Food Deaerators Market by Type (Spray-Tray Type, Spray Type, and Vacuum Type), Function (Oxygen Removal, Water Heating Aroma & Flavor Retention, and Others), Application (Food and Beverages), and Region - Global Forecast to 2023

[125 Pages Report] The study involves four major activities to estimate the current market size for food deaerators. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market size was validated with industry experts across value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

To know about the assumptions considered for the study, download the pdf brochure

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

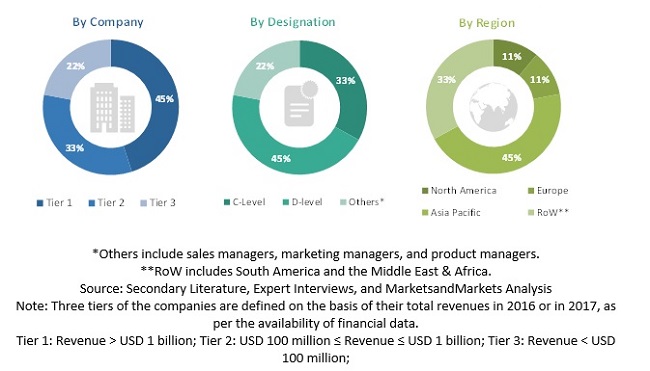

The food deaerators market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by the rising demand for convenience food products and extend their shelf-life of these products. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the food deaerators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size includes the following:

The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the food and beverage industry.

Report Objectives

- To define, segment, and project the global market size for food deaerators products

- To understand the structure of the food deaerators market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the four regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value(USD) |

|

Segments covered |

Type, Function, Application, and Region |

|

Geographies covered |

North America, APAC, Europe and RoW |

|

Companies covered |

GEA Group (Germany), JBT Corporation (US), Alfa Laval (Sweden), SPX FLOW (US), Stork Thermeq B.V. (Netherlands), and Parker Boiler Co. (US) |

This research report categorizes the food deaerator market based on type, function, application, and region.

On the basis of type, the food deaerators market has been segmented as follows:

- Spray-Tray Type Deaerators

- Spray Type Deaerators

- Vacuum Type Deaerators

On the basis of function, the food deaerators market has been segmented as follows: Oxygen Removal

- Oxygen removal

- Water Heating

- Aroma & Flavor Retention

- Other (steam pressure control, water-level control, and shelf-life extension)

On the basis of application the food deaerators market has been segmented as follows:

- Beverages

- Food

On the basis of region the food deaerators market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America and the Middle East)

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe food deaerators products market into Russia, Denmark, Turkey, Sweden, Belgium, and Norway

Company Information

- Detailed analysis and profiling of additional market players (up to five)

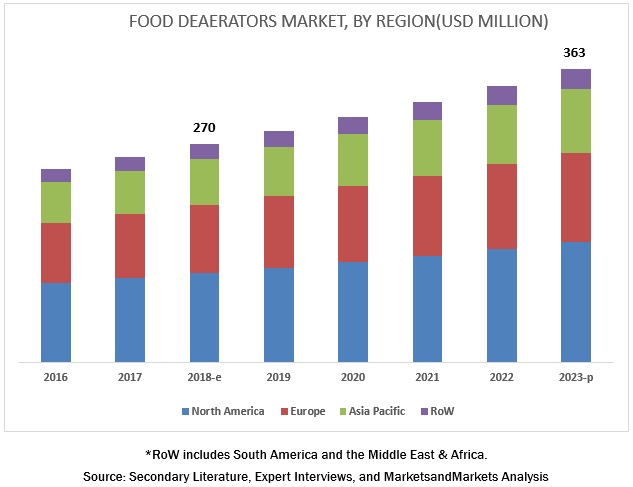

The food deaerators market is projected to grow at a CAGR of 6.1% from 2018, to reach a value of USD 363 Million by 2023. The growth of the food deaerators market is driven by the rising demand for convenience food products with extended shelf-life. Food deaerators find applications in beverage products such as fruit drinks, dairy products, alcoholic beverages, and food products such as desserts, baby food, and ketchup and sauces.

The spray-tray type segment is projected to be the largest revenue contributor in the food deaerators market during the forecast period.

The spray-tray type segment held the largest share of the food deaerators market in 2017. Spray-tray type deaerators are largely used in the beverage industry due to their efficiency and effectivity as compared to other types of deaerators. Different types of deaerators are chosen based on properties of sources and end applications.

The oxygen removal segment is projected to account for the largest market size during the forecast period.

On the basis of function, the food deaerator market is segmented into oxygen removal, water heating, aroma & flavor retention, and others. The oxygen removal segment led the food deaerators market with a share of 55.0% in 2018. A food deaerator is a device largely used for removing oxygen from food & beverages, which helps in extending the shelf-life of products. Hence, the oxygen removal function of deaerators in the beverage industry is witnessing growth.

The beverages segment is estimated to account for the largest share in the food deaerators market in 2018

On the basis application, the food deaerators market is dominated by the beverages segment. Beverages are further classified into fruit drinks, dairy products, alcoholic beverages, and others such as non-carbonated artificial beverages and sports drinks. The fruit drinks segment is estimated to account for the largest share in 2018. Beverage production is increasing across regions, due to the rising demand for various beverage products. To offer a diverse range of products, the industry has developed different processes of food and beverage production.

North America is projected to account for the largest market size during the forecast period

The market is also segmented on the basis of region into North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is projected to dominate in the food deaerators market throughout the forecast period. The increasing demand for food deaerators in the beverage industry is a major factor influencing the market growth. The food deaerators market has witnessed significant growth in the last five years, and this trend is projected to continue in the near future. Increasing shelf-life of food products is also projected to fuel the demand for food deaerators globally.

Key players identified in this market include GEA Group (Germany), JBT Corporation (US), Alfa Laval (Sweden), SPX FLOW (US), Stork Thermeq B.V. (Netherlands), and Parker Boiler Co. (US). Key players are focusing on increasing their presence through undertaking acquisitions and expansions and developing products specific to consumer tastes and preferences in these regions. These companies have a strong presence in Europe and North America. They have also set up manufacturing facilities in various regions and have a strong distribution networks.

Recent Developments

- In January 2018, GEA acquired Vipoll (Slovenia) to strengthen its position as a global supplier of the complete processing solutions to the beverage industry.

- In November 2016, JBT Corporation acquired Tipper Tie, Inc. (US) for USD 160 million. This enabled the company to expand its food processing segment.

- In January 2017, SPX FLOW expanded its production capabilities by setting up a new manufacturing campus in Europe. This expansion will help the company to expand its business in the region.

- In December 2016, GEA constructed a milk processing plant for Fonterra Co-operative Group (New Zealand). This creates an opportunity for the company to enter the deaerators market.

- In August 2015, Alfa Laval entered into an agreement with Alfa-Laval AB (India) to supply a process solution for one of its plants in India. Due to this, the company was able to offer its services across the countries in the Asia Pacific region.

Key Questions addressed by the report

- What are new application areas, which the food deaerators companies are exploring?

- Which are the key players in the market and how intense is the competition?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Food Deaerators Market

4.2 Food Deaerators Market Size, By Region

4.3 Food Deaerators Market, By Type

4.4 Food Deaerators Market, By Application, 2018–2023

4.5 Food Deaerators Market, By Function & Region, 2017

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for Convenience Food Products With an Extended Shelf Life

5.2.1.2 Reduction of the Side-Effects of High Levels of Dissolved Oxygen in Beverages

5.2.1.3 Rise in Per Capita Consumption of Beverages

5.2.2 Restraints

5.2.2.1 Requirement of High Capital Investment

5.2.3 Opportunities

5.2.3.1 The Emerging Markets Illustrate Great Potential for Deaerators

5.2.3.2 Growth in Investment Opportunities in the Development of New Food & Beverage Processing Technologies

5.2.3.3 Investments By Governments in the Food Processing Machinery & Equipment

5.2.4 Challenges

5.2.4.1 Rise in Costs of Production Due to Increasing Energy and Labor Costs

5.2.4.2 Infrastructural Challenges in Developing Countries

5.3 Supply Chain Analysis

5.4 Patent Analysis

6 Food Deaeration Process Flow (Page No. - 38)

7 Food Deaerators Market, By Type (Page No. - 41)

7.1 Introduction

7.2 Spray-Tray Type Deaerators

7.2.1 Asia Pacific is the Fastest Growing Region for Spray Tray Type Food Deaerators

7.3 Spray Type Deaerators

7.3.1 North America is the Largest Market for Spray Type

7.4 Vacuum Type Deaerators

7.4.1 Vacuum Deaerators Also Known as Degasifiers, are Designed to Remove Non-Condensable Gases From the Liquid Stream

8 Food Deaerators Market, By Function (Page No. - 49)

8.1 Introduction

8.2 Oxygen Removal

8.2.1 Oxygen Removal to Lead the Food Deaerators Market Between 2018 and 2023

8.3 Water Heating

8.3.1 Food Deaerators Perform the Function of Water Heating for Use in Food and Beverage Processing

8.4 Aroma & Flavor Retention

8.4.1 North America is the Major Market for Aroma & Flavour Retention

8.5 Other Functions

9 Food Deaerators Market, By Application (Page No. - 55)

9.1 Introduction

9.2 Beverages

9.2.1 Fruit Drinks

9.2.1.1 in the Fruit Drinks Manufacturing Process, Deaeration Process is Used for Removing Dissolved Oxygen

9.2.2 Dairy Products

9.2.2.1 to Remove the Odors and Gas Present in Milk, Deaeration Process is Used

9.2.3 Alcoholic Beverages

9.2.3.1 Oxygen is Detrimental to the Flavor Stability of Alcoholic Beverages Thus They are Deaerated

9.2.4 Other Beverages

9.3 Food

9.3.1 Desserts

9.3.1.1 Changing Lifestyle and Consumption Patterns Drives the Deaetors Market

9.3.2 Ketchup and Sauces

9.3.2.1 Growing Demand for Ketchup and Sauces Expected to Fuel Food Deaerators Market

9.3.3 Baby Food

9.3.3.1 The Baby Food Market has Experienced Rapid Growth, Due to the Increasing Number of Working Women and the Increasing Parental Concerns About Nutrition

9.3.4 Other Food

10 Food Deaerators Market, By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 Us

10.2.1.1 US Accounted for the Largest Market Size in the Food Deaerators Market in North America

10.2.2 Canada

10.2.2.1 There is A Positive Market Scenario for the Deaerators Market in Canada

10.2.3 Mexico

10.2.3.1 Mexico is Expected to Witness the Highest Growth Rate in the Food Deaerators Market in North America

10.3 Europe

10.3.1 Germany

10.3.1.1 Germany Dominated the European Food Deaerators Market

10.3.2 UK

10.3.2.1 Advanced Technologies in Europe Boosting the Food Deaerators Market

10.3.3 France

10.3.3.1 Strict Regulations in France's Food and Beverage Sector Which Affects Deaerators Market

10.3.4 Italy

10.3.4.1 Italy is One of the Top Exporter of Food Processing Equipment

10.3.5 Spain

10.3.5.1 The Booming Food Industry in Spain Affect the Deaerators Market

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China is One of the Leading Exporters of Machinery & Equipment to Eu Countries

10.4.2 India

10.4.2.1 The Indian Deaerators Market is Mainly Driven By the Beverage Industry

10.4.3 Japan

10.4.3.1 High Consumption Rate of Seafood and Processed Meat Led the Growth of the Deaerators Market in Japan

10.4.4 Australia & New Zealand

10.4.4.1 Australia & New Zealand are Largest Importer of Food & Beverage Processing Equipment Which Drives Food Deaerators Market

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 South America

10.5.1.1 The Rise in Purchasing Power of Consumers Which Gives Good Opportunities for Beverage Manufactures

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 96)

11.1 Overview

11.2 Acquisitions

11.3 Expansions

11.4 Agreements

12 Company Profiles (Page No. - 100)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 GEA Group

12.2 JBT Corporation

12.3 Alfa Laval

12.4 SPX Flow

12.5 Stork Thermeq B.V.

12.6 Parker Boiler Co.

12.7 Indeck Power Equipment Company

12.8 Cornell Machine Co.

12.9 Mepaco

12.10 Fulton Thermal Corporation, Inc.

12.11 Jaygo Incorporated

12.12 Pentair PLC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 118)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (66 Tables)

Table 1 USD Exchange Rate Considered, 2014–2017

Table 2 Food Deaerators Market Size, By Type, 2016-2023 (USD Million)

Table 3 Spray-Tray Type Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 4 Spray Type Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 5 Vacuum Type Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 6 Food Deaerators Market Size, By Function, 2016–2023 (USD Million)

Table 7 Food Deaerators Market Size for Oxygen Removal, By Region, 2016–2023 (USD Million)

Table 8 Food Deaerators Market Size for Water Heating, By Region, 2016–2023 (USD Million)

Table 9 Food Deaerators Market Size for Aroma & Flavor Retention, By Region, 2016–2023 (USD Million)

Table 10 Food Deaerators Market Size for Other Function, By Region, 2016–2023 (USD Million)

Table 11 Food Deaerators Market Size, By Application, 2016-2023 (USD Million)

Table 12 Food Deaerators Market Size in Beverages, By Sub-Application, 2016-2023 (USD Million)

Table 13 Food Deaerators Market Size in Food, By Sub-Application, 2016-2023 ( USD Million)

Table 14 Beverages Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 15 Fruit Drinks: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 16 Dairy Products: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 17 Alcoholic Beverages: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 18 Others: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 19 Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 20 Desserts: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 21 Ketchup and Sauces: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 22 Baby Food: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 23 Others: Food Deaerators Market Size, By Region, 2016-2023 (USD Million)

Table 24 Food Deaerators Market Size, By Region, 2016–2023 (USD Million)

Table 25 North America: Food Deaerators Market Size, By Country, 2016–2023 (USD Million)

Table 26 North America: Food Deaerators Market Size, By Type, 2016–2023 (USD Million)

Table 27 North America: Food Deaerators Market Size, By Function, 2016–2023 (USD Million)

Table 28 North America: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 29 North America: Food Deaerators Market Size in Beverages, By Subapplication, 2016–2023 (USD Million)

Table 30 North America: Food Deaerators Market Size in Food, By Subapplication, 2016–2023 (USD Million)

Table 31 US: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 32 Canada: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 33 Mexico: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 34 Europe: Food Deaerators Market Size, By Country, 2016–2023 (USD Million)

Table 35 Europe: Food Deaerators Market Size, By Type, 2016–2023 (USD Million)

Table 36 Europe: Food Deaerators Market Size, By Function, 2016–2023 (USD Million)

Table 37 Europe: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 38 Europe: Food Deaerators Market Size in Beverages, By Subapplication, 2016–2023 (USD Million)

Table 39 Europe: Food Deaerators Market Size in Food, By Subapplication, 2016–2023 (USD Million)

Table 40 Germany: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 41 France: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 42 Spain: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 43 Rest of Europe: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 44 Asia Pacific: Food Deaerators Market Size, By Country, 2016–2023 (USD Million)

Table 45 Asia Pacific: Food Deaerators Market Size, By Type, 2016–2023 (USD Million)

Table 46 Asia Pacific: Food Deaerators Market Size, By Function, 2016–2023 (USD Million)

Table 47 Asia Pacific: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 48 Asia Pacific: Food Deaerators Market Size in Beverages, By Subapplication, 2016–2023 (USD Million)

Table 49 Asia Pacific: Food Deaerators Market Size in Food, By Subapplication, 2016–2023 (USD Million)

Table 50 China: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 51 India: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 52 Japan: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 53 Australia & New Zealand: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 54 Rest of Asia Pacific: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 55 RoW: Food Deaerators Market Size, By Region, 2016–2023 (USD Million)

Table 56 RoW: Food Deaerators Market Size, By Type, 2016–2023 (USD Million)

Table 57 RoW: Food Deaerators Market Size, By Function, 2016–2023 (USD Million)

Table 58 RoW: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 59 RoW: Food Deaerators Market Size in Beverages, By Subapplication, 2016–2023 (USD Million)

Table 60 RoW: Food Deaerators Market Size in Food, By Subapplication, 2016–2023 (USD Million)

Table 61 South America: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 62 Middle East: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 63 Africa: Food Deaerators Market Size, By Application, 2016–2023 (USD Million)

Table 64 Acquisitions, 2014 –2018

Table 65 Expansions, 2014–2017

Table 66 Agreements, 2014–2015

List of Figures (41 Figures)

Figure 1 Food Deaerators Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Food Deaerators Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Beverages Segment to Dominate the Food Deaerators Market, By Application, 2018 vs 2023 (USD Million)

Figure 9 Spray-Tray Type Segment to Dominate the Food Deaerators Market, By Type, 2018 vs 2023 (USD Million)

Figure 10 Oxygen Removal Segment to Dominate the Food Deaerators Market, By Function, 2018 vs 2023 (USD Million)

Figure 11 North America to Be the Largest Market for Food Deaerators

Figure 12 Benefits Associated With Food Deaerators Fuel Their Demand

Figure 13 Food Deaerators Market Size, By Region, 2018–2023 (USD Million)

Figure 14 Spray-Tray Type to Hold the Largest Share Throughout the Forecast Period

Figure 15 Food to Grow at A Higher Rate Between 2018 and 2023

Figure 16 Oxygen Removal Accounted for the Largest Share Across All Regions in 2017

Figure 17 Food Deaerators Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Food Deaerators Market: Supply Chain Analysis

Figure 19 Functioning of Deaerators

Figure 20 Flowsheet of A Deaeration Process for Milk

Figure 21 Spray-Tray Type Segment to Witness the Highest Growth Between 2016 and 2023 (USD Million)

Figure 22 Spray-Tray Type Deaerator

Figure 23 Spray Type Deaerator

Figure 24 Vacuum Type Deaerator

Figure 25 Oxygen Removal Segment to Record the Highest Growth Between 2018 and 2023 (USD Million)

Figure 26 The Beverages Segment Dominated the Market From 2018 to 2023 (USD Million)

Figure 27 Mexico to Witness Fastest Growth in the Food Deaerators Market in North America By 2023

Figure 28 Germany is Projected to Be the Fastest-Growing in the Food Deaerators Market in Europe By 2023 (USD Million)

Figure 29 Asia Pacific: Food Deaerators Market Snapshot

Figure 30 Global Food Deaerators Market Ranking, 2017

Figure 31 Key Developments in the Food Deaerators Market, 2014–January 2018

Figure 32 Number of Developments in the Deaerators Market, 2014–January 2018

Figure 33 GEA Group: Company Snapshot

Figure 34 GEA Group: SWOT Analysis

Figure 35 JBT Corporation: Company Snapshot

Figure 36 JBT Corporation: SWOT Analysis

Figure 37 Alfa Laval: Company Snapshot

Figure 38 Alfa Laval: SWOT Analysis

Figure 39 SPX Flow.: Company Snapshot

Figure 40 SPX Flow: SWOT Analysis

Figure 41 Pentair PLC: Company Snapshot

Growth opportunities and latent adjacency in Food Deaerators Market

interesting