This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US Census Bureau, ), World Health Organization (WHO), World Bank, Centers for Disease Control and Prevention (CDC), Food and Drug Administration (FDA), Health Canada, European Medicines Agency (EMA), Medicines and Healthcare Products Regulatory Agency (MHRA, UK), American College of Cardiology (ACC), American Heart Association, Centers for Medicare & Medicaid Services (CMS) were referred to identify and collect information for the global defibrillator market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the pulse oximeters market. The primary sources from the demand side include key executives from hospitals, physicians, clinicians, and research institutes.

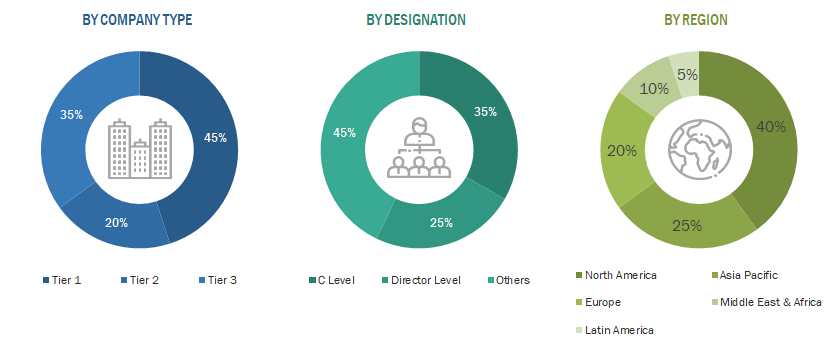

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

All major product manufacturers offering various defibrillators were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value defibrillator market was also split into various segments and subsegments at the region and country level based on:

-

Product mapping of various manufacturers for each type of defibrillator market at the regional and country level

-

Relative adoption pattern of each defibrillator market among key end-user segments at the regional and/or country level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Defibrillator Market: Top-Down & Bottom Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the defibrillator industry.

Market Definition

A defibrillator is a device that monitors the heart rhythm and delivers electric shocks upon detecting an abnormal heart rhythm to restore the normal heart rhythm. The device plays an important role in the management and treatment of sudden cardiac arrest.

Stakeholders

-

Manufacturers of Defibrillators

-

Distributors of Defibrillators

-

Hospitals, Clinics, Cardiac Centers

-

Non-government Organizations

-

Government Regulatory Authorities

-

Contract Manufacturers and Third-party Suppliers

-

Research Laboratories and Academic Institutes

-

Clinical Research Organizations (CROs)

-

Government and Non-governmental Regulatory Authorities

Report Objectives

-

To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To define, describe, segment, and forecast the defibrillator market by product, patient type, end user, and region

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall defibrillator market

-

To forecast the size of the defibrillator market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile key players in the defibrillator market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, & partnerships, and R&D activities of the leading players in the defibrillator market

-

To benchmark players within the defibrillator market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Gary

Sep, 2023

Define Defibrillator CAGR.