Electric Fuse Market

Electric Fuse Market by Type (Power Fuse & Fuse Link, Distribution Cutouts, Cartridge & Plug Fuse), Current Type (AC, DC), Voltage (Low, Medium, High), End Users (Utilities, Transportation, Industrial, Residential, Commercial), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global electric fuse market is projected to reach USD 5.07 billion by 2030 from an estimated USD 4.00 billion in 2025, at a CAGR of 4.9% during the forecast period. The market growth is driven by the increasing adoption of electrification across industrial, commercial, and residential sectors, as well as the integration of renewable energy systems and smart grids.Rising safety and reliability standards, along with stringent electrical codes and regulatory compliance requirements, are encouraging utilities and industrial operators to adopt advanced fuse solutions. Additionally, technological advancements in current-limiting fuses, modular designs, and digital monitoring are enhancing operational efficiency, fault protection, and system reliability, further supporting market expansion across critical power distribution networks.

KEY TAKEAWAYS

-

BY CURRENT TYPEThe electric fuse market, by current type, is segmented into AC and DC fuses. AC fuses dominate the market due to their widespread use in residential, commercial, and industrial electrical networks. These fuses are designed to interrupt alternating current flow effectively, ensuring equipment protection and circuit reliability. Continuous improvements in arc-quenching materials and fuse element design have enhanced their operational lifespan and breaking capacity.

-

BY TYPEThe electric fuse market, by type, includes Power Fuses & Fuse Links, Distribution Cutouts, Cartridge & Plug Fuses, and Other Types. The Distribution Cutouts segment is projected to register the highest CAGR during the forecast period, driven by their essential role in protecting overhead distribution lines and transformers. Advancements in weather-resistant housings, polymer materials, and self-resetting mechanisms are enhancing field reliability and ease of maintenance.

-

BY VOLTAGEThe electric fuse market, by voltage, is categorized into Low Voltage, Medium Voltage, and High Voltage segments. The Medium Voltage segment holds the largest market share owing to extensive deployment in utility substations, industrial switchgear, and renewable power distribution systems. Rising grid modernization projects, coupled with safety upgrades and integration of renewable energy sources, are driving demand for medium voltage fuse solutions.

-

BY END USERThe electric fuse market, by end user, includes Power Generation, Industrial, Transportation, Residential, Commercial, and Others. The Transportation segment is expected to grow at the fastest rate, supported by increasing electrification in railways, EV charging infrastructure, and marine systems. Fuses designed for high current and voltage transients are gaining traction in mobility applications to ensure operational safety and performance stability.

-

BY REGIONThe Asia Pacific region dominates the electric fuse market, driven by rapid industrialization, expanding manufacturing bases, and strong investments in power infrastructure across China, India, Japan, and South Korea. The increasing adoption of smart grids, renewable energy integration, and electric mobility solutions has significantly boosted fuse demand across utilities and industrial applications. Moreover, supportive regulatory frameworks and large-scale electrification projects continue to position Asia Pacific as a key growth hub for fuse manufacturers.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and agreements. For instance, Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Eaton (Ireland) and Littelfuse, Inc. (US)have entered into a number of agreements and partnerships to cater to the growing demand for electric fuse.

The electric fuse market is influenced by the growing demand for reliable, safe, and efficient circuit protection solutions across power, industrial, and mobility applications. The shift toward electrification, renewable energy integration, and smart grid modernization has increased the need for high-performance fuses capable of managing fluctuating loads and protecting sensitive electrical systems. These developments have accelerated investments in advanced fuse manufacturing technologies, product standardization, and automation within production facilities. Although consumption remains concentrated in key regions such as Asia Pacific, North America, and Europe, expanding infrastructure, digitalization of power networks, and regulatory mandates for electrical safety and energy efficiency are reshaping the market landscape and driving sustained growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The electric fuse market is witnessing a significant transformation driven by increasing electrification, renewable integration, and the rapid expansion of industrial automation. Utilities, OEMs, and industrial users are demanding advanced fuses with higher breaking capacities, faster response times, and improved thermal performance to protect sensitive grid and electronic equipment. Growing investments in EV infrastructure, data centers, and smart grids are prompting fuse manufacturers to innovate in compact, modular, and eco-efficient fuse designs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for protection devices in distributed generation systems

-

Government safety regulations and energy-efficiency mandates

Level

-

Presence of other substitutes

-

Volatility in raw material prices

Level

-

Industrial automation and digitalization

-

Rapid electrification of transportation and expansion of EV charging infrastructure.

Level

-

Challenges associated with designing fuses that can handle fast transients in advanced power electronics

-

High maintenance and replacement frequency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Development of Smart Grid Infrastructure Requiring Advanced Protection Components

The growing development of smart grid infrastructure is one of the key drivers of the electric fuse market. Smart grids integrate advanced communication, automation, and control systems to enhance power reliability, efficiency, and grid resilience. As these networks connect distributed energy resources such as solar, wind, and energy storage systems, they require highly sensitive and adaptive protection components to manage complex load variations and bidirectional power flow. Electric fuses play a critical role in ensuring fault isolation, system stability, and safety in these digitalized grid environments. With the increasing deployment of smart substations and advanced metering infrastructure (AMI), the demand for fuses with higher breaking capacities, faster response times, and superior arc-quenching capabilities has grown substantially. Furthermore, utilities and grid operators are focusing on compact, maintenance-free, and eco-efficient fuse solutions to support decentralized power generation, grid automation, and evolving standards for reliable energy transmission and distribution.

Restraint: Volatility in Raw Material Prices Affecting Production Costs

The electric fuse market faces significant restraints due to the volatility in prices of key raw materials such as silver, copper, and ceramics. These materials are critical for fuse manufacturing—silver is used for fuse elements due to its high conductivity and stability, copper is essential for terminals and connections, while ceramics are widely used for insulation and housing. Fluctuations in global commodity prices, driven by supply chain disruptions, mining constraints, and geopolitical tensions, directly impact production costs and profit margins for manufacturers. The increasing demand for these metals across industries like electronics, renewable energy, and electric vehicles further adds pressure on availability and pricing. As a result, fuse manufacturers are challenged to maintain cost competitiveness while ensuring product quality and reliability. To mitigate these effects, companies are focusing on material optimization, recycling, and developing cost-effective alternatives without compromising performance or safety standards.

Opportunity: Rapid Electrification of Transportation and Expansion of EV Charging Infrastructure

The growing electrification of the transportation sector presents a major opportunity for the electric fuse market. As electric vehicles (EVs), hybrid vehicles, and electric public transport systems continue to expand globally, the need for reliable overcurrent protection becomes increasingly critical. Electric fuses are essential components in EV power electronics, battery management systems, and on-board chargers, providing safety against short circuits and overloads. Additionally, the rapid deployment of EV charging infrastructure—ranging from residential AC chargers to high-power DC fast-charging stations—requires robust fuse protection to handle higher voltages and currents safely. Governments worldwide are introducing incentives and mandates to accelerate EV adoption, which in turn is spurring demand for supporting electrical infrastructure. With advancements in high-voltage fuse technology and the increasing focus on fast-charging networks, manufacturers have significant opportunities to develop specialized fuses tailored to the evolving needs of the EV ecosystem.

Challenge: High maintenance and replacement frequency in some high-current applications

One of the key challenges facing the electric fuse market is the frequent need for maintenance and replacement in high-current and heavy-duty applications. In industries such as power transmission, railways, and large-scale manufacturing, fuses are subjected to extreme electrical loads and environmental stress. Continuous exposure to high fault currents, temperature fluctuations, and mechanical vibrations accelerates fuse wear and reduces operational lifespan. This results in recurring maintenance cycles, leading to higher operational costs and downtime for end users. Additionally, in critical installations such as substations or industrial automation systems, replacement often requires system shutdowns, further impacting productivity. While advancements in fuse material design and thermal endurance are helping extend fuse life, the lack of predictive maintenance tools and monitoring technologies for conventional fuses continues to challenge end users. Hence, manufacturers are focusing on developing smart fuse systems with self-diagnostic and real-time monitoring capabilities to mitigate these issues.

Electric Fuse Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Rexel Electrical Knoxfield faced challenges managing low-volume, high-mix fuse inventories, leading to stockouts, service delays, and operational inefficiencies. Fuseco partnered with Rexel to restructure the fuse section, introducing clearly labeled tote boxes, digital inventory reconciliation, and assorted fuse kits to improve accessibility for miniature and cartridge fuses. | The initiative streamlined inventory management by reducing obsolete and excess stock while improving accuracy through digital reconciliation. Customer accessibility and service levels were enhanced, allowing faster order fulfillment and better availability of specialty fuses. The solution also increased fuse sales, picking accuracy, and operational efficiency, strengthening Rexel’s reputation as a reliable supplier of niche and hard-to-find fuse products. |

|

Fuse Service provided a turnkey electrical installation for a newly constructed U.S. home, covering design, wiring, panel setup, outlets, lighting, and low-voltage systems. The solution ensured code compliance, streamlined delivery, and future-ready capacity for EV charging, security, and data systems. | The integrated solution ensured code compliance, seamless coordination, and reduced project complexity. Homeowners received a fully operational electrical system with future-proof capacity for upgrades, improved efficiency in installation, and a single point of contact for all electrical needs. The project minimized delays, enhanced quality, and offered convenience and reliability throughout the construction process. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The electric fuse market ecosystem represents an integrated value chain connecting material providers, component manufacturers, OEMs, testing bodies, and end users, ensuring safety, performance, and compliance across applications. Raw material providers such as Boliden Group (Sweden), Rio Tinto (UK), Saint-Gobain (France), BASF SE (Germany), and 3M Company (US) supply key inputs like metals, ceramics, and insulation materials essential for fuse production. Component and subassembly manufacturers, including Mersen SA (France), SIBA GmbH (Germany), Schott AG (Germany), and Weidmüller Interface GmbH (Germany), develop precision-engineered components that ensure high thermal and electrical reliability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Electric Fuse Market, By Current Type

Based on current type, the electric fuse market is categorized into AC fuses and DC fuses, each designed to handle distinct electrical characteristics. AC fuses are widely used in alternating current systems, such as household wiring, industrial power distribution, and grid infrastructure, where the current periodically changes direction. These fuses are optimized to interrupt fault currents efficiently at zero-crossing points, ensuring minimal arcing.

Electric Fuse Market, By Type

The market is segmented into power fuses & fuse links, distribution cutouts, cartridge & plug fuses, and other specialized types. Power fuses and cutouts are widely used in medium- and high-voltage grid applications, while cartridge and plug fuses dominate low-voltage and consumer electronics. The growing demand for reliable protection across industrial and renewable systems is driving adoption across all fuse categories.

Electric Fuse Market, By Voltage

The electric fuse market, by voltage, is segmented into low voltage, medium voltage, and high voltage fuses. Low-voltage fuses are widely used in residential, commercial, and automotive applications for circuit and equipment protection. Medium-voltage fuses serve industrial systems, substations, and distribution networks, while high-voltage fuses are deployed in transmission and heavy-duty utility infrastructure. The increasing expansion of renewable energy grids and smart substations is driving demand across all voltage categories.

Electric Fuse Market, By End User

The electric fuse market, by end user, is segmented into residential, commercial, industrial, transportation, and utilities. The industrial and utilities segments hold the largest share, driven by extensive deployment of fuses in switchgear, transformers, substations, and grid protection systems to ensure safe and reliable power distribution. The transportation sector is emerging as a high-growth segment, supported by rapid electrification of vehicles, expansion of EV charging infrastructure, and adoption of high-performance fuses in electric mobility applications.

REGION

North America to exhibit highest CAGR during forecast period

North America is projected to witness the highest CAGR in the global electric fuse market during the forecast period, driven by increasing investments in grid modernization, renewable energy integration, and industrial automation. The replacement of aging transmission and distribution infrastructure is a key factor supporting demand for medium- and high-voltage fuses, while the growing adoption of low-voltage fuses in residential, commercial, and industrial applications further contributes to market expansion. The region’s strong growth is also influenced by government incentives and policies promoting clean energy and energy storage systems, which require reliable protection devices in electrical circuits. Additionally, the rise of electric vehicle (EV) infrastructure and battery storage installations is driving demand for specialized fuses, including DC and fast-acting variants. Major players such as Eaton, Littelfuse, ABB, and Siemens are actively expanding their footprint in the region to capitalize on these growth opportunities.

Electric Fuse Market: COMPANY EVALUATION MATRIX

ABB is a leading player in the global electric fuse market, recognized for its advanced technology, extensive product range, and strong international footprint. The company provides low-, medium-, and high-voltage fuses for industrial, commercial, utility, and renewable energy applications, ensuring high reliability and overcurrent protection. ABB’s continuous focus on innovation, system integration, and high rupturing capacity designs enhances efficiency, safety, and cost-effectiveness. Strategic partnerships with utilities, governments, and industries further strengthen its position, driving widespread adoption of ABB fuses across modernized grids, energy storage systems, and industrial installations worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 3.77 Billion |

| Revenue Forecast in 2030 | USD 5.07 Billion |

| Growth Rate | CAGR of 4.9% from 2025–2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2030 |

| Units considered | Value (USD Million) and Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Electric Fuse Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electric Fuse Market for EU, Southeast Asia, and the Middle East focusing on LV and MV Fuses | The study was customized to provide a regional breakdown of the LV (Low Voltage) and MV (Medium Voltage) fuse markets, including country-level demand assessment, regulatory frameworks, and product segmentation. The report analyzed market dynamics, key suppliers, and end-user adoption trends. It also included competitive benchmarking of major regional players with focus on technological advancements and import–export analysis. | Delivered in-depth regional insights identifying high-growth opportunities across EU, Southeast Asia, and the Middle East. Provided fuse type–specific market sizing with CAGR projections and policy-driven market enablers. |

RECENT DEVELOPMENTS

- September 2025: : Eaton announced launch of its global fuse portfolio to support electric vehicles and energy storage systems. The new fuses offer both low- and high-voltage protection, improving safety and performance. Eaton will showcase these circuit protection solutions at The Battery Show 2025.

- May 2025: : Littelfuse, Inc launched the Nano² 415 SMD Series Fuse, the first surface-mount fuse from the company with a 1500 A interrupting rating at 277 V. The fuse is ideal for consumer electronics, industrial systems, automotive charging, appliances, and home automation.

- March 2025: : Mitsubishi Electric announced the establishment of a new Factory Automation (FA) Business Headquarters in China. The headquarters will focus on developing autonomous FA systems tailored to local customer needs. The move aims to accelerate innovation, leverage local expertise, and strengthen the company’s presence in China’s growing automation market.

- May 2024 : Littelfuse, Inc opened Manufacturing Facility in Piedras Negras, Mexico, doubling its manufacturing capacity in the region. The 106,000 sq. ft. facility uses advanced automation and sustainable practices to support industrial applications like renewable energy, data centers, and factory automation. It employs around 1,000 people, boosting local jobs and community engagement.

- July 2023 : Littelfuse released AEC-Q200 Rev E-qualified fuses, including thin film, Nano², PICO®, and cartridge types, designed for automotive and EV electronics. These fuses provide reliable circuit protection for applications like OBCs, PDUs, BMS, DC/DC converters, ignition systems, and ADAS. The portfolio ensures high inrush current withstand and long-term reliability in harsh automotive environments.

Table of Contents

Methodology

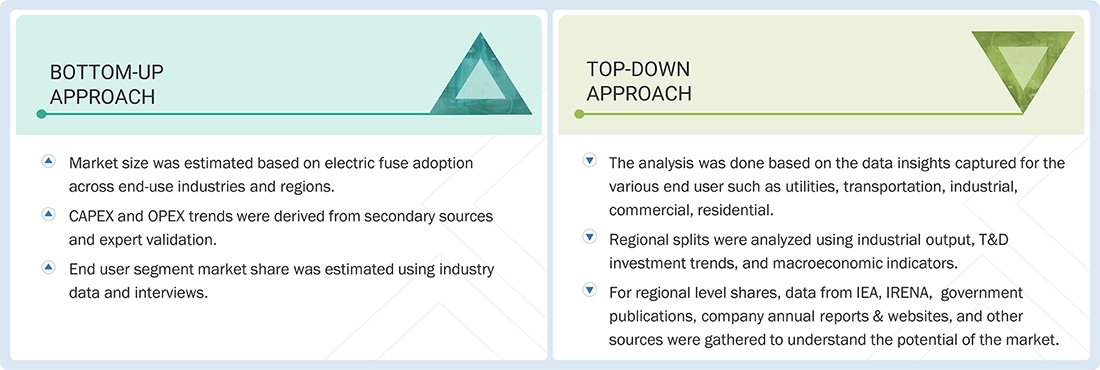

The study involved major activities in estimating the current size of the electric fuse market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation techniques were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study utilized extensive secondary sources, directories, and databases, including Hoover’s, Bloomberg, Factiva, IRENA, the International Energy Agency, and Statista Industry Journal, to collect and identify valuable information for a technical, market-oriented, and commercial study of the electric fuse. Other secondary sources included annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, as well as manufacturer associations, trade directories, and databases.

Primary Research

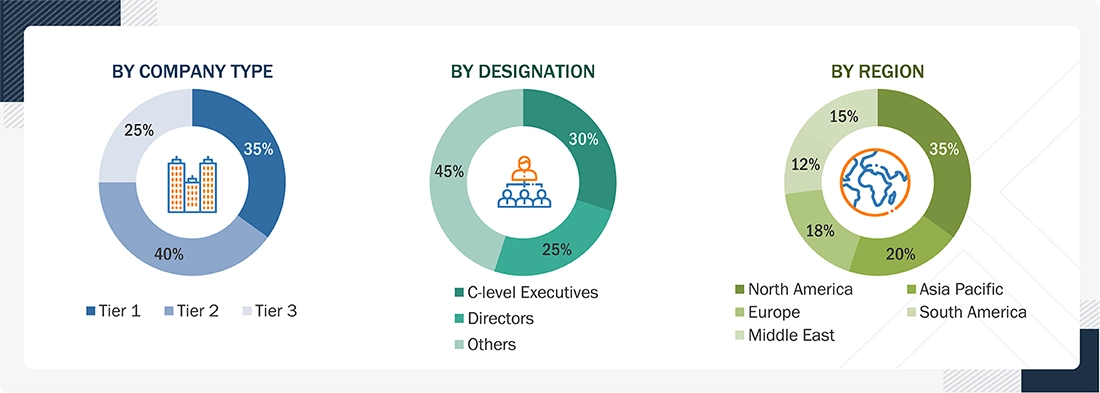

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the electric fuse market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion,

Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the electric fuse market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following.

Electric Fuse Market : Top-Down and Bottom-Up Approach

Data Triangulation

The total market was split into several segments and subsegments after arriving at the overall market size from the above estimation process. Data triangulation and market breakdown processes were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

An electric fuse is a safety device used in electrical circuits to protect equipment and wiring from overcurrent or short circuits. It consists of a metallic wire or strip that melts when the current flowing through it exceeds a specified limit, thereby interrupting the circuit and preventing damage or fire. Electric fuses help protect electrical equipment from overcurrent situations in circuits and avoid catastrophic aftereffects such as fire or electric arcing.

The electric fuse market is defined as the total revenue generated by companies from the sale of electric fuses across various end-use industries such as utilities, industrial, residential, commercial, EV Charging, transportation, data centers, and others.

Stakeholders

- Electric fuse manufacturers, dealers, and suppliers

- Energy utilities

- Government and industry associations

- Government and research organizations

- Institutional investors

- Investors/shareholders

- Power and energy associations

- Transmission and distribution utilities

Report Objectives

- To describe, segment, and forecast the electric fuse market size, by type, current type, voltage, and end user in terms of value

- To forecast the market size across five key regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with the country-level market sizes, in terms of value

- To forecast the market size across five key regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, in terms of volume

- To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the electric fuse market

- To strategically analyze the electric fuse market for individual growth trends, prospects, and contributions of each segment to the market

- To provide information pertaining to the supply chain, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, impact of AI/Gen AI, impact of US Tariff, Porter’s five forces analysis, and regulatory landscape of the electric fuse market.

- To strategically analyze the micromarkets1 with respect to individual growth trends, upcoming expansions, and their contributions to the overall market

- To analyze opportunities for stakeholders in the electric fuse market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

- To track and analyze competitive developments, such as contracts, agreements, investments, expansions, product launches, partnerships, joint ventures, collaborations, and acquisitions, in the electric fuse market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies using the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the electric fuse market by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Electric Fuse Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Electric Fuse Market