Global Defense Industry Outlook Market - 2025

The global military expenditure is estimated to be USD 2,563.1 billion in 2024 and is expected to reach USD 2,688.7 billion in 2025 at a growth rate of 4.9% from 2024 to 2025.The Global Defense Outlook 2025 provides an in-depth examination of significant trends and recent advancements in the defense sector. It anticipates potential future developments and associated opportunities in 2025 and beyond. This study is designed to empower participants in the defense industry to make strategic decisions, with a particular focus on key forthcoming opportunities.

Utilizing meticulously curated datasets within the Aerospace and Defense practice, the analysis incorporates insights from both the research team and industry experts. In addition to drawing on major findings from published syndicate studies, this outlook study incorporates firsthand observations from recent, thorough investigations. The analysis encompasses crucial programs and contracts, along with an assessment of the impact of ongoing and recent conflicts. Persistent threat perceptions and emerging defense risks are also addressed to validate future predictions.

Global macroeconomic trends are scrutinized to compare economic indicators and their correlation with defense spending, especially capital expenditure. Special attention is given to the competitive landscape of the defense industry, highlighting new product launches and significant contract wins to substantiate the developments and future opportunities under consideration.

The analysis goes on to evaluate the performance of the global defense industry in 2024 and projects the same for 2025. The predictive analysis for 2025 also outlines the expected key trends in the defense industry. This particular segment is crafted to offer a comprehensive overview of emerging opportunities for defense industry participants, particularly those targeted for customized, in-depth investigations by the Aerospace & Defense practice.

Share at:ChatGPT Perplexity Grok Google AI

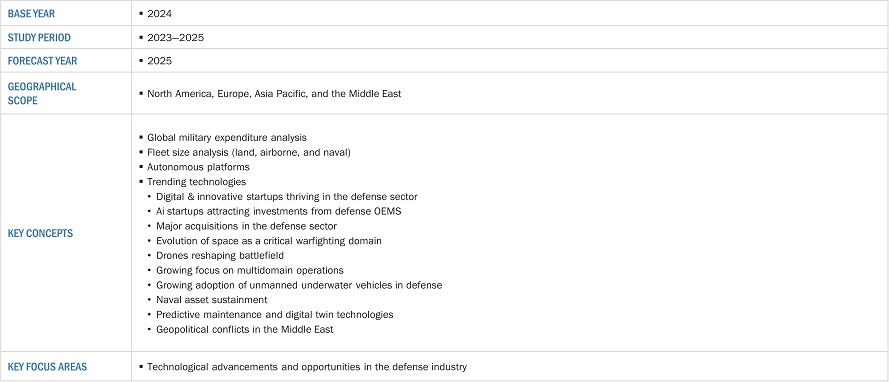

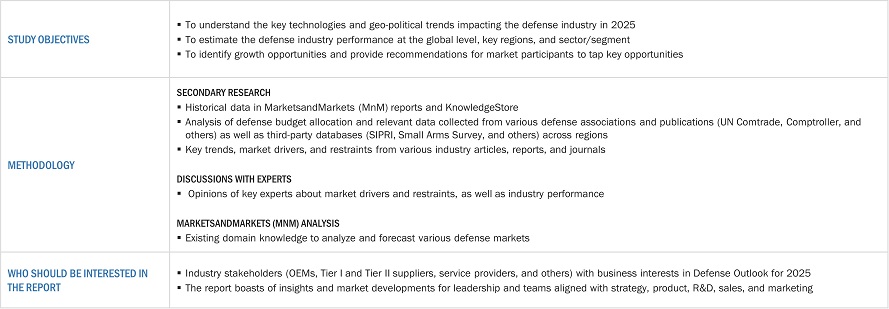

The Global Defense Outlook 2025 provides an in-depth examination of significant trends and recent advancements in the defense sector. It anticipates potential future developments and associated opportunities in 2025 and beyond. This study is designed to empower participants in the defense industry to make strategic decisions, with a particular focus on key forthcoming opportunities.

Utilizing meticulously curated datasets within the Aerospace and Defense practice, the analysis incorporates insights from both the research team and industry experts. In addition to drawing on major findings from published syndicate studies, this outlook study incorporates firsthand observations from recent, thorough investigations. The analysis encompasses crucial programs and contracts, along with an assessment of the impact of ongoing and recent conflicts. Persistent threat perceptions and emerging defense risks are also addressed to validate future predictions.

Global macroeconomic trends are scrutinized to compare economic indicators and their correlation with defense spending, especially capital expenditure. Special attention is given to the competitive landscape of the defense industry, highlighting new product launches and significant contract wins to substantiate the developments and future opportunities under consideration.

The analysis goes on to evaluate the performance of the global defense industry in 2024 and projects the same for 2025. The predictive analysis for 2025 also outlines the expected key trends in the defense industry. This particular segment is crafted to offer a comprehensive overview of emerging opportunities for defense industry participants, particularly those targeted for customized, in-depth investigations by the Aerospace & Defense practice.

Key 2024 Trends Covered in the Study:

- Digital and innovative startups thriving in the defense sector

- AI startups attracting investments from defense OEMs

- Major acquisitions in the defense sector

- Evolution of space as a critical warfighting domain

- Drones reshaping battlefield

- Growing focus on multidomain operations

- UUVs in defense

- Naval Asset Sustainment

- Predictive maintenance & digital twin in defense

- Geopolitical conflicts in the Middle East

- Defense stock prices

Growth opportunities and latent adjacency in Global Defense Industry Outlook Market