Data Mesh Market by Offering (Solutions (Data Integration & Delivery, Federated Data Governance), Services), Application (Data Privacy & Customer Experience Management), Approach, Business Function, Vertical and Region - Global Forecast to 2028

Data Mesh Market - Industry Analysis, Demand & Size

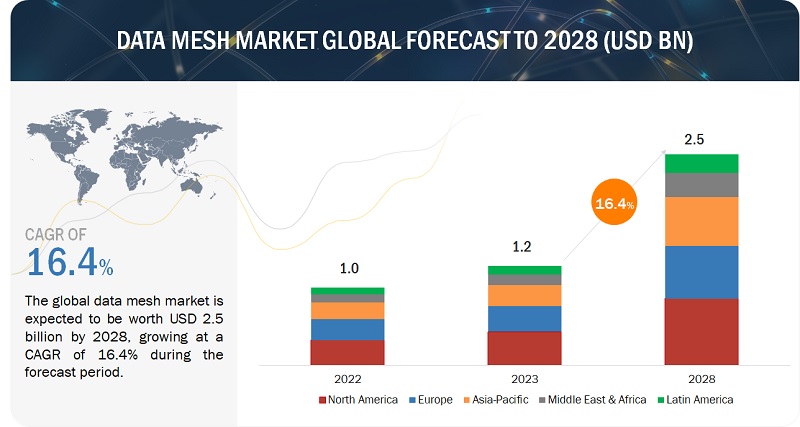

The global data mesh market size was valued at USD 1.2 billion in 2023 and is expected to grow at a CAGR of 16.4% from 2023 to 2028. The revenue forecast for 2028 is projected to reach $2.5 billion. The base year for estimation is 2022, and the historical data spans from 2023 to 2028.

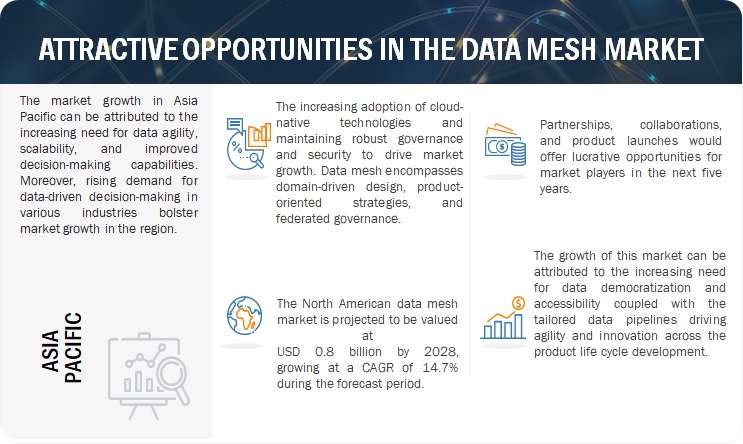

Due to various business drivers, the data mesh market is expected to grow significantly during the forecast period. The market is experiencing significant growth due to the increasing need for data democratization and accessibility. increasing adoption of cloud native technologies, and maintaining robust governance and security and tailored data pipelines driving agility and innovation are also responsible for driving the market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increasing need for data democratization and accessibility

The imperative for data democratization and accessibility stands as a pivotal driver in propelling the data mesh market forward. Within the framework of data mesh architecture, this need signifies a shift towards empowering various stakeholders across an organization with seamless access to relevant and reliable data. By democratizing data, organizations dismantle traditional silos, fostering a culture where diverse teams can autonomously access, understand, and leverage data pertinent to their roles and objectives. This democratized approach not only promotes greater collaboration but also accelerates decision-making processes by enabling quick access to real-time, contextualized data. Moreover, it engenders a culture of data ownership and responsibility among teams, fostering innovation and driving efficiencies. Data mesh strategies prioritize accessibility by encapsulating data into self-serve, manageable domains, ensuring that data is not only available but also comprehensible and usable for those who require it. This shift towards democratization and accessibility of data forms a foundational driver in the data mesh market, catering to the evolving needs of organizations striving for agility, informed decision-making, and innovation in a data-driven landscape.

Restraints: Addressing security and compliance conundrums

In the burgeoning landscape of the data mesh paradigm, the intricacies surrounding security and compliance pose as critical restraints, prompting a careful balancing act between innovation and safeguarding sensitive information. The distributed nature of data mesh, with its decentralized ownership of data domains, introduces a myriad of security challenges that demand meticulous attention. As data is fragmented across various domains and owned by different teams within the organization, ensuring consistent security measures and compliance standards becomes increasingly complex. This fragmentation inherently heightens the risk of data breaches, unauthorized access, and inconsistent application of security protocols across diverse datasets. Data mesh's emphasis on democratizing data and promoting autonomy at the domain level further exacerbates security concerns. Addressing these security and compliance conundrums demands comprehensive strategies encompassing robust encryption, access control mechanisms, consistent auditing, and monitoring practices across the data mesh architecture. Achieving this balance will be instrumental in realizing the full potential of data mesh while ensuring the protection and integrity of sensitive information within today's data-driven ecosystem.

Opportunity: Unlocking granular control for data governance

In the evolving landscape of data mesh architecture, the concept of federated computational governance emerges as a crucial opportunity, offering a paradigm shift in how organizations manage and govern their distributed data. This approach represents a decentralized model where governance is not centralized but distributed across various data domains and domains of expertise within an organization. Federated computational governance is a framework that facilitates collaboration and decision-making while ensuring compliance, security, and quality across interconnected data domains. Within this context, federated computational governance enables the establishment of federated data ownership, where domain-specific experts, rather than a central governing body, are responsible for ensuring the quality, security, and privacy of their data. This distributed ownership fosters a sense of accountability and ownership among data stewards and domain experts, aligning governance practices more closely with the nuances and intricacies of each data domain. Furthermore, this framework integrates metadata management and data cataloging across domains, facilitating the discovery and understanding of data assets while ensuring consistent metadata standards and governance policies. This decentralized governance model encourages the rapid prototyping of new ideas, promotes data-driven decision-making, and facilitates the exploration of novel data use cases without compromising compliance and security standards. Therefore, increasing adoption of federated computational governance is anticipated to provide growth opportunities for the data mesh market.

Challenge: Bridging the gap between data silos

Data silos, entrenched repositories of information isolated within different departments or systems, present a significant hurdle to achieving the interconnectedness and agility sought after in modern data ecosystems. These silos often result from legacy infrastructures, varied data formats, incompatible technologies, or departmentalized data ownership within organizations. The challenge lies not only in breaking down these barriers but also in harmonizing disparate data sources without compromising their autonomy or integrity. In the context of data mesh architecture, the challenge intensifies due to the decentralized nature of data ownership and management. Each domain or team in a data mesh operates independently, managing its data domain with its own rules, formats, and governance protocols. This decentralization, while empowering individual units, can exacerbate the problem of data silos. It's essential to establish a framework that encourages collaboration and interoperability without compromising the autonomy of these domains. The intricacies of bridging data silos within a data mesh framework require innovative approaches. Companies venturing into the data mesh market face the task of implementing technologies and methodologies that facilitate seamless data exchange and integration while respecting the sovereignty of each data domain. This demands robust data governance frameworks, standardized protocols, and interoperable tools that enable data discovery, access, and sharing across domains. Additionally, fostering a culture of collaboration and alignment with overarching business objectives becomes crucial to break down silos effectively. Addressing this challenge not only requires technological advancements but companies also need to invest in change management strategies, fostering a culture that prioritizes data democratization while ensuring compliance with security and privacy standards.

Data Mesh market Ecosystem

By approach, the Fine-grained segment to register the highest CAGR during the forecast period.

The data mesh market by approach includes fine-grained mesh, hybrid federated mesh, value chain-aligned mesh, and coarse-grained mesh. The fine-grained mesh segment within the broader context of data mesh is witnessing notable growth driven by several pivotal factors. This specialized niche within data mesh focuses on intricate, granular data management, catering to the evolving needs of organizations for precise and detailed data control. The surge in data complexity and diversity, coupled with the need for more targeted data handling at micro-levels, has propelled the demand for fine-grained mesh solutions.

By vertical, healthcare and life sciences register the highest CAGR during the forecast period.

The healthcare and life sciences segment is projected to grow more during the forecast period. The increasing volumes of healthcare data, including patient records, genomic information, and research data, necessitate innovative approaches like data mesh. The decentralized nature of data mesh aligns with the diverse and specialized domains within healthcare and life sciences, enabling better integration and analysis across different data sources. Additionally, the emphasis on interoperability and data sharing among healthcare institutions and research entities is driving the adoption of data mesh frameworks. Furthermore, the growing importance of personalized medicine and precision healthcare relies heavily on comprehensive, domain-specific data insights, making data mesh an appealing solution.

By business function, the HR segment to register highest CAGR during the forecast period.

The data mesh is reshaping the landscape of HR business functions, experiencing notable growth due to several influential factors. The increasing focus on employee-centric strategies demands a more personalized understanding of workforce data, driving the adoption of data mesh frameworks. HR departments are leveraging these frameworks to handle the complexity of diverse data sources, spanning employee engagement metrics, performance data, skills inventory, and more. Moreover, the rising prominence of AI and analytics in HR functions requires a holistic and domain-oriented data approach, aligning well with the core ethos of data mesh.

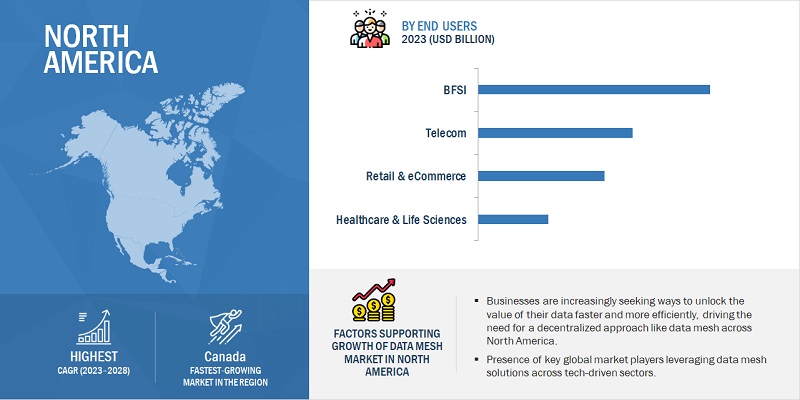

By region, North America to witness the largest market size during the forecast period.

North America is experiencing significant technological growth in the data mesh market. Companies in this region are increasingly embracing the data mesh paradigm, recognizing its potential to address complex data challenges. One notable trend is the rise of specialized tools and platforms catering specifically to data mesh principles. These solutions aim to facilitate decentralized data architectures, enabling seamless integration, governance, and accessibility across diverse domains and teams.

Key Market Players

The data mesh solution and service providers have implemented various types of organic and inorganic growth strategies, such as product upgrades, new product launches, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the data mesh market include IBM (US), AWS (US), SAP (Germany), Oracle (US), Informatica (US), K2view (US), Talend (US), Denodo (US), HPE (US), NetApp (US), Teradata (US), Monte Carlo (US), Radiant Logic (US), Snowflake (US), Google (US), Microsoft (US), Global IDs (US), Estuary (US), DataKitchen (US), Databricks (US), Cinchy (Canada), Intenda (Netherlands), Ataccama (Canada), Alation (US), Collibra (US), Dremio (US), Starburst (US), Nexla (US), NextData (Australia), Hevo Data (US), Atlan (US), CluedIn (Denmark), Iguazio (Israel) and Alex Solutions (Australia).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Offering, Approach, Business Function, Application, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), AWS (US), SAP (Germany), Oracle (US), Informatica (US), K2view (US), Talend (US), Denodo (US), HPE (US), NetApp (US), Teradata (US), Monte Carlo (US), Radiant Logic (US), Snowflake (US), Google (US), Microsoft (US), Global IDs (US), Estuary (US), DataKitchen (US), Databricks (US), Cinchy (Canada), Intenda (Netherlands), Atacama (Canada), Alation (US), Collibra (US), Dremio (US), Starburst (US), Nexla (US), NextData (Australia), Hevo Data (US), Atlan (US), CluedIn (Denmark), Iguazio (Israel) and Alex Solutions (Australia). |

This research report categorizes the data mesh market based on offering, approach, business function, application, vertical, and region.

By Offering:

-

Solution

-

Data Integration and Delivery

- ETL (Extract, Transform, Load)

- Data Pipeline and Workflow Management

- Data Mapping and Transformation

-

Federated Data Governance

- Metadata Management

- Data Quality and Security

- Compliance and Regulatory Tools

-

Data Operations

- Monitoring and Observability

- Data Cataloging and Discovery

- Data Lifecycle Management

-

Data Transformation and Orchestration

- Schema Evolution

- Data Orchestration and Synchronization Platforms

- Other solutions

-

Data Integration and Delivery

-

Solutions by Deployment Mode

- Cloud

- On-premise

-

Services

-

Professional Services

- Consulting and Implementation

- Support and Maintenance

- Training and Education

- Advisory and Strategy

- Implementation and Deployment

- Governance and Security

- Managed Services

-

Professional Services

By Business Function:

- Finance & Accounting

- Sales & Marketing

- Research & Development

- Operations & Supply Chain

- HR

- ITSM

By Approach:

-

Fine-grained

- Fully Federated Mesh

- Fully Governed Mesh

- Hybrid federated mesh

- Value chain-aligned mesh

-

Coarse-grained

- Aligned Mesh

- Governed Mesh

By Application:

- Customer Experience Management

- Data Privacy Management

- Chatbots/ Virtual Assistants

- Campaign Management

- IoT Monitoring

- Other Applications

By Vertical:

- BFSI

- Healthcare & Life Sciences

- Telecom

- Retail & E-Commerce

- Government & Public Sector

- Energy & Utilities

- IT/ITeS

- Transportation & Logistics

- Manufacturing

- Other Vertical

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Egypt

- Turkey

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In December 2023, IBM Cloud Pak for Data team announced the general availability of Cloud Pak for Data (CPD) version 4.8. The release includes an array of features tied together with an emphasis around serviceability enhanced the management and maintenance of CPD Platform and services. These serviceability improvements provide more information about the platform to proactively ensure a stable environment for CPD production workloads.

- In September 2023, Oracle and Microsoft have announced Oracle Database at Azure, which gives customers direct access to Oracle database services running on Oracle Cloud Infrastructure (OCI) and deployed in Microsoft Azure datacenters.

- In June 2023, Informatica announced the availability of the company’s leading end-to-end AI-powered data management platform Intelligent Data Management Cloud (IDMC) in AWS Asia Pacific (Tokyo) region to support customers in their data-led cloud modernization journey.

- In April 2023, Siemens and IBM announced to expand their long-term partnership by collaborating to develop a combined software solution. The new software solution integrate their respective offerings for systems engineering, service lifecycle management and asset management.

- In March 2023, SAP announced SAP Datasphere, a comprehensive data service built on SAP Business Technology Platform (SAP BTP) that enables every data professional to deliver seamless and scalable access to mission-critical business data. State-of-the-art data flow capabilities allow organizations to automatically generate pipelines at enterprise scale. We also enriched the business semantic layer with advanced modeling capabilities.

Frequently Asked Questions (FAQ):

What is Data Mesh?

Data mesh embodies a solution architecture centered around crafting business-centric data products, acknowledging the pervasive presence of data. It strongly advocates for centralizing data in product design, urging data product or domain owners to establish upfront data product requisites. This proactive approach aids organizations in constructing self-service data platforms tailored to specific domains, expediting the pace of data delivery.

What is the total CAGR expected to be recorded for the Data Mesh market during forecast period?

The market is expected to record a CAGR of 16.4% during the forecast period.

Which are the key drivers supporting the growth of the Data Mesh market?

Some factors driving the growth of the data mesh market are increasing need for data democratization and accessibility, tailored data pipelines driving agility and innovation, increasing adoption of cloud native technologies, and maintaining robust governance and security.

Which are the key business functions prevailing in the Data Mesh market?

The key business functions gaining a foothold in the data mesh market are finance & accounting, sales & marketing, research & development, operations & supply chain, HR and ITSM.

Who are the key vendors in the Data Mesh market?

Some major players in the data mesh market include IBM (US), AWS (US), SAP (Germany), Oracle (US), Informatica (US), K2view (US), Talend (US), Denodo (US), HPE (US), NetApp (US), Teradata (US), Monte Carlo (US), Radiant Logic (US), Snowflake (US), Google (US), Microsoft (US), Global IDs (US), Estuary (US), DataKitchen (US), Databricks (US), Cinchy (Canada), Intenda (Netherlands), Ataccama (Canada), Alation (US), Collibra (US), Dremio (US), Starburst (US), Nexla (US), NextData (Australia), Hevo Data (US), Atlan (US), CluedIn (Denmark), Iguazio (Israel) and Alex Solutions (Australia). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

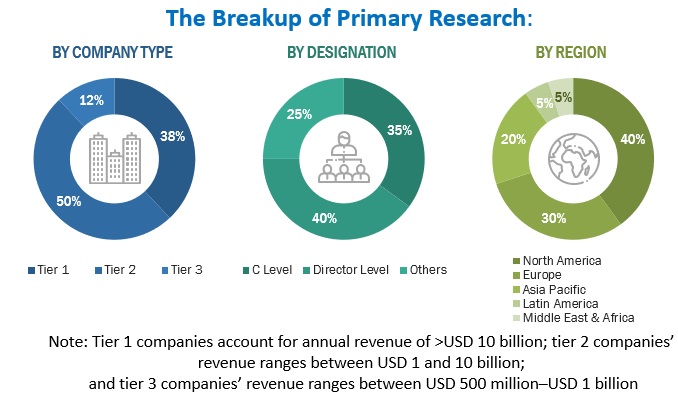

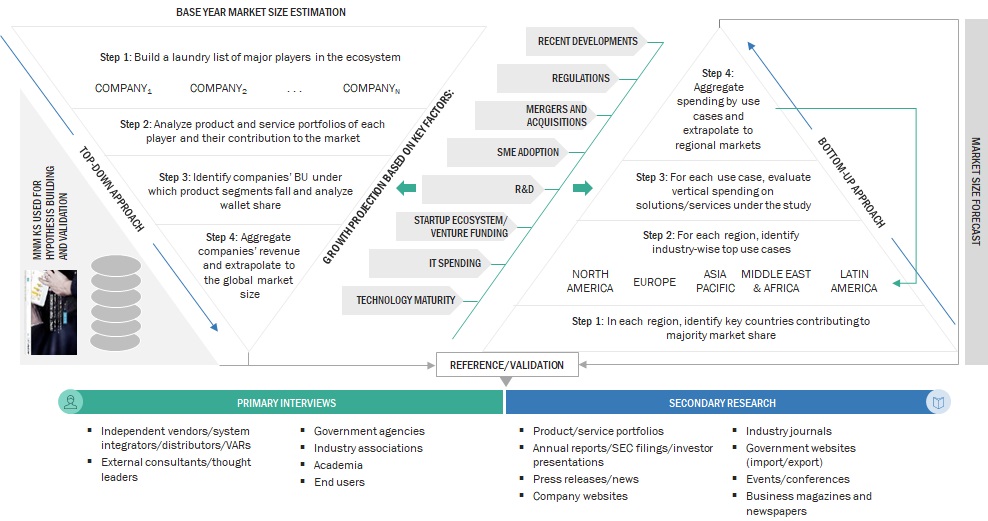

The data mesh market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred data mesh providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, data mesh spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, approach, business function, application, vertical, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and data mesh expertise; related key executives from data mesh solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using data mesh solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of data mesh solutions and services, which would impact the overall data mesh market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Atlan |

Director |

|

K2view |

Director of Marketing |

|

Informatica |

Director of Platform and Industry Marketing |

|

Denodo |

Director of Product Marketing |

Market Size Estimation

In the bottom-up approach, the adoption rate of data mesh solutions and services among different end users in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of data mesh solutions and services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the data mesh market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major data mesh providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall data mesh market size and segments’ size were determined and confirmed using the study.

Global Data Mesh Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the data mesh market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major data mesh providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall data mesh market size and segments’ size were determined and confirmed using the study.

Market Definition

A data mesh serves as an architectural blueprint aimed at addressing intricate data security concerns by embracing a distributed, decentralized ownership model. Organizations often grapple with numerous data sources stemming from various business sectors, necessitating integration for comprehensive analytics. Through a data mesh architecture, these diverse data origins are effectively unified and interconnected using centralized guidelines for data sharing and governance.

Stakeholders

- Data mesh vendors

- Data mesh service vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the data mesh market by offering (solutions, services, and solutions by deployment mode), business function, approach, application, vertical and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of recession across all the regions across the data mesh market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American data mesh market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Data Mesh Market