Glycated Albumin Assay Market Size, Share & Trends by Application (Prediabetes, Type 1 Diabetes, Type 2 Diabetes), End User (Hospitals & Diabetic Care Center, Diagnostic Laboratory) & Region (North America, Europe, APAC, Latin America, & MENA) - Global Forecast to 2028

Glycated Albumin Assay Market Size, Share & Trends

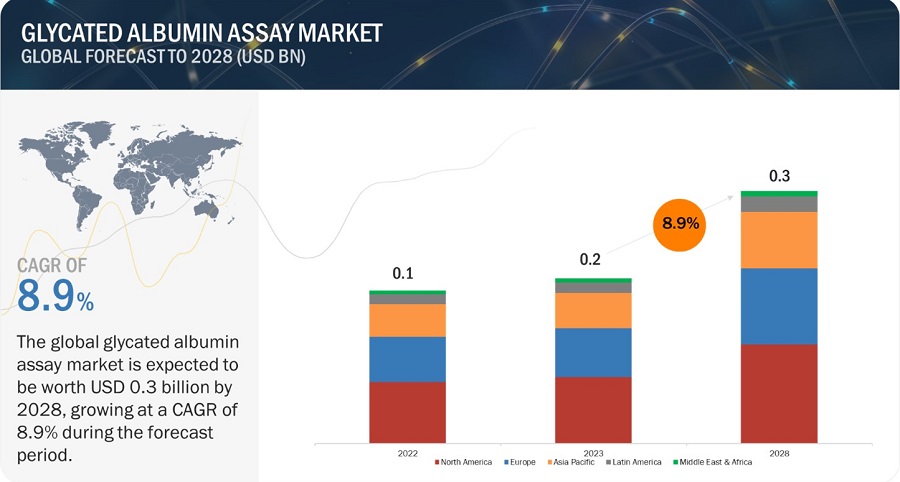

The global glycated albumin assay market, valued at US$0.1 billion in 2022, is forecasted to grow at a robust CAGR of 8.9%, reaching US$0.2 billion in 2023 and an impressive US$0.3 billion by 2028. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Market growth is driven by the increased focus of the government on disease diagnosis, the high prevalence of diabetes, and increasing initiatives to spread awareness of diabetes diagnosis.

Glycated Albumin Assay Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Glycated Albumin Assay Market Dynamics

Driver: Rising prevalence of diabetes

Diabetes is a common chronic metabolic disease that occurs due to insulin dysfunction in the pancreas. Hyperglycemia, also called raised blood glucose or raised blood sugar, is a common effect of uncontrolled diabetes. Diabetes can cause serious damage to bodily functions, especially nerves and blood vessels. The increasing prevalence of diabetes has a positive impact on the glycated albumin assay industry.

Restraint: Unfavorable reimbursement scenario

Inadequate reimbursement is a major factor restraining the growth of the glycated albumin assay diagnostics market. Most diagnostic companies face a major challenge in commercializing their tests is getting approval and reimbursement for the diagnostic product. most diagnostic companies face in commercializing their tests is getting Medicare and private health insurers to pay for them. This is important not only to help the decision-making process of physicians within the practice of evidence-based medicine but also to achieve regulatory approvals and reimbursements for the tests. The reimbursement levels for diagnostics set by the Centers for Medicare and Medicaid Services (CMS) does not adequately reflect their actual cost or clinical value. This decline and additional budgetary concerns among healthcare systems will be a major obstacle to implementing novel diagnostic techniques in clinical laboratories.

Opportunity: Rising investments in healthcare and life sciences research

The market is anticipated to have considerable growth possibilities in emerging markets like India, South Korea, Brazil, and Mexico. This is explained by the high disease prevalence, substantial patient population, enhanced healthcare system, rising disposable income, and expanding medical tourism in these nations. The Asia Pacific region has become a flexible and business-friendly hub because to fewer onerous rules and data requirements, in addition to the aforementioned considerations.

Challenge: Changing regulatory landscape

Regulatory and legal requirements applied to diagnostics (including glycated albumin assay) in the US and European countries are becoming more stringent. Under US federal regulations, device manufacturers must submit a 510(k) application for any further modifications to a device, which is a major challenge in the growth of this market.

IVD devices must comply with Annex 1 of the directive’s essential requirements, and products must be CE-marked to be legally marketed in the EU. New regulations are expected to replace earlier EU directives and add stringent requirements for the CE Marking of new and existing devices. Su.ch changes in the regulatory landscape can prove challenging to the growth of the glycated albumin assay industry.

Glycated Albumin Assay Market Ecosystem/Market Map

The glycated albumin assay ecosystem market map consists of the elements present in the market. Manufacturers are the organizations involved in the entire process of research, product development, optimization, and launch. Distributors include third parties and e-commerce sites linked with the organization for the marketing and distribution of glycated albumin assays. Research and development includes in-house research facilities, contract research organizations, and contract development and manufacturing organizations. End users are the key stakeholders in the supply chain of the market, and the major influencers are investors/funders and health regulatory bodies.

In 2022, type 2 diabetes segment accounted for the largest share of the glycated albumin assay industry, by application

The glycated albumin assay market is segmented into prediabetes, type 1 diabetes, and type 2 diabetes. The type 2 diabetes segment accounted for the largest share of the market in 2022, mainly due to the rising geriatric population & type 2 diabetes prevalence.

In 2022, hospitals and diabetes care centers segment dominated the glycated albumin assay industry, by end user

The glycated albumin assay market is segmented into hospitals and diabetes care centers, diagnostic laboratories and other end users based on end user. In 2022, the hospitals and diabetes care centers segment accounted for the largest share. Laboratories within these segments perform glycated albumin assays to identify or diagnose diabetes and determine appropriate treatments. These urine and blood samples are tested for the physiological parameters related to diabetes. As compared to reference laboratories, hospitals offer quicker test results and are more accessible. This is expected to support the growth of this end user segment.

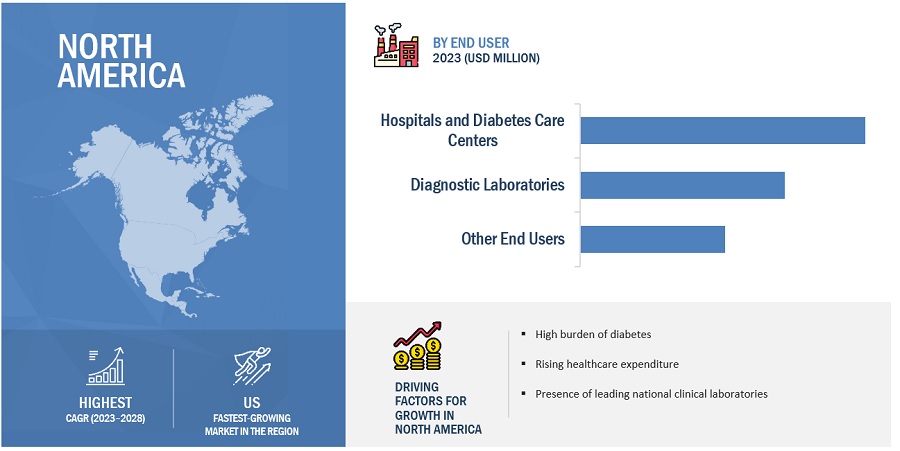

North America is the largest regional market for glycated albumin assay industry

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa are the five main geographic segments of the worldwide glycated albumin assay market. North America held the biggest market share for glycated albumin assays globally in 2022. The North American market's growth can be attributed to the increase prevalence of lifestyle diseases such as diabetes and supportive government initiatives regarding effective diabetes management. Healthcare coverage expansions by Medicaid, Medicare, and private health insurance companies in the region are also expected to play a significant role in fueling the market growth. Other factors supporting market growth include the growing geriatric population, the implementation of favorable government initiatives, and technologically advanced assays.

To know about the assumptions considered for the study, download the pdf brochure

Some key players in the glycated albumin assay market are Asahi Kasei Corporation (Japan), Beijing Strong Biotechnologies, Inc. (China), Diazyme Laboratories, Inc. (US), DxGen Corp. (South Korea), Weldon Biotech, Inc. (India), and Hzymes Biotech (China). The market leadership of these players stems from their comprehensive product portfolios. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the Glycated Albumin Assay Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$0.2 billion |

|

Projected Revenue Size by 2028 |

$0.3 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.9% |

|

Market Driver |

Rising prevalence of diabetes |

|

Market Opportunity |

Rising investments in healthcare and life sciences research |

This report categorizes the glycated albumin assay market to forecast revenue and analyze trends in each of the following submarkets:

By Application

- Prediabetes

- Type 1 Diabetes

- Type 2 Diabetes

By End User

- Hospital and Diabetes Care Centers

- Diagnostic laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global glycated albumin assay market?

The global glycated albumin assay market boasts a total revenue value of $0.3 billion by 2028.

What is the estimated growth rate (CAGR) of the global glycated albumin assay market?

The global glycated albumin assay market has an estimated compound annual growth rate (CAGR) of 8.9% and a revenue size in the region of $0.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of diabetes- Growing focus on early detection of diabetes- Increase in age-associated diabetic ailmentsRESTRAINTS- Unfavorable reimbursement scenarioOPPORTUNITIES- Rising investments in life sciences researchCHALLENGES- Stringent regulatory requirements for diagnostic products- Presence of alternative tests

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSISGLYCATED ALBUMIN ASSAY MARKET: LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISGLYCATED ALBUMIN ASSAY MARKET: ECOSYSTEM ROLE

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- Brazil- MexicoMIDDLE EASTAFRICA

-

5.10 TRADE ANALYSISTRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS- Import data for diagnostic and laboratory reagents, by country, 2018–2022 (USD million)- Export data for diagnostic and laboratory reagents, by country, 2018–2022 (USD million)

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 PESTLE ANALYSIS

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 TYPE 2 DIABETESDIETARY AND LIFESTYLE CHANGES TO CONTRIBUTE TO MARKET GROWTH

-

6.3 PREDIABETESINSULIN RESISTANCE AND RISING CASES OF PREDIABETES TO DRIVE MARKET

-

6.4 TYPE 1 DIABETESINCREASING INCIDENCE AMONG CHILDREN AND ADOLESCENTS TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 HOSPITALS AND DIABETES CARE CENTERSABILITY TO OFFER RAPID RESULTS IN ACCESSIBLE SETTING TO DRIVE MARKET

-

7.3 DIAGNOSTIC LABORATORIESRISING OUTSOURCING OF RESEARCH ACTIVITIES FOR COST REDUCTION TO DRIVE MARKET

- 7.4 OTHER END USERS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAUS- High healthcare expenditure for diabetes treatment & diagnosis to drive marketCANADA- Rising awareness of early diabetes detection to support market growthNORTH AMERICA: RECESSION IMPACT

-

8.3 EUROPEGERMANY- Provision of healthcare coverage for technologically advanced assays to drive marketUK- Rising geriatric population and diabetes-associated ailments to drive marketFRANCE- Increasing R&D expenditure for product commercialization to drive marketITALY- Improvements in healthcare infrastructure to support market growthSPAIN- Rising incidence of diabetes among senior women to support market growthREST OF EUROPEEUROPE: RECESSION IMPACT

-

8.4 ASIA PACIFICCHINA- Improving healthcare infrastructure to propel marketJAPAN- Universal healthcare reimbursement policy to support market growthINDIA- implementation of favorable government initiatives to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

8.5 LATIN AMERICARISING GOVERNMENT-FUNDED PROGRAMS FOR ACCURATE AND EARLY DISEASE DIAGNOSIS TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

8.6 MIDDLE EAST & AFRICAEXPANSION OF KEY MARKET PLAYERS TO SUPPORT MARKET GROWTHMIDDLE EAST & AFRICA: RECESSION IMPACT

- 9.1 OVERVIEW

- 9.2 REVENUE SHARE ANALYSIS OF LEADING MARKET PLAYERS

-

9.3 MARKET SHARE ANALYSISGLYCATED ALBUMIN ASSAY MARKET

-

9.4 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.5 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

9.6 COMPETITIVE BENCHMARKINGPRODUCT AND REGIONAL FOOTPRINT ANALYSIS

-

10.1 KEY PLAYERSASAHI KASEI CORPORATION- Business overview- Products offered- MnM viewBEIJING STRONG BIOTECHNOLOGIES, INC.- Business overview- Products offered- MnM viewDIAZYME LABORATORIES, INC.DXGEN CORP.WELDON BIOTECH, INC.HZYMES BIOTECH

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 TOTAL HEALTH EXPENDITURE (USD) FOR DIABETES (20–79 YEARS), BY COUNTRY (2021)

- TABLE 2 AVERAGE SELLING PRICE OF GLYCATED ALBUMIN ASSAY PRODUCTS

- TABLE 3 GLYCATED ALBUMIN ASSAY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: CLASSIFICATION OF DEVICES

- TABLE 9 DETAILED LIST OF CONFERENCES AND EVENTS (2022−2023)

- TABLE 10 GLYCATED ALBUMIN ASSAY MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 11 KEY BUYING CRITERIA FOR GLYCATED ALBUMIN ASSAYS, BY END USER

- TABLE 12 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 13 GLYCATED ALBUMIN ASSAY MARKET FOR TYPE 2 DIABETES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 GLYCATED ALBUMIN ASSAY MARKET FOR PREDIABETES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 INCIDENCE OF TYPE 1 DIABETES IN CHILDREN AND ADOLESCENTS AGED 0 TO 19, BY REGION, 2021 (THOUSANDS)

- TABLE 16 GLYCATED ALBUMIN ASSAY MARKET FOR TYPE 1 DIABETES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 18 GLYCATED ALBUMIN ASSAY MARKET FOR HOSPITALS AND DIABETES CARE CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 GLYCATED ALBUMIN ASSAY MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 GLYCATED ALBUMIN ASSAY MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 GLYCATED ALBUMIN ASSAY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 25 US: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 26 US: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 27 INCIDENCE OF DIABETES IN CANADA, 2019 VS. 2029

- TABLE 28 CANADA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 29 CANADA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 30 PREVALENCE OF DIABETES IN EUROPE, 2021 VS. 2045

- TABLE 31 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 33 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 34 GERMANY: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 GERMANY: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 36 UK: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 37 UK: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 FRANCE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 39 FRANCE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 40 ITALY: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 41 ITALY: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 42 SPAIN: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 SPAIN: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 44 REST OF EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 45 REST OF EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 49 CHINA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 CHINA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 JAPAN: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 JAPAN: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 INDIA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 INDIA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 57 LATIN AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 LATIN AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 MIDDLE EAST & AFRICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 MIDDLE EAST & AFRICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 61 GLYCATED ALBUMIN ASSAY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 62 GLYCATED ALBUMIN ASSAY MARKET: COMPETITIVE EVALUATION OF KEY PLAYERS

- TABLE 63 GLYCATED ALBUMIN ASSAY MARKET: COMPANY PRODUCT FOOTPRINT

- TABLE 64 GLYCATED ALBUMIN ASSAY MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 65 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- TABLE 66 BEIJING STRONG BIOTECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 67 DIAZYME LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 68 DXGEN CORP: COMPANY OVERVIEW

- TABLE 69 WELDON BIOTECH, INC.: COMPANY OVERVIEW

- TABLE 70 HZYMES BIOTECH: COMPANY OVERVIEW

- FIGURE 1 GLYCATED ALBUMIN ASSAY MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

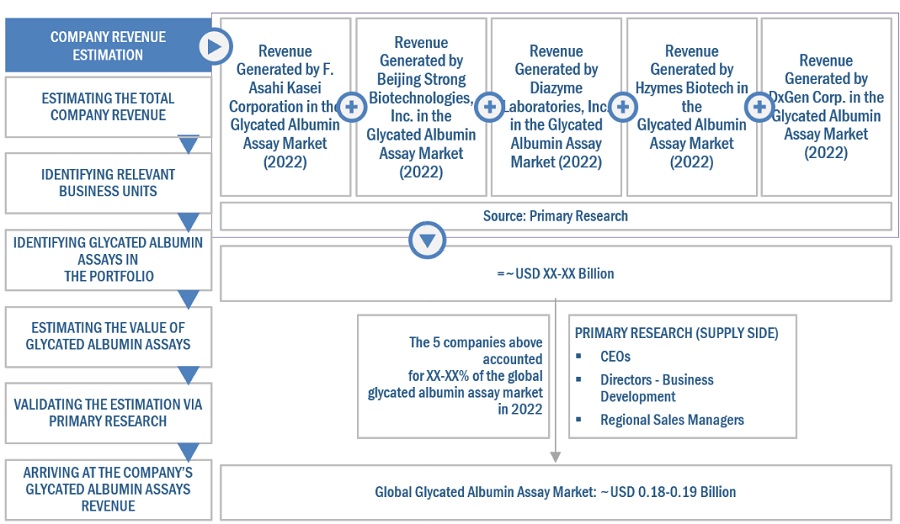

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

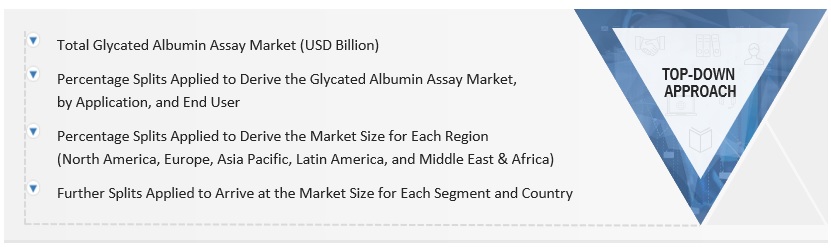

- FIGURE 6 GLYCATED ALBUMIN ASSAY MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 GLYCATED ALBUMIN ASSAY MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 INCREASING PREVALENCE OF DIABETES TO DRIVE MARKET

- FIGURE 12 TYPE 2 DIABETES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 HOSPITALS AND DIABETIC CARE CENTERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 GLYCATED ALBUMIN ASSAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PREVALENCE OF DIABETES IN ADULTS (20–79 YEARS), BY REGION, 2021 VS. 2045 (USD MILLION)

- FIGURE 17 PATENT ANALYSIS FOR GLYCATED ALBUMIN ASSAYS (JANUARY 2013–DECEMBER 2022)

- FIGURE 18 GLYCATED ALBUMIN ASSAY MARKET: MAJOR VALUE IS ADDED DURING MANUFACTURING & ASSEMBLY PHASES

- FIGURE 19 GLYCATED ALBUMIN ASSAY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 GLYCATED ALBUMIN ASSAY MARKET: ECOSYSTEM MAP

- FIGURE 21 GLYCATED ALBUMIN ASSAY MARKET: REVENUE SHIFT MAPPING

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR GLYCATED ALBUMIN ASSAYS

- FIGURE 23 GLYCATED ALBUMIN ASSAY MARKET: KEY BUYING CRITERIA

- FIGURE 24 CASE STUDY ANALYSIS: MARKET ASSESSMENT AND CONSUMER BUYING BEHAVIOR IN INDIA

- FIGURE 25 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET SNAPSHOT

- FIGURE 27 GLYCATED ALBUMIN ASSAY MARKET: REVENUE SHARE ANALYSIS

- FIGURE 28 GLYCATED ALBUMIN ASSAY MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 29 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 30 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 31 GLYCATED ALBUMIN ASSAY MARKET: PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

- FIGURE 32 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 33 BEIJING STRONG BIOTECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the current size of the glycated albumin assay market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

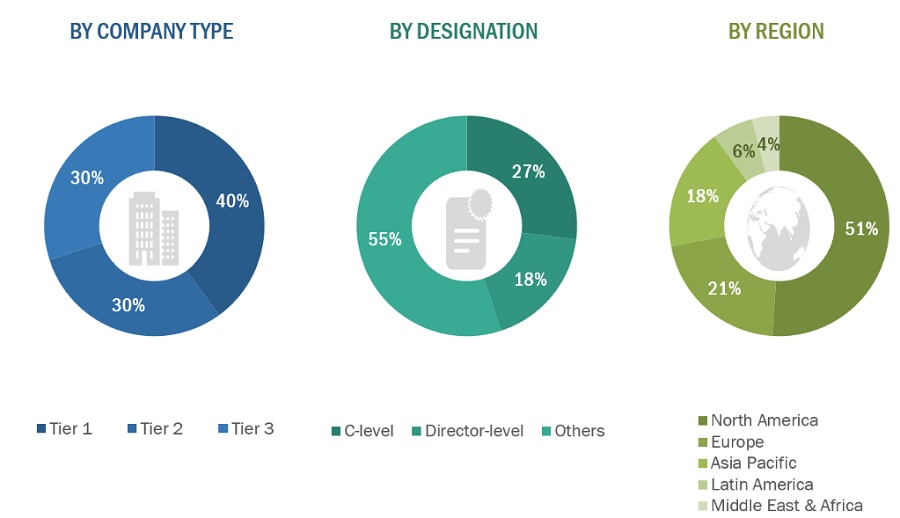

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the glycated albumin assay market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the glycated albumin assay market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Molecular Diagnostics Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Glycated Albumin Assay Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Glycated albumin assay is an in vitro test used for the quantitative determination of glycated albumin in a sample. The test reflects short term glycemia which is not affected by A1C levels. It is measured by an enzymatic method used for detection of diabetes.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the glycated albumin assay market by application, end user and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities and challenges).

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa,

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2.

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Glycated albumin assay market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa.

Company profiles

- Product portfolio matrix for leading market players.

Growth opportunities and latent adjacency in Glycated Albumin Assay Market