COVID-19 Impact on Logistics & Supply Chain Industry Market by Industry Verticals (Automotive, FMCG, Healthcare, Energy & Utilities,Industrial Machinery & Equipment), Mode of Transport (Roadways, Railways, Airways, Maritime), Region - Global Forecast to 2021

COVID-19 Impact on Logistics & Supply Chain Industry Market

Since logistics and supply chain form the key for seamless functioning of any industry vertical, disruption due to COVID-19 has brought business operations across several industries to a standstill. Logistics and transportation companies have faced sever losses across sectors such as automotive and industrial machinery & equipment. On the other hand, the market players have been under immense pressure due to higher emphasis of national governments on the continued supply of essential commodities and healthcare products. Thus, FMCG and healthcare sectors are expected to provide the much-needed push to logistics and supply chain companies, especially through the pandemic.

Top 10 Players:

- DHL: DHL was Founded in 1969 and headquartered in Bonn, Germany. In its fight against the pandemic, DHL implemented a warehouse management system and bought the retail and eCommerce inventories together.

- UPS: UPS was founded in 1907 and is headquartered in Georgia, US. To contain the virus, the company temporarily adjusted its Signature Required guidelines to ensure employee and customer safety.

- FedEx: FedEx was stablished in 1971 and is headquartered in Tennessee, US. It updated its store hours and available services for FedEx Office and other retail locations and suspended Signature Required for most shipments during the ongoing COVID-19 pandemic crisis.

- CEVA Logistics: Established in 2006 and headquartered in London, UK, CEVA adopted smart strategies for logistics cost optimization.

- Kuehne+Nagel: Established in 1890 and headquartered in Schindellegi, Switzerland, Kuehne+Nagel focused on protecting the health and safety of its employees. The company implemented global travel restrictions and conducted meetings through video conferencing.

- DB Schenker

- SNCF

- XPO Logistics

- Kenco Group

- Hitachi Transport System

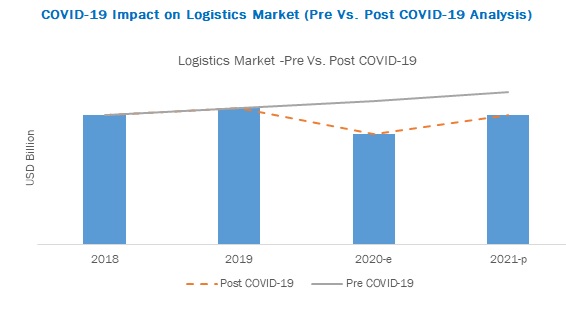

[60 Pages Report] Post-COVID-19, the global logistics & supply chain industry market size is projected to grow at a Y-O-Y growth of 17.6% from 2020 to 2021, to reach USD 3,215 billion in 2021 from USD 2,734 billion in 2020. The projection for 2021 is estimated to be down by over 10-15% as compared to pre-COVID-19 estimation.

The major drivers of this market are increasing supply of essential commodities, creation of supply chain stabilization task force to fight COVID-19, and growing demand and distribution of personal protective equipment.

To know about the assumptions considered for the study, Request for Free Sample Report

FMCG and healthcare industries to remain the largest in the logistics market.

Countries have exempted the manufacturing services regarding medical machinery and their supplies. The manufacturing of ventilators has increased as the number of COVID-19 positive cases continues to grow. For example, on April 14, 2020, Royal Philips planned to increase its hospital ventilator production to 4,000 units/week by Q3 2020 and introduced its new Philips Respironics E30 ventilator with immediate production of 15,000 units/week. Furthermore, the production and distribution of masks, gloves, medicines like HCQ has increased. The supply of essentials and the manufacturing of medical equipment is expected to drive the pharmaceutical and healthcare industry, and this will further boost the growth for the logistics and supply chain industry.

FMCG is one of the industries facing significant logistics challenges. Countries having a huge consumer base are facing major challenges when it comes to ensuring the continued supply of essential commodities. With limited availability of fast-moving consumer goods, consumers are experiencing a change in their lifestyle as they are receiving fewer products because of COVID-19 impact on the logistics and supply chain industry. However, FMCG companies are continuously tracking the current situation and are coming up with new strategies to contain the pandemic. The agriculture sector has been exempted from the restrictions laid by the countries. This has ensured sufficient supplies of food and other daily needs products. E-groceries continue to meet the increasing demand for daily supplies by the consumers. Amid the COVID-19 pandemic, Walmart Grocery application hit all-time high downloads in the US.

Roadways are the largest segment for the logistics market

Roadways and railways are relatively less affected by the COVID-19’s impact on the logistics sector when compared with airways and waterways. Due to heavy restrictions on international transport, roadways and railways have emerged highly important to maintain the optimum supply chain, especially for essential commodities. Being the preferred mode of transportation for essential goods, road transport is heavily relied upon for the continued supply of food, medicine, and other essential products.

Asia Pacific to have the largest logistics market size during the forecast period

Asia Pacific is expected to have the largest market sizing as the region has taken stringent measures to contain the virus. China has started to recover from the COVID-19 pandemic faster than any other country. Only some provinces of the entire country are in lockdown after the second wave of COVID-19. The World Health Organization has also appreciated India’s control over the spread of the pandemic. This has allowed the logistics and supply chain companies to meet consumer demands during the pandemic situation. The supply of vital products in Singapore, South Korea, and Japan has also regained normalcy. Thus, the Asia Pacific region is expected to show positive signs in the near future as the supply chain industry recovers gradually.

Key Market Players:

The logistics market is dominated by global players and comprises several regional players. Some of the key players in the logistics and supply chain industry market are DHL (Germany), UPS (US), FedEx (US), Kuehne+Nagel (Switzerland), CEVA Logistics (Switzerland), DB Schenker (Germany), SNCF (France), XPO Logistics (US), Kenco Group (US), and Hitachi Transport System (Japan).

DHL, UPS, and Kuehne+Nagel are some of the global logistics and supply chain industry that have adopted the strategies of partnerships, new product development, and supply chain contracts to retain their global presence in the market. By strengthening their business growth strategies, they have left a mark not only on the current market but also in emerging markets.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2021 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2021 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Industry vertical, Mode of Transport, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

DHL (Germany), UPS (US), Kuehne+Nagel (Switzerland), SNCF (France), and XPO Logistics (US) |

This research report categorizes the COVID-19 impact on logistics & supply chain industry market based on industry verticals, mode of transports, and regions.

By Industry Verticals

- Automotive

- FMCG

- Healthcare

- Energy & Utilities

- Industrial Machinery & Equipment

By Mode of Transport

- Roadways

- Railways

- Airways

- Maritime

By Region

- Asia Pacific

- Europe

- North America

- RoW

Recent Developments

COMPANY NAME |

PRECAUTIONARY MEASURES ADOPTED |

|

DHL |

|

|

UPS |

|

|

FedEx |

|

|

CEVA |

|

|

Kuehne+Nagel |

|

Key Questions Addressed by the Report

- What is the impact of COVID-19 on the logistics & supply chain industry market?

- What would be the impact of COVID-19 on the logistics & supply chain industry market by 2021?

- What are the business opportunities for global logistics companies?

- Which players of the logistics and supply chain ecosystem would get impacted? (Positive/Negative)

- Who are the major competitors in the logistics & supply chain industry market, and what are their growth strategies?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

1.2 IMPACT ON THE GDP OF MAJOR COUNTRIES

1.3 DEFINITION OF SCENARIOS (PESSIMISTIC, REALISTIC, & OPTIMISTIC)

(Statistics on COVID-19 cases and deaths by geography; worst affected countries and key measures (which may affect businesses) taken to overcome the pandemic)

2 RESEARCH METHODOLOGY

2.1 RESEARCH ASSUMPTION

2.2 PRIMARY ASSUMPTIONS

2.3 INCLUSION/EXCLUSION

2.4 STAKEHOLDERS

3 COVID 19 IMPACT ON LOGISTICS AND SUPPLY CHAIN INDUSTRY MARKET ECOSYSTEM

3.1 INTRODUCTION

3.2 COVID IMPACT ON OVERALL ECOSYSTEM AND KEY STAKEHOLDERS

3.2.1 MATERIAL SUPPLIERS

3.2.2 MANUFACTURERS

3.2.3 WAREHOUSING AND TRANSPORTATION

3.2.4 WHOLESALERS/DISTRIBUTORS

3.2.5 RETAILERS

3.3 KEY STRATEGIES ADOPTED BY SUPPLY CHAIN PARTICIPANTS

3.3.1 MANAGING CRITICAL SUPPLY CHAIN OPERATIONS AND LOGISTICS SERVICES

3.3.2 HEALTH AND SAFETY OF STAFF AND CUSTOMERS

3.3.3 COST AND CAPACITY OPTIMISATION

3.3.4 TECHNOLOGY USE CASES AND INNOVATION

3.3.5 RISK MANAGEMENT AND BUSINESS CONTINUITY

3.4 BUSINESS OPPORTUNITIES (TOP GAINERS V/S TOP LOSERS)

3.4.1 INVENTORY MANAGEMENT, PROCUREMENT

3.4.2 WAREHOUSING AND TRANSPORTATION

3.4.3 DISTRIBUTION/LOGISTICS

3.5 MACRO-ECONOMIC INDICATORS

3.5.1 SHORT TERM DRIVERS

3.5.2 SHORT TERM RESTRAINTS

(This chapter will include an overview of logistics and supply chain ecosystem and impact of COVID 19 of each stakeholder group, Recommendations & best practices followed across industry verticals)

4 COVIND 19 IMPACT ON SUPPLY CHAIN FUNCTIONS

4.1 PLANNING & STRATEGY

4.2 SOURCING

4.3 MANUFACTURING/PRODUCTION

4.4 DELIVERY/LOGISTICS

4.5 RETURN SYSTEM

(The chapter will include qualitative information on covid-19 impact across these aspects, key corrective measures taken by the companies to minimize the damage)

5 COVID-19 IMPACT ON LOGISTICS & SUPPLY CHAIN INDUSTRY MARKET SIZE, BY INDUSTRY VERTICAL

5.1 INTRODUCTION

5.2 AUTOMOTIVE

5.3 FMCG

5.4 HEALTHCARE

5.5 ENERGY & UTILITIES

5.6 INDUSTRIAL MACHINERY & EQUIPMENT

(The chapter will include the impact (in terms of revenue and growth/decline - 2018 to 2021) on overall logistics market for each industry vertical; key logistics trends observed across each industry amid the pandemic)

6 COVID-19 IMPACT ON LOGISTICS & SUPPLY CHAIN INDUSTRY MARKET SIZE, BY MODE OF TRANSPORT

6.1 INTRODUCTION

6.2 ROADWAYS

6.3 RAILWAYS

6.4 MARITIME

6.5 AIRWAYS

6.6 BIGGEST GAINERS & LOSERS, BY MODE OF TRANSPORT

(The chapter will cover the impact of COVID-19 (in terms of revenue and growth/decline - 2018 to 2021) on overall logistics market; the chapter would also cover the key trends observed across each mode of transport)

7 COVID-19 IMPACT ON LOGISTICS & SUPPLY CHAIN INDUSTRY MARKET SIZE, BY REGION

7.1 INTRODUCTION

7.2 ASIA PACIFIC

7.3 EUROPE

7.4 NORTH AMERICA

7.5 REST OF THE WORLD

(The chapter would cover quantitative and qualitative insights on logistics market w.r.t. COVID-19 by region - 2018 to 2021)

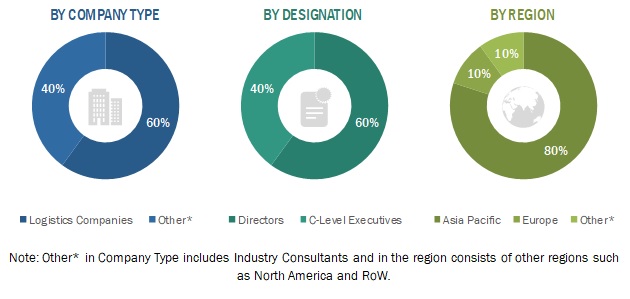

The study involves four main activities to estimate the current size of the logistics market. Exhaustive secondary research was done to collect information on the market, such as industry, mode of transport, and the impact of COVID-19. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, directories, databases, and articles from recognized associations and government publishing sources. Some of the sources include the World Bank, International Monetary Fund, International Union of Railways, and Society of Indian Automotive Manufacturers, among others. Various data points have been collected through secondary research such as key company’s revenues, gross domestic product, number of COVID-19 cases, and number of drivers.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the logistics market and supply chain scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side players across four major regions, namely North America, Europe, Asia Pacific, and the rest of the world (RoW—Latin America, the Middle East, and Africa). Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as supply chain, management, and logistics operations, to provide a holistic viewpoint in our report. The primary validations include the base market size, forecasted market size, CAGR, segment level data, and trends of each segment.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the global market. The logistics market size, by value, has been derived by identifying the region-wise restriction/trends on industry-wise operations as well as logistics services based on the available mode of transport.

All percentage shares, splits, breakdowns, and COVID-19 impact estimation have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data is mapped for each region under the scope of the study. Country-wise state of operation across different industry verticals was mapped during the study to estimate the possible impact on the logistics sector. Similarly, key factors challenging the logistics companies, along with major restrictions imposed on transportation, were studied to estimate the decline in logistics services across different regions. The market was also analyzed using a bottom-up approach to understand the region-wise impact of industrial operations on the logistics market.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in this report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast the logistics market based on industry, mode of transport, and region

- To forecast the market size of the logistics market, by value, based on industry (automotive, FMCG, healthcare, energy & utilities, and industrial machinery & equipment)

- To forecast the market size of the logistics market, in terms of value, based on the mode of transport (roadways, railways, airways, and maritime)

- To assess the impact of COVID-19 on each of the above segments and region

- To forecast the market size of the logistics market, in terms of value, with respect to key impacted regions (Asia Pacific, Europe, North America, and Rest of the World)

- To provide detailed information about the major factors influencing the growth of the COVID-19 impact on logistics & supply chain industry market (short term drivers, short term restraints, and business opportunities)

- To strategically analyze the market with respect to individual growth trends and prospects, and determine the contribution of each segment to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

- Textile Logistics Market

- Logistics Market for Select Countries

Growth opportunities and latent adjacency in COVID-19 Impact on Logistics & Supply Chain Industry Market

May i know the overall impact on all forms of logistics ,i.e(Road,Rail,Air,Water)?

I am interested in understanding the impact of this pandemic on Electronics manufacturing industry (home appliances, consumer electronics etc.). Can this be included in the study?

Interested in knowing the future of rail freight due to COVID-19 pandemic. What regions will offer more opportunities for rail freight in the future? Also, what can be the impact on other modes of transport?