Extracorporeal Membrane Oxygenation Machine Market / ECMO Machine Market by Product, Component, Patient Type (Neonates, Pediatrics and Adults), Modality Outlook (Veno-Venous, Veno-Arterio and Arterio-Venous), Applications, and Region - Global Forecast to 2026

The global ECMO Machine Market in terms of revenue was estimated to be worth $531 million in 2021 and is poised to reach $673 million by 2026, growing at a CAGR of 4.9% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The major factors driving the growth of this market include the increasing geriatric population and growth in disease incidence as well as favorable government regulations, investments, and initiatives. The advantages of ECMO machines have played a key part in their adoption; their speed and accuracy, as well as quick processing times, allow for significantly higher patient screening volumes than earlier. This has pushed companies to focus on product development and innovation. However, these systems are priced at a premium, which slows their greater adoption. Other factors such as declining reimbursements, lack of infrastructure, particularly in developing and underdeveloped countries, and potential risks associated with radiation exposure are also expected to hinder the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

ECMO Machine Market Dynamics

Driver: Growing adoption of ECMO in Lung Transplantation Procedures

The number of lung transplantation has increased in the last few decades, especially in the treatment of end stage lung diseases such as Chronic Obstructive Pulmonary Disease (COPD), Interstitial Lung Disease and Cystic Fibrosis.

Over the years, the adoption of ECMO machine in lung transplantation procedure has increased significantly in the management of patients with severe lung disease. The most common indication for the use of ECMO is Primary Graft Dysfunction (PGD) post lung transplantation. PGD is a syndrome consisting of lung injusry during the first 72 hours following lung transplant. With significant improvements in technologies, several studies have shown positive outcomes related to the use of ECMO as a bridging strategy as well as therapy for patients suffering from PGD, post transplant.

With the increasing prevalence of lung diseases across the globe, the use of ECMO is expected to rise further in the coming years.

Restraint: High cost of ECMO products

ECMO is an expensive therapy. Apart from the costs associated with the systems, other expenses include cost of staying at the hospital and the cost of additional disposable accessories. In addition to this, an entire team of medical professionals is required to take care of the patient undergoing an ECMO procedure, which adds to the cost of the treatment, although it differs depending upon the duration of its use. The average hospital stay for a patient with ECMO support is typicaly 1-2 weeks, however, it varies on the severity of the illness and can extend beyond this time frame. This increases the overall expense of the procedure which most patients can’t afford.

Opportunity: Increasing survival rates with ECMO

Survival rates of ECMO patients vary depending on the underlying condition and the patient’s age. VV-ECMO is indicated for patients with potentially reversible respiratory failure, including those with severe acute respiratory distress syndrome (ADRS), primary graft dysfunction post a lung transplant, and trauma to the lungs. Using VV-ECMO for respiratory failure patients increase their survival rates.

ECMO machines are also used for cardiac applications due to its ability to support failing cardiovascular systems with oxygenation functions. Using these systems for cardiac failures improve the survival rates for cardiac patients. Improving the survival rates with ECMO is expected to provide favourable growth opportunities for the ECMO market.

Challenge: Lack of Skilled Professionals

Lack of skilled professionals is one of the major challenges in the ECMO market. Despite the health sector employing millions of workers across the globe it continues to have low density health professionals according to a World Health Organization database.

ECMO Machine Market Ecosystem

Respiratory segment accounted for the largest share of global ECMO machine market

On the basis of applications, the market is segmented into respiratory, cardiac and ECPR applications. The respiratory segment is expected to dominate this market during the forecast period. Growth in this market can be attributed to the increasing prevalence of target diseases, high demand for early diagnosis and diagnostic imaging, and technological advancements in the ECMO machine market. Moreover, the rising prevalence of lung diseases like tuberculosis, thoracic malignancies, osteoporosis, fractures, and CVDs increases the demand for medical imaging for diagnosis.

Arterio-Venous segment accounted for the largest market share of the ECMO machine market

On the basis of modality, the market is segmented into veno-arterio, veno-venous and arterio-venous. The arterio-venous segment accounted for the larger market share. The advantages associated with this segment, such as effective dynamic range, better medical evaluation, are contributing to the growth of this technology segment.

Increasing number of disorders/diseases in growing population resulting in an increase in the purchase of ECMO machines

On the basis of patient type, the ECMO machine market is segmented into neonates, pediatric and adults. The adult segment contributed to the largest share of global ECMO machine market in 2020. ECMO has been used for more than 40 years, and its benefits with neonates with respiratory distress are well recognized. The benefits of ECMO in adult patients with cardiac or respiratory failure are still debated, as ECMO was initially associated with low survival rates. However, recent technological advancements in ECMO circuits have led to a reduction in the rate of technical issues and complications.

To know about the assumptions considered for the study, download the pdf brochure

Controllers, by component, have contributed the largest share in the ECMO machine market

Based on component, the global market is segmented into pumps, oxygenators, controllers, cannula and accessories. The controllers segment is expected to dominate the market during the forecast period. The large share of this segment can be attributed to the greater adoption of the systems among end users due to their lowercost compared to others.

Portable ECMO machine Segment, of ECMO machine market, by product type, has commanded the highest growth rate in the forecast period

Based on product type, the market is segmented into Static ECMO machines and Portable ECMO machines. Portable ECMO machine segment is expected to dominate the market during the forecast period. Portable ECMO machines can be transported to any desired location and they are light in weight. These systems are especially used in a variety of imaging-set ups, including intensive care units, cardiac care units, neonatal intensive care units, operating rooms, emergency rooms, and at the patient’s beside for critically ill patients or patients with mobility challenges.

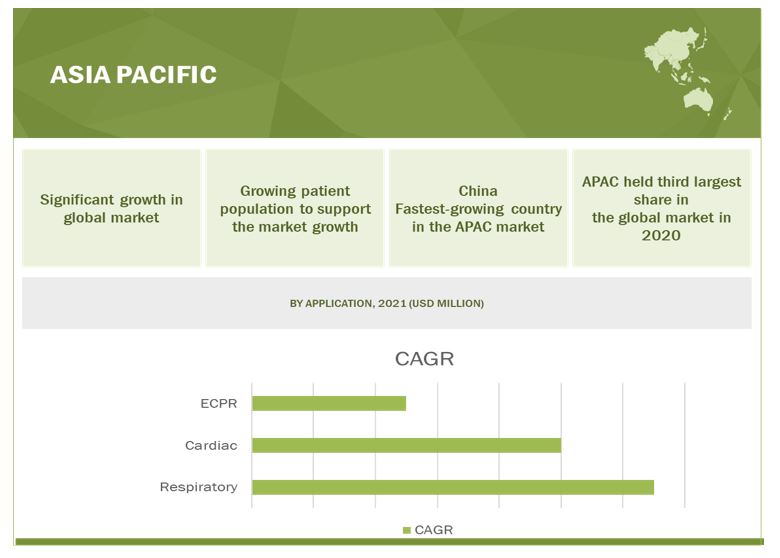

The APAC region of ECMO machine market to register highest growth rate in the forecast period

The market is segmented into five major regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The asia-pacific market is expected to register the highest growth in the forecast period. Growth in the ECMO machine market in the Asia Pacific is mainly driven by the growing geriatric population, particularly in Japan; increasing disposable incomes, allowing for greater affordability for advanced technologies; the rising prevalence of target diseases; and favorable government initiatives. Such factors help to drive the market for digital imaging systems in this region and draw foreign investments and partnerships. On the other hand, low hospital budgets, high equipment costs, and a lack of government investments in some countries are limiting the growth of the market in the Asia Pacific to a certain extent.

The ECMO machine market is dominated by Getinge Group (Sweden), Medtronic plc (US), Fresenius Medicalcare AG & Co. KGAA (Germany), Microport (China), and Terumo Cardiovascular Systems Corporation (Japan). The other leading market players include Livanova plc (UK), Nipro Corporation (Japan), Eurosets S.R.L. (Italy), Origin Biomedical (US), Cytosorbents Corporation (Australia), and Abiomed (US).

Fresenius Medical Care AG & Co. KGaA is one of the leading providers of ECMO products and services to patients. The company operates through two business divisions- Healthcare Services and Healthcare Products. The Healthcare Products division includes two major segments, namely, Dialysis Products ad Non-Dialysis Products. It focuses on inorganic and organic growth strategies, including new product launches, partnerships, and agreements, to enhance and maintain its position in the market. The company has launched various products in the ECMO machine market in the last three years and is constantly engaged in R&D for product innovation. The company has a wide geographic presence in Europe, Africa, the Middle East, Asia, Australia, and the US, and is constantly engaged in strategic deals and partnerships to promote growth in the market.

ECMO Machine Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$ 531 million |

|

Projected Revenue by 2026 |

$673 million |

|

Revenue Rate |

Poised to grow at a CAGR of 4.9% |

|

Market Driver |

Growing adoption of ECMO in Lung Transplantation Procedures |

|

Market Opportunity |

Increasing survival rates with ECMO |

This study categorizes the global ECMO machine market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

ECMO Machines

- Portable Devices

- Static Devices

- Software

By Component

- Pumps

- Oxygenators

- Controllers

- Cannul

- Assessories

By Modality Outlook

- Veno-Venous

- Veno-Arterials

- Arterio-Venous

By Portability

-

Neonates

- Neonates

- Pediatrics

- Adults

-

Pediatrics

- Neonates

- Pediatrics

- Adults

-

Adults

- Neonates

- Pediatrics

- Adults

By Patient Type

- Neonates

- Pediatrics

- Adults

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments:

- In February 2020, Fresenius Medical care AG & Co. KGaA (Germany) received US FDA clearance Novalung, a heart and lung support system for the treatment of acute respiratory or cardiopulmonary failure

- In July 2021, Xenios AG(Germany) received received approval from the National Medical Products Administration (NMPA) in China for the Xenios Console and patient kits for ECMO therapy.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the ECMO machine market?

The ECMO machine market boasts a total revenue value of $673 million by 2026.

What is the estimated growth rate (CAGR) of the ECMO machine market?

The global ECMO machine market has an estimated compound annual growth rate (CAGR) of 4.9% and a revenue size in the region of $531 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 KEY MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.2 MARKET SIZE ESTIMATION METHODOLOGY

2.3 MARKET DATA VALIDATION AND TRIANGULATION

2.4 KEY RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.5.1 METHODOLOGY-RELATED LIMITATIONS

2.6 RISK ASSESSMENT

2.7 GROWTH RATE ASSUMPTIONS

2.8 COVID-19 HEALTH ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.1 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ECMO MARKET OVERVIEW

4.2 ECMO MARKET SHARE, BY REGION AND PATIENT TYPE (2020)

4.3 ECMO MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

4.4 ECMO MARKET: GEOGRAPHIC SNAPSHOT

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of cardiovascular and respiratory diseases

5.2.1.2 Growing adoption of ECMO in lung transplantation procedures

5.2.1.3 Growth in the number of ECMO centers

5.2.1.4 Technological advancements in ECMO machines

5.2.2 RESTRAINTS

5.2.2.1 Complications associated with ECMO

5.2.2.2 High cost of ECMO procedures

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing survival rates with ECMO

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled professionals

5.2.4.2 Eligibility issues for ECMO

5.2.4.3 Issues related to selecting the right equipment

5.2.4.4 Risks related to the transport of ECMO patients

5.2.4.5 Issues related to treatment decision-making

5.3 REGULATORY LANDSCAPE

5.3.1 NORTH AMERICA

5.3.1.1 US

5.3.1.2 Canada

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.3.1 India

5.3.3.2 Japan

5.3.3.3 China

5.4 COVID-19 IMPACT ON THE ECMO MARKET

5.4.1 REIMBURSEMENT SCENARIO

5.5 PATENT ANALYSIS

5.5.1 PATENTS GRANTED FOR ECMO MACHINES

5.5.2 PUBLICATION TRENDS FOR PATENTS ON ECMO MACHINES

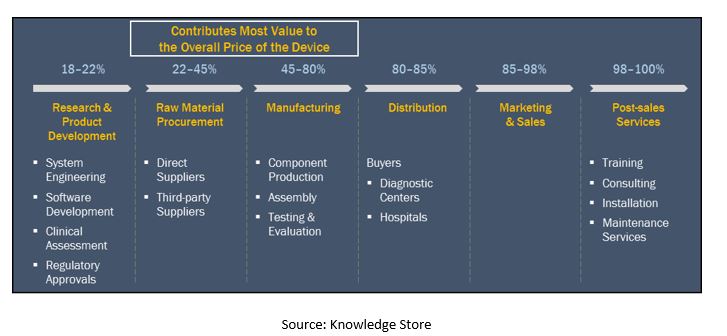

5.6 VALUE CHAIN ANALYSIS

5.7 PRICING TREND ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 ECOSYSTEM LANDSCAPE

6 ECMO MACHINE MARKET, BY PRODUCT (Page No. - 60)

6.1 INTRODUCTION

6.2 ECMO MACHINES

6.2.1 STATIC ECMO MACHINES SEGMENT TO DOMINATE THE ECMO MACHINES MARKET

6.2.2 PORTABLE ECMO MACHINES

6.2.3 STATIC ECMO MACHINES

6.3 SOFTWARE

6.3.1 SOFTWARE SEGMENT TO GROW AT A STEADY CAGR DURING THE FORECAST PERIOD

7 ECMO MACHINE MARKET, BY COMPONENT (Page No. - 69)

7.1 INTRODUCTION

7.2 PUMPS

7.2.1 CENTRIFUGAL BLOOD PUMPS HAVE BECOME THE PUMP OF CHOICE FOR ADULT EXTRACORPOREAL LIFE SUPPORT

7.3 OXYGENATORS

7.3.1 PMP OXYGENATORS HAVE SIGNIFICANTLY LESS PRIMING VOLUME

7.4 CONTROLLERS

7.4.1 CONTROLLERS ALLOW OPERATORS OF ECMO CIRCUITS TO ADJUST THE SETTINGS AS NEEDED

7.5 CANNULAS

7.5.1 THE CHOICE OF CANNULAS IS IMPORTANT IN ECMO PROCEDURES

7.6 ACCESSORIES

8 ECMO MACHINE MARKET, BY MODALITY (Page No. - 75)

8.1 INTRODUCTION

8.2 VENOARTERIAL ECMO

8.2.1 INCREASING INCIDENCE OF HEART-LUNG FAILURE TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

8.3 VENOVENOUS ECMO

8.3.1 VENOVENOUS ECMO IS USED WHEN ADEQUATE HEART FUNCTION IS AVAILABLE

8.4 ARTERIOVENOUS ECMO

8.4.1 ARTERIOVENOUS ECMO MACHINES ARE SMALLER AND MORE PORTABLE

9 ECMO MACHINE MARKET, BY PATIENT TYPE (Page No. - 79)

9.1 INTRODUCTION

9.2 NEONATES

9.2.1 A LARGE NUMBER OF NEONATES ARE CARED FOR WITH ECMO WORLDWIDE

9.3 PEDIATRIC PATIENTS

9.3.1 PEDIATRIC PATIENTS FORM A LARGE PATIENT GROUP FOR ECMO PROCEDURES

9.4 ADULTS

9.4.1 TECHNOLOGICAL ADVANCEMENTS ARE DRIVING THE USE OF ECMO IN ADULT PATIENTS

10 ECMO MACHINE MARKET, BY APPLICATION (Page No. - 83)

10.1 INTRODUCTION

10.2 RESPIRATORY APPLICATIONS

10.2.1 RESPIRATORY APPLICATIONS FOR NEONATES

10.2.2 RESPIRATORY APPLICATIONS FOR PEDIATRIC PATIENTS

10.2.3 RESPIRATORY APPLICATIONS FOR ADULTS

10.3 CARDIAC APPLICATIONS

10.3.1 CARDIAC APPLICATIONS FOR ADULTS

10.3.2 CARDIAC APPLICATIONS FOR PEDIATRIC PATIENTS

10.3.3 CARDIAC APPLICATIONS FOR NEONATES

10.3.4 EXTRACORPOREAL CARDIOPULMONARY RESUSCITATION (ECPR)

10.3.5 ECPR APPLICATIONS FOR ADULTS

10.3.6 ECPR APPLICATIONS FOR PEDIATRIC PATIENTS

10.4 NEONATES

11 ECMO MACHINE MARKET, BY REGION (Page No. - 90)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 US accounted for the largest share of the North American market

11.2.2 CANADA

11.2.2.1 Implementation of the ABF model in Canadian hospitals to drive market growth

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 Increasing volume of ECMO procedures to drive market growth in Germany

11.3.2 FRANCE

11.3.2.1 Rising healthcare spending to drive market growth in France

11.3.3 UK

11.3.3.1 Rising adoption of ECMO procedures and increasing prevalence of lifestyle diseases to drive market growth in the UK

11.3.4 ITALY

11.3.4.1 High burden of CVDs contributing to the growth of the ECMO market in Italy

11.3.5 SPAIN

11.3.5.1 High adoption of advanced technologies to drive market growth in Spain

11.4 REST OF EUROPE

11.5 ASIA PACIFIC

11.5.1 JAPAN

11.5.1.1 Favorable healthcare infrastructure in Japan to drive market growth

11.5.2 CHINA

11.5.2.1 Rising geriatric population and increasing prevalence of CVD to drive market growth in China

11.5.3 INDIA

11.5.3.1 Growing applications and rising adoption of ECMO to drive market growth in India

11.5.4 AUSTRALIA

11.5.4.1 Technological advancements to drive market growth in Australia

11.5.5 SOUTH KOREA

11.5.5.1 Increasing incidence of cardiac disorders to drive market growth in South Korea

11.5.6 REST OF APAC

11.6 LATIN AMERICA

11.6.1 BRAZIL

11.6.1.1 Rising adoption of ECMO as a bridge to heart and lung transplantation to drive market growth in Brazil

11.6.2 MEXICO

11.6.2.1 High burden of CVDs in the country to drive market growth in Mexico

11.6.3 REST OF LATIN AMERICA

11.6.4 MIDDLE EAST & AFRICA

11.6.4.1 Increasing prevalence of target diseases to drive market growth in the Middle East & Africa

12 COMPETITIVE LANDSCAPE (Page No. - 118)

12.1 INTRODUCTION

12.2 REVENUE SHARE ANALYSIS

12.3 MARKET SHARE ANALYSIS

12.4 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2020)

12.4.1 TERMINOLOGY/NOMENCLATURE

12.4.1.1 Stars

12.4.1.2 Emerging leaders

12.4.1.3 Pervasive players

12.4.1.4 Participants

12.5 COMPETITIVE LEADERSHIP MAPPING: START-UP/SME EVALUATION QUADRANT (2020)

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

12.6 COMPETITIVE BENCHMARKING

12.7 COMPETITIVE SCENARIO (2018–2021)

12.7.1 NEW PRODUCT LAUNCHES & APPROVALS

13 COMPANY PROFILES (Page No. - 131)

13.1 KEY PLAYERS

13.1.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

13.1.1.1 Business overview

13.1.1.2 Products offered

13.1.1.3 Recent developments

13.1.1.4 MnM view

13.1.2 GETINGE GROUP

13.1.2.1 Business overview

13.1.2.2 Products offered

13.1.2.3 MnM view

13.1.3 MEDTRONIC PLC

13.1.3.1 Business overview

13.1.3.2 Products offered

13.1.3.3 MnM view

13.1.4 MICROPORT

13.1.4.1 Business overview

13.1.4.2 Products offered

13.1.5 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION

13.1.5.1 Business overview

13.1.5.2 Products offered

13.1.5.3 MnM view

13.1.6 NIPRO CORPORATION

13.1.6.1 Business overview

13.1.6.2 Products offered

13.1.7 LIVANOVA PLC

13.1.7.1 Business overview

13.1.7.2 Products offered

13.1.8 EUROSETS S.R.L.

13.1.8.1 Business overview

13.1.8.2 Products offered

13.1.9 ORIGEN BIOMEDICAL, INC.

13.1.9.1 Business overview

13.1.9.2 Products offered

13.1.10 CYTOSORBENTS CORPORATION

13.1.10.1 Business overview

13.1.10.2 Products offered

13.1.11 ABIOMED

13.1.11.1 Business overview

13.1.11.2 Products offered

13.1.12 BRAILE BIOMÉDICA

13.1.12.1 Business overview

13.1.12.2 Products offered

13.1.13 SPECTRUM MEDICAL

13.1.13.1 Business overview

13.1.13.2 Products offered

13.1.14 HAEMONETICS

13.1.14.1 Business overview

13.1.14.2 Products offered

13.1.15 XENIOS AG

13.1.15.1 Business overview

13.1.16 PRODUCTS OFFERED

13.1.16.1 Recent developments

13.1.17 KANEKA CORPORATION

13.1.17.1 Business overview

13.1.17.2 Products offered

13.1.18 SB-KAWASUMI LABORATORIES, INC.

13.1.18.1 Business overview

13.1.18.2 Products offered

13.1.19 WEIGAO GROUP

13.1.19.1 Business overview

13.1.19.2 Products offered

13.1.19.3 Zhengyuan Technology

13.1.20 BUSINESS OVERVIEW

13.1.20.1 Products offered

13.1.21 BREETHE, INC.

13.1.21.1 Business overview

13.1.21.2 Products offered

14 APPENDIX (Page No. - 131)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (171 Tables)

TABLE 1 RISK ASSESSMENT: ECMO MARKET

TABLE 2 NUMBER OF DEATHS FROM CARDIOVASCULAR AND RESPIRATORY DISEASES ACROSS THE GLOBE, 1990 VS. 2019

TABLE 3 GLOBAL INCREASE IN THE NUMBER OF ECMO CENTERS

TABLE 4 AVERAGE COST OF ECMO IN VARIOUS COUNTRIES

TABLE 5 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING THE ECMO MARKET

TABLE 6 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

TABLE 7 CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY IN JAPAN

TABLE 8 NMPA MEDICAL DEVICE CLASSIFICATION

TABLE 9 PATENTS GRANTED FROM 2016 TO 2021

TABLE 10 FILED PATENTS, 2000–2021

TABLE 11 RANTED PATENTS, 2010–2021

TABLE 12 PUBLISHED PATENTS, 2016–2021

TABLE 13 AVERAGE PRICE OF ECMO, BY COUNTRY, 2020 (USD)

TABLE 14 ECMO MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 15 ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 16 ECMO MACHINE MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 17 ECMO MACHINES MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 ECMO MACHINES MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 19 ECMO MACHINES MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 20 ECMO MACHINES MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 21 ECMO MACHINES MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 22 PORTABLE ECMO MACHINES MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 23 PORTABLE ECMO MACHINES MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 24 PORTABLE ECMO MACHINES MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 25 PORTABLE ECMO MACHINES MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 26 STATIC ECMO MACHINE MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 27 STATIC ECMO MACHINES MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 28 STATIC ECMO MACHINES MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 29 STATIC ECMO MACHINES MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 30 STATIC ECMO MACHINES MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 31 ECMO SOFTWARE MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 32 ECMO SOFTWARE MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 33 ECMO SOFTWARE MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 34 ECMO SOFTWARE MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 35 ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 36 ECMO MACHINE MARKET FOR PUMPS, BY REGION, 2018–2026 (USD MILLION)

TABLE 37 ECMO MARKET FOR OXYGENATORS, BY REGION, 2018–2026 (USD MILLION)

TABLE 38 ECMO MARKET FOR CONTROLLERS, BY REGION, 2018–2026 (USD MILLION)

TABLE 39 ECMO MARKET FOR CANNULAS, BY REGION, 2018–2026 (USD MILLION)

TABLE 40 ECMO MARKET FOR ACCESSORIES, BY REGION, 2018–2026 (USD MILLION)

TABLE 41 ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 42 VENOARTERIAL ECMO MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 43 VENOVENOUS ECMO MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 44 ARTERIOVENOUS ECMO MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 45 COMMON INDICATIONS FOR ECMO IN NEONATES, PEDIATRIC PATIENTS, AND ADULTS

TABLE 46 ECMO MACHINE MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 47 ECMO MARKET FOR NEONATES, BY REGION, 2018–2026 (USD MILLION)

TABLE 48 ECMO MARKET FOR PEDIATRIC PATIENTS, BY REGION, 2018–2026 (USD MILLION)

TABLE 49 ECMO MARKET FOR ADULTS, BY REGION, 2018–2026 (USD MILLION)

TABLE 50 ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 51 ECMO MARKET FOR RESPIRATORY APPLICATIONS, BY REGION, 2018–2026 (USD MILLION)

TABLE 52 NUMBER OF NEONATES RECEIVING ECMO SUPPORT FOR RESPIRATORY APPLICATIONS

TABLE 53 NUMBER OF PEDIATRIC PATIENTS RECEIVING ECMO SUPPORT FOR RESPIRATORY APPLICATIONS

TABLE 54 NUMBER OF ADULTS RECEIVING ECMO SUPPORT FOR RESPIRATORY APPLICATIONS

TABLE 55 ECMO MARKET FOR CARDIAC APPLICATIONS, BY REGION, 2018–2026 (USD MILLION)

TABLE 56 ECMO MARKET FOR ECPR APPLICATIONS, BY REGION, 2018–2026 (USD MILLION)

TABLE 57 ECMO MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: ECMO MACHINE MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: ECMO MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 65 US: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 66 US: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 67 CANADA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 68 CANADA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 69 EUROPE: ECMO MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 70 EUROPE: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 71 EUROPE: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 72 EUROPE: ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 73 EUROPE: ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 74 EUROPE: ECMO MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 75 EUROPE: ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 76 GERMANY: ECMO MACHINE MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 77 GERMANY: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 78 FRANCE: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 79 FRANCE: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 80 UK: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 81 UK: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 82 ITALY: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 83 ITALY: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 84 SPAIN: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 85 SPAIN: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 86 REST OF EUROPE: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 87 REST OF EUROPE: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: ECMO MACHINE MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC: ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: ECMO MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 95 JAPAN: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 96 JAPAN: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 97 CHINA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 98 CHINA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 99 INDIA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 100 INDIA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 101 AUSTRALIA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 102 AUSTRALIA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 103 SOUTH KOREA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 104 SOUTH KOREA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 105 REST OF APAC: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 106 REST OF APAC: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 107 LATIN AMERICA: ECMO MACHINE MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 108 LATIN AMERICA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 109 LATIN AMERICA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 110 LATIN AMERICA: ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 111 LATIN AMERICA: ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 112 LATIN AMERICA: ECMO MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 114 BRAZIL: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 115 BRAZIL: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 116 MEXICO: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 117 MEXICO: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 118 REST OF LATIN AMERICA: ECMO MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 119 REST OF LATIN AMERICA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: ECMO MACHINE MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: ECMO MACHINES MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: ECMO MARKET, BY COMPONENT, 2018–2026 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: ECMO MARKET, BY MODALITY, 2018–2026 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: ECMO MARKET, BY PATIENT TYPE, 2018–2026 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: ECMO MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 126 PRODUCT FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE ECMO MARKET

TABLE 127 APPLICATION FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE ECMO MARKET

TABLE 128 COMPANY FOOTPRINT ANALYSIS IN THE ECMO MARKET

TABLE 129 FRESENIUS MEDICAL CARE AG & CO. KGAA: BUSINESS OVERVIEW

TABLE 130 FRESENIUS MEDICAL CARE AG & CO. KGAA: PRODUCT OFFERINGS

TABLE 131 PRODUCT LAUNCHES

TABLE 132 GETINGE GROUP: BUSINESS OVERVIEW

TABLE 133 GETINGE GROUP: PRODUCT OFFERINGS

TABLE 134 MEDTRONIC PLC: BUSINESS OVERVIEW

TABLE 135 MEDTRONIC PLC: PRODUCT OFFERINGS

TABLE 136 MICROPORT: BUSINESS OVERVIEW

TABLE 137 MICROPORT: PRODUCT OFFERINGS

TABLE 138 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION: BUSINESS OVERVIEW

TABLE 139 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION: PRODUCT OFFERINGS

TABLE 140 NIPRO CORPORATION: BUSINESS OVERVIEW

TABLE 141 NIPRO CORPORATION: PRODUCT OFFERINGS

TABLE 142 LIVANOVA PLC.: BUSINESS OVERVIEW

TABLE 143 LIVANOVA PLC.: BUSINESS OVERVIEW

TABLE 144 LIVANOVA PLC: PRODUCT OFFERINGS

TABLE 145 EUROSETS S.R.L.: BUSINESS OVERVIEW

TABLE 146 EUROSETS S.R.L.: PRODUCT OFFERINGS

TABLE 147 ORIGEN BIOMEDICAL, INC.: BUSINESS OVERVIEW

TABLE 148 ORIGEN BIOMEDICAL, INC.: PRODUCT OFFERINGS

TABLE 149 CYTOSORBENTS CORPORATION: BUSINESS OVERVIEW

TABLE 150 CYTOSORBENTS CORPORATION: PRODUCT OFFERINGS

TABLE 151 ABIOMED: BUSINESS OVERVIEW

TABLE 152 ABIOMED: PRODUCT OFFERINGS

TABLE 153 BRAILE BIOMÉDICA: BUSINESS OVERVIEW

TABLE 154 BRAILE BIOMÉDICA: PRODUCT OFFERINGS

TABLE 155 SPECTRUM MEDICAL: BUSINESS OVERVIEW

TABLE 156 SPECTRUM MEDICAL: PRODUCT OFFERINGS

TABLE 157 HAEMONETICS: BUSINESS OVERVIEW

TABLE 158 HAEMONETICS: PRODUCT OFFERINGS

TABLE 159 XENIOS AG: BUSINESS OVERVIEW

TABLE 160 XENIOS AG: PRODUCT OFFERINGS

TABLE 161 PRODUCT LAUNCHES

TABLE 162 KANEKA CORPORATION: BUSINESS OVERVIEW

TABLE 163 KANEKA CORPORATION: PRODUCT OFFERINGS

TABLE 164 SB-KAWASUMI LABORATORIES, INC.: BUSINESS OVERVIEW

TABLE 165 SB-KAWASUMI: PRODUCT OFFERINGS

TABLE 166 WEIGAO GROUP: BUSINESS OVERVIEW

TABLE 167 WEIGAO GROUP: PRODUCT OFFERINGS

TABLE 168 ZHENGYUAN TECHNOLOGY: BUSINESS OVERVIEW

TABLE 169 ZHENGYUAN TECHNOLOGY: PRODUCT OFFERINGS

TABLE 170 BREETHE, INC.: BUSINESS OVERVIEW

TABLE 171 BREETHE, INC.: PRODUCT OFFERINGS

LIST OF FIGURES (37 Figures)

FIGURE 1 ECMO MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN

FIGURE 3 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 4 DATA TRIANGULATION METHODOLOGY

FIGURE 5 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 6 RECOVERY SCENARIO OF THE GLOBAL ECONOMY (2021–2022)

FIGURE 7 ECMO MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 8 ECMO MARKET SHARE, BY MODALITY, 2021 VS. 2026

FIGURE 9 ECMO MARKET, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE ECMO MARKET

FIGURE 11 RISING PREVALENCE OF TARGET DISEASES TO DRIVE MARKET GROWTH

FIGURE 12 NORTH AMERICA DOMINATED THE ECMO MARKET IN 2020

FIGURE 13 ECMO MACHINES SEGMENT WILL CONTINUE TO DOMINATE THE ECMO MARKET DURING THE FORECAST PERIOD

FIGURE 14 EMERGING MARKETS ARE ESTIMATED TO REGISTER HIGHER GROWTH RATES THAN DEVELOPED MARKETS

FIGURE 15 ECMO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 VALUE CHAIN OF THE ECMO MARKET

FIGURE 17 THREAT OF NEW ENTRANTS

FIGURE 18 THREAT OF SUBSTITUTES

FIGURE 19 BARGAINING POWER OF SUPPLIERS

FIGURE 20 BARGAINING POWER OF BUYERS

FIGURE 21 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 22 ECMO MARKET: ECOSYSTEM LANDSCAPE

FIGURE 23 NORTH AMERICA: ECMO MARKET SNAPSHOT

FIGURE 24 ASIA PACIFIC: ECMO MARKET SNAPSHOT

FIGURE 25 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE ECMO MARKET, 2018–2021

FIGURE 26 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE ECMO MARKET

FIGURE 27 ECMO MARKET SHARE, BY KEY PLAYER, 2020

FIGURE 28 ECMO MARKET: DEGREE OF COMPETITION

FIGURE 29 ECMO MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 30 ECMO MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS, 2020

FIGURE 31 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY SNAPSHOT

FIGURE 32 GETINGE GROUP: COMPANY SNAPSHOT

FIGURE 33 MEDTRONIC PLC: COMPANY SNAPSHOT

FIGURE 34 MICROPORT: COMPANY SNAPSHOT

FIGURE 35 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION: COMPANY SNAPSHOT

FIGURE 36 NIPRO CORPORATION: COMPANY SNAPSHOT

FIGURE 37 LIVANOVA PLC.: COMPANY SNAPSHOT

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the ECMO machine market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

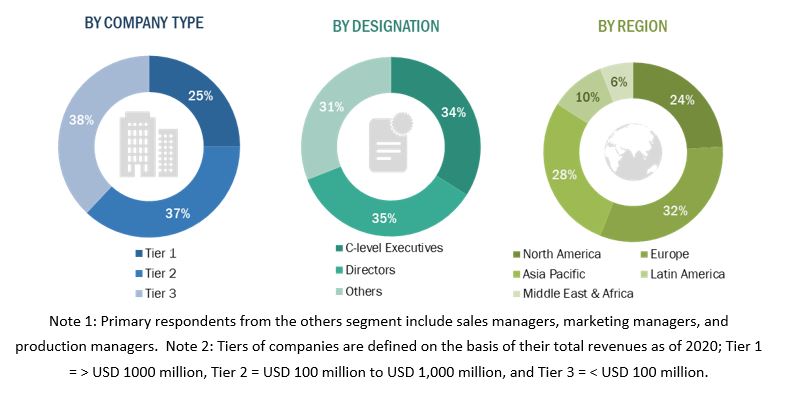

Primary research was conducted after acquiring extensive knowledge about the global ECMO machie market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as CROs, hospitals, transplant centers, healthcare service providers, commercial service providers, academia, and research organizations) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 20% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 80%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

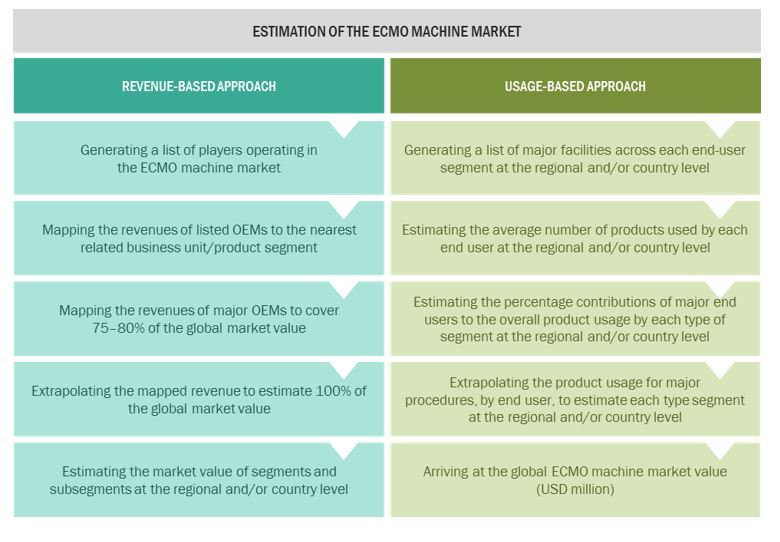

ECMO Machine Market Estimation Methodology

The top-down and bottom-up approaches were used to estimate and validate the sizes of the global market and various other dependent submarkets of the ECMO machine market. The research methodology used to estimate the market size includes the following details:

- The key players in the market were identified through secondary research, and their market contributions in respective regions were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined by secondary sources and verified through primary sources.

- All the possible parameters affecting the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to reach the final quantitative and qualitative data.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Data Triangulation:

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives:

- To define, describe, and forecast the global ECMO machine market on the basis of patient type, application, component, modality outlook, product and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the revenue of market segments with respect to five key regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East & Africa

- To profile the key market players and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments such as new product launches, agreements & partnerships, acquisitions, and research & development activities in the ECMO machine market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global ECMO machine market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe ECMO machine market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific ECMO machine market into New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American ECMO machine market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Extracorporeal Membrane Oxygenation Machine Market

Can you share the detailed information on technological advancements in the ECMO Machine Market?

In what way COVID19 is Impacting the global growth of the ECMO Machine Market?

Can you enlighten us about the key players operating in the global ECMO Machine Market?