Industrial Burner Market by Type (Regenerative, High Thermal, Radiant, Direct-Fired), Fuel Type (Oil, Gas, Dual, Solid), End Use (F&B, Petrochemical, Power, Chemical, Metals & Mining), Operating Temperature, Automation, Region - Global Forecast to 2027

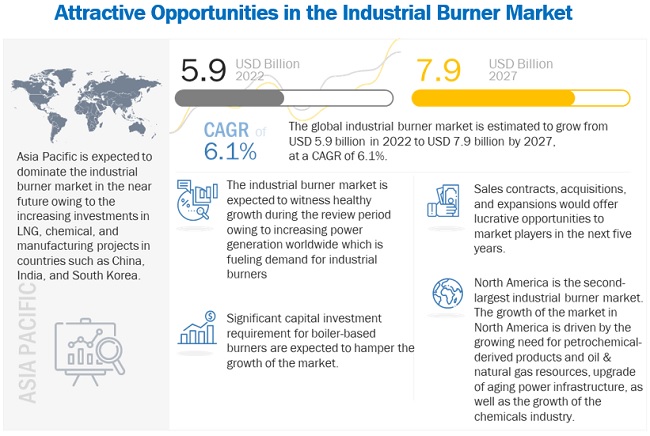

The global industrial burner market in terms of revenue was estimated to be worth $5.9 billion in 2022 and is poised to reach $7.9 billion by 2027, growing at a CAGR of 6.1% from 2022 to 2027. The growth of the industrial burner market can be attributed to the increasing deployment of natural gas-based industrial burners, especially in Europe. The rapidly expanding manufacturing sector is also fueling demand for industrial burners.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Burner Market Dynamics

Driver: Increasing power generation worldwide fueling demand for industrial burners

In 2022, the global electricity demand will rebound significantly. After declining by roughly 1% in 2020, worldwide electricity demand is expected to rise by close to 4% in 2022. The Asia Pacific region is expected to account for the largest share in the overall electricity demand. In 2022, China, one of the world's largest energy consumers, will account for almost 50% of worldwide growth. India, the third-largest consumer, will account for 9% of global growth.

According to the IEA, in the Stated Policies Scenario, the global electricity demand is projected to grow at 2.1% per year through 2040, which is twice the rate of primary energy demand. This would increase the share of electricity in total final energy consumption from 19% in 2022 to 24% in 2040. The demand for energy is being driven by rising income, growing industrial production, and an rapidly expanding services sector. According to the US Energy Information Administration (EIA), global energy consumption is expected to increase by roughly 50% between 2018 and 2050. The majority of this growth is concentrated in regions with substantial economic growth, notably in Asia Pacific. In 2021, Asia Pacific was the world's largest electricity consumer, accounting for about half of all global consumption. Southeast Asia's electricity demand has grown at a rate of 6% per year on average, according to the International Energy Agency.

Moreover, power plant boilers use various fuels such as coal, natural gas, petroleum, and biomass/wastes to produce high-pressured steam, so that plants can generate electricity. As a result, the increasing use of boilers in power generation plants will boost the demand for industrial burners, which are an integral part of industrial boilers.

Restraint: Significant capital investment requirement for boiler-based burners

The production of boiler-based industrial burners is a capital-intensive process. Companies should focus on identifying the raw material that they can procure economically and have an uninterrupted supply for a long period of time. Selecting and procuring raw materials and other auxiliary components of industrial boilers, including industrial burners, require significant R&D and funding. Once this is done, significant R&D, engineering, and designing activities are undertaken for the project, which are time- and capital-intensive.

The construction of industrial boiler plants also requires high investments in terms of engineering, procurement, and construction (EPC) or turnkey services, investment in technology, and procurement of fuel, among others. Post-construction phases such as maintenance, installation of technology, after-sales services also require considerable capital investment.

The cost of industrial boilers varies largely due to design parameters and varying levels of after-sales support. Budget industrial boilers offer shorter lifespans, shorter warranties, and a lower level of customer support as compared to the standard industrial boilers. The expenditure pattern of boiler affects the procurement cost of an industrial burner. All these factors impact the overall cost of industrial burners and result into high procurement and maintenance costs.

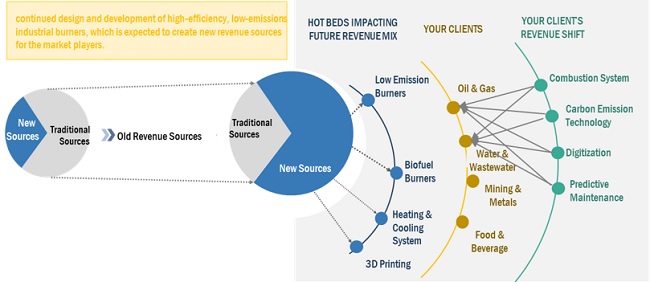

Opportunities: Development of sophisticated liquid and gas burners with 3D printing technology

3D printing technology has helped to develop many complex products and lower production costs significantly. Burners with well-designed flames for liquid and gas are produced using 3D printing technology. For instance, Euro-K GmbH, a prominent manufacturer of power conversion devices, has developed compact technology burners to boost fuel consumption and provide significant flexibility in performance. As the amplifier generates a mixture of fuel and air, the micro-burner can burn both gas and liquid fuel.

Moreover, 3D technology is also used in the marine sector, wherein improved and technologically advanced industrial burners are used and act as catalyst in the process of diesel or oil being injected into furnaces that ignite the ship's boilers, producing steam that turns the turbines that propel the ship. All these factors are likely to present great opportunities for industrial burners developed with 3D printing technology.

Challenges: Complexities associated with retrofitting, maintenance, and replacement of industrial burners

The existing industrial burners use carbon steel rotary registers and operate on ambient, forced draught combustion air. The challenges pertaining to the complex retrofitting procedure of industrial burners vary from project to project. For instance, Zeeco, one of the leading manufacturers of industrial burners, faced issues related to retrofitting procedure of industrial burners as the existing designs were quite complex. The project was implemented in 2020 for a large refinery on the US Gulf Coast on a burner retrofit project for a crude heater process furnace. The original burner rotary registers had stopped working and were stuck in one position. Moreover, even after restoring the registers to working order, the carbon steel substance oxidized in the high humidity and saline of Gulf Coast air, causing them to freeze again in a short period of time. Additionally, there was not enough time during the projected turnaround time for this retrofit project to make any floor adjustments to the furnace. As a result, the proposed solution could not include any heater floor or refractory modifications, and the retrofit burners would have to be compatible with the furnace's existing burner installation. All these factors can pose a challenge to the industrial burner market.

Market Trends

Market Interconnection

Power generation segment, by end-user industry, is expected to grow at the highest CAGR during the forecast period

The power generation segment is expected to register the highest CAGR during the forecast period. Industrial burners are used in boilers in gas turbine-based power plants, steam power plants, coal-fired power plants, and diesel-fired power plants in order to produce high pressured steam in order to generate electricity. The rising demand for power is triggering the need for additional power generation. This, coupled with the need to replace and modernize existing power plants, has resulted in the extensive use of combined-cycle gas turbine (CCGT) power plants.

By operating temperature, high temperature (> 1,400°F) segment is expected to be the most significant contributor to the global industrial burner market during the forecast period

By operating temperature, the industrial burner market has been segmented into low temperature (< 1,400°F) and high temperature (> 1,400°F). High temperature (> 1,400°F) is expected to be the largest and fastest-growing segment during the forecast period. These burners are commonly used in forging various metals and heat treatment in ceramics, metals and mining, glass, food & beverage, chemical, textile, and paper applications. The growth of the market can be mainly attributed to the surging demand for furnaces, ovens, kilns and other heating equipment from the chemicals, food & beverages, metals & mining, glass, and textiles industries in developing economies in Asia Pacific such as China and India.

Dual fuel burners are expected to witness the second largest market growth, by fuel type, during the forecast period

Dual fuel burners allow the utilization of cheap fuel sources combined with a secondary fuel, which is more costly but has a permanent and reliable supply. The efficiency of single-fuel industrial burners is relatively low as compared to dual-fuel burners. In developed economies, the adoption of dual fuel industrial burners is promoted to lower their imprint on depleting fossil fuels and other natural energy resources.

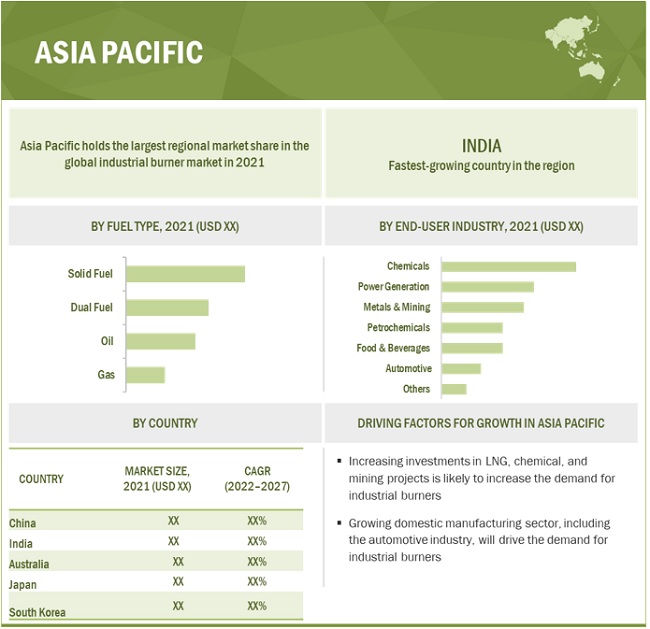

“Asia Pacific: The largest and fastest industrial burner market”

Asia Pacific is expected to dominate the global industrial burner market between 2022–2027, followed by North America and the Europe. The industrial burner market in Asia Pacific is witnessing significant developments in the manufacturing sector due to industrialization, which has supported the demand for industrial burners across countries of the region. The increasing investments in LNG, chemicals, and mining along with the growth of the domestic manufacturing sector is fueling the growth for industrial burners in countries such as China, India, South Korea, and Vietnam.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The industrial burner market is dominated by a few major players that have a wide regional presence. The major players in the industrial burner market are ANDRITZ Group (Austria), NIBE Group (Sweden), Honeywell International Inc. (US), Ariston Group N.V. (Italy), Fives (France), Weishaupt (Germany), Riello S. p. A. (Italy), Selas Heat Technology Company (US), Oilon Group Oy (Finland), C.I.B. Unigas S.p.A. (Italy), and EBICO (Italy). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the industrial burner market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Fuel Type, Burner Type, Automation, Operation Temperature, End-user Industry, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ANDRITZ Group (Austria), NIBE Group (Sweden), Honeywell International Inc. (US), Ariston Group N.V. (Italy), Fives (France), Weishaupt (Germany), Selas Heat Technology Company (US), Riello S. p. A. (Italy), Oilon Group Oy (Finland), EBICO (Italy), Baltur S.p.A. (Italy), Sookook Corporation (South Korea), John Zink Hamworthy Combustion (US), Bloom Engineering (US), Zeeco (US), SAACKE GmbH (Germany), C.I.B. Unigas S.p.A. (Italy), Limpsfield Combustion Engineering (UK), ALZETA Corporation (US), Faber Burner Company (US), MFBurners (China), Oxilon Pvt Ltd (India), Wayne Combustion Systems (US), Power Flame Inc. (US), and WESMAN GROUP (India). |

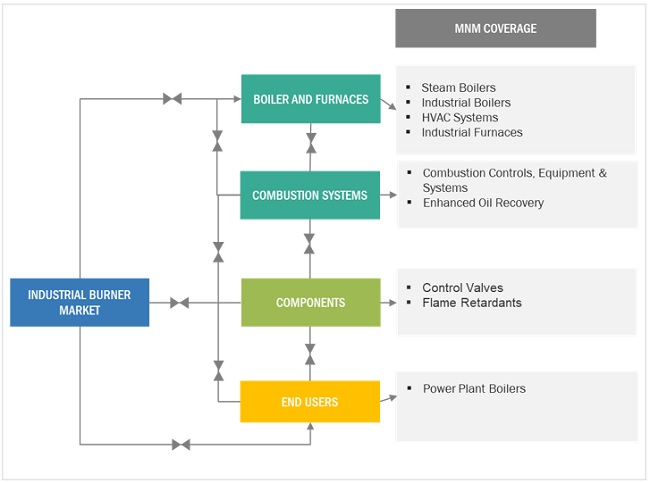

This research report categorizes the industrial burner market by fuel type, burner type, automation, operation temperature, end-user industry, and region

On the basis of fuel type:

- Oil

- Gas

- Solid Fuel

- Dual Fuel

On the basis of burner type:

- Regenerative Burner

- High Thermal Release Burner

- Radiant Burner

- Direct-fired Burner

- Self-recuperative Burner

- Others (Ribbon burners, line burners, duct burners, pipe burners, and high-velocity burners)

On the basis of operating temperature:

- High Temperature (> 1,400°F)

- Low Temperature (< 1,400°F)

On the basis of by power rating:

- Monoblock

- Duoblock

On the basis of by sales channel:

- Food & Beverages

- Petrochemicals

- Power Generation

- Chemicals

- Metals & Mining

- Automotive

- Others (Textiles, glass, paper and pulp, ceramics, and rubber)

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2021, Fives received an order to provide a French cement plant with an 8.5 MW Pillard ROTAFLAM for a clay calcination kiln. The burner is expected to be delivered mid-2022 and commissioned during the second half of the year.

- In November 2020, ANDRITZ Group acquired Enviroburners Oy which designs and manufactures advanced industrial burner solutions for energy production and environmental protection.

- In November 2019, Weishaupt opened a new branch office in Regensburg in Germany. The new office provides customer support and training services to the Upper Palatinate and Lower Bavaria administrative districts and the Ingolstadt region.

- In January 2018, Selas Heat Technology introduced the new Red-Ray high intensity gas-fired infrared burner designed exclusively for paper drying. This new technology uses a unique 3D printed Siliconized Silicon-Carbide (Si-SiC) lattice design that enables the burner to reach an industry leading maximum temperature of 2,450 °F (1,350 °C), providing mill operators the flexibility to increase throughput or decrease energy usage.

Frequently Asked Questions (FAQ):

What is the current size of the industrial burner market?

The current market size of global industrial burner market is USD 5.6 billion in 2021.

What is the major drivers for industrial burner market?

The global industrial burner market is driven by the Surging adoption of dual-fuel industrial burners to lower imprint of depleting fossil fuels and increased deployment of natural gas-based industrial burners, especially in Europe. The rapidly expanding manufacturing sector is also fueling demand for industrial burners.

Which is the fastest-growing region during the forecasted period in industrial burner market?

Asia Pacific is the fastest-growing region during the forecasted period owing the high economic growth rate of China has led to an increase in the demand for power generation equipment in the country thus subsequently increasing the demand for boiler and burner systems. Increasing investments in LNG, chemical, and mining projects are also likely to increase the demand for industrial burners.

Which is the fastest-growing segment, by fuel type during the forecasted period in industrial burner market?

The gas segment is witnessing a high demand during the forecasted period owing the advantages of gas burners, along with the development of the gas distribution network, are expected to prompt end users to install gas burners for various applications, which would drive the growth of the gas-fired burner market. The increasing technological advancements in hydrogen burners and government initiatives toward the production of H2 provide new opportunities to burner manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INDUSTRIAL BURNER MARKET, BY BURNER TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY AUTOMATION: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY FUEL TYPE: INCLUSIONS & EXCLUSIONS

1.2.4 MARKET, BY OPERATING TEMPERATURE: INCLUSIONS & EXCLUSIONS

1.2.5 MARKET, BY END-USER INDUSTRY: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL BURNER MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 IMPACT OF COVID-19 ON INDUSTRY

2.4 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR INDUSTRIAL BURNERS

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

2.5.3.1 Assumptions for demand side

2.5.3.2 Calculation for demand-side

2.5.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF INDUSTRIAL BURNERS

FIGURE 7 MARKET: SUPPLY-SIDE ANALYSIS

2.5.4.1 Supply-side calculation

2.5.4.2 Assumptions for supply side

FIGURE 8 COMPANY REVENUE ANALYSIS, 2020

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 INDUSTRIAL BURNER MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 10 RADIANT BURNER SEGMENT IS PROJECTED TO HOLD LARGEST SHARE OF MARKET, BY BURNER TYPE, DURING FORECAST PERIOD

FIGURE 11 MONOBLOCK IS EXPECTED TO LEAD MARKET, BY AUTOMATION, DURING FORECAST PERIOD

FIGURE 12 GAS SEGMENT IS PROJECTED TO REGISTER HIGHEST CAGR IN MARKET, BY FUEL TYPE, DURING FORECAST PERIOD

FIGURE 13 CHEMICALS SEGMENT IS PROJECTED TO HOLD LARGEST SIZE OF MARKET, BY END-USER INDUSTRY, DURING FORECAST PERIOD

FIGURE 14 HIGH TEMPERATURE (>1400°F) SEGMENT IS PROJECTED TO WITNESS THE HIGHEST CAGR IN MARKET, BY OPERATING TEMPERATURE, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL BURNER MARKET

FIGURE 15 SURGING ADOPTION OF DUAL-FUEL INDUSTRIAL BURNERS TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC MARKET IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY BURNER TYPE AND COUNTRY

FIGURE 17 DIRECT-FIRED BURNER SEGMENT IN CHINA DOMINATED ASIA PACIFIC MARKET IN 2021

4.4 MARKET, BY FUEL TYPE

FIGURE 18 OIL SEGMENT IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF MARKET, BY FUEL TYPE, UNTIL 2027

4.5 MARKET, BY AUTOMATION

FIGURE 19 MONOBLOCK SEGMENT IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF MARKET, BY AUTOMATION, UNTIL 2027

4.6 ARKET, BY OPERATING TEMPERATURE

FIGURE 20 HIGH TEMPERATURE (>1400°F) IS PROJECTED TO CONTINUE TO HOLD LARGER SIZE OF MARKET, BY OPERATING TEMPERATURE, UNTIL 2027

4.7 MARKET, BY BURNER TYPE

FIGURE 21 RADIANT BURNER SEGMENT TO DOMINATE MARKET, BY BURNER TYPE, IN 2027

4.8 MARKET, BY END-USER INDUSTRY

FIGURE 22 CHEMICALS SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY END-USER INDUSTRY, IN 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 23 COVID-19 GLOBAL PROPAGATION

FIGURE 24 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 COMPARISON OF GDP FOR SELECT G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 26 INDUSTRIAL BURNER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Increasing power generation worldwide fueling demand for industrial burners

FIGURE 27 ELECTRICITY CONSUMPTION (TWH), 2017–2020

5.4.1.2 Surging adoption of dual-fuel industrial burners to lower imprint of depleting fossil fuels

TABLE 2 FOSSIL FUEL EMISSION LEVELS (POUNDS PER BILLION BTU OF ENERGY), 2021

FIGURE 28 COMPARISON OF DEMAND FOR BIOFUEL VS. OTHER FUELS, 2020 & 2026

5.4.1.3 Increased deployment of natural gas-based industrial burners, especially in Europe

TABLE 3 TOP 10 NATURAL GAS CONSUMERS IN WORLD (2020)

FIGURE 29 BIOFUEL DEMAND, BY REGION, 2019 TO 2026

5.4.2 RESTRAINTS

5.4.2.1 Significant capital investment requirement for boiler-based burners

5.4.2.2 Implementation of stringent government regulations pertaining to environmental pollution

5.4.3 OPPORTUNITIES

5.4.3.1 Aging power generation infrastructure and increasing refurbishment of industrial burners used in other applications

5.4.3.2 Development of sophisticated liquid and gas burners with 3D printing technology

5.4.3.3 Adoption of biofuels, hazardous waste, and hydrogen-based industrial burners

5.4.4 CHALLENGE

5.4.4.1 Complexities associated with retrofitting, maintenance, and replacement of industrial burners

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN INDUSTRIAL BURNER MARKET

FIGURE 30 REVENUE SHIFT FOR INDUSTRIAL BURNER PROVIDERS

5.6 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS: INDUSTRIAL BURNER MARKET

5.6.1 RAW MATERIAL SUPPLIERS

5.6.2 INDUSTRIAL BURNER PROVIDERS

5.6.3 DISTRIBUTORS

5.6.4 END USERS

5.7 MARKET MAP

FIGURE 32 MARKET MAP: INDUSTRIAL BURNER MARKET

5.8 PRICING ANALYSIS

5.8.1 AVERAGE SELLING PRICE: REGIONAL ANALYSIS

5.8.2 REGION-WISE AVERAGE SELLING PRICE TREND

TABLE 4 REGION-WISE AVERAGE SELLING PRICE OF INDUSTRIAL BURNERS

5.9 TECHNOLOGY ANALYSIS

5.10 CODES AND REGULATORY FRAMEWORK

5.10.1 CODES AND REGULATIONS RELATED TO INDUSTRIAL BURNERS

TABLE 5 INDUSTRIAL BURNER MARKET: REGULATORY FRAMEWORK

5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 INDUSTRIAL BURNER MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 INDUSTRIAL BURNER MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF SUBSTITUTES

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USER

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP END USERS (%)

5.12.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR TOP 4 END USERS

TABLE 12 KEY BUYING CRITERIA, BY POWER RATING

5.13 CASE STUDY ANALYSIS

5.13.1 HEATING SPECIALISTS WEISHAUPT EXPANDED ITS INTERNET OF THINGS (IOT) ACTIVITY WITH NEW GENERATION OF GAS CONDENSING BOILERS

5.13.2 INDUSTRIAL PROCESS HEAT: PROCESS STEAM IN DAIRY FACTORY VIA FAST PYROLYSIS BIO-OIL

5.13.3 RIELLO BURNERS HELP TO MEET STRICT GLA EMISSION REQUIREMENTS

5.14 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 13 INDUSTRIAL BURNERS: INNOVATIONS AND PATENT REGISTRATIONS

5.15 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 14 INDUSTRIAL BURNER MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 INDUSTRIAL BURNER MARKET, BY BURNER TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 36 INDUSTRIAL BURNER MARKET, BY BURNER TYPE, 2021

TABLE 15 MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

6.2 REGENERATIVE BURNER

6.2.1 REGENERATIVE BURNERS ARE SPECIFICALLY ADOPTED IN HIGH-TEMPERATURE FURNACES

TABLE 16 REGENERATIVE BURNER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 HIGH THERMAL RELEASE BURNER

6.3.1 HIGH THERMAL RELEASE BURNERS HAVE LOW NOX EMISSIONS

TABLE 17 HIGH THERMAL RELEASE BURNER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 RADIANT BURNER

6.4.1 RADIANT BURNERS CAN BE USED IN BOTH LOW- AND HIGH-TEMPERATURE APPLICATIONS

TABLE 18 RADIANT BURNER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 DIRECT-FIRED BURNER

6.5.1 DIRECT-FIRED BURNERS OFFER ADVANTAGES OF LOW FUEL CONSUMPTION AND OPERATING COST

TABLE 19 DIRECT-FIRED BURNER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.6 SELF-RECUPERATIVE BURNER

6.6.1 SELF-RECUPERATIVE BURNERS ARE EASY TO INCORPORATE INTO RETROFIT INSTALLATIONS

TABLE 20 SELF-RECUPERATIVE BURNER: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.7 OTHERS

TABLE 21 OTHER BURNER TYPES: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 INDUSTRIAL BURNER MARKET, BY FUEL TYPE (Page No. - 85)

7.1 INTRODUCTION

FIGURE 37 INDUSTRIAL BURNER MARKET, BY FUEL TYPE, 2021

TABLE 22 MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

7.2 OIL

7.2.1 OIL-FIRED BURNERS CAN BE USED IN ANY LOCATION

TABLE 23 OIL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 GAS

7.3.1 EXPANDING NATURAL GAS DISTRIBUTION NETWORK TO ACCELERATE DEMAND FOR GAS-FIRED INDUSTRIAL BURNERS

TABLE 24 GAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 DUAL FUEL

7.4.1 DUAL FUEL BURNERS OFFER INCREASED EFFICIENCY AND RELIABILITY

TABLE 25 DUAL FUEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 SOLID FUEL

7.5.1 INCREASING ADOPTION OF BIOMASS AND INDUSTRIAL WASTE BURNERS TO FUEL DEMAND FOR SOLID FUEL BURNERS

TABLE 26 SOLID FUEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 INDUSTRIAL BURNER MARKET, BY AUTOMATION (Page No. - 91)

8.1 INTRODUCTION

FIGURE 38 INDUSTRIAL BURNER MARKET, BY AUTOMATION, 2021

TABLE 27 MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

8.2 MONOBLOCK

8.2.1 MONOBLOCK BURNERS ARE COMPACT, HAVE REDUCED FOOTPRINT, AND ARE SPECIALLY DESIGNED TO MINIMIZE NOX EMISSIONS

TABLE 28 MONOBLOCK: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 DUOBLOCK

8.3.1 INCREASING DEMAND FOR DUOBLOCK BURNERS IN FOOD & BEVERAGES INDUSTRY TO DRIVE MARKET GROWTH

TABLE 29 DUOBLOCK: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 INDUSTRIAL BURNER MARKET, BY OPERATING TEMPERATURE (Page No. - 95)

9.1 INTRODUCTION

FIGURE 39 MARKET, BY OPERATING TEMPERATURE, 2021

TABLE 30 MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

9.2 LOW TEMPERATURE (< 1400°F)

9.2.1 LOW-TEMPERATURE BURNERS ARE IDEAL FOR LOW-TEMPERATURE DRYING APPLICATIONS

TABLE 31 LOW TEMPERATURE (< 1400°F): MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 HIGH TEMPERATURE (> 1400°F)

9.3.1 HIGH-TEMPERATURE BURNERS ARE USED IN MULTIPLE APPLICATIONS

TABLE 32 HIGH TEMPERATURE (> 1400°F): MARKET, BY REGION, 2020–2027 (USD MILLION)

10 INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY (Page No. - 99)

10.1 INTRODUCTION

FIGURE 40 MARKET, BY END-USER INDUSTRY, 2021

TABLE 33 MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

10.2 FOOD & BEVERAGES

10.2.1 INCREASE IN USE OF INDUSTRIAL BURNERS IN FOOD PROCESSING FACILITIES TO BOOST MARKET GROWTH

TABLE 34 FOOD & BEVERAGES: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 POWER GENERATION

10.3.1 NEED TO REPLACE AND MODERNIZE EXISTING POWER PLANTS TO DRIVE MARKET GROWTH

TABLE 35 POWER GENERATION: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.4 CHEMICALS

10.4.1 GROWING USE OF BURNERS IN ETHYLENE CRACKING AND OTHER CHEMICAL PROCESSES TO BOOST MARKET GROWTH

TABLE 36 CHEMICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.5 PETROCHEMICALS

10.5.1 GROWING NUMBER OF REFINERIES IN ASIA PACIFIC TO ACCELERATE DEMAND FOR BURNERS

TABLE 37 PETROCHEMICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.6 METALS & MINING

10.6.1 INCREASE IN DEMAND FOR BURNERS IN MINING OPERATIONS TO PROPEL MARKET GROWTH

TABLE 38 METALS & MINING: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.7 AUTOMOTIVE

10.7.1 SURGING USE OF INDUSTRIAL BURNERS IN CURING OVEN AND SPRAYING SYSTEMS TO PROPEL MARKET GROWTH

TABLE 39 AUTOMOTIVE: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.8 OTHERS

TABLE 40 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 REGIONIONAL ANALYSIS (Page No. - 108)

11.1 INTRODUCTION

11.2 IMPACT OF COVID-19 ON INDUSTRIAL BURNER MARKET

FIGURE 41 MARKET: REGIONAL SNAPSHOT

FIGURE 42 REGION-WISE SHARE ANALYSIS OF INDUSTRIAL BURNER MARKET,2021

TABLE 41 MARKET, BY REGION, 2020–2027 (USD MILLION)

11.3 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

11.3.1 BY BURNER TYPE

TABLE 42 ASIA PACIFIC: MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET, BY BURNER TYPE, 2020–2027 (THOUSAND UNITS)

11.3.2 BY FUEL TYPE

TABLE 44 ASIA PACIFIC: MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

11.3.3 BY OPERATING TEMPERATURE

TABLE 45 ASIA PACIFIC: MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

11.3.4 BY AUTOMATION

TABLE 46 ASIA PACIFIC: MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

11.3.5 BY END-USER INDUSTRY

TABLE 47 ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6 BY COUNTRY

TABLE 48 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.3.6.1 China

11.3.6.1.1 LNG capacity addition and increase in EV production to fuel industrial burner market growth

TABLE 49 CHINA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6.2 India

11.3.6.2.1 Growth of chemicals and petrochemicals industries to fuel growth of industrial burner market

TABLE 50 INDIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6.3 Australia

11.3.6.3.1 Favorable government policies for lithium mining to drive market growth

TABLE 51 AUSTRALIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6.4 Japan

11.3.6.4.1 Sustained growth of manufacturing industry and rising demand for LNG to augment market growth

TABLE 52 JAPAN: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6.5 South Korea

11.3.6.5.1 Growth of chemicals industry in South Korea to drive growth of industrial burner market

TABLE 53 SOUTH KOREA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.3.6.6 Rest of Asia Pacific

TABLE 54 REST OF ASIA PACIFIC: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.4 NORTH AMERICA

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

11.4.1 BY BURNER TYPE

TABLE 55 NORTH AMERICA: MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY BURNER TYPE, 2020–2027 (THOUSAND UNITS)

11.4.2 BY FUEL TYPE

TABLE 57 NORTH AMERICA: MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

11.4.3 BY OPERATING TEMPERATURE

TABLE 58 NORTH AMERICA: MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

11.4.4 BY AUTOMATION

TABLE 59 NORTH AMERICA: MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

11.4.5 BY END-USER INDUSTRY

TABLE 60 NORTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.4.6 BY COUNTRY

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.4.6.1 US

11.4.6.1.1 Surge in demand for boilers and heating equipment in power generation, petrochemicals, and chemicals industry to drive market growth

TABLE 62 US: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.4.6.2 Canada

11.4.6.2.1 Growing investments in mining industry to provide lucrative opportunities to industrial burner providers

TABLE 63 CANADA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.4.6.3 Mexico

11.4.6.3.1 Increasing investments for refinery capacity additions to boost demand for industrial burners

TABLE 64 MEXICO: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5 EUROPE

11.5.1 BY BURNER TYPE

TABLE 65 EUROPE: MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY BURNER TYPE, 2020–2027 (THOUSAND UNITS)

11.5.2 BY FUEL TYPE

TABLE 67 EUROPE: MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

11.5.3 BY OPERATING TEMPERATURE

TABLE 68 EUROPE: MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

11.5.4 BY AUTOMATION

TABLE 69 EUROPE: MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

11.5.5 BY END-USER INDUSTRY

TABLE 70 EUROPE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6 BY COUNTRY

TABLE 71 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.5.6.1 Germany

11.5.6.1.1 Growth of chemicals and food & beverage industries foster industrial burner market growth

TABLE 72 GERMANY: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6.2 France

11.5.6.2.1 Demand for industrial burners in chemicals industry is fueling market growth

TABLE 73 FRANCE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6.3 Italy

11.5.6.3.1 Increase in demand from food & beverage and automotive industries fuels market growth

TABLE 74 ITALY: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6.4 UK

11.5.6.4.1 Discontinuation of coal-fired industrial boilers to spur demand for natural gas-fired industrial boilers

TABLE 75 UK: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6.5 Spain

11.5.6.5.1 Growing demand for burners in chemical and food processing applications to promote market growth

TABLE 76 SPAIN: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.5.6.6 Rest of Europe

TABLE 77 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 BY BURNER TYPE

TABLE 78 MIDDLE EAST & AFRICA: MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

TABLE 79 MIDDLE EAST & AFRICA: MARKET, BY BURNER TYPE, 2020–2027 (THOUSAND UNITS)

11.6.2 BY FUEL TYPE

TABLE 80 MIDDLE EAST & AFRICA: MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

11.6.3 BY OPERATING TEMPERATURE

TABLE 81 MIDDLE EAST & AFRICA: MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

11.6.4 BY AUTOMATION

TABLE 82 MIDDLE EAST & AFRICA: MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

11.6.5 BY END-USER INDUSTRY

TABLE 83 MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6.6 BY COUNTRY

TABLE 84 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.6.6.1 Saudi Arabia

11.6.6.1.1 Growing crude oil production is prominent driver for industrial burner market

TABLE 85 SAUDI ARABIA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6.6.2 UAE

11.6.6.2.1 Growing investments in petrochemicals sector leading to growth of industrial burner market

TABLE 86 UAE: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6.6.3 Kuwait

11.6.6.3.1 Surplus oil reserves likely to drive market for industrial burner market

TABLE 87 KUWAIT: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6.6.4 South Africa

11.6.6.4.1 Developing automotive industry and mining activities will lead to growth of industrial burner market in South Africa

TABLE 88 SOUTH AFRICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.6.6.5 Rest of Middle East & Africa

TABLE 89 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL BURNER MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.7 SOUTH AMERICA

11.7.1 BY BURNER TYPE

TABLE 90 SOUTH AMERICA: MARKET, BY BURNER TYPE, 2020–2027 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET, BY BURNER TYPE, 2020–2027 (THOUSAND UNITS)

11.7.2 BY FUEL TYPE

TABLE 92 SOUTH AMERICA: MARKET, BY FUEL TYPE, 2020–2027 (USD MILLION)

11.7.3 BY OPERATING TEMPERATURE

TABLE 93 SOUTH AMERICA: MARKET, BY OPERATING TEMPERATURE, 2020–2027 (USD MILLION)

11.7.4 BY AUTOMATION

TABLE 94 SOUTH AMERICA: MARKET, BY AUTOMATION, 2020–2027 (USD MILLION)

11.7.5 BY END-USER INDUSTRY

TABLE 95 SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.7.6 BY COUNTRY

TABLE 96 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.7.6.1 Brazil

11.7.6.1.1 Growing focus on diversifying energy mix to foster demand for industrial burners

TABLE 97 BRAZIL: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.7.6.2 Argentina

11.7.6.2.1 Prime focus on food & beverages, chemical, and petrochemical production activities to support market growth

TABLE 98 ARGENTINA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

11.7.6.3 Rest of South America

TABLE 99 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 153)

12.1 KEY PLAYERS STRATEGIES

TABLE 100 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2018– JANUARY 2022

12.2 MARKET SHARE ANALYSIS OF TOP SIX PLAYERS

TABLE 101 INDUSTRIAL BURNER MARKET: DEGREE OF COMPETITION

FIGURE 45 MARKET: MARKET SHARE ANALYSIS, 2020

12.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 REVENUE OF TOP PLAYERS IN MARKET FROM 2016 TO 2020

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 47 COMPETITIVE LEADERSHIP MAPPING: INDUSTRIAL BURNER MARKET, 2021

12.5 STARTUP/SME EVALUATION QUADRANT

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 48 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

TABLE 102 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 103 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.6 INDUSTRIAL BURNER MARKET: COMPANY FOOTPRINT

TABLE 104 BY FUEL TYPE: COMPANY FOOTPRINT

TABLE 105 BY END-USER INDUSTRY: COMPANY FOOTPRINT

TABLE 106 BY REGION: COMPANY FOOTPRINT

TABLE 107 COMPANY FOOTPRINT

12.7 COMPETITIVE SCENARIO

TABLE 108 MARKET: DEALS, NOVEMBER 2020

TABLE 109 MARKET: OTHERS, NOVEMBER 2019–JANUARY 2022

13 COMPANY PROFILES (Page No. - 169)

13.1 KEY PLAYERS

(Business and financial overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 ANDRITZ GROUP

TABLE 110 ANDRITZ GROUP: BUSINESS OVERVIEW

FIGURE 49 ANDRITZ GROUP: COMPANY SNAPSHOT, 2021

TABLE 111 ANDRITZ GROUP: PRODUCTS OFFERED

TABLE 112 ANDRITZ GROUP: DEALS

TABLE 113 ANDRITZ GROUP: SALES CONTRACT

13.1.2 NIBE GROUP

TABLE 114 NIBE GROUP: BUSINESS OVERVIEW

FIGURE 50 NIBE GROUP: COMPANY SNAPSHOT, 2020

TABLE 115 NIBE GROUP: PRODUCTS OFFERED

13.1.3 HONEYWELL INTERNATIONAL INC.

TABLE 116 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT, 2021

TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

13.1.4 ARISTON GROUP N. V.

TABLE 118 ARISTON GROUP N. V.: BUSINESS OVERVIEW

FIGURE 52 ARISTON GROUP N. V.: COMPANY SNAPSHOT, 2021

TABLE 119 ARISTON GROUP N. V.: PRODUCTS OFFERED

13.1.5 FIVES

TABLE 120 FIVES: BUSINESS OVERVIEW

FIGURE 53 FIVES: COMPANY SNAPSHOT, 2020

TABLE 121 FIVES: PRODUCTS OFFERED

TABLE 122 FIVES: SALES CONTRACT

13.1.6 WEISHAUPT

TABLE 123 WEISHAUPT: BUSINESS OVERVIEW

TABLE 124 WEISHAUPT: PRODUCTS OFFERED

TABLE 125 WEISHAUPT: EXPANSION

13.1.7 SELAS HEAT TECHNOLOGY COMPANY

TABLE 126 SELAS HEAT TECHNOLOGY COMPANY: BUSINESS OVERVIEW

TABLE 127 SELAS HEAT TECHNOLOGY COMPANY: PRODUCTS OFFERED

TABLE 128 SELAS HEAT TECHNOLOGY COMPANY: PRODUCT LAUNCHES

13.1.8 RIELLO S. P. A.

TABLE 129 RIELLO S. P. A.: BUSINESS OVERVIEW

TABLE 130 RIELLO S. P. A.: PRODUCTS OFFERED

13.1.9 C.I.B. UNIGAS S.P.A.

TABLE 131 C.I.B. UNIGAS S.P.A.: BUSINESS OVERVIEW

TABLE 132 C.I.B. UNIGAS S.P.A.: PRODUCTS OFFERED

13.1.10 EBICO

TABLE 133 EBICO: BUSINESS OVERVIEW

TABLE 134 EBICO: PRODUCTS OFFERED

TABLE 135 EBICO: SALES CONTRACT

13.1.11 BALTUR S.P.A.

TABLE 136 BALTUR S.P.A.: BUSINESS OVERVIEW

TABLE 137 BALTUR S.P.A.: PRODUCTS OFFERED

TABLE 138 BALTUR S.P.A.: PRODUCT LAUNCHES

13.1.12 OILON GROUP OY

TABLE 139 OILON GROUP OY: BUSINESS OVERVIEW

TABLE 140 OILON GROUP OY: PRODUCTS OFFERED

13.1.13 OXILON PVT LTD

TABLE 141 OXILON PVT LTD: BUSINESS OVERVIEW

TABLE 142 OXILON PVT LTD: PRODUCTS OFFERED

13.1.14 ZEECO

TABLE 143 ZEECO: BUSINESS OVERVIEW

TABLE 144 ZEECO: PRODUCTS OFFERED

TABLE 145 ZEECO: EXPANSION

13.1.15 ALZETA CORPORATION

TABLE 146 ALZETA CORPORATION: BUSINESS OVERVIEW

TABLE 147 ALZETA CORPORATION: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 BLOOM ENGINEERING

13.2.2 LIMPSFIELD COMBUSTION ENGINEERING

13.2.3 POWER FLAME INC.

13.2.4 WESMAN GROUP

13.2.5 SOOKOOK CORPORATION

13.2.6 JOHN ZINK HAMWORTHY COMBUSTION

13.2.7 SAACKE GMBH

13.2.8 WAYNE COMBUSTION SYSTEMS

13.2.9 FABER BURNER COMPANY

13.2.10 MFBURNER

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 230)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved major activities in estimating the current size of the industrial burner market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the industrial burner market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global industrial burner market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

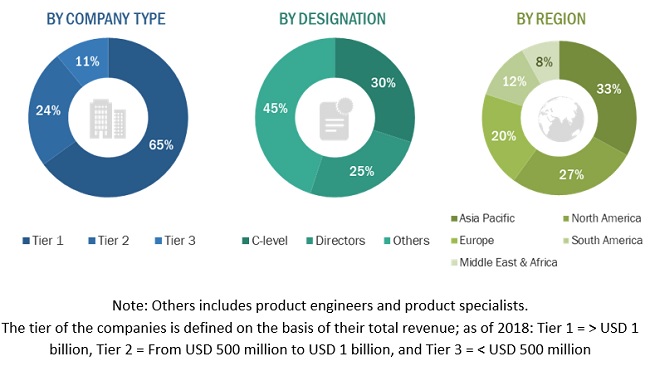

The industrial burner market comprises several stakeholders such as industrial burner manufacturers, boiler manufacturers, manufacturers of subcomponents of industrial burners, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for burners in boilers, furnaces, dryers, hot air generators, ovens, and other heating and combustion equipment across a wide variety of end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

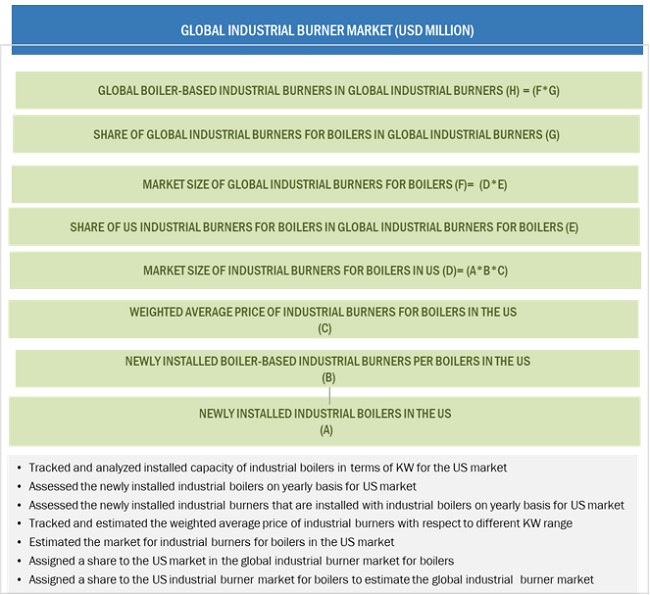

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial burner market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Industrial burner Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the industrial burner market size based on burner type, automation, fuel type, operating temperature, and end-user industry

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 5 main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the industrial burner market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Burner Market