Image-Guided Radiation Therapy Market by Product (4D RT, LINAC, MRI-guided radiotherapy, Portal CT Imaging), Procedure (IMRT, Stereotactic, Particle), Application (Neck, Prostate, Breast cancer), End User (Hospital, ACC) & Region - Global Forecast to 2028

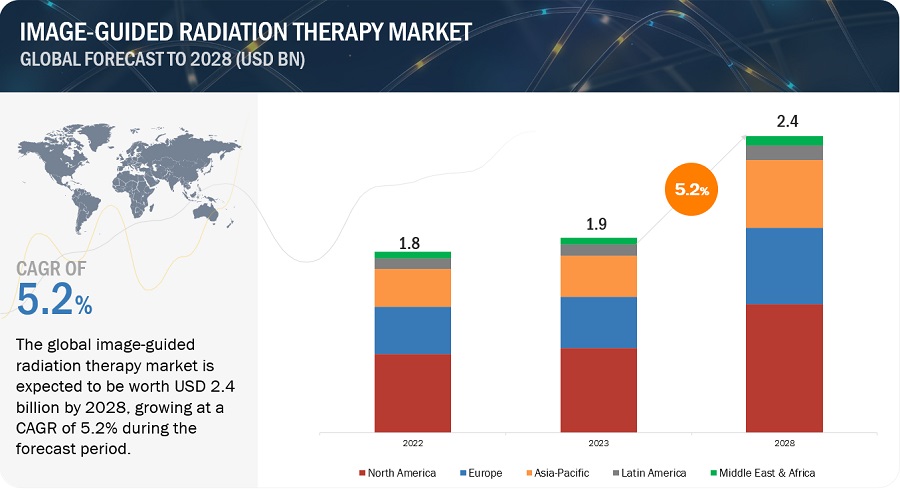

The global image-guided radiation therapy market in terms of revenue was estimated to be worth $1.9 billion in 2023 and is poised to reach $2.4 billion by 2028, growing at a CAGR of 5.2% from 2023 to 2028. Rising demand for image-guided interventions and growth in non-invasive treatments of cancer management are a few drivers that collectively contribute to the growth of the image-guided radiation therapy market, and as healthcare technologies continue to evolve, the demand for image-guided radiation therapy is expected to rise further in the upcoming years. However, higher costs and availability limit the market growth.

Attractive Opportunities in the Image-guided Radiation Therapy Market

To know about the assumptions considered for the study, Request for Free Sample Report

Image-guided Radiation Therapy Market: Market Dynamics

Driver: Increase in non-invasive cancer treatments through radiation therapy

Non-invasive radiation therapy significantly mitigates the probability of surgical complications and diminishes the potential for adverse effects in the post-treatment phase. This augmentation distinctly contributes to the advancement and market elevation of image-guided radiation therapy, positioning it as a pivotal solution in the landscape of cancer treatment.

Increasing government initiatives for cancer management:

The augmentation of government initiatives for cancer management is driven by a confluence of factors, encompassing imperatives in public health, deliberations of economic significance, advocacy on behalf of patients, commitments on the global stage, and a unified endeavor to bolster healthcare systems and foster health equity. This amalgamation distinctly contributes to the advancement and market elevation of image-guided radiation therapy, solidifying its position as a pivotal solution within the broader spectrum of cancer treatment modalities.

Rising cancer patient population:

The upward trajectory of the cancer patient population stems from a multifaceted interplay of interconnected elements that collectively influence individual susceptibility and contribute to the overarching burden of cancer across societies. This intricate amalgamation distinctly contributes to the advancement and market elevation of image-guided radiation therapy, positioning it as an instrumental solution within the expansive domain of cancer care and treatment.

Restraint: The dearth of skilled radiologist/oncologist:

The scarcity of proficient radiologists and oncologists constitutes a multifaceted challenge underscored by factors including escalating demand, shifting demographics, hurdles in training, work environment considerations, and the imperative for continuous professional advancement. This intricate interplay distinctly contributes to the advancement and market elevation of image-guided radiation therapy (IGRT), positioning it as an indispensable solution within the realm of oncological care and management.

Affordability and accessibility of treatment:

The accessibility and affordability of cancer treatment are intricately shaped by a multifaceted interplay of variables, including treatment expenditure, insurance provisions, regional discrepancies, supportive service availability, and the financial ramifications of treatment. Collectively, these elements contribute to the delineation of the cancer care landscape, ultimately impacting patients' capacity to obtain and finance essential treatments. This intricate amalgamation distinctly contributes to the advancement and market elevation of image-guided radiation therapy (IGRT), positioning it as an instrumental solution in addressing the affordability and accessibility aspects within the domain of cancer care.

Complexity of imaging technology for treatments:

The intricacy of imaging technology in the context of cancer treatments is a result of the dynamic interplay between advancing technologies, the imperative for specialized expertise, complexities in data analysis, challenges in seamless treatment integration, and the essentiality of cross-disciplinary collaboration. This synergy of factors collectively molds the framework of imaging-guided cancer treatments, underscoring the heightened capabilities and intricacies within this domain. This distinct interrelation significantly contributes to the advancement and market augmentation of image-guided radiation therapy (IGRT), positioning it as a pivotal solution that aligns with the complex demands of contemporary cancer care, thus fostering its prominence and adoption.

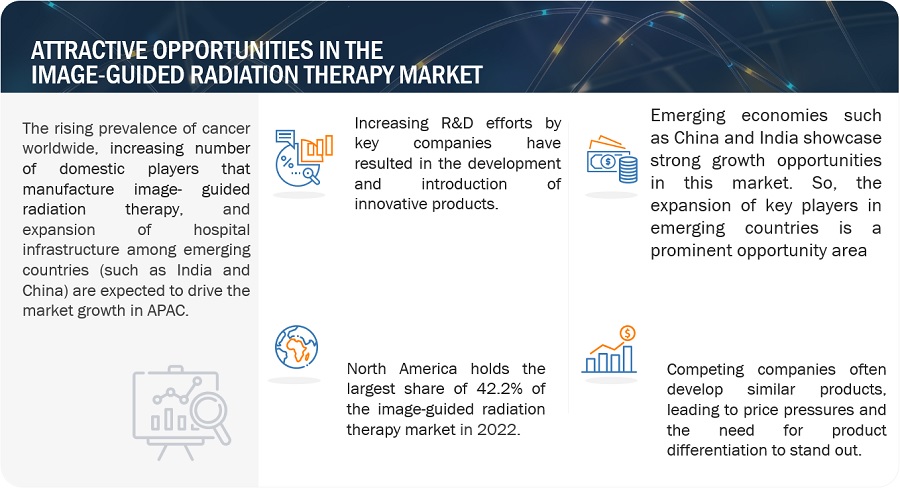

Opportunity: Rising healthcare expenditure across developing countries

The rise in healthcare spending in developing countries is driven by a complex interplay of factors like changing demographics, disease trends, improved infrastructure, technological advancements, and healthcare workforce growth. This dynamic interaction shapes the healthcare landscape and guides financial resource allocation for services and treatments. Amid this context, image-guided radiation therapy (IGRT) emerges as a strategic solution equipped with advanced capabilities that align with evolving healthcare needs.

Expansion of key players in emerging countries:

Prominent industry leaders are expanding in emerging countries due to untapped markets, strategic collaborations, and adapting expertise to evolving healthcare needs. In this context, image-guided radiation therapy (IGRT) plays a pivotal role in meeting the healthcare demands of these growing markets.

Challenges: Availability of alternative technology:

Navigating the landscape of alternative technologies poses a challenge for the IGRT market, driven by ongoing technological advancements, the pursuit of superior treatment outcomes, and the competitive dynamics inherent within cancer treatment modalities. Amidst this complexity, the strategic rise and market expansion of image-guided radiation therapy (IGRT) becomes imperative, as it must effectively align its unique attributes to meet evolving cancer care needs while contending with alternative technological options.

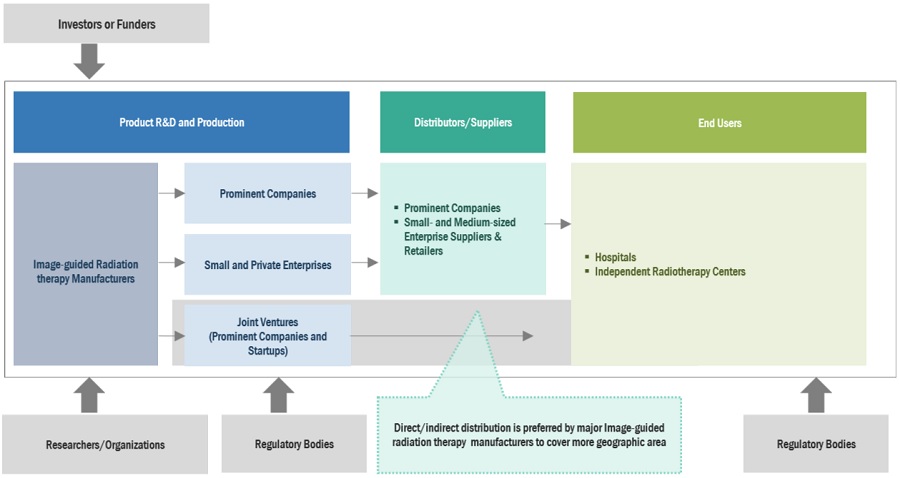

Image-Guided Radiation Therapy Market Ecosystem

Major companies in this market include well-established and financially stable suppliers of image-guided radiation therapy, radiotherapy, and imaging technology. Prominent companies in this market include Siemens Healthiineers AG (Germany), Elekta (Sweden), Accuray Incorporated (US), Varian Medical Systems (US), GE Healthcare Company (US), Hitachi (Japan), Koninklijke Philips (Netherlands), Toshiba Corporation (Japan), among several others.

PET/ MRI-guided radiation therapy segment of the Image-guided Radiation Therapy Industry to register a significant growth rate over the forecast period of 2022-2028.

Based on the product, the image-guided radiation therapy market is segmented into 4D gating/ 4D RT, CT scanning, LINAC (linear accelerator), PET/ MRI-guided radiation therapy, and portal imaging. PET/ MRI-guided radiation therapy product segment to register a significant growth rate over the forecast period of 2022-2028. PET/MRI integration enables timely treatment response assessment, empowering providers to adapt plans swiftly. This improves outcomes and intervention precision. Real-time insights advance decision-making and enhance IGRT's prominence, aligning with patient-centric values. This synergy positions PET/MRI and IGRT as integral to progressive cancer care.

The prostate cancer application segment accounted for the highest CAGR of the image-guided radiation therapy industry in 2022-2028.

Based on the application, the image-guided radiation therapy market is segmented into prostate cancer, breast cancer, lung cancer, head & neck cancer, gynecological cancer, gastrointestinal cancer, and other applications. IGRT enables radiologists to perform complex prostate cancer applications using non-invasive techniques. The integration of image-guided radiation therapy (IGRT) within prostate cancer treatment is substantiated by its adeptness in navigating the intricacies of prostate anatomy, mitigating treatment-associated uncertainties, tailoring treatment regimens, and synergizing with evolving therapeutic frameworks. This amalgamation of attributes significantly amplifies the advancement and prominence of IGRT within the context of the prostate cancer application segment, thereby augmenting its strategic position in the broader market of radiation therapy.

The stereotactic therapy procedure segment accounted for the highest growth rate of the image-guided radiation therapy industry in 2022-2028.

Based on the procedure, the image-guided radiation therapy market is segmented into intensity modulation radiation therapy, stereotactic therapy, particle therapy, 3D conformal radiation therapy, and proton beam therapy. The stereotactic therapy procedure segment is estimated to hold the highest growth rate of the image-guided radiation therapy market during the forecast period.

This segment held a CAGR of 39.2% in 2022. Stereotactic therapy's efficiency in requiring fewer treatment sessions than conventional methods aligns with IGRT's streamlined approach. This benefits patients, healthcare providers, and resource allocation, enhancing patient satisfaction and adherence. This convergence highlights IGRT's strategic importance, solidifying its market prominence as an essential modality for efficient and effective cancer care.

Independent radiotherapy centers segment to register for the highest growth rate of the image-guided radiation therapy industry in 2022-2028.

The major end users in the image-guided radiation therapy market are hospitals and independent radiotherapy centers. Independent radiotherapy centers are expected to dominate the market during the forecast period. The embrace of IGRT within independent radiotherapy centers is propelled by their capacity to deliver tailored and individualized healthcare, harness cutting-edge technologies, and establish a distinct and specialized footprint within the healthcare sector. This amalgamation of factors synergistically fosters the expansion and market advancement of IGRT within the realm of independent radiotherapy centers.

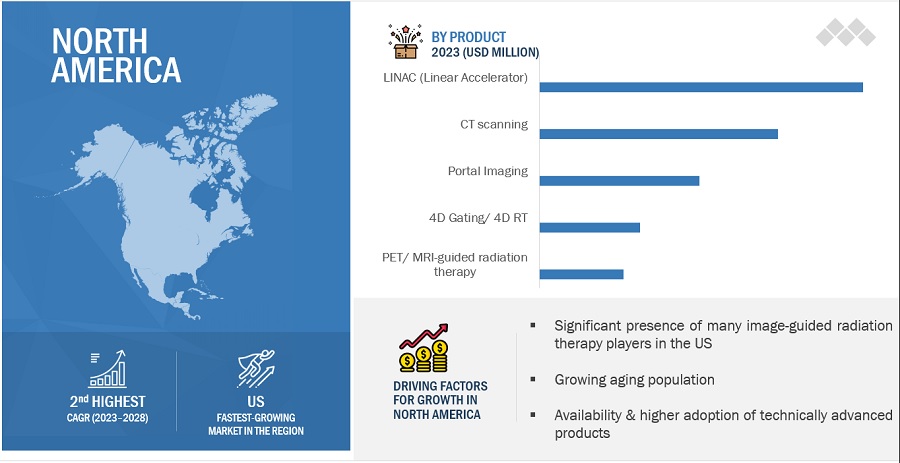

North America is expected to be the largest market for the Image-guided Radiation Therapy Industry during the forecast period.

North America, comprising the US and Canada, held the largest share of the image-guided radiation therapy market in 2022. With its resilient healthcare infrastructure and access to cut-throat medical technologies, North America provides an ideal setting for the adoption of sophisticated treatment methodologies like image-guided radiation therapy (IGRT).

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the market are Siemens Healthineers AG (Germany) (Germany), Elekta (Sweden), Accuray Incorporated (US), GE HealthCare (US), Vyaire Medical, Inc. (US), and Hitachi (Japan)), among others.

Scope of the Image-guided Radiation Therapy Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.9 billion |

|

Estimated Value by 2028 |

$2.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.2% |

|

Market Driver |

Increase in non-invasive cancer treatments through radiation therapy |

|

Market Opportunity |

Rising healthcare expenditure across developing countries |

This report has segmented the global image-guided radiation therapy market to forecast revenue and analyze trends in each of the following submarkets:

By Product Type

- 4D gating/4D RT

- LINAC (Linear Accelerator)

- PET/MRI- guided radiation therapy

- Portal Imaging

- CT scanning

By Application

- Head and neck cancers

- Prostate cancer

- Lung cancer

- Breast cancer

- Gynecological cancers

- Gastrointestinal cancers

- Central nervous system

By Procedure

- Intensity-modulation radiation therapy

- 3D Conformal Radiation therapy

- Stereotactic therapy

- Proton beam therapy

- Particle therapy

By End User

- Hospitals

- Independent Radiotherapy Centers

By region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- MEA

Recent market Developments of Image-guided Radiation Therapy Industry

- In 2023, Philips extended the company’s mobile C-arm portfolio with Zenition 10.

- In 2023, GE HealthCare Advances PET/MR Capabilities with AIR Technologies to enhance diagnostic precision and simplify treatment evaluation while elevating patient comfort.

- In 2023, The launch of Pixxoscan expands GE HealthCare’s portfolio of Magnetic Resonance Imaging (MRI) contrast agents, now offering two leading macrocyclic molecules to customers - Clariscan (gadoteric acid) and Pixxoscan (gadobutrol).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global image-guided radiation therapy market?

The global image-guided radiation therapy market boasts a total revenue value of $2.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global image-guided radiation therapy market?

The global image-guided radiation therapy market has an estimated compound annual growth rate (CAGR) of 5.2% and a revenue size in the region of $1.9 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of radiotherapy for noninvasive cancer treatment- Rising cancer patient population- Initiatives and support for cancer managementRESTRAINTS- Complexity of imaging technology- Affordability and accessibility of treatmentOPPORTUNITIES- Expansion of key players in emerging economies- Rising healthcare expenditure across emerging economiesCHALLENGES- Availability of alternatives to IGRT- Dearth of skilled personnel

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECOSYSTEM MAPPING

-

5.5 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTPROCUREMENT AND PRODUCT DEVELOPMENTMARKETING, SALES & DISTRIBUTION, AND POST-SALES SERVICES

-

5.6 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL & MEDIUM-SIZED COMPANIESEND USERS

-

5.7 REGULATORY ANALYSISUSEUROPEJAPAN

- 5.8 REIMBURSEMENT SCENARIO

- 5.9 PRICING ANALYSIS

-

5.10 PATENT ANALYSIS

- 5.11 CASE STUDY

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 IMAGE-GUIDED RADIATION THERAPY MARKET: RECESSION IMPACT

- 6.1 INTRODUCTION

-

6.2 LINACSLINACS TO HOLD LARGEST MARKET SHARE TILL 2028

-

6.3 CT SCANNINGGROWING NUMBER OF IMAGE-GUIDED AND MINIMALLY INVASIVE MEDICAL PROCEDURES TO BOOST MARKET

-

6.4 PORTAL IMAGINGTRANSITION FROM MANUAL TO ROBOTIC TREATMENT TO SUPPORT MARKET GROWTH

-

6.5 4D GATING/4D RADIATION THERAPYRISING NUMBER OF CANCER TREATMENTS TO DRIVE MARKET

-

6.6 PET/MRI-GUIDED RADIATION THERAPYLARGE PATIENT POPULATION FOR CANCER TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 IMRTIMRT TO HOLD LARGEST MARKET SHARE OVER FORECAST PERIOD

-

7.3 3D CONFORMAL RADIATION THERAPYADVANTAGES AND INCREASED ADOPTION OF RADIATION THERAPY TO BOOST ADOPTION

-

7.4 STEREOTACTIC THERAPYHIGH PRECISION AND EASE OF USE FOR SURGEONS TO DRIVE ADOPTION

-

7.5 PARTICLE THERAPYGOVERNMENT SUPPORT TO BOOST NUMBER OF PARTICLE THERAPY CENTERS

-

7.6 PROTON BEAM THERAPYRISING ESTABLISHMENT OF PROTON THERAPY CANCER CENTERS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 BREAST CANCERBREAST CANCER TO HOLD LARGEST SHARE OF APPLICATIONS MARKET

-

8.3 LUNG CANCERRISING NUMBER OF CLINICAL TRIALS TO SUPPORT GROWTH

-

8.4 PROSTATE CANCERPREFERENCE FOR NONINVASIVE TREATMENT TO BOOST GROWTH

-

8.5 HEAD & NECK CANCERRISING AWARENESS OF BENEFITS OF NONINVASIVE TREATMENTS TO SUPPORT GROWTH

-

8.6 GYNECOLOGICAL CANCER APPLICATIONSGROWING AWARENESS AND NEED FOR EARLY, EFFECTIVE TREATMENT TO SUPPORT ADOPTION

-

8.7 GASTROINTESTINAL CANCERRISING GI CANCER INCIDENCE TO BOOST MARKET GROWTH

- 8.8 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HOSPITALSLARGE NUMBER OF SURGICAL AND DIAGNOSTIC PROCEDURES TO PROPEL MARKET

-

9.3 INDEPENDENT RADIOTHERAPY CENTERSLIMITED SURGICAL CAPABILITIES OF AVAILABLE PRODUCTS TO RESTRAIN ADOPTION

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to dominate North American marketCANADA- Rising cancer prevalence and growing awareness to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to dominate market in EuropeUK- High burden of cancer and large volume of radiation therapy procedures to ensure demandFRANCE- Growth of French healthcare sector to support market growthITALY- Increasing geriatric population to aid growthSPAIN- Technological developments in healthcare sector to propel marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTJAPAN- Japan to hold largest share of APAC marketCHINA- Growing prevalence of cancer and developing healthcare infrastructure to aid growthINDIA- Increasing target patient population and rising availability of advanced surgical treatments to drive marketAUSTRALIA- Developing healthcare sector and increasing availability of advanced surgical treatments to favor marketSOUTH KOREA- Growing target patient population to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Developing healthcare sector and increasing availability of advanced surgical treatments to boost market growthMEXICO- Favorable government initiatives to drive marketREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAINCREASING FOCUS OF MARKET PLAYERS ON MIDDLE EASTERN COUNTRIES TO PROPEL MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET RANKING ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPANY FOOTPRINT ANALYSIS

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

-

12.1 KEY PLAYERSSIEMENS HEALTHINEERS AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHITACHI- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKONINKLIJKE PHILIPS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewELEKTA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewACCURAY INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCANON MEDICAL SYSTEMS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsC-RAD AB- Business overview- Products/Services/Solutions offered- Recent developmentsVIEWRAY, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsIBA WORLDWIDE- Business overview- Products/Services/Solutions offered- Recent developmentsVISION RT LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsPANACEA MEDICAL TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developmentsMEVION MEDICAL SYSTEMS- Business overview- Products/Services/Solutions offered- Recent developmentsGE HEALTHCARE- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER PLAYERSREFLEXIONASG SUPERCONDUCTORSGALBINO TECHNOLOGYIZI MEDICALXSTRAHLAEP LINAC

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 IMAGE-GUIDED RADIATION THERAPY MARKET: ASSUMPTIONS

- TABLE 2 IMAGE-GUIDED RADIATION THERAPY MARKET: LIMITATIONS

- TABLE 3 RISE IN CANCER CASES, 2020 VS. 2025 VS. 2030

- TABLE 4 IMAGE-GUIDED RADIATION THERAPY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 7 CPT CODES FOR MAJOR AUTOMATED RADIATION THERAPY TREATMENT MODALITIES

- TABLE 8 HEALTHCARE COMMON PROCEDURE CODING SYSTEM (HCPCS) CODES FOR IGRT

- TABLE 9 REIMBURSEMENT FOR IMAGE-GUIDED RADIATION THERAPY PROCEDURES PER COURSE, 2021 VS. 2022

- TABLE 10 FREESTANDING PER COURSE NATIONAL AVERAGE MEDICARE REIMBURSEMENT, 2021 VS. 2022

- TABLE 11 PRICING ANALYSIS OF AUTOMATED RADIATION SYSTEMS (USD)

- TABLE 12 IMPORT DATA FOR IMAGE-GUIDED RADIATION THERAPY (HS CODE 9022), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR IMAGE-GUIDED RADIATION THERAPY (HS CODE 9018), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 14 CASE STUDY: ENABLING MR-GUIDED SBRT TREATMENTS FOR PROSTATE CANCER

- TABLE 15 IMAGE-GUIDED RADIATION THERAPY MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS IN 2023–2024

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCT SEGMENTS (%)

- TABLE 17 IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 18 LINACS MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 19 LINACS MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 20 LINACS MARKET, BY APPLICATION, 2020–2028(USD MILLION)

- TABLE 21 LINACS MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 22 CT SCANNING MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 23 CT SCANNING MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 24 CT SCANNING MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 25 CT SCANNING MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 26 PORTAL IMAGING MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 27 PORTAL IMAGING MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 28 PORTAL IMAGING MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 29 PORTAL IMAGING MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 30 4D GATING/4D RADIATION THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 31 4D GATING/4D RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 32 4D GATING/4D RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 33 4D GATING/4D RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 34 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 35 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 36 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 37 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 38 IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 39 IMRT MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 40 3D CONFORMAL RADIATION THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 41 STEREOTACTIC THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 42 PARTICLE THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 43 PROTON BEAM THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 44 IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 45 IMAGE-GUIDED RADIATION THERAPY MARKET FOR BREAST CANCER, BY REGION, 2020–2028 (USD MILLION)

- TABLE 46 IMAGE-GUIDED RADIATION THERAPY MARKET FOR LUNG CANCER, BY REGION, 2020–2028 (USD MILLION)

- TABLE 47 IMAGE-GUIDED RADIATION THERAPY MARKET FOR PROSTATE CANCER, BY REGION, 2020–2028 (USD MILLION)

- TABLE 48 IMAGE-GUIDED RADIATION THERAPY MARKET FOR HEAD & NECK CANCER, BY REGION, 2020–2028 (USD MILLION)

- TABLE 49 IMAGE-GUIDED RADIATION THERAPY MARKET FOR GYNECOLOGICAL CANCER, BY REGION, 2020–2028(USD MILLION)

- TABLE 50 IMAGE-GUIDED RADIATION THERAPY MARKET FOR GASTROINTESTINAL CANCER, BY REGION, 2020–2028 (USD MILLION)

- TABLE 51 IMAGE-GUIDED RADIATION THERAPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 52 IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 53 IMAGE-GUIDED RADIATION THERAPY MARKET FOR HOSPITALS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 54 IMAGE-GUIDED RADIATION THERAPY MARKET FOR INDEPENDENT RADIOTHERAPY CENTERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 55 IMAGE-GUIDED RADIATION THERAPY MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 61 US: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 62 CANADA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 63 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 64 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 65 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 66 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 67 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 68 GERMANY: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 69 UK: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 70 FRANCE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 71 ITALY: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 72 SPAIN: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 79 JAPAN: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 80 CHINA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 81 INDIA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 82 AUSTRALIA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 83 SOUTH KOREA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 84 REST OF ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 85 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 87 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 88 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 89 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 90 BRAZIL: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 91 MEXICO: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 92 REST OF LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020–2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020–2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET

- TABLE 98 TECHNIQUE AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET

- TABLE 99 FOOTPRINT ANALYSIS OF COMPANIES, BY TECHNIQUE

- TABLE 100 FOOTPRINT ANALYSIS OF COMPANIES, BY REGION

- TABLE 101 KEY PRODUCT LAUNCHES AND APPROVALS

- TABLE 102 KEY DEALS

- TABLE 103 OTHER KEY DEVELOPMENTS

- TABLE 104 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 105 HITACHI: COMPANY OVERVIEW

- TABLE 106 KONINKLIJKE PHILIPS: COMPANY OVERVIEW

- TABLE 107 ELEKTA: COMPANY OVERVIEW

- TABLE 108 ACCURAY INCORPORATED: COMPANY OVERVIEW

- TABLE 109 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 110 C-RAD: COMPANY OVERVIEW

- TABLE 111 VIEWRAY, INC.: COMPANY OVERVIEW

- TABLE 112 IBA: COMPANY OVERVIEW

- TABLE 113 VISION RT LTD.: COMPANY OVERVIEW

- TABLE 114 PANACEA MEDICAL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 115 MEVION MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 116 GE HEALTHCARE: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY AND DEMAND-SIDE PARTICIPANTS

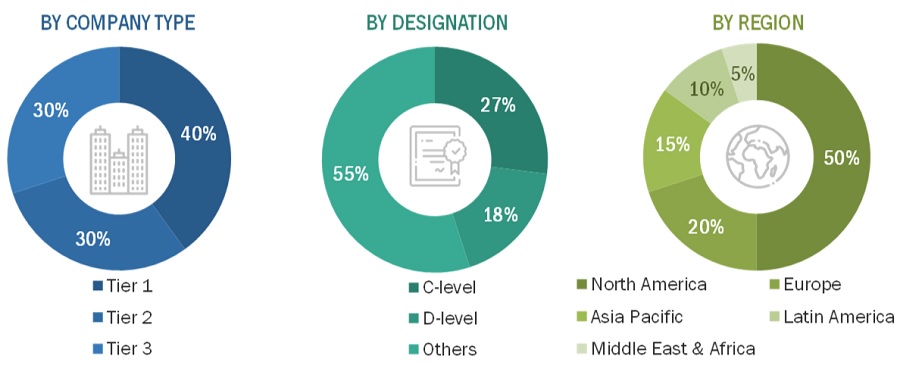

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 IMAGE-GUIDED RADIATION THERAPY MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 6 IMAGE-GUIDED RADIATION THERAPY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 IMAGE-GUIDED RADIATION THERAPY MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 14 INCREASING CANCER PATIENT POPULATION AND GROWING NONINVASIVE CANCER TREATMENT TO DRIVE MARKET

- FIGURE 15 NORTH AMERICA TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 16 HOSPITALS DOMINATED IMAGE-GUIDED RADIATION THERAPY MARKET IN 2022

- FIGURE 17 MEXICO TO GROW AT HIGHEST RATE IN GLOBAL MARKET

- FIGURE 18 IMAGE-GUIDED RADIATION THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 OVERVIEW OF CANCER PATIENT POPULATION: MALE VS. FEMALE

- FIGURE 20 GOVERNMENT HEALTH EXPENDITURE AS % OF GENERAL GOVERNMENT EXPENDITURE (GGE)

- FIGURE 21 IMAGE-GUIDED RADIATION THERAPY MARKET: ECOSYSTEM MAP

- FIGURE 22 IMAGE-GUIDED RADIATION THERAPY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 IMAGE-GUIDED RADIATION THERAPY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 EMERGING TRENDS AND OPPORTUNITIES AFFECTING FUTURE REVENUE MIX

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR IMAGE-GUIDED RADIATION THERAPY MARKET

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET, 2018–2022 (USD BILLION)

- FIGURE 29 IMAGE-GUIDED RADIATION THERAPY MARKET (2022)

- FIGURE 30 IMAGE-GUIDED RADIATION THERAPY MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 31 IMAGE-GUIDED RADIATION THERAPY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/ SMES, 2022

- FIGURE 32 SIEMENS AG: COMPANY SNAPSHOT (2022)

- FIGURE 33 HITACHI: COMPANY SNAPSHOT (2022)

- FIGURE 34 KONINKLIJKE PHILIPS: COMPANY SNAPSHOT (2022)

- FIGURE 35 ELEKTA: COMPANY SNAPSHOT (2022)

- FIGURE 36 ACCURAY INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 37 CANON, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 C-RAD: COMPANY SNAPSHOT (2022)

- FIGURE 39 VIEWRAY, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 IBA: COMPANY SNAPSHOT (2022)

- FIGURE 41 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the image-guided radiation therapy market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the image-guided radiation therapy market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

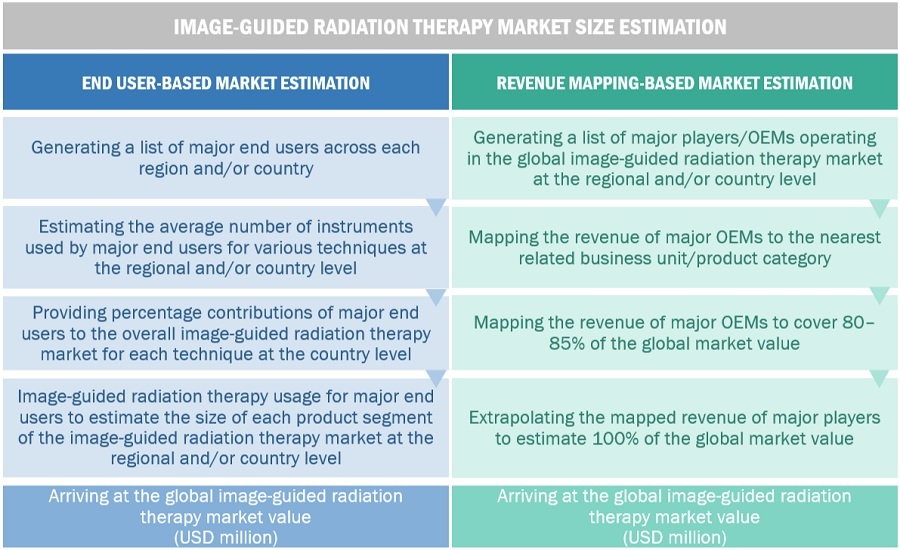

Market Estimation Methodology

In this report, the global image-guided radiation therapy market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the image-guided radiation therapy business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the image-guided radiation therapy market

- Mapping annual revenues generated by major global players from the image-guided radiation therapy market segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover a major share of the global market as of 2021

- Extrapolating the global value of the image-guided radiation therapy industry

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global image-guided radiation therapy market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the image-guided radiation therapy market was validated using both top-down and bottom-up approaches.

Market Definition

Image-guided radiation therapy (IGRT) is a specialized technique used in radiation oncology to precisely target and deliver radiation to cancerous tumors in the body. It combines advanced imaging technology with radiation therapy to enhance the accuracy of treatment and minimize the impact on surrounding healthy tissues. When undergoing IGRT, high-quality images are taken before each radiation therapy treatment session. The images are used to increase the accuracy and precision of the radiation treatment.

Key Stakeholders

- Radiotherapy product manufacturers

- Distributors, suppliers, and commercial service providers

- Healthcare service providers

- Clinical research organizations (CROs)

- Radiotherapy service providers

- Radiotherapy product distributors

- Medical research laboratories

- Cancer care centers

- Cancer research organizations

- Academic medical centers and universities

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the Image-guided radiation therapy market based on product, procedure, application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key market players and comprehensively analyze their market shares and core competencies.

- To forecast the revenue of the market segments with respect to five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa.

- To track and analyze competitive developments such as new product launches and approvals; agreements, partnerships, expansions, acquisitions; and collaborations in the Image-guided radiation therapy market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global image-guided radiation therapy market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top thirteen companies.

Company Information

- Detailed analysis and profiling of additional market players (up to 13)

Geographic Analysis

- Further breakdown of the Rest of Europe image-guided radiation therapy market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among others.

- Further breakdown of the Rest of Asia Pacific image-guided radiation therapy market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries.

- Further breakdown of the Rest of the world image-guided radiation therapy market into Latin America, MEA, and Africa.

Growth opportunities and latent adjacency in Image-Guided Radiation Therapy Market