Fish Pumps Market by Size (2.5” Pumps, 4” Pumps, 6” Pumps, 8” Pumps, 10” Pumps, 12” Pumps, and 14” Pumps), Application (Aquaculture and Fishing), Mode of Operation (Manual and Automatic) and Region - Global Forecast to 2027

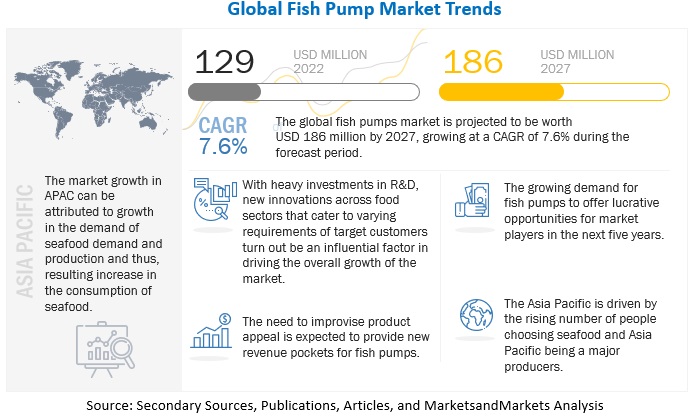

The fish pumps market is set to reel in substantial revenue, with a projected US$186 million by 2027. With a steady growth rate of 7.6% from 2022 to 2027, this market is estimated to be valued at USD 129 million in 2022. As the demand for efficient fish pumping solutions increases, this market presents an ocean of opportunities for businesses to make a splash in the fishing industry. The segmentation of the fish pumps market is based on size, mode of operation, and application. Fish pumps assist in moving water along with fish with greater efficiency, resulting in lower operating costs and ultra-quiet operation. Advancements in the aquaculture industry like Recirculatory Aquaculture System (RAS) and continuous growth in the demand for fish are some factors that are expected to support the growth of the fish pumps market.

To know about the assumptions considered for the study, Request for Free Sample Report

Fish Pumps Market Dynamics

Drivers: Rising aquaculture industry

As the global population is growing, the demand for fish is increasing around the world. This trend is expected to continue as the developing world's population grows, urbanization expands, and incomes rise. Furthermore, due to the negative aspects associated with meat and poultry not being sustainable and red meat being harmful to the body, consumers are shifting to fish. According to a study published in the journal Communications Earth & Environment in 2022 titled 'Assessing seafood nutritional diversity in conjunction with climate impacts informs more comprehensive dietary advice,' fishes such as shellfish, mackerel, and herring emit fewer greenhouse-gas emissions and are more nutrient dense than beef, pork, or chicken. According to the FAO, the demand for fish and fish products in the Asia-Pacific region is expected to increase by 30% by 2030 as a result of the anticipated population growth and the improved living standards of the people in the region. To meet such an increased demand for fish, aquaculture production will need to increase by 50% to 60% from the present level by 2030.

According to International Trade Administration, US Department of Commerce, aquaculture is expected to grow exponentially due to the high demand for seafood and the annual decline in the amount of captured wild fish. Aquaculture aids in global, regional, and local food security. Aquaculture is expected to grow the most in Asia-Pacific, as it is a major sector in the region's domestic economies. Adoption and advancement of technology and automation are expected to positively impact the market.

Restraints: Cavitation effect in industrial pumps

Cavitation refers to the vapor phase formation in a liquid when subjected to reduced pressures at a constant ambient temperature. Vapor bubbles formed within industrial pumps due to inadequate liquid tend to move toward high-pressure areas within them to collapse under sufficient pressure and return to the liquid state. The imposition of these bubbles flakes of small portions of metal from impeller surfaces results in low-frequency vibration and noise and extensive damage to industrial pumps. In the case of cavitation, this formation and collapse are both rapid and violent. This impacts the performance of pumps, resulting in their reduced sales and high replacement costs. Disrupted or poorly executed processing lines can cause suction or discharge pressure to fall, which leads to cavitation. Thus, cavitation and dry-run related failures can hinder the growth of the industrial pumps market.

Opportunities: Demand for advanced machinery with high productivity and efficiency

Industrial pumps and components play a crucial role in transferring fluid from one point to another. The increased growth in the fish transfer pumps is witnessed worldwide, mainly due to the advanced technology, presence of key players, and demand for process optimization. Various recent trends such as automation, Internet of Things (IoT) disruption, product innovation, and the outbreak of the COVID-19 pandemic are shaping the market and creating huge scope for the players to move forward. Due to globalization, there has been a growing awareness among consumers regarding various automation trends. Industrial pump manufacturing companies are expanding their presence globally due to the liberalization of trade. The domestic players in the market are also expanding their product offerings to achieve a competitive edge over other players in the market.

The popularity of Omega-3 fatty acids in human diets has contributed to an increase in fish consumption, increasing aquaculture production. The aquaculture industry has the potential to benefit from block chain because it allows a distributed ledger to record product movements and other data, allowing for more efficient and accurate traceability of seafood sources. Because aquaculture companies invest heavily in sustainable farming and cannot risk producing inferior products, blockchain technology helps to maintain security and ensure fish quality. Blockchain technology, like IBM (US), helps combat fraud and track critical chain of custody. These are critical as fishery products move through national and international supply chains from harvesting to trans-shipment, landing, and processing before reaching the consumer end market.

Aquaculture industry seeks advanced machinery and delivery solutions to meet safety standards and increase productivity to meet the changes in consumer demand. This will also drive the demand for industrial pumps as they transfer fish gently, thus avoiding human contact.

Challenges: Increase in consumer appetite for vegan diets

With greater awareness of climate change and animal suffering, an increasing number of individuals are opting for alternatives that are healthier for the planet. The growth in awareness related to the health benefits of adopting a vegetarian and vegan diet has led to an increase in the demand for plant-sourced food products. This awareness is prominent in developed regions, such as North America and Europe, where consumers are increasingly consuming vegetarian food in their daily diets. Consumer preference for vegetarian and vegan foods has also been witnessed in other regions also, such as Asia Pacific, where consumer preference for vegan foods is expected to increase as a result of consumers’ health and environmental concerns.

The Introduction Of Government Policies is Providing a Major Boost to Aquaculture

Over the last 50 years, global fish and seafood production has quadrupled. Not only has the world population more than doubled during this time, but the average person now consumes nearly twice as much seafood as they did half a century ago. This has put additional strain on fish stocks around the world.

The aquaculture industry is growing due to the various initiatives taken by the governments of the respective countries. For instance, government benefits such as The Kisan Credit Card facility for farmers engaged in fisheries, aquaculture, and animal husbandry was extended in India's budget for 2018-2019, and a dedicated fund of Rs. 10,000 crores were allocated to develop the sector. Additionally, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) provides monetary support for activities in marine, inland fisheries, and aquaculture, in addition to government investments in infrastructure such as cold chain and markets. In addition, the United States Department of Agriculture (USDA) is providing leadership to ensure a healthy, competitive, and sustainable aquaculture sector in the country. These factors are boosting the aquaculture sector, which helps create employment and feed the population.

Moreover, the European Commission-approved MAR 2020 Operational Programme (PO MAR 2020) for implementing the European maritime and fisheries fund throughout Portugal provides subsidies for investments in aquaculture projects throughout continental Portugal. It can aid in revitalizing this primary sector, which is particularly suited for facility modernization, innovation, and increasing the efficiency and competitiveness of Portuguese aquaculture companies. It provides an excellent opportunity to capitalize on a growing market at both the national and European levels, severely lacking in local producers and required to meet rising domestic demand and from the booming tourism sector.

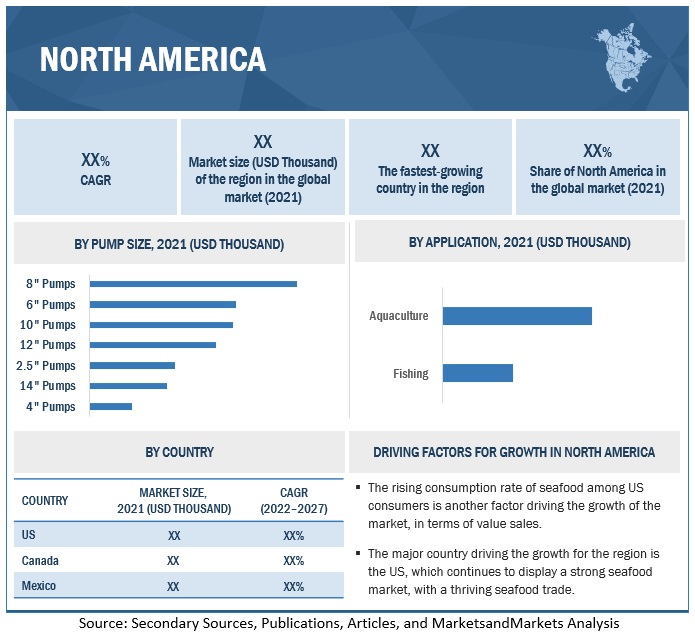

The North American Region is Primarily Driven by Growth in the US and Canadian Markets

The markets within North America studied for this report are the US, Canada, and Mexico. The region occupied the third largest global fish pumps market share in 2021. North America, being a highly developed economy, witnessed major developments and innovations in the fish pumps market. The major country driving the growth for the region is the US, which continues to display a strong seafood market, with a thriving seafood trade. Moreover, the country’s seafood consumption has continuously increased over the past decade, making it more economically viable for fish pumps.

Aquaculture provides a means for Canada to produce healthy, sustainable seafood which will translate in an increased demand for fish pumps. However, growth in this sector has not been exceptional, which can be attributed to climate change and lack of government's adequate policy. Furthermore, events like Storm Fiona have an impact on production.

To know about the assumptions considered for the study, download the pdf brochure

Key Companies

The key players in this market include Cflow (Norway), Pg Flow Solutions (Norway), Pentair AES (US), MMC First Process (Norway), Faivre (France), Maskon (Norway), Marel (Iceland), Mjos Metallvarefabrikk As (Norway), Sterner (UK), Smir (Norway), Desmi (Denmark), Acuinuga (Spain), Inventive Marine Products Limited (Canada), and Innovasea (US).

Fish Pumps Market Report Scope

|

Report Metric |

Details |

|

Market volume in 2022 |

USD 129 million |

|

Financial outlook in 2027 |

USD 186 million |

|

Expansion rate |

CAGR of 7.6% |

|

Historical data |

2020-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Size, Region, Mode of Application |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Leading companies featured |

Cflow (Norway), Pg Flow Solutions (Norway), Pentair AES (US), MMC First Process (Norway), Faivre (France), Maskon (Norway), Marel (Iceland), Mjos Metallvarefabrikk As (Norway), Sterner (UK), Smir (Norway), Desmi (Denmark), Acuinuga (Spain), Inventive Marine Products Limited (Canada), and Innovasea (US) |

|

Major driving factors |

|

Target Audience:

- Supply side: Fish pump producers, suppliers, distributors, importers, and exporters

- Demand side: Aquaculture industry and fishing industry

- Regulatory bodies: Government agencies and Non-Governmental Organization (NGO)

- Commercial R&D institutions and financial institutions

-

Associations, regulatory bodies, and other industry-related bodies:

- National Fisheries Development Board

- Connecticut Seafood Advisory Council

- Delaware Fisheries Section

- US Aquaculture Society

- Florida Aquaculture Association

- Hawaii Aquaculture and Aquaponics Association

- European Pump Manufacturers Association

- California Aquaculture Association

This research report categorizes the fish pumps market, based on size, application, mode of operation, and region.

Based on Size

- 2.5” Pumps

- 4” Pumps

- 6” Pumps

- 8” Pumps

- 10” Pumps

- 12” Pumps

- 14” Pumps

Based on Application

-

Aquaculture

- Fishing

Based on Mode of Operation

- Manual

- Automated

Based on Region

- North America

- Asia Pacific

- Europe

- Rest of the World (RoW)

Recent Developments (Revenue, USD million, 2022 - 2027)

- In November 2021, TH Company The company opened its new office in Ecuador. This is the country's new hydraulic and pneumatic material logistics hub company. The new office enabled the company to provide technical assistance and better serve its customers.

Frequently Asked Questions (FAQ):

What is the expected market size for the global fish pumps market in the coming years?

The Fish Pumps Market is swimming toward a lucrative future, with an estimated revenue of US$186 million by 2027. With a steady growth rate of 7.6% from 2022 to 2027, this market is expected to be valued at USD 129 million in 2022. As fish pumping technology continues to evolve, this market is set to create a ripple effect in the fishing industry.

What is the estimated growth rate (CAGR) of the global fish pumps market for the next five years?

The global fish pumps market is set to grow at a moderate rate, representing a CAGR of 7.6% during the forecast period.

What are the major revenue pockets in the fish pumps market currently?

North America's fish pumps market is making waves, occupying the third largest global market share in 2021. With highly developed economies and a thriving seafood trade, this region has witnessed major innovations and advancements in fish pump technology. The US, in particular, has been the key driver of growth, with a strong seafood market and increasing seafood consumption, making fish pumps an economically viable solution for the industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research involves the extensive use of secondary sources; directories; and databases, such as the National Fisheries Development Board, Connecticut Seafood Advisory Council, Delaware Fisheries Section, US Aquaculture Society, Florida Aquaculture Association, Hawaii Aquaculture and Aquaponics Association, European Pump Manufacturers Association, California Aquaculture Association, Bloomberg, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the fish pumps market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Maryland Aquaculture and Industry Enhancement Division, Association of the National Organizations of Fishery Enterprises in the European Union, European Association of Fish Producers Organizations, were referred to identify and collect information for this study. The secondary sources also include medical journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The fish pumps market comprises several stakeholders, including fish pump manufacturers and suppliers’ raw material suppliers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviews from the supply-side include research institutions involved in R&D to introduce technology, distributors, wholesalers, importers & exporters of fish pumps, fish pump manufacturers and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of fishing machinery manufacturing companies, and aquaculture companies, through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the fish pumps market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the food & beverage industry pumps and agricultural pumps market—was considered to validate further the market details of fish pumps.

-

Bottom-up approach:

- The market size was analyzed based on the consumption pattern of each type of fish pumps at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include the penetration rate of different type of fish pumps in distinguished application sectors, such as aquaculture and fishing; market presence; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the fish pumps market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall fish pumps market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for fish pumps market based on size, application, mode of operation, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in fish pumps market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the South America fish pumps market, by key country

- Further breakdown of the Rest of Europe fish pumps market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fish Pumps Market