solution on-board, imparting training, and handling and maintaining the software solution. Companies offering these services encompass consultants, solution experts, and dedicated project management teams that specialize in the design and delivery of critical decision support software, tools, and services.

Cloud deployment mode segment to grow at a higher CAGR during the forecast period.

The CDR market is segmented by deployment type into on-premises and cloud segment. The cloud deployment mode is expected to grow at a higher CAGR during the forecast period. CDR solutions are migrating to the cloud from the on-premises deployment model as the former offers benefits such as reduced operational costs, making the technology accessible to the organizations and departments that lack capital and good infrastructure to support the on-premises deployment model. ECDR software can be deployed as a cloud-based model, allowing multiple users to access information through the internet. Cloud services require no upfront cost or pay according to the user requirement. The cloud deployment model offers various benefits to organizations, such as quick deployment, scalability, and anywhere access. Data security is a major concern while adopting cloud services. Thus, organizations are moving toward private and hybrid cloud solutions.

Manufacturing vertical to grow at a higher CAGR during the forecast period.

The manufacturing industry vertical is expected to grow at the highest CAGR during the forecast period. To aptly serve the needs of citizens, government agencies must advance and expand the deployment of advanced technologies for the development of infrastructure. Manufacturing companies are increasingly relying on software applications to automate processes, manage supply chains, and facilitate R&D. The digitalization of processes and products has made the endpoints and networks vulnerable to various advanced threats. This is likely to drive the demand for CDR solutions

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

North America and Europe are the largest revenue contributors to the CDR market, as the growth in these regions is driven by the increasing instances of sophisticated cyber-attacks and the growing use of cost-effective cloud-based cyber security solutions. The other three regions: APAC, MEA, and Latin America, are expected to grow at a high rate as the adoption of IT security solutions in these regions was slow in the past, but now traction is observed across these regions due to an increase in the number of cyber-attacks. APAC is expected to grow at a higher CAGR during the forecast period. The Asia Pacific region comprises emerging economies including China, Japan, Australia, and the rest of APAC. It is highly concerned with the increase in security spending owing to the ever-growing threat landscape. The region has several established SMEs. SMEs in this region are growing at an exponential rate to cater to their large customer base. Machine learning, IoT, big data analytics, and AI are the emerging methodologies that are deployed in this region. Organizations are migrating their businesses to the cloud to increase productivity speed and business performance. The nature of cyber threats is changing continuously and becoming more sophisticated. Ransomware, ad fraud malware, Android malware, DDoS, botnets, banking trojans, and adware are the topmost malware attacks in this region.

Content Disarm and Reconstruction Market Players

The CDR solution vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The content disarm and reconstruction market comprises major providers, such as Check Point Software Technologies(Israel), Fortinet(US), Broadcom (US), OPSWAT(US), Peraton(US), Deep Secure (UK), Votiro (US), Resec Technologies(Israel), odix (Israel), Glasswall Solutions (England), Sasa Software (Israel) JiranSecurity (South Korea), YazamTech(Israel), Solebit(Mimecast), CybACE Solutions (India), SoftCamp (South Korea), and Gatefy (US).

Scope of the report

|

Report Metric |

Details |

|

Market value in 2026 |

USD 0.5 Billion |

|

Market value in 2021 |

USD 0.2 Billion |

|

Market Growth Rate |

15.7% CAGR |

|

Largest Market |

Asia Pacific (APAC) |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Segments covered |

Component, Application Area(Email, Web, FTP, Removable Devices), Deployment Model (On-premises and Cloud), Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Check Point Software Technologies(Israel), Fortinet(US), Broadcom (US), OPSWAT(US), Peraton(US), Deep Secure (UK), Votiro (US), Resec Technologies(Israel), odix (Israel), Glasswall Solutions (England), Sasa Software (Israel) JiranSecurity (South Korea), YazamTech(Israel), Solebit(Mimecast), CybACE Solutions (India), SoftCamp (South Korea), and Gatefy (US) |

This research report of content disarm and reconstruction market based on application, vertical, deployment model, type, component, and region.

Based on the component:

- Solutions

- Services

Based on the application area:

- Web

- FTP

- Removable devices

Based on the deployment mode:

- On-premises

- Cloud

Based on the organization size:

- SMEs

- Large Enterprises

Based on the vertical

- Government and Defense

- BFSI

- IT and Telecom

- Energy and Utilities

- Manufacturing

- Healthcare

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Australia and New Zealand

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments

- In June 2021, Check Point launched Check Point CloudGuard Workload Protection, an automated cloud workload security solution which empowers security teams with tools to automate security across applications, Application Programming Interfaces (APIs), and microservices from development to runtime via a single interface.

- September 2021, Fortinet and Linksys announced a joint new solution to enable enterprise organizations to support and secure work-from-home networks.

- In April 2020, OPSWAT launched MetaDefender for Secure Storage which offers enterprises an integrated, comprehensive approach for securing their data across multi-platform cloud storage providers.

- In September 2019, Broadcom announced that Telecom Italia signed a strategic agreement as a Portfolio License Agreement customer. The agreement will see innovative Broadcom software and hardware combined, thereby accelerating IT solutions from software to silicon yielding cutting-edge offerings for TIM’s enterprise infrastructure.

Frequently Asked Questions (FAQ):

What is the projected market value of the global content disarm and reconstruction market?

The global content disarm and reconstruction market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period, to reach USD 0.5 billion by 2026 from USD 0.2 billion in 2021.

Which region has the highest market share in the content disarm and reconstruction market?

North America and Europe hold the highest market share of the global content disarm and reconstruction market in 2021.

Who are the major vendors in the content disarm and reconstruction market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as Check Point Software Technologies(Israel), Fortinet(US), Broadcom (US), OPSWAT(US), Peraton(US), Deep Secure (UK), Votiro (US), Resec Technologies(Israel), odix (Israel), Glasswall Solutions (England), Sasa Software (Israel) JiranSecurity (South Korea), YazamTech(Israel), Solebit(Mimecast), CybACE Solutions (India), SoftCamp (South Korea), and Gatefy (US).

What are some of the latest trends that will shape the content disarm and reconstruction market in the future?

Emergence of AI and cloud enabled offerings, ML, which significantly improve the content disarm and reconstruction market is expected to shape the market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 CONTENT DISARM AND RECONSTRUCTION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

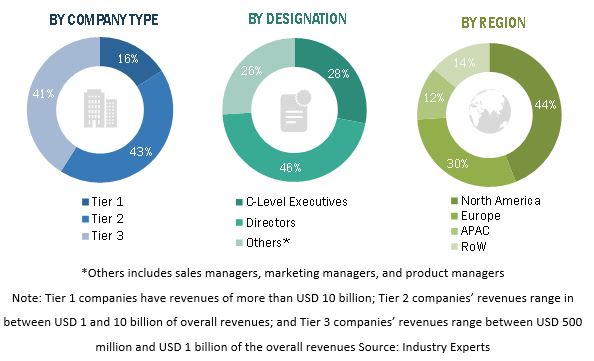

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 1 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF THE CDR MARKET FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (SUPPLY SIDE) - CONTENT DISARM AND RECONSTRUCTION MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – DEMAND-SIDE ANALYSIS: MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 14 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 15 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 16 CONTENT DISARM AND RECONSTRUCTION MARKET: GLOBAL SNAPSHOT, 2019-2026

FIGURE 17 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 18 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 INTEGRATION AND IMPLEMENTATION SERVICES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 20 CLOUD DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 21 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 22 MANUFACTURING VERTICAL IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 23 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 BRIEF OVERVIEW OF THE CONTENT DISARM AND RECONSTRUCTION MARKET

FIGURE 24 INCREASING ADVANCED AND PERSISTENT THREATS AND THE GROWING ZERO-DAY ATTACKS TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2021 VS. 2026

FIGURE 25 SOLUTIONS SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.3 MARKET, BY DEPLOYMENT MODE, 2021 VS. 2026

FIGURE 26 ON-PREMISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.4 MARKET, BY ORGANIZATION SIZE, 2021 VS. 2026

FIGURE 27 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.5 MARKET, BY VERTICAL, 2021 VS. 2026

FIGURE 28 GOVERNMENT AND DEFENSE VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.6 CONTENT DISARM AND RECONSTRUCTION MARKET INVESTMENT SCENARIO

FIGURE 29 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing cost of data breaches

FIGURE 31 AVERAGE COST OF A DATA BREACH, BY ORGANIZATION SIZE, 2019-2020

5.2.1.2 Growing stricter regulation and compliance for content security

5.2.1.3 Increasing number of zero-day and file-based attacks

5.2.2 RESTRAINTS

5.2.2.1 Lack of relevant expertise and strategic planning

FIGURE 32 GAP IN CYBER SECURITY PROFESSIONALS SINCE 2019

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in demand for cloud-based security solutions among SMEs

FIGURE 33 CLOUD SPENDING AMONG SMALL AND MEDIUM BUSINESSES, 2020-2021

5.2.3.2 Growing adoption of BYOD policy among enterprises

5.2.4 CHALLENGES

5.2.4.1 Implementing CDR solutions in existing infrastructure

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: ENHANCE SECURITY TO OVERCOME CYBER SECURITY THREATS

5.3.2 CASE STUDY 2: ENABLE EXTERNAL FILES ACCESSING THE BANK NETWORK SAFELY

5.3.3 CASE STUDY: 3 IMPROVED WEB BROWSING AND EMAIL SECURITY

5.4 ECOSYSTEM

FIGURE 34 CONTENT DISARM AND RECONSTRUCTION MARKET: ECOSYSTEM

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 35 MARKET: SUPPLY CHAIN

5.6 PRICING ANALYSIS

TABLE 3 PRICING ANALYSIS OF VENDORS IN THE MARKET

5.7 PATENT ANALYSIS

FIGURE 36 NUMBER OF PATENT DOCUMENTS PUBLISHED

FIGURE 37 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 4 TOP TEN PATENT OWNERS

TABLE 5 PATENTS GRANTED TO VENDORS IN THE MARKET

5.8 TECHNOLOGICAL ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE

5.8.2 CLOUD COMPUTING

5.9 COVID-19 DRIVEN MARKET DYNAMICS

5.9.1 DRIVERS AND OPPORTUNITIES

5.9.2 RESTRAINTS AND CHALLENGES

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 38 CONTENT DISARM AND RECONSTRUCTION MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATIONS

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 MIDDLE EAST AND SOUTH AFRICA

5.11.5 LATIN AMERICA

6 CONTENT DISARM AND RECONSTRUCTION MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

FIGURE 39 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 SOLUTIONS

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 40 INTEGRATION AND IMPLEMENTATION SERVICES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY SERVICES, 2016–2020 (USD MILLION)

TABLE 12 CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY SERVICES, 2021–2026 (USD MILLION)

6.3.1 CONSULTING

6.3.2 INTEGRATION AND IMPLEMENTATION

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 CONTENT DISARM AND RECONSTRUCTION MARKET, BY APPLICATION AREA (Page No. - 83)

7.1 INTRODUCTION

7.1.1 APPLICATION AREA: MARKET DRIVERS

7.1.2 APPLICATION AREA: COVID-19 IMPACT

7.2 EMAIL

7.3 WEB

7.4 FILE TRANSFER PROTOCOL

7.5 REMOVABLE DEVICES

8 MARKET, BY DEPLOYMENT MODE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 41 CLOUD DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 15 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 16 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.1.2 DEPLOYMENT MODEL: COVID-19 IMPACT

8.2 ON-PREMISES

TABLE 17 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 18 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 19 CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 CONTENT DISARM AND RECONSTRUCTION MARKET, BY ORGANIZATION SIZE (Page No. - 90)

9.1 INTRODUCTION

FIGURE 42 SMALL AND MEDIUM ENTERPRISES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 22 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.1.1 ORGANIZATION SIZE: MARKET DRIVERS

9.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 23 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

TABLE 25 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MARKET, BY VERTICAL (Page No. - 94)

10.1 INTRODUCTION

FIGURE 43 MANUFACTURING VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 28 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

10.2 GOVERNMENT AND DEFENSE

TABLE 29 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 31 BFSI: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 BFSI: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 IT AND TELECOM

TABLE 33 IT AND TELECOM: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 ENERGY AND UTILITIES

TABLE 35 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 MANUFACTURING

TABLE 37 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 HEALTHCARE

TABLE 39 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 HEALTHCARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHERS

TABLE 41 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 CONTENT DISARM AND RECONSTRUCTION MARKET, BY REGION (Page No. - 104)

11.1 INTRODUCTION

FIGURE 44 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 UNITED STATES

TABLE 55 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 56 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 57 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 58 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.2.4 CANADA

TABLE 59 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 60 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 61 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 62 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3 EUROPE

TABLE 63 EUROPE: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 UNITED KINGDOM

TABLE 73 UNITED KINGDOM: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 74 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 75 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 76 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.4 GERMANY

TABLE 77 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 78 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 79 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 80 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.5 FRANCE

TABLE 81 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 82 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 83 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 84 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 85 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: CONTENT DISARM AND RECONSTRUCTION MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.3 CHINA

TABLE 99 CHINA: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 100 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 101 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 102 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 103 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 104 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 105 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 106 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.5 INDIA

TABLE 107 INDIA: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 108 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 109 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 110 INDIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 111 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 112 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 113 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: CONTENT DISARM AND RECONSTRUCTION MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 115 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD THOUSAND)

TABLE 116 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD THOUSAND)

TABLE 117 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 118 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 119 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 120 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

TABLE 121 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD THOUSAND)

TABLE 122 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD THOUSAND)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD THOUSAND)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

11.5.3 MIDDLE EAST

TABLE 125 MIDDLE EAST: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 126 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 127 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 128 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

11.5.4 AFRICA

TABLE 129 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 130 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 131 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 132 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 133 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD THOUSAND)

TABLE 134 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD THOUSAND)

TABLE 135 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 136 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 137 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 138 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

TABLE 139 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD THOUSAND)

TABLE 140 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD THOUSAND)

TABLE 141 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD THOUSAND)

TABLE 142 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

11.6.3 MEXICO

TABLE 143 MEXICO: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 144 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 145 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 146 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

11.6.4 BRAZIL

TABLE 147 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 148 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 149 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 150 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

11.6.5 REST OF LATIN AMERICA

TABLE 151 REST OF LATIN AMERICA: CONTENT DISARM AND RECONSTRUCTION MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD THOUSAND)

TABLE 152 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD THOUSAND)

TABLE 153 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD THOUSAND)

TABLE 154 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 144)

12.1 INTRODUCTION

FIGURE 47 MARKET EVALUATION FRAMEWORK

12.2 MARKET SHARE OF TOP VENDORS

FIGURE 48 CONTENT DISARM AND RECONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

12.3 KEY MARKET DEVELOPMENTS

12.3.1 NEW LAUNCHES

TABLE 155 NEW LAUNCHES, 2019-2021

12.3.2 DEALS

TABLE 156 DEALS, 2019- 2021

12.3.3 OTHERS

TABLE 157 OTHERS, 2019- 2021

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

FIGURE 49 CONTENT DISARM AND RECONSTRUCTION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

TABLE 158 COMPANY APPLICATION AREA FOOTPRINT

TABLE 159 COMPANY VERTICAL FOOTPRINT

TABLE 160 COMPANY REGION FOOTPRINT

TABLE 161 COMPANY FOOTPRINT

13 COMPANY PROFILES (Page No. - 152)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

13.2.1 CHECK POINT SOFTWARE TECHNOLOGIES

TABLE 162 CHECK POINT: BUSINESS OVERVIEW

FIGURE 50 CHECK POINT: COMPANY SNAPSHOT

TABLE 163 CHECK POINT: PRODUCTS OFFERED

TABLE 164 CHECK POINT: PRODUCT LAUNCHES

TABLE 165 CHECK POINT: DEALS

13.2.2 FORTINET

TABLE 166 FORTINET: BUSINESS OVERVIEW

FIGURE 51 FORTINET: COMPANY SNAPSHOT

TABLE 167 FORTINET: PRODUCTS OFFERED

TABLE 168 FORTINET: PRODUCT LAUNCHES

TABLE 169 FORTINET: DEALS

13.2.3 BROADCOM

TABLE 170 BROADCOM: BUSINESS OVERVIEW

FIGURE 52 BROADCOM: COMPANY SNAPSHOT

TABLE 171 BROADCOM: PRODUCTS OFFERED

TABLE 172 BROADCOM: PRODUCT LAUNCHES

TABLE 173 BROADCOM: DEALS

13.2.4 OPSWAT

TABLE 174 OPSWAT: BUSINESS OVERVIEW

TABLE 175 OPSWAT: PRODUCTS OFFERED

TABLE 176 OPSWAT: PRODUCT LAUNCHES

TABLE 177 OPSWAT: DEALS

13.2.5 PERATON

TABLE 178 PERATON: BUSINESS OVERVIEW

TABLE 179 PERATON: PRODUCTS OFFERED

TABLE 180 PERATON: DEALS

13.2.6 DEEP SECURE

TABLE 181 DEEP SECURE: BUSINESS OVERVIEW

TABLE 182 DEEP SECURE: PRODUCTS OFFERED

TABLE 183 DEEP SECURE: PRODUCT LAUNCH

TABLE 184 DEEP SECURE: DEALS

13.2.7 VOTIRO

TABLE 185 VOTIRO: BUSINESS OVERVIEW

TABLE 186 VOTIRO: PRODUCTS OFFERED

TABLE 187 VOTIRO: PRODUCT LAUNCHES

TABLE 188 VOTIRO: DEALS

13.2.8 RESEC TECHNOLOGIES

TABLE 189 RESEC TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 190 RESEC TECHNOLOGIES: PRODUCTS OFFERED

13.2.9 ODIX

TABLE 191 ODIX: BUSINESS OVERVIEW

TABLE 192 ODIX: PRODUCTS OFFERED

TABLE 193 ODIX: PRODUCT LAUNCHES

TABLE 194 ODIX: DEALS

13.2.10 GLASSWALL SOLUTIONS

TABLE 195 GLASSWALL SOLUTIONS: BUSINESS OVERVIEW

TABLE 196 GLASSWALL SOLUTIONS: PRODUCTS OFFERED

TABLE 197 GLASSWALL SOLUTIONS: PRODUCT LAUNCHES

TABLE 198 GLASSWALL SOLUTIONS: DEAL

13.2.11 SASA SOFTWARE

TABLE 199 SASA SOFTWARE: BUSINESS OVERVIEW

TABLE 200 SASA SOFTWARE: PRODUCTS OFFERED

TABLE 201 SASA SOFTWARE: DEALS

13.3 OTHER PLAYERS

13.3.1 JIRANSECURITY

13.3.2 YAZAMTECH

13.3.3 SOLEBIT (MIMECAST)

13.3.4 CYBACE SOLUTIONS

13.3.5 SOFTCAMP

13.3.6 GATEFY

*Details on Business overview, Products offered, Recent developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

14 ADJACENT MARKET (Page No. - 183)

14.1 INTRODUCTION

14.1.1 RELATED MARKETS

14.2 CYBERSECURITY MARKET

TABLE 202 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 203 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 204 CYBERSECURITY MARKET SIZE FOR SOFTWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 205 CYBERSECURITY MARKET SIZE FOR SOFTWARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 206 SERVICES: CYBERSECURITY MARKET SIZE, BY TYPE, 2015–2020 (USD MILLION)

TABLE 207 SERVICES: CYBERSECURITY MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 208 CYBERSECURITY MARKET SIZE, BY SOFTWARE, 2015–2020 (USD MILLION)

TABLE 209 CYBERSECURITY MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 210 CYBERSECURITY MARKET SIZE, BY SECURITY TYPE, 2015–2020 (USD MILLION)

TABLE 211 CYBERSECURITY MARKET SIZE, BY SECURITY TYPE, 2020–2026 (USD MILLION)

TABLE 212 CYBERSECURITY MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 213 CYBERSECURITY MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 214 CYBERSECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 215 CYBERSECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 216 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 217 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 218 CYBERSECURITY MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 219 CYBERSECURITY MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

14.3 DATA PROTECTION MARKET

TABLE 220 DATA PROTECTION MARKET SIZE, BY COMPONENT, 2015–2022 (USD BILLION)

TABLE 221 DATA PROTECTION MARKET SIZE, BY DEPLOYMENT MODE, 2015–2022 (USD BILLION)

TABLE 222 DATA PROTECTION MARKET SIZE, BY ORGANIZATION SIZE, 2015–2022 (USD BILLION)

TABLE 223 DATA PROTECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2015–2022 (USD BILLION)

TABLE 224 DATA PROTECTION MARKET SIZE, BY REGION, 2015–2022 (USD BILLION)

15 APPENDIX (Page No. - 192)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global content disarm and reconstruction market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from content disarm and reconstruction software vendors, industry associations, and independent consultants; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Content disarm and reconstruction market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the content disarm and reconstruction market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Content disarm and reconstruction market based on component, application area, deployment mode, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the content disarm and reconstruction market

- To analyze the impact of COVID-19 on components, application areas, verticals, organization size, deployment types, and regions across the globe.

- To analyze the market with respect to individual growth trends, prospects, and contributions to the content disarm and reconstruction market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the content disarm and reconstruction market

- To profile key players in the Content disarm and reconstruction market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the content disarm and reconstruction market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Content Disarm and Reconstruction Market