Digital Thread Market by Technology (PLM, SLM, CAD, MES, IoT, ERP, edge computing, Digital Twin, ALM, SCADA), Module (Data collection, Data management & Integration), Deployment, Application, Vertical, Region - Global Forecast to 2030

Updated on : August 21, 2025

Digital Thread Market Size & Share

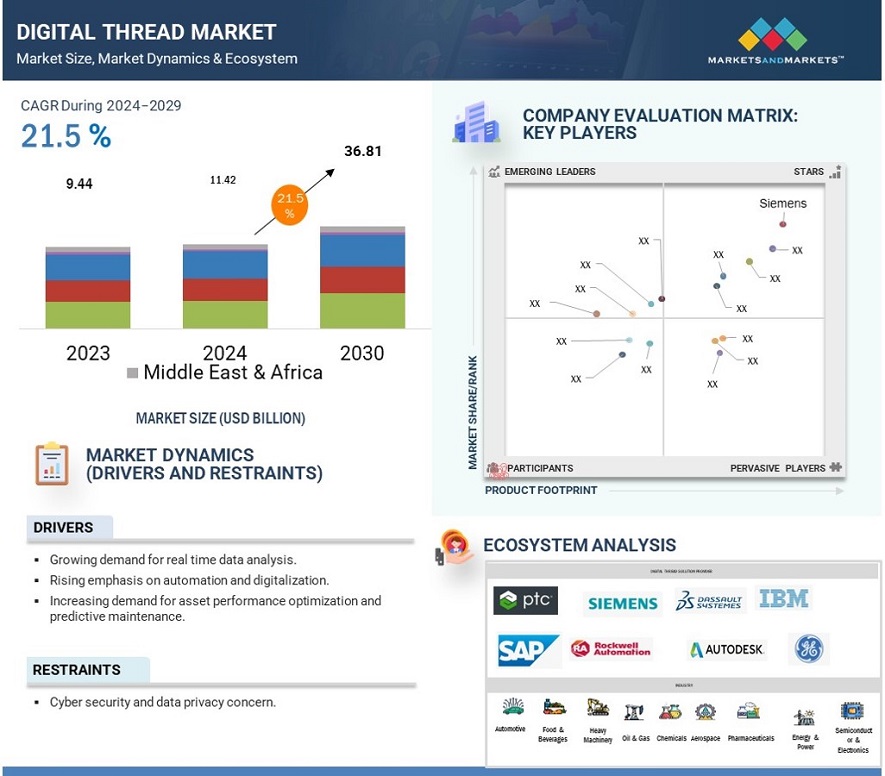

The global Digital Thread Market was valued at USD 11.42 billion in 2024 and is projected to grow from USD 13.83 billion in 2025 to USD 36.81 billion by 2030, at a CAGR of 21.5% during the forecast period. This rapid growth is driven by the increasing demand for real-time data analytics, the rising emphasis on automation and digitization, and the need for optimizing asset performance and predictive maintenance. Key technologies such as AI and ML are playing a significant role in enhancing the capabilities of digital threads by enabling advanced data analysis, automation, and decision-making across entire product lifecycles.

Key Takeaways:

•The global Digital Thread Market was valued at USD 11.42 billion in 2024 and is projected to grow from USD 13.83 billion in 2025 to USD 36.81 billion by 2030, at a CAGR of 21.5% during the forecast period.

• By Technology: There is a rising shift toward cloud-based solutions, offering lucrative growth opportunities as organizations seek to reduce upfront investment in IT infrastructure.

• By Application: The manufacturing sector is witnessing increased demand to address complexities in processes, fueled by the integration of IoT for real-time insights and the growing adoption of smart manufacturing practices.

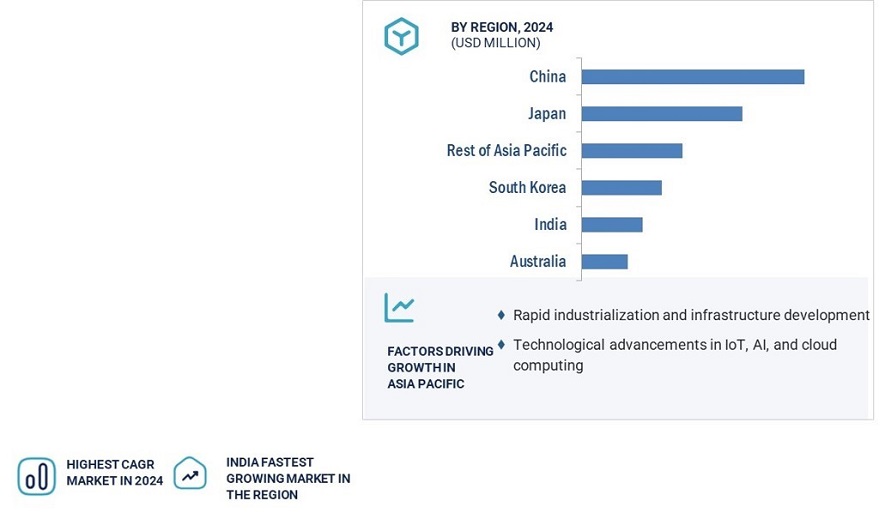

• By Region: ASIA PACIFIC is expected to grow fastest at a 22.2% CAGR, driven by rapid industrialization, increasing investments in digital transformation, and the proliferation of advanced technologies.

• Market Dynamics: While the market benefits from drivers like the growing emphasis on automation and digitization, it faces challenges such as high costs of implementation and lack of standardization.

• Opportunities & Challenges: Advancements in AI and ML present opportunities for building robust digital threads using enterprise iPaaS, whereas data silos and cybersecurity concerns remain significant restraints.

• Competitive Landscape: North America holds a significant market share due to its strong ecosystem of technology companies, heavy investment in digital transformation, and the integration of AI in enhancing digital thread capabilities.

The Digital Thread Market is poised for substantial growth, propelled by technological advancements and the increasing need for operational efficiency. Long-term projections suggest that as industries continue to embrace digital transformation, the adoption of digital threads will become integral to enhancing product lifecycle management, predictive maintenance, and supply chain optimization. The market is likely to witness further innovations, particularly in AI and IoT, which will continue to drive efficiency and reduce costs across various sectors.

.

Digital Thread Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

North America accounted for a significant share of USD 3,166.4 million in the digital thread industry in 2023. The North American region holds the largest market share in digital threads due to several factors. North America has a strong ecosystem of advanced technology companies, including those specializing in software, cloud computing, AI, and IoT, which are integral to the development and implementation of digital thread solutions. Additionally, companies in North America are heavily investing in digital transformation to stay competitive in a rapidly evolving global market.

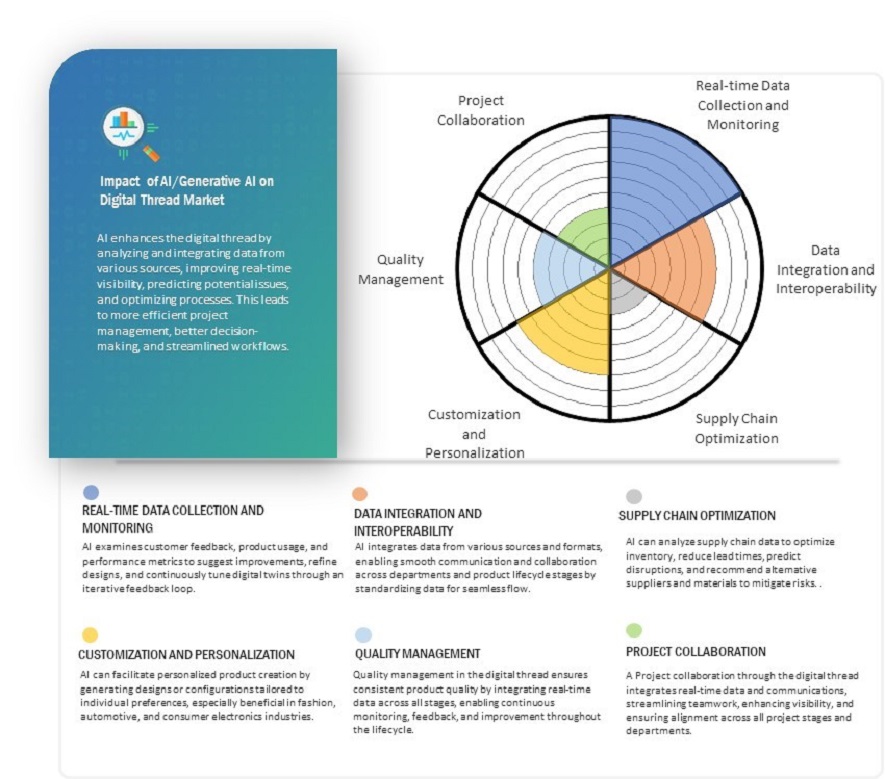

AI plays an important role in strengthening the digital thread's capabilities by enabling advanced data analysis, automation, and decision-making across the entire product lifecycle. The digital thread connects various stages of a product's lifecycle, from design and manufacturing to operation and maintenance, by integrating data, processes, and systems. AI improves digital threads by enabling real-time data collection and monitoring, optimizing performance, and predicting failures. Furthermore, Al in digital thread facilitates seamless data integration across systems, improving interoperability and ensuring a similar information flow. Al also optimizes supply chains by predicting demand, managing inventory, and identifying disruptions while supporting mass customization through personalized customer data analysis. Additionally, it improves quality management with automated defect detection and enhances project collaboration by streamlining communication and information sharing.

Digital Thread Market Trends:

Driver: Growing emphasis on automation and digitization

The increasing demand for asset performance optimization and predictive maintenance signifies a shift in industries toward better operational efficiency and cost reduction. Asset performance optimization aims to enhance the effectiveness of assets throughout their lifecycle by using advanced analytics and real-time data to improve resource utilization, reduce downtime, and increase productivity. Predictive maintenance, a critical component of this optimization, employs data from sensors, IoT devices, and historical records to provide early warnings of equipment faults. This allows for proactive intervention by analyzing trends and anomalies, reducing unexpected downtime, and extending the life of assets compared to manual and reactive maintenance processes, which typically result in higher costs and more operational disruptions. In addition, other technological advancements such as artificial intelligence and machine learning support these practices by enabling more accurate predictions and smarter maintenance procedures. Real-time data analytics integration provides valuable insights that drive decision-making processes towards optimization of plans. Hence, the emphasis on asset performance optimization and predictive maintenance is driven by the goals of improving efficiency, reducing costs, and gaining competitive advantages, which are crucial for long-term success and sustainability in today's industries.

Restraint: Cyber security and data privacy concerns

Cybersecurity and data privacy concerns pose significant challenges to the growth of the digital thread market. As digital thread technology facilitates seamless data flow across a product’s lifecycle, it inherently relies on secure data management, system integration, and regulatory compliance. However, increasing global data privacy regulations, such as GDPR in Europe and CCPA in California, add complexity to implementation. Compliance with these stringent frameworks requires organizations to invest heavily in security measures, which can drive up costs and slow down adoption.

Moreover, the risk of cyber threats remains a major deterrent. As digital threads connect multiple systems, they create potential entry points for cyberattacks, data breaches, and intellectual property theft. Companies must implement robust security protocols, including encryption, multi-factor authentication, and real-time monitoring, to mitigate these risks. However, the financial burden of maintaining such advanced cybersecurity measures can discourage businesses from fully adopting digital thread technologies. Another challenge lies in securely integrating various legacy and modern systems, as the lack of standardized cybersecurity practices makes implementation inconsistent across industries. Addressing these concerns requires a proactive approach—developing standardized security frameworks, fostering cross-industry collaboration, and investing in advanced cybersecurity solutions to ensure digital thread adoption remains secure, efficient, and scalable.

Another challenge lies in securely integrating various legacy and modern systems, as the lack of standardized cybersecurity practices makes implementation inconsistent across industries. Addressing these concerns requires a proactive approach—developing standardized security frameworks, fostering cross-industry collaboration, and investing in advanced cybersecurity solutions to ensure digital thread adoption remains secure, efficient, and scalable.

Opportunity: Building digital threads with enterprise iPaaS

Digital threads in enterprise Integration Platform as a Service (iPaaS) enable organizations to seamlessly integrate data and processes across the entire product lifecycle, from design and manufacturing to deployment and customer support. By implementing iPaaS, businesses can gain a comprehensive, interconnected view of their operations, leading to improved decision-making, enhanced product quality, and accelerated time to market. iPaaS facilitates real-time data synchronization across diverse systems and applications, ensuring the smooth flow of information throughout the enterprise. This capability is crucial for driving digital transformation, boosting operational efficiency, and enabling the development of new business models in an increasingly competitive landscape. As industries increasingly adopt Industry 4.0 technologies, the demand for digital threads is growing. iPaaS offers the scalability, flexibility, and real-time integration necessary to meet this demand, providing a solid foundation for continuous innovation and maintaining a competitive advantage. Organizations that seize this opportunity can optimize operations, reduce costs, and enhance customer experiences, positioning themselves as leaders in their markets./p>

Challenge: High cost of implementation

The implementation of digital thread can be challenging and costly due to the need to integrate with existing IT systems and handle a variety of data. Custom development planning is essential, as substantial amounts of data need to be managed to ensure quality and consistency. This requires significant investment in new technologies such as IoT sensors, cloud computing, and data analytics platforms. Costs also arise from training staff and managing changes in processes. Additionally, ensuring data security and compliance with industry regulations adds another layer of complexity and cost to the system. Customization and scalability further contribute to costs, as digital thread systems require tailored solutions and upgrades, which can be expensive. In many cases, dedicated teams and external consultants are needed for effective project management, increasing overall expenditure. Therefore, considering the complexity and cost of implementation is crucial despite the potential benefits of Digital Thread, such as improved efficiency, enhanced collaboration, and better decision-making.

Digital Thread Market Ecosystem

Prominent companies in this market include well-established, financially stable digital thread providers such as PTC (US), IBM (US), Siemens (Germany), Dassault Systemes (France), and Rockwell Automation (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks.

Digital Thread Market Segment Analysis

By technology, PLM technology segment is expected to account for the largest market share during the forecast period.

The digital thread market is composed of a wide range of technologies, including Product Lifecycle Management (PLM), Asset Performance Management (APM), Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), Service Lifecycle Management (SLM), Application Lifecycle Management (ALM), Material Requirements Planning (MRP), Enterprise Resource Planning (ERP), Manufacturing Execution Systems (MES), Edge Computing, Industrial Sensors, Supervisory Control and Data Acquisition (SCADA), and Industrial Communication. Each of these technologies plays a crucial role in enabling seamless data flow across a product's lifecycle.

Among these, PLM stands out as one of the most influential technologies driving digital thread adoption. PLM facilitates the integration of data, workflows, and processes across a product's lifecycle—from initial design to production, maintenance, and end-of-life management. By offering a centralized platform for data management, PLM enhances collaboration across departments, ensuring that all stakeholders have access to real-time, accurate information. This leads to improved decision-making, streamlined operations, and better regulatory compliance.

By end user industry, Pharmaceuticals segment is projected to record the highest CAGR during the forecast period.

The pharmaceuticals segment experience the highest CAGR of 22.7% during the forecast period, driven by rapid adoption of digital thread technology. As pharmaceutical companies navigate an increasingly complex regulatory landscape, digital threads play a crucial role in ensuring compliance, maintaining traceability, and improving overall operational efficiency. By seamlessly connecting data across the entire product lifecycle, from drug discovery to manufacturing and distribution, digital threads enhance quality management and reduce inefficiencies in research and development.

One of the key advantages of this technology is its ability to streamline intricate supply chains. By integrating real-time data across various stages of production and distribution, digital threads improve visibility, minimize disruptions, and enable proactive decision-making. Additionally, the rise of personalized medicine has further accelerated the need for digital thread adoption. By aggregating patient-specific data, pharmaceutical companies can develop targeted treatments with greater precision, ultimately leading to improved patient outcomes.

Furthermore, digital threads facilitate seamless collaboration across departments and external stakeholders, enhances innovation and accelerating drug development timelines. This enhanced data connectivity not only ensures adherence to the industry's stringent regulatory standards but also supports cost reduction and operational agility. As the industry continues to evolve, digital thread technology will remain a cornerstone for driving advancements in pharmaceutical research, manufacturing, and patient care

Asia Pacific is projected to exhibit the highest CAGR during the forecast period.

The digital thread market in the Asia-Pacific region is experiencing significant growth, driven by several key factors. First, the increasing adoption of Industry 4.0 technologies is boosting the need for integrated data flow across the product lifecycle. As manufacturers seek greater efficiency and transparency, digital thread solutions provide seamless connectivity between design, engineering, and production.

The region's focus on smart manufacturing and automation also plays a crucial role in this market's expansion. Countries like Japan, South Korea, and China are heavily investing in digital transformation and advanced technologies like IoT, AI, and 3D printing to optimize production processes. Moreover, the rise of cloud computing and data analytics enables real-time decision-making, enhancing the implementation of digital threads across industries.

Government initiatives and policies promoting digitalization in sectors such as automotive, aerospace, and electronics further stimulate market growth. With a growing demand for innovation and digital solutions, the digital thread market in Asia-Pacific is expected to continue evolving, providing vast opportunities for manufacturers and technology providers alike.

Digital Thread Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Digital Thread Companies - Key Market Players

Major players covered in the

- Siemens (Germany),

- PTC (US),

- Dassault Systèmes (France),

- IBM (US),

- SAP (Germany),

- Rockwell Automation (US),

- Oracle (US),

- Autodesk, Inc. (US),

- General Electric Company (US),

- AVEVA Group Limited (UK),

- Accenture (Ireland),

- DXC Technology Company (US) are some of the key players in the digital thread companies.

In this report, the overall digital thread market has been segmented based on Technology, module, deployment, application, vertical, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Module |

|

|

By Deployment |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Digital Thread Industry

- In January 2025, Siemens (Germany) introduced the Teamcenter Digital Reality Viewer, powered by NVIDIA Omniverse. This innovative solution enables real-time, photorealistic visualization of complex digital twins, enhancing Siemens' digital thread capabilities. By improving collaboration, accuracy, and operational efficiency across product lifecycles, the new tool strengthens digital transformation in manufacturing and engineering.

- In December 2024, PTC (US) and Microsoft (US) partnered with Volkswagen Group (Germany) to transform the digital thread market. Their collaboration introduced AI-powered Codebeamer Copilot, leveraging generative AI to streamline software development and enhance product lifecycle efficiency.

- In November 2024, Rockwell Automation (US) introduced FactoryTalk Analytics VisionAI, an AI-driven inspection solution designed to enhance manufacturing quality. By detecting anomalies and optimizing decision-making, the solution seamlessly integrates with automation systems, providing remote visibility and scalability.

- In October 2024, Oracle introduced agentic AI capabilities to Oracle Fusion Cloud Service and Fusion Field Service to enhance service automation. These AI-driven workflows improve service efficiency, accelerate resolution times, and enhance the customer experience by automating repetitive tasks and enabling smarter decision-making.

- In October 2024, Siemens (Germany) acquired Altair Engineering Inc. (US), enhancing its digital twin and simulation capabilities. This strategic acquisition strengthens Siemens' position in the industrial software market, driving innovation, improving product development efficiency, and expanding its reach across diverse industries.

Frequently Asked Questions (FAQ’s):

Which are the major companies in the digital thread market? What are their major strategies to strengthen their market presence?

The major companies in the digital thread market include PTC (US), IBM (US), Siemens (Germany), Dassault Systemes (France), and Rockwell Automation (US), and the major strategies adopted by these players are product launches and developments. .

What is the digital thread?

The digital thread is the seamless flow of relevant data regarding a product throughout its life cycle. A digital thread provides a comprehensive view of a product's life cycle, starting with design and development and going through manufacturing, maintenance, service, and retirement.

Which region is expected to hold the highest global isostatic pressing market share?

North America will dominate the global digital thread market in 2024.

What are the drivers and opportunities for the digital thread market?

Growing demand for real-time data analytics growing emphasis on automation and digitization, increasing demand for asset performance optimization and predictive maintenance, building digital threads with enterprise Integration Platform as a Service (iPaaS), and advancements in AI and ML.

What are the restraints and challenges for the digital thread market?

Data Silos and heterogeneity issues and a high cost of implementation are the restraints and challenges for the digital thread market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for real-time data analytics- Rising emphasis on automation and digitization- Increasing demand for asset performance optimization and predictive maintenanceRESTRAINTS- Data silos and heterogeneity issues- Cyber security and data privacy concernsOPPORTUNITIES- Building digital threads with enterprise iPaaS- Advancements in AI and MLCHALLENGES- High cost of implementation- Lack of standardization

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF PLM OFFERED BY KEY PLAYERSINDICATIVE PRICING TREND, BY TECHNOLOGY

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISPOLARIS LEVERAGED PTC’S WINDCHILL ENTERPRISE PLM SOLUTION THAT OPTIMIZED COSTSCELLI GROUP IMPLEMENTED DIGITAL THREAD USING PTC PRODUCT SUITE THAT INTEGRATED AND SYNCHRONIZED DATA ACROSS PRODUCT LIFECYCLEKIRLOSKAR COLLABORATED WITH PTC TO DEVELOP DIGITAL THREAD THAT IMPROVED AND EXPEDITED CUSTOMER SERVICE

-

5.11 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Industrial cybersecurityCOMPLEMENTARY TECHNOLOGIES- BlockchainADJACENT TECHNOLOGIES- AR and VR

-

5.12 TRADE ANALYSISIMPORT SCENARIO (HS CODE 851769)EXPORT SCENARIO (HS CODE 851769)

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 22025

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.16 IMPACT OF AI/GENERATIVE AI ON DIGITAL THREAD MARKETINTRODUCTIONCASE STUDYFUTURE OF AI/GENERATIVE AI IN DIGITAL THREAD MARKET

- 6.1 INTRODUCTION

-

6.2 PLMRISING SHIFT TOWARD CLOUD-BASED SOLUTIONS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

-

6.3 APMINTEGRATION OF IOT TO OBTAIN REAL-TIME INSIGHTS TO BOOST DEMAND

-

6.4 CADINCREASING ADOPTION IN MANUFACTURING AND AEROSPACE INDUSTRIES TO DRIVE MARKET

-

6.5 CAMGROWING ADOPTION OF CNC MACHINING TO ACCELERATE DEMAND

-

6.6 SLMSURGING DEMAND FOR PERSONALIZED SERVICES TO DRIVE MARKET

-

6.7 ALMINTEGRATION WITH DEVOPS TO AUTOMATE WORKFLOWS TO FUEL MARKET GROWTH

-

6.8 MRPADOPTION OF ADVANCED ANALYTICS AND AI TO ACCELERATE DEMAND

-

6.9 ERPGROWING NEED TO REDUCE MANUAL EFFORTS TO BOOST DEMAND

-

6.10 MESRISING ADOPTION OF SMART MANUFACTURING TO DRIVE MARKET

-

6.11 EDGE COMPUTINGDECREASED LATENCY AND IMPROVED SECURITY TO SPUR DEMAND

-

6.12 INDUSTRIAL SENSORSGROWING ADOPTION IN MANUFACTURING, ENERGY, HEALTHCARE INDUSTRIES TO FUEL MARKET GROWTH

-

6.13 SCADAINCREASING NEED TO MONITOR COMPLEX SYSTEMS IN INDUSTRIAL PLANTS TO BOOST DEMAND

-

6.14 INDUSTRIAL COMMUNICATIONASSISTANCE IN DECISION-MAKING AND PROCESS OPTIMIZATION TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 DATA COLLECTIONINCREASING DEMAND FOR UNIFIED AND REAL-TIME FLOW OF INFORMATION TO DRIVE MARKET

-

7.3 DATA MANAGEMENT & INTEGRATIONRISING DEMAND FOR WELL-STRUCTURED DATA COLLECTION TO FUEL MARKET GROWTH

-

7.4 CONNECTIVITY & INTEROPERABILITYABILITY TO OFFER SEAMLESS COMMUNICATION AND DATA EXCHANGE BETWEEN PLATFORMS AND DEVICES TO DRIVE MARKET

-

7.5 ANALYTICS & VISUALIZATIONENHANCED DECISION-MAKING AND IMPROVED OPERATIONAL EFFICIENCY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.1 INTRODUCTION

-

8.2 ON-PREMISESPRESSING NEED TO SECURE DATA TO DRIVE MARKET

-

8.3 CLOUD-BASEDGROWING NEED TO REDUCE UPFRONT INVESTMENT IN IT INFRASTRUCTURE TO SPUR DEMAND

- 9.1 INTRODUCTION

-

9.2 DESIGN & ENGINEERINGREDUCED NEED FOR PHYSICAL PROTOTYPES TO BOOST DEMAND

-

9.3 MANUFACTURINGINCREASING DEMAND TO ADDRESS COMPLEXITIES OF MANUFACTURING PROCESSES TO FUEL MARKET GROWTH

-

9.4 DISTRIBUTIONABILITY TO OFFER REAL-TIME PRODUCT TRACKING TO ACCELERATE DEMAND

-

9.5 CUSTOMER SUPPORTGROWING FOCUS ON ENHANCING REAL-TIME PERFORMANCE TO BOOST DEMAND

-

9.6 MAINTENANCE & SERVICESRISING EMPHASIS ON BOOSTING ASSET MANAGEMENT AND SERVICE OPERATIONS TO SPUR DEMANDDIGITAL THREAD MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

-

10.2 AUTOMOTIVEABILITY TO FACILITATE REAL-TIME COLLABORATION TO DRIVE MARKET

-

10.3 AEROSPACEADOPTION OF BIG DATA AND IOT TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

-

10.4 ENERGY & POWERINTEGRATION OF IOT, AI, AND PREDICTIVE ANALYTICS FOR ENHANCED ASSET MANAGEMENT TO FUEL MARKET GROWTH

-

10.5 PHARMACEUTICALSIMPROVED DECISION-MAKING AND OPERATIONAL EFFICIENCY TO DRIVE MARKET

-

10.6 MEDICAL DEVICESENHANCED PATIENT CARE AND DEVICE PERFORMANCE TO FUEL MARKET GROWTH

-

10.7 OIL & GASRISING EMPHASIS ON DIGITAL TRANSFORMATION TO DRIVE MARKET

-

10.8 CONSUMER GOODSINCREASING FOCUS ON OFFERING PERSONALIZED EXPERIENCES TO BOOST DEMAND

-

10.9 ELECTRONICS & SEMICONDUCTORSGROWING DEMAND FOR ACCURATE PRODUCT DEVELOPMENT TO DRIVE MARKET

-

10.10 HEAVY MACHINERYIMPROVED VISIBILITY AND TRACEABILITY TO FUEL MARKET GROWTH

-

10.11 CHEMICALSREDUCED WASTE AND DOWNTIME TO SPUR DEMAND

-

10.12 FOOD & BEVERAGESADOPTION OF CLOUD-BASED MANAGEMENT PLATFORMS TO FUEL MARKET GROWTH

- 10.13 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Growing adoption in aerospace and defense sectors to drive marketCANADA- Government-led initiatives to boost digitalization in manufacturing industry to spur demandMEXICO- Rising automation in manufacturing sector to fuel market growth

-

11.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Adoption of innovative manufacturing initiatives to accelerate demandGERMANY- Thriving automotive and machinery sectors to spur demandFRANCE- Rising emphasis on developing next-generation digital factories to offer lucrative growth opportunitiesREST OF EUROPE

-

11.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Increasing focus on smart manufacturing projects to boost demandJAPAN- Growing emphasis on modernizing manufacturing infrastructure to drive marketSOUTH KOREA- Integration of digital technologies with intelligent manufacturing processes to fuel market growthINDIA- Rising demand for real-time monitoring and reduced manufacturing costs to drive marketREST OF ASIA PACIFIC

-

11.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- increasing partnerships among industry vendors and process licensors to boost demand- GCC countries- Rest of Middle EastAFRICA- Rising investments in industrial automation and digital transformation to offer lucrative growth opportunitiesSOUTH AMERICA- Growing number of smart factories to fuel market growth

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025

- 12.3 REVENUE ANALYSIS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Region footprint- Technology footprint- Deployment footprint- End-use industry footprint

-

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

13.1 KEY PLAYERSSIEMENS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPTC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDASSAULT SYSTÈMES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developmentsAUTODESK INC.- Business overview- Products/Solutions/Services offered- Recent developmentsORACLE- Business overview- Products/Solutions/Services offered- Recent developmentsAVEVA GROUP LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsGENERAL ELECTRIC COMPANY- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSACCENTUREANSYS, INC.TATA CONSULTANCY SERVICES LIMITEDHEXAGON ABCOGNIZANTDXC TECHNOLOGY COMPANYBOSCH GLOBAL SOFTWARE TECHNOLOGIES PRIVATE LIMITEDBENTLEY SYSTEMES, INCORPORATEDMATTERPORT INC.HITACHI VANTARA LLCPROSTEP INCARASALTAIR ENGINEERING INC.RAZORLEAFCAPGEMINIAEGIS INDUSTRIAL SOFTWARE CORPORATIONTACTON SYSTEMS AB

-

14.1 DIGITAL TWIN MARKET, BY ENTERPRISEINTRODUCTIONLARGE ENTERPRISES- Adoption of blockchain technology in healthcare and oil & gas industries to spur demandSMALL & MEDIUM ENTERPRISES- Improved inventory management and quick access to real-time data to fuel market growth

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 ROLES OF COMPANIES IN DIGITAL THREAD ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE TREND OF PLM OFFERED BY KEY PLAYERS, BY REGION (USD)

- TABLE 3 INDICATIVE PRICING TREND, BY TECHNOLOGY (USD)

- TABLE 4 DIGITAL THREAD MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 7 IMPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2024 (Q1–Q3) (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2024 (Q1–Q3) (USD MILLION)

- TABLE 9 DIGITAL THREAD MARKET: LIST OF KEY PATENTS, 2022–2024

- TABLE 10 DIGITAL THREAD MARKET: LIST OF CONFERENCES AND EVENTS, 2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 DIGITAL THREAD MARKET: STANDARDS

- TABLE 16 DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 17 DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 18 PLM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 19 PLM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 20 APM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 21 APM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 22 CAD: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 23 CAD: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 24 CAM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 25 CAM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 26 SLM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 27 SLM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 28 ALM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 29 ALM: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 30 MRP: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 31 MRP: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 32 ERP: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 33 ERP: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 34 MES: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 35 MES: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 36 EDGE COMPUTING: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 37 EDGE COMPUTING: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 38 INDUSTRIAL SENSORS: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 39 INDUSTRIAL SENSORS: DIGITAL THREAD MARKET, BY END-USE INDUSTRY,2024–2030 (USD MILLION)

- TABLE 40 SCADA: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 41 SCADA: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 42 INDUSTRIAL COMMUNICATION: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 43 INDUSTRIAL COMMUNICATION: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 44 DIGITAL THREAD MARKET, BY MODULE, 2022–2023 (USD MILLION)

- TABLE 45 DIGITAL THREAD MARKET, BY MODULE, 2024–2030 (USD MILLION)

- TABLE 46 DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 47 DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 48 ON-PREMISES: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 49 ON-PREMISES: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 50 CLOUD-BASED: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 51 CLOUD-BASED: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 52 DIGITAL THREAD MARKET, BY APPLICATION, 2022–2023 (USD MILLION)

- TABLE 53 DIGITAL THREAD MARKET, BY APPLICATION, 2024–2030 (USD MILLION)

- TABLE 54 DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 55 DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 56 AUTOMOTIVE: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 57 AUTOMOTIVE: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 58 AUTOMOTIVE: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 59 AUTOMOTIVE: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 60 AUTOMOTIVE: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 61 AUTOMOTIVE: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 62 AEROSPACE: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 63 AEROSPACE: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 64 AEROSPACE: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 65 AEROSPACE: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 66 AEROSPACE: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 67 AEROSPACE: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 68 ENERGY & POWER: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 69 ENERGY & POWER: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 70 ENERGY & POWER: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 71 ENERGY & POWER: DIGITAL THREAD MARKET, BY DEPLOYMENT,2024–2030 (USD MILLION)

- TABLE 72 ENERGY & POWER: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 73 ENERGY & POWER: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 74 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 75 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY TECHNOLOGY,2024–2030 (USD MILLION)

- TABLE 76 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 77 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 78 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 79 PHARMACEUTICALS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 80 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 81 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 82 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 83 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY DEPLOYMENT,2024–2030 (USD MILLION)

- TABLE 84 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 85 MEDICAL DEVICES: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 86 OIL & GAS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 87 OIL & GAS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 88 OIL & GAS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 89 OIL & GAS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 90 OIL & GAS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 91 OIL & GAS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 92 CONSUMER GOODS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 93 CONSUMER GOODS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 94 CONSUMER GOODS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 95 CONSUMER GOODS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 96 CONSUMER GOODS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 97 CONSUMER GOODS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 98 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 99 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 100 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 101 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 102 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 103 ELECTRONICS & SEMICONDUCTORS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 104 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY TECHNOLOGY,2022–2023 (USD MILLION)

- TABLE 105 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 106 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 107 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 108 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 109 HEAVY MACHINERY: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 110 CHEMICALS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 111 CHEMICALS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 112 CHEMICALS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 113 CHEMICALS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 114 CHEMICALS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 115 CHEMICALS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 116 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 117 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 118 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 119 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 120 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 121 FOOD & BEVERAGES: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 122 OTHERS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2022–2023 (USD MILLION)

- TABLE 123 OTHERS: DIGITAL THREAD MARKET, BY TECHNOLOGY, 2024–2030 (USD MILLION)

- TABLE 124 OTHERS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2022–2023 (USD MILLION)

- TABLE 125 OTHERS: DIGITAL THREAD MARKET, BY DEPLOYMENT, 2024–2030 (USD MILLION)

- TABLE 126 OTHERS: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 127 OTHERS: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 128 DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 129 DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: DIGITAL THREAD MARKET, BY COUNTRY, 2022–2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: DIGITAL THREAD MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: DIGITAL THREAD MARKET, BY END-USE INDUSTRY,2024–2030 (USD MILLION)

- TABLE 134 EUROPE: DIGITAL THREAD MARKET, BY COUNTRY, 2022–2023 (USD MILLION)

- TABLE 135 EUROPE: DIGITAL THREAD MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 136 EUROPE: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 137 EUROPE: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DIGITAL THREAD MARKET, BY COUNTRY, 2022–2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DIGITAL THREAD MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 142 ROW: DIGITAL THREAD MARKET, BY REGION, 2022–2023 (USD MILLION)

- TABLE 143 ROW: DIGITAL THREAD MARKET, BY REGION, 2024–2030 (USD MILLION)

- TABLE 144 MIDDLE EAST: DIGITAL THREAD MARKET, BY COUNTRY, 2022–2023 (USD MILLION)

- TABLE 145 MIDDLE EAST: DIGITAL THREAD MARKET, BY COUNTRY, 2024–2030 (USD MILLION)

- TABLE 146 ROW: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2022–2023 (USD MILLION)

- TABLE 147 ROW: DIGITAL THREAD MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION)

- TABLE 148 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025

- TABLE 149 DIGITAL THREAD MARKET: DEGREE OF COMPETITION, 2023

- TABLE 150 DIGITAL THREAD MARKET: REGION FOOTPRINT

- TABLE 151 DIGITAL THREAD MARKET: TECHNOLOGY FOOTPRINT

- TABLE 152 DIGITAL THREAD MARKET: DEPLOYMENT FOOTPRINT

- TABLE 153 DIGITAL THREAD MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 154 DIGITAL THREAD MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 155 DIGITAL THREAD MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- TABLE 156 DIGITAL THREAD MARKET: PRODUCT LAUNCHES, JANUARY 2022–JANUARY 2025

- TABLE 157 DIGITAL THREAD MARKET: DEALS, JANUARY 2022–JANUARY 2025

- TABLE 158 DIGITAL THREAD MARKET: EXPANSIONS, JANUARY 2022–JANUARY 2025

- TABLE 159 SIEMENS: COMPANY OVERVIEW

- TABLE 160 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SIEMENS: PRODUCT LAUNCHES

- TABLE 162 SIEMENS: DEALS

- TABLE 163 PTC: COMPANY OVERVIEW

- TABLE 164 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 PTC: DEALS

- TABLE 166 DASSAULT SYSTÈMES: COMPANY OVERVIEW

- TABLE 167 DASSAULT SYSTÈMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 DASSAULT SYSTÈMES: DEALS

- TABLE 169 IBM: COMPANY OVERVIEW

- TABLE 170 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 IBM: DEALS

- TABLE 172 SAP: COMPANY OVERVIEW

- TABLE 173 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 SAP: PRODUCT LAUNCHES

- TABLE 175 SAP: DEALS

- TABLE 176 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 177 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SAP: PRODUCT LAUNCHES

- TABLE 179 ROCKWELL AUTOMATION: DEALS

- TABLE 180 AUTODESK INC.: COMPANY OVERVIEW

- TABLE 181 AUTODESK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 AUTODESK INC.: PRODUCT LAUNCHES

- TABLE 183 AUTODESK INC.: DEALS

- TABLE 184 ORACLE: COMPANY OVERVIEW

- TABLE 185 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ORACLE: PRODUCT LAUNCHES

- TABLE 187 AVEVA GROUP LIMITED: COMPANY OVERVIEW

- TABLE 188 AVEVA GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 AVEVA GROUP LIMITED: PRODUCT LAUNCHES

- TABLE 190 AVEVA GROUP LIMITED: EXPANSIONS

- TABLE 191 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 192 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 194 ACCENTURE: COMPANY OVERVIEW

- TABLE 195 ANSYS, INC.: COMPANY OVERVIEW

- TABLE 196 TATA CONSULTANCY SERVICES LIMITED: COMPANY OVERVIEW

- TABLE 197 HEXAGON AB: COMPANY OVERVIEW

- TABLE 198 COGNIZANT: COMPANY OVERVIEW

- TABLE 199 DXC TECHNOLOGY COMPANY: COMPANY OVERVIEW

- TABLE 200 BOSCH GLOBAL SOFTWARE TECHNOLOGIES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 201 BENTLY SYSTEMES, INCORPORATED: COMPANY OVERVIEW

- TABLE 202 MATTERPORT INC.: COMPANY OVERVIEW

- TABLE 203 HITACHI VANTARA LLC: COMPANY OVERVIEW

- TABLE 204 PROSTEP INC: COMPANY OVERVIEW

- TABLE 205 ARAS: COMPANY OVERVIEW

- TABLE 206 ALTAIR ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 207 RAZORLEAF: COMPANY OVERVIEW

- TABLE 208 CAPGEMINI: COMPANY OVERVIEW

- TABLE 209 AEGIS INDUSTRIAL SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 210 TACTON SYSTEMS AB: COMPANY OVERVIEW

- TABLE 211 DIGITAL TWIN MARKET, BY ENTERPRISE, 2019–2022 (USD MILLION)

- TABLE 212 DIGITAL TWIN MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 213 LARGE ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 214 LARGE ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 215 SMALL & MEDIUM ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 216 SMALL & MEDIUM ENTERPRISES: DIGITAL TWIN MARKET, BY REGION,2023–2028 (USD MILLION)

- FIGURE 1 DIGITAL THREAD MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DIGITAL THREAD MARKET: RESEARCH DESIGN

- FIGURE 3 DIGITAL THREAD MARKET: BOTTOM-UP APPROACH

- FIGURE 4 DIGITAL THREAD MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY DIGITAL THREAD PROVIDERS

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 CLOUD-BASED SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 ANALYTICS & VISUALIZATION SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 9 DESIGN & ENGINEERING SEGMENT TO LEAD MARKET IN 2024

- FIGURE 10 EDGE COMPUTING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 12 NORTH AMERICA CLAIMED LARGEST MARKET SHARE IN 2023

- FIGURE 13 EXPANDING PHARMACEUTICAL INDUSTRY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 14 CLOUD-BASED DEPLOYMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ANALYTICS & VISUALIZATION SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DESIGN & ENGINEERING TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 PLM TECHNOLOGY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 PHARMACEUTICALS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO SECURE LARGEST MARKET SHARE IN 2024

- FIGURE 20 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 DIGITAL THREAD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 DIGITAL THREAD MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 DIGITAL THREAD MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 DIGITAL THREAD MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 DIGITAL THREAD MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 DIGITAL THREAD MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 DIGITAL THREAD MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 AVERAGE SELLING PRICE TREND OF PLM OFFERED BY KEY PLAYERS, BY REGION

- FIGURE 30 AVERAGE SELLING PRICE TREND OF PLM, BY REGION, 2019–2023

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 DIGITAL THREAD MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 34 BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 35 IMPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019–2024 (Q1–Q3)

- FIGURE 36 EXPORT DATA FOR HS CODE 851769-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019–2024 (Q1–Q3)

- FIGURE 37 DIGITAL THREAD MARKET: PATENTS APPLIED AND GRANTED, 2015–2024

- FIGURE 38 DIGITAL THREAD USE CASES IN AI/GENERATIVE AI

- FIGURE 39 IMPACT OF AI/GENERATIVE AI ON DIGITAL THREAD MARKET

- FIGURE 40 EDGE COMPUTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ANALYTICS & VISUALIZATION SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 42 DIGITAL THREAD MARKET, BY DEPLOYMENT

- FIGURE 43 CLOUD-BASED SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 DESIGN & ENGINEERING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 DIGITAL THREAD MARKET, BY END-USE INDUSTRY

- FIGURE 46 PLM TO DOMINATE MARKET IN 2030

- FIGURE 47 DIGITAL THREAD MARKET, BY REGION

- FIGURE 48 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: DIGITAL THREAD MARKET SNAPSHOT

- FIGURE 50 EUROPE: DIGITAL THREAD MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: DIGITAL THREAD MARKET SNAPSHOT

- FIGURE 52 MIDDLE EAST TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 53 DIGITAL THREAD MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019–2023

- FIGURE 54 MARKET SHARE ANALYSIS OF DIGITAL THREAD PROVIDERS, 2023

- FIGURE 55 COMPANY VALUATION, 2024

- FIGURE 56 FINANCIAL METRICS

- FIGURE 57 DIGITAL MARKET THREAD: BRAND/PRODUCT COMPARISON

- FIGURE 58 DIGITAL THREAD MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 59 DIGITAL THREAD MARKET: COMPANY FOOTPRINT

- FIGURE 60 DIGITAL THREAD MARKET: COMPANY EVALUATION MATRIX(STARTUPS/SMES), 2023

- FIGURE 61 SIEMENS: COMPANY SNAPSHOT

- FIGURE 62 PTC: COMPANY SNAPSHOT

- FIGURE 63 DASSAULT SYSTÈMES: COMPANY SNAPSHOT

- FIGURE 64 IBM: COMPANY SNAPSHOT

- FIGURE 65 SAP: COMPANY SNAPSHOT

- FIGURE 66 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 67 AUTODESK INC.: COMPANY SNAPSHOT

- FIGURE 68 ORACLE: COMPANY SNAPSHOT

- FIGURE 69 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 70 DIGITAL TWIN MARKET, BY ENTERPRISE

- FIGURE 71 SMALL & MEDIUM ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

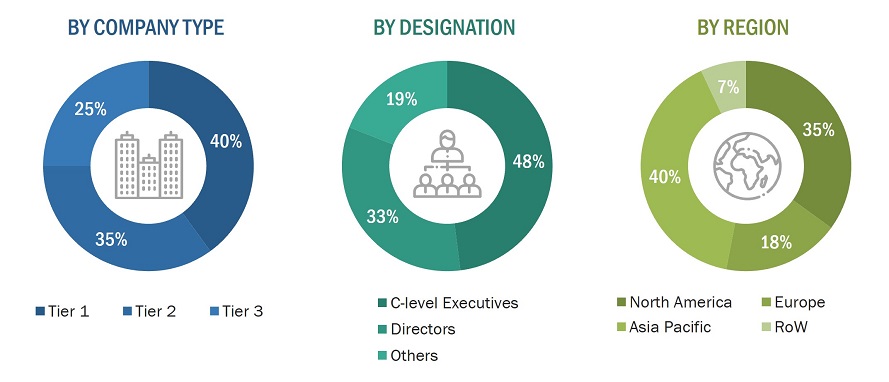

The study involves four major activities that estimate the size of the digital thread market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the digital thread market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from digita thread providers, (such as Capgemini, Accenture, Siemens, PTC, SAP) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the digital thread market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Market Size Estimation Methodology-Bottom-up approach

Bottom-Up Approach

Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

A digital thread provides a comprehensive view of a product's life cycle, starting with design and development and going all the way through manufacturing, maintenance, service, and retirement. It provides a continuous, traceable flow of information, enabling real-time access to and analysis of data from various stages and sources. This integration ensures that all stakeholders have a unified view of the product and its lifecycle, facilitating better decision-making, improving efficiency, and enhancing product quality and performance.

Stakeholders

- End users

- Government bodies, venture capitalists, and private equity firms

- Digital thread solution provider

- Digital thread service provider

- Digital thread industry associations

- Professional service/solution providers

- Cloud service providers

- Consulting firms

- Research institutions and organizations

- Standards organizations and regulatory authorities

- System integrators

- Technology consultants

The main objectives of this study are as follows:

- To describe and forecast the digital thread market in terms of value based on technology, module, deployment, application, vertical, and region

- To forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the digital thread ecosystem

- To provide a detailed analysis of the impact of the AI on the digital thread market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Digital Thread Market