Digital Therapeutics Market / DTx Market by Offerings (Platform, Virtual Reality/Games), Revenue Model (Subscription, Value Based), Application (Therapy (Diabetes, Obesity, CNS, Respiratory, CVD), Drug Adherence, Rehab/Patient care) - Global Forecast to 2028

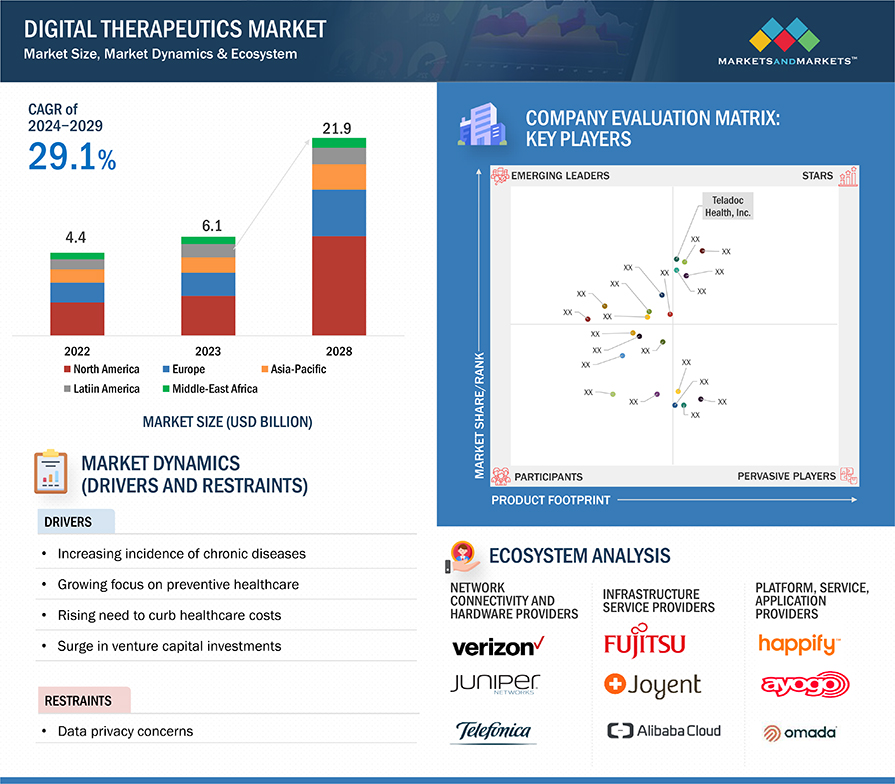

The global digital therapeutics market in terms of revenue was estimated to be worth $6.1 billion in 2023 and is poised to reach $21.9 billion by 2028, growing at a CAGR of 29.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

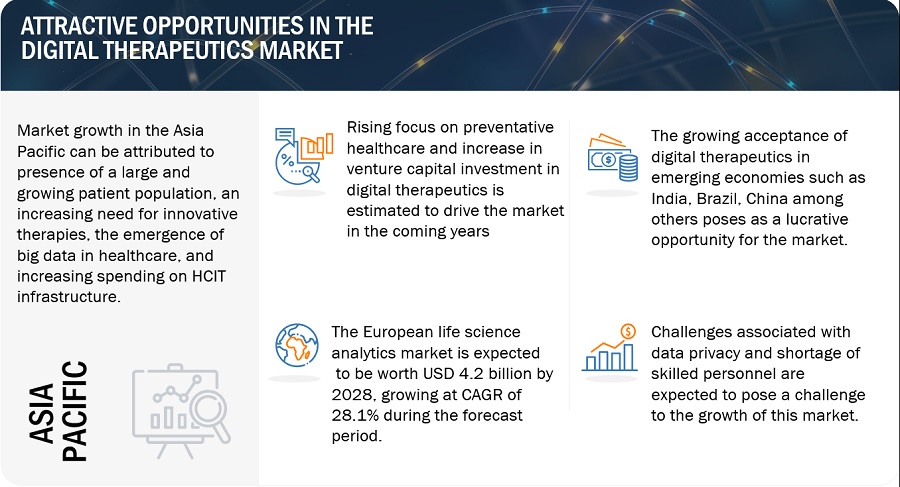

Growth in this market is primarily driven by the rising of preventable chronic diseases, the need to control healthcare costs, increasing venture capital investment and benefits of digital therapeutics. North America held the highest share in the global market. North America boasts a highly advanced and well-established healthcare infrastructure. The presence of technologically advanced healthcare systems, a high level of digital literacy among healthcare professionals, and a widespread use of electronic health records create a conducive environment for the integration of digital therapeutics.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Digital Therapeutics Market Dynamics

Driver: Rising focus on Preventative Healthcare

Primary preventive measures can help prevent or arrest the disease in its earliest stages by promoting healthier lifestyles or immunizing against infectious diseases. Many leading causes of death and disability can be prevented with adequate measures. There is a growing consensus among policymakers, providers, and patients that preventive, behavioral, and lifestyle changes are effective pills or procedures.

In the US, chronic conditions account for ~75% of the USD 3.5-trillion annual healthcare spending (Source: chronicdisease.org and the CMS, 2019). However, these chronic diseases are largely preventable. Government legislation and initiatives, such as the Patient Protection and Affordable Care Act (PPACA) (2010), aim at making preventive care affordable and accessible. Owing to the Act, programs incentivizing preventive treatment options are becoming popular.

Restraint: Reluctance among patients to adopt digital therapeutics

Motivating people to use digital therapeutics and building their confidence is a major challenge faced by digital therapeutics providers. While older and underserved populations show maximum susceptibility to diseases and the highest occurrence rates, they are the least likely to use digital therapeutics products due to low technology literacy levels. Furthermore, the limit of how much behavioral change will be observed with digital therapeutics is still undefined.

The clinical validation and deployment of digital therapeutics are carried out on self-selected or volunteer patients; however, their effect on patients showing resistance is still unknown. Furthermore, it is unknown whether digital therapeutics can be sustained over longer periods; there is little information on total patient retention and long-term outcomes. Many patients still rely on traditional means of diagnosis and treatment and thus show reluctance to adopt these novel therapies. This poses a major challenge to the digital therapeutics market.

Opportunity: Large undiagnosed and untreated population

Despite the availability of highly effective and low-cost treatment options for chronic disorders, a large undiagnosed and untreated population still exists. According to the WHO, many people affected by chronic diseases do not get the required treatment and care. According to WHO, in 2019, over one billion people with hypertension (82% of all people with hypertension worldwide) lived in low and middle-income countries. According to BMC Public health Journal 2022, the overall prevalence rates of undiagnosed, untreated, and undertreated hypertension among older adults in India were 42.3%, 6%, and 18.7%, respectively. Approximately 90% of COPD deaths occur in low and middle-income countries, as they do not get the required treatment. Over 75% of CVD-related deaths occur in low and middle-income countries, primarily due to low/limited access to appropriate care. Often, treatment for these conditions is not integrated into primary healthcare—the only access to medical care across these regions.

Hence, the affected population is deprived of the necessary care. Other factors, such as underdeveloped health delivery systems, a lack of trained personnel, the absence of essential drugs, and the prevalence of traditional beliefs and practices, also lead to a significant untreated population. This population presents ample opportunities for the implementation of digital therapeutics. Since digital therapeutics is delivered online, it is more accessible than conventional treatment solutions and can reach more patients.

Challenge: Lack of awareness and access to digital therapeutics programs in developing countries

Healthcare information technology has witnessed significant growth in developing regions owing to healthcare reforms. However, the IT infrastructure is still inadequate to meet the demands and needs of the increasing population in these countries. Most healthcare professionals (HCPs) highlighted a lack of awareness regarding the availability and benefits of digital therapeutics.

In general, there is a lack of knowledge about the efficacy of digital therapeutics and whether these solutions have robust clinical trial data to support their use. This notion is even more prominent in markets with elevated skepticism and conservatism toward digital technology (e.g., Germany and Belgium). Digital health advancements are currently restricted primarily to economically and socially developed regions. As a result, developing regions lack awareness and access to these technological advancements in healthcare. This condition is more pronounced among the underserved populations in the rural areas of developing countries. Some common barriers include a lack of appropriate knowledge about healthcare, lack of competency for using e-health solutions, lack of digital literacy, limited or no access to the Internet, and an overall lack of awareness of digital therapeutics and its advantages.

Digital Therapeutics Market Ecosystem

The market ecosystem comprises entities responsible for the end-to-end workflow of digital therapeutics services. The major stakeholders present in this market include network connectivity providers, infrastructure service providers, platform/service/application providers, hospitals and healthcare systems, employers, healthcare payers, government regulatory bodies and start up companies. The demand continues to grow and expand, especially after the outbreak of the COVID-19 pandemic. Solution and service providers continue to enhance and mature their offerings to add value.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

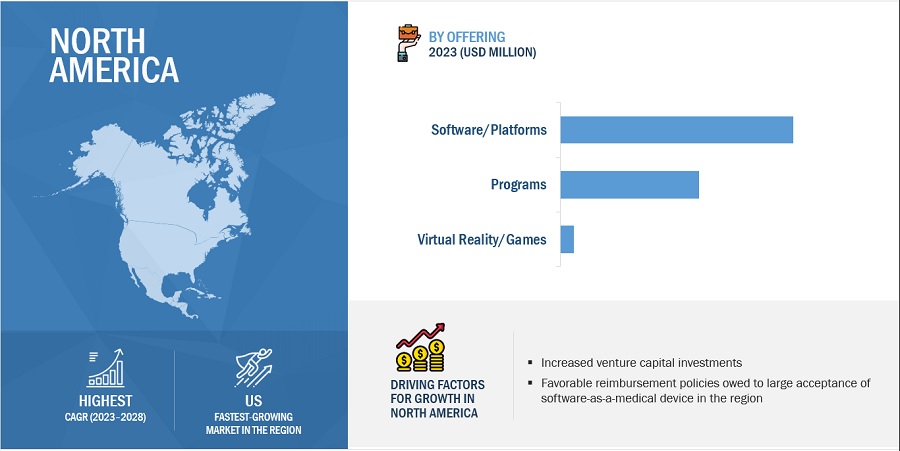

Software/Platforms segment of the digital therapeutics industry is anticipated to garner the highest share during the forecast period.

The digital therapeutics market based on offering is segmented into software/platforms, programs, and virtual reality/games. Software/Platforms is estimated to capture the largest share over the study period. This dominance is driven by the increasing reliance on sophisticated software solutions to deliver therapeutic interventions, reflecting a growing trend toward digital health solutions. The segment's prominence highlights the crucial role of advanced technologies and platforms in shaping the trajectory of the global market.

Business-to-Buisness segment is anticipated to account for the lion’s share of digital therapeutics industry, by Sales in 2022.

The digital therapeutics market is divided based on sales channel into business-to-business (B2B), and business-to-customer (B2C). This is owing to the increasing adoption among payers, employers, and providers understanding the benefits of digital therapeutics. Additionally, the inclination of pharmaceutical companies to incorporate digital therapeutics with their drug products is also estimated to drive the adoption of the products within these end-user segment.

Care-related/Treatment applications are the highest share of the digital therapeutics industry, by applications in 2022.

The digital therapeutics market is bifurcated based on applications into care-related/treatment and preventive applications. The growth of the care-related/treatment applications segment is owed to the rising economic burden of their treatment, and investments in digital therapeutics to promote the advancement of cost-effective and scalable treatment platforms for these conditions.

North America to lead the digital therapeutics industry in 2022.

The segmentation of the digital therapeutics market based on region, encompasses North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. As of 2022, North America held the dominant market share, with Europe following closely behind. The accelerated growth in North America is primarily ascribed to increased investments in digital therapeutics, improvements in the reimbursement framework for these solutions, a surge in the number of new startups in the digital therapeutics sector, and government initiatives aimed at promoting technological advancements in this region.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in digital therapeutics market include Noom, Inc (US), Teladoc Health, Inc. (US), Omada Health, Inc. (US), WellDoc, Inc (US), Biofourmis (US), Better Therapeutics, Inc (US), Amalgm Rx (US), CogniFit Inc (US), Headspace Health (US), Propeller Health (US), Virta Health Corp (US), 2Morrow, Inc. (US), Realizedcare (US), Canary Health (US), Twill Inc. (US), Click Therapeutics, Inc. (US), Akili, Inc. (US), Cognoa, Inc (US), Wellthy Therapeutics Pvt. Ltd. (India), Kaia Health (Germany), Ayogo (Canada), Mindable Health GmbH (Germany), Hinge Health, Inc. (US), and Freespira (US).

Scope of the Digital Therapeutics Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$6.1 billion |

|

Projected Revenue by 2028 |

$21.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 29.1% |

|

Market Driver |

Rising focus on Preventative Healthcare |

|

Market Opportunity |

Large undiagnosed and untreated population |

The research report categorizes the digital therapeutics market to forecast revenue and analyze trends in each of the following submarkets:

By Offering

- Programs

- Software/Platforms

- Virtual Reality/Games

By Revenue Modal

- Subscription

- One time Purchase/Licensing

- Outcome/Value based

By Sales Channel

- B2C

- Patients

- Caregivers

- B2B

- Providers

- Payers

- Employers

- Pharmaceutical Companies

- Other Buyers

By Application

- Preventive Applications

- Prediabetes

- Obesity

- Nutrition

- Lifestyle Management

- Other Preventive Applications

- Treatment/Care-related Applications

- Diabetes

-

CNS Disorders

- Mental Health Disorder

- Other CNS Disorders

- Chronic Respiratory Disorders

- Musculoskeletal Disorders

- Cardiovascular Diseases

- Smoking Cessation

- Medication Adherence

- Gastrointestinal Disorders

- Substance Use & Addiction Management

- Rehabilitation & Patient Care

- Other Treatment/Care-related Applications

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of the APAC

-

Latin America (LATAM)

- Brazil

- Mexico

- Rest of Latin America (RoLATAM)

-

Middle East & Africa (MEA)

- GCC Countries

- Rest of Middle East & Africa (RoMEA)

Recent Developments of Digital Therapeutics Industry:

- In May 2023, Noom, Inc. announced a new program, Noom Med, designed to fight the disease of obesity. Noom Med is a program that has offers telehealth services with Noom’s personalized psychological tools for patients enrolling for weight loss.

- In May 2023, Omada Health announced a specialized program enhancement for members taking GLP-1s, in response to the growing interest and demand for the medication.

- In August 2022, Teladoc Health announced a home A1C (hemoglobin A1C) testing program for its Livongo product to help Teladoc Health members manage and control their diabetes via blood glucose meters.

- In April 2021, Welldoc (US) partnered with Dexacom (US). This partnership helped provide BlueStar with Dexcom G6 CGM as a single platform to people with Type 2 diabetes for improved health.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital therapeutics market?

The global digital therapeutics market boasts a total revenue value of $21.9 billion by 2028.

Which offerings have been included in the Digital Therapeutics market report?

The global digital therapeutics market has an estimated compound annual growth rate (CAGR) of 29.1% and a revenue size in the region of $6.1 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

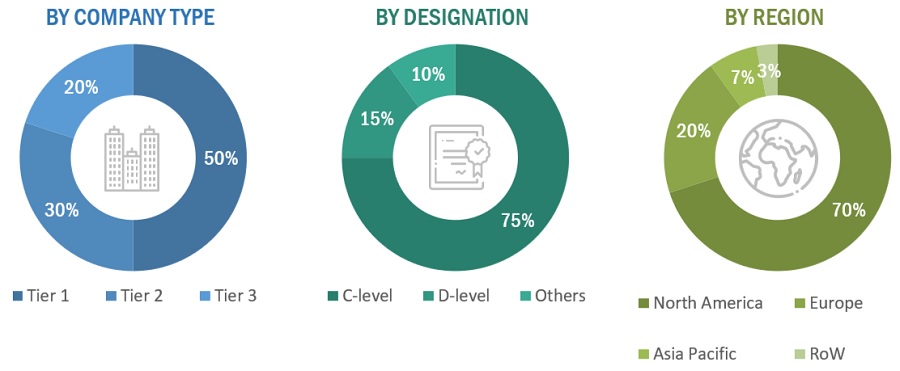

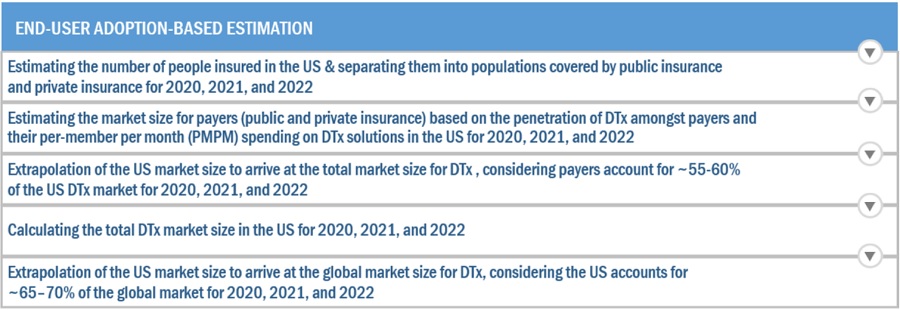

The digital therapeutics market research study includes four key steps to estimate the market size. Extensive secondary research was carried out to gather information about the market, its key players and its parent industry. The following step was to authenticate the research outcomes, insights and evaluations through primary research with industry experts across the value chain. A combination of bottom-up and top down approaches were executed to derive the final market sizes. Market segmentation and data triangulation techniques were conducted to estimate the market size of segments and sub-segments.

Secondary Research

Secondary research served as the primary method for identifying and gathering information for the comprehensive, technical, market-oriented, and commercial analysis of the digital therapeutics market. Various secondary sources, including directories, databases such as Bloomberg Businessweek, Factiva, and Wall Street Journal, white papers, and annual reports, were consulted to extract key information about major players, market classification, and segmentation based on industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth dialogues were conducted with diverse primary respondents, including subject matter experts (SMEs), key industry participants, industry consultants and C-level executives of major market players, among other experts. This was done to acquire and validate critical qualitative and quantitative information, as well as to assess the market prospects. Various primary sources from both the supply and demand sides of the market were engaged in interviews to obtain qualitative and quantitative insights. The breakdown of primary respondents is detailed below:

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales, marketing, and product and service managers.

Note 3: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 100 million, Tier 2 = USD 100 million to USD 10 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The determination of the total size of the digital therapeutics market involved the utilization of both top-down and bottom-up approaches. These methods were extensively applied to assess the sizes of various subsegments within the market. The research methodology employed for market size estimation is outlined as follows:

- Identification of key players in the industry and markets was conducted through thorough secondary research. This involved studying annual and quarterly financial reports, regulatory filings, and data books of major market players. Additionally, insights were gathered through interviews with industry experts to obtain detailed market perspectives.

- All percentage shares, splits, and breakdowns for the global digital therapeutics market were derived from secondary sources and subsequently verified through primary sources.

- Key macro indicators influencing the revenue growth of market segments and subsegments were considered. These factors were examined in detail, verified through primary research, and analyzed to obtain validated quantitative and qualitative data.

- The collected market data underwent consolidation and was complemented with detailed inputs and analysis, resulting in the comprehensive presentation found in this report.

Digital Therapeutics: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Therapeutics: Top Down Approach

Data Triangulation

Following the determination of the overall market size in the estimation process, the total market was segmented into various segments and subsegments. To finalize the market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were applied whenever applicable. The triangulation of data involved a comprehensive study of various factors and trends from both the demand and supply sides of the market.

Market Definition

Digital therapeutics are health or social care interventions delivered either wholly or significantly through a smart device to induce a behavioral change in the patient. Digital therapies/programs are cost-effective and can improve patient engagement and bring about substantial changes in patient health. These solutions are evidence-based, clinically approved, and prescribed as software-as-a-drug.

Key Stakeholders

- Digital Therapeutics Platform/Software/App/Therapy/Program Developers

- Healthcare Institutions/Providers (Hospitals, medical Groups, Physician Practices, Community Clinics, Psychiatrists, and Outpatient Clinics)

- Healthcare Insurance Companies/Payers

- Healthcare IT Solution Providers

- Venture Capitalists

- Government Agencies

- Market Research and Consulting Firms

Report Objectives

- To provide detailed information regarding the major factors influencing market growth, including drivers, restraints, opportunities, and challenges.

- To define, describe, and forecast the digital therapeutics market based on sales channel, application, and region.

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall digital therapeutics market.

- To forecast the size of market segments in four main regions: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), and Middle East & Africa (MEA).

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To profile key players and analyze their market shares and core competencies.

- To track and analyze competitive developments such as product launches, partnerships, agreements, expansions, mergers, and acquisitions in the digital therapeutics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Therapeutics Market

Which is the fastest growing market of Digital Therapeutics Market?

Which are the key factors driving the growth of the Global Digital Therapeutics Market?

What are the growth estimates for Digital Therapeutics Market till 2026?