Digital Diabetes Management Market by Product (Device (CGM, Smart Glucometer, Insulin Patch Pump), Diabetes Apps, Service, Software & Platforms), Device Type (Handheld & Wearables), End User (Hospitals & Self/Home Healthcare) - Global Forecast to 2028

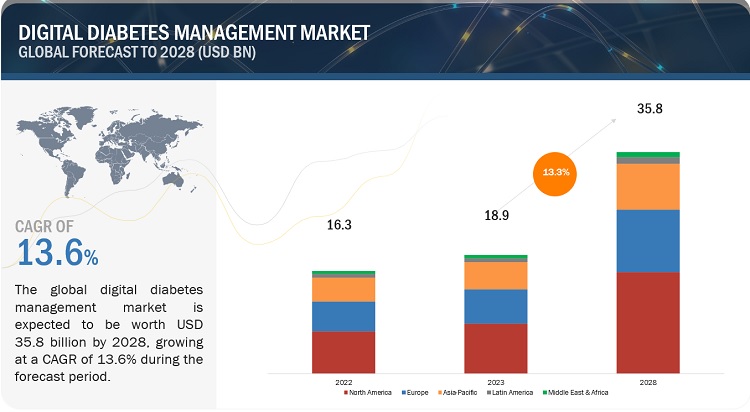

The global digital diabetes management market, valued at US$16.3 billion in 2022, stood at US$18.9 billion in 2023 and is projected to advance at a resilient CAGR of 13.6% from 2023 to 2028, culminating in a forecasted valuation of US$35.8 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The demand for better diabetes care solutions has grown of greater significance as diabetes prevalence has increased. Additionally, technological developments have made it possible to introduce highly adaptable solutions to the market. Other significant drivers of market growth include the increasing popularity for the use of connected devices and apps as well as the growing adoption of cloud-based enterprise solutions. However, during the forecast period, growth in this market is expected to be restricted by factors like high device costs, a lack of reimbursement in developing countries, and a higher acceptance of traditional diabetes management devices.

Global Digital Diabetes Management Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Diabetes Management Market Dynamics

Driver: Advent Of Artificial Intelligence In Diabetes Care Devices

Artificial intelligence (AI) is a fast-growing field, and its applications in diabetes have reformed the approach to the diagnosis and management of this chronic condition. Principles of machine learning have been used to build algorithms to support predictive models for the risk of developing diabetes or its consequent complications.

Technical advances have helped to optimize resource use in diabetes. Together, these intelligent technical reforms have produced better glycemic control with reductions in fasting and postprandial glucose levels, glucose excursions, and glycosylated hemoglobin. AI will introduce a paradigm shift in diabetes care from conventional management strategies to building targeted data-driven precision care. Livongo Health (US), for example, is using a big-data-enabled approach to help people manage their health and improve their lifestyles. Several people are using the company’s innovative products, including blood glucose meters, blood pressure cuffs, and scales, which have the ability to collect data and send it to a larger database. This data is subsequently used by the company to generate comprehensive insights for the benefit of patients.

Several companies are leveraging artificial intelligence (AI) in diabetes care devices to enhance monitoring, management, and treatment of the condition. Here are a few notable examples:

Medtronic: Medtronic is a leading medical technology company that has developed an artificial pancreas system called the MiniMed 670G. This closed-loop system uses AI algorithms to automatically adjust insulin delivery based on continuous glucose monitoring. The AI-powered system aims to maintain optimal glucose control and reduce the burden on individuals with diabetes.

Abbott: Abbott's FreeStyle Libre system utilizes AI algorithms to provide glucose trend predictions and alerts. The device continuously monitors glucose levels, and the accompanying mobile app uses AI to analyze the data and provide insights to help individuals make informed decisions about their diabetes management.

Dexcom: Dexcom is known for its continuous glucose monitoring (CGM) systems, such as the Dexcom G7. These devices use AI algorithms to analyze glucose data and provide real-time information on glucose trends, enabling users to proactively manage their diabetes. Dexcom's algorithms also provide predictive alerts for hypoglycemia and hyperglycemia.

Restraint: High cost of devices and lack of reimbursement in developing countries

The cost of insulin delivery devices, such as smartphone-connected insulin pumps, is ~USD 4,500–6,500. Moreover, the average selling price of sensor-based continuous glucose monitors is USD 1,000–1,400, with sensors requiring replacement every few days. Digital self-monitoring blood glucose meters cost around USD 15–20. Given the high initial cost and the frequent use of associated consumables (requiring repeated purchase), this puts advanced devices out of reach for a large portion of end users—particularly those in developing countries with an unfavorable reimbursement scenario.

In developed countries, the cost of currently marketed devices is covered under most commercial health plans; in developing countries, disparities in reimbursement policies often result in non-compliance to treatment. In China and India, patients with diabetes are required to entirely bear the expenses for blood glucose monitors, insulin, integrated CGM systems, and their maintenance. Consequently, the high costs and lack of reimbursements in developing countries can be expected to limit the adoption of digital diabetes management solutions in the coming years.

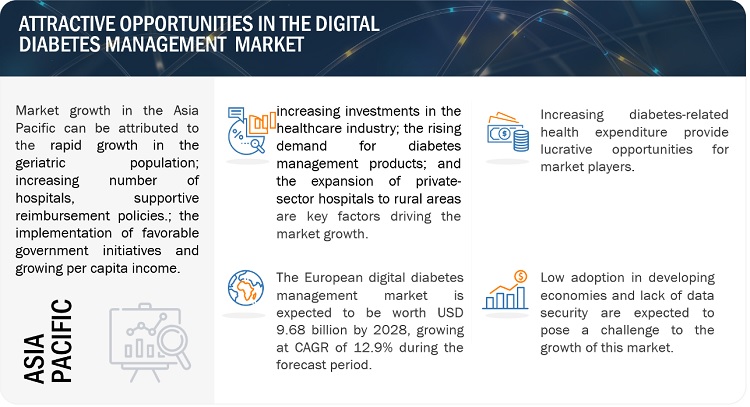

Opportunity: Increasing diabetes-related health expenditure

The increase in global health expenditure due to diabetes has been considerable, growing from USD 232 billion in 2007 to USD 966 billion in 2021 for adults aged 20–79 years. This represents a 316% increase over 15 years. Part of this increase can be attributed to improved data quality. The direct costs of diabetes are expected to continue to grow. The IDF estimates that total diabetes-related health expenditure will reach USD 1.03 trillion by 2030 and USD 1.05 trillion by 2045 (Source: IDF Atlas 2021). The North America and Caribbean region has the highest diabetes-related health expenditure per adult with diabetes (USD 8,209), followed by the Europe region (USD 3,086), South and Central America region (USD 2,190), and WP region (USD 1,204). This figure is USD 465 per person with diabetes in the Middle East and North Africa region, USD 547 in the Africa region, and USD 112 in the Southeast Asia region. Expenditure due to diabetes has a substantial impact on total health expenditure worldwide, representing 11.5% of the total global health spending. Considering the increasing diabetes-related health expenditure in emerging countries, many digital diabetes management device manufacturers are focusing on expanding their business in these markets to capitalize on new opportunities.

Challenge: Low penetration in developing economies

The penetration of technologically advanced digital diabetes management platforms is comparatively less in developing countries as opposed to developed countries. This is attributed to the inadequate infrastructure, unclear nationwide e-health agendas, the need to overcome public uncertainty over data privacy and security, difficulties in achieving interoperability, lack of a trained workforce in health informatics (and existing initiatives for its development), and fewer strategies to achieve regional integration.

In developing countries, low levels of private and public financial resources are spent on health, which affects access to healthcare as well as the quality of the health system. According to a WHO and World Bank report, as of 2021, 480 million people do not have access to essential health services (mostly in Africa and South Asia) and up to 5 billion people will still be unable to access health care in 2030. Poor access and quality and low levels of digitization have negative implications on not only key health outcomes but also the poverty rate. The result is a general reluctance and inability to fully adopt advanced solutions, including those for digital diabetes management.

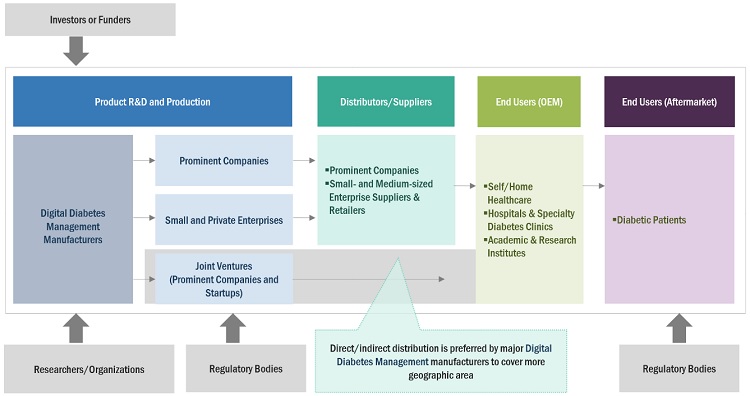

Digital Diabetes Management Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Digital Diabetes Management. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Medtronic (Ireland), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US), Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), Insulet Corporation (US), Tandem Diabetes Care (US), Ascensia Diabetes Care Holdings AG (Switzerland), LifeScan, Inc. (US), Tidepool (US), AgaMatrix (US), Glooko, Inc. (US), DarioHealth Corporation (Israel), One Drop (US), Dottli (Finland), Ypsomed Holding AG (Switzerland), ARKRAY (Japan), ACON Laboratories, Inc. (US), Care Innovations, LLC (US), Health2Sync (Taiwan), Emperra GmbH E-Health Technologies (Germany), Azumio (US), Decide Clinical Software GmbH (Austria), Pendiq GmbH (Germany), and BeatO (India).

Smart Insulin Pen segment of digital diabetes management industry to grow at the highest CAGR during the forecast period.

The demand for insulin pens has increased considerably in recent years owing to the increasing incidence of diabetes, low cost of insulin pens, and less painful and more effective insulin delivery. The other key factors driving the growth of this segment of the digital diabetes management market include the increasing demand for personalized or patient-centric devices and the increasing need to prevent needle-stick injuries. However, the limited use of smart insulin pens for patients requiring a mixture of two types of insulins is restricting the growth of this market segment.

Wearable devices segment held the largest share in the digital diabetes management industry in 2022.

The digital diabetes management market is divided into handheld and wearable devices based on device type. In 2022, wearable devices accounted for 60.3% of the market for digital diabetes management devices. The significant market share of this segment is primarily attributable to a number of developments, including the rise in closed-loop pump systems, smart insulin patches, and other pipeline devices, as well as the increasing adoption of smart insulin pumps and insulin patches for self-insulin delivery for the management of diabetes.

The Digital Diabetes Management Apps segment of the digital diabetes management industry to grow at the fastest CAGR during the forecast period”

The Digital Diabetes Management Apps segment is projected to grow at the highest CAGR of 15.4% during the forecast period. This segment is further categorized into diabetes & blood glucose tracking apps and weight & diet management apps. The diabetes & blood glucose tracking apps segment accounted for a share of 44.9% of the digital diabetes management market in 2022.

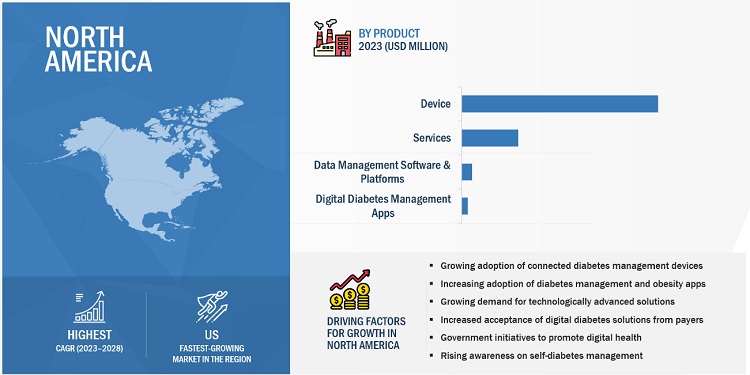

North America will grow by highest CAGR in the digital diabetes management industry, by region.

In 2022, North America will grow by highest CAGR in the digital diabetes management market, by region, followed by Europe, Asia Pacific, Latin America, Middle East & Africa. The highest CAGR of North America can be attributed to the growing adoption of connected diabetes management devices, increasing adoption of diabetes management and obesity apps, growing demand for technologically advanced solutions, increased acceptance of digital diabetes solutions from payers, government initiatives to promote digital health, and rising awareness on self-diabetes management in the region.

Geographic Snapshot: Digital Diabetes Management Market

To know about the assumptions considered for the study, download the pdf brochure

The prominent players operating in the global digital diabetes management market are Medtronic (Ireland), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US), Abbott Laboratories (US), F. Hoffmann-La Roche (Switzerland), Insulet Corporation (US), Tandem Diabetes Care (US), Ascensia Diabetes Care Holdings AG (Switzerland), LifeScan, Inc. (US), Tidepool (US), AgaMatrix (US), Glooko, Inc. (US), DarioHealth Corporation (Israel), One Drop (US), Dottli (Finland), Ypsomed Holding AG (Switzerland), ARKRAY (Japan), ACON Laboratories, Inc. (US), Care Innovations, LLC (US), Health2Sync (Taiwan), Emperra GmbH E-Health Technologies (Germany), Azumio (US), Decide Clinical Software GmbH (Austria), Pendiq GmbH (Germany), and BeatO (India).

Scope of the Digital Diabetes Management Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$16.8 billion |

|

Projected Revenue by 2028 |

$31.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 13.3% |

|

Market Driver |

Advent Of Artificial Intelligence In Diabetes Care Devices |

|

Market Opportunity |

Increasing diabetes-related health expenditure |

|

Related Segment & Geographic Reports |

US Digital Diabetes Management Market |

The research report categorizes closed system transfer device market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Devices

- Smart Glucose Meters

- Continuous Glucose Monitoring (CGM) Systems

- Smart Insulin Pens

- Smart Insulin Pumps/Closed-loop Pumps & Smart Insulin Patches

-

Application

- Diabetes & Blood Glucose Tracking Apps

- Obesity & Diet Management Apps

- Data Management Software & Platforms

- Services

By Device Type

- Handheld Devices

- Wearable Devices

By End User

- Self/Home Healthcare

- Hospitals & Specialty Diabetes Clinics

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East and Africa

Recent Developments of Digital Diabetes Management Industry

- In February 2023, Dexcom launched Dexcom G7 CGM device in the US and is planning to launch in Europe and Asia Pacific by first quarter of 2024

- In October 2022, Abbott laboratories launched Freestyle Libre 3 CGM device worldwide.

- In April 2022, Dexcom launched Dexcom ONE device. The company launched the new Dexcom ONE Continuous Glucose Monitoring System in the UK.

- In April 2022, Ascensia Diabetes Care Holdings AG (Switzerland) launched Eversense's 6-month CGM system in the US.

- In October 2021, LifeScan, Inc. (US) launched OneTouch Solutions. This is a holistic digital health offering linking people with diabetes to solutions and support from proven experts.

- In September 2020, Roche Diagnostics (Switzerland) launched a remote patient monitoring ssolution, which is a new element of the RocheDiabetes Care Platform and uses its pattern detection feature.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital diabetes management market?

The global digital diabetes management market boasts a total revenue value of $35.8 billion in 2028.

What is the estimated growth rate (CAGR) of the global digital diabetes management market?

The global digital diabetes management market has an estimated compound annual growth rate (CAGR) of 13.6% and a revenue size in the region of $18.9 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of diabetes- Technological advancements- Growing adoption of cloud-based enterprise solutions for diabetes management- Advent of artificial intelligence in diabetes care devices- Increasing penetration of digital platforms and adoption of mobile apps for diabetes managementRESTRAINTS- High cost of devices and lack of reimbursement in developing countriesOPPORTUNITIES- Increasing diabetes-related health expenditureCHALLENGES- Low adoption in developing economies- Data security

-

5.3 INDUSTRY TRENDSGROWING DEMAND FOR HYBRID CLOSED-LOOP SYSTEMS/ARTIFICIAL PANCREAS DEVICE SYSTEMSGROWING NUMBER OF COLLABORATIONS BETWEEN STAKEHOLDERSINCREASING DEMAND FOR FLASH GLUCOSE MONITORING (FGM) SYSTEMS

-

5.4 REGULATORY ANALYSISREGULATORY LANDSCAPE- North America- Europe- Asia Pacific- Latin AmericaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTES

-

5.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR DIGITAL DIABETES MANAGEMENTTOP APPLICANTS (COMPANIES) FOR DIGITAL DIABETES MANAGEMENT PATENTSJURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR DIGITAL DIABETES MANAGEMENT PATENTS

-

5.9 PRICING ANALYSISKEY PLAYERS: AVERAGE SELLING PRICE, BY DEVICE

- 5.10 SUPPLY CHAIN ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.13 TECHNOLOGY ANALYSIS

- 5.14 REIMBURSEMENT SCENARIO

- 5.15 TRADE ANALYSIS

- 6.1 INTRODUCTION

-

6.2 DEVICESSMART GLUCOSE METERS- Reducing prices and technological innovations to drive growthCONTINUOUS GLUCOSE MONITORING SYSTEMS- CGM segment to grow at highest CAGR during forecast periodSMART INSULIN PENS- Increasing demand for personalized/patient-centric devices without risk of needle-stick injuries to drive growthSMART INSULIN PUMPS/CLOSED-LOOP SYSTEMS AND SMART INSULIN PATCHES- Benefits of smart insulin pumps and closed-loop systems to drive growth

-

6.3 DIGITAL DIABETES MANAGEMENT APPSDIABETES AND BLOOD GLUCOSE TRACKING APPS- Growing adoption of connected devices to drive growthWEIGHT AND DIET MANAGEMENT APPS- Growing obese population and increasing need to prevent diabetes to drive growth

-

6.4 DATA MANAGEMENT SOFTWARE AND PLATFORMSGROWING DEMAND FOR DIABETES DATA MANAGEMENT TO DRIVE GROWTH

-

6.5 SERVICESINCREASING ADOPTION OF REMOTE ONLINE COACHING SERVICES AMONG DIABETES PATIENTS TO DRIVE GROWTH

- 7.1 INTRODUCTION

-

7.2 WEARABLE DEVICESWEARABLE DEVICES TO DOMINATE DIGITAL DIABETES MANAGEMENT DEVICES MARKET DURING FORECAST PERIOD

-

7.3 HANDHELD DEVICESINCREASING DEMAND FOR REMOTE MONITORING TO BOOST GROWTH

- 8.1 INTRODUCTION

-

8.2 SELF/HOME HEALTHCAREHIGH COST OF INPATIENT CARE TO FUEL PREFERENCE FOR SELF/HOME CARE

-

8.3 HOSPITALS AND SPECIALTY DIABETES CLINICSRISING DEMAND FOR POC TESTING IN HOSPITALS TO BOOST GROWTH

-

8.4 ACADEMIC AND RESEARCH INSTITUTESPRODUCT INNOVATION FOR DIABETES MANAGEMENT TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing diabetes prevalence and high penetration of digital platforms to boost marketCANADA- Favorable reimbursement scenario to drive digital diabetes management adoption in Canada

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate European market over forecast periodUK- Government initiatives to support market growthFRANCE- Affordability of healthcare to propel adoption of digital solutionsITALY- Rising diabetes prevalence to offer growth opportunitiesSPAIN- Growing healthcare budget and efforts to boost local manufacturing of medical productsREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- China to hold largest share of APAC marketJAPAN- High acceptance of digital solutions for diabetes management to boost growthINDIA- Rising diabetes prevalence and focus on cost curtailment to favor adoptionAUSTRALIA- Initiatives to help treat or manage diabetes-related problems to drive market growthSOUTH KOREA- Government initiatives for diabetes management to drive growthREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- High private healthcare expenditure and increasing geriatric population to drive marketMEXICO- Growing obesity rate in Mexico to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICASLOW DIGITIZATION OF HEALTH SYSTEMS IN AFRICAN COUNTRIES TO AFFECT GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 STRATEGIES OF KEY PLAYERS/RIGHT TO WIN

- 10.3 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN DIGITAL DIABETES MANAGEMENT MARKET

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 EVALUATION MATRIX FOR START-UP/SME PLAYERS (2022)PROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIES

-

10.7 COMPETITIVE BENCHMARKINGOVERALL FOOTPRINT OF COMPANIES

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSMEDTRONIC- Business overview- Products & services offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE- Business overview- Products & services offered- Recent developments- MnM viewDEXCOM, INC.- Business overview- Products offered- Recent developments- MnM viewASCENSIA DIABETES CARE HOLDINGS AG- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products offered- Recent developments- MnM viewB. BRAUN MELSUNGEN AG- Business overview- Products offeredTIDEPOOL- Business overview- Products offered- Recent developmentsGLOOKO, INC.- Business overview- Products offered- Recent developmentsLIFESCAN, INC.- Business overview- Products offered- Recent developmentsAGAMATRIX- Business overview- Products offered- Recent developmentsTANDEM DIABETES CARE, INC.- Business overview- Products offered- Recent developmentsINSULET CORPORATION- Business overview- Products offered- Recent developmentsDARIOHEALTH CORPORATION- Business overview- Products offered- Recent developmentsONE DROP- Business overview- Products offered- Recent developmentsYPSOMED HOLDING AG- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSARKRAYDOTTLIACON LABORATORIES, INC.CARE INNOVATIONS, LLCHEALTH2SYNCEMPERRA GMBH E-HEALTH TECHNOLOGIESAZUMIODECIDE CLINICAL SOFTWARE GMBHPENDIQ GMBHBEATO

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 TOP FIVE COUNTRIES WITH HIGHEST NUMBER OF DIABETICS (20–79 YEARS), 2021 VS. 2045

- TABLE 3 PRODUCT LAUNCHES WITH NEW TECHNOLOGICAL ADVANCEMENTS

- TABLE 4 HYBRID CLOSED-LOOP SYSTEMS: LATEST EXAMPLES

- TABLE 5 RECENT COLLABORATIONS IN DIGITAL DIABETES MANAGEMENT MARKET

- TABLE 6 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 7 CANADA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 8 CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODY IN JAPAN

- TABLE 9 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 10 INDICATIVE LIST OF REGULATORY AUTHORITIES

- TABLE 11 DIGITAL DIABETES MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 AVERAGE SELLING PRICE, BY DEVICE, 2022

- TABLE 13 DIGITAL DIABETES MANAGEMENT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 16 DIGITAL DIABETES MANAGEMENT PRODUCTS: GLOBAL COVERAGE AND REIMBURSEMENT

- TABLE 17 TOP EXPORTERS OF DIGITAL DIABETES MANAGEMENT DEVICES, BY COUNTRY (2022)

- TABLE 18 TOP IMPORTERS OF DIGITAL DIABETES MANAGEMENT DEVICES, BY COUNTRY (2022)

- TABLE 19 DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 20 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 21 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (THOUSAND UNITS)

- TABLE 23 KEY SMART GLUCOSE METERS OFFERED BY MARKET PLAYERS

- TABLE 24 SMART GLUCOSE METERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 SMART GLUCOSE METERS MARKET, BY REGION, 2021–2028 (THOUSAND UNITS)

- TABLE 26 KEY CGM SYSTEMS OFFERED BY MARKET PLAYERS

- TABLE 27 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET, BY REGION, 2021–2028 (THOUSAND UNITS)

- TABLE 29 KEY SMART INSULIN PENS OFFERED BY MARKET PLAYERS

- TABLE 30 SMART INSULIN PENS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 SMART INSULIN PENS MARKET, BY REGION, 2021–2028 (THOUSAND UNITS)

- TABLE 32 KEY SMART INSULIN PUMPS/CLOSED-LOOP SYSTEMS AND SMART INSULIN PATCHES OFFERED BY MARKET PLAYERS

- TABLE 33 SMART INSULIN PUMPS/CLOSED-LOOP SYSTEMS AND SMART INSULIN PATCHES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 SMART INSULIN PUMPS/CLOSED-LOOP SYSTEMS AND SMART INSULIN PATCHES MARKET, BY REGION, 2021–2028 (THOUSAND UNITS)

- TABLE 35 DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 36 DIGITAL DIABETES MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 KEY DIABETES AND BLOOD GLUCOSE TRACKING APPS OFFERED BY MARKET PLAYERS

- TABLE 38 DIABETES AND BLOOD GLUCOSE TRACKING APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 KEY WEIGHT AND DIET MANAGEMENT APPS OFFERED BY MARKET PLAYERS

- TABLE 40 WEIGHT AND DIET MANAGEMENT APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 KEY DATA MANAGEMENT SOFTWARE AND PLATFORMS OFFERED BY MARKET PLAYERS

- TABLE 42 DATA MANAGEMENT SOFTWARE AND PLATFORMS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 KEY SERVICES OFFERED BY MARKET PLAYERS

- TABLE 44 DIGITAL DIABETES MANAGEMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 WEARABLE DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 HANDHELD DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 DIGITAL DIABETES MANAGEMENT MARKET FOR SELF/HOME HEALTHCARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 DIGITAL DIABETES MANAGEMENT MARKET FOR HOSPITALS AND SPECIALTY DIABETES CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 DIGITAL DIABETES MANAGEMENT MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 DIGITAL DIABETES MANAGEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 US: MACROECONOMIC INDICATORS

- TABLE 60 US: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 61 US: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 62 US: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 63 US: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 US: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 CANADA: MACROECONOMIC INDICATORS

- TABLE 66 CANADA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 68 CANADA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: DIGITAL DIABETES MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: MACROECONOMIC INDICATORS

- TABLE 78 GERMANY: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 79 GERMANY: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 80 GERMANY: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 GERMANY: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 UK: MACROECONOMIC INDICATORS

- TABLE 84 UK: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 85 UK: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 86 UK: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 UK: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 UK: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 89 FRANCE: MACROECONOMIC INDICATORS

- TABLE 90 FRANCE: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 ITALY: MACROECONOMIC INDICATORS

- TABLE 96 ITALY: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 97 ITALY: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 98 ITALY: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 ITALY: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 ITALY: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 SPAIN: MACROECONOMIC INDICATORS

- TABLE 102 SPAIN: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 103 SPAIN: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 104 SPAIN: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 105 SPAIN: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 SPAIN: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 CHINA: MACROECONOMIC INDICATORS

- TABLE 119 CHINA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 120 CHINA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 121 CHINA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 CHINA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 123 CHINA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 JAPAN: MACROECONOMIC INDICATORS

- TABLE 125 JAPAN: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 JAPAN: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 JAPAN: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 130 INDIA: MACROECONOMIC INDICATORS

- TABLE 131 INDIA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 132 INDIA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 133 INDIA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 INDIA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 INDIA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 137 AUSTRALIA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 138 AUSTRALIA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 139 AUSTRALIA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 AUSTRALIA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 AUSTRALIA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 142 SOUTH KOREA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 144 SOUTH KOREA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 152 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 154 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 159 BRAZIL: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 160 BRAZIL: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 161 BRAZIL: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 BRAZIL: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 BRAZIL: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 164 MEXICO: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 165 MEXICO: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 166 MEXICO: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 MEXICO: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 MEXICO: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 REST OF LATIN AMERICA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 174 AFRICA: MACROECONOMIC INDICATORS

- TABLE 175 MIDDLE EAST & AFRICA: DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2021–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 180 OVERALL FOOTPRINT OF COMPANIES

- TABLE 181 COMPANY FOOTPRINT: BY PRODUCT & SERVICE

- TABLE 182 COMPANY FOOTPRINT: BY DEVICE TYPE

- TABLE 183 COMPANY FOOTPRINT: BY END USER

- TABLE 184 COMPANY FOOTPRINT: BY REGION

- TABLE 185 PRODUCT LAUNCHES

- TABLE 186 DEALS

- TABLE 187 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 188 F. HOFFMANN-LA ROCHE: BUSINESS OVERVIEW

- TABLE 189 DEXCOM, INC.: BUSINESS OVERVIEW

- TABLE 190 ASCENSIA DIABETES CARE HOLDINGS AG: BUSINESS OVERVIEW

- TABLE 191 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 192 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- TABLE 193 TIDEPOOL: BUSINESS OVERVIEW

- TABLE 194 GLOOKO, INC.: BUSINESS OVERVIEW

- TABLE 195 LIFESCAN, INC.: BUSINESS OVERVIEW

- TABLE 196 AGAMATRIX: BUSINESS OVERVIEW

- TABLE 197 TANDEM DIABETES CARE, INC.: BUSINESS OVERVIEW

- TABLE 198 INSULET CORPORATION: BUSINESS OVERVIEW

- TABLE 199 DARIOHEALTH CORPORATION: BUSINESS OVERVIEW

- TABLE 200 ONE DROP: BUSINESS OVERVIEW

- TABLE 201 YPSOMED HOLDING AG: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 MARKET SIZE ESTIMATION: COMPANY-WISE REVENUE SHARE ANALYSIS (2022)

- FIGURE 7 SUPPLY-SIDE ANALYSIS: DIGITAL DIABETES MANAGEMENT MARKET (2022)

- FIGURE 8 SUPPLY-SIDE ANALYSIS: SMART GLUCOSE METERS MARKET (2022)

- FIGURE 9 SUPPLY-SIDE ANALYSIS: CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET (2022)

- FIGURE 10 SUPPLY-SIDE ANALYSIS: SMART INSULIN PENS MARKET (2022)

- FIGURE 11 SUPPLY-SIDE ANALYSIS: SMART INSULIN PUMPS/CLOSED-LOOP SYSTEMS AND SMART INSULIN PATCHES MARKET (2022)

- FIGURE 12 SUPPLY-SIDE ANALYSIS: DIGITAL DIABETES MANAGEMENT APPS MARKET (2022)

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR DIGITAL DIABETES MANAGEMENT MARKET (2023–2028)

- FIGURE 14 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF DIGITAL DIABETES MANAGEMENT MARKET

- FIGURE 15 TOP-DOWN APPROACH: GLOBAL DIGITAL DIABETES MANAGEMENT MARKET

- FIGURE 16 BOTTOM-UP APPROACH: GLOBAL DIGITAL DIABETES MANAGEMENT MARKET

- FIGURE 17 GLOBAL DIGITAL DIABETES MANAGEMENT MARKET SIZING, BY DEVICE TYPE

- FIGURE 18 DATA TRIANGULATION METHODOLOGY

- FIGURE 19 DIGITAL DIABETES MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY PRODUCT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 21 DIGITAL DIABETES MANAGEMENT APPS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 22 DIGITAL DIABETES MANAGEMENT DEVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 23 DIGITAL DIABETES MANAGEMENT MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 24 DIGITAL DIABETES MANAGEMENT MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 25 INCREASING PREVALENCE OF DIABETES AND GROWING DEMAND FOR DIGITAL SOLUTIONS TO DRIVE MARKET GROWTH

- FIGURE 26 DEVICES TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET

- FIGURE 27 US TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICAN MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 DEVELOPED ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 30 DIGITAL DIABETES MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 FDA 510(K) APPROVAL PROCESS

- FIGURE 32 CE APPROVAL PROCESS FOR DIGITAL DIABETES MANAGEMENT SOLUTIONS

- FIGURE 33 DIGITAL DIABETES MANAGEMENT MARKET: ECOSYSTEM ANALYSIS (2022)

- FIGURE 34 DIGITAL DIABETES MANAGEMENT DEVICES MARKET: VALUE CHAIN ANALYSIS (2022)

- FIGURE 35 PATENT PUBLICATION TRENDS (JANUARY 2014–MAY 2023)

- FIGURE 36 TOP APPLICANT COMPANIES FOR DIGITAL DIABETES MANAGEMENT PATENTS, 2014–2023

- FIGURE 37 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR DIGITAL DIABETES MANAGEMENT PATENTS, 2014–2023

- FIGURE 38 DIGITAL DIABETES MANAGEMENT MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 41 DIGITAL DIABETES MANAGEMENT MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 42 NORTH AMERICA: DIGITAL DIABETES MANAGEMENT MARKET SNAPSHOT

- FIGURE 43 EUROPE: DIGITAL DIABETES MANAGEMENT MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: DIGITAL DIABETES MANAGEMENT MARKET SNAPSHOT

- FIGURE 45 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL DIABETES MANAGEMENT MARKET

- FIGURE 46 REVENUE SHARE ANALYSIS OF KEY PLAYERS OPERATING IN DIGITAL DIABETES MANAGEMENT MARKET (2018–2022)

- FIGURE 47 MARKET SHARE ANALYSIS: SMART GLUCOSE METERS MARKET (2022)

- FIGURE 48 MARKET SHARE ANALYSIS: CONTINUOUS GLUCOSE MONITORING DEVICES MARKET (2022)

- FIGURE 49 MARKET SHARE ANALYSIS: INSULIN PUMPS MARKET (2022)

- FIGURE 50 MARKET SHARE ANALYSIS: SMART INSULIN PENS MARKET (2022)

- FIGURE 51 MARKET SHARE ANALYSIS: DIABETES APPS MARKET (2022)

- FIGURE 52 DIGITAL DIABETES MANAGEMENT MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 53 DIGITAL DIABETES MANAGEMENT MARKET: COMPANY EVALUATION MATRIX FOR START-UP/SME PLAYERS, 2022

- FIGURE 54 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 55 F. HOFFMANN-LA ROCHE: COMPANY SNAPSHOT (2022)

- FIGURE 56 DEXCOM, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 57 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 58 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2022)

- FIGURE 59 TANDEM DIABETES CARE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 60 INSULET CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 61 DARIOHEALTH CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 62 YPSOMED HOLDING AG: COMPANY SNAPSHOT (2022)

The study involved four major activities in estimating the current size of the Digital Diabetes Management market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Digital Diabetes Management and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Digital Diabetes Management market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Digital Diabetes Management market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Digital Diabetes Management manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, customer/end users who are using Digital Diabetes Management were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of Digital Diabetes Management and future outlook of their business which will affect the overall market.

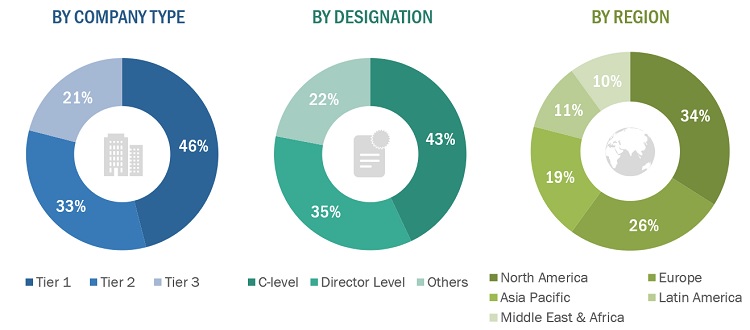

Breakdown of Primary Interviews : Supply-Side Participants, By Company Type, Designation, and region

Note1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note2: Other primaries include sales managers, marketing managers, and product managers.

Note3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1=>USD 1billion, Tier 2=USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Digital Diabetes Management market includes the following details.

The market sizing of the market was undertaken from the global side.

Country level Analysis: The size of the digital diabetes management market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall digital diabetes management market was obtained from secondary data and validated by primary participants to arrive at the total digital diabetes management market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall digital diabetes management market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Digital Diabetes Management Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Digital diabetes management refers to electronic medical solutions used for remote monitoring, analysis and management of patients with diabetes. Diabetes is a metabolic disorder that leads to elevated blood sugar levels in the body. Digital diabetes management involves the use of software-based applications, platforms and devices, such as smart glucose meters, insulin pens, sensors, closed-loop systems and insulin patches.

These systems are used to manage blood glucose, pressure and cholesterol levels and effectively track and maintain the record of the patients. They also aid in improving healthcare processes, delay or prevent diabetes complications and minimize medical costs for the patients. As a result, they are widely used across at-home and self-care facilities, hospitals, clinics and research institutes.

Key Stakeholders

- Senior Management

- End Users

- Diabetes Care Providers

- Finance/Procurement Department

Report Objectives

- To define, describe, analyze, and forecast the digital diabetes management market by product, type, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the digital diabetes management market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile key players in the global digital diabetes management market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, agreements, and other developments of leading players in the global digital diabetes management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe digital diabetes management market into the Netherlands, Austria, Belgium, and others

- Further breakdown of the Rest of Asia Pacific digital diabetes management market into Singapore, Malaysia, and others

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Diabetes Management Market